Professional Documents

Culture Documents

Hybrid Annuity Model For Road Projects

Hybrid Annuity Model For Road Projects

Uploaded by

buntysuratOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hybrid Annuity Model For Road Projects

Hybrid Annuity Model For Road Projects

Uploaded by

buntysuratCopyright:

Available Formats

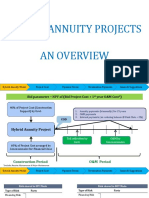

The Hybrid Annuity Model (HAM)

In India, the new HAM is a mix of BOT Annuity and EPC models. As per the

design, the government will contribute to 40% of the project cost in the first five

years through annual payments (annuity). The remaining payment will be made

on the basis of the assets created and the performance of the developer. Here,

hybrid annuity means the first 40% payment is made as fixed amount in five

equal instalments whereas the remaining 60% is paid as variable annuity amount

after the completion of the project depending upon the value of assets created.

As the government pays only 40%, during the construction stage, the developer

should find money for the remaining amount. Here, he has to raise the remaining

60% in the form of equity or loans.

There is no toll right for the developer. Under HAM, Revenue collection would be

the responsibility of the National Highways Authority of India (NHAI).

Advantage of HAM is that it gives enough liquidity to the developer and the

financial risk is shared by the government. While the private partner continues to

bear the construction and maintenance risks as in the case of BOT (toll) model,

he is required only to partly bear the financing risk.

Governments policy is that the HAM will be used in stalled projects where other

models are not applicable.

You might also like

- Division of Responsibilities MatrixDocument5 pagesDivision of Responsibilities MatrixbuntysuratNo ratings yet

- Typical Transformer Test ReportDocument6 pagesTypical Transformer Test ReportbuntysuratNo ratings yet

- Lightning CalculationsDocument48 pagesLightning Calculationsbuntysurat86% (7)

- Indian Road Sector: Hybrid Annuity ModelDocument3 pagesIndian Road Sector: Hybrid Annuity ModelAjay Singh0% (1)

- Idm 31Document29 pagesIdm 31Sam RogerNo ratings yet

- Qap of Motor R 3Document7 pagesQap of Motor R 3buntysurat100% (1)

- Variable Frequency Drives EngDocument100 pagesVariable Frequency Drives Engrlevybooth100% (11)

- What Is Hybrid Annuity ModelDocument2 pagesWhat Is Hybrid Annuity Modelisquare77No ratings yet

- Rating Methodology For Road Projects Based On Hybrid Annuity Model (HAM)Document12 pagesRating Methodology For Road Projects Based On Hybrid Annuity Model (HAM)Ashish SinghNo ratings yet

- Principles of InsuranceDocument5 pagesPrinciples of InsuranceayushNo ratings yet

- Air Port 6th Sem Print PDFDocument33 pagesAir Port 6th Sem Print PDFDiwakar GurramNo ratings yet

- Aircraft Characteristic SDocument36 pagesAircraft Characteristic SGAURAV SRIVASTAVANo ratings yet

- ManasDocument15 pagesManasVaibhav ChandrakarNo ratings yet

- Aircraft Characteristics Affecting Airport Design: Gaurav Srivastava Civil Engg Deptt. Foet, LuDocument36 pagesAircraft Characteristics Affecting Airport Design: Gaurav Srivastava Civil Engg Deptt. Foet, LuGAURAV SRIVASTAVANo ratings yet

- Curves PDFDocument19 pagesCurves PDFOmbir RatheeNo ratings yet

- Unit 1 IntroductionDocument49 pagesUnit 1 IntroductionPRINCE KUMAR (RA1811002010265)No ratings yet

- Airport GeometryDocument62 pagesAirport Geometry20BME114Umang KaushalNo ratings yet

- Trans Part IDocument11 pagesTrans Part IabhilashjanaNo ratings yet

- Design of Airport Runway by International Standards: Kaustubh Wakhale, Sameer Surve, Rohit ShindeDocument5 pagesDesign of Airport Runway by International Standards: Kaustubh Wakhale, Sameer Surve, Rohit ShindeBenito MosesNo ratings yet

- Aircraftcharacteristics 150420075140 Conversion Gate02Document36 pagesAircraftcharacteristics 150420075140 Conversion Gate02Satish SajjaNo ratings yet

- Unit 2 Airport PlanningDocument26 pagesUnit 2 Airport PlanningVishnu KiranNo ratings yet

- Ce415 Lec 2 4Document61 pagesCe415 Lec 2 4Jackie ArulNo ratings yet

- Financing Infrastructure Projects PDFDocument4 pagesFinancing Infrastructure Projects PDFshubham agarwalNo ratings yet

- Ic-38 Gen Practice Paper-1Document20 pagesIc-38 Gen Practice Paper-1Akash ChhayaNo ratings yet

- Ic38 FaqsDocument2 pagesIc38 FaqsdeepuzzNo ratings yet

- MoRTH Quality Control Tests - Comparision TableDocument5 pagesMoRTH Quality Control Tests - Comparision TableAbdullah RafeekNo ratings yet

- Curves Are Regular Bends Provided in The Lines of Communication Like Roads, Railways and Canals Etc. To Bring About Gradual Change of DirectionDocument44 pagesCurves Are Regular Bends Provided in The Lines of Communication Like Roads, Railways and Canals Etc. To Bring About Gradual Change of DirectionOmbir RatheeNo ratings yet

- Reliance Life InsuranceDocument98 pagesReliance Life Insuranceagoyal88100% (2)

- AFME Guide To Infrastructure FinancingDocument99 pagesAFME Guide To Infrastructure Financingfunction_analysisNo ratings yet

- Viability Gap Funding PaperDocument5 pagesViability Gap Funding PaperNiranjanNo ratings yet

- 5 2016 04 04!05 48 16 PM PDFDocument110 pages5 2016 04 04!05 48 16 PM PDFRupesh MandalNo ratings yet

- Module 5 (Airport Design)Document23 pagesModule 5 (Airport Design)Akshay AradhyaNo ratings yet

- Aviation Sector in IndiaDocument25 pagesAviation Sector in IndiaArun DwivediNo ratings yet

- Key Development Public Private Partnership Projects at Mumbai: Selected Case StudiesDocument5 pagesKey Development Public Private Partnership Projects at Mumbai: Selected Case StudiessadhanaNo ratings yet

- POS Training ModuleDocument81 pagesPOS Training Moduleshalini iyer0% (1)

- Final IC 38 - IA - Common - EnglishDocument104 pagesFinal IC 38 - IA - Common - Englishsayali kthalkarNo ratings yet

- What Is Highway EngineeringDocument4 pagesWhat Is Highway EngineeringNagesh SinghNo ratings yet

- Road Infrastructure Financing Models (PPP) (BOT, BOOT, LOT, DBFO, Concession)Document29 pagesRoad Infrastructure Financing Models (PPP) (BOT, BOOT, LOT, DBFO, Concession)Devanjan ChakravartyNo ratings yet

- A Comparative Analysis of PPP Financing PDFDocument14 pagesA Comparative Analysis of PPP Financing PDFRuslan KuzhekovNo ratings yet

- FinancialViabilityofProject CasestudyonMumbai PuneExpressHighwayDocument20 pagesFinancialViabilityofProject CasestudyonMumbai PuneExpressHighwayGoanengineerNo ratings yet

- Grade 5 - Regular VerbsDocument25 pagesGrade 5 - Regular Verbsthuy trinh nguyenNo ratings yet

- Diff Policies NHAI IIMA StudyDocument37 pagesDiff Policies NHAI IIMA StudykumarnramNo ratings yet

- Basics of InsuranceDocument20 pagesBasics of InsuranceSunny RajNo ratings yet

- Infrastructure FinanceDocument7 pagesInfrastructure FinanceKaran VasheeNo ratings yet

- IC34 Question Bank New Syllabus - Sep. '15Document28 pagesIC34 Question Bank New Syllabus - Sep. '15Lalit JainNo ratings yet

- Sinha - Case Study Noida Toll BridgeDocument18 pagesSinha - Case Study Noida Toll BridgeSumitAggarwalNo ratings yet

- Principles & Types of InsuranceDocument6 pagesPrinciples & Types of InsuranceSudhansu Shekhar pandaNo ratings yet

- Economic Feasibility Analysis of Highway Project Using Highway Development and Management (HDM-4) ModelDocument4 pagesEconomic Feasibility Analysis of Highway Project Using Highway Development and Management (HDM-4) ModelSUMIT KUMARNo ratings yet

- 22 The Main Characteristic of PPP IsDocument3 pages22 The Main Characteristic of PPP IsSurya ShekharNo ratings yet

- NICMAR ASSIGNMENT - Management of PPPDocument37 pagesNICMAR ASSIGNMENT - Management of PPPjijo.b.raj100% (3)

- Strategic Jewar AirportDocument12 pagesStrategic Jewar AirportNaveen KenchanagoudarNo ratings yet

- NICMAR AssignmentDocument28 pagesNICMAR AssignmentPramod BurteNo ratings yet

- Runway Orientation CE7002 Section-A: Satish SajjaDocument14 pagesRunway Orientation CE7002 Section-A: Satish SajjaSatish SajjaNo ratings yet

- Concept of ClaimsDocument23 pagesConcept of ClaimsbapparoyNo ratings yet

- Ham - 16062017Document17 pagesHam - 16062017sumit pamecha100% (1)

- Yogesh Singh: Email: Contact No. 8920548421Document4 pagesYogesh Singh: Email: Contact No. 8920548421Yogesh SinghNo ratings yet

- Road Administration and FinanceDocument39 pagesRoad Administration and FinanceAbhishekNo ratings yet

- Chapter 8 AIR POLLUTION PDFDocument20 pagesChapter 8 AIR POLLUTION PDFMy SelfNo ratings yet

- Lecture 1 Airport - Intro 2180602Document52 pagesLecture 1 Airport - Intro 2180602Ujjval Solanki67% (3)

- Coastal Zone - Transition Zone Between Marine & TerrestriaDocument15 pagesCoastal Zone - Transition Zone Between Marine & TerrestriaShanmuga SundharamNo ratings yet

- Different Types of ModelsDocument2 pagesDifferent Types of ModelssharathNo ratings yet

- Public Private Partnership ModelsDocument4 pagesPublic Private Partnership ModelsMANISH ANANDNo ratings yet

- Project Finance - Latest News - 25/6/2016Document11 pagesProject Finance - Latest News - 25/6/2016LaviNo ratings yet

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1KaRin MerRoNo ratings yet

- Case 1Document4 pagesCase 1otabek.kurbonov.89No ratings yet

- SR NO. Description C&S CodeDocument2 pagesSR NO. Description C&S CodebuntysuratNo ratings yet

- DrawingsDocument19 pagesDrawingsbuntysuratNo ratings yet

- 19-08-2014 11:43:38 H:/KIT DEVELOPMENT/Useful Literature/ARDUINO/diy - Qwerty - Keyboard - Kit - Lucid (1) /qwerty - Kit - SCH (Sheet: 1/1)Document1 page19-08-2014 11:43:38 H:/KIT DEVELOPMENT/Useful Literature/ARDUINO/diy - Qwerty - Keyboard - Kit - Lucid (1) /qwerty - Kit - SCH (Sheet: 1/1)buntysuratNo ratings yet

- Cbts LayoutDocument1 pageCbts LayoutbuntysuratNo ratings yet

- Drawing REV1Document21 pagesDrawing REV1buntysuratNo ratings yet

- APFC Panel BOQDocument2 pagesAPFC Panel BOQbuntysuratNo ratings yet

- Typical Power Plant ELE-BOQDocument12 pagesTypical Power Plant ELE-BOQbuntysuratNo ratings yet

- T1000 PLUS Customer ListDocument33 pagesT1000 PLUS Customer ListbuntysuratNo ratings yet

- Company Profile Sr. No Certification/Registration DetailsDocument2 pagesCompany Profile Sr. No Certification/Registration DetailsbuntysuratNo ratings yet

- Gen Test ListDocument1 pageGen Test ListbuntysuratNo ratings yet

- Substation Automation IEC 61850 Protocol: Baskaran BoopathiDocument39 pagesSubstation Automation IEC 61850 Protocol: Baskaran BoopathibuntysuratNo ratings yet