Professional Documents

Culture Documents

Cases RJR Nabisco 90 & 91 - Assignment Questions

Cases RJR Nabisco 90 & 91 - Assignment Questions

Uploaded by

BrunoPereiraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cases RJR Nabisco 90 & 91 - Assignment Questions

Cases RJR Nabisco 90 & 91 - Assignment Questions

Uploaded by

BrunoPereiraCopyright:

Available Formats

HBS Case RJR Nabisco 1990 Assignment Questions

1. How have the various participants in the RJR buyout fared to date?

2. Compare the characteristics of the fixed income instruments issued by RJR Nabisco after the

LBO (interest rate, amortization schedule, optionalities, indentures and the various exotic

features) with those of pre-buyout debt. What are the likely reasons for such stark difference in

complexity?

3. What was the left-hand side of RJRs balance sheet worth in the spring of 1990? What was the

market value of all claims on the right-hand side? Does the market value of the liabilities equal

the value of the assets? If not, can you explain the difference?

4. How will holders of the PIK Debentures fare if the interest rates on these securities are reset on

or before April 28, 1991 so that they trade at par?

5. What were the problems facing KKR in the spring of 1990? Why was KKR in negotiation with

lenders regarding the refinancing of a $1.2 billion bridge loan due to be repaid only in February

1991? Would it make sense for KKR to infuse new equity into RJR?

HBS Case RJR Nabisco 1991 Assignment Questions

A)

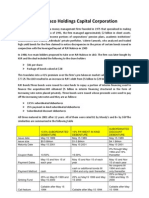

What package of Discount Debentures and Treasury STRIPs would produce one synthetic

13.5% Debenture? On January 15, 1991, how much would it cost Ms. Samuels to buy the

components of one synthetic 13.5% bond?

B)

How will the synthetic 13.5% and the RJR 13.5% Debentures perform differently over time?

You may want to consider factors including, but not limited to, how the investments are affected

by interest rate changes, changes in RJRs credit rating, etc.

C)

How could Ms. Samuels profit from the relative mispricing of the RJR 13.5% Debentures

and the Discount Debentures? What advice might she give to the following tax exempt clients?

Client A who already owns the 13.5% RJR Debenture;

Client B who does not own the 13.5% RJR Debenture.

So Paulo, September 4th 2016

You might also like

- China Fire Case AssignmentDocument3 pagesChina Fire Case AssignmentTony LuNo ratings yet

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Case 5 Midland Energy Case ProjectDocument7 pagesCase 5 Midland Energy Case ProjectCourse HeroNo ratings yet

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- Sure CutDocument1 pageSure Cutchch917No ratings yet

- MFIN Case Write-UpDocument7 pagesMFIN Case Write-UpUMMUSNUR OZCANNo ratings yet

- Sun Brewing Case ExhibitsDocument26 pagesSun Brewing Case ExhibitsShshankNo ratings yet

- Clarkson TemplateDocument7 pagesClarkson TemplateJeffery KaoNo ratings yet

- Michael McClintock Case1Document2 pagesMichael McClintock Case1Mike MCNo ratings yet

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- Kohler Case StudyDocument13 pagesKohler Case StudySambashiva Srisailapathy50% (2)

- BNYC and Mellons Merger, Grp-11, MACR-BDocument2 pagesBNYC and Mellons Merger, Grp-11, MACR-Balok_samal_250% (2)

- RJR Nabisco ValuationDocument33 pagesRJR Nabisco ValuationShivani Bhatia100% (4)

- Clarkson Lumbar CompanyDocument41 pagesClarkson Lumbar CompanyTheOxyCleanGuyNo ratings yet

- Homework Assignment 1 KeyDocument6 pagesHomework Assignment 1 KeymetetezcanNo ratings yet

- Section A - Group DDocument6 pagesSection A - Group DAbhishek Verma100% (1)

- RJRJRJJRJRJRJJR111111Document4 pagesRJRJRJJRJRJRJJR111111John Paul Chua57% (7)

- RJR Nabisco Holdings Capital CorporationDocument3 pagesRJR Nabisco Holdings Capital CorporationManogana RasaNo ratings yet

- Calculating The NPV of The AcquisitionDocument23 pagesCalculating The NPV of The Acquisitionkooldude1989100% (1)

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNo ratings yet

- RJRDocument4 pagesRJRliyulongNo ratings yet

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakNo ratings yet

- Winfield Refuse. - Case QuestionsDocument1 pageWinfield Refuse. - Case QuestionsthoroftedalNo ratings yet

- In Re RJR Nabisco Inc.Document3 pagesIn Re RJR Nabisco Inc.viva_33No ratings yet

- VIB Case Study On RJR NabiscoDocument1 pageVIB Case Study On RJR NabiscoSatyajeet SenapatiNo ratings yet

- Case Assignment - RJR NabiscoDocument1 pageCase Assignment - RJR NabiscoMuhammad Rehan NasirNo ratings yet

- Nabisco - Sol v0.1 PDFDocument13 pagesNabisco - Sol v0.1 PDFMohit Khandelwal100% (1)

- Clarkson Lumber Analysis - TylerDocument9 pagesClarkson Lumber Analysis - TylerTyler TreadwayNo ratings yet

- RJR Nabisco ValuationDocument38 pagesRJR Nabisco ValuationJCNo ratings yet

- Dell CaseDocument3 pagesDell CaseJuan Diego Vasquez BeraunNo ratings yet

- The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationDocument24 pagesThe Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationAhsen Ali Siddiqui100% (1)

- RJR Nabisco ValuationDocument33 pagesRJR Nabisco ValuationKrishna Chaitanya KothapalliNo ratings yet

- American Chemical Corporation: Financial Analysis: June 2010Document9 pagesAmerican Chemical Corporation: Financial Analysis: June 2010BenNo ratings yet

- Bond Problem - Fixed Income ValuationDocument1 pageBond Problem - Fixed Income ValuationAbhishek Garg0% (2)

- Seagate NewDocument22 pagesSeagate NewKaran VasheeNo ratings yet

- Kraft Foods Case SummaryDocument2 pagesKraft Foods Case Summaryrkodo1126No ratings yet

- Clarkson Lumber Co Calculations For StudentsDocument27 pagesClarkson Lumber Co Calculations For StudentsQuetzi AguirreNo ratings yet

- Coursehero 40252829Document2 pagesCoursehero 40252829Janice JingNo ratings yet

- RJR Nabisco 1Document6 pagesRJR Nabisco 1gopal mundhraNo ratings yet

- RJR Case StudyDocument5 pagesRJR Case StudyFelipe Kasai MarcosNo ratings yet

- M&a Assignment - Syndicate C FINALDocument8 pagesM&a Assignment - Syndicate C FINALNikhil ReddyNo ratings yet

- Case Sheet - Ameritrade: GROUP 16: Answer 9Document31 pagesCase Sheet - Ameritrade: GROUP 16: Answer 9tripti maheshwariNo ratings yet

- ClarksonDocument22 pagesClarksonfrankstandaert8714No ratings yet

- case-UST IncDocument10 pagescase-UST Incnipun9143No ratings yet

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoNo ratings yet

- Debt Policy at UST IncDocument5 pagesDebt Policy at UST Incggrillo73No ratings yet

- Facebook IPO SlidesDocument14 pagesFacebook IPO SlidesLof Kyra Nayyara100% (1)

- M&a Assignment 2 Group 14Document4 pagesM&a Assignment 2 Group 14Digraj Mahanta100% (1)

- This Study Resource Was: 1 Hill Country Snack Foods CoDocument9 pagesThis Study Resource Was: 1 Hill Country Snack Foods CoPavithra TamilNo ratings yet

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Document6 pagesDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNo ratings yet

- Ocean Carriers Executive SummaryDocument2 pagesOcean Carriers Executive SummaryAniket KaushikNo ratings yet

- Berkshire - IntroDocument2 pagesBerkshire - IntroRohith ThatchanNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- 6may IIBF ALMDocument62 pages6may IIBF ALMmevrick_guyNo ratings yet

- Class Lecture-9Document16 pagesClass Lecture-9Tanay BansalNo ratings yet

- Hapter EST ANK: Ultiple Choice QuestionsDocument19 pagesHapter EST ANK: Ultiple Choice QuestionsMalinga LungaNo ratings yet

- CBM Question BankDocument34 pagesCBM Question BankHimanshu AroraNo ratings yet

- CSM-TTM 13 - Long Term LiabilitiesDocument5 pagesCSM-TTM 13 - Long Term LiabilitiesaseppahrudinNo ratings yet

- Class Lecture 5 To 8Document57 pagesClass Lecture 5 To 8Tanay BansalNo ratings yet