Professional Documents

Culture Documents

100%(1)100% found this document useful (1 vote)

117 viewsVeronica Sanchez v. Collector of Internal Revenue

Veronica Sanchez v. Collector of Internal Revenue

Uploaded by

Kyla MaeganVeronica Sanchez constructed an accessoria in 1947 for the purpose of renting it out to tenants. She manages the property herself and the rental income is her main source of livelihood, making her a real estate dealer by definition. The CIR demanded she pay income tax and real estate dealer's tax for 1946-1950. While Sanchez is required to pay both property tax and real estate dealer's tax, she is entitled to a refund for the taxes paid in 1946 since her operations did not begin until 1947. The Supreme Court ruled that while double taxation occurred, it is constitutional for the state to collect both a property tax on land used for business and a license tax on the business itself.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Digest - Evangelista vs. CIRDocument1 pageDigest - Evangelista vs. CIRPaul Vincent Cunanan100% (4)

- Veronica Sanchez vs. The Collector of Internal RevenueDocument5 pagesVeronica Sanchez vs. The Collector of Internal RevenueMary.Rose RosalesNo ratings yet

- Veronica Sanchez Vs CirDocument3 pagesVeronica Sanchez Vs CirArthur John Garraton0% (1)

- Sanchez v. CIR (1955, 97 Phil 867)Document4 pagesSanchez v. CIR (1955, 97 Phil 867)KTNo ratings yet

- Sanchez v. Collector of Internal RevenueDocument1 pageSanchez v. Collector of Internal RevenueEmil BautistaNo ratings yet

- Usuf DigDocument41 pagesUsuf DigBob VillanuevaNo ratings yet

- Evangelista v. CIRDocument2 pagesEvangelista v. CIREva TrinidadNo ratings yet

- The Collector of Internal Revenue and The Court of Tax Appeals, RespondentsDocument136 pagesThe Collector of Internal Revenue and The Court of Tax Appeals, RespondentsbalunosarronNo ratings yet

- 12 Evangelista VS CIRDocument2 pages12 Evangelista VS CIRNichole LanuzaNo ratings yet

- Evangelista Vs CIR 102 Phil 140Document7 pagesEvangelista Vs CIR 102 Phil 140krisninNo ratings yet

- G.R. No. 155394 February 17, 2005Document6 pagesG.R. No. 155394 February 17, 2005Analou Agustin VillezaNo ratings yet

- Fabie Vs DavidDocument4 pagesFabie Vs DavidJoovs JoovhoNo ratings yet

- Evangelista V. Collector of Internal Revenue, 102 Phil. 140 (1957)Document6 pagesEvangelista V. Collector of Internal Revenue, 102 Phil. 140 (1957)Ryan Andrew ApilisNo ratings yet

- Tax Appeals Income Tax: The Collector of Internal Revenue and The Court of Tax Appeals, RespondentsDocument46 pagesTax Appeals Income Tax: The Collector of Internal Revenue and The Court of Tax Appeals, RespondentssantasantitaNo ratings yet

- Facts:: The Collector of Internal Revenue and The Court OF TAX APPEALS, Respondents. Ruling: YesDocument6 pagesFacts:: The Collector of Internal Revenue and The Court OF TAX APPEALS, Respondents. Ruling: YesMay ChanNo ratings yet

- Fabie v. David, 75 Phil. 536Document7 pagesFabie v. David, 75 Phil. 536juan dela cruzNo ratings yet

- CASE DIGEST G.R. No. L-9996Document1 pageCASE DIGEST G.R. No. L-9996Mark Allen Salvador OrcioNo ratings yet

- 7 - Evangelista Et Al V CirDocument4 pages7 - Evangelista Et Al V CircloudNo ratings yet

- The Collector of Internal Revenue and The Court of Tax APPEALS, RespondentsDocument27 pagesThe Collector of Internal Revenue and The Court of Tax APPEALS, RespondentsNate AlfaroNo ratings yet

- Office of The Solicitor General For Petitioner. Manuel B. Pineda For and in His Own Behalf As RespondentDocument3 pagesOffice of The Solicitor General For Petitioner. Manuel B. Pineda For and in His Own Behalf As RespondentAnn SCNo ratings yet

- 6 - Cir VS PinedaDocument2 pages6 - Cir VS PinedacloudNo ratings yet

- G.R. No. L-123 December 12, 1945Document18 pagesG.R. No. L-123 December 12, 1945Fj EdmaNo ratings yet

- De La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsDocument27 pagesDe La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsAmber QuiñonesNo ratings yet

- LORENZO T. OÑA v. CIRDocument2 pagesLORENZO T. OÑA v. CIRKhalid Sharrif 0 SumaNo ratings yet

- Fabia Vs DavidDocument6 pagesFabia Vs DavidGoodyNo ratings yet

- Fabian V FabianDocument3 pagesFabian V FabianMichael C. PayumoNo ratings yet

- Petitioner Vs Vs Respondents Sancho Onocencio, Severino B. Orlina, No AppearanceDocument8 pagesPetitioner Vs Vs Respondents Sancho Onocencio, Severino B. Orlina, No AppearanceFrance SanchezNo ratings yet

- Petitioner Vs Vs Respondents Sancho Onocencio, Severino B. Orlina, No AppearanceDocument8 pagesPetitioner Vs Vs Respondents Sancho Onocencio, Severino B. Orlina, No AppearanceEm EstrellaNo ratings yet

- Benedicto Vs Villaflores, Et AlDocument6 pagesBenedicto Vs Villaflores, Et Alley092No ratings yet

- Usufruct DigestDocument3 pagesUsufruct DigestFritzie G. PuctiyaoNo ratings yet

- Full Text Set 3 - TaxDocument33 pagesFull Text Set 3 - TaxulticonNo ratings yet

- (Commissioner of Internal Revenue vs. Pineda, 21 SCRA 105 (1967) ) PDFDocument6 pages(Commissioner of Internal Revenue vs. Pineda, 21 SCRA 105 (1967) ) PDFJillian BatacNo ratings yet

- Atp CasesDocument48 pagesAtp CasesElyn ApiadoNo ratings yet

- Usufruct Cases HalfDocument16 pagesUsufruct Cases HalfDiane UyNo ratings yet

- 2 Evangelista, Et. Al. vs. CIR, L-9996, October 15, 1957Document10 pages2 Evangelista, Et. Al. vs. CIR, L-9996, October 15, 1957Francis Leo TianeroNo ratings yet

- Evangelista v. CIRDocument7 pagesEvangelista v. CIRHudson CeeNo ratings yet

- Fabie Vs GutierrezDocument6 pagesFabie Vs Gutierrezjulieanne07No ratings yet

- Supreme Court: Office of The Solicitor General For Petitioner - Manuel B. Pineda For and in His Own Behalf As RespondentDocument2 pagesSupreme Court: Office of The Solicitor General For Petitioner - Manuel B. Pineda For and in His Own Behalf As RespondentAndrea Peñas-ReyesNo ratings yet

- Cir Vs Pineda 21 Scra 105Document4 pagesCir Vs Pineda 21 Scra 105Atty JV AbuelNo ratings yet

- Usufruct CasesDocument24 pagesUsufruct CasesSamantha Bonilla BaricauaNo ratings yet

- CIR v. PinedaDocument1 pageCIR v. PinedazacNo ratings yet

- Taxation I Cases Part 1Document63 pagesTaxation I Cases Part 1carinokatrinaNo ratings yet

- Sy Kiong, Floresca, de Jesus Case DigestsDocument1 pageSy Kiong, Floresca, de Jesus Case DigestsMis DeeNo ratings yet

- 16 Evangelista Vs CIRDocument6 pages16 Evangelista Vs CIRcertiorari19No ratings yet

- CIR v. PINEDA - No. L-22734. September 15, 1967Document3 pagesCIR v. PINEDA - No. L-22734. September 15, 1967Jeng PionNo ratings yet

- Tax 1 - Ass No. 2Document6 pagesTax 1 - Ass No. 2De Guzman E AldrinNo ratings yet

- Evangelista Vs CirDocument5 pagesEvangelista Vs CirjessapuerinNo ratings yet

- 1 GR No L-9996Document7 pages1 GR No L-9996remramirezNo ratings yet

- Tax CasesDocument28 pagesTax CasesDelOmisolNo ratings yet

- Tax CasesDocument13 pagesTax CasesMhiletNo ratings yet

- Office of The Solicitor General For Petitioner. Manuel B. Pineda For and in His Own Behalf As RespondentDocument2 pagesOffice of The Solicitor General For Petitioner. Manuel B. Pineda For and in His Own Behalf As RespondentSushane BituinNo ratings yet

- Partnership CasesDocument139 pagesPartnership CasesAnonymous IobsjUatNo ratings yet

- Tax 1 CAses PArt 1 1Document167 pagesTax 1 CAses PArt 1 1Abegail Olario AdajarNo ratings yet

- 01 Engracio Francia V Intermediate Appellate Court and Ho Fernandez GR L 67649 June 28 1988Document1 page01 Engracio Francia V Intermediate Appellate Court and Ho Fernandez GR L 67649 June 28 1988Nojoma PangandamanNo ratings yet

- Supreme Court: Republic of The Philippines Manila en BancDocument4 pagesSupreme Court: Republic of The Philippines Manila en BancGoodyNo ratings yet

- Mercado v. RealDocument3 pagesMercado v. RealMarianeHernandezNo ratings yet

- Lorenzo Ona V CIRDocument20 pagesLorenzo Ona V CIRChatNo ratings yet

- Real Estate: How to Find Auctions, Foreclosures, and the Cheapest PropertiesFrom EverandReal Estate: How to Find Auctions, Foreclosures, and the Cheapest PropertiesNo ratings yet

- LOT 1: A LEGAL DECRIPTION OF JUDICIAL CORRUPTION IN COOK COUNTY, ILLINOIS COOK COUNTY PARCEL NUMBERS ARE NOT LOT NUMBERSFrom EverandLOT 1: A LEGAL DECRIPTION OF JUDICIAL CORRUPTION IN COOK COUNTY, ILLINOIS COOK COUNTY PARCEL NUMBERS ARE NOT LOT NUMBERSNo ratings yet

- Report of Al Capone for the Bureau of Internal RevenueFrom EverandReport of Al Capone for the Bureau of Internal RevenueNo ratings yet

Veronica Sanchez v. Collector of Internal Revenue

Veronica Sanchez v. Collector of Internal Revenue

Uploaded by

Kyla Maegan100%(1)100% found this document useful (1 vote)

117 views1 pageVeronica Sanchez constructed an accessoria in 1947 for the purpose of renting it out to tenants. She manages the property herself and the rental income is her main source of livelihood, making her a real estate dealer by definition. The CIR demanded she pay income tax and real estate dealer's tax for 1946-1950. While Sanchez is required to pay both property tax and real estate dealer's tax, she is entitled to a refund for the taxes paid in 1946 since her operations did not begin until 1947. The Supreme Court ruled that while double taxation occurred, it is constitutional for the state to collect both a property tax on land used for business and a license tax on the business itself.

Original Description:

Taxation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVeronica Sanchez constructed an accessoria in 1947 for the purpose of renting it out to tenants. She manages the property herself and the rental income is her main source of livelihood, making her a real estate dealer by definition. The CIR demanded she pay income tax and real estate dealer's tax for 1946-1950. While Sanchez is required to pay both property tax and real estate dealer's tax, she is entitled to a refund for the taxes paid in 1946 since her operations did not begin until 1947. The Supreme Court ruled that while double taxation occurred, it is constitutional for the state to collect both a property tax on land used for business and a license tax on the business itself.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

100%(1)100% found this document useful (1 vote)

117 views1 pageVeronica Sanchez v. Collector of Internal Revenue

Veronica Sanchez v. Collector of Internal Revenue

Uploaded by

Kyla MaeganVeronica Sanchez constructed an accessoria in 1947 for the purpose of renting it out to tenants. She manages the property herself and the rental income is her main source of livelihood, making her a real estate dealer by definition. The CIR demanded she pay income tax and real estate dealer's tax for 1946-1950. While Sanchez is required to pay both property tax and real estate dealer's tax, she is entitled to a refund for the taxes paid in 1946 since her operations did not begin until 1947. The Supreme Court ruled that while double taxation occurred, it is constitutional for the state to collect both a property tax on land used for business and a license tax on the business itself.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

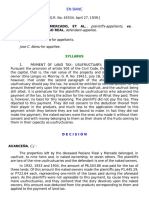

Veronica Sanchez v.

Collector of Internal Revenue (Constitutionality of Double Taxation)

Facts:

- Veronica Sanchez constructed her 4 door accessoria purposely for rent or profit

- she had been continuously leasing the same to third persons since its construction in 1947;

- she manages her property herself; and that said leased holding appears to her main source of

livelihood

- The building has an assessed value of 21,540, and the land assessed at 7,980; a total of 29,540. In

1949, she derived an income of 7,540 annually, She runs a small dry good store in Pasay market with

an income of 1, 300 annually.

- In early part of 1951, CIR made a demanded upon the appellant for the payment of 163.51 as income

tax for the yr 1950, and 637as real estate dealers tax for the year 1946 to 1950 , plus the sum of 50

pesos as compromise. The appellant paid the taxes demanded under protest. Oct 16, 1951 she filed

and action against CIR in the court of first instance.

Issue/s:

1. WON Veronica Sanchez is a real estate dealer

2. WON she can refund payment of taxes

Held:

1. Yes she is a real estate dealer

a. includes all persons who for their own account are engaged in the sale of lands, bdgs,

interests therein or leasing real estate (RA No 42)

b. Constructed the accessoria purposely for profit or rent, leased to third persons since 1947,

manages the property herself, lease is her main source of livelihood therefore she is engaged

in leasing the real estate and she is a real estate dealer

2. She can refund only her payment for 1946

a. She started her operations in 1947 but paid real estate dealers tax for 1946

b. Petitioner: she is paying real estate taxes and she is now required to pay real estate brokers

tax as well. This amounts to double taxation

c. Supreme court: license tax may be levied upon a business or occupation although the land/

property used may be subjected to property tax, and that the state may collect an ad valorem

tax on property used in a calling, and at the same time impose a license tax on the pursuit on

a latter kind of tax being in a sense of double tax.

You might also like

- Digest - Evangelista vs. CIRDocument1 pageDigest - Evangelista vs. CIRPaul Vincent Cunanan100% (4)

- Veronica Sanchez vs. The Collector of Internal RevenueDocument5 pagesVeronica Sanchez vs. The Collector of Internal RevenueMary.Rose RosalesNo ratings yet

- Veronica Sanchez Vs CirDocument3 pagesVeronica Sanchez Vs CirArthur John Garraton0% (1)

- Sanchez v. CIR (1955, 97 Phil 867)Document4 pagesSanchez v. CIR (1955, 97 Phil 867)KTNo ratings yet

- Sanchez v. Collector of Internal RevenueDocument1 pageSanchez v. Collector of Internal RevenueEmil BautistaNo ratings yet

- Usuf DigDocument41 pagesUsuf DigBob VillanuevaNo ratings yet

- Evangelista v. CIRDocument2 pagesEvangelista v. CIREva TrinidadNo ratings yet

- The Collector of Internal Revenue and The Court of Tax Appeals, RespondentsDocument136 pagesThe Collector of Internal Revenue and The Court of Tax Appeals, RespondentsbalunosarronNo ratings yet

- 12 Evangelista VS CIRDocument2 pages12 Evangelista VS CIRNichole LanuzaNo ratings yet

- Evangelista Vs CIR 102 Phil 140Document7 pagesEvangelista Vs CIR 102 Phil 140krisninNo ratings yet

- G.R. No. 155394 February 17, 2005Document6 pagesG.R. No. 155394 February 17, 2005Analou Agustin VillezaNo ratings yet

- Fabie Vs DavidDocument4 pagesFabie Vs DavidJoovs JoovhoNo ratings yet

- Evangelista V. Collector of Internal Revenue, 102 Phil. 140 (1957)Document6 pagesEvangelista V. Collector of Internal Revenue, 102 Phil. 140 (1957)Ryan Andrew ApilisNo ratings yet

- Tax Appeals Income Tax: The Collector of Internal Revenue and The Court of Tax Appeals, RespondentsDocument46 pagesTax Appeals Income Tax: The Collector of Internal Revenue and The Court of Tax Appeals, RespondentssantasantitaNo ratings yet

- Facts:: The Collector of Internal Revenue and The Court OF TAX APPEALS, Respondents. Ruling: YesDocument6 pagesFacts:: The Collector of Internal Revenue and The Court OF TAX APPEALS, Respondents. Ruling: YesMay ChanNo ratings yet

- Fabie v. David, 75 Phil. 536Document7 pagesFabie v. David, 75 Phil. 536juan dela cruzNo ratings yet

- CASE DIGEST G.R. No. L-9996Document1 pageCASE DIGEST G.R. No. L-9996Mark Allen Salvador OrcioNo ratings yet

- 7 - Evangelista Et Al V CirDocument4 pages7 - Evangelista Et Al V CircloudNo ratings yet

- The Collector of Internal Revenue and The Court of Tax APPEALS, RespondentsDocument27 pagesThe Collector of Internal Revenue and The Court of Tax APPEALS, RespondentsNate AlfaroNo ratings yet

- Office of The Solicitor General For Petitioner. Manuel B. Pineda For and in His Own Behalf As RespondentDocument3 pagesOffice of The Solicitor General For Petitioner. Manuel B. Pineda For and in His Own Behalf As RespondentAnn SCNo ratings yet

- 6 - Cir VS PinedaDocument2 pages6 - Cir VS PinedacloudNo ratings yet

- G.R. No. L-123 December 12, 1945Document18 pagesG.R. No. L-123 December 12, 1945Fj EdmaNo ratings yet

- De La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsDocument27 pagesDe La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsAmber QuiñonesNo ratings yet

- LORENZO T. OÑA v. CIRDocument2 pagesLORENZO T. OÑA v. CIRKhalid Sharrif 0 SumaNo ratings yet

- Fabia Vs DavidDocument6 pagesFabia Vs DavidGoodyNo ratings yet

- Fabian V FabianDocument3 pagesFabian V FabianMichael C. PayumoNo ratings yet

- Petitioner Vs Vs Respondents Sancho Onocencio, Severino B. Orlina, No AppearanceDocument8 pagesPetitioner Vs Vs Respondents Sancho Onocencio, Severino B. Orlina, No AppearanceFrance SanchezNo ratings yet

- Petitioner Vs Vs Respondents Sancho Onocencio, Severino B. Orlina, No AppearanceDocument8 pagesPetitioner Vs Vs Respondents Sancho Onocencio, Severino B. Orlina, No AppearanceEm EstrellaNo ratings yet

- Benedicto Vs Villaflores, Et AlDocument6 pagesBenedicto Vs Villaflores, Et Alley092No ratings yet

- Usufruct DigestDocument3 pagesUsufruct DigestFritzie G. PuctiyaoNo ratings yet

- Full Text Set 3 - TaxDocument33 pagesFull Text Set 3 - TaxulticonNo ratings yet

- (Commissioner of Internal Revenue vs. Pineda, 21 SCRA 105 (1967) ) PDFDocument6 pages(Commissioner of Internal Revenue vs. Pineda, 21 SCRA 105 (1967) ) PDFJillian BatacNo ratings yet

- Atp CasesDocument48 pagesAtp CasesElyn ApiadoNo ratings yet

- Usufruct Cases HalfDocument16 pagesUsufruct Cases HalfDiane UyNo ratings yet

- 2 Evangelista, Et. Al. vs. CIR, L-9996, October 15, 1957Document10 pages2 Evangelista, Et. Al. vs. CIR, L-9996, October 15, 1957Francis Leo TianeroNo ratings yet

- Evangelista v. CIRDocument7 pagesEvangelista v. CIRHudson CeeNo ratings yet

- Fabie Vs GutierrezDocument6 pagesFabie Vs Gutierrezjulieanne07No ratings yet

- Supreme Court: Office of The Solicitor General For Petitioner - Manuel B. Pineda For and in His Own Behalf As RespondentDocument2 pagesSupreme Court: Office of The Solicitor General For Petitioner - Manuel B. Pineda For and in His Own Behalf As RespondentAndrea Peñas-ReyesNo ratings yet

- Cir Vs Pineda 21 Scra 105Document4 pagesCir Vs Pineda 21 Scra 105Atty JV AbuelNo ratings yet

- Usufruct CasesDocument24 pagesUsufruct CasesSamantha Bonilla BaricauaNo ratings yet

- CIR v. PinedaDocument1 pageCIR v. PinedazacNo ratings yet

- Taxation I Cases Part 1Document63 pagesTaxation I Cases Part 1carinokatrinaNo ratings yet

- Sy Kiong, Floresca, de Jesus Case DigestsDocument1 pageSy Kiong, Floresca, de Jesus Case DigestsMis DeeNo ratings yet

- 16 Evangelista Vs CIRDocument6 pages16 Evangelista Vs CIRcertiorari19No ratings yet

- CIR v. PINEDA - No. L-22734. September 15, 1967Document3 pagesCIR v. PINEDA - No. L-22734. September 15, 1967Jeng PionNo ratings yet

- Tax 1 - Ass No. 2Document6 pagesTax 1 - Ass No. 2De Guzman E AldrinNo ratings yet

- Evangelista Vs CirDocument5 pagesEvangelista Vs CirjessapuerinNo ratings yet

- 1 GR No L-9996Document7 pages1 GR No L-9996remramirezNo ratings yet

- Tax CasesDocument28 pagesTax CasesDelOmisolNo ratings yet

- Tax CasesDocument13 pagesTax CasesMhiletNo ratings yet

- Office of The Solicitor General For Petitioner. Manuel B. Pineda For and in His Own Behalf As RespondentDocument2 pagesOffice of The Solicitor General For Petitioner. Manuel B. Pineda For and in His Own Behalf As RespondentSushane BituinNo ratings yet

- Partnership CasesDocument139 pagesPartnership CasesAnonymous IobsjUatNo ratings yet

- Tax 1 CAses PArt 1 1Document167 pagesTax 1 CAses PArt 1 1Abegail Olario AdajarNo ratings yet

- 01 Engracio Francia V Intermediate Appellate Court and Ho Fernandez GR L 67649 June 28 1988Document1 page01 Engracio Francia V Intermediate Appellate Court and Ho Fernandez GR L 67649 June 28 1988Nojoma PangandamanNo ratings yet

- Supreme Court: Republic of The Philippines Manila en BancDocument4 pagesSupreme Court: Republic of The Philippines Manila en BancGoodyNo ratings yet

- Mercado v. RealDocument3 pagesMercado v. RealMarianeHernandezNo ratings yet

- Lorenzo Ona V CIRDocument20 pagesLorenzo Ona V CIRChatNo ratings yet

- Real Estate: How to Find Auctions, Foreclosures, and the Cheapest PropertiesFrom EverandReal Estate: How to Find Auctions, Foreclosures, and the Cheapest PropertiesNo ratings yet

- LOT 1: A LEGAL DECRIPTION OF JUDICIAL CORRUPTION IN COOK COUNTY, ILLINOIS COOK COUNTY PARCEL NUMBERS ARE NOT LOT NUMBERSFrom EverandLOT 1: A LEGAL DECRIPTION OF JUDICIAL CORRUPTION IN COOK COUNTY, ILLINOIS COOK COUNTY PARCEL NUMBERS ARE NOT LOT NUMBERSNo ratings yet

- Report of Al Capone for the Bureau of Internal RevenueFrom EverandReport of Al Capone for the Bureau of Internal RevenueNo ratings yet