Professional Documents

Culture Documents

Customer Information Form CIF Rev 02-12-17 2014

Customer Information Form CIF Rev 02-12-17 2014

Uploaded by

Zoryel MontanoCopyright:

Available Formats

You might also like

- Termination FormDocument1 pageTermination FormMMdrNo ratings yet

- Easytrip RFID Subscription Form and Terms ConditionDocument4 pagesEasytrip RFID Subscription Form and Terms ConditionJen TurlaNo ratings yet

- Philippine Seven Corporation: CertificationDocument1 pagePhilippine Seven Corporation: Certificationmikee guimbalNo ratings yet

- Mayor's Permit QC 2 - 2Document2 pagesMayor's Permit QC 2 - 2Zachary YapNo ratings yet

- Yummy Company (YC) Opens A Branch in Davao City: Location StrategyDocument9 pagesYummy Company (YC) Opens A Branch in Davao City: Location StrategyPaulo TorresNo ratings yet

- 1-BPI-Philam Cash Surrender Form P1-4 CC Copy4!28!21Document4 pages1-BPI-Philam Cash Surrender Form P1-4 CC Copy4!28!21JunMamauagDelaCruzNo ratings yet

- Dear SmartDocument1 pageDear Smarthannah100% (1)

- SSS Disbursement Account Enrollment Module RemindersDocument2 pagesSSS Disbursement Account Enrollment Module Remindersgemvillarin100% (3)

- FPF060 Member'sContributionRemittance V01Document3 pagesFPF060 Member'sContributionRemittance V01christine_balanagNo ratings yet

- Car Sticker Form & GuidelinesDocument2 pagesCar Sticker Form & GuidelinesCrisline Pilapil100% (1)

- Hand Hell Ge FanucDocument64 pagesHand Hell Ge FanucLuis Humberto Ruiz BetanzosNo ratings yet

- BFP Pensioner Update FormDocument4 pagesBFP Pensioner Update FormBfp Tigaon Cam Sur0% (1)

- Membership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Document2 pagesMembership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Sevy D PoloyapoyNo ratings yet

- Gcash FormDocument1 pageGcash FormJohn Mari Lloyd DaosNo ratings yet

- Asian Homes - Pag-IBIG Multi-Purpose Loan ApplicationDocument1 pageAsian Homes - Pag-IBIG Multi-Purpose Loan ApplicationRodolfo Gamboa Pinzon100% (1)

- Application Form For Airgun Registration PDFDocument2 pagesApplication Form For Airgun Registration PDFEroll L. RodriguezNo ratings yet

- Transaction SlipDocument2 pagesTransaction SlipSIMPLEJG88% (8)

- 1905 January 2018 ENCS - Corrected PDFDocument3 pages1905 January 2018 ENCS - Corrected PDFJoseph Jr TengayNo ratings yet

- Certificate of Employment - ClubDocument2 pagesCertificate of Employment - ClubRenelito Dichos TangkayNo ratings yet

- Move-Out Clearance For Tenant/S: Additional Instructions by Chief Engineer And/computation by Accounting, If AnyDocument1 pageMove-Out Clearance For Tenant/S: Additional Instructions by Chief Engineer And/computation by Accounting, If AnytristanmunarNo ratings yet

- Sample Acknowledgment LetterDocument6 pagesSample Acknowledgment LetterKathleen LiraNo ratings yet

- RHED Financing Application Form 1Document2 pagesRHED Financing Application Form 1Kenneth Inui100% (1)

- Subscription Certificate PLDT Home Voice (Landline) and Data (Broadband) ServicesDocument3 pagesSubscription Certificate PLDT Home Voice (Landline) and Data (Broadband) Servicesneo14100% (1)

- Authorization Letter Sss Loan ApplicationDocument1 pageAuthorization Letter Sss Loan ApplicationnashapkNo ratings yet

- HLF058 Bvs-Da V03Document1 pageHLF058 Bvs-Da V03James CaberaNo ratings yet

- Application For Re-Admission: Admission and Registration Section ServicesDocument2 pagesApplication For Re-Admission: Admission and Registration Section ServicesDianneBarcelonaNo ratings yet

- Autorization LetterDocument1 pageAutorization LetterhungrynomadphNo ratings yet

- Authorization LetterDocument2 pagesAuthorization LetterCraze AhmedNo ratings yet

- V LUNA PHS TemplateDocument12 pagesV LUNA PHS TemplateDexel Lorren ValdezNo ratings yet

- Skybroadband Authorization LetterDocument1 pageSkybroadband Authorization LetterSaid SayreNo ratings yet

- Form For Ingress and EgressDocument4 pagesForm For Ingress and Egressrhizza basilioNo ratings yet

- Dswd-Rla Form 2 - Application Form For Reg License - FoundationDocument4 pagesDswd-Rla Form 2 - Application Form For Reg License - Foundationentabs201650% (2)

- COE Clark Tech Hub 45Document2 pagesCOE Clark Tech Hub 45Neil Andra PascualNo ratings yet

- Landbank LetterDocument1 pageLandbank LetterFrancia AbieraNo ratings yet

- LandBank - Cash Card FormDocument2 pagesLandBank - Cash Card FormPete Rahon94% (16)

- Sponsorship LetterDocument2 pagesSponsorship LetterAlou Mae Pedrigal RaganitNo ratings yet

- Notre Dame of Trece Martires: Tel. No 046-4192484Document1 pageNotre Dame of Trece Martires: Tel. No 046-4192484Irene Dulay100% (3)

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- Scholarship Application FormDocument2 pagesScholarship Application Formrobyngaylebautista2No ratings yet

- R E N E W A L F O R M: "Tulong Pang-Edukasyon para Sa Bulakenyo"Document2 pagesR E N E W A L F O R M: "Tulong Pang-Edukasyon para Sa Bulakenyo"T VinassaurNo ratings yet

- Site Inspection-Affidavit - Water Supply SystemDocument1 pageSite Inspection-Affidavit - Water Supply SystemWam OwnNo ratings yet

- eSRS GuideDocument3 pageseSRS GuideJulio LuisNo ratings yet

- Curriculum Vitae: Application FormDocument2 pagesCurriculum Vitae: Application FormKeisha Pearl Jaime SillaNo ratings yet

- SSS Change RequestDocument3 pagesSSS Change RequestAngelica SarzonaNo ratings yet

- PPG Annex B-1 - AAO Electronic Online System FormDocument2 pagesPPG Annex B-1 - AAO Electronic Online System FormFatima Bognadon100% (1)

- Sir/Madame:: Enclosure 4: Transmittal and Acknowledgement Receipt (Schools)Document1 pageSir/Madame:: Enclosure 4: Transmittal and Acknowledgement Receipt (Schools)Paul BronNo ratings yet

- Termination Letter PLDTDocument1 pageTermination Letter PLDTJunRobotboi100% (2)

- Converge LetterDocument1 pageConverge LetterDaphne Beloro0% (1)

- Buyer Registration Form: Procurement Service - PhilgepsDocument2 pagesBuyer Registration Form: Procurement Service - PhilgepsJefferson DayoNo ratings yet

- BancNet EGov Users Manual For SSS FinalDocument27 pagesBancNet EGov Users Manual For SSS FinalAnthony Santos50% (2)

- Damayan Membership Application Form: SCHOOL/OFFICE ADDRESSDocument1 pageDamayan Membership Application Form: SCHOOL/OFFICE ADDRESSRoselyn San Diego PacaigueNo ratings yet

- Affidavit of Loss: Republic of The Philippines) ) S.S. City of Meycauayan)Document1 pageAffidavit of Loss: Republic of The Philippines) ) S.S. City of Meycauayan)Cherilou Tanglao100% (2)

- Submission and Updating of 201 Files Download Black Ball PenDocument1 pageSubmission and Updating of 201 Files Download Black Ball PenCarlie MaeNo ratings yet

- What's New Feature - PHIC New Case Rate v2Document41 pagesWhat's New Feature - PHIC New Case Rate v2nhamokidNo ratings yet

- Atty. Jose V. GambitoDocument11 pagesAtty. Jose V. GambitoPROCEDE NUEVA VIZCAYANo ratings yet

- PA - PRO1 2019-015 Submission of Scanned Copy of CF4 As Additional Claim Requirement Until December 31, 2019Document1 pagePA - PRO1 2019-015 Submission of Scanned Copy of CF4 As Additional Claim Requirement Until December 31, 2019Leonard Paris GabatNo ratings yet

- Sample Template For MOTORCYCLEDocument2 pagesSample Template For MOTORCYCLEJoshKristina NavarroNo ratings yet

- WNB-Contract Jess TaayDocument2 pagesWNB-Contract Jess TaayAting NavarroNo ratings yet

- Cir 220556064300-2Document1 pageCir 220556064300-2LRD ComputersNo ratings yet

- Maxicare Cif-2Document1 pageMaxicare Cif-2Eprs 033No ratings yet

- Gsis TCDocument2 pagesGsis TCricricafort21No ratings yet

- 610 10th Ed Datasheets (SI)Document11 pages610 10th Ed Datasheets (SI)sjois_hsNo ratings yet

- Electronic Warfare11Document5 pagesElectronic Warfare11Dyana AnghelNo ratings yet

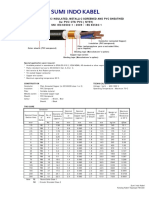

- 600/1000 V PVC Insulated, Metallic Screened and PVC Sheathed Cu/Pvc/Cts/Pvc (Nysy) SNI IEC 60502-1: 2009 / IEC 60502-1Document3 pages600/1000 V PVC Insulated, Metallic Screened and PVC Sheathed Cu/Pvc/Cts/Pvc (Nysy) SNI IEC 60502-1: 2009 / IEC 60502-1Muhamad YasrinNo ratings yet

- Linear WinchesDocument12 pagesLinear Winchesfrdsim50% (2)

- Day To Day Duties of A FirefighterDocument6 pagesDay To Day Duties of A FirefighterStanka ZahurancováNo ratings yet

- Deviation in Pharma: What Is A DeviationDocument2 pagesDeviation in Pharma: What Is A DeviationAshok KumarNo ratings yet

- A Chinese Brand That Leads With Quality: Great Wall Motor Company LimitedDocument8 pagesA Chinese Brand That Leads With Quality: Great Wall Motor Company LimitedDana Ross Capcha MaximilianoNo ratings yet

- New DDL Week 4 June 27-30Document4 pagesNew DDL Week 4 June 27-30Josenia Constantino0% (1)

- General Construction Notes: S-2 Proposed 4-Storey ApartmentDocument1 pageGeneral Construction Notes: S-2 Proposed 4-Storey ApartmentArch. John Bernard AbadNo ratings yet

- CIGRE-HVDC-SCB4 - 2015 - Colloquium - Paper ALLDocument389 pagesCIGRE-HVDC-SCB4 - 2015 - Colloquium - Paper ALLJose Valdivieso100% (1)

- Airflow FormulasDocument16 pagesAirflow FormulasJames ChanNo ratings yet

- Egret Complete ProposalDocument99 pagesEgret Complete ProposalBRAYAN SARNo ratings yet

- Manuale - MGV25 - ENG - vs3 - 7 MOTORDocument20 pagesManuale - MGV25 - ENG - vs3 - 7 MOTORAdan CaceresNo ratings yet

- Infineon IGCM04G60HA DS v02 - 04 EN PDFDocument16 pagesInfineon IGCM04G60HA DS v02 - 04 EN PDFsupriyo110No ratings yet

- CEt 2019Document2 pagesCEt 2019Amit MishraNo ratings yet

- Premier Guitar 022017Document244 pagesPremier Guitar 022017franekzapa100% (3)

- Check in Preocedures DialogueDocument5 pagesCheck in Preocedures DialogueNina OaipNo ratings yet

- Analog IC DesignDocument4 pagesAnalog IC DesignMinh ThiệuNo ratings yet

- Elastomeric Seals and Materials at Cryogenic TemeraturesDocument81 pagesElastomeric Seals and Materials at Cryogenic Temeraturesjohndoe_218446No ratings yet

- EBTANASDocument6 pagesEBTANASSri HandayaniNo ratings yet

- Lecture35 Ch12 CoherenceDocument25 pagesLecture35 Ch12 Coherencepavan457No ratings yet

- Rotary Airlock Combined-Manual Final PDFDocument53 pagesRotary Airlock Combined-Manual Final PDFMechanical ShauryaNo ratings yet

- Indoor + Outdoor Substation With Generator RoomDocument1 pageIndoor + Outdoor Substation With Generator RoomMukterNo ratings yet

- Komatsu Training Academy Training CalendarDocument4 pagesKomatsu Training Academy Training CalendarZIBA KHADIBI100% (1)

- LECO Evacuated Pin TubesDocument2 pagesLECO Evacuated Pin TubesBoris ChicomaNo ratings yet

- PLC Operation - 8.1Document9 pagesPLC Operation - 8.1GvidonNo ratings yet

- Hydro Box Service Manual 202301Document26 pagesHydro Box Service Manual 202301Stjepan KrpanNo ratings yet

- Anticorodal50 Englisch 01Document1 pageAnticorodal50 Englisch 01dmalfazNo ratings yet

Customer Information Form CIF Rev 02-12-17 2014

Customer Information Form CIF Rev 02-12-17 2014

Uploaded by

Zoryel MontanoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Information Form CIF Rev 02-12-17 2014

Customer Information Form CIF Rev 02-12-17 2014

Uploaded by

Zoryel MontanoCopyright:

Available Formats

Maxicare Healthcare Corporation

Main Office: Maxicare Tower, 203 Salcedo Street, Legaspi Village, Makati City

Call Center Toll-Free No.: 1-800-10-5821-900 or 1-800-8-5821-900

Call Center Hotline: 582-1900 or 798-7777

SMS Inquiry: 0918-889 MAXI (6294)

Homepage: http://www.maxicare.com.ph

Customer Information Form

INSTRUCTIONS: Please fill out this form and attach all original documents. This form should be submitted to Maxicare Healthcare

Corporation. Please ensure that all pertinent information are completely accomplished and written in PRINT.

MEMBER GENERAL INFORMATION

Cardholders Name

Maxicare Card No.

(Last Name, First Name, Middle Name)

TIN

SSS No.

Unified ID No.

Passport No.

Date of Birth (mm/dd/yyy)

Place of Birth

(City/Municipality, Province, Zip Code)

Mothers Maiden Name (Last Name, First Name, Middle Name)

E-mail Address

Present Address

Mobile No.

(No., Street, Subd., City/Municipality, Province, Zip Code)

Permanent Address

Civil Status

Home Phone

(City/Municipality, Province, Zip Code)

Single

Married

Widow(er)

Separated

Educational Attainment

Gender

Citizenship

Female

Male

Occupation

Name of Business/Employer/School (Corp Code Account Name)

Position

Nature of Business/Work

Source of Fund

Valid ID

(Please check the box with the photocopy of valid ID card to be submitted to Maxicare)

Company ID**

Postal ID

Senior Citizen Card

PRC ID

Drivers License*

Police Clearance

OWWA ID

SSS Card

GOCC IDs

OFW ID

Alien Certificate of

Registration***

Voters ID

GSIS e-card

Seamans book

Passport*

NBI Clearance

Students ID****

Integrated Bar of the

Philippines ID

By signing below I/We hereby acknowledge that I/we have read, understood and agreed to abide by and be bound, jointly and

severally, by the terms and conditions governing the Maxicare Card stated at the back of the form. I/We further warrant that all

information given by me/us in this application are true and correct. I/We authorize Maxicare and EqB to confirm all information from

whatever source and procedure it may choose.

Members Signature

*

**

***

****

Date

local or foreign issued;

issued by private entities registered and regulated by SEC, BSP or IC;

or Immigrant Certificate Registration;

signed by head of school or principal

Underwriting / December 17, 2014 / FO-URG-0.003 / Rev.02

TERMS AND CONDITIONS

1.

Definition of Terms

a) Maxicare Card (Card). This Card is a personal and non-transferable health card distributed by Maxicare to its members as Maxicare membership ID. At the

same time, said Card has a cash card feature which may be loaded with funds through the EqB-Medilink XP facility. As a cash card, it functions both as an ATM and

purchase card to the extent of the maximum value/amount loaded into the Card, subject to the limits set forth by EqB.

The amount loaded into the Card shall not earn interest, and shall not be subject to rewards or other similar incentives convertible to cash, nor be purchased at a

discount. It is understood that the Card is not a deposit account; hence, it is not insured with the Philippine Deposit Insurance Corporation.

b) Automated Teller Machine (ATM). A designated teller machine that dispenses cash and provides account related services once the Card is inserted and the

correct Personal Identification Number (PIN) associated with the Card is entered and verified by the machine.

c) Electronic Data Capture (EDC) Terminal. A Point of Sale (POS) terminal that reads the card details on the Card magnetic stripe when the card is swiped

through the terminal, without the need of a manual imprinter and/or having merchant's representatives manually enter the information.

Ang Maxicare Card (Card) ay isang Prepaid card na mula sa Equicom Savings Bank (EqB) sa pamamagitan ng MediLink. Ang Card ay nakapangalan sa taong

nagmamay-ari nito at hindi maaaring ipagamit sa iba. Ito ay magagamit na pangwithdraw ng cash mula sa ATM at pambili ng anuman hanggang sa buong halaga na

napakaloob dito. Ito ay hindi kumikita ng interest o magagamit na pambali ng may anumang diskwento. Hindi ito ordinaryong deposito sa bangko kaya hindi ito

nakaseguro sa Philippine Deposit Insurance Corporation.

2.

Responsibilities of the Cardholder - The Cardholder should sign the Card immediately upon receipt thereof. The Cardholder should remember his PIN and shall be

fully responsibile for the security, custody and possession of the Card and PIN as well as any transaction made using the said Card. Further, it is the responsibility of

the Cardholder to report lost/stolen Card immediately to the Maxicare Hotlines or Equicom 24/7 Customer Service.

The Cardholder undertakes to provide the necessary KYC documents and information required or which will be required by EqB.

3.

Loss or Theft of Card In case the Card is lost or stolen, the Cardholder shall immediately report it to Equicom 24/7 Customer Service or Maxicare Customer

Service. Likewise, the Cardholder shall submit a duly notarized Affidavit of Loss as a pre-requisite for the Card replacement. However, purchases and ATM

transactions made prior to reporting to Equicom 24/7 Customer Service or Maxicare shall be for the sole account of the Cardholder. Further, as the Cardholder is

responsible for the security of the Card and the PIN, any unauthorized withdrawals shall be charged to the Cardholder as long as the Card used matches with the PIN

registered in EqBs system. Applicable fees shall be charged accordingly for the replacement of the Card. The remaining balance left on the declared lost Card shall

be transferred to the new/replacement Card. The Cardholder shall render EqB and Maxicare free and harmless for any losses due to theft or fraud that have occurred

prior to the reporting required herein.

4.

Expiry of the Card The Card shall be valid until the last day of the contract with Maxicare. Following the last day of the contract with Maxicare, the cash card

feature of said Card shall also be terminated. The period may be shortened: (a) when the Cardholder voluntarily cancels and surrenders the Card to EqB or (b)

when Maxicare cancels the Card. The Card shall be allowed for renewal upon approval of Maxicare. Following the renewal, a new Card with the same Card number

and PIN shall be issued to the Cardholder.

EqB shall terminate the cash card function of the Card due to zero card value, and may be reactivated upon the loading of funds.

5.

Card Acceptability The Card functions as a regular ATM Card such that the Cardholder can access their account at EqB ATMs or any Megalink and Bancnet

ATMs in the Philippines thru PIN verification. It also functions as a purchase card up to the value loaded into the Card and is honored at Bancnet merchants

nationwide. Each time the Card is used at ATMs or participating merchants, the transaction amount is immediately deducted from the remaining value of the Card. It

is the responsibility of the Cardholder to keep track of the available balance on the Card. Merchants will not be able to determine the available balance on the Card.

The available balance and card transaction details can be obtained at www.equicomsavings.com or via Equicom 24/7 Customer Service, internet banking quick

inquiry or via the EqB Mobile Banking (text INQ <card number that starts with 116801> to 0918-818-EQUI (3784).

6.

ATM Transaction Fees-Transaction fees shall be imposed on the following ATM transactions using the Card: (a) applicable fees shall apply for every successful

ATM transactions done at any ATM other than EqB ATMs in the Philippines. The said ATM transaction fees shall be deducted immediately from the remaining card

balance and shall be subject to change without prior notice.

7.

Transaction Receipt For purchases using the Card, the transaction receipt shall be provided by the merchants after every successful POS transaction. The

Cardholder shall sign the transaction receipt and retains a copy thereof.. An ATM transaction receipt is likewise provided for every ATM transaction. It is the

responsibility of the Cardholder to monitor and review all his transactions. Disputed transactions should be reported immediately within 10 calendar days from

transaction date; otherwise, the transactions will be considered as valid.

8.

Denied/Declined Transaction A transaction may be declined/denied based on the following: (a) Card has no sufficient balance; (b) POS terminal at the merchant

establishment is off-line; or (c) the Card is either suspended or blocked. The Cardholder expressly holds EqB, Maxicare, and MediLink free and harmless from any

liability for these denied/declined transactions. The Cardholder shall be responsible for ascertaining the remaining balance of contained in the Card.

9.

Erroneous Loading- The Cardholder hereby authorizes EqB to automatically debit an amount erroneously loaded into the Card. The Cardholder shall render EqB

free and harmless for this debiting.

10. Issuance of Managers Check- The Cardholder authorizes EqB to automatically debit the remaining balance in the Card and issue a Managers Check in favor of

the Cardholder covering the remaining amount in the following instances:

Termination of employment/resignation/separation of the Cardholder from Maxicares Client.

Cancellation of the Card due to the non-renewal of the Maxicare Health plan by the client of Maxicare or cancellation of the Card by Maxicare for any other

reasons.

Expiration of the Card as stated in paragraph 4.

In cases when withdrawal of funds through ATM and purchase through POS is not feasible.

The Cardholder shall render EqB free and harmless from any liabilities that may arise in effecting this authority.

11.

Non-transferability Clause The Card is the sole property of Equicom Savings Bank. The cash card privileges and health card functions may be terminated by

either EqB and/or Maxicare at any time for whatever cause. The Cardholder agrees to hold EqB and Maxicare free and harmless from any claim for damages arising

from such termination

12. Amendments EqB, MediLink, and Maxicare may at any time and for whatever reason, amend, revise or modify this Agreement when deemed necessary and shall

inform the Cardholder by publication, posting or any other means that EqB deems proper. Following this, the Cardholders continuous usage of the Card shall be

deemed as acceptance of said amendment/s.

13. Venue of Action, Attorneys Fees, Damages Should judicial action be necessary to enforce this Agreement, or to collect the Cardholders obligation under this

Agreement, venue of all actions shall be in Makati City. In case the account is referred to a collection agency or law firm, Cardholder agrees to pay the cost of

collection and attorneys fees.

14. Separability Clause Should any provision of this Agreement be declared unconstitutional, invalid or unenforceable by a court of competent jurisdiction, such

declaration shall not affect in any manner whatsoever the constitutionality, validity or enforceability of other provisions.

15. Acknowledgement- By using the Card, the Cardholder acknowledges having received a copy of, read, understood and agree to be bound by the terms and

conditions also set out herein.

Conforme:

Signature over Printed Name

Date Signed

Underwriting / December 17, 2014 / FO-URG-0.003 / Rev.02

You might also like

- Termination FormDocument1 pageTermination FormMMdrNo ratings yet

- Easytrip RFID Subscription Form and Terms ConditionDocument4 pagesEasytrip RFID Subscription Form and Terms ConditionJen TurlaNo ratings yet

- Philippine Seven Corporation: CertificationDocument1 pagePhilippine Seven Corporation: Certificationmikee guimbalNo ratings yet

- Mayor's Permit QC 2 - 2Document2 pagesMayor's Permit QC 2 - 2Zachary YapNo ratings yet

- Yummy Company (YC) Opens A Branch in Davao City: Location StrategyDocument9 pagesYummy Company (YC) Opens A Branch in Davao City: Location StrategyPaulo TorresNo ratings yet

- 1-BPI-Philam Cash Surrender Form P1-4 CC Copy4!28!21Document4 pages1-BPI-Philam Cash Surrender Form P1-4 CC Copy4!28!21JunMamauagDelaCruzNo ratings yet

- Dear SmartDocument1 pageDear Smarthannah100% (1)

- SSS Disbursement Account Enrollment Module RemindersDocument2 pagesSSS Disbursement Account Enrollment Module Remindersgemvillarin100% (3)

- FPF060 Member'sContributionRemittance V01Document3 pagesFPF060 Member'sContributionRemittance V01christine_balanagNo ratings yet

- Car Sticker Form & GuidelinesDocument2 pagesCar Sticker Form & GuidelinesCrisline Pilapil100% (1)

- Hand Hell Ge FanucDocument64 pagesHand Hell Ge FanucLuis Humberto Ruiz BetanzosNo ratings yet

- BFP Pensioner Update FormDocument4 pagesBFP Pensioner Update FormBfp Tigaon Cam Sur0% (1)

- Membership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Document2 pagesMembership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Sevy D PoloyapoyNo ratings yet

- Gcash FormDocument1 pageGcash FormJohn Mari Lloyd DaosNo ratings yet

- Asian Homes - Pag-IBIG Multi-Purpose Loan ApplicationDocument1 pageAsian Homes - Pag-IBIG Multi-Purpose Loan ApplicationRodolfo Gamboa Pinzon100% (1)

- Application Form For Airgun Registration PDFDocument2 pagesApplication Form For Airgun Registration PDFEroll L. RodriguezNo ratings yet

- Transaction SlipDocument2 pagesTransaction SlipSIMPLEJG88% (8)

- 1905 January 2018 ENCS - Corrected PDFDocument3 pages1905 January 2018 ENCS - Corrected PDFJoseph Jr TengayNo ratings yet

- Certificate of Employment - ClubDocument2 pagesCertificate of Employment - ClubRenelito Dichos TangkayNo ratings yet

- Move-Out Clearance For Tenant/S: Additional Instructions by Chief Engineer And/computation by Accounting, If AnyDocument1 pageMove-Out Clearance For Tenant/S: Additional Instructions by Chief Engineer And/computation by Accounting, If AnytristanmunarNo ratings yet

- Sample Acknowledgment LetterDocument6 pagesSample Acknowledgment LetterKathleen LiraNo ratings yet

- RHED Financing Application Form 1Document2 pagesRHED Financing Application Form 1Kenneth Inui100% (1)

- Subscription Certificate PLDT Home Voice (Landline) and Data (Broadband) ServicesDocument3 pagesSubscription Certificate PLDT Home Voice (Landline) and Data (Broadband) Servicesneo14100% (1)

- Authorization Letter Sss Loan ApplicationDocument1 pageAuthorization Letter Sss Loan ApplicationnashapkNo ratings yet

- HLF058 Bvs-Da V03Document1 pageHLF058 Bvs-Da V03James CaberaNo ratings yet

- Application For Re-Admission: Admission and Registration Section ServicesDocument2 pagesApplication For Re-Admission: Admission and Registration Section ServicesDianneBarcelonaNo ratings yet

- Autorization LetterDocument1 pageAutorization LetterhungrynomadphNo ratings yet

- Authorization LetterDocument2 pagesAuthorization LetterCraze AhmedNo ratings yet

- V LUNA PHS TemplateDocument12 pagesV LUNA PHS TemplateDexel Lorren ValdezNo ratings yet

- Skybroadband Authorization LetterDocument1 pageSkybroadband Authorization LetterSaid SayreNo ratings yet

- Form For Ingress and EgressDocument4 pagesForm For Ingress and Egressrhizza basilioNo ratings yet

- Dswd-Rla Form 2 - Application Form For Reg License - FoundationDocument4 pagesDswd-Rla Form 2 - Application Form For Reg License - Foundationentabs201650% (2)

- COE Clark Tech Hub 45Document2 pagesCOE Clark Tech Hub 45Neil Andra PascualNo ratings yet

- Landbank LetterDocument1 pageLandbank LetterFrancia AbieraNo ratings yet

- LandBank - Cash Card FormDocument2 pagesLandBank - Cash Card FormPete Rahon94% (16)

- Sponsorship LetterDocument2 pagesSponsorship LetterAlou Mae Pedrigal RaganitNo ratings yet

- Notre Dame of Trece Martires: Tel. No 046-4192484Document1 pageNotre Dame of Trece Martires: Tel. No 046-4192484Irene Dulay100% (3)

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- Scholarship Application FormDocument2 pagesScholarship Application Formrobyngaylebautista2No ratings yet

- R E N E W A L F O R M: "Tulong Pang-Edukasyon para Sa Bulakenyo"Document2 pagesR E N E W A L F O R M: "Tulong Pang-Edukasyon para Sa Bulakenyo"T VinassaurNo ratings yet

- Site Inspection-Affidavit - Water Supply SystemDocument1 pageSite Inspection-Affidavit - Water Supply SystemWam OwnNo ratings yet

- eSRS GuideDocument3 pageseSRS GuideJulio LuisNo ratings yet

- Curriculum Vitae: Application FormDocument2 pagesCurriculum Vitae: Application FormKeisha Pearl Jaime SillaNo ratings yet

- SSS Change RequestDocument3 pagesSSS Change RequestAngelica SarzonaNo ratings yet

- PPG Annex B-1 - AAO Electronic Online System FormDocument2 pagesPPG Annex B-1 - AAO Electronic Online System FormFatima Bognadon100% (1)

- Sir/Madame:: Enclosure 4: Transmittal and Acknowledgement Receipt (Schools)Document1 pageSir/Madame:: Enclosure 4: Transmittal and Acknowledgement Receipt (Schools)Paul BronNo ratings yet

- Termination Letter PLDTDocument1 pageTermination Letter PLDTJunRobotboi100% (2)

- Converge LetterDocument1 pageConverge LetterDaphne Beloro0% (1)

- Buyer Registration Form: Procurement Service - PhilgepsDocument2 pagesBuyer Registration Form: Procurement Service - PhilgepsJefferson DayoNo ratings yet

- BancNet EGov Users Manual For SSS FinalDocument27 pagesBancNet EGov Users Manual For SSS FinalAnthony Santos50% (2)

- Damayan Membership Application Form: SCHOOL/OFFICE ADDRESSDocument1 pageDamayan Membership Application Form: SCHOOL/OFFICE ADDRESSRoselyn San Diego PacaigueNo ratings yet

- Affidavit of Loss: Republic of The Philippines) ) S.S. City of Meycauayan)Document1 pageAffidavit of Loss: Republic of The Philippines) ) S.S. City of Meycauayan)Cherilou Tanglao100% (2)

- Submission and Updating of 201 Files Download Black Ball PenDocument1 pageSubmission and Updating of 201 Files Download Black Ball PenCarlie MaeNo ratings yet

- What's New Feature - PHIC New Case Rate v2Document41 pagesWhat's New Feature - PHIC New Case Rate v2nhamokidNo ratings yet

- Atty. Jose V. GambitoDocument11 pagesAtty. Jose V. GambitoPROCEDE NUEVA VIZCAYANo ratings yet

- PA - PRO1 2019-015 Submission of Scanned Copy of CF4 As Additional Claim Requirement Until December 31, 2019Document1 pagePA - PRO1 2019-015 Submission of Scanned Copy of CF4 As Additional Claim Requirement Until December 31, 2019Leonard Paris GabatNo ratings yet

- Sample Template For MOTORCYCLEDocument2 pagesSample Template For MOTORCYCLEJoshKristina NavarroNo ratings yet

- WNB-Contract Jess TaayDocument2 pagesWNB-Contract Jess TaayAting NavarroNo ratings yet

- Cir 220556064300-2Document1 pageCir 220556064300-2LRD ComputersNo ratings yet

- Maxicare Cif-2Document1 pageMaxicare Cif-2Eprs 033No ratings yet

- Gsis TCDocument2 pagesGsis TCricricafort21No ratings yet

- 610 10th Ed Datasheets (SI)Document11 pages610 10th Ed Datasheets (SI)sjois_hsNo ratings yet

- Electronic Warfare11Document5 pagesElectronic Warfare11Dyana AnghelNo ratings yet

- 600/1000 V PVC Insulated, Metallic Screened and PVC Sheathed Cu/Pvc/Cts/Pvc (Nysy) SNI IEC 60502-1: 2009 / IEC 60502-1Document3 pages600/1000 V PVC Insulated, Metallic Screened and PVC Sheathed Cu/Pvc/Cts/Pvc (Nysy) SNI IEC 60502-1: 2009 / IEC 60502-1Muhamad YasrinNo ratings yet

- Linear WinchesDocument12 pagesLinear Winchesfrdsim50% (2)

- Day To Day Duties of A FirefighterDocument6 pagesDay To Day Duties of A FirefighterStanka ZahurancováNo ratings yet

- Deviation in Pharma: What Is A DeviationDocument2 pagesDeviation in Pharma: What Is A DeviationAshok KumarNo ratings yet

- A Chinese Brand That Leads With Quality: Great Wall Motor Company LimitedDocument8 pagesA Chinese Brand That Leads With Quality: Great Wall Motor Company LimitedDana Ross Capcha MaximilianoNo ratings yet

- New DDL Week 4 June 27-30Document4 pagesNew DDL Week 4 June 27-30Josenia Constantino0% (1)

- General Construction Notes: S-2 Proposed 4-Storey ApartmentDocument1 pageGeneral Construction Notes: S-2 Proposed 4-Storey ApartmentArch. John Bernard AbadNo ratings yet

- CIGRE-HVDC-SCB4 - 2015 - Colloquium - Paper ALLDocument389 pagesCIGRE-HVDC-SCB4 - 2015 - Colloquium - Paper ALLJose Valdivieso100% (1)

- Airflow FormulasDocument16 pagesAirflow FormulasJames ChanNo ratings yet

- Egret Complete ProposalDocument99 pagesEgret Complete ProposalBRAYAN SARNo ratings yet

- Manuale - MGV25 - ENG - vs3 - 7 MOTORDocument20 pagesManuale - MGV25 - ENG - vs3 - 7 MOTORAdan CaceresNo ratings yet

- Infineon IGCM04G60HA DS v02 - 04 EN PDFDocument16 pagesInfineon IGCM04G60HA DS v02 - 04 EN PDFsupriyo110No ratings yet

- CEt 2019Document2 pagesCEt 2019Amit MishraNo ratings yet

- Premier Guitar 022017Document244 pagesPremier Guitar 022017franekzapa100% (3)

- Check in Preocedures DialogueDocument5 pagesCheck in Preocedures DialogueNina OaipNo ratings yet

- Analog IC DesignDocument4 pagesAnalog IC DesignMinh ThiệuNo ratings yet

- Elastomeric Seals and Materials at Cryogenic TemeraturesDocument81 pagesElastomeric Seals and Materials at Cryogenic Temeraturesjohndoe_218446No ratings yet

- EBTANASDocument6 pagesEBTANASSri HandayaniNo ratings yet

- Lecture35 Ch12 CoherenceDocument25 pagesLecture35 Ch12 Coherencepavan457No ratings yet

- Rotary Airlock Combined-Manual Final PDFDocument53 pagesRotary Airlock Combined-Manual Final PDFMechanical ShauryaNo ratings yet

- Indoor + Outdoor Substation With Generator RoomDocument1 pageIndoor + Outdoor Substation With Generator RoomMukterNo ratings yet

- Komatsu Training Academy Training CalendarDocument4 pagesKomatsu Training Academy Training CalendarZIBA KHADIBI100% (1)

- LECO Evacuated Pin TubesDocument2 pagesLECO Evacuated Pin TubesBoris ChicomaNo ratings yet

- PLC Operation - 8.1Document9 pagesPLC Operation - 8.1GvidonNo ratings yet

- Hydro Box Service Manual 202301Document26 pagesHydro Box Service Manual 202301Stjepan KrpanNo ratings yet

- Anticorodal50 Englisch 01Document1 pageAnticorodal50 Englisch 01dmalfazNo ratings yet