Professional Documents

Culture Documents

Cultural Challenges of Integration-Daiichi Sankyo and Ranbaxy - ModATeam5

Cultural Challenges of Integration-Daiichi Sankyo and Ranbaxy - ModATeam5

Uploaded by

Mahda SumayyahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cultural Challenges of Integration-Daiichi Sankyo and Ranbaxy - ModATeam5

Cultural Challenges of Integration-Daiichi Sankyo and Ranbaxy - ModATeam5

Uploaded by

Mahda SumayyahCopyright:

Available Formats

Value creation and daiichi sankyos indian acquisition

case study

Module A - Team 5

Mahda Sumayyah

Jeongsang Yu

Mahesh Kulkarni

Joyce Ogunlade

Rafael Carceller Zazo

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

Cultural Challenges of Integration: Value Creation and Daiichi Sankyos Indian

Acquisition

Historically, about 75% of international mergers fail (Strategic Direction.2006, p.25-28).

International mergers struggle to succeed not because of the business itself but because of a

failure to synergize geographical, structural, and cultural differences. Below is a critical analysis

of how the above factors as well as other issues played a role in Daiichi Sankyos acquisition of

the Indian generic pharmaceutical company, Ranbaxy.

First, it is important to execute a SWOT ANALYSIS to evaluate the strengths, weaknesses,

opportunities and threats of the acquisition. Then we will be able to identify and analyze the

internal(S&W) and external (O&T) factors that can have an impact on the viability of the

acquisition and provide an outline for the strategic decision-making. In the SWOT analysis is

included potential events during the pre-acquisition and post-acquisition.

The biggest strengths from Ranbaxy are strong market in generics, big scale production,

alliances with important Pharmaceutical companies, marketing and business developing in big

markets (USA, Europe, Brazil, Japan, etc.), low cost manpower, and strong experience to get

permission for distribution drugs in potential countries. For Daiichi Sankyo, the strengths before

merge are high R&D potential, 3rd largest company in the Pharmaceutical sector in Japan, top 20

world sales and big potential in the creation of blockbuster drugs. After the acquisition, the is the

possibility of creation of hybrid model, diversification of the assets of the companies, synergies

in generics and innovator drugs, optimizing resources, synergies in Know-How of the companies

and potential increase of exportations.

The weaknesses of the acquisition were poor strategic planning, products duplication,

Page 1

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

loss of the main directors from Ranbaxy, low credibility, legalization problems from Ranbaxy in

major markets, financial problems for Daiichi Sankyo, the fact that 40% of the patents Daiichi

Sankyo would expire in 2012, and difficulties in cultural integration.

The opportunities that would the acquisition provided were the production of new generic

drugs in big scale, introducing in new potential markets (globalization), reduction requirements

for approval generic drugs by the governments and possibility to increase sales in emerging

countries with the hybrid model. Lastly, the threats arose where competitors started to have the

same model (generics+innovators drugs), the expiration and reduction of drugs patents terms,

reduction of expenses in drugs by countries and difficulties for approval for the drug

commercialization by the different Sanitary Agencies (Appendix 1). In addition to a SWOT

analysis, a critical look into the histories of the two organizations will also provide insight into

what may have caused disparity between the two organizations.

Daiichi Sankyo was formed by a merger in 2005 between Daiichi Pharmaceuticals and

Sankyo Co Ltd, both established Japanese firms, each with more than 100 years history. Because

each company has their own history of more than 100 years respectively, they must have

established different cultures from each other in many ways. Ranbaxy was set up in 1961 as an

India-based distributer of vitamins and anti-tuberculosis drugs for a Japanese drug manufacture.

Bhai Mohan Singh took over Ranbaxy in 1996 and his son Parvinder Singh joined him in the late

1960s. By early 1990s, Ranbaxy was Indias largest generic medicine company with annual sales

of about US$200 million and distribution network spanning more than 50 countries. Exports

contributed 40 percent of its total annual sales. Ranbaxy was ranked among the Top 10 generic

companies in the world and was the only Indian company in the Top 100 Pharmaceutical

companies across the globe (Www.asiacase.com, p.3). As mentioned above, Daiichi Sankyo was

Page 2

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

a merged company with two different company cultures and values, and this merged company

merged with another different firm that was even in a different field. Therefore, there must have

been confusion after a merge.

Also, at Ranbaxy, the acquisition was followed quickly by several leadership changes.

Chairman/CEO Malvinder Singh, the grandson of Ranbaxys founder, resigned in May 2009;

Atul Sobti who took over as CEO, resigned the following year citing differences with the

Japanese company on the running of Ranbaxy. Then in early 2011, Ranbaxys President and

Chief Financial Officer, Omesh Sethi also left the company (Www.asiacase.com, p.3). With the

fact that many changes of leadership occurred after the merge, we can speculate that there was

the cross-cultural challenges of integrating the two businesses.

It was stated by Atul Sobti that the reason for his leaving was due to the difference of

company future course with Daiichi Sankyo. Daiichi Sankyos primary focus was to enter the

global generic drug market while at the same time introduce innovative drugs to Indian market.

Ranbaxy, on the other hand, had immediate priority to resolve the issue that were surrounding

their drug ban by United States Food and Drug Administration and AIP issue. Ranbaxy and

Daiichi Sankyo were facing different company orientations at the early stages of their

acquisition. It seemed that both Daiichi Sankyo and Ranbaxy did not bring the issue of their

company orientation to the table when they first merged. Hofstede demonstrated that there are

different cultural dimensions that impact the organizational behavior of the company (Hofstede,

Geert, 2001). One of the cultural dimensions that best explains the above situation is Long-term

versus Short-term Orientation (Dean B., McFarlin & Paul D., Sweeney, 2013, p.47).

Also, Hofstede spoke about uncertainty avoidance as a cultural dimension that affects the

ways organizations behave (Hopkins, Bryan, 2009, p. 40). The turnover in Ranbaxy C-level may

Page 3

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

possibly be explained by uncertainty avoidance. Both cultures, Japanese and Indian, have

differing levels of how they deal with future uncertainty. According to research, Indians

generally have a very low rating in uncertainty avoidance. Japanese, on the other hand, show the

highest level of uncertainty avoidance. India post the lowest rating in uncertainty avoidance. On

the other hand, Japan is the highest in this rating. In addition to the cultural and ethical

implications, it is important to review the efforts each company made to structurally during the

acquisition.

Daiichi Sankyo was the third largest Innovator pharmaceutical (Www.asiacase.com, p.3)

company in Japan and Ranbaxy emerged as Indias largest generic drug manufacturing company

by 1990, which was due to the vision of CEO, Parvinder Singh, who took advantage of India

Patent Act of 1970 that ended the product patent protection in the country. Ranbaxy also had the

advantage of being a low cost manufacturer and due to which it spread the distribution network

among emerging markets in 50 countries with annual sales mounting to US$200 in 1990s.

I On the other hand, in Japan, during the year 2000 the government regulated the guidelines on

drug reimbursements to control the health costs due to which the profits of innovator drug

companies soar. Also, the government set a target of increasing market share of generic drug use

to 30% by 2012, which is an increase of around 18% of the earlier target of 2007.Hence to

maintain profits and future growth, Daiichi Sankyo was looking for the acquisition of generic

drug manufacturer to enter into emerging markets. Ranbaxy was the best choice for acquisition

for following reasons: Largest generic drug manufacturer in India operating on low cost basis;

Established export network in US and European markets like Irelands, France and Spain; Daiichi

Sankyo entered into this acquisition with the vision to become a Global Pharma Innovator by

2015. For Ranbaxy it was the advantage to utilize the innovation of Daiichi Sankyo, free itself

Page 4

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

from debt, and entry into Japanese market. The deal made both the companies 15th largest

Pharma Company in the world (Www.asiacase.com, p.3).

I As a result of the acquisition, the EPS for Daiichi Sankyo was doubled, however, without

increase in gross profit. Also current liabilities were increased to 161% compared to Current

Assets that was increased by 15.8% (www.slideshare.net, slide 24). In Sep 2008, US FDA

implemented a ban on drugs manufactured by two of Ranbaxys plants and also in Feb 2009

invoked AIP against Ranbaxys Paonta Sahib Facility in India. This made Ranbaxys share price

plummet to 1/5th in Mar 2009. Daiichi Sankyo still went ahead with the acquisition in Nov 2008

considering the ban by US FDA as a risk factor that can be resolved. However Daiichi also

booked a valuation loss of US$3.9 billion in Dec 2009 (www.www.asiacase.com, p.12). The

other causes were not receiving the approval from SEBI to waive of +1% ceiling for this block

deal (www.slideshare.net, slide 29).

Up until its acquisition of controlling shares in Ranbaxy, Daiichi Sankyo focused solely on

operating as a Japanese company. The company did not effectively prepare to integrate the two

geographic cultures and therefore, its efforts to manage cultural diversity between the two

companies was minimal. Daiichi Sankyo set up a team to spearhead its integration efforts,

however, the team was comprised of two Japanese members and one Indian member. Secondly,

the person selected as Director of Quality Control was also a former member of Daiichi Sankyo

(Www.www.asiacase.com, p.6). Because the countries operated under two very different

geographical cultures and constraints, in order for the integration to be successful, Daiichi

Sankyo needed to make more significant effort to unite the two cultures together.

An alternative approach for Daiichi Sankyo could be to ensure the team created to head the

integration efforts consists of two Japanese and two Indians. By comprising the team of an even

Page 5

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

number of Japanese and an even number of Indians, it would eliminate the dominance of

Japanese officials and provide an avenue for both cultures to equally participate. Additionally,

because of what Daiichi Sankyo wants to accomplish in the Indian market, it has to understand

business from the perspective of Ranbaxy personnel, people who have hands on experience

working in India and under the regulatory constraints it regularly endures.

Daiichi Sankyos goal must also be to understand the work customs of Ranbaxy. Because of

the geographical advantages of patent protection and financial capability, Japanese workers were

able to innovate while Indians workers were trained to emulate. To manage the diverse cultures,

Daiichi Sankyo must continue to allow Ranbaxy personnel to operate the way they had

traditionally operated in India.

Considering the aforementioned analysis, there are a number of structural, cultural, and ethnic

implications of bringing Daiichi Sankyo and Ranbaxy together. A more successful Hybrid model

would aim, not at bringing both companies under one umbrella, but to allow both companies

more liberty to continue most of its operations separately. Some of the changes of to the Hybrid

model that would provide a more successful integration are:

In terms of Specialization, they need to have VP and CFO respectively for each business

to avoid confusion from a merge and keep their own traditional trait.

In terms of Centralization, quality and Safety Management Supply Chain Management

are operated as hybrid model as they can reduce logistics cost with this system and both

need to follow FDA.

(See Appendix 2)

In conclusion, Daiichi Sankyo should have applied proper due diligence prior to their

acquisition of Ranbaxy. Daiichi Sankyo and Ranbaxy has wide cultural difference that impacted

Page 6

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

the overall success of the merger. In terms of organization structure, the acquired company has to

create a new Hybrid Business Model.

Page 7

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

References

Geok, Wee Beng, Chua, Wilfred (2012), Cultural Challenges of Integration: Value Creation and

Daiichi Sankyos Indian Acquisition, Www.asiacase.com

Routray, Nihar (2012), Acquisition of Ranbaxy by Daiichi, Www.slideshare.net

Strategic Direction (Vol. 22 Issue 1) (2006), p. 25-28

Hofstede, Geert (2nd Eds.) (2008), Cultures Consequences: Comparing Values, Behavior,

Institutions and Organizations across Nations, p. 83

Hopkins, Bryan (2009), Cultural Differences & Improving Performance: How Values & Beliefs

Influence Organizational Performance, p. 40

McFarlin, Dean B., Sweeney, Paul D. (2013), International Organizational Behavior:

Transcending Borders & Cultures, p. 47

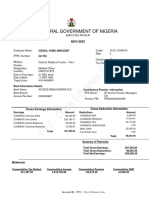

Appendix 1

Page 0

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

INTERNAL

EXTERNAL

ANALYSISANALYSIS

WEAKNESS

-R directives left company reducing information and synergies

-Lack of planning in the hybrid business model

- D&S difficult financial situation after the acquisition

-D&S 40% patents expire 2012

-Difficulties in the cultural issues of integration

-Decrease of the rate of discovery new profits moleculars

NEGATIVES

-R

sa

US

-Ex

-R

-Re

-In

ma

-A

co

-U

his

-D

(e.

-Re

sa

SWO

STRENGTH

-R Largest Indian generic drug company

-R strong market in generics

-R Big experience in scale production

-R effective technology in reverse engineering for generics

-R Alliances with Top Pharma companies, strong world market

- R Low cost manpower

-R Strong experience legalization drugs distribution in other countries. High

rating to get the approval 457/526

-R Marketing and business developing in big markets ( USA, Europe, Brazil,

Japan, etc.)

-R Pre-Knowledge of Japanese market

-D&S 3rd largest innovator drug Co. in Japan and presence in 21 countries.

Top20 world sales

-D&S experience in merger progress(but same country)

-D&S Large potential in creation of blockbuster drugs

-D&S Research collaboration with important laboratories

-Synergies companies business generic+innovator drug market

-Merger result covered 4 markets new prescriptions drugs, generics, OTC

drugs and vaccines

-Creation in 2009 a Synergy Office for integration of the companies

- Diversification of the assets of the companies in different countries

POSITIVES

Page 1

Cultural Challenges of Integration:

Value Creation And Daiichi Sankyos Indian Acquisition

Mod A Team 5

Appendix 2

Page 0

You might also like

- ICAEW Professional Level Financial Management Question Bank - Twelfth Edition 2018Document385 pagesICAEW Professional Level Financial Management Question Bank - Twelfth Edition 2018Optimal Management Solution100% (2)

- Eli Lilly's Project Resilience (A) : Anticipating The Future of The Pharmaceutical Industry.Document17 pagesEli Lilly's Project Resilience (A) : Anticipating The Future of The Pharmaceutical Industry.YountekNo ratings yet

- Five Competitive Forces in China's Automobile IndustryDocument8 pagesFive Competitive Forces in China's Automobile IndustrykatnavNo ratings yet

- What Are The Advantages and Disadvantages of Starting and Operating A Pharmaceutical Firm in India?Document2 pagesWhat Are The Advantages and Disadvantages of Starting and Operating A Pharmaceutical Firm in India?Phạm Long100% (1)

- NullDocument4 pagesNullZunairaNo ratings yet

- Case Format ProcterDocument6 pagesCase Format Procterlovelysweet_gaby100% (1)

- Ib Case Sec D 130 SatyajtiDocument6 pagesIb Case Sec D 130 SatyajtiAditya ChoudharyNo ratings yet

- Case Study of Maruti Udyog LimitedDocument4 pagesCase Study of Maruti Udyog LimitedShashank Singh75% (4)

- Toyota's Strategy and Initiatives in Europe: The Launch of TheDocument4 pagesToyota's Strategy and Initiatives in Europe: The Launch of TheMisti WalkerNo ratings yet

- A Case Analysis On BioconDocument3 pagesA Case Analysis On BioconArchit Patel89% (9)

- The Collapse of Continental Illinois National Bank Wharton CaseDocument31 pagesThe Collapse of Continental Illinois National Bank Wharton Casebpetrov13No ratings yet

- Case Study On Merging of Ranbaxy and Diichi SankyoDocument13 pagesCase Study On Merging of Ranbaxy and Diichi SankyoLavanya PrabhakaranNo ratings yet

- Eli Lilly in IndiaDocument8 pagesEli Lilly in IndiaJunaid MunirNo ratings yet

- indian Pharmaceutical Industry:-: 1) Introduction: - HistoryDocument13 pagesindian Pharmaceutical Industry:-: 1) Introduction: - HistoryPRASH43No ratings yet

- Ranbaxy Daiichi SankyoDocument28 pagesRanbaxy Daiichi SankyoRehanNo ratings yet

- Ranbaxy DaiichiDocument37 pagesRanbaxy Daiichiapjain2701No ratings yet

- Bio ConDocument4 pagesBio ConSachin HanwateNo ratings yet

- 08-081 Biocon India GroupDocument11 pages08-081 Biocon India GroupHarini SridharanNo ratings yet

- International Management - ToyotaDocument13 pagesInternational Management - ToyotaPriyanka Gulati MehtaNo ratings yet

- Japan Economic MiracleDocument9 pagesJapan Economic MiracleJoseph LiNo ratings yet

- Ridhima Yadav - G023 - 80511020325: Brand Management Faculty: Dr. Smriti PandeDocument5 pagesRidhima Yadav - G023 - 80511020325: Brand Management Faculty: Dr. Smriti PandeRidhima YadavNo ratings yet

- Tata Motors AssignmentDocument7 pagesTata Motors AssignmentUINo ratings yet

- Biocon Case Answers HBSDocument1 pageBiocon Case Answers HBSNikhil JosephNo ratings yet

- MGT368 Case Study Solution.Document4 pagesMGT368 Case Study Solution.TauhidHasanRifatNo ratings yet

- Project Report LizaDocument42 pagesProject Report LizaSunill SamantaNo ratings yet

- HondaDocument3 pagesHondaNabeel YaqoobNo ratings yet

- Kinetic Honda Joint Venture-Case Study: 1. Summary of The CaseDocument2 pagesKinetic Honda Joint Venture-Case Study: 1. Summary of The CaseAbhishek kumarNo ratings yet

- History of Bajaj Auto: VespaDocument18 pagesHistory of Bajaj Auto: VespaDevashish ParmarNo ratings yet

- Strategic Management Sony SamsungDocument12 pagesStrategic Management Sony Samsungsyeda salmaNo ratings yet

- An Investigation Into Nokia Microsoft Strategic Alliance Joining Forces in The Global Smartphone IndustryDocument7 pagesAn Investigation Into Nokia Microsoft Strategic Alliance Joining Forces in The Global Smartphone IndustryMuhtasim RafatNo ratings yet

- The Product Life Cycle (PLC)Document5 pagesThe Product Life Cycle (PLC)tejaNo ratings yet

- Biocon Case SummaryDocument2 pagesBiocon Case SummaryTamal Kishore Acharya67% (3)

- Final Report On Nikon Camera: Submitted By: NAME: C.B. Sujeeth Bharadwaj C13Document22 pagesFinal Report On Nikon Camera: Submitted By: NAME: C.B. Sujeeth Bharadwaj C13Sujeeth BharadwajNo ratings yet

- Vodafone India Evaluation and Entry StrategyDocument15 pagesVodafone India Evaluation and Entry StrategySadia AnumNo ratings yet

- Entrepreneurship Project: Biocon: Submitted To-Submitted by - Dr. Abha Aman Bajaj 237/15 Bcom LLB (Hons.)Document20 pagesEntrepreneurship Project: Biocon: Submitted To-Submitted by - Dr. Abha Aman Bajaj 237/15 Bcom LLB (Hons.)Aman BajajNo ratings yet

- Sun Pharma ReportDocument10 pagesSun Pharma ReportVijayalakshmi Kannan100% (1)

- Electrical Equipment Industry 2020Document2 pagesElectrical Equipment Industry 2020Ipsita Bhattacharjee100% (1)

- SWOT Analysis For NIRMADocument2 pagesSWOT Analysis For NIRMAAnuj SinghNo ratings yet

- Pestel Analysis Political FactorsDocument3 pagesPestel Analysis Political FactorsAbhishekNo ratings yet

- Ford Case Study (Brief)Document2 pagesFord Case Study (Brief)Anoop Koshy100% (1)

- Hero HondaDocument46 pagesHero Hondamaisha_nsuNo ratings yet

- Sun Pharma Industry AnalysisDocument23 pagesSun Pharma Industry AnalysisAdiNo ratings yet

- Entering Lnternational MarketsDocument173 pagesEntering Lnternational MarketsNitin SharmaNo ratings yet

- Hindalco Novelis CaseDocument13 pagesHindalco Novelis Casekushal90100% (1)

- Balaji Corporate PresentationDocument34 pagesBalaji Corporate PresentationPrashant PatilNo ratings yet

- DocDocument17 pagesDocsimarjeet singh100% (2)

- Global Pharmaceutical Industry-OverviewDocument6 pagesGlobal Pharmaceutical Industry-OverviewNaveen Reddy50% (4)

- ENDO Lighting Company Profile PDFDocument16 pagesENDO Lighting Company Profile PDFganeshp_eeeNo ratings yet

- Marico Swot & Pestle Analysis: © Barakaat Consulting - An Ezzy IT Consulting BusinessDocument6 pagesMarico Swot & Pestle Analysis: © Barakaat Consulting - An Ezzy IT Consulting BusinessAbinashNo ratings yet

- Marico's Case StudyDocument13 pagesMarico's Case StudyAnjali GuptaNo ratings yet

- Introduction To Service Sector: Brief Introduction of Nirula'sDocument23 pagesIntroduction To Service Sector: Brief Introduction of Nirula'starun-neha100% (1)

- Product Life CycleDocument36 pagesProduct Life CyclesamirmanchekarNo ratings yet

- The Indian Audio MarketDocument2 pagesThe Indian Audio MarketDisha SharmaNo ratings yet

- InfosysDocument11 pagesInfosysHardy TomNo ratings yet

- Cultural Challenges of Integration PDFDocument16 pagesCultural Challenges of Integration PDFpaps3535_29555442No ratings yet

- 13 - Chapter 6 PDFDocument36 pages13 - Chapter 6 PDFAadi LokhandeNo ratings yet

- 13 - Chapter 6 PDFDocument36 pages13 - Chapter 6 PDFAadi LokhandeNo ratings yet

- Daiichi Sankyo RanbaxyDocument2 pagesDaiichi Sankyo RanbaxyPramod kNo ratings yet

- EntrepreneuerDocument13 pagesEntrepreneuerhasitNo ratings yet

- Project Report On M & A of Ranbaxy Ltd. and Daiichi SankyoDocument14 pagesProject Report On M & A of Ranbaxy Ltd. and Daiichi SankyoNikita AgarwalNo ratings yet

- Sun Pharma ProjectDocument26 pagesSun Pharma ProjectVikas Ahuja100% (1)

- Skjaervo Enc Ir KAYĀNIĀNDocument72 pagesSkjaervo Enc Ir KAYĀNIĀNTataritosNo ratings yet

- Megillah 3Document70 pagesMegillah 3Julian Ungar-SargonNo ratings yet

- The Golden Age of Comic Books - Representations of American CulturDocument14 pagesThe Golden Age of Comic Books - Representations of American CulturGasterSparda8No ratings yet

- Chapter 2 PolynomialsDocument39 pagesChapter 2 PolynomialsRamesh RathoreNo ratings yet

- Assignment 3 Individual AssignmentDocument13 pagesAssignment 3 Individual AssignmentThư Phan MinhNo ratings yet

- Viktoria Saat FPDocument41 pagesViktoria Saat FPdidacbrNo ratings yet

- Vitamin B2Document10 pagesVitamin B2Rida IshaqNo ratings yet

- Lewis Mutswatiwa...Document69 pagesLewis Mutswatiwa...LEWIS MUTSWATIWANo ratings yet

- The Death of UniversitiesDocument2 pagesThe Death of UniversitiesMolitvena zajednica sv. Mihaela arhanđelaNo ratings yet

- Assignment 14Document2 pagesAssignment 14peter t. castilloNo ratings yet

- Chapter 4 Referenes Arranged AlphabeticalDocument5 pagesChapter 4 Referenes Arranged AlphabeticalJoselito GelarioNo ratings yet

- CBLM Tourman Core 2Document41 pagesCBLM Tourman Core 2John Joseph AmilerNo ratings yet

- Gabion Wall at IntakeDocument13 pagesGabion Wall at IntakeBert EngNo ratings yet

- Reinvent Your Business ModelDocument26 pagesReinvent Your Business Modelvargasjunior65100% (1)

- Term Paper Draft IMDocument14 pagesTerm Paper Draft IMDewan Ashikul AlamNo ratings yet

- Nervous System Worksheet1Document3 pagesNervous System Worksheet1fe jandugan0% (1)

- Province Tourist Destinations Festivals: REGION XI - Davao RegionDocument13 pagesProvince Tourist Destinations Festivals: REGION XI - Davao Regionaaron manaogNo ratings yet

- Pre-Lesson: - ActivitiesDocument3 pagesPre-Lesson: - ActivitiesnitiyahsegarNo ratings yet

- ThorDocument5 pagesThorandreea uNo ratings yet

- November 2023Document1 pageNovember 2023innoozokoNo ratings yet

- HRM BBA MBA Lec 789 Job Analysis and DesignDocument41 pagesHRM BBA MBA Lec 789 Job Analysis and Designrhmafia786No ratings yet

- Dhan Allyn Romero 11 Saturn ABM EAPPDocument7 pagesDhan Allyn Romero 11 Saturn ABM EAPPJhevie RanileNo ratings yet

- Lesson Plan in Business FinanceDocument9 pagesLesson Plan in Business FinanceEmelen VeranoNo ratings yet

- Department of Education: Schools Division of Ozamiz CityDocument3 pagesDepartment of Education: Schools Division of Ozamiz CityDoone Heart Santander Cabuguas100% (1)

- PetroSync - API 579 Fitness For Service 2023 Oil Gas TrainingDocument5 pagesPetroSync - API 579 Fitness For Service 2023 Oil Gas TrainingPetro SyncNo ratings yet

- TAX Chapter 1-2 - Intoduction To Taxation - QuizDocument6 pagesTAX Chapter 1-2 - Intoduction To Taxation - QuizRejay VillamorNo ratings yet

- Sport Psychology ToolsDocument169 pagesSport Psychology Toolsfeldexxor100% (5)

- Reading in Philippines HistoryDocument7 pagesReading in Philippines Historyrafaelalmazar416No ratings yet

- Turbo-Couplings-Fluid Couplings-with-Constant-Fill - Operating-ManualDocument108 pagesTurbo-Couplings-Fluid Couplings-with-Constant-Fill - Operating-ManualCarollina AzevedoNo ratings yet