Professional Documents

Culture Documents

Accounting Principles: A Business Perspective, 8e

Accounting Principles: A Business Perspective, 8e

Uploaded by

Jarvis HarrisonCopyright:

Available Formats

You might also like

- Acca f3 Financial Accounting FormulaDocument4 pagesAcca f3 Financial Accounting FormulaNadir Muhammad100% (2)

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetZee Drake100% (6)

- Final Presentasi MCI by Grup 5Document23 pagesFinal Presentasi MCI by Grup 5Prayogi Purnapandhega0% (1)

- Quiz Bee Questions (Semis and Finals)Document4 pagesQuiz Bee Questions (Semis and Finals)John Vincent PardillaNo ratings yet

- MAF CH 2 NEWDocument58 pagesMAF CH 2 NEWAsegid H/meskelNo ratings yet

- f3 Acowtancy - Com Textf PDFDocument151 pagesf3 Acowtancy - Com Textf PDFkrisu86No ratings yet

- Accounting For ManagersDocument98 pagesAccounting For Managersutkarshmannu.ismsNo ratings yet

- AFM CH 2Document58 pagesAFM CH 2Birhanu MengisteNo ratings yet

- Chapter 1. Accounting in ActionDocument3 pagesChapter 1. Accounting in ActionÁlvaro Vacas González de EchávarriNo ratings yet

- Financial Accounting BasicsDocument2 pagesFinancial Accounting Basicssmartanand2009No ratings yet

- C1 - Introduction To Financial StatementsDocument10 pagesC1 - Introduction To Financial Statementsacerverap6No ratings yet

- ACCT 101 Chapter 1 HandoutDocument3 pagesACCT 101 Chapter 1 HandoutLlana RoxanneNo ratings yet

- Summary Chapter 6 Accounting For Managers - Paul M. CollierDocument4 pagesSummary Chapter 6 Accounting For Managers - Paul M. CollierMarina_1995No ratings yet

- An Intro To Bussiness AccountingDocument57 pagesAn Intro To Bussiness AccountingNadia AnuarNo ratings yet

- Chapter 1 Notes: Created Tags UpdatedDocument6 pagesChapter 1 Notes: Created Tags UpdatedTristan RamosNo ratings yet

- Fabm Research ProjectDocument41 pagesFabm Research ProjectMon Kiego MagnoNo ratings yet

- Social AccountingDocument28 pagesSocial Accountingfeiyuqing_276100% (1)

- Introduction To AccountingDocument8 pagesIntroduction To AccountingibrahimhujiratNo ratings yet

- Chapter 1 NotesDocument4 pagesChapter 1 NotesAbrar YasinNo ratings yet

- FAR 1st Discusssion NoteDocument5 pagesFAR 1st Discusssion NoteApril GumiranNo ratings yet

- For ACCO 101 - Review of Accounting Concepts and Process (Part 1)Document32 pagesFor ACCO 101 - Review of Accounting Concepts and Process (Part 1)Fionna Rei DeGaliciaNo ratings yet

- Financial Tools (Me Encanta)Document9 pagesFinancial Tools (Me Encanta)KajoeraNo ratings yet

- Ffa AcowtancyDocument110 pagesFfa AcowtancyHasniza HashimNo ratings yet

- Financial AccountingDocument17 pagesFinancial AccountingSamarendra PatasaniNo ratings yet

- Chapter 1 - Accounting in ActionDocument42 pagesChapter 1 - Accounting in ActionFify AmalindaNo ratings yet

- Part Two: Financial Accounting: An IntroductionDocument139 pagesPart Two: Financial Accounting: An IntroductionRobel Habtamu100% (1)

- Finance Terms and IntroductionDocument10 pagesFinance Terms and IntroductionPooja ChoudharyNo ratings yet

- Fundamentals OF Accounting I: By: Jason P. GregorioDocument14 pagesFundamentals OF Accounting I: By: Jason P. GregorioJason GregorioNo ratings yet

- Accounting in ActionDocument42 pagesAccounting in ActionMuhammad TausiqueNo ratings yet

- 10 Element of FRDocument12 pages10 Element of FRIloNo ratings yet

- QDocument9 pagesQbalrampal500No ratings yet

- Financial Management For Engineers & ProfessionalsDocument10 pagesFinancial Management For Engineers & Professionalsumair_b86No ratings yet

- Fabm ReviewerDocument5 pagesFabm ReviewerHeaven Krysthel Bless R. SacsacNo ratings yet

- Fundamentals of AccountingDocument4 pagesFundamentals of AccountingSamantha Nicole BonitoNo ratings yet

- Accounting Principles and Procedures: Indian Quantity Surveyors Association IQSA-APC-MatrixDocument11 pagesAccounting Principles and Procedures: Indian Quantity Surveyors Association IQSA-APC-MatrixKishan SolankimbaccepmpNo ratings yet

- Acct TutorDocument22 pagesAcct TutorKthln Mntlla100% (1)

- bd4769edd615cbff9a10b93d43ba3972Document17 pagesbd4769edd615cbff9a10b93d43ba3972Tanish HandaNo ratings yet

- Fabm 1Document4 pagesFabm 1hanhermosilla0528No ratings yet

- Accounting Unit 1 NotesDocument13 pagesAccounting Unit 1 NotesLeon BurresNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting ConceptsYessameen Franco R. CastilloNo ratings yet

- Accounting EquationDocument9 pagesAccounting EquationZahidul Islam SumonNo ratings yet

- Bài C A NhiDocument5 pagesBài C A NhiTien Dung HoangNo ratings yet

- ACCT Note 1Document10 pagesACCT Note 1kayla tsoiNo ratings yet

- Financial Statement Analysis C 1 PPT 4ob3Document40 pagesFinancial Statement Analysis C 1 PPT 4ob3Dr. M. SamyNo ratings yet

- Journalize TransactionsDocument16 pagesJournalize Transactionsfiya cruzNo ratings yet

- Corporate Financial Reporting Chapter: Fundamental Accounting Concepts and The Conceptual FrameworkDocument10 pagesCorporate Financial Reporting Chapter: Fundamental Accounting Concepts and The Conceptual FrameworkSrawar Jahan TareqNo ratings yet

- Chapter 1 Intro To AccoutingDocument32 pagesChapter 1 Intro To Accoutingprincekelvin09No ratings yet

- Basics of AccountingDocument16 pagesBasics of Accountingmule mulugetaNo ratings yet

- Discussion QuestionsDocument4 pagesDiscussion QuestionsPatrick John RifilNo ratings yet

- Accounting IntroductionDocument10 pagesAccounting Introductionomer mazharNo ratings yet

- Fabm MidtermDocument7 pagesFabm MidtermSamantha LiberatoNo ratings yet

- Cash Flow + Income Statement NotesDocument5 pagesCash Flow + Income Statement NotesElla AikenNo ratings yet

- Basic AccountingDocument29 pagesBasic AccountingNoor UddinNo ratings yet

- Financial Management and Accounting - 1Document26 pagesFinancial Management and Accounting - 1ssmodakNo ratings yet

- Basic of AccountingDocument35 pagesBasic of AccountingArdian MustofaNo ratings yet

- Finance Dossier 2022Document105 pagesFinance Dossier 2022SHREY BAZARINo ratings yet

- The Original Attachment: BasicsDocument32 pagesThe Original Attachment: BasicsvijayNo ratings yet

- Accounting 1 MaterialsDocument8 pagesAccounting 1 MaterialsnardsdelNo ratings yet

- Chapter 3 SummaryDocument3 pagesChapter 3 SummaryDarlianne Klyne BayerNo ratings yet

- Financial Statement: Why Do We Need Financial Information To Make Business Decision?Document19 pagesFinancial Statement: Why Do We Need Financial Information To Make Business Decision?steven johnNo ratings yet

- FCA Notes 01Document8 pagesFCA Notes 01US10No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- General Guidelines For Spreading Financial StatementsDocument8 pagesGeneral Guidelines For Spreading Financial StatementsChandan Kumar ShawNo ratings yet

- Llpreg 1996Document809 pagesLlpreg 1996Priska MalvinNo ratings yet

- Serba Dinamik: Hit To Reputation Amid Audit FlagsDocument4 pagesSerba Dinamik: Hit To Reputation Amid Audit FlagsRichbull TraderNo ratings yet

- TODAY at BULLET Chapter 2 TVM ContinuedDocument8 pagesTODAY at BULLET Chapter 2 TVM ContinuedThùy LêNo ratings yet

- Microsoft Word - Challan FormDocument1 pageMicrosoft Word - Challan FormOm ParkashNo ratings yet

- Accounting Igcse Chapter 1Document11 pagesAccounting Igcse Chapter 1Emily Goodge100% (1)

- Circular No 4 2023Document2 pagesCircular No 4 2023NESL WebsiteNo ratings yet

- The Soviet Collapse: Grain and OilDocument8 pagesThe Soviet Collapse: Grain and OilearlNo ratings yet

- E Sign DocDocument26 pagesE Sign DocShaik ShabanaNo ratings yet

- ExamDocument3 pagesExamshaylieeeNo ratings yet

- Principles of Accountancy MCQDocument10 pagesPrinciples of Accountancy MCQlindakutty67% (3)

- SyllabusDocument45 pagesSyllabusPrachi PNo ratings yet

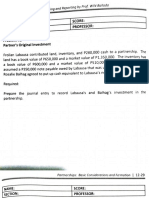

- Name:: Score: ProfessorDocument6 pagesName:: Score: ProfessorkakaoNo ratings yet

- OnenessDocument160 pagesOnenessbikram111209005No ratings yet

- SCH 03Document7 pagesSCH 03Naseeb Ullah TareenNo ratings yet

- Nykaa - Fundamental Technical AnalysisDocument6 pagesNykaa - Fundamental Technical Analysiskhyati kaulNo ratings yet

- Module 15 UPDATEDDocument11 pagesModule 15 UPDATEDelise tanNo ratings yet

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- Car Loan FinalDocument21 pagesCar Loan Finalislamkilaniya66100% (1)

- Investment Appraisal Camb AL New (1) RIKZY EESADocument14 pagesInvestment Appraisal Camb AL New (1) RIKZY EESAAyesha ZainabNo ratings yet

- Final Report by Abhishek DubeyDocument64 pagesFinal Report by Abhishek DubeyJatin SharmaNo ratings yet

- Dynamics of ValueDocument8 pagesDynamics of ValueHardik GoriNo ratings yet

- Financial Statement Group 2 Assignment 1Document4 pagesFinancial Statement Group 2 Assignment 1Bryan LesmadiNo ratings yet

- Sanction Letter 643735Document6 pagesSanction Letter 643735Purushothaman PurushothNo ratings yet

- Finance For ExecutivesDocument9 pagesFinance For ExecutivesFreiestrasseNo ratings yet

- Satisfaction Level of Investors With Their Broking FirmDocument81 pagesSatisfaction Level of Investors With Their Broking FirmVijaysinh Parmar50% (2)

- Different Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountDocument4 pagesDifferent Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountSunaina Kodkani100% (1)

Accounting Principles: A Business Perspective, 8e

Accounting Principles: A Business Perspective, 8e

Uploaded by

Jarvis HarrisonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Principles: A Business Perspective, 8e

Accounting Principles: A Business Perspective, 8e

Uploaded by

Jarvis HarrisonCopyright:

Available Formats

Accounting Principles:

A Business Perspective, 8e

Chapter 1:

Accounting and Its

Use in Business

Decisions

Copyright 2005 Hermanson Edwards Maher

Chapter 1

Forms of Business Organizations

z A business entity is any business organization

that exists as an economic unit.

z Single or sole proprietorship

a business owned by an individual and often

managed by that same individual.

z Partnership

a business owned by two or more persons

associated as partners.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

Forms of Business Organizations

Continued

z Corporation

A business owned by a few persons or by

thousands of persons and is incorporated under the

laws of one of the 50 states.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

Activities Performed by Business

Organizations

z Service companies

Provide services for a fee.

z Merchandising companies

Purchase goods that are ready for sale and then

resell them to customers.

z Manufacturing companies

Buy materials, convert them into products, and then

sell the products to other companies or to final

customers.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

Primary Objectives of Every

Business

z Solvency

The ability to pay debts as they become due.

z Profitability

The ability to generate income.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

Financial Statements

The income statement

z Reports the profitability of a business

organization for a stated period of time.

Revenues are defined as the inflow of assets

resulting from the sale of products or the rendering

of services to customers.

Expenses are the costs incurred to produce

revenues.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

Financial Statements

Continued

The statement of retained earnings

z Reports the changes in retained earnings that

occurred between two balance sheet dates.

Net income increases retained earnings.

Net loss decreases retained earnings

Dividends (distributions of income to owners)

reduce retained earnings.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

Financial Statements

Continued

The balance sheet

z Reflects a firms solvency as of a specific

moment in time.

Assets are things of value, which are owned by a

business.

Liabilities are the debts owed by a firm.

Stockholders equity is the share of the business

that the stockholders (shareholders) own outright

z equal to assets minus liabilities.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

Financial Statements

Continued

The statement of cash flows

z Shows the cash inflows and cash outflows from

operating activities, investing activities, and

financing activities.

Operating activities generally include the cash

effects of transactions and other events that enter

into the determination of net income.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

Financial Statements

Continued

Investing activities generally include transactions

involving the acquisition or disposal of long-term

(noncurrent) assets such as land, buildings, and

equipment.

Financing activities generally include the cash

effects of transactions and other events involving

creditors and owners (stockholders).

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

The Financial Accounting Process

z The accounting equation:

ASSETS = LIABILITIES + STOCKHOLDERS EQUITY

As a business engages in economic activity, the

dollar amounts and the composition of its assets,

liabilities, and stockholders equity change, but the

equality of the basic equation always holds.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

The Financial Accounting Process

Continued

z Transactions provide much of the raw data

entered in the accounting process. Some

underlying assumptions or concepts used by

the accountant in recording business

transactions include:

Business entitythe business is assumed to have an

existence separate from its owners, creditors,

employees, and other interested parties.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

The Financial Accounting Process

Continued

Money measurementeconomic activity is initially

recorded and reported in terms of a common unit of

measurement, such as the dollar.

Costmost assets are recorded at their acquisition

cost measured in terms of money paid.

Continuity (going-concern)unless strong evidence

exists to the contrary, the accountant assumes the

entity will continue operations into the indefinite

future.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

The Financial Accounting Process

Continued

Periodicityan entitys life can be subdivided into

time periods for purposes of reporting its economic

activities.

z Transaction analysis

A summary of transactions format is used to

summarize activity and provide a basis for

preparation of the income statement and balance

sheet

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

Chapter 1

The Equity Ratio

z The equity ratio:

stockholders equity

total equities or total assets

The higher the ratio, the more solvent is the

company.

If the ratio is very high, profitability may suffer

because borrowed funds usually earn more than the

interest cost.

Accounting Principles: A Business Perspective 8e

Copyright 2005 Hermanson Edwards Maher

You might also like

- Acca f3 Financial Accounting FormulaDocument4 pagesAcca f3 Financial Accounting FormulaNadir Muhammad100% (2)

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetZee Drake100% (6)

- Final Presentasi MCI by Grup 5Document23 pagesFinal Presentasi MCI by Grup 5Prayogi Purnapandhega0% (1)

- Quiz Bee Questions (Semis and Finals)Document4 pagesQuiz Bee Questions (Semis and Finals)John Vincent PardillaNo ratings yet

- MAF CH 2 NEWDocument58 pagesMAF CH 2 NEWAsegid H/meskelNo ratings yet

- f3 Acowtancy - Com Textf PDFDocument151 pagesf3 Acowtancy - Com Textf PDFkrisu86No ratings yet

- Accounting For ManagersDocument98 pagesAccounting For Managersutkarshmannu.ismsNo ratings yet

- AFM CH 2Document58 pagesAFM CH 2Birhanu MengisteNo ratings yet

- Chapter 1. Accounting in ActionDocument3 pagesChapter 1. Accounting in ActionÁlvaro Vacas González de EchávarriNo ratings yet

- Financial Accounting BasicsDocument2 pagesFinancial Accounting Basicssmartanand2009No ratings yet

- C1 - Introduction To Financial StatementsDocument10 pagesC1 - Introduction To Financial Statementsacerverap6No ratings yet

- ACCT 101 Chapter 1 HandoutDocument3 pagesACCT 101 Chapter 1 HandoutLlana RoxanneNo ratings yet

- Summary Chapter 6 Accounting For Managers - Paul M. CollierDocument4 pagesSummary Chapter 6 Accounting For Managers - Paul M. CollierMarina_1995No ratings yet

- An Intro To Bussiness AccountingDocument57 pagesAn Intro To Bussiness AccountingNadia AnuarNo ratings yet

- Chapter 1 Notes: Created Tags UpdatedDocument6 pagesChapter 1 Notes: Created Tags UpdatedTristan RamosNo ratings yet

- Fabm Research ProjectDocument41 pagesFabm Research ProjectMon Kiego MagnoNo ratings yet

- Social AccountingDocument28 pagesSocial Accountingfeiyuqing_276100% (1)

- Introduction To AccountingDocument8 pagesIntroduction To AccountingibrahimhujiratNo ratings yet

- Chapter 1 NotesDocument4 pagesChapter 1 NotesAbrar YasinNo ratings yet

- FAR 1st Discusssion NoteDocument5 pagesFAR 1st Discusssion NoteApril GumiranNo ratings yet

- For ACCO 101 - Review of Accounting Concepts and Process (Part 1)Document32 pagesFor ACCO 101 - Review of Accounting Concepts and Process (Part 1)Fionna Rei DeGaliciaNo ratings yet

- Financial Tools (Me Encanta)Document9 pagesFinancial Tools (Me Encanta)KajoeraNo ratings yet

- Ffa AcowtancyDocument110 pagesFfa AcowtancyHasniza HashimNo ratings yet

- Financial AccountingDocument17 pagesFinancial AccountingSamarendra PatasaniNo ratings yet

- Chapter 1 - Accounting in ActionDocument42 pagesChapter 1 - Accounting in ActionFify AmalindaNo ratings yet

- Part Two: Financial Accounting: An IntroductionDocument139 pagesPart Two: Financial Accounting: An IntroductionRobel Habtamu100% (1)

- Finance Terms and IntroductionDocument10 pagesFinance Terms and IntroductionPooja ChoudharyNo ratings yet

- Fundamentals OF Accounting I: By: Jason P. GregorioDocument14 pagesFundamentals OF Accounting I: By: Jason P. GregorioJason GregorioNo ratings yet

- Accounting in ActionDocument42 pagesAccounting in ActionMuhammad TausiqueNo ratings yet

- 10 Element of FRDocument12 pages10 Element of FRIloNo ratings yet

- QDocument9 pagesQbalrampal500No ratings yet

- Financial Management For Engineers & ProfessionalsDocument10 pagesFinancial Management For Engineers & Professionalsumair_b86No ratings yet

- Fabm ReviewerDocument5 pagesFabm ReviewerHeaven Krysthel Bless R. SacsacNo ratings yet

- Fundamentals of AccountingDocument4 pagesFundamentals of AccountingSamantha Nicole BonitoNo ratings yet

- Accounting Principles and Procedures: Indian Quantity Surveyors Association IQSA-APC-MatrixDocument11 pagesAccounting Principles and Procedures: Indian Quantity Surveyors Association IQSA-APC-MatrixKishan SolankimbaccepmpNo ratings yet

- Acct TutorDocument22 pagesAcct TutorKthln Mntlla100% (1)

- bd4769edd615cbff9a10b93d43ba3972Document17 pagesbd4769edd615cbff9a10b93d43ba3972Tanish HandaNo ratings yet

- Fabm 1Document4 pagesFabm 1hanhermosilla0528No ratings yet

- Accounting Unit 1 NotesDocument13 pagesAccounting Unit 1 NotesLeon BurresNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting ConceptsYessameen Franco R. CastilloNo ratings yet

- Accounting EquationDocument9 pagesAccounting EquationZahidul Islam SumonNo ratings yet

- Bài C A NhiDocument5 pagesBài C A NhiTien Dung HoangNo ratings yet

- ACCT Note 1Document10 pagesACCT Note 1kayla tsoiNo ratings yet

- Financial Statement Analysis C 1 PPT 4ob3Document40 pagesFinancial Statement Analysis C 1 PPT 4ob3Dr. M. SamyNo ratings yet

- Journalize TransactionsDocument16 pagesJournalize Transactionsfiya cruzNo ratings yet

- Corporate Financial Reporting Chapter: Fundamental Accounting Concepts and The Conceptual FrameworkDocument10 pagesCorporate Financial Reporting Chapter: Fundamental Accounting Concepts and The Conceptual FrameworkSrawar Jahan TareqNo ratings yet

- Chapter 1 Intro To AccoutingDocument32 pagesChapter 1 Intro To Accoutingprincekelvin09No ratings yet

- Basics of AccountingDocument16 pagesBasics of Accountingmule mulugetaNo ratings yet

- Discussion QuestionsDocument4 pagesDiscussion QuestionsPatrick John RifilNo ratings yet

- Accounting IntroductionDocument10 pagesAccounting Introductionomer mazharNo ratings yet

- Fabm MidtermDocument7 pagesFabm MidtermSamantha LiberatoNo ratings yet

- Cash Flow + Income Statement NotesDocument5 pagesCash Flow + Income Statement NotesElla AikenNo ratings yet

- Basic AccountingDocument29 pagesBasic AccountingNoor UddinNo ratings yet

- Financial Management and Accounting - 1Document26 pagesFinancial Management and Accounting - 1ssmodakNo ratings yet

- Basic of AccountingDocument35 pagesBasic of AccountingArdian MustofaNo ratings yet

- Finance Dossier 2022Document105 pagesFinance Dossier 2022SHREY BAZARINo ratings yet

- The Original Attachment: BasicsDocument32 pagesThe Original Attachment: BasicsvijayNo ratings yet

- Accounting 1 MaterialsDocument8 pagesAccounting 1 MaterialsnardsdelNo ratings yet

- Chapter 3 SummaryDocument3 pagesChapter 3 SummaryDarlianne Klyne BayerNo ratings yet

- Financial Statement: Why Do We Need Financial Information To Make Business Decision?Document19 pagesFinancial Statement: Why Do We Need Financial Information To Make Business Decision?steven johnNo ratings yet

- FCA Notes 01Document8 pagesFCA Notes 01US10No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- General Guidelines For Spreading Financial StatementsDocument8 pagesGeneral Guidelines For Spreading Financial StatementsChandan Kumar ShawNo ratings yet

- Llpreg 1996Document809 pagesLlpreg 1996Priska MalvinNo ratings yet

- Serba Dinamik: Hit To Reputation Amid Audit FlagsDocument4 pagesSerba Dinamik: Hit To Reputation Amid Audit FlagsRichbull TraderNo ratings yet

- TODAY at BULLET Chapter 2 TVM ContinuedDocument8 pagesTODAY at BULLET Chapter 2 TVM ContinuedThùy LêNo ratings yet

- Microsoft Word - Challan FormDocument1 pageMicrosoft Word - Challan FormOm ParkashNo ratings yet

- Accounting Igcse Chapter 1Document11 pagesAccounting Igcse Chapter 1Emily Goodge100% (1)

- Circular No 4 2023Document2 pagesCircular No 4 2023NESL WebsiteNo ratings yet

- The Soviet Collapse: Grain and OilDocument8 pagesThe Soviet Collapse: Grain and OilearlNo ratings yet

- E Sign DocDocument26 pagesE Sign DocShaik ShabanaNo ratings yet

- ExamDocument3 pagesExamshaylieeeNo ratings yet

- Principles of Accountancy MCQDocument10 pagesPrinciples of Accountancy MCQlindakutty67% (3)

- SyllabusDocument45 pagesSyllabusPrachi PNo ratings yet

- Name:: Score: ProfessorDocument6 pagesName:: Score: ProfessorkakaoNo ratings yet

- OnenessDocument160 pagesOnenessbikram111209005No ratings yet

- SCH 03Document7 pagesSCH 03Naseeb Ullah TareenNo ratings yet

- Nykaa - Fundamental Technical AnalysisDocument6 pagesNykaa - Fundamental Technical Analysiskhyati kaulNo ratings yet

- Module 15 UPDATEDDocument11 pagesModule 15 UPDATEDelise tanNo ratings yet

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- Car Loan FinalDocument21 pagesCar Loan Finalislamkilaniya66100% (1)

- Investment Appraisal Camb AL New (1) RIKZY EESADocument14 pagesInvestment Appraisal Camb AL New (1) RIKZY EESAAyesha ZainabNo ratings yet

- Final Report by Abhishek DubeyDocument64 pagesFinal Report by Abhishek DubeyJatin SharmaNo ratings yet

- Dynamics of ValueDocument8 pagesDynamics of ValueHardik GoriNo ratings yet

- Financial Statement Group 2 Assignment 1Document4 pagesFinancial Statement Group 2 Assignment 1Bryan LesmadiNo ratings yet

- Sanction Letter 643735Document6 pagesSanction Letter 643735Purushothaman PurushothNo ratings yet

- Finance For ExecutivesDocument9 pagesFinance For ExecutivesFreiestrasseNo ratings yet

- Satisfaction Level of Investors With Their Broking FirmDocument81 pagesSatisfaction Level of Investors With Their Broking FirmVijaysinh Parmar50% (2)

- Different Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountDocument4 pagesDifferent Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountSunaina Kodkani100% (1)