Professional Documents

Culture Documents

Sample Payroll Record - Farm Labor

Sample Payroll Record - Farm Labor

Uploaded by

ABOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Payroll Record - Farm Labor

Sample Payroll Record - Farm Labor

Uploaded by

ABCopyright:

Available Formats

Sample Payroll Record - Farm Labor

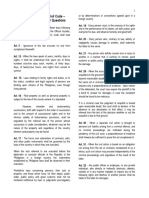

NYS Department of Labor

Note: This is a sample only. The Department of Labor does not furnish these forms.

Division of Labor Standards

Payroll Record

Week ending:

1

Name and Address

of Each Worker *

2

Social

Security

Number

Show hours worked for all employees.

In addition, show units produced for

piece rate employees

S

T W

Total

Rate of Pay

Hourly

Rate

Piece

Rate

Cash

Wages

Earned

6

Allowances

(If claimed

as part of

minimum

wage)

7

Total

Wages

Hrs.

Units

Hrs.

Units

Hrs.

Units

Hrs.

Units

Hrs.

Units

Hrs.

Units

Hrs.

Units

Column 4 - Rate of Pay - enter hourly rate, if employee is paid on hourly basis. If paid on other than hourly or piece basis, indicate such basis.

For piece worker, enter the amount paid per unit and units used - example 50 cents per bushel.

Column 5 - The total wages earned at rates shown in column #4.

Column 6 - The amount claimed as credit for meals and other allowances in the wage orders.

Column 7 - Total of cash wages and allowances. This figure, when divided by hours worked, must equal or exceed the current hourly minimum wage.

Column 8 - Social Security Deduction

Column 9 -10 - Deductions permitted by law.

Column 11 - Actual cash paid to employee.

* Additional information required for employees:

1)

A record of date of birth of the minor and the name of the parent or guardian

for every minor under 17 years of age, employed as a hand-harvest worker on the

same farm as his parent or guardian and who is paid on a piece-rate basis at the

same piece rate as employees 17 years of age or over.

2)

For minors under 16 years of age, the farm work permit number issued to such employee.

3)

Copy of applicable employee work agreement.

LS 455 (03/14)

8

Social

Security

10

Deductions

11

Net

Wages

Paid

You might also like

- Answer To Interrogatories Case 3Document3 pagesAnswer To Interrogatories Case 3AB100% (2)

- SAP HR and Payroll Wage TypesDocument2 pagesSAP HR and Payroll Wage TypesMuhammad Javeed100% (1)

- Auditing Payroll Systems Case Study: Roger CompanyDocument1 pageAuditing Payroll Systems Case Study: Roger CompanygeyeolNo ratings yet

- Example 4.2: Aggregate Planning ModelsDocument36 pagesExample 4.2: Aggregate Planning ModelsLaís ContierNo ratings yet

- UNIT 3 Employee OnDocument10 pagesUNIT 3 Employee OnMeghraj ChoudharyNo ratings yet

- Busmath Reviewer ColazzonDocument3 pagesBusmath Reviewer ColazzonHaedriel CapiliNo ratings yet

- Labour Cost and Systems of Wage PaymentDocument19 pagesLabour Cost and Systems of Wage PaymentAnusha_SahukaraNo ratings yet

- Labour Costing PptDocument98 pagesLabour Costing PptsebastgeofreyNo ratings yet

- Payroll Monthly SampleDocument57 pagesPayroll Monthly Samplejak kad1No ratings yet

- MCR Step by StepDocument13 pagesMCR Step by StepAna Cristina Raluca CostacheNo ratings yet

- Process of Payroll System and Establish & Maintain PayrolDocument17 pagesProcess of Payroll System and Establish & Maintain Payrolarifmustefa03No ratings yet

- Cac 2Document8 pagesCac 2cesiareenaNo ratings yet

- Wages and Salary AdministrationDocument20 pagesWages and Salary AdministrationKamaldeep Kaur GrewalNo ratings yet

- Salary Payslip SampleDocument38 pagesSalary Payslip SamplemaxiforddNo ratings yet

- Methods of Wage PaymentsDocument11 pagesMethods of Wage PaymentsKajal Mehta100% (1)

- ERP Blog 11Document6 pagesERP Blog 11Avinash Ganesh PuratNo ratings yet

- Pay SlipDocument2 pagesPay SlipAbhilash KanaparthiNo ratings yet

- Salary and Overtime Pay Computation Using A Spread SheetDocument4 pagesSalary and Overtime Pay Computation Using A Spread SheetJade ivan parrochaNo ratings yet

- Wage Type Screen ShotsDocument33 pagesWage Type Screen ShotsBhoj RawalNo ratings yet

- Incentive System of WagesDocument3 pagesIncentive System of WagesÑàdààñ ShubhàmNo ratings yet

- PTO EverytingDocument34 pagesPTO Everytingbala.oracleappsNo ratings yet

- SAP HCM Payroll Concept: Reference by Guru99Document17 pagesSAP HCM Payroll Concept: Reference by Guru99Ritu Gupta100% (4)

- Labour CostingDocument27 pagesLabour CostingkalongolelamaryNo ratings yet

- HR fORMULAEDocument1 pageHR fORMULAESukeshni ThakurNo ratings yet

- Monthly Statement PF PayrollDocument2 pagesMonthly Statement PF PayrollRaju BhaiNo ratings yet

- Accounting For Labor Slides LMSDocument33 pagesAccounting For Labor Slides LMSPrince Nanaba EphsonNo ratings yet

- SAP HCM Study Material - PayrollDocument8 pagesSAP HCM Study Material - PayrollAditya_Vickram_540No ratings yet

- Wages and IncentivesDocument16 pagesWages and IncentivesMariya Johny100% (1)

- Concept:: Unit - Iv Wage and Salary AdministrationDocument27 pagesConcept:: Unit - Iv Wage and Salary AdministrationSai PrabhasNo ratings yet

- Concept:: Unit - Iv Wage and Salary AdministrationDocument27 pagesConcept:: Unit - Iv Wage and Salary AdministrationSai PrabhasNo ratings yet

- Concept:: Unit - Iv Wage and Salary AdministrationDocument27 pagesConcept:: Unit - Iv Wage and Salary AdministrationSai PrabhasNo ratings yet

- Wages and Salary DeterminationDocument13 pagesWages and Salary DeterminationDAN OSSONo ratings yet

- If You Start Using The Spreadsheet Mid-Year Time Off Award Donate Annual LeaveDocument35 pagesIf You Start Using The Spreadsheet Mid-Year Time Off Award Donate Annual LeavejavedkaleemNo ratings yet

- US DOL Fact Sheet 21Document2 pagesUS DOL Fact Sheet 21Sw00sh04No ratings yet

- PayrollDocument28 pagesPayrollMaayur MittapallyNo ratings yet

- Hiring Process HRDocument46 pagesHiring Process HRHOSAM HUSSEINNo ratings yet

- Shalu GuptaDocument5 pagesShalu GuptaRitesh SinghNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsRia GabsNo ratings yet

- Income Tax Calculator SampleDocument10 pagesIncome Tax Calculator SamplesumondccNo ratings yet

- SAP HR and Payroll Wage TypesDocument3 pagesSAP HR and Payroll Wage TypesBharathk Kld0% (1)

- Instructions For Using 2007 Summer Pay CalculatorDocument3 pagesInstructions For Using 2007 Summer Pay CalculatorDocgleNo ratings yet

- Useful Info On Wage Type CharacteristicsDocument6 pagesUseful Info On Wage Type Characteristicsnuta24No ratings yet

- Wage and Salary AdministrationDocument20 pagesWage and Salary AdministrationURSULA BALAONo ratings yet

- Incentive SchemeDocument4 pagesIncentive Schemerahulravi4u100% (1)

- KSRTCDocument39 pagesKSRTCVidyaNo ratings yet

- During Your Base Period? Were You Unable To WorkDocument1 pageDuring Your Base Period? Were You Unable To WorkKen SuNo ratings yet

- Acts Influence Compensation StructureDocument6 pagesActs Influence Compensation StructureCyrus FernzNo ratings yet

- Wages and Its TypesDocument17 pagesWages and Its TypesAditya JoshiNo ratings yet

- LABOUR REMUNERATION Presention1Document10 pagesLABOUR REMUNERATION Presention1peterkiamaw492No ratings yet

- Lecture Notes Labor LawDocument3 pagesLecture Notes Labor LawMaphile Mae CanenciaNo ratings yet

- Meaning of Labour CostDocument12 pagesMeaning of Labour CostNandan Kumar JenaNo ratings yet

- 7 Benchmarking Mercer 2010 MethodologyDocument17 pages7 Benchmarking Mercer 2010 MethodologyAdelina Ade100% (2)

- Annual Leave TemplateDocument8 pagesAnnual Leave TemplateNakkolopNo ratings yet

- Wage Type CharacteristicsDocument29 pagesWage Type Characteristicsananth-jNo ratings yet

- Understanding The Central Responsibilities of The Nurse ManagerDocument4 pagesUnderstanding The Central Responsibilities of The Nurse ManagerSarah Ann Jamilla FaciolanNo ratings yet

- Staffing Plan TemplateDocument3 pagesStaffing Plan Templateameer100% (2)

- Fringe BenefitsDocument16 pagesFringe Benefitsnmhrk1118No ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Del Carmen Vs BacoyDocument4 pagesDel Carmen Vs BacoyAB100% (1)

- Top 400 Provisions of The Civil CodeDocument39 pagesTop 400 Provisions of The Civil CodeABNo ratings yet

- De Mendez Vs DabonDocument5 pagesDe Mendez Vs DabonABNo ratings yet

- "I'll Never Love Again": (Chorus)Document1 page"I'll Never Love Again": (Chorus)ABNo ratings yet

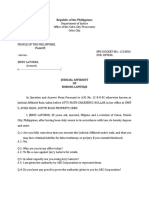

- Judicial Affidavit of Bobong LapetajeDocument4 pagesJudicial Affidavit of Bobong LapetajeABNo ratings yet

- 1 Contract CondoDocument7 pages1 Contract CondoABNo ratings yet

- Deja VuDocument3 pagesDeja VuABNo ratings yet

- Employment Contract Annex BDocument2 pagesEmployment Contract Annex BABNo ratings yet

- Blue Ridge by Ellen Bryant VoigtDocument2 pagesBlue Ridge by Ellen Bryant VoigtABNo ratings yet

- Tenderness and Rot by KAY RYANDocument1 pageTenderness and Rot by KAY RYANABNo ratings yet

- Annex 1 Purchase OrderDocument1 pageAnnex 1 Purchase OrderABNo ratings yet

- Valentine by Tom PickardDocument1 pageValentine by Tom PickardABNo ratings yet

- Republic Act No Ra 10168Document10 pagesRepublic Act No Ra 10168ABNo ratings yet

- A Glimpse by Walt WhitmanDocument1 pageA Glimpse by Walt WhitmanABNo ratings yet

- Solve For X by Oliver Dela PazDocument1 pageSolve For X by Oliver Dela PazABNo ratings yet

- For Robert Philen: Related Poem Content DetailsDocument1 pageFor Robert Philen: Related Poem Content DetailsABNo ratings yet

- Tel Convo 1Document12 pagesTel Convo 1ABNo ratings yet

- What Is Debating?: StyleDocument15 pagesWhat Is Debating?: StyleABNo ratings yet