Professional Documents

Culture Documents

National Pension System India

National Pension System India

Uploaded by

pkjmesra0 ratings0% found this document useful (0 votes)

70 views8 pagesThe document describes in detail about national pension system of India.

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document describes in detail about national pension system of India.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

70 views8 pagesNational Pension System India

National Pension System India

Uploaded by

pkjmesraThe document describes in detail about national pension system of India.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 8

Information on Scheme - You can get information on your

current scheme preference in CRA i. scheme details along

with the percentage for cantrbution investment. You can also

{otinformation on scheme wise unitbalances along with their

NAV and Schome wise total value of holdings.

‘Status of Change Request - You can check the status of

various request raised by you through the POP, such as

‘personal details change request, scheme setup request otc.

by providing the acknowledgement number issued by CRA

for the request.

Other services - You can raise request for Transaction

Statement (TS) by providing the financial year for which SOT

's required. CRA shall send the SOT at your emall ID

registered with CRA,

Talk to Customer Care Executive - For any other queries

you can speak to the Customer Care Executive who will

provide you with therequiredassistance.

Contact us:

Central Recordkeeping Agency

NSDL e-Governance Inrastrueture Limited

1st Floor, Times Tower,

Kamala tills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai 400013

Telephone: 1800222080,

Visit us at: tps npscra.nsd.co.in

Foi us on: facobook.cominps. NSDL :

NAOMI Oe TIIEY

National Pension System

ba EU Ce mcg

reece

Central Recordkeeping Agency

‘On behalf of Pension Fund Regulatory and Development Authority

(PFRDA), NSOL e-Governance Infrastructure Limited-Central

Recordkeeping Agency (CRA), welcomes you to National Pension

‘System (NPS). This easy to understand guide will help you in

‘managing your Permanent Retemont Account opened with CRA.

‘As a subscriber of NPS, you shall now enjoy various facillies and

Tights including online access to your account, transaction

slatement, an online platform to raise grievances etc. Further, your

PRAN is portable across empoyer, La you can continue with the

same PRAN even alter you aro not associated with your current

employer.

‘Scheme Preference:

In NPS, a Corporate would have flexibility to decide investment

‘choice either at subscriber level or atthe corporate level centrally for

allits underlying subscribers, Atcorporate level, scheme preference

is decided by the corporate at the time of comporate registration with

the CRA. Hence, the scheme setup will be applicable for all the

subscribers which are mapped to raspective corporate.

Subsequently, tthe Corporate changes the Investment choice, the

‘Same wil alsobe applicable toallthe associated subscribers.

In case of subscriber level scheme preference, the subscribers

‘are empowered to solect investment option as per their choice. It

‘means how your money is invested will depend upon your own

choice. NPS offers you a number of Pension Fund Managors

(PFM) and muttiple asset class to choose from. You may refer the

detals of PFMs and asset class from the corporate website

htps:npscra.nsdl.co.in!

‘The NPS offers youtwo approaches to investin your account:

|. Active choice- Individual Funds (E, Cand G Assetciasses)

1. Auto choice -Litecyole Fund

11. Active choice-Individual Funds

You will have the option to actively decide as to haw your NPS

Ponsion wealthis tobe Invested in th following three options:

E ‘High return, High risk" investments in predominantly equity

‘marketinstrumonts

© = “Medium return, Medium risk” investments in predominantly

{fixed income bearing instruments.

“Low return, Low risk” investments in purely fixed income

Instruments.

‘You can choose to invest your entire pension wealth in C or G asset

classes and upto a maximum of 50% in equity (Asset class E). You

can also distribute your pension wealth across E, C and G asset

lasses, subject to such conditions as may be prescribed by PFRDA.

Incase you decide to actively exercise your choice about investment

‘options, you shall be required to mandatoriy indicate your choice of

PEM tromamong the available PFMs appointed by PFRDA.

2, Autochoice-Lifecycle Fund

NPS offers an easy option for those participants who do not want to

actively manage their NPS investments. In case you are unable!

Lunwiling 10 exercise any choice, your funds will be invested in

accordance wit the Aute Choice option.

Inthis option, the investments willbe made in alif-cycte fund. Here,

tho fraction of funds invested across three asset classes will be

determined by a pre-defined pontalo, At the lawest age of enty (18

years), the auto choice will entail investment of 50% of pension

\wealt in E Class, 30% in C Class and 20% in G Class, These ratios,

(of investment wil remain fixed for all controutons until the

Participant reaches the age of 98. From age 96 onwards, the weight

In and C asset class will decrease annually and the weight in G.

class wllincrease annualy tilitreaches 10%inE, 10%in C and 80%

inG class at age 55. (Please refer to the Auto Choice Investment

Matrix)

Like the ‘Active Choice’, subscriber must mandatorlly choose a PFM

under aute choice,

‘Auto ChoiceInvestment Matrix

Age ‘AssetClassE AssotClassC Asset Class G

Uptossyeas 50% 30% 20%

Seyears 48% 20% 20%

s7years 46% 28% 26%

seyears 44% 27% 20%

9years 2% 26% 32%

4oyears 40% 25% 35%

Atyoars 38% 24% 938%

42years 36% 23% 41%

4gyears 34% 22% 42%

sayears 32% 21% 47%

4Syears 30% 20% 50%

4syears 28% 19% 53%

a7years 26% 18% 55%

48 years 28% 17% 59%

49 years 22% 16% 62%

Soyears 20% 15% 65%

Styoars 18% 14% 68%

S2years 16% 13% 71%

Sayears 14% 12% 74%

Sayears 12% 11% 1%

SSyearsBabove 10% 10% 80%

‘Taxbenefitto Subscriber

Employee as well as employer's contribution to the account of

employee is eligible for tax exemotion as per the Income Tax Act,

+1961 as amended from time to time. As per france bill 2011-12, the

‘employee contribution to NPS upto 10% ofbasie plus DAis allowable

deduction under section 80 CCD(1) within overall mit of © 4 lakh.

‘The employer's contribution to NPS upto 10% of basic plus DA is

allowed deduction under section 8OCCD (2) and excluded from the

limitof® lakh. (htp:/inclabudget nic.)

‘Managing your Permanent Retirement Account

You can manage your account in GRA through various facities,

detaliedasfolows:

1. Online Access to your Permanent Retirement Accour

CRA website will provide you with an online access to your

Permanent Retirement account. On registration with CRA system,

you willbe provided with an L-PIN fr logging to CRA website. -PINs

the Internet Personal Identification Number issued to you o access.

your Permanent Retirement Account. In corporate sector, PRAN kit

‘and PIN mailer is sent either to the subscriber orto the corporate

bbasedon the option solectedby the corporate during registration.

How do you access your CRA account?

Step: Visit www.era-nsd.co.in. You can also logon to the

CRA website htips:inpscra.rsd.coin’ From where

youvillbe given alinktoyour GRA account.

Step2 Clickon*Login for Password based Users’

Step3 | Enteryour UserID (PRAN) and L-PIN and click on the

‘Submit button.

Step4 Selactthe requiredoption to view the deta,

First Timelogin:

‘ter logging to CRA website forthe fist time, you wil have to accept

the tarms and conditions for using CRA website and Interactive

Voice Response facility (IVR). On acceptance of the terms and

conditions, you willbe directed to set your new password for using

your online account, You should also set your secret question forthe

purpose of rasating your -PIN, inthe event you forgetyour -PIN,

Reason {or denial of access to CR:

‘Access to CRA maybe denied duet the folowing reasons:

> Incorrect PRAN provided

> Incorrect |-PIN provided: I you have forgotten your -PIN, you

may reset it by answering the seoret question or submit 2

request fora teissus of PIN through your POP-SP.

“As a safety measure to provent unauthorised access, the

‘account will be locked if the subscribers uses wrong password

{or five consecutive attempts. The subscriber shall have an

option to reset the PIN by answering the secret question even

alter the account is locked. In case the subscriber is not able to

remember the answer to the secret question and is

unsuccessful in resetting the password, the subscriber shall

hhaveto submit request for reissue of -PIN.”

To prevent misuse please:

> Change your LPIN after your fistlogin

> Memorise your LPIN and password and destroy the PIN

‘mailer

> Donotwrite yourl-PINforreference

> Donotaisclose your -PINto anyone

> Your password should be minimum eight characters and

maximum fourteen characters

> Migadvisableouse combination of alphabets and numeric in

your password

> tisadvisable to change your -PIN regularly

2. Contribution Accounting

‘Your contribution towards pension willbe investedin the schemes as.

opted by you! your corporate office. For this purpose the designated

ofice will upload your pension contribution details to CRA and

tranafer the funds fo Trustee Bank (TB) Lo. Axis Bank. CRA will

Instruct the Pension Fund Manager(s). chosen by you! your

corporate to invest the contribution as per your scheme preference.

The units created will be credited by CRA to your Permanent

Retirement account,

‘You can check your up to date account detalis from the transaction

statement avaliable at CRA website through the online access

provided o you.

3. Change in Subscriber Details

For carrying out any change in your details, you have to submit the

‘subscriber change request farm (CS-S2) to your employer as per the

{format prescribed by PFRDA. The designated olfice shall update

your requostin CRA through online access givento them,

You can update the folowing changes to your account at CRA, by

submiting a Request for Change/Correction in Subscriber,

Master details and/or Reissue of LPINT-PINPRAN Card tothe

employer.

> Change inPersonal Details

> Changein Nomination Details

> Re-issueof PIN orT-PIN (you forgetthe PIN)”

> Reissue of PRAN card (you have ostihe PRAN card)”

+ These requests.are chargeable by CRA.

CRA, youcanuptyourproarahersinatio by string |

Pesistrcungeinsstin ander cigs promeh's |

CrAtvough dosgatedatic, wrest cubmtyourtawestete |

Facatn Corer ppoiedby CRA orupdaingte awe.

4. Change in scheme preference

NPS provides you the option to change your scheme preferences.

(change the PFMischemes opted by you for investing your pension

contribution) only it your employer has given the option to select

sscheme preference to the associated employee. A change in

scheme preference would result into switch redemption of units held

In the previous PFMischeme and investment into the PFMinew

schemes opted by you) of all your holdings to the new schome

Preference chosen by you. Youcan, at any time, invest with only one

PEM.

IMustration:

‘Subscriber A makes an initial investment of % 2000, the initial

scheme preference givanby subscriber is as follows:

PFM | Schemes PEMX | (60%)

360%)

‘On 1st June 2010, the subscribor submits a raquest for change in

scheme preference specifying the new choice of PFM and schemes.

Thenew choices as olows:

PEM | Schemes PMY | (60%)

G (60%)

In the above example, all the previous holdings with PFM Xin

scheme E and G would be redeemed and invested in PFM Y,

scheme C and G as per the new scheme preference chosen by the

subscriber

For both Tier I and Tier Il, you can change your scheme preference

{change of PFM, choice of investment (Acivelauto), asset allocation

Fatio} once in a financial year by submiting the request (form CS —

83)toyour employer.

The change in scheme preference willbe charged as per prescribed

rates, Prosontly, the CRA charges for change in schome preference!

‘switch are 4/per transaction,

5. PRAN Portability

‘One ofthe core attribute of National Pension System is portability of

PRAN actoss sectors. A subscriber can shift from one sector 10

‘another sector withthe same PRAN e.9. Corporate sector to UOS,

Corporate sector to Central Government ete. This is referred to as

“Inter Sector Shiting’. Subscriber, who intends to change his / hor

sector, needs to submit a duly filed ISS-1 form to target employer /

Point of Presence Service Provider (POP-SP). If the scheme

preference of the source and target sector varies, then the

‘accumulated units will be redeemed and reinvested as per the

scheme preference opted under the target sector. With the help of

this feature, a subscriber can continue with the same PRAN

lrespective of his geographical location and employment status tl

helshe exits romNPS.

While siting rom one corporate to another corporate the subscriber

‘needs to follow the process as mentionedin he below matt

‘Sr.

No,

‘Joining (Target) | Procedure for shifting

1 [Corporate 1 Corporate 2 ottering | A completely filed |SS-1

NPS foem needs to be

‘submited to the new

‘employer (Corporate 2)

H¥eorporate 2 has given

choice of scheme

preference tothe

subscriber, scheme

preference will have tobe

selected by subscriber at

the time of shiting,

A completly filed SS-1

form neads to bo

submited to any

registered (POP-SP).

2. [Corporate 1 | Corporate 2 not

fering NPS

6. Shitting of Tier Ito other POP-SP within the same POP

‘You can shift to any POP-SP within the same POP by submitting a

exquest form (UOS-S5) for tansfer of your account either through the

destination POP-SP orthe existing POP-SP.

7. Freezing of Account

‘As per the Offer Document issued by PFRDA, a Subscriber is

required to contribute a minimum amount of € 6,000 ina financial

year (FY) in Tier | account. For Tier Il, the minimum account

‘balance (value of holdings) atthe ond ofthe FY needs to be 2,000.

Moreover, a Subscriber is required 10 make at least one

‘contribution transaction ina FY in both Tiers | and Tier Il account.

‘The PRANs not meeting these minimum contribution criteria are

Fequiredto be frozen, The yearly account treezing process willstart

(on the last working day of the FY. This process will consider only

active PRANs registered on or before the previous FY end. For

‘example, or account freezing process of FY 2011-2012, the PRAN

(generated on or before March 31, 2011 and not meeting the above

‘mentioned contribution criterion during FY 2011-12, wilbe frozen.

To unfreeze an account, Subscriber needs to submit duly filled

physical request (Annexure- UOS S10A) to the associated POP-

‘SP along with the minimum amount required (including penalty).

The information on minimum amount can be obtained from the

associated POP-SP only.

8. Withdrawal

‘The accumulated units in yout account can be withdrawn nthe event

of your exit from NPS (in such case, annutisation shal bo 80%). In

the event of attaining the age of 60 years, you will have 1 provide a

Fequest fr withdrawal tothe CRA through your Employer. On receipt

of the withdrawal request, the units held in your account will be

redeemed and a percentage ofthe redemption amount as requested

by you will be transferred to the Annuity Service Provider (ASP)

chosen by you and the remaining proceeds disbursed to you. The

[ASP shall then provide you with monthly pension. The minimum

‘amount to be transferred to ASP shall bo subject tothe guidelines

Issued by the PFROA In the unfortunate event of demise of the

‘Subsetibor, the option willbe available to the nominees /logal heir to

recelve 100% of the NPS pension wealth in lump sum. However, i

the nominee / legal heir wishes to continue with NPS, helshe shall

have to subscribe toNPS individual after folowing KYC procedure.

‘As per the present tax dispensation, the amount you decide to

receive in lumpsum shall be taxable at your marginal rate of tax, at

the time of exit rom the NPS. The amount of your pension wealth

hich you choose to annuitze (subject to a minimum of 40%) a the

payout stage shall be completely tax-exempt. Thus, if you opt to

annuitize your ence pension wealth on exit, you shall not be subject

toany taxthereon.

9. Transaction Statement:

[At the end of every finaneial year, CRA will send a Transaction

‘Statement containing deta ofthe transactions in your Permanent

Retirement account during the year. It wil contain details of

Contisution, amount invested during the year and the corresponding

units alloted, Switch transactions (any), unit holdings under the

‘scheme at the end of the financial year and any changes in your

tails which were updated during te financial year

| You may also view Transactions Statement at CRA website through

the online access provided to you. A view ofthe sample Transaction

Statement is depicted as under:

‘Wensicon Cawect

a cote

saree a_|

Se a

CRA has established Grievance Redressal mechanism for entities

registeredwith CRA. Ityou wish to lodge any grievance against CRA

‘or against your designated POP for functions performed under NPS,

you may register your grievance through te following channels

Online grievance registration:

You can raise your grievance through CRA websito wiw.cra-

‘nsd.com or hitps:/npscra.nsd.co.n! For this purpose, you wil have

to login to CRA website, authenticate yourself wit your PRAN’ and.

"LPIN' and provide the grievance details in the online grievance

submission form.

Writetous:

You may also wite to us by

Registration Form and submit

mentioned CRA address #

Central RecordKeeping Agency

Subserber Care group

NSDLe Governance Infrastructure Limited

‘stFloor, Times Tower, Kamala Mils Compound

‘Senapati Bapat Marg, LowerParel, Mumbal 400013,

filing the Subscriber Grievance

to POP or send it to the below

(On registration of your grievance through any ofthe above channels,

‘token number willbe issued to you for reference. CRA shall resolve

the grievances raised against; whereas in case of grievance raised

against your POP, CRA shall forward the details to tha concarned

POP for resolution. The Token number and recoluton detals willbe

‘sentoy CRA at your emailID registered with CRA,

You can check the status of your grievance through CRA Helpline or

CRA website by providing the Token number issued to you on

registration of he grievance.

Views & Information availableat CRA website:

» Accounts Details - You can view your personal, nomination,

bank and scheme preference details which are registaredwith

CRA.

> Statement of Holding - You can view the number of units

hold by you under citferentschomes.

> Transaction Statement - You can view the dotais of

transactionin your account for amaximum period of3 years

> NAV Details - You can view the NAV of various schemes

which are available in CRA. NAV disclosure shall be as per

‘uidelines prescribedby PFRDA,

> Status of Different Requests - You can rack the status of

different requests submitted to the POP, such as change

‘request, Scheme preference raquest, switch request ot

> Grievance Raising - You can log your grievances against

CRA or POP,

10

> Change of -PIN - Youcan change your -PINby providing te

old -PINand new PIN,

> Change of security question - You can chango your secret

question orchanging the PIN,

> Information repository - You can access host of information

such as Frequently Asked Questions, Standard Operating

Procedures etc, and download forms for various types of

request forms from the CRA Corporate website

https:npsera.nsdl.co in!

CRAHeIpline

‘You can access your Permanent Retirement Account through CRA,

Holline.

‘On registration with GRA system, you willbe issued T-PIN whichis a

Telephone Personal Identtication Number to access your

Permanent Retirement Account

‘Accessing the CRAHelpline

Follow these simple stops

Step! : Calltne CRA Helpline -olltree 1800222080.

Slep2 : Authenticate yourself using your User ID

(PRAN)andT-PIN,

‘StepS ; The Interactive Voice Response (IVR) will guide

You through the menu in the language of your choice

Hindi or English. Selec the required option to access

the information,

‘You also have the option to speak to the Customer Care Executives:

forany other queries.

First Time Access:

For the first time access, after authenticating yoursaf, you will be

promptodto setanewT-PINasper your choice.

Services availed throughiVR

> TFPIN Change - You can change your T-PIN by providing the

‘existing T-PIN and the required new T-PIN. Also in case you

have forgotten your T-PIN, you can resel the same through

VR,

1"

Introduction to Tier Il Account

Tier! Account:

(On behalf of Pension Fund Regulatory and Development

‘Authority (PFRDA), the Central Recordkeeping Agency

(GRA) welcomes all the NPS Subscribers to have an add-on

‘account viz., Tier II account. This may be considered as

“Investment and Trading Account. It aims to provide a window

Cf liquidity to meet financial contingencies and build savings

through investments

“Tier II account Is a voluntary saving facility wherein the

withdrawalis as per subscriber's choice’.

Key features of Tier-Il account:

1. No additional CRA charges for account opening and

‘annwal maintenance nrespectof Teri.

2 You can enjoy unlimited number of withdrawals

depending upon your requirements. The only

criteria is that you have 0 maintain a minimum

balance of & 2,000 at the end of Financial Year ie, as”

onMarch 3".

3. You will have facilly to have separate nomination in

Tier

4. You can) deposit your contributions to any

POP/POP-SP otyourchoice.

5, You can have a separate choice of scheme

‘preference for Tir

6, You can dacide the scheme preference for Tier ti

(once In a financial year) from the choice of available

Pension Fund Managers (PFM). For more details visit

hitps/inpscra.nedi.co i! or www. pfrda.orgin

7. Twoinvestmentoptions

> Active Choice Individual Funds (E,C,G assets)

> Auto Choioe- Life Cycle Funds.

8, Bank account details are mandatory for opening Tier I!

‘account (Along with cancelled cheque leaf),

How to Open Tier Il account

‘As NPS Subsorber, Tier Il Activation can be done by

submitting UOS-S10 application form to the Point

‘of Presence Service Provider (POP-SP) along with

the minimum contribution amount of 8 1000), ie, Ter I

‘account to be opened with a minimum contribution of

10001-

‘The subscribers of NPS- all ctizens of India have fo submit

the form to POP-SP with whom they have opened Tier I

account. The lst of POP-SPs and thelr contact delalls are

available in CRA website iips:/inpscra.nsdl.co.inv

‘Any new subscriber, wio wishes to join NPS, can open Tier

& Il account simultaneously. He /she has to submit

‘Composite application form (CAF)

You can download these forms trom our website

www.npscra.nsdi.co.in.

Contributing to Tierll account

You have to make a minimum contibution of & 250 and

hhave to make minimum one contribution ina Financial Year

Youcan contibuteo Tir! account il youhave active Tier

account.

Charges for Tier!

There are no additional Account Opening and Annual

Maintenance charges of CRA for Tier II account. The

transaction charges of CRA as wellas the POP charges are

ssameas of Tier! Account

Things canbe done in Tir Account

Change of Subscriber deta: (Form UOS -S2)

» Nomination details

> Bank details

‘Scheme Preference change (Form UOS-3)

Contribution (NPS contribution instruction Slip)

‘Withdrawal (FormUOS-S12)

Contact us:

Central Recordkeeping Agency

NSDL e-Governance infrastructure Limited,

4st Floor, Times Tower, Kamala Mills Compound

‘Senapati Bapat Marg, Lower Parel, Mumbai 400013

Telephone: 1800222080

Visit us at: hitosinpsera.nsd.coind

Follow us on: facebook, comings. NSDL

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- First Nations Fact Sheet - Idle No MoreDocument2 pagesFirst Nations Fact Sheet - Idle No MoreNetNewsLedger.comNo ratings yet

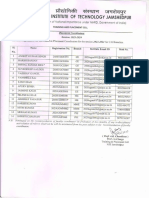

- Placement Coordinators - UG - 2023-2024Document1 pagePlacement Coordinators - UG - 2023-2024pkjmesraNo ratings yet

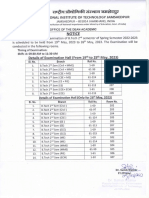

- NitDocument24 pagesNitpkjmesraNo ratings yet

- Bitszc463 Sep22 FNDocument2 pagesBitszc463 Sep22 FNpkjmesraNo ratings yet

- Iszc444 Sep20 AnDocument2 pagesIszc444 Sep20 AnpkjmesraNo ratings yet

- Quiz2 NetworkSecurityDocument3 pagesQuiz2 NetworkSecuritypkjmesraNo ratings yet

- SS ZG513Document14 pagesSS ZG513pkjmesraNo ratings yet

- Holiday List Nagpur Pune 2019Document1 pageHoliday List Nagpur Pune 2019pkjmesraNo ratings yet

- Oct Bill ElectricityDocument1 pageOct Bill ElectricitypkjmesraNo ratings yet

- Sam Security CertificationsDocument12 pagesSam Security CertificationspkjmesraNo ratings yet

- Profeta vs. DrilonDocument2 pagesProfeta vs. DrilonKris Antonnete DaleonNo ratings yet

- Libro Mark TriplettDocument104 pagesLibro Mark TriplettJoseAliceaNo ratings yet

- Mica English AugDocument116 pagesMica English AugSuman SatvayaNo ratings yet

- Income From Other SourcesDocument16 pagesIncome From Other SourcesRewant MehraNo ratings yet

- Formation of Employment ContractsDocument9 pagesFormation of Employment ContractsShifan TariqNo ratings yet

- Deductions On Gross IncomeDocument6 pagesDeductions On Gross IncomeJamaica DavidNo ratings yet

- Olesen 2012 PDFDocument3 pagesOlesen 2012 PDFKaren KleissNo ratings yet

- SAICA Guide On 2020 Tax On RSA Residents and CitizensDocument58 pagesSAICA Guide On 2020 Tax On RSA Residents and CitizensCharles Arnestad100% (3)

- Atal Pension Yojana Subscriber FormDocument1 pageAtal Pension Yojana Subscriber FormTarsem SoniNo ratings yet

- Tax SyllabusDocument196 pagesTax SyllabusSaurabh SagarNo ratings yet

- MetlifeDocument5 pagesMetlifeblogs414No ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Sheikh Mohd Danish SiddiquiNo ratings yet

- Tanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MDocument7 pagesTanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MJudicial Watch, Inc.No ratings yet

- Pay Slip 17623 March, 2022Document1 pagePay Slip 17623 March, 2022Abrham TadesseNo ratings yet

- Application Form For Central Sector Scholarship Scheme (Govt. of India)Document6 pagesApplication Form For Central Sector Scholarship Scheme (Govt. of India)ocinejNo ratings yet

- IAS 19 Employee BenefitsDocument14 pagesIAS 19 Employee BenefitsShiza ArifNo ratings yet

- T4032-NL, Payroll Deductions Tables - CPP, EI, and Income Tax Deductions - Newfoundland and LabradorDocument12 pagesT4032-NL, Payroll Deductions Tables - CPP, EI, and Income Tax Deductions - Newfoundland and LabradorclaokerNo ratings yet

- Ed Peters 50 Years JBLCDocument4 pagesEd Peters 50 Years JBLCJB_LifeguardsNo ratings yet

- Planning and Saving For RetirementDocument34 pagesPlanning and Saving For RetirementbutterNo ratings yet

- Sean Morey Request For Information From NFLPADocument6 pagesSean Morey Request For Information From NFLPARobert Lee100% (1)

- Learning Packet 3Document15 pagesLearning Packet 3Armando Dacuma AndoqueNo ratings yet

- Income Tax CalculatorDocument8 pagesIncome Tax CalculatorbabulalseshmaNo ratings yet

- Amazing! You Touch It and You Can See The Miracle!Document16 pagesAmazing! You Touch It and You Can See The Miracle!prudhvi chowdaryNo ratings yet

- Annual Shareholders' Meeting - 04.15.2013 - MinutesDocument12 pagesAnnual Shareholders' Meeting - 04.15.2013 - MinutesBVMF_RINo ratings yet

- AuctusDocument13 pagesAuctusPlacement Cell SRCCNo ratings yet

- What Is An Annuity?: Annuities - The BasicsDocument2 pagesWhat Is An Annuity?: Annuities - The Basicsmignot tamiratNo ratings yet

- Life InsuranceDocument7 pagesLife Insurancerupesh_kanabar1604100% (8)

- F 8915Document2 pagesF 8915IRS100% (1)

- Artifact 5 PF Withdrawal Application PDFDocument1 pageArtifact 5 PF Withdrawal Application PDFRamesh BabuNo ratings yet