Professional Documents

Culture Documents

Declaration For Income Tax

Declaration For Income Tax

Uploaded by

jameerahmadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration For Income Tax

Declaration For Income Tax

Uploaded by

jameerahmadCopyright:

Available Formats

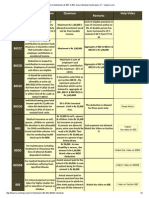

DECLARATION FOR INCOME TAX SAVINGS FOR THE FINANCIAL YEAR 2016-17

Following are the savings particulars/others income statement for the Financial Year 2015-16

Assessment Year 2016-17 For calculation of Income Tax on salary

Sl No.

1

Particulars

HBA Principal

Under sec

80C

Life Insurance Premium

80C

Mutual Fund/share/Debentures etc.

80C

NSC/C.govt Securities

80C

Postal Life Insurance

80C

PPF/GPF/EPF etc.

80C

Tuition Fee

80C

Annuity Pension Plan

80CCC

Notified Pension Scheme

80CCD

10

Health Insurance/Mediclaim

(self/spouse/child)

Health Insurance/Mediclaim

(Parents - SR)

Health Insurance/Mediclaim

(Parents - NONSR)

Deposit/Treatment disabled Dependent

/

Treatment for specified Disease

/

Accrued interest on Education loan

80D

80U

17

Physically handicapped resident person with

disability/severe disability

Accrued interest on Housing loan

18

Rent receipt if any(attached form 10 BA)

80GG

19

Other income (in case of savings bank interest

beyond

. if any

80TTA

11

12

13

14

15

16

NB:- Please score out

If not applicable

Amount (in Rs.)

80D

80D

80DD

80DDB

80E

24(b)

Signature of the Employee:

Name and Designation:

Contact No.:

HRMS No.:

All the information may be submitted as early as possible to the O/o AO(W&B)/CS, Calcutta Telephones, Telephone

Bhavan,1st floor,Kolkata-700001.Last date of submission 15.04.2016

You might also like

- Income Tax Calculator 2016-17 v1804Document2 pagesIncome Tax Calculator 2016-17 v1804Pankaj BatraNo ratings yet

- IT Declaration Form 2011-2012Document1 pageIT Declaration Form 2011-2012Shishir RoyNo ratings yet

- Latest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsDocument90 pagesLatest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsTambi ThambiNo ratings yet

- Income Tax Declaration Form 2012-13Document2 pagesIncome Tax Declaration Form 2012-13asfsadfSNo ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- 2009 Tax Calculator-1Document2 pages2009 Tax Calculator-1Sandip S NagareNo ratings yet

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- Maulana Azad National Urdu University: CircularDocument4 pagesMaulana Azad National Urdu University: CircularDebasish BiswalNo ratings yet

- De Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Document5 pagesDe Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Lakshmanan SNo ratings yet

- HRA, Chapter VI A - 80CCD, 80C, 80D, Other IncomeDocument9 pagesHRA, Chapter VI A - 80CCD, 80C, 80D, Other Incomefaiyaz432No ratings yet

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDocument4 pagesFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiNo ratings yet

- In Service Facilities or BenefitsDocument16 pagesIn Service Facilities or BenefitsFood Corporation of IndiaNo ratings yet

- Investment Declaration Form F.Y. 2016-17Document2 pagesInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryDocument2 pagesEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777No ratings yet

- Tax Saving Declaration FormatDocument2 pagesTax Saving Declaration FormatPraveen Francis0% (1)

- IncomeTax DeductionsDocument5 pagesIncomeTax DeductionsAjay MagarNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- 12.TAX 4-IT FormatDocument4 pages12.TAX 4-IT FormatRagavendra RagsNo ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledDocument2 pagesSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarNo ratings yet

- IT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsDocument106 pagesIT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsnarayanan630% (1)

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- Apeejay Surrendra Group Investment Declaration Form - F.Y. 2024-25Document2 pagesApeejay Surrendra Group Investment Declaration Form - F.Y. 2024-25Antara NagNo ratings yet

- Guideline On ITDocument19 pagesGuideline On ITmikekikNo ratings yet

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNo ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Some of The Tax Saving SavingsDocument3 pagesSome of The Tax Saving SavingsNira SinhaNo ratings yet

- Income Tax Calculator 2012-13Document2 pagesIncome Tax Calculator 2012-13Cool Friend GksNo ratings yet

- Auto Income Tax Calculator Version 5.1 2010-11Document19 pagesAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyNo ratings yet

- IT Declaration Format-05-12-2023Document6 pagesIT Declaration Format-05-12-2023somaNo ratings yet

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Document6 pagesLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenNo ratings yet

- 12ba KishanDocument11 pages12ba KishanChaitanya SwaroopNo ratings yet

- Declaration Format For Salary For FY 2017-18 A.Y 2018-19Document1 pageDeclaration Format For Salary For FY 2017-18 A.Y 2018-19Sudeep Singh78% (9)

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Deductions: From Gross Total IncomeDocument11 pagesDeductions: From Gross Total IncomeSushAnt SenNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Deductions U/s 80C To 80U For Assessment Year 2012-13Document3 pagesDeductions U/s 80C To 80U For Assessment Year 2012-13ram_somalaNo ratings yet

- Taxation Ce2Document10 pagesTaxation Ce2Ratnesh PalNo ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- IT Declaration Form 2016-17Document11 pagesIT Declaration Form 2016-17JoooNo ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- Tax Proof Submission FY 2021-22Document10 pagesTax Proof Submission FY 2021-22cutieedivyaNo ratings yet

- Covering Sheet For Investment Proof 2011-12Document1 pageCovering Sheet For Investment Proof 2011-12sanyu1208No ratings yet

- Income Tax Calculator Ay 2015-16 For Resident Individuals & HufsDocument3 pagesIncome Tax Calculator Ay 2015-16 For Resident Individuals & HufsVasan GovindNo ratings yet

- Wealth Managemen T Project: Submitted by Talluri PrasanthDocument7 pagesWealth Managemen T Project: Submitted by Talluri PrasanthPrasanth TalluriNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- Income Tax StatementDocument2 pagesIncome Tax StatementgdNo ratings yet

- How To Save Tax For FY 2013 14Document42 pagesHow To Save Tax For FY 2013 14duderamNo ratings yet

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Document4 pagesOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Deductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActDocument8 pagesDeductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActalisagasaNo ratings yet

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

- Setting up, operating and maintaining Self-Managed Superannuation FundsFrom EverandSetting up, operating and maintaining Self-Managed Superannuation FundsNo ratings yet

- J.K. Lasser's Your Income Tax 2023: Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2023: Professional EditionNo ratings yet

- Monthly Collections From Members of Jamath For The Month of January - 2015Document11 pagesMonthly Collections From Members of Jamath For The Month of January - 2015jameerahmadNo ratings yet

- Southern Power Distribution Company of Andhra Pradesh LimitedDocument1 pageSouthern Power Distribution Company of Andhra Pradesh LimitedjameerahmadNo ratings yet

- May16 PDFDocument1 pageMay16 PDFjameerahmadNo ratings yet

- Inspection ReportDocument3 pagesInspection ReportjameerahmadNo ratings yet

- Cancellation Details: SL No. Name Age Gender Booking Status Current StatusDocument1 pageCancellation Details: SL No. Name Age Gender Booking Status Current StatusjameerahmadNo ratings yet

- Southern Power Distribution Company of Andhra Pradesh LimitedDocument1 pageSouthern Power Distribution Company of Andhra Pradesh LimitedjameerahmadNo ratings yet

- Stipend ApplicationDocument1 pageStipend ApplicationjameerahmadNo ratings yet

- Taweez Gandon Aur Jinnat o Jadu Ka IlaajDocument73 pagesTaweez Gandon Aur Jinnat o Jadu Ka Ilaajjameerahmad100% (2)