Professional Documents

Culture Documents

Preserve Myga 8 5x11 Flyer - Grandfather

Preserve Myga 8 5x11 Flyer - Grandfather

Uploaded by

api-297791728Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preserve Myga 8 5x11 Flyer - Grandfather

Preserve Myga 8 5x11 Flyer - Grandfather

Uploaded by

api-297791728Copyright:

Available Formats

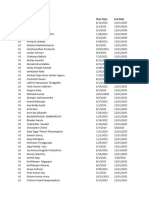

Preserve Multi-Year Guaranteed Annuity

Guaranteed

Period Option

Rates

3- Year

1.80%

5-Year

2.40%

7-Year

2.60%

10-Year

2.90%

AGENT NAME

TITLE

COMPANY

PHONE: XXX-XXX-XXXX

Interest rate shown is as of 6/01/2016, is subject to change and may vary in accord with state regulations. Preserve Annuities are issued by

and are obligations of Guggenheim Life and Annuity Company, home office at 401 Pennsylvania Pkwy., Suite 300, Indianapolis, Indiana

46280. Annuity products are not insured by the FDIC. Annuity contracts contain charges and limitations. Preserve annuities have varying

surrender charge periods with substantial penalties for early withdrawal, and may be subject to a market value adjustment. Preserve annuities and/or certain optional features of such annuities may not be available in all states. Guggenheim Life and Annuity Company is not

licensed in New York. The contract is issued on form numbers GLA-MYGA-01 or variations of such. 071601A

Lifetime Income

May Avoid Probate

Guggenheim Life can provide you with

a guaranteed income stream with the

purchase of your tax-deferred annuity,

through the ability to annuitize, which

turns the deferred account into a

scheduled stream of income payments.

You will have the ability to choose from

several different annuity payout options

that may meet your future income needs.

By naming a beneficiary, your deferred

annuity will be paid directly to the

beneficiary, thereby avoiding inclusion

in a probated estate. This benefit may

minimize these delays, expenses and

publicity often associated with probate.

Your designated beneficiary receives

death proceeds in either a lump sum or a

series of income payments.

Penalty-Free Withdraws

Tax-Deferred Growth

Preserve Multi-Year Guaranteed Annuity

provides a single penalty-free withdrawal

each year beginning in contract year two.

The maximum free withdrawal amount

will be 10% of your account value on the

previous contract anniversary. A penaltyfree withdrawal waives any surrender

charges or market value adjustment on the

withdrawn amount. Amounts withdrawn

in excess of the 10% penalty free amount

will incur a surrender charge and market

value adjustment, if applicable.

Tax-deferred growth allows your money

to grow faster because you earn interest

in dollars that would otherwise be

immediately taxable. Your premium earns

interest, the interest compounds within

the contract, and the money would

would have paid in taxes earns interest.

Income taxes are deferred until funds are

withdrawn from the contract.

For more information, contact:

AGENT NAME

TITLE

COMPANY

PHONE:XXX-XXX-XXXX

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- Birth Certificate BondDocument1 pageBirth Certificate BondJeff Anderson99% (141)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Adp 2019 02 12 PDFDocument2 pagesAdp 2019 02 12 PDFAdam Olsen100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- CC Sem VBV BRDocument3 pagesCC Sem VBV BRjocianemarcelino1No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Document1 pageThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableMorenita Pareles100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- LC 154 Eisenhower Dollar ChecklistDocument1 pageLC 154 Eisenhower Dollar ChecklistMichelléBranyakNo ratings yet

- BMI Real Estate Report 2016Document62 pagesBMI Real Estate Report 2016Umal MultanNo ratings yet

- Ca De-4Document4 pagesCa De-4Kevin Marcos FelicianoNo ratings yet

- "Foreign Currency Deposit Unit" or "FCDU" Shall Refer To That Unit of A Local BankDocument3 pages"Foreign Currency Deposit Unit" or "FCDU" Shall Refer To That Unit of A Local Bankalimoya13No ratings yet

- Essentials of Federal Taxation Chapyter5-8Document16 pagesEssentials of Federal Taxation Chapyter5-8Amanda_CChenNo ratings yet

- Money TimesDocument20 pagesMoney TimespasamvNo ratings yet

- AAPI QLI Convention BrochureDocument4 pagesAAPI QLI Convention BrochureAAPI ConventionNo ratings yet

- 6.30 Investment HoldingsDocument87 pages6.30 Investment HoldingsNBC MontanaNo ratings yet

- Fivecoat Foreclosures & FraudDocument429 pagesFivecoat Foreclosures & FraudAlbertelli_Law100% (1)

- 320 Hydraulic PartDocument134 pages320 Hydraulic PartOecox Cah DjadoelNo ratings yet

- Bigstock 2018 Tax Form PDFDocument1 pageBigstock 2018 Tax Form PDFBalint RoxanaNo ratings yet

- US Internal Revenue Service: I1040 - 2005Document142 pagesUS Internal Revenue Service: I1040 - 2005IRSNo ratings yet

- Gov. Walz 2015 Tax Returns - RedactedDocument13 pagesGov. Walz 2015 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- SOS Welcome LetterDocument1 pageSOS Welcome Letteradamcash200No ratings yet

- Form 8888 For RefundDocument1 pageForm 8888 For Refundpolaoapp3044No ratings yet

- List of Passers: Real Estate Broker Licensure Exam 2016 ResultsDocument111 pagesList of Passers: Real Estate Broker Licensure Exam 2016 ResultsHopplerNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 4blon majorsNo ratings yet

- Yearly Earnings - Sheet1Document1 pageYearly Earnings - Sheet11048477No ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- August 252010 PostsDocument313 pagesAugust 252010 PostsAlbert L. PeiaNo ratings yet

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Obamacare & GSEs - Key Players Trading HatsDocument51 pagesObamacare & GSEs - Key Players Trading HatsJoshua Rosner100% (4)

- Active US ResourcesDocument12 pagesActive US ResourcesVarma PinnamarajuNo ratings yet

- Ohio Charitable Trust Act Information SheetDocument1 pageOhio Charitable Trust Act Information SheetMary GallagherNo ratings yet