Professional Documents

Culture Documents

Bilant Engleza PDF

Bilant Engleza PDF

Uploaded by

Nica IoanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bilant Engleza PDF

Bilant Engleza PDF

Uploaded by

Nica IoanaCopyright:

Available Formats

, g ‘of which = eovabla taken by assignment om associated Toga parsons_| 719) 1 Receivables taken by asignment fom lez persons (at acquisition co), of wish 128 receivables taken by assignment Rom ailited Taal PEON, | 35, of which | {-reosvabla len by assignment om associated legal persons | 229 +) For the sts of “affliated egal persons" the provision of art 124°20 let.) of Law no. $71/2003 regaring the Fiscal Code, as subsequently amended ‘and supplemented wil be ten nto consideration, 9) Subsidies forthe simulation of labour force transfers from the state budget to employer) ~ represent the amounts given to employees forthe payment of graduates of ehoation isntuions, stimulation ofthe unemployed who pet a job efor the de time of he unemployment period, simulation of enplovect eho get afb for undetermined porod, wnonplyed with the age over 43 years old, unemployed who are the only onc o support tet amy or unemployed who thin years from employment date fll the conditions necessary to demand a paral antepated pension or to receive pension forage limit. or for ‘other tuations provided by the law in force concerning the insurance sytem for unemployment a simulation of labour force ‘7 iil be filed in with the expentes made forthe research-development act), respectively he fundamental research, the applicative research the technological development and innovation, established according othe provisions of the Government (Ordinance no. 57/2002 regarding the scientific research and technological development, sith further amendmonts and supplements by Law no, 3242003, with farther amendments and supplements 868) The mnoation expenses are determined according to the Regulations (CE) nr. 1450-2004 ofthe Commission from 13 August 2004 apply the decision no. 16082008CE of the European Parliament and Council regarding the production and development ‘of conmuntysaisis concerning innovation published inthe Oficial Journal of European Union, series Ln. 267 rom Ith August 2004 For recervabes tae by axsigrment rom legal person wal be fled in Both wih thelr nomial value and thar acquisition cost. 1) Inthe category ‘Other debs related to natural persons and legal persons, other han debts related o public institutions state istition) ‘wil not include _gubventions related o incomes existing inthe Balance of account 472. 5 tmroms 182-191, col(2), wil be writes the percentage corresponding tothe social capital held in the total subscribed capital pad, written in row 18. For the status of “afte legal persons” the provision of ar. 7 paragraph (1) point 21 letter) of Law no, 5371/2003 regarding he Fiscal Code, as subsequently amended and supplemented wil be taken into consideration. ADMINISTRATOR, PREPARED, [Lastname and frst name: assoriate prof PhD. dor [Lastname and first name: . Elena Sihigea Cie ‘Quality: Director Economic Signature Signore [Lastname and frst name: Anina Rags Signature ‘Uni seal ‘Notes rom page 18 to page 55 ar nig part of he nancial satemans 7 SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A. SITUATION OF FIXED ASSETS - GROSS VALUES o Iei Reductions Note ‘which; | Final balance Elements of non-current assets No. | Initial batance | Increases i. = co, Gera 3) A B 10) ey reee ees) 56) INTANGIBLE ASSETS = = Constitution and research-development expenses (ct. 2014203) on o o 0 x 0 ‘Other non current assets (ct. 205+207+208) a 42,902 787 4136 x 39533 ‘Advances and intangible assets in progress (t.233) | 03 0 of oe x 0 TOTAL (row 01 1003) of 42,902 787 | 4136 Xx 39,533 TANGIBLE ASSETS = Lands (211) B 2,014,880 0 9717 x 2,005,163, Constructions 212) 06 12,317,094 0 723,15 11,593,979 “Technical installations and machines (¢t 213) 7 2,817,772, 18,169 335,195 233,300 2,500,746 ‘Other installations, equipments and furniture (214) | 08 202,582 14,939 34,161 15417 183,360 ‘Advances and tangible assets in progress (ct. = 231) __| 09 : 0 0 x o TOTAL Gow 051009) 10 T3325 33.108 | 1,102,188 268,786 | 16.283.248 | FINANCIAL ASSETS(t. 261+2624263+2644265+2664267) u 915,412,075 | 293,623,951 | 245,767,703 x 963,268,323 FIXED ASSETS - TOTAL (rows 04410411) 2 932,807,305 | 293,657,846 | 246,874,047 268,786 | _ 979,591,104 ADMINISTRATOR, ELABORATED, Last name and first name: conf, univ.drec. Tudor Last name and first name:: ec, Ciurezu Elena Sichigea Quality: Economic Manager Signature Signature Last name and first name: jr. Anina Radu Signature Unit seal [Notes from page 18 to page 55 are integral part of the financial statements SOCIETATEA DE INVESTITH FINANCIARE OLTENIA S.A. SITUATION OF AMORTIZATION OF FIXED ASSETS 0 : = ei ‘Amortization Bue related to non | Amortization at the lements of non current assets No inatbatance | Amortization | Curreatanets | "cao he year removed from (9=6+7-8) evidence A B 6a) 7Q) 83) 94) INTANGIBLE ASSETS _ ‘Constitution and research-development expenses (Ct. 280142803) 13 0 0 o 0 ‘Other non current assets (ct 2805+2807*2808) i B29 945 4.156 39,008 TOTAL (rows 13+14) 15 2.219 945 4.156 39,008 ‘TANGIBLE ASSETS Lands (ct. 2811) 16, 0 0 oO 0 Constructions (et. 2812) 7 #163 415,635 2139 457,659 “Technical installations and machines (ct. 2813) 18 2,590,500 101,581 | ____335,195 2,356,886 Other tangible assets (ct. 2814) 19 125.011 21,129 26,752 119,388 ETOTAL (row 161019) 20 2,759,674 358345 364,086 7933,933 | ‘AMORTIZATIONS -TOTAL (row 15+20) 21 2,801,893 539.290 368,242 2.972.941 ADMINISTRATOR, ELABORATED Last name and first name: Last name and first name: conf, univ.dr.ec. Tudor Ciureza cc. Elena Sichigea Quality:Eeonomic Manager Signature Signature Last mame and first name: jt. Anina Radu Signature Unit seal Notes from page 18 to page 55 are integral part of the financial statements SOCIETATEA DE INVESTITH FINANCIARE OLTENIA S.A. SITUATION OF PROVISIONS FOR DEPRECIATION 0 = ae Ie No. heen of non crret sets ror daring the yar (s-wrtet) A B 112) 1304) INTANGIBLE ASSETS _ ‘Constitution and development expenses (ct. 2903) 2 0 0 0 ° ‘Other non current assets (ct. 2905+2907+2908) 23 0 0 0 0 intangible asses in course (€1.2933) 24 0 0 0 0 TOTAL (row 22 0 24) 25 0 0 0 0 ‘TANGIBLE ASSETS - Lands (¢t.2911) 26 gegen 0 0 ‘Constructions (ci 2912) 27 0 0 0 0 “Technical installations and machines (et 2913) 28 0 0 0 0 (Other installations, equipments and furniture (ct. 2914) | 29 0 0 0 _ 0 ‘Advances and tangible assets in progress (ct 2931) 30 0 0 0 ° TOTAL (ows 26 to 30) 31 0 0 0 0 [FINANCIAL ASSETS (1.296) —__[ 32 [___118,224,065, 32,709,485 90317175 60,616,575 PROVISIONS FOR DEPRECIATION - TOTAL, 7 rows 25431432) 118,224,065, 32,709,485 90,317,175 60,616,375 ADMINISTRATOR, ELABORATED, ‘Last name and firstname: ec, Elena Last name and first name: conf. univ.dr.e. Tudor Ciurezu Sichigea Quality:Economic Manager Signature ‘Last name and first name: jr. Anina Radu Signature Unit seal Notes from page 18 to page 55 are integral part of the financial statements 4 SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A. ‘THE SITUATION OF MODIFICATIONS OF THE OWN CAPITAL ON 31.12.2013 ti Balance ‘account at INCREASES REDUCTIONS: Balance | a account at Name ofthe element begining ot | ToT By Wansfer | the end ofthe ‘the financial which: wencial exercise earcien a 4 z 3 7 5 fea] 7 | Seber epi BeOTeaTT BOTeaTT 2 | Cantal premis 7 3 Reseves Fomrevataion TAOIST TERE | — Tower | —ToasT ATT | Lega reseves 75.6084 7.608314 '5 | Reserves formed from the adiustments for value losses | (112,839,881) | (16,419,854) (85,638,457) (42,421,278) of financial assets e (balance account D) © | Staion ot conkacialreseves eaTe Ta aiaTa Reserves fomed form evalu offrancal asses] —T43651,170 | 6270828 310807 75551 09 7 | ecqures whee te | Roses rerseing i apl cconpahedtan’ | — 4257708 | 10352 | TESS] BIT STE revaluation reseres| | 9 | Other reserves 460,429,000 | 12,987,720 | 12,961,152 166,049 (473,250,761 1 | Own ares 3 ‘| Gains connected wth hermano cum cepts ° | Loses cemecte it te nurens of oun capil | ‘a | Tetesucariedrvardrepreseing | Balance C ESD | BR TRTOO | REG | —TETOTISD o notalocatedproftornotcovered oss | Sarees ot Te esl cried Toward carved fom | Balance C me 7 14 | te adopt forte fret te of AS ess | | IAS 29 | Balance D 0 | —y | Te omit arianardcaned an —| Banoo 7 theconedionotaccounanterass | Bales v Te esl cared fowara cerved Fart | Balance C | passing tote appcaton othe | 1 | accountant Reglatons according tho | Fourth Directive of the European | Balance D i Ecenaie Communes Therese marca erecise | Baree © | —SBSO24 | TOONMOOET eae eaE | — ea aaDCO | —TIOOOOIR u Balance D 0 7B | Profan 7 7 | Teal own caps Timea | BAAN BRO | TORIES | TRE MESRT | —TOOSHE TOE | —TOSATEIE {ADMINISTRATOR ELABORATED, Lastname and fratrame, satire andunitseal (Quality: Econcic Manager -conf. univ.dr.ec. Tudor Ciurezu ‘Signature Jp Radu Anina ‘Notes from page T8 to page 55 are integral part ofthe Tinancial Satements 5 SOCIETATEA DE INVESTITI FINANCIARE OLTENIA S.A, SITUATION OF MODIFICATIONS OF THE OWN CAPITAL ON 31.12.2013 (continuation) Information regarding the situation of modifications the own capital ‘The own capitals were influenced as follows: ) 2012 2013 Wi Tocalized increases: = reserves from revaluation 780.876 5 reserves from evaluation at fir value of securities held on 31.12.2013 (GH265.070) | USAT RSD, ~ reserves formed from the value of securities acquired free of charge from companies in| 6.748.227) 9.524919 hich securities are held ~ reunification ofthe reserve formed for securities received free of charge, by cancellation | 4.251.603 | 6.685.907 of provisions for taxes (sales of securities) ~ other reserves, representing own financing soaroes from the net profit (by transfer) 7982999 | 12961157 reserves representing surplus accomplished from revaluation reserves (by transfer), | 470.720] 1.048.352 respectively the difference between amortization calculated based on the initial cost and amortization caleulated at revaluated value, for tangible asses = the result of the financial exercise ‘BR 382,694 | 130.000.0060 = reunification of reserves by cancellation of provisions Tor axes 261.687 26.568 = the result caried forward derived from the correction of accountant errors 38.108 : = the result carried forward regarding non allocated profit, BH2.670 | 88582608 TOTAL INCREASES 158.096.534 | 233,209,800 | reductions localized: al ~ profit distribution according to the Decision of Ordinary General Assembly of Sharcholders 83.442.670 | 88.382.694 | = reserves formed from the value of securities acquired free of charge, amount related to | 26.572.521 | _41.786.920 | sales of securities | = reserves formed from the value of securities aoquired five of charge, amount related to | 1079716 | 1.523.987) provisions for taxes ~ other reserves, representing securiios exited Irom the company (exclusively sale), | 1.635545 [ 166.089 respectively bankruptcy or reduction of nominal value ~ reserves ffom revaluation (by transfer). amount transferred in the result carried forward | 470.720 | 1.048.337 representing surplus obtained from revaluation reserves, respectively difference between amortization calculated based on initial cost and amortization calculated atthe revaluated vale, for fixed assets ~ reserves from revaluation 121976 7 = profit allocation for legal reserve Sane [ae reserves from evaluation at just value of securities held on 31.12.2013 (57.336.464) | (B5.838.457) Teserves representing surplos from revaluation of tangible assets, amount Telaed to] 45.076 aI provisions for tax ~ oir reserves, coniribulion amount in Kind fo the social capital related to sales of shares = = =the result caried forward regarding non allocated profit, BIH 670_| BE IBZ TOTAL REDUCTIONS 139,474.40 | 138.495.550 ‘Notes From page T8 to page 55 are iniegral part of the nancial statements 16 SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A, THE SITUATION OF CASH FLOWS lei ‘Name of the element ‘The financial exercise Previous Current a 1 2 Treasury flows from exploitation activities [Cashes from customers 121,559,577 349,016,206 [Payments to suppliers and employees 16,530,513 -17,930,292 interests paid [Profit tax paid 8,146,973, -27,899,422 [Cashes from insurance against earthquakes Net cash from exploitation activities 96,882,091 303,186,492 {Cash flows from investment activities: [Payments for the acquisition of shares -114.969.539 280,710,951 [Payments for the acquisition of tangible assets 41,211 26,931 97,016 759,338 2,067,965 1,177,531 34,845,688 35,716,104 -78,000,081 243,084,909 59,928,414 ~59,787,358, [Net cash from financing activities “59,928,414 ~59,787,358 Net treasury increase and cash equivalents -41,046,404 314,225 [Cash and cash equivalents at the beginning of the financial exercise 79,819,400 38,772,996 [Cash and cash equivalents at the end of the financial exercise 38,772,996 39,087,221 ADMINISTRATOR, ELABORATED, Last name and first name conf_univ.dr.ce. Tudor Ciurezu Last name and first nz ec. Elena Sichigea Quality Economic Manager Signature Signature Last name and first name jr. Anina Radu Signature Unit seal Notes from page 16 to page 55 are integral part of the financial statements ‘SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A, NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31st DECEMBER 2013 1, FIXED ASSETS Tei Value adjustments (amortizations and adjustments for Gross value depreciation or value loss ) Balance at Cessions, | Balance at the| the beginning| Adjustments Balance at the Balance at the transfers and | end of the ofthe | registered during end of the beginning of the other reporting | financial | the reporting | Reductions or| reporting Name of the fixed element {financial exercise| Increases _| reductions period exercise period retaking | period 0 i 2 3 4=1+2-3 5 6 7 B=5+6-7 [Other intangible assets 2902 787] 4156 39,533} #229 a5| 4.156 39,008] 1_|(ci.201+203+205+2074208) [Advances and intangible asseis.in course of 9 a 0 0 0 2 lexecution_(ct_2334234-2933) 3_|TOTAL INTANGIBLE ASSETS aZ907| 77 4.156] 39,533 2219) 45 4156] 39,008 4 [Lands (211) 2,014,880] 0 9.717] 2,005,163] d '3_[Constructions(ct212) 12,317,094] 0 723,115| 11,593,979] 183 F15,635 2,139 457,659] ‘6 [Technological equipments (Ct 2131) $30,825] 0 206,302] 624,523[ 741,505] 25,855 206,302 561,056] [Measuring, control and adjustment devices 429,115} 18,169} 128,893 318,389] 416.930] 10,122] 128,893 298,159 7_[and installations (ct.2132) ‘8 [Means of transportation (61.2133) 1557834] a Of 1.557.854] 1,432,067] 5504] Oo} 1497.671 Furniture, office automation devices, 202,582| 14,939] Sa161 183,360 125.011 21,129] 26,752 119,388} 9 [protection equipments, other tangible assets 10 [Non-current assets in progress (¢.231) q 0 0 q q 1 [TOTAL TANGIBLE ASSETS 17,352,328 33,108[1,102,188| 16,283,248] 2,759,674 S845 364,086[ 7,933,933 Financial assets. (ct. 261 + 262 +263 + 268 915,412,075] 293,623,951] 245,767,703] 963,268,323] 118,224,065 32,709,485] 90,317,175] _60,616,375| 12 [+ 265 + 266 + 267 - 269%) 13 [TOTAL FINANCIAL ASSETS 915,412,075] 293,623,951] 245,767,703] 963,268,523] 118,224,068] 32,709,485] 90,317,173] 60,616,375] 14 | GENERAL TOTAL 932,807,305] 293,657,846] 246,874,047] 979,591,108] _121.025.958] 33,248,775] 90,685,417] 63,589,316] Notes from page 18 to page 55 are integral part ofthe financial statements 18 SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A. NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31ST DECEMBER 2013 | 1. FIXED ASSETS (continuation) In the balance sheet, fixed assets are presented on a net basis (gross value - amortization), 1. Intangible assets in the balance on 31.12.2013 consist of informatics programs, SIF Oltenia logo-brand and ‘concession on the land in the gross amount of 39.533 lei as follows: ~ informatics programs 36.161 lei = concession of Bucharest representative office 13,93 sqm related to apt. no.2, bl. MI, 1.922 let Mircea Voda blvd no.3 sector 3 Bucharest and 6,46 sqm related to apt. no 27. bl MI, Mircea Voda bivd no.3 sector 3 Bucharest = SIF Ottenia logo-brand 1.450 lei TOTAL 39.533 lei During the year 2013 the increase of 787 lei represents: ~ tax for land concession in undivided share related to apt. 2 and apt. 27 of BI. MI, 87 ei Mircea Voda Blvd concluded with Bucharest City Hall, according to concession contracts no. 3762 and 3763 / 02.08.2007 for the year 2013 -~ acquisition of OEM Microsoft licence, WIN 7 700 tei TOTAL 787 lei ‘The exists of intangible assets during the year 2013 represent: = concession of Gor) representative office 20 sqm according to the concession agreement 709 tei ‘no, 6017/20, 11.1996 exited following the sale of building in Gor) = cassation of software licence 3.447 lei TOTAL 4.156 let ‘The amortization of intangible assels is made according to legal provisions in force. 2. Tangible assets are composed of lands and fixed assets and sum up at the end of the year the gross amount of 16,283,248 lei During the year 2013 increases of tangible assets took place in the amount of 33.108 lei placed as follows: ‘© Tangible assets acquired are in the amount of 33.108 lei and represent: ~ adjustment, contol, measuring devices and installations (computers) 18.169 ei = furniture, office automation, other tangible assets (sign board) 14.939 lei TOTAL 33.108 ei ‘The outputs of tangible assets in the amount of 1.102.188 lei are found as follows: © Sales of fixed assets in the amount of 779,946 lei Registration Value Depreciated Value building land Giurgiu 732,832 lei 2.139 lei - technological equipments 29.685 lei 29.685 lei adjustment, control, measuring devices and 4.840 lei 4.840 lei installations - furniture, office automation, other tangible assets __12.589 lei 5.180 lei TOTAL 779,946 lei F844 Tet ‘© Disposals of fixed assets in the amount of de 268.786 lei, found on items as follows: Registration Value Depreciated Value ~ technological equipments 159,695 lei 159,695 lei adjustment, control, measuring devices and 93.674 let 93.674 lei installations furniture, office automation, other tangible assets __15.417 lei 15.417 lei TOTAL 268.786 lei 268.786 lei ‘+ Transfer of fixed assets of the kind of inventory objects fully depreciated at inventory objects outside the balance shect in the amount of $3.456 lei, as follows: ‘Notes from page 18 to page 55 are integral part of the financial statements 9 SOCIETATEA DE INVESTITH FINANCIARE OLTENIA S.A. NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31ST DECEMBER 2013 1, FIXED ASSETS (continu: Registration Value Depreciated Value - technological equipments 16.922 let 16,922 let ~ adjustment, control, measuring devices and 30.379 lei 30.379 lei installations | furniture, office automation, other tangible assets ___6.155 lei 6.1551 TOTAL 33.456 lei 33.456 lei ‘The amortization method used for tangible assets is linear, and the durations of use are established by the decision of the Administration Council no. 2/10.02.2005 having as determination basis HG 2139/2004. The durations of use of tangible assets are defined as follows: = constructions 12-50 years = technological equipments -20 years - adjustment, control, measuring devices and installations 3-8 Years = means of transport 5-10 years furniture, office automation, other tangible assets 3-15 years 3. Financial assets In the category of financial assets are included: 3.1 Securities held, in the amount of 962,500,738 lei and which represent 99.92% of the total financial assets. Inthe year 2013, the inputs of securities are inthe amount of 290,008,640 lei and consist of; = Units acquired as a consequence of cash contribution to the social 7.142.385 lei capital = _ Units acquired from the capital market 273.341.336 lei ~ Securities acquired free of charge registered on capitals 9.524.919 lei ‘The outputs of securities were in the amount of 238.619.472 lei, structured as follows: ~ Securities sold (of which registered on costs: 196.605.300 lei) 238,392,212 leit = Other outputs (radiations, withdrawal of social capital) 227.260 lei The securities are reflected in the balance sheet at acquisition cost reduced by value adjustments for depreciation. On 31,12.2013, the market value of securities held, calculated according to the Disposition of ‘measures of RN.S.C. (current A.S.F) no 23/20.12.2012, is of 1.686.220.768 lei, compared to 1.585.942.304 lei on 31.12.2012, registering in the year 2013 an increase of 100,278,464 lei, In the financial statements, in determining adjustments for depreciation of securities, the evaluation is made as follows: for securities listed and traded in the last 30 trading days, the market value was determind by taking into account the quotation of the last transaction day (closing quotation) on the main capital market, and for securities listed which did not had transactions in the last 30 trading days as well as for securities not listed, the ‘market value was determined according to own capitals of issuers, based on the provisions of the Disposition of ‘measures of R.N.S.C. (current A.S.F) no 23/20.12.2012. ‘There were registered adjustments for depreciation in securities during the year 2013, adjustments registered on capitals account, respectively in the debit of the account 1062 ~ « Reserves formed from adjustments for value losses of financial assets», in the amount of 15.419.854 lei as well as adjustments registered on expenses in the amount of 17.289.629 lei and retaking of adjustments in the amount of 78.245,328 lei ‘The total adjustments for depreciation of securities in balance at the end of the year are in the amount of 60,616,375 lei. From value adjustments rogistered for depreciation of securities existing in balance at the end of the year 2012, during the year 2013 it was resumed to income the amount of 773.108 lei, and in capitals the amount of 11,298,739 lei, depreciation related to securities sold. 3.2 Fixed receivables, in the amount of 767.585 lei, composed from: = Deposits for management warranties ‘© Initial balance 319.020 lei ‘Notes fom page 18 to page 55 are integral part of the financial statements 20 SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A. NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31ST DECEMBER 2013 1. FIXED ASSETS (continuation) Amounts advanced during the year 54.583 lei Amounts reduced as consequence of termination of work agreement and the 5.846 let Position of administrator Final balance 367.757 let = Receivables related to participating interests (amounts advanced as cash contribution to the socal capital) Initial balance Amounts advanced during the year : + Amounts reduced as consequence of elaboration of registration formalities to 7.142.385 lei ‘orc 7.142.385 lei ‘+ Final balance ei ~ other fixed receivables (amounts o advance as contribution in cash tothe social capital) ‘Initial balance 3.980.317 lei ‘© Amounts to advance during the year “3.581.657 lei ‘© Amounts advanced during the year 7 Final balance 398.660 lei = other fixed receivables (warranties for current utilities) 1.168 lei 2 ‘Notes from page 18 to page 55 are integral part of the financial statements SOCIETATEA DE INVESTITI FINANCIARE OLTENIA S.A. ‘NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31" DECEMBER 2013 2. PROVISIONS lei Balance ‘Transfers Balance account at the account at the Name of the provision Inthe | Fromthe | endof the account | account financial exercise 0 2 3 0 T._| Provisions for taxes F7191.539 [1567997 | 6712473 | 4. ONG ST Other provisions 8.198.829 | 5.000.000 | 4.987.298 | _8211,531 TOTAL '55.390.358 | 6.567.297 | _11.699.773 | 0.257.882 1, Provisions for taxes Provisions for taxes in balance account on 31.12.2013 are resulted from the application of the profit tax quote of 16% on the reserves from the value of securities, on the reserves formed from excess of tangible assets revaluation, on the reserves formed from the value of shares acquired free of charge. ‘These provisions for taxes are totally formed on own capitals, having a temporary fiscal effect. During the reporting period provisions for taxes in the amount of 1.567.297 lei were formed, of which - the amount of 43.310 represents provisions for taxes related to surplus from revaluation of tangible assets recorded on the costs and transferred from the revaluation reserve in the reserve representing surplus accomplished from revaluation reserves. + the amount of 1.523.987 represents provisions for taxes related to shares acquired with free ttle During the reporting period were retaken provisions in the amount of 6.712.475 lei representing the payment tax related to the shares received free of charge which were sold and shares exited by radiation, On 31.12.2013 the provisions for taxes are in the amount of 42.046.351 lei and are detailed as follows: Provisions for taxes related to: 31122012 31.12.2013, = reserves from value of securities 46319820 41,131332 reserves from revaluation of tangible assets 715.082 758.352 other reserves 156.667 136.667 Total 47,191,529 42.046.351 2. Other provisions On 01.01.2013 there existed in the balance account provisions in the amount of 8.198.829 lei, of which: = the amount of 1.042.380 lei represents provision formed for the participation of employees to profit; ofthe effective leadership and administrators to profit for the year 2010, not allocated (litigation in course of solving); = the amount of 1.316.912 lei represents provisions formed for social contributions related to the participation fund of the employees to profit constituted in the year 2009 and distributed in the year 2010, "uncertain obligation from the point of view of indebtedness, = the amount of 839.537 lei represents provision formed for the participation to profit of ‘employees, ofthe effective leadership and administrators to the profit of the year 2011 not allocated; = the amount of 5.000.000 lei representing the participation of employees, of the effective leadership and administrators to the profit of the year 2012, which also includes social contributions. The constitution of the provision was accomplished in accordance with the provisions of the collective work agreement, of the articles of incorporation and the approval of the Administration Board of SIF OLTENIA SA, provided in BVC and approved in in AGOA of 20.04.2013. In the course of 2013 it was retaken to incomes the antount of 4.987.298 lei, by consumption in the form of payments, of the participation fund of the personnel to profit for the year 2012, which also includes social contributions The distribution of incentives to employees, effective leadership (leaders based on mandate) and administrators was made according to the provisons of the company contract, of ‘Notes from page 18 to page 55 are infogral part of the financial statements 2D SOCIETATEA DE INVESTITH FINANCIARE OLTENIA S.A, NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31* DECEMBER 2013, 2, PROVISIONS (continuation) the collective work contract and of mandate contract on the basis of the approval of the Ordinary General Assembly of Shareholders of 20.04.2013. On 31.12.2013 provisions in the amount of 5.000.000 lei were registered representing participation of employees, of the effective leadership and administrators to profit for the year 2013, ‘which also includes social contributions. The constitution of the provision was accomplished in accordance with the provisions of the collective work agreement, ofthe articles of incorporation and the approval of the Administration Board of SIF Ottenia SA from 17.02.2014. The distribution of incentives to employees, effective leadership (leaders based on mandate) and administrators was made according to the provisons of the company contract, of the collective work contract and of mandate contract on the basis of the approval of the Ordinary General Assembly of Shareholders ‘Notes from page 18 to page 55 are integral part of the Financial statements a SOCIETATEA DE INVESTITH FINANCIARE OLTENIA S.A, | NOTES AT THE FINANCIAL STATEMENTS | FOR THE FINANCIAL EXERCISE CONCLUDED ON 31ST DECEMBER 2013 3. THE ALLOCATION OF THE PROFIT lei ‘The financial exercise The destination of the profit oe = A__| NETPROFIT TO BE ALLOCATED 88.382,694 1 [own financing sources 12.961.151 2.__| -dividends 75.421.543 B._| NOT ALLOCATED PROFIT = 130,000,062 Inthe Ordinary General Assembly of Shareholders, established for 28/29 April 2014, the Administration Board proposes the allocation of the net profit inthe amount of 130,000,062 ei forthe following destinations: ~ dividends to be allocated for the year 2013 (gross dividend on share - 0,16 lei) 92.826.514 lei, own financing sources 37,173,548 lei, The allocation ofthe profit for the year 2012 was approved by the Ordinary General Assembly of Shareholders inthe meeting from 20 April 2013. The company declared gross dividend of 0,13 lei/ share for the year 2012. Dividends declared for the year 2012 are presented as a reduction of own capitals inthe financial statements ofthe year 2013, ‘Notes from page 18 to page 55 are integral part of the Financial statements 24 SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A. NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31ST DECEMBER 2013, 4.THE ANALYSIS OF THE RESULT OF THE CURRENT ACTIVITY (EXPLOITATION) ‘The financial exercise Indicators No. Row - Previous Current 1 | Incomes from financial assets (et. 761) a 34,886,642 | 35,716,108 2 _| tncomes from financial investments on short term (ct. 762) o 0 o 3_| Incomes from fixed receivables (ct. 763) 0 0 0 [Incomes from financial investments ceded (ct. 758*#769), 8 121,252,383 | 346,610,172 5_| incomes from works accomplished and services performed (ct. 704) 05 0 0 6 | Incomes from reactivated receivables and various debtors (ct. 754) 06 0 0 7 _| Incomes from commissions _(ct. 781+786) 7 4.714.839 | 9,602,625, 8 | Incomes from differences of exchange rate (ct. 765) 08 1346874 | 659,286 9 | Incomes from interests (ct. 766) o 1,975,379 | 1,180,840 19 | Hcomes from the fixed production, tangibte and intangible (ct. a 7214722) 0 o Ti_| Other incomes from the current activity (row 12 tol) i 276,961 | 1,035,480 = from studies and researches (ct. 705) 2 0 0 = from royalties, locations and renis (ct. 706) B 112.926 | _119.297 = from other various activities (et. 708) i 0 0 ~ from subventions (et. 741) 15 0 0 = from other incomes (ct. 758") 16 97,519 | 841,558 = from discounts obtained (ct. 767) 7 65.434 69,904 = from other financial incomes (ct, 768) 18 1,082 4.791 12. | INCOMES FROM THE CURRENT ACTIVITY (row Ol to 11) 19 164,493,078 | 394,804,507 13 | Losses related to receivables connected to participations (ct. 663) 20 0 0 14_| Expenses regarding financial investments ceded (ot. 658466) [21 0,639,584 | 196,605,300 15_| Expenses from differences ofthe exchange rate (ct. 665) 22 599,710 |___778,331 16_| Expenses regarding inerests (ct. 666) 23 0 o 17_| Expenses regarding commissions and fees (ct. 622) 24 1,133,502 | 1,716,368 18 | Expenses with bank services and assimilated (ct. 627) 25 22.783 24,542 19 _| Losses from receivables and various debtors (ct 654) 26 Of 129,202 20 | Expenses with commissions and amortizations (ct. 681+686) 27 6,960,588 | — 22,834,506 2 | ests - 1s.3497 | 15700086 = with materials (ct. 602+603+608) 29 298,015 | __ 286,500 = with energy and water (ct, 605) 30 139,494 | __ 144,206 = with the personnel (row 32433) 31 11,898,852 | 11,965,869 = wages(el. 626414642) 32 9.751.179 | 9,689,458 = insurances and social protection (645) 3 2,147,673 | 2,276,411 = with external services row 35 10 46) 4 912,671 | 1,378,959 = maintenance andl repairs (Gt. 611) 35 130335 | 102.417 = royalties, locations and rents (@t. 612) 36 6317 o ~ insurance premiums (ct. 613) a 37 92.710 78.291 studies and researches (61) 38 0 0 = protocol, advertisoment, publicityet. 623) 39 38.371 45772 ~ transport of goods and persons (ct. 624) 40 0 0 = travels, detachments, transfers (et. 625) a 63,102 47214 = mail and telecommunications (ct 626) 2 69,960 61,723 23 ‘Notes from page 18 to page 55 are integral part of the financial statements SOCIETATEA DE INVESTITI FINANCIARE OLTENIA S.A. NOTES AT THE FINANCIAL STATEMENTS. FOR THE FINANCIAL EXERCISE CONCLUDED ON 31ST DECEMBER 2013 4.THE ANALYSIS OF THE RESULT OF THE CURRENT ACTIVITY (EXPLOITATION) = other services performed by third parties (ct. 628) 316,639 | __ 204.613 ~ other expenses (ct. 658°*) 4 170,180 | _834,001 expenses regarding discounts given (667) & 0 0 ~ other Financial expenses (ct. 668) 46 5,087 4928 ~ expenses with other taxes, fees and assimilated payments (et. 635) | 47 1,864,465 | 1,924,552 22 | EXPENSES FROM THE CURRENT ACTIVITY (row 201028) | 48 64,469,664 | 237,788,531 49 2B RESULT FROM THE CURRENT ACTIVITY (row 19-48) 99,963,414 | 157,015,976 ‘Notes from page 18 to page 55 are integral part of the financial statements 6 SOCIETATEA DE INVESTITH FINANCIARE OLTENIA S.A. NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31ST DECEMBER 2013 5. THE SITUATION OF RECEIVABLES AND DEBTS In absolute values the receivables ofthe company appear as flows: li Banco accountat | Balance acount LQUOITY TERM Ae anon | wena, | ateandatne joRow | thefinancial | financial exercise rane il xerse (Trae yaar | — Over Tyear 2012 a 7 = z 7 TOTAL of wet | ses0972 asoase | 4901.99 0 T Receabls rom fred aso, of hick ase ras fares aa ° =Receraiescomecindioparicpatoniniresis | 03 | seen si7 saeco | 3.60 | o ~Otarfendrecdbian * so, 168 sears | 363925 o TT Racovabies om eatng asses fat 6s ea Tes |i a ~Camimrcial recenebwes, advances assgned © | 08 spl andthe assmlted accounts ie -. | receivables personel andassmiatd accounts | _O7 1.562 155 1.665 o = Recehabls the buat of soll surance and) 08 the state bucgot 2.546768 002002 | 3002002 ° -Inerests tobe cashed 7 6 32 a2 ° Debs so | 2600732 1.160 | 1,140.382 o “Diner cei if aan oa 5 (0n34.12.2013 the campany has regitered austen for deprecaton of eevee inthe amount 1.117.956 te Balance "| Balance EXIGIBILTY TERM seo account at No. | theend ot Dette the end ofthe | Row | Weta | “enc | under tyer | Sateents | owe S| exercise | yarcise 2013 3 1 Baas 3 a 5 [| Torat ofwiter: or | szmos6.er7 | 135506356 | 139908356 of 0 | Debs thatmustbe palin aperadattyear,ot | ich szaoser7 | 13890856 | 13,006,356 o ° Oa ESS @ ass ee aes | a ob Conrarci bs, evar ecsved Fo = castoners lated accounts eee ee ecesie| _orasso | 1455 ° a —Dabiswinthepaomal ondesimiaidoomne | 05 | yanomna | _sansou | 1assoue a F “Debi connected He buat oT aaa] 7 insurances and stat ne oe ozone | aaeou | _ os2n0u1 o a Payment ides o7 | v12.s.60s | 7.55764 | 127,558,764 | ° 0 [oe 0 | sososaa | oases | sone | o | ‘Notes Irom page T8 to page 55 are integral par of The Racial Savements 7H ‘SOCIETATEA DE INVESTITI FINANCIARE OLTENIA S.A, NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31 DECEMBER 2013 6, PRINCIPLES, POLICIES AND ACCOUNTANT METHODS Chapter I General Background 1. Legal background, ‘The accountant regulations according to the IVth Directive of CEE applicable to the authorized cnttics, settled and supervised by the National Commission of Securities. approved by the Order RN.S.C. (current A.SF.) nr, 13/2011, respectively Regulations no, 4/2011, define in art. 234(1) of the 3" Section, the accountant policies as being represented by “the specific principles, bases, conventions, rules. and practices applied by an entity when elaborating and presenting the financial statements”. 2 ‘The structuring of the accountant policies. The present accountant policies were correlated with the ‘main policies of enterprise that S.LF. OLTENIA S.A. applies, regarding the organization, analysis and processing of documents, the policies of internal control, efc. At the same time, where the case required it, the accountant policies were correlated with the specific regulations issued by R.N.S.C. (current AS.F.) ‘The accountant policies applicable to S.LF. OLTENIA S.A. were structured in * General accountant policies, regarding background problems of the organization of the financial reporting, respectively recognition, classification, evaluation, significance threshold, et. ‘© Specific accountant policies regarding the specific categories of assets, debis, own capitals, incomes, expenses and results. 3. General accountant polices. The individual financial statements fallin the responsibilty of SF. OLTENIA S.A. leadership and are elaborated according to the provisions of the Accountancy Law no. 82/1991 Rand ofthe Order RN'S.C. no. 13/2011 forthe approval ofthe Regulations no, 4/2011, regarding Accountant Regulations complying to the [Vth Directive of CEE, applicable to the authorized entities, settled and ‘supervised by the National Commission of Securities. At the same time, provisions of the legislation in force specific to the companies of financial investments and capital markets were used. ‘The financial statements are prepared on the basis of historical cost. The RN'S.C. (current A.S.F.) order no. 13/2011 regarding accounting regulations compliant with Directive IV of CEE, applicable to authorized entities, regulated and supervised by the National Commission of Securities, provides. the preparation of financial statements a historical cos. ‘The financial statements of S.LF. OLTENIA S.A. reflect the transactions for the current financial exercise and are elaborated in lei, Receivables, debts and reserves in foreign currency existing on 31.12.2013 are converted in lei at the reference exchange rate of the present day. In accordance with R.N.S.C. (current A.S.F.) Order no, 116/21.12.2011 for the approval of Instruction no. 62011 and R.NS.C. (current ASF.) Order no. 1/2013 regarding the application of International Financial Reporting Standards by authorized entities, regulated and supervised by the National Commission of Securities. the companies of financial investments are required to prepare anal financial statements in accordance with International Financial Reporting Standards, for information purposes, for the financial exercises ofthe years 2011, 2012 and 2013, within 180 days from the closing of the financial ‘year, Financial statements prepared under IFRS will be obtained by restating the information presented in ‘the annual financial statements prepared under accounting evidence organized in accordance with ‘Accounting Regulations in compliance with Directive IV of CEE applicabile to authorized entities, regulated and supervised by RNSC. The financial statements prepared in accordance with IFRS are published on the own website and are subject to financial audit, In accordance with RNSC (current A.S.F.) decision no, 1176/15.09.2010, companies of financial investments are required to prepare and submit to RNSC (current A.S.F.) annual consolidated financial statements, in accordance with Intemational Financial Reporting Standards adopted by the European Union, within 8 months from the closing of the financial year. The Group S.LF. OLTENIA S.A., including S.LF. Oltenia S.A. and its subsidiaries, will prepare a set of consolidated financial statements in accordance with IFRS for the financial exercise concluded on 31.12.2013, for information purposes, ‘hich will be published in accordance with Romanian legislation requirements in force As general rules forthe recognition of the elements from the financial situations, we state that S.LF. OLTENIA S.A. availed ofthe following conventions, principles and niles: "The convention of commitments accountancy, based on which the effects of the transactions and of ‘other events are recognized (and implicitly registered in accountancy and reported inthe financial statements) ‘when they appear and not atthe moment when the cash flows intervene, ~The accountant principles used are: Notes from page IR to page 53 are iniegral part of the financial statements 59 SOCIETATEA DE INVESTITI FINANCIARE OLTENIA S.A, NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31" DECEMBER 2013 6, PRINCIPLES, POLICIES AND ACCOUNTANT METHODS * the principle of the activity continuity supposes that S.LF. OLTENIA S.A. will continue to operate normally in the foreseeable future without entering in the impossibility to continue its business or its significant reduction; ‘the principle of the methods permanence consists in the application of the same rules and standards forthe evaluation, registration in accountancy and submission of assets and liabilities, as well as of results, while ensuring the comparability in time of accounting information; = the principle of prudence requires that the value of any item is determined by taking into account © only profits recognized until the date of preparation of financial statements, © foreseeable obligations and potential losses incurred during the reporting period completed or during an earlier exercise, even if such obligations or losses occur betvvoen the balance sheet date and the date of its preparation, all depreciation, regardless if the result of the financial exercise is profit or loss, + the principle of exerlse Independence requires taal icone and expenses cosponding othe financial year for which the reporting is made to be taken into consideration, regardless ofthe date of receipt of amounts or payments made; + the principle of the separate evaluation of the elements of assets and liabilities requires the separate determination of the value related to each individual item of asset ot liability, ‘the principle of intangibiity requires thatthe opening balance sheet of an exercise must correspond to the closing balance ofthe previous year; ‘+ the principle of non compensation requires that the values of the elements representing assets ‘cannot be compensated with the values of elements representing liabilities, respectively incomes with expenses, ‘the principle ofthe economic prevalence on the juridie requires thatthe information presented in the annual financial statements should reflect the economic reality of events and transactions, not only their legal form: + the principle of the significance threshold requires that any clement that has a significant value should be presented separately in the annual financial statements. Elements of insignificant value with the same nature or similar functions must be added, not being necessary to disclose them separately. The qualities of the accountant information which were taken into consideration inthe elaboration of the financial statements are: clarity, relevance, ability and comparability - SLE, OLTENIA S.A. aims at maintaining financial capital by determining the current value of own equity atthe end of each financial year Business continuity. These financial statements have been prepared on the basis of business continuity principle, which assumes the fact that S.LF. OLTENIA S.A. will continue its activity also in the foreseeable future. In order to evaluate the applicability of this statement, the company management analyzes future predictions at future cash inflows. Use of estimates. The preparation of financial statements in accordance with RNSC (current ASF) Order no, 13/2011, as amended, requires the management of S.LF. OLTENIA S.A. to make estimates and assumptions that affect the reported amounts of assets and liabilities, the presentation of assets and contingent debis at the date of preparation of individual financial statements and incomes and expenses reported for the respective period. Although these estimates are made by the management of S.LF. OLTENIA S.A. based on the best information available at the date of the financial statements, the results obtained may differ from these estimates, Funetional and presentation currency. Functional and presentation currency of the financial statements is leu (RON). ‘Transactions and balances in foreign currency. Transactions of S.LF, OLTENIA S.A. in foreign currencies are registered at the exchange rate communicated by the National Bank of Romania BNR") of the transactions date. Gains and losses resulting from the settlement of transactions in a foreign currency and from conversion of monetary assets and liabilities denominated in foreign currencies, are recognized in the profit and loss account ofthe current year. Foreign currency balances are converted in fet at the exchange rates communicated by BNR for the balance sheet date. On 31st December 2013, the main official exchange rates used were: 4,4847 lei for | EURO (31st December 2012: 4.4287) and 3.2551 lei for 1 USD (st December 2012: 3,3575). Notes from page 8 to page 53 are integral part of the financial statements 3 SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A. NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31" DECEMBER 2013 6. PRINCIPLES, POLICIES AND ACCOUNTANT METHODS, 4. Specific accountant policies. LF. OLTENIA S.A. avails of the following rules for the recognition and evaluation of the elements from the financial statements: 4.1, Assets recognition and evaluation. The recognition ofan asset is accomplished according to: = utility, expressed through the obtainment of future economic benefits as a consequence of use or sale; utility is appreciated by the Administration Board for special situations like donations, subventions, exchanges ‘of assets, etc or by the effective Leadership of the company for usta situations, operations or transactions. In this respect, any entry of asset in the administration of S.LF. OLTENIA $.A. will have to be correlated with the investment budget or the budget of the exploitation activity = its credible evaluation. The evaluation of assets is made, according to case, at one of the following values: acquisition cost, production cost, fair value, utility value, the smallest value between cost and recoverable value, the smallest value between cost and net accomplishable value SIF. OLTENIA S.A, does not include in the acquisition cast of assets: expenses associated to the unfavourable differences of the exchange rate, the reorganization commissions, dismounting and displacement of the assets ‘The fair value is defined as being the value for which an asset can be traded or a debt can be discounted, between partis interested and aware of it, within a transaction determined in objective conditions. ‘The fair value of the assets credibly evaluated is considered to be the market value (if an active ‘market exists) or the replacement cost, In determining the far value (When a market value does not exist) or the ‘utility value, the company will use experts, independent evaluators. 4.1.1, ‘The testing upon depreciation of assets. S.LF. OLTENIA S.A. accomplishes at the end of each year the testing upon depreciation of assets. The testing upon depreciation of fixed assets also takes place when there is information that a series of internal or external conditions associated to the asset functioning changed significantly and there are the premises of a significant deterioration of value. Thus, an asset is considered ‘depreciated if the net accountant value is significantly superior to its recoverable value (for the fixed assets) or {o its net accomplishable value (for the current asses) 4.12. The revaluation of the fixed assets SF. OLTENIA S.A. proceeds tothe revaluation of the tangible assets periodically, and the difference from revaluation will determine the adequate accountant registration, if the fair value determined by revaluation is significantly different toward the accountant value, The differences from revaluation are registered lke this: a) when the fair value is significantly greater than the accountant value, the difference willbe registered = ian account of own capitals, or = iman account of incomes, if a previous revaluation determined a value depreciation which was registered ‘on expenses, and only within te limit of that deprecation, the difference being registered sill in an account of covn capitals. ') when the fair value is significantly smaller than the accountant value, the difference will be registered like this: = inan account of expenses, or = in an account of own capitals if, a previous revaluation determined the registration of a difference from revaluation in that account of own capitals and only within the limit of that amount, the difference ‘being registered still in an account of expenses with the depreciation of assets, 42, Debts recognition and evaluation, The recognition ofa debt is fulfilled by the company according to the following criteria: = the possibitity of an output of resources bearing economic benefits, = the evaluation must be fulfilled in a credible way. ‘The evaluation of debs is accomplished: + at input, atthe historical value of updated value ofthe future outputs of cash or of resources necessary to discount the debt; = at inventory, atthe updated value of the outpats of future resources, = atthe balance sheet, atthe accountant value or at the updated accountant value, in case of debts expressed in ei reported toa foreign currency. Debs over one year will be brought to the updated value according to the legal dispositions or to the conventions and contracts concluded . The update of bank credits and leasing rates will be made according to the contractual provisions. ‘Noles from page 18 fo page 35 are infogral part of the Financial statements 30 SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A. NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31" DECEMBER 2013 6. PRINCIPLES, POLICIES AND ACCOUNTANT METHODS. 43. Own capitals. Own capitals represent the residual inferest of shareholders in the assets of the institution, after the deduction ofall debts and are composed of = social capita: = premiums connected tothe capital, which represent the difference between the issue value of newly issued shares and their nominal value and can be issue premiums, contribution premiums, fusion premiums, division premiums, conversion of bonds in shares, ec. = reserves from revaluation, constituted by the registration of surplus from the non-current assets revaluation; = reserves associated tothe allocations from the annual profit before or afer taxation, according to law; = reserves formed from adjustments for value loss of financial intangible assets; = the result of the exercise; = the result retained in which are registered: * the result retained representing not allocated profit or not covered loss from the previous years; * the result retained resulted from the adoption forthe first time of LAS, less [AS 29 * the result retained resulted from the correction of accountant errors; * the result retained resulted from the passing to the application of the Accountant Regulations corresponding tothe [Vth Directive ofthe European Economic Community 44, Expenses and incomes in advance, These are posts of regularization of incomes and expenses which are related to other financial exercises than the current one, 45. Incomes recognition and evaluation. The recognition of incomes is fulfilled according to the following criteria: ~ the increase of future economic benefits (through increases of assets ot reductions of debts) when there are fulfilled cumulatively the conditions: the transfer of all risks and advantages related to the property over the good; the effective control on the sold good is no longer held; the respective good can no longer be administered = the credible evaluation. 46 The recognition of expenses is fulfilled when: 4. diminution of the fature economic benefits is estimated by the diminution of asses or the increase of debis, and ~ they ae credibly evaluated Chapter I Policies related to tangible and intangible assets Intangible assets. The classification and presentation isthe one provided by the Regulations The computational programs are evaluated at the acquisition cost, they are classified according to {destination and amortized monthly for a period of 3 years, The expenses with the current maintenance of the computational systems are recognized as expenses of the period. Tangible assets ‘They are structured in the balance sheet in the following subcategories: = Tans and constructions, = technica installations and machines; = other istallations, equipments and furniture, = _advances and tangible assets in process S.LF. OLTENIA S.A. will revaluate the buildings and lands and the other tangible assets periodically. ‘The last revaluation made and registered was on 31.12.2012. ‘The lands held by S.LF, OLTENIA S.A. cannot be amortized because their useful life duration cannot ‘be determined, but they are periodically tested upon depreciation ‘The expenses forthe arrangement, rearrangement and modemization ofthe buildings and lands and of ‘other non-current assets ae included in the accountant value ofthe respective non current assets. ‘The expenses with the current repairs and for maintenance related to the tangible assets are recognized as expenses of the period, “The testing upon deprecation of the tangible assets willbe fulfilled at the end of each financial exercise, the significance threshold for the registration of the differences being established at 10% of the accountant value of the tangible assets. ‘Notes from page 18 to page 55 are integral part of the financial statements 31 SOCIETATEA DE INVESTITII FINANCIARE OLTENIA S.A, NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31” DECEMBER 2013 6, PRINCIPLES, POLICIES AND ACCOUNTANT METHODS ‘The tangible assets are amortized in a linear system, the useful life durations being those established by the CA resolution no. 2/10,02.2005 having as a determination basis HG 2139/2004. The useful life duration of tangible assets are established as follows: = constructions 12-50 years + technical installations and machines 3-20 years other installations, equipments and furniture 3+13 years (Chapter III — Policies related to investments and financial instruments S.LF. OLTENIA S.A. invests in securities issued by other companies or public or private organisms, their presentation in the balance sheet being made: ~ in financial non currentassets (fixed assets) for the titles kept until the due time, placements and receivables on average and long term of the company toward third parties, financial assets available for sale = In financial investments on short term (current assets) for financial instruments destined to transactioning and which are usually kept for a limited period in the portfolio. ‘The financial investments held by S.LF. OLTENIA S.A. in the form of the participations tothe social capital of other companies are part of the category of financial assets available for sae, being registered in financial assets. Occasionally, when the effective leadership of the company considers that the interests of sharcholders are better protected, certain financial investments can be included and treated likewise, in the category of financial investments on short term, At input, the investments are registered at acquisition cost, which also includes trading costs directly assignable to their acquisition. In the annual financial statements, the financial investments are evaluated according to the RNS.C. (current A.S.F_) Order no 13/2011 and no. 11/11.03.2009, respectively = securities on short term (shares) admitted fo transaction on a setled marke, are evaluated at the quotation value from the last transaction day and those not transacted at the historical cost less the eventual adjustments for value losses. = securities on long term are evaluated at historic cost less the eventual adjustments for valuc losses. In the annual financial statements in determining the adjustments for depreciation of Participation units, the market value is the value established based on the provisions of the Disposition of reasures no, 23/20.12.2012 issued by RNSC (current A.S.F.) with applicability ftom the month of March 2013 and of the Decision of the Administration Board no. 1/31.01.2013 for the approval to use the alternative methods provided in this Disposition of measures as follows + In case of securities (shares) traded in the last 30 trading days, the market value is calculated based on the closing price of the market section considered the main market or the reference price provided by other trading system than regulated markets, including altemative systems within the respective trading system, for the day for which the calculation is made. ‘+ For securities admitted to trading, but not traded in the last 30 trading days and for securities not admitted to trading, the market value is given by the accountant value per share, the way it results from the last annual financial statement (prepared in accordance with National Accountant Regulations applicable to the issuer) of the respective entity. In case of credit institutions, the accountant value per share has as a calculation bases the value of the own equity contained in the ‘monthly reports submitted to BNR. ‘+ Securities not traded or admitted to trading and not traded in the last 30 working days, whose financial statements are not available within 90 days from the legal dates of filing, are evaluated at the value set by using information from quarterly/half yearly financial reports published on the websites of the regulated market, o, if they are not available, atthe zero value. + The market value of securities held in commercial companies not admitted to trading, with negative values of own equity and of commercial companies in insolvency procedure, reorganization, Judicial liquidation or other forms of liquidation and of those in temporary or permanent cessation of ‘activity is set to zero. = For securities issued by 0.P.C, admitted to trading or traded in the last 30 trading days on a regulated market, the market value is established at the closing price of the market section considered the main market or teh reference price provided by other trading systems than regulated markets including altemative systems by the operator of the respective trading system related to the day for which the calculation is made. ‘Notes from page 18 to page 55 are integral part of the financial statements 2 SOCIETATEA DE INVESTITH FINANCIARE OLTENIA S.A. NOTES AT THE FINANCIAL STATEMENTS FOR THE FINANCIAL EXERCISE CONCLUDED ON 31 DECEMBER 2013 6, PRINCIPLES, POLICIES AND ACCOUNTANT METHODS ‘* In case of securities issued by O.P.C admitted to trading and not traded in the last 30 trading days as well as in the case of those not admitted to trading, the market value is established by the evaluation ‘method based on the last unitary value of the net asset calculated and published. S.LF. OLTENIA S.A. has chosen to establish the market value based on the Disposition of ‘measures no, 23/20.12.2012 because it is a generally accepted method, used in the reports submited to ASF. and investors, to calculate the monthly and annual net asset (Annex no. 16 and Annex no. 17). S.LF. OLTENIA S.A. believes that the value of the securities presented to investors in the financial statements cannot be determined by different methods, $.LF, OLTENIA S.A. consistently applied this method of evaluation. ‘The negative adjustments are registered on. accounts of capitals, using the account 1062 “Reserves formed from adjustments for losses of value of financial assets” according to RNSC (current .S.F.) Order no. 11/11.03,2009. ‘The evaluation ofthe financial investments is performed and registered atthe end of every year. Shares received with five title are registered in the account 1065 ,,Reserves formed from the value of financial intangible assets acquired with free title ‘When exiting the patrimony the participation units (shares) are subtracted from administration based on the FIFO method (first entered, first exited) Chapter IV — Policies related to stocks S.LF. OLTENIA S.A. evaluates stocks at the acquisition cost which contains the totality of expenses related to the acquisition and bringing of goods in state of use or utilization. The administration of stocks is ‘organized based on the quantitative — value method, according to the nature of goods. ‘When exiting the administration, stocks of material values are registered in accountancy by applying the FIFO method (first entered, first exited) ‘The materials of the ype of inventory objects are registered fully on costs when given tobe used. Inthe balance sheet stocks are evaluated at cost, andthe testing upon depreciation is made atthe end of each year ‘The stocks will be inventoried atthe end of each financial exercise Chapter V - Policies related to receivables Receivables on short term (with due dates up to 12 months) are evaluated atthe nominal value, at the date oftheir apparition; those on long term are distinguished inthe balance sheet atthe updated value according to an average rate of inter-banking interest, the currency exchange rate or according to the phasing diagram of cashes and contractual conditions. ‘The dividends to be cashed are registered inthe accountant evidence on ex-dividend date, and the non cashing on the dates established by AGOA Resolution, are adjusted with full amount, inthe asset, being registered with zero value (Disposition of measures no. 23/2012 of RNS.) ‘A reclassification of receivables in uncertain receivables is made when the non-cash risk becomes significant. Receivables will be classified according to the oldness of non-cash and each category will have a ‘non cash risk associated to it From the fiscal point of view, the deducibility of the adjustments for the depreciation of receivables will be circumscribed to the legal provisions in force. The differences of the exchange rate related to the receivables in the estimates at the end of each ‘month, are recognized as incomes or financial expenses of the respective period. (Chapter VI- Policies related to the money reserves and equivalents in cash The reserves are distinguished distinctly and registered in accountancy on each particular type of carrency. The evidence of the movement is kept in le. atthe exchange rate from the transaction date. At the end of each month, the balance in foreign currency is converted according tote exchange rate communicated bby BNR from the last banking day of the month concerned and the differences of the exchange rte are distinguished as incomes or financial expenses of the period. Chapter VII — Policies related to debts Notes from page 18 to page 53 are integral part of the financial statements 3

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

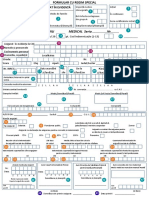

- Certificat de Concediu Medical - CompletatDocument2 pagesCertificat de Concediu Medical - CompletatNica Ioana80% (5)

- Fisa Sala FitnessDocument3 pagesFisa Sala FitnessNica Ioana100% (1)

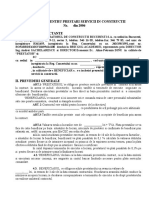

- Contract Alb ConstructiiDocument3 pagesContract Alb ConstructiiNica Ioana100% (1)

- Contract de Împrumut Si Act Aditional de Renuntare La ImprumutDocument4 pagesContract de Împrumut Si Act Aditional de Renuntare La ImprumutNica Ioana100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PV Scoatere Din Functiune Si DeclaraseDocument2 pagesPV Scoatere Din Functiune Si DeclaraseNica Ioana100% (3)

- Obligaţiile Companiilor Prin Prisma Legii Privind Prevenirea Şi Combaterea Spălării BanilorDocument9 pagesObligaţiile Companiilor Prin Prisma Legii Privind Prevenirea Şi Combaterea Spălării BanilorNica IoanaNo ratings yet

- Model Raport Tranzacţii Cu Numerar Mai Mari de 10.000 EuroDocument3 pagesModel Raport Tranzacţii Cu Numerar Mai Mari de 10.000 EuroNica IoanaNo ratings yet

- Contravenţii Şi Infracţiuni Privind Nerespectarea Legii 129Document13 pagesContravenţii Şi Infracţiuni Privind Nerespectarea Legii 129Nica IoanaNo ratings yet

- Articol Nr11 12 Ioana MociarDocument12 pagesArticol Nr11 12 Ioana MociarNica IoanaNo ratings yet

- Ce Reprezintă Infracţiunea de Spălare A Banilor Şi Infracţiunea de Finanţare A TerorismuluiDocument1 pageCe Reprezintă Infracţiunea de Spălare A Banilor Şi Infracţiunea de Finanţare A TerorismuluiNica IoanaNo ratings yet

- WIDK SocialDumping RO 170314Document4 pagesWIDK SocialDumping RO 170314Nica IoanaNo ratings yet

- Dec 700Document2 pagesDec 700Nica IoanaNo ratings yet

- Anunt TVA Exemple 21 NovDocument3 pagesAnunt TVA Exemple 21 NovNica IoanaNo ratings yet

- Schema Înfințării Unei Persoane Juridice - Persoane FiziceDocument1 pageSchema Înfințării Unei Persoane Juridice - Persoane FiziceNica IoanaNo ratings yet

- Afirmatii Eu Sunt Arhitectul Vieţii MeleDocument1 pageAfirmatii Eu Sunt Arhitectul Vieţii MeleNica Ioana100% (1)