Professional Documents

Culture Documents

Plaintiff's Letter To Judge Edward L Scott

Plaintiff's Letter To Judge Edward L Scott

Uploaded by

Neil GillespieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Plaintiff's Letter To Judge Edward L Scott

Plaintiff's Letter To Judge Edward L Scott

Uploaded by

Neil GillespieCopyright:

Available Formats

Page 1 of 1

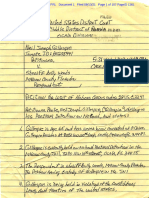

Neil Gillespie

From:

To:

Cc:

Sent:

Attach:

Subject:

"Pat Alred" <pat@stoneandgerken.com>

<neilgillespie@mfi.net>

"Grant Watson" <grant@stoneandgerken.com>; "Kevin Stone" <kevin@stoneandgerken.com>

Wednesday, August 17, 2016 11:05 AM

Letter-Judge Scott.pdf; Proposed Order (SECO v Gillespie).pdf

SERVICE OF COURT DOCUMENT - Case No. 2015-CA-000712 (Marion)

The attached court documents are being served upon you via electronic service pursuant to

Florida Rules of Judicial Administration 2.516.

Court in which proceeding is

pending:

Circuit Court of the 5

County, Florida

th

Judicial Circuit, Marion

Case No.

2015-CA-000712

Initial Party (Plaintiffs):

Sumter Electric Cooperative, Inc.

Initial Party (Defendants):

Neil J. Gillespie

Title of document(s) being

served:

Letter to Judge Scott; and

Attorneys Name and Telephone

number:

William Grant Watson, Esq.

Proposed Order

Stone & Gerken, P.A.

(352) 357-0330

Regards,

Pat Alred

pat@stoneandgerken.com

Stone & Gerken, P.A.

4850 N. Highway 19A

Mount Dora, FL 32757

(352) 357-0330

CONFIDENTIALITY NOTICE - The information contained in this message is confidential and may also be subject to the attorney-client privilege or may

constitute privileged work product. The information is intended only for the use of the individual or entity to whom it is addressed. If you are not the intended

recipient or the agent or employee responsible for delivery to the intended recipient, you are hereby notified that any use, dissemination, distribution or

reproduction of this communication is strictly prohibited. If you have received this message in error, please immediately notify us by telephone at (352)3570330, delete this message, and return any hard copies of the original to us at 4850 North Highway 19A, Mount Dora, Florida 32757. Thank you.

Disclaimer under Circular 230: Any statement regarding tax matters made herein, including any attachments, are not formal tax opinions by this firm, cannot be

relied upon or used by any person to avoid tax penalties, and are not intended to be used or referred to in any marketing or promotional materials.

8/17/2016

You might also like

- Cousins Lawsuit That Triggered FiringDocument30 pagesCousins Lawsuit That Triggered FiringWHYY NewsNo ratings yet

- Jane Doe Liberty CounterclaimDocument5 pagesJane Doe Liberty CounterclaimPat ThomasNo ratings yet

- 37 2016 00015560 CL en CTL Roa 1-05-09 16 CA Labor Board Judgment Digital Ear, IncDocument15 pages37 2016 00015560 CL en CTL Roa 1-05-09 16 CA Labor Board Judgment Digital Ear, IncdigitalearinfoNo ratings yet

- Chart - Types of MisconductDocument1 pageChart - Types of Misconducttheplatinumlife7364No ratings yet

- Cohen Letter To JudgeDocument9 pagesCohen Letter To Judgepaul weichNo ratings yet

- Sample Letter of AgreementDocument1 pageSample Letter of AgreementDan Paolo AlbintoNo ratings yet

- Complaint US Ex Rel - Barron and Scheel V Deloitte and Touche Consulting, False Claims ActDocument53 pagesComplaint US Ex Rel - Barron and Scheel V Deloitte and Touche Consulting, False Claims ActRick ThomaNo ratings yet

- Baker v. CanadaDocument52 pagesBaker v. CanadaHafiz Asif RazaNo ratings yet

- Motion To Reduce SentenceDocument3 pagesMotion To Reduce SentenceWABE 90.1FM100% (1)

- Petitioner's Proposed Recommended OrderDocument28 pagesPetitioner's Proposed Recommended Orderabatchelorwplg.comNo ratings yet

- Resolution 6021Document4 pagesResolution 6021al_crespoNo ratings yet

- Laurato V DeMichelle - Complaint and Answer and ExhibitsDocument171 pagesLaurato V DeMichelle - Complaint and Answer and ExhibitsDavid Arthur Walters100% (1)

- Danco V LXLDocument28 pagesDanco V LXLLet's TessellateNo ratings yet

- Texas Name Change Petition For An AdultDocument2 pagesTexas Name Change Petition For An AdulthowtochangeyournameNo ratings yet

- Chen Probable Cause Affidavit 050714Document7 pagesChen Probable Cause Affidavit 050714USA TODAYNo ratings yet

- United States District Court Southern District of Florida Case No. 10-60786-Civ-COOKE/BANDSTRADocument30 pagesUnited States District Court Southern District of Florida Case No. 10-60786-Civ-COOKE/BANDSTRADavid Oscar MarkusNo ratings yet

- RI Social Security Disability LawyerDocument3 pagesRI Social Security Disability LawyerwmdmlawNo ratings yet

- 07-111 Flory Gardens (Blank CO)Document40 pages07-111 Flory Gardens (Blank CO)gdouglasgray111No ratings yet

- Plaintiffs' Suggestion of Subsequently Decided AuthorityDocument13 pagesPlaintiffs' Suggestion of Subsequently Decided AuthorityEquality Case FilesNo ratings yet

- Luke Rankin Sued For DefamationDocument84 pagesLuke Rankin Sued For DefamationMyrtleBeachSC newsNo ratings yet

- Filed United States Court of Appeals Tenth CircuitDocument28 pagesFiled United States Court of Appeals Tenth CircuitScribd Government DocsNo ratings yet

- The Chork v. Berk - ComplaintDocument49 pagesThe Chork v. Berk - ComplaintSarah BursteinNo ratings yet

- The Writ of Habeas CorpusDocument24 pagesThe Writ of Habeas CorpusVaibhav ChaudharyNo ratings yet

- Cross-Motion For Default JudgmentDocument9 pagesCross-Motion For Default JudgmentSLAVEFATHERNo ratings yet

- Petition To Stop The Racial Profiling of Asian American & Asian Immigrants - Advancing Justice - AAJCDocument1,483 pagesPetition To Stop The Racial Profiling of Asian American & Asian Immigrants - Advancing Justice - AAJCOjieze OsedebamhenNo ratings yet

- 2012 04-02 Doc 28 Scheduling and Discovery OrderDocument19 pages2012 04-02 Doc 28 Scheduling and Discovery OrderalmbladscamNo ratings yet

- Garcia Motion For ContinuanceDocument5 pagesGarcia Motion For ContinuanceTony OrtegaNo ratings yet

- Via Email: Peter W. Ginder Acting City AttorneyDocument6 pagesVia Email: Peter W. Ginder Acting City AttorneyScott JohnsonNo ratings yet

- McKee Tort NoticeDocument9 pagesMcKee Tort NoticeMegan BantaNo ratings yet

- Garwood Civil SuitDocument34 pagesGarwood Civil SuitKavahn MansouriNo ratings yet

- Mansion Party TRO Petition E-FiledDocument21 pagesMansion Party TRO Petition E-FiledKVIA ABC-7No ratings yet

- Sample Affidavit of Heirship - Texaslawhelp 0 PDFDocument4 pagesSample Affidavit of Heirship - Texaslawhelp 0 PDFcodigotrueno100% (1)

- Filed Summons & Complaint 09.30.2020 PDFDocument20 pagesFiled Summons & Complaint 09.30.2020 PDFLive 5 NewsNo ratings yet

- Texas Mandamus PetitionDocument67 pagesTexas Mandamus PetitionEquality Case Files100% (1)

- Ohio State Board of Trustees DRAFT of Meeting Minutes 11-16-2018Document56 pagesOhio State Board of Trustees DRAFT of Meeting Minutes 11-16-2018Beverly TranNo ratings yet

- Westlaw - Peoplemap Report MR James A AlefantisDocument33 pagesWestlaw - Peoplemap Report MR James A AlefantisSergio MuñozNo ratings yet

- Annotated Summary of Public Records History-1Document260 pagesAnnotated Summary of Public Records History-1al_crespo_2No ratings yet

- ComplaintDocument6 pagesComplaintSabrina LoloNo ratings yet

- Gahler Opposition To FroshDocument27 pagesGahler Opposition To FroshRohan MNo ratings yet

- On behalf of PR guy Jeff Salzgeber (Radiant Media Group, Austin, TX), Chicago attorney Jeanine Lynda Stevens sent me a baseless defamation threat letter that warned me not to publish her letter and threatened me with “further causes of action” if I do; so I filed a complaint against her with the IL Attorney Registration and Disciplinary CommissionDocument17 pagesOn behalf of PR guy Jeff Salzgeber (Radiant Media Group, Austin, TX), Chicago attorney Jeanine Lynda Stevens sent me a baseless defamation threat letter that warned me not to publish her letter and threatened me with “further causes of action” if I do; so I filed a complaint against her with the IL Attorney Registration and Disciplinary CommissionPeter M. HeimlichNo ratings yet

- Sample Subpoena Policy - HIPPA-PHIDocument6 pagesSample Subpoena Policy - HIPPA-PHITheresa WalkerNo ratings yet

- Human Rights AlertDocument12 pagesHuman Rights AlertHuman Rights Alert - NGO (RA)No ratings yet

- Leonard Williamson v. Oregon Department of Corrections, Colette PetersDocument21 pagesLeonard Williamson v. Oregon Department of Corrections, Colette PetersStatesman Journal100% (1)

- 2nd Letter To Chief Justice John Roberts Concerning Judy v. Obama 12-5276Document2 pages2nd Letter To Chief Justice John Roberts Concerning Judy v. Obama 12-5276Cody Robert JudyNo ratings yet

- Starletta Banks V State of Michigan, Court of Appeal On Termination of Parental RightsDocument3 pagesStarletta Banks V State of Michigan, Court of Appeal On Termination of Parental RightsBeverly TranNo ratings yet

- Posner Hakeen El Bey OrderDocument3 pagesPosner Hakeen El Bey OrderBrianna PenaNo ratings yet

- Ken Klippenstein FOIA Lawsuit Re Unauthorized Disclosure Crime ReportsDocument5 pagesKen Klippenstein FOIA Lawsuit Re Unauthorized Disclosure Crime ReportsTheNationMagazine100% (1)

- West, Keith - Petition For PardonDocument9 pagesWest, Keith - Petition For PardonMelindaNo ratings yet

- United States District Court Southern District of Florida Case No.: 1:18-cv-24190Document16 pagesUnited States District Court Southern District of Florida Case No.: 1:18-cv-24190al_crespoNo ratings yet

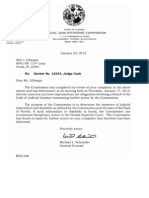

- JQC Complaint No. 12554 Judge Martha J CookDocument10 pagesJQC Complaint No. 12554 Judge Martha J CookNeil GillespieNo ratings yet

- Watchung Hills Regional High School District LawsuitDocument40 pagesWatchung Hills Regional High School District LawsuitAlexis TarraziNo ratings yet

- 10000021291Document490 pages10000021291Chapter 11 DocketsNo ratings yet

- Robert Sweeney's Delay Tactics in CourtDocument11 pagesRobert Sweeney's Delay Tactics in CourtjpenknifeNo ratings yet

- Docket Number 3576 EDA 2016 ORDER DISMISSED TO DOCKET 3575 EDA 2016 KATHLEEN KANE SUPERIOR COURT DOCKET SHEET Friday December 23, 2016Document63 pagesDocket Number 3576 EDA 2016 ORDER DISMISSED TO DOCKET 3575 EDA 2016 KATHLEEN KANE SUPERIOR COURT DOCKET SHEET Friday December 23, 2016Stan J. CaterboneNo ratings yet

- Notice Default SanctionsDocument3 pagesNotice Default SanctionsTheresa MartinNo ratings yet

- 10-24-2016 Criminal Complaint Against Div Lawyer Ilona Ely Freedman Grenadier HeckmanDocument18 pages10-24-2016 Criminal Complaint Against Div Lawyer Ilona Ely Freedman Grenadier HeckmanJaniceWolkGrenadierNo ratings yet

- IJIB Complaint Against Appellate Court Judges Tom Lytton, Mary McDade and Daniel Schmidt July 2013Document8 pagesIJIB Complaint Against Appellate Court Judges Tom Lytton, Mary McDade and Daniel Schmidt July 2013Mark HexumNo ratings yet

- Google Florida Bar ComplaintDocument26 pagesGoogle Florida Bar ComplaintNeil GillespieNo ratings yet

- Google Lawsuit Notice of Voluntary DismissalDocument22 pagesGoogle Lawsuit Notice of Voluntary DismissalNeil GillespieNo ratings yet

- Google Lawsuit First Amended ComplaintDocument49 pagesGoogle Lawsuit First Amended ComplaintNeil GillespieNo ratings yet

- Habeas Petition Re Judge Peter Brigham 5d23-1176Document168 pagesHabeas Petition Re Judge Peter Brigham 5d23-1176Neil GillespieNo ratings yet

- Habeas Petition 5D23-0913 Judge Peter BrighamDocument146 pagesHabeas Petition 5D23-0913 Judge Peter BrighamNeil GillespieNo ratings yet

- Appeal Order Denying Motion To Withdraw Plea 5D23-2005Document180 pagesAppeal Order Denying Motion To Withdraw Plea 5D23-2005Neil GillespieNo ratings yet

- Neil Gillespie Kar Kingdom Bucks County Courier TimesDocument8 pagesNeil Gillespie Kar Kingdom Bucks County Courier TimesNeil GillespieNo ratings yet

- TRUMP V ANDERSON No. 23-719 USSC Response To Amicus EOTDocument97 pagesTRUMP V ANDERSON No. 23-719 USSC Response To Amicus EOTNeil GillespieNo ratings yet

- Neil Gillespie United Nations Fight Against CorruptionDocument13 pagesNeil Gillespie United Nations Fight Against CorruptionNeil GillespieNo ratings yet

- Offer To Settle Google Lawsuit Neil Gillespie AffidavitDocument2 pagesOffer To Settle Google Lawsuit Neil Gillespie AffidavitNeil GillespieNo ratings yet

- Appendix B Google Complaint For Replevin (Verizon)Document7 pagesAppendix B Google Complaint For Replevin (Verizon)Neil GillespieNo ratings yet

- Petition To Remove Judge Peter Brigham 5D23-0814Document44 pagesPetition To Remove Judge Peter Brigham 5D23-0814Neil GillespieNo ratings yet

- Letter of Martin Levine Realtor For Neil GillespieDocument7 pagesLetter of Martin Levine Realtor For Neil GillespieNeil GillespieNo ratings yet

- Appendix A Google Complaint For RepelvinDocument87 pagesAppendix A Google Complaint For RepelvinNeil GillespieNo ratings yet

- Gillespie V Google Amended Motion For Writ of ReplevinDocument23 pagesGillespie V Google Amended Motion For Writ of ReplevinNeil GillespieNo ratings yet

- Appendix C, Google Complaint For Replevin (Trump V Anderson, No. 23-719)Document83 pagesAppendix C, Google Complaint For Replevin (Trump V Anderson, No. 23-719)Neil GillespieNo ratings yet

- Gillespie V Google Remanded, Pending Motion For Writ of ReplevinDocument37 pagesGillespie V Google Remanded, Pending Motion For Writ of ReplevinNeil GillespieNo ratings yet

- Gillespie V Google, Complaint For ReplevinDocument61 pagesGillespie V Google, Complaint For ReplevinNeil GillespieNo ratings yet

- Gillespie V Google, Verified Motion For ReplevinDocument33 pagesGillespie V Google, Verified Motion For ReplevinNeil GillespieNo ratings yet

- Gillespie V Google, Complaint For Replevin, 2024-CA-0209Document238 pagesGillespie V Google, Complaint For Replevin, 2024-CA-0209Neil GillespieNo ratings yet

- Defendants Motion To Waive Confidentiality For Psychological EvaluationDocument18 pagesDefendants Motion To Waive Confidentiality For Psychological EvaluationNeil GillespieNo ratings yet

- Psychological Evaluation of Neil GillespieDocument5 pagesPsychological Evaluation of Neil GillespieNeil GillespieNo ratings yet

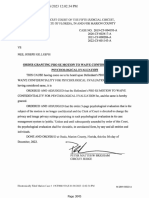

- Order Granting Motion To Waive Confidentiality For Psychological EvaluationDocument7 pagesOrder Granting Motion To Waive Confidentiality For Psychological EvaluationNeil GillespieNo ratings yet

- Jailhouse Federal Habeas Corpus Petition From The Marion County Jail, Ocala FloridaDocument116 pagesJailhouse Federal Habeas Corpus Petition From The Marion County Jail, Ocala FloridaNeil GillespieNo ratings yet

- Notice of Filing Love Letters From Sarah ThompsonDocument11 pagesNotice of Filing Love Letters From Sarah ThompsonNeil GillespieNo ratings yet

- Notice of Prosecutorial Misconduct Case 2022-Cf-1143Document43 pagesNotice of Prosecutorial Misconduct Case 2022-Cf-1143Neil GillespieNo ratings yet

- Verified Notice of Nolle Prosequi in Case 2020-CF-2417Document31 pagesVerified Notice of Nolle Prosequi in Case 2020-CF-2417Neil GillespieNo ratings yet

- Notice of Prosecutorial Misconduct Case 2021-Cf-0286Document79 pagesNotice of Prosecutorial Misconduct Case 2021-Cf-0286Neil GillespieNo ratings yet

- Appendix Prosecutorial Misconduct 2022-Cf-1143Document187 pagesAppendix Prosecutorial Misconduct 2022-Cf-1143Neil GillespieNo ratings yet

- Jailhouse Amended Verified Motion To Dismiss Charges Against DefendantDocument19 pagesJailhouse Amended Verified Motion To Dismiss Charges Against DefendantNeil GillespieNo ratings yet