Professional Documents

Culture Documents

Balaji Viswanathan's Answer To How Is It Possible That Only 3% of Indians Pay Income Tax - Quora

Balaji Viswanathan's Answer To How Is It Possible That Only 3% of Indians Pay Income Tax - Quora

Uploaded by

R. SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balaji Viswanathan's Answer To How Is It Possible That Only 3% of Indians Pay Income Tax - Quora

Balaji Viswanathan's Answer To How Is It Possible That Only 3% of Indians Pay Income Tax - Quora

Uploaded by

R. SinghCopyright:

Available Formats

Balaji Viswanathan's answer to How is it possible that only 3% of Indians pay income tax?

- Quora

Sign In

How is it possible that only 3% of Indians pay

income tax?

Balaji Viswanathan, Indian by Birth. Indian by Thought.

64.4k Views Upvoted by Sameer Bhagwat, Nationalist Indian supporting Modi, Sanket Shah, I

am an Indian, Shashi Hegde, Indian by birth,blood,heart and mind

Balaji is a Most Viewed Writer in Tax Policy.

There is nothing shocking about the news item. What you need to do is parse the statistic

that our news media is too lazy to do. Let's start from here:

Less than 3 percent file income tax return in India

Only 3.5 crore people, or 2.89 percent of the country's total population of more than 121

crore, file income tax return in India

Out of the 121 crore people might be your 1 year old son and a 95 year old grandma who

might be earning no income. Neither need to file taxes. In fact, there are only 47 crore

people who are actually working. India has a workforce of 47.41 crore: Government

Of these almost half are employed in agriculture. That is pretty much exempt from income

tax. Our nation, like many others, have an idylistic attitude towards agriculture - a

hangover from the agricultural past. We somehow assume that farmers are doing a more

important job than rest of us.

In any case, that leaves only about 23 crore workers who work in factories and the service

sector.

To pay income tax you need to be earning Rs. 2.5 lakhs or more per year. Because, we don't

want to tax the poor. Now, how many of the workers do you see around you make Rs.

22000 or more per month? How about your maid? Not likely. How about the assistant

sitting in the shop? Not likely.

This is a slightly old data, but what it shows is that the top 20% people even make far less

than Rs. 2.5 lahs/year.

https://www.quora.com/How-is-it-possible-that-only-3-of-Indians-pay-income-tax/answer/Balaji-Viswanathan-2?srid=dy8l&share=a3e46d8b[08 Tuesday Mar 3 16 1:27:16 AM]

Balaji Viswanathan's answer to How is it possible that only 3% of Indians pay income tax? - Quora

Of the 24 crore factory & sector workers, well less than 20% might actually be making Rs.

2.5 lakhs or more per year. That number is not far more than 3.5 crore people who are

filing the taxes.

Learn to look beyond the screaming TV reporter. Visit outside of a major metro areas and

see how many make Rs. 25k or more per month on salaries. That is not really a big

percentage of the total population [that includes kids, students, unemployed, old aged,

homemakers etc]. That percentage is unlikely to be more than 4%.

However, this is not a small number in aggregate. We have more income tax payers than

say UK or Germany. And together they generate Rs. 3.5 lakh crores in revenue to the

government [http://indiabudget.nic.in/ub2016... ]

This is the second biggest source of income to the Union Government [after

corporate taxes] and pays way more than what the government spends on defense,

education and health put together. It is no small amount.

I'm not sure what kind of economics people are taught in India. Our total GDP [in nontechnical terms it is the sum total of all the incomes of all Indians] is about Rs. 125 lakh

crores. No one thinks think it is an underestimate [in fact, some economists even think

that this might be overestimating a bit due to the recent changes in calculation]. Think of

that number for your basic math and before you make a statement that a lot of people are

making Rs. 25L or more [as seen in the comments].

Let's say we have 5 crore people who earn Rs. 25lakhs. That itself would be Rs. 125 lakh

crores with the rest 115 crore people arming Rs. 0. It is absurd. In short, the number of

people earning Rs. 25 lakhs or so will be way, way less than 5 crores. Once you also

account that the billionaires at the top get a way bigger chunk, you can shrink the fairly

rich [Rs. 25L+] to under 1 crore people. Then there might be about 4 crore people who

might be earning Rs. 5-25 lakhs. Thus, our taxable pool is probably only 5 crore people

and if we remove those with agricultural income, the really eligible taxpayers might not

more than 4 crore people. This is also consistent with the economic survey [since the

survey is a few years old, adjust for inflation]. It says 3.4 crore households are actually at

or above the middle class [the tax paying class].

https://www.quora.com/How-is-it-possible-that-only-3-of-Indians-pay-income-tax/answer/Balaji-Viswanathan-2?srid=dy8l&share=a3e46d8b[08 Tuesday Mar 3 16 1:27:16 AM]

Balaji Viswanathan's answer to How is it possible that only 3% of Indians pay income tax? - Quora

Sure, there is tax evasion, but nothing close to what our citizens imagine [often they are fed

with some unrealistic "black money" numbers by our vote seeking politicians].

And while the middle class often whines that they pay most of the taxes, they often ignore

that they also get the larger share of the government benefits. Almost all of the

government salaries and pensions [accounting for a huge portion of the spending] goes to

the middle class. The metro railways where the government is spending tens of thousands

of crores are not for the rich and not for the poor. It is for the middle.

Same for all the spending on IITs, IIMs & other higher education institutions. Middle class

occupations like IT services are also very lightly regulated by the government and

government/PSU jobs have some of the highest perks and pensions. Most of the tax

payers are from these two segments - that are otherwise treated well by the government.

At some point, the middle class has to realize how powerful they are & how much the

government spend on them. The government doesn't spend much for the rich class [even

with all the tax evasion, a rich person pays more in indirect taxes than the benefits he/she

receives] and didn't spend much on the poor class either.

See the part 2 of this: Indian Middle Class Delusion: Part 2

Written 7 Mar 2016 View Upvotes Answer requested by Monish Sivalingan

Tweet 5

Share 11

View 4 Other Answers to this Question

https://www.quora.com/How-is-it-possible-that-only-3-of-Indians-pay-income-tax/answer/Balaji-Viswanathan-2?srid=dy8l&share=a3e46d8b[08 Tuesday Mar 3 16 1:27:16 AM]

Indian Middle Class Delusion: Part 2 - Ode on a Grecian Urn - Quora

Sign In

ODE ON A GRECIAN URN

Indian Middle Class Delusion: Part 2

BALAJI VISWANATHAN

A while ago someone asked why Indian government's universities are world class

[IITs, IIMs, NITs, AIIMS] while the government's schools are world's worst. The

simple answer is that while the universities are targeted at the Indian middle

class, the government's schools are targeted at the poor.

We are a country where the government runs subsidized airlines & hotels [again

for the middle class], while the basic health facilities for the poor are appalling. A

poor person driving a TVS-50 moped have to pay premium fuel [petrol] while a

middle class guy in his Innova pays for the subsidized diesel.

While the Indian government always claims to be pro-poor, it was always the

middle class that got the best part of the government [and when the government

schools are used by the middle class - such as the Kendriya Vidyalayas - the

government can surely run it excellently].

Even with all that, middle class leads the whining about how the government is

spending so less on them.

Less than 10 crore people of India are middle class or above. 90% of India are

below that class. Is the government fairly spending 90% of its budget on the poor?

Not anywhere close. Breaking Down Indian Government's Expenses.

Our government heavily subsidizes household electricity, however most of the

poor don't have access to reliable electricity [thus the benefit primarily reaches

the middle class]. On the other hand, the factories are heavily charged for

electricity - hurting not just the rich owner, but the poor factory worker, who now

has few jobs, due to Indian factories not being competitive in pricing.

Our government subsidizes banking, but most poor are unbanked. BSNL and its

predecessors subsidized telephones for decades, but most poor had no access to

phones until a decade ago. Yeah right, for the poor.

Our government heavily subsidizes universities, but most poor cannot get that far

as the elementary schools have very poor investments. Compare these two

numbers. Government expenditure per tertiary student as % of GDP per capita

(%) vs. Government expenditure per primary student as % of GDP per capita

(%)

Don't worry about the units and for now focus on just the raw numbers in both

these pages. In developed countries [such as Australia and US], the spending on

tertiary [university] education per student is same as primary education. In India,

the former is 6.5 times more than the latter. In short, the poor guys going to

government schools get far less spent on them than the middle class guys going to

government universities.

That is the truth the middle class refuses to acknowledge.

When the government is spending more on metro railways, expressways,

superfast trains and new airports [mostly benefitting the middle class] we don't

https://balajiviswanathan.quora.com/Indian-Middle-Class-Delusion-Part-2[08 Tuesday Mar 3 16 1:28:57 AM]

Indian Middle Class Delusion: Part 2 - Ode on a Grecian Urn - Quora

acknowledge how much we get more than the poor. On the other hand, the village

roads & passenger trains have not improved much over the years and the poor

villagers are stuck like deers in headlights unable to cross these new expressways

with the middle class zipping past them.

The next time you pay income taxes, realize how much you as the middle class get

the benefit of the central government far more than any other class.

336 views 75 upvotes Written 3h ago

https://balajiviswanathan.quora.com/Indian-Middle-Class-Delusion-Part-2[08 Tuesday Mar 3 16 1:28:57 AM]

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sbi PDFDocument10 pagesSbi PDFdisewazoNo ratings yet

- Financials & Key RatiosDocument1 pageFinancials & Key RatiosR. SinghNo ratings yet

- HTTP WWW - Prudenttrader.com PT-TripleSDocument6 pagesHTTP WWW - Prudenttrader.com PT-TripleSR. SinghNo ratings yet

- Safal Niveshak Mastermind BrochureDocument3 pagesSafal Niveshak Mastermind BrochureR. SinghNo ratings yet

- Duos (Amiduos)Document13 pagesDuos (Amiduos)R. SinghNo ratings yet

- Investor CurriculumDocument22 pagesInvestor CurriculumR. SinghNo ratings yet

- Analysis of Indian Cement Industry & Financial Performance of ACC LTDDocument1 pageAnalysis of Indian Cement Industry & Financial Performance of ACC LTDR. SinghNo ratings yet

- Funny Full Forms.........Document7 pagesFunny Full Forms.........R. SinghNo ratings yet

- SL - No Particulars Sessions 1 Session of 3 HoursDocument1 pageSL - No Particulars Sessions 1 Session of 3 HoursR. SinghNo ratings yet

- Rounding Off DecimalsDocument3 pagesRounding Off DecimalsR. SinghNo ratings yet

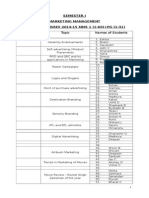

- Date of Presentation Topic Names of StudentsDocument2 pagesDate of Presentation Topic Names of StudentsR. SinghNo ratings yet

- Born To Serve .Document3 pagesBorn To Serve .R. SinghNo ratings yet

- PFC Equity Reportfor Upload-10th July 2012Document31 pagesPFC Equity Reportfor Upload-10th July 2012R. SinghNo ratings yet

- Bust A MumbaiDocument28 pagesBust A MumbaiR. SinghNo ratings yet

- All Debt Products.Document3 pagesAll Debt Products.R. SinghNo ratings yet

- 4) ResearchDocument63 pages4) ResearchCarraa BaqqalaaNo ratings yet

- Tutorial Miroeconomics - StuDocument14 pagesTutorial Miroeconomics - StuD Dávíd FungNo ratings yet

- Health Sector Reform HSR in India Vol IDocument121 pagesHealth Sector Reform HSR in India Vol Ibkshukla6669No ratings yet

- Delegation of Financial Powers RulesDocument65 pagesDelegation of Financial Powers Rulesvvallirao100% (1)

- Final Resolution - 1Document8 pagesFinal Resolution - 1Romulo Sierra Jr.No ratings yet

- QUIZDocument4 pagesQUIZBryan Ibarrientos100% (2)

- Math Final Project On BudgetDocument13 pagesMath Final Project On BudgetMeenakshi Yadav33% (3)

- ENT600 Fin Plan SpreadsheetDocument39 pagesENT600 Fin Plan SpreadsheetNajmi TalibNo ratings yet

- Unit-4 Controlling: Definitions: Knootz and O'DonnelDocument5 pagesUnit-4 Controlling: Definitions: Knootz and O'Donnelmanjunatha TKNo ratings yet

- Checklist For Preparation and Review of Year End Reports Rev3122020Document70 pagesChecklist For Preparation and Review of Year End Reports Rev3122020errolNo ratings yet

- Oracle Primavera P6 EPPMDocument2 pagesOracle Primavera P6 EPPMsakkhanNo ratings yet

- Gov Mock Congress BillDocument2 pagesGov Mock Congress Billapi-303081350No ratings yet

- Solution Question 2 Quiz 2005 PDFDocument3 pagesSolution Question 2 Quiz 2005 PDFsaurabhsaurs100% (1)

- Edristi March 2018 English PDFDocument132 pagesEdristi March 2018 English PDFHiranya MishraNo ratings yet

- A15 Ipsas - 06Document32 pagesA15 Ipsas - 06Marius SteffyNo ratings yet

- RBCPB CoDocument1 pageRBCPB CoJogie BonNo ratings yet

- Notes6 DisbursementsDocument15 pagesNotes6 DisbursementsRachel GellerNo ratings yet

- Cash & Liquidity MGTDocument19 pagesCash & Liquidity MGTsabijagdishNo ratings yet

- Assignment Drive SPRING 2017 Program MBA Semester I Ssubject Code & Name MBA104 Financial and Management Accounting BK Id B1624 Credit 4 Marks 60Document3 pagesAssignment Drive SPRING 2017 Program MBA Semester I Ssubject Code & Name MBA104 Financial and Management Accounting BK Id B1624 Credit 4 Marks 60rakeshNo ratings yet

- B3223Document45 pagesB3223Irwan Meidi LubisNo ratings yet

- Technical Assistance Consultant's ReportDocument59 pagesTechnical Assistance Consultant's Reportceejaye100% (2)

- Canteen Operations Statement of Revenues / Expenses and Fund Equity Changes (Gaap Basis) InstructionsDocument2 pagesCanteen Operations Statement of Revenues / Expenses and Fund Equity Changes (Gaap Basis) InstructionsToss BernalNo ratings yet

- Chapter 8 Savings and Invest (New)Document20 pagesChapter 8 Savings and Invest (New)Laiba KhanNo ratings yet

- Railway Budget: BY:-Rahul Sharma Salman Sandeep Gautam Sritam Tanya Karanjai ThulasiramDocument16 pagesRailway Budget: BY:-Rahul Sharma Salman Sandeep Gautam Sritam Tanya Karanjai ThulasiramSheeba Singh RanaNo ratings yet

- Cotton and Products India 2013Document22 pagesCotton and Products India 2013Kannan KrishnamurthyNo ratings yet

- Issues & Problems of State AccountingDocument13 pagesIssues & Problems of State AccountingMartin AcantiladoNo ratings yet

- PMC - Scope of ServicesDocument8 pagesPMC - Scope of ServicesAr Kajal GangilNo ratings yet

- 1) MASTER Marketing Budget TemplateDocument7 pages1) MASTER Marketing Budget TemplateShravanNo ratings yet

- Unit 4: Managing The EconomyDocument58 pagesUnit 4: Managing The EconomylanNo ratings yet

- Analysis of Union Budget by Ayussh SanghiDocument9 pagesAnalysis of Union Budget by Ayussh SanghiRavi Agrahari100% (2)