Professional Documents

Culture Documents

Autos: Cvs Struggle 2Ws and Pvs Outshine

Autos: Cvs Struggle 2Ws and Pvs Outshine

Uploaded by

Dinesh ChoudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Autos: Cvs Struggle 2Ws and Pvs Outshine

Autos: Cvs Struggle 2Ws and Pvs Outshine

Uploaded by

Dinesh ChoudharyCopyright:

Available Formats

SECTOR UPDATE

02 SEP 2016

Autos

CVs struggle; 2Ws and PVs outshine

TP Revision

Company

TP

Tata Motors

625

Change

Sneha Prashant

sneha.prashant@hdfcsec.com

+91-22-6171-7336

Abhishek Kumar Jain

abhishekkumar.jain@hdfcsec.com

+91-22-6171-7324

Navin Matta

navin.matta@hdfcsec.com

Rupin

Shah

+91-22-6171-7322

rupin.shah@hdfcsec.com

+91-22-6171-7337

Reco

BUY

Auto sales for Aug-16 have been positive with 2Ws

and PVs showing double digit growth YoY. Rural

demand revival and early festive season inventory

build-up aided healthy growth in scooters and

motorcycles. Honda was the only company to post a

negative growth in the PV segment. TTMT posted

sharp growth led by strong Tiago numbers. CV

volumes were dismal for the third consecutive

month led by postponement of fleet replacement &

expansion and higher base last year. VECV reported

strong growth of 14% YoY. Retain Tata Motors, HMCL

and Maruti Suzuki as our top picks.

PV: Strong growth

MSIL reported strong growth led by robust volumes

from Brezza, Baleno and Ciaz. However, entry level

segment faces pressure from new players.

Tata Motors (Tiago) and Toyota, were the

outperformers.

Rural demand picks up and good festive season

could drive strong demand in the coming months.

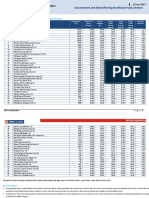

Domestic PV Sales For Major Players

2W: Early festive season inventory build-up spurts

growth

2W players reported robust sales growth driven by

inventory built up in anticipation of a good festive

season and improving rural sentiments.

Rural demand revival, new launches in festive

season, implementation of 7th pay commision and

positive impact of recent launches to drive steady

growth.

CV: Weakness persists

Higher base last year led to key CV players in the

MHCV sub-segment reporting de-growth. LCVs

showed a muted trend owing to postponement of

replacement demand.

However, we expect MHCV demand to pick up in 4Q

with revival in construction activities scrappage

implementation and BS IV related pre-buying.

Domestic 2W Sales For Major Players

Company

Maruti Suzuki

Hyundai

M&M

Honda

Tata Motors

Toyota

Total

Aug-16 Aug-15

119,931 106,781

43,201

40,505

18,246

14,198

13,941

15,655

13,002

11,194

12,801

11,047

221,122 199,380

Company

% YoY

Jul-16

12.3% 125,764

6.7%

41,201

28.5%

17,356

-10.9%

14,033

16.2%

13,547

15.9%

12,404

10.9% 224,305

% MoM

-4.6%

4.9%

5.1%

-0.7%

-4.0%

3.2%

-1.4%

Aug-16

Aug-15

% YoY

Hero Moto*

616,424

480,537

28.3%

532,113

HMSI

466,342

373,202

25.0%

429,527

8.6%

TVS Motor

238,984

183,653

30.1%

206,605

15.7%

Bajaj Auto*

200,314

160,307

25.0%

198,022

1.2%

55,721

42,360

31.5%

53,378

4.4%

27.2% 1,419,645

11.1%

Royal Enfield

Total

1,577,785 1,240,059

Jul-16 % MoM

15.8%

Domestic CV Sales For Major Players

Company

Aug-16

Aug-15

% YoY

Jul-16

% MoM

Tata Motors

23,464

24,284

-3.4%

24,242

-3.2%

Ashok Leyland #

10,897

11,544

-5.6%

10,492

3.9%

Eicher Motors #

4,100

3,611

13.5%

4,315

-5.0%

38,461

39,439

-2.5%

39,049

-1.5%

Total

Source: Companies, HDFC sec Inst Research. * Hero/Bajaj sales include exports/3W volumes respectively. # AL and Eicher sales include export volumes

HDFC securities Institutional Research is also available on Bloomberg HSLB <GO> & Thomson Reuters

AUTOS : SECTOR UPDATE

Entry segment continues to

face pressure owing to

competition from

incumbents like Renault

Kwid and Nissan Redi-go

Retail volume growth were

in line with wholesale

growth of 12.5-13% YoY in

Aug16

Maruti Suzuki India (CMP Rs 5,061, Market Cap Rs 153tn, BUY)

Sales Volumes (In Units)

Particulars

Mini (Alto, Wagon-R)

Compact (Swift, Ritz, Dzire,

Celerio, Baleno)

Super Compact (Dzire Tour)

Mid-size (Ciaz)

Total Passenger cars

Utility Vehicles (Gypsy, S-Cross,

Ertiga, Vitara Brezza)

Vans (Omni, Eeco)

LCV (Super Carry)

Total Domestic Sales

Total Export Sales

Total Sales (Domestic + Export)

FY17

163,264

YTD

FY16 % Change

180,218

-9.4%

45,579

41,461

9.9%

228,166

219,766

3.8%

2,986

6,214

90,269

3,172

4,156

86,454

-5.9%

49.5%

4.4%

13,841

25,066

430,337

14,451

19,629

434,064

-4.2%

27.7%

-0.9%

16,806

7,836

114.5%

73,536

30,302

142.7%

12,831

25

119,931

12,280

132,211

12,491

0

106,781

11,083

117,864

2.7%

12.3%

10.8%

12.2%

64,137

25

568,035

49,721

617,756

58,514

0

522,880

58,025

580,905

9.6%

8.6%

-14.3%

6.3%

Ask rate for 7MFY17

Monthly

% YoY

126,925

11,614

138,539

13.5%

23.4%

14.3%

Source: Company, HDFC sec Inst Research

Domestic Sales Growth Bounced Back Sharply

Domestic

160

140

120

100

80

60

40

20

0

Exports

Cars

40%

100%

30%

80%

20%

10%

0%

-10%

-20%

Source: Company, HDFC sec Inst Research

Mix Remains Stable

YoY Growth

(in '000 units)

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

Management is confident

of maintaining double digit

growth in FY17E

2016

35,490

Aug

2015 % Change

37,665

-5.8%

UVs

Vans

60%

40%

20%

0%

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

MSIL reported volume

growth of 12% YoY.

Domestic growth was

strong at 12% YoY driven by

Brezza, Baleno and Ciaz

Source: Company, HDFC sec Inst Research

Page | 2

AUTOS : SECTOR UPDATE

M&Ms PV sales rose 29%

YoY, led by launches of

TUV300 and KUV100 in

2HFY16

LCV sales (< 3.5 T), mainly

representing pick-ups, saw

small growth of 7% YoY

MHCV volumes continue to

show strong growth on a

low base

Mahindra & Mahindra (CMP Rs 1,454, Market Cap Rs 858bn, BUY)

Auto Sales Volumes (In Units)

Particulars

2016

18,246

17,119

1,127

13,993

13,049

573

371

4,705

36,944

3,647

40,591

Passenger Vehicles

- Utility Vehicles

- Cars + Vans

Commercial vehicles

- LCV < 3.5T

- LCV > 3.5T

- MHCV

3W (incl. Alfa)

Total Auto Sector (Dom.)

Exports (UV +3W)

Total Vehicles (Dom + Exp)

Aug

2015 % Change

14,198

28.5%

13,307

28.6%

891

26.5%

13,023

7.4%

12,254

6.5%

428

33.9%

341

8.8%

4,483

5.0%

31,704

16.5%

3,512

3.8%

35,216

15.3%

FY17

94,962

88,990

5,972

66,757

60,920

3,594

2,243

21,491

183,210

18,369

201,579

YTD

Ask rate for 7MFY17

FY16 % Change Monthly

% YoY

82,133

15.6%

75,865

17.3%

6,268

-4.7%

60,644

10.1%

55,934

8.9%

3,048

17.9%

1,662

35.0%

21,132

1.7%

163,909

11.8%

49,056

16.7%

15,526

18.3%

2,776

-5.2%

179,435

12.3%

51,832

15.3%

FY17

100,428

5,263

105,691

YTD

Ask rate for 7MFY17

FY16 % Change Monthly

% YoY

84,174

19.3%

16,854

12.8%

5,343

-1.5%

958

23.6%

89,517

18.1%

17,813

13.3%

Farm Equipment Segment Sales Volumes (In Units)

2016

12,327

1,216

13,543

Domestic

Exports

Total Tractors (Dom + Exp)

Aug

2015

10,751

948

11,699

% Change

14.7%

28.3%

15.8%

Source: Company, HDFC sec Inst Research

Auto Segment Growth Going Strong

60

Tractor Sales Performance Improved YoY

YoY Growth

(in '000 units)

50

Tractors

30%

20%

40

30

20

25

20

0%

15

-10%

-20%

(in '000 units)

30

10%

10

Source: Company, HDFC sec Inst Research

35

YoY Growth

10

5

0

120%

100%

80%

60%

40%

20%

0%

-20%

-40%

-60%

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

Auto

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

M&Ms domestic tractor

sales rose 16% YoY aided by

a low base and improving

rural sentiments (owing to

above normal monsoon)

Particulars

Source: Company, HDFC sec Inst Research

Page | 3

AUTOS : SECTOR UPDATE

There continues to be stress

in the overseas markets of

Srilanka, Bangladesh,

Nigeria and Philippines.

Egypt on the other hand is

witnessing some

improvement. Nigeria

recorded 16-17k 2W retails

and 1.5-2k 3Ws

BAL Sales Volumes (In Units)

Particulars

2016

279,911

45,436

325,347

125,033

200,314

Motorcycles

3Ws

Total

Exports

Domestic

Aug

2015

290,436

51,529

341,965

181,658

160,307

% Change

FY17

-3.6% 1,437,978

-11.8%

211,935

-4.9% 1,649,913

-31.2%

627,493

25.0% 1,022,420

YTD

Ask rate for 7MFY17

FY16 % Change Monthly

% YoY

1,448,104

-0.7%

237,121

-10.6%

1,685,225

-2.1% 363,434

15.2%

822,844

-23.7% 159,261

21.6%

862,381

18.6% 204,172

10.7%

Source: Company, HDFC sec Inst Research

Domestic MC Volumes Outpaces The Industry

2W

500

3W

Exports Continue To Be Under Stress

Exports

YoY Growth

(in '000 units)

30%

20%

400

10%

300

0%

200

-10%

100

-20%

-30%

Source: Company, HDFC sec Inst Research

200

YoY Growth

(in '000 units)

30%

20%

150

10%

0%

100

-10%

-20%

50

-30%

-40%

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

The management believes

that its market share in

domestic motorcycles is

stable at 20% for the month

and sees a monthly run rate

of 220k+ units going ahead

for FY17

Bajaj Auto (CMP Rs 2,999, Market Cap Rs 868bn, NEUTRAL)

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

Bajaj Autos Aug-16

volumes were soft in line

with the management

commentary. However,

domestic motorcycles were

up 25% vs industry growth

of 22% led by the recent

launch of V15

Source: Company, HDFC sec Inst Research

Pulsar 400s launch has

been pushed ahead to

3QFY17 as the

management indicated the

immediate focus would be

on the festive season

Page | 4

AUTOS : SECTOR UPDATE

Hero MotoCorp (CMP Rs 3,548, Market Cap Rs 708bn, BUY)

HMSI reported strongest

ever domestic sales led by

robust scooter sales owing

to higher supplies from its

fourth Gujarat plant. The

company has gained 2%

market share in Aug-16

The company is well-placed

to benefit from the festive

season given its capacities

are in place. In a period of 2

months, HMSI achieved

100% peak production at its

second assembly line

Particulars

2016

616,424

Total sales

Aug

2015

480,537

YTD

Ask rate for 7MFY17

% Change

FY17

FY16 % Change Monthly

% YoY

28.3% 2,893,926 2,613,660

10.7%

615,155

7.2%

Source: Company, HDFC sec Inst Research

HMSI Sales Volumes (In Units)

Particulars

2016

336,393

129,949

26,074

492,416

Scooters

Motorcycles

Exports

Total

Aug

2015

246,763

126,373

22,060

395,196

YTD

% Change

36.3%

2.8%

18.2%

24.6%

FY17

1,442,719

691,164

107,130

2,241,013

FY16

1,138,644

619,945

82,801

1,841,390

% Change

26.7%

11.5%

29.4%

21.7%

Source: Company, HDFC sec Inst Research

Hero Posted Strongest Ever Growth

2W

HMSI Strong Show Across Board

2W

YoY Growth

(in '000 units)

YoY Growth

(in '000 units)

40%

600

30%

500

30%

20%

400

20%

10%

300

10%

0%

200

0%

100

-10%

100

-10%

-20%

-20%

700

600

500

400

300

200

Source: Company, HDFC sec Inst Research,

40%

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

The company has lined up

15 new launches in the

domestic and export

market in FY17. Of these

15, 3 would be launched in

the festive season (Achiever

150cc, Super Splendor,

Passion Pro)

HMCL Sales Volumes (In Units)

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

HMCL recorded highest

ever volumes in Aug-16 of

28% YoY owing to a low

base last year, above

average monsoon and early

festive season.

Source: Company, HDFC sec Inst Research

Page | 5

AUTOS : SECTOR UPDATE

Ashok Leyland (CMP Rs 84, Market Cap Rs 238bn, Neutral)

ALs domestic MHCV sales

declined 8% YoY owing to

higher base and pre-buying

in 2QFY15 (implementation

of ABS) last year

AL Sales Volumes (In Units)

Particulars

2016

8,201

2,696

10,897

MHCV

LCV

Total sales

Aug

2015

8,903

2,641

11,544

% Change

-7.9%

2.1%

-5.6%

FY17

40,408

12,144

52,552

YTD

FY16

39,223

11,561

50,784

% Change

3.0%

5.0%

3.5%

Ask rate for 7MFY17

Monthly

% YoY

11,956

18.6%

3,132

14.6%

15,088

17.8%

Source: Company, HDFC sec Inst Research

Weak MHCV Vols For Second Consecutive Month

MHCV

14.0

YoY Growth

(in '000 units)

LCV

120%

12.0

100%

10.0

80%

8.0

60%

6.0

40%

4.0

20%

2.0

0%

0.0

-20%

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

The management reckons

that with BS IV norms

coming in from Apr-17,

there could be pick up of

volumes in 2HFY17 owing

to pre-buying

LCV Witnessed Muted Performance

Source: Company, HDFC sec Inst Research

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

YoY Growth

(in '000 units)

50%

40%

30%

20%

10%

0%

-10%

-20%

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

LCV segment reported a

weaker performance than

the industry

Source: Company, HDFC sec Inst Research

Page | 6

AUTOS : SECTOR UPDATE

Eicher Motors (CMP Rs 22,774, Market Cap Rs 617bn, BUY)

LMD segments volume

growth tapered down

during the month

Eicher Sales Volumes (In Units)

Particulars

2016

2,328

939

833

4,100

55,721

LMD

HD

Buses

Total ETB

Royal Enfield

Aug

2015

2,243

744

624

3,611

42,360

FY17

11,813

5,690

6,826

20,014

256,582

YTD

FY16

9,518

3,532

6,076

15,474

189,733

% Change

24.1%

61.1%

12.3%

29.3%

35.2%

Ask rate for 7MFY17

Monthly

% YoY

5,873

54,012

28.2%

18.7%

Source: Company, HDFC sec Inst Research

ETB Witnessing Robust Growth Across Segments

Total ETB

RE Sales Growth Above Expectation

YoY Growth

7,000

RE

70.0%

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

-10.0%

6,000

5,000

4,000

3,000

2,000

1,000

0

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

RE recorded highest ever

volumes owing to the

recent launch of Himalayan

and higher penetration in

new markets (rolling out 23 outlets per week in

smaller cities)

% Change

3.8%

26.2%

33.5%

13.5%

31.5%

Source: Company, HDFC sec Inst Research

60.0

YoY Growth

(in '000 units)

50.0

40.0

30.0

20.0

10.0

-

80%

70%

60%

50%

40%

30%

20%

10%

0%

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

Eichers ETB division

reported strong growth of

14% YoY, much ahead of

the industry growth driven

by strong volumes in the

HD segment. The HD

segment growth at 26% is

much higher than other

industry incumbents

Source: Company, HDFC sec Inst Research

Page | 7

AUTOS : SECTOR UPDATE

Management indicated

that MHCVs volumes were

disappointing owing to

postponement of

replacement and fleet

expansion

Tata Motors (CMP Rs 544, Market Cap Rs 185tn, BUY)

TTMT Sales Volumes (In Units)

Particulars

LCV

MHCV

Commercial Vehicles

Cars

UVs & SUVs

Passenger Vehicles

Exports

Total

2016

13,495

9,969

23,464

11,435

1,567

13,002

6,595

43,061

Aug

2015

12,267

12,017

24,284

9,814

1,380

11,194

5,202

40,680

% Change

10.0%

-17.0%

-3.4%

16.5%

13.6%

16.2%

26.8%

5.9%

We raise our JLR multiple

given the strong product

pipeline and diversified

geographical presence and

our revised SOTP stands at

Rs 625

36,467

23.6%

12,798

5,691

54,956

23.0%

16.5%

22.7%

MHCV

20.0

LCVs Growing Steadily On A Low Base

YoY Growth

(in '000 units)

15.0

10.0

LCV

80%

25.0

60%

20.0

40%

15.0

20%

0%

5.0

0.0

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

UV segment is also picking

up pace and recorded

highest ever growth since

Aug-12

% Change

5.9%

1.7%

4.0%

17.0%

-27.4%

10.2%

8.4%

6.1%

Ask rate for 7MFY17

Monthly

% YoY

Source: Company, HDFC sec Inst Research

MHCVs Continued To De-Grow

Passenger car segment is

going strong with strong

demand for Tiago. As per

channel checks, Tiago has a

waiting period of three

months

FY17

69,186

56,848

126,034

52,587

5,928

58,515

25,782

210,331

YTD

FY16

65,356

55,884

121,240

44,951

8,164

53,115

23,791

198,146

Source: Company, HDFC sec Inst Research

YoY Growth

(in '000 units)

20%

10%

0%

-10%

10.0

-20%

-20%

5.0

-30%

-40%

0.0

-40%

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

Tata Motors reported sharp

de-growth in MHCV volume

for the third consecutive

month of 17% YoY. LCV

sales continued its strong

show with 104% YoY

growth

Source: Company, HDFC sec Inst Research

Page | 8

AUTOS : SECTOR UPDATE

SML Isuzu (CMP Rs 1,353, Market Cap Rs 20bn, BUY)

The companys product

portfolio is equipped well in

advance for the

implementation of Bharat

Stage IV emission norms

across India by Apr-17 and

new bus body code in the

CV Industry. We believe,

this will augur well for SML,

which has 20% market

share in the school bus

segment

SML Sales Volumes (In Units)

Particulars

2016

1,082

Total sales

Aug

2015

960

% Change

12.7%

FY17

7,343

YTD

FY16

5,878

% Change

24.9%

Ask rate for 7MFY17

Monthly

% YoY

1,109

13.8%

Source: Company, HDFC sec Inst Research

SML Volume Growth Was Muted

Total sales

YoY Growth

2500

140%

120%

100%

80%

60%

40%

20%

0%

-20%

-40%

2000

1500

1000

500

0

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

SML reported strong 12%

YoY volume growth in an

otherwise weak month for

the industry

Source: Company, HDFC sec Inst Research

Page | 9

AUTOS : SECTOR UPDATE

Atul Auto (CMP Rs 442, Market Cap Rs 10bn, BUY)

Particulars

2016

3,915

Total Sales

Aug

2015

3,906

% Change

0.2%

FY17

14,701

YTD

FY16

16,461

% Change

-10.7%

Ask rate for 7MFY17

Monthly

% YoY

4,486

14.5%

Source: Company, HDFC sec Inst Research

AALs Monthly Volume Trend

(in '000 units)

Atul Auto

Major 3W OEMs Volume Trend*

Bajaj Auto

YoY Growth

Atul Auto

60

40%

20%

0%

-20%

-40%

10

-60%

Source: Company, HDFC sec Inst Research

TVS Motor

50

40

30

20

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

The sales volume picked up

MoM (+23%) owing to

healthy spread of monsoon

ATA Sales Volumes (In Units)

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

After reporting bad volume

growth in July, Atul Auto

posted flat volume growth

(+0.2% YoY) in August

Source: Company, HDFC sec Inst Research

*These 3 companies account for 70% of total 3W volume

Page | 10

AUTOS : SECTOR UPDATE

Peer Valuations

Ashok Leyland

Atul Auto

Bajaj Auto

Eicher Motors

Hero Motocorp

M&M

Maruti Suzuki

SML Isuzu

Tata Motors

MCAP

(Rs/bn)

CMP

(Rs/sh)

Reco

TP

238

10

868

617

708

858

1,529

20

1,846

84

442

2,999

22,774

3,548

1,454

5,061

1,353

544

NEU

BUY

NEU

BUY

BUY

BUY

BUY

BUY

BUY

82

569

2,716

24,736

3,731

1,615

5,318

1,588

625

Adj EPS (Rs/sh)

FY16 FY17E FY18E

3.9

4.3

5.1

21.6

26.0

32.3

126.2 139.4 157.2

587.1 672.5 894.4

156.8 177.7 207.1

55.5

69.8

88.3

153.9 200.4 245.6

35.3

52.7

67.9

40.6

49.9

59.2

FY16

21.5

20.5

23.8

38.8

22.6

26.2

32.9

38.3

13.4

P/E (x)

FY17E

19.5

17.0

21.5

33.9

20.0

20.8

25.3

25.7

10.9

FY18E

16.3

13.7

19.1

25.5

17.1

16.5

20.6

19.9

9.2

EV/EBITDA (x)

FY16 FY17E FY18E

11.5

10.4

9.1

12.6

10.0

8.0

16.3

14.5

12.5

21.8

19.1

14.3

15.2

13.1

10.9

15.6

12.7

10.3

16.8

15.2

12.4

23.3

16.3

12.4

6.2

5.5

4.8

FY16

20.9

34.4

31.8

41.0

43.1

15.6

18.3

15.9

20.1

RoE (%)

FY17E FY18E

21.0

22.4

32.6

32.3

30.8

30.8

41.5

40.1

40.7

40.6

17.5

19.5

20.7

21.9

20.7

22.8

19.1

18.9

Source: Company, HDFC sec Inst Research

Page | 11

AUTOS : SECTOR UPDATE

Quarterly Average Price Trends For Key Commodities

If commodity prices

continue to remain

northward bound, it could

lead to price markups for

PV segment players

Commodities

CRC (USD/MT)

LME Aluminium (USD/MT)

LME Lead (USD/MT)

Brent (USD/bbl)

RSS4 (Rs/MT)

2QFY15

649

1,988

2,181

102

13,272

3QFY15

634

1,968

2,001

76

11,970

4QFY15

574

1,801

1,810

54

12,606

1QFY16

509

1,767

1,938

62

12,617

2QFY16

431

1,594

1,718

50

11,846

3QFY16

379

1,494

1,682

43

10,873

4QFY16

442

1,515

1,740

35

9,989

1QFY17

QTD

500

479

1,572 1,633

1,718 1,837

46

46

13,215 13,978

% QoQ

CRC (USD/MT)

LME Aluminium (USD/MT)

LME Lead (USD/MT)

Brent (USD/bbl)

RSS4 (Rs/MT)

2QFY15

(1.3)

10.4

4.0

(6.9)

(8.2)

3QFY15

(2.3)

(1.0)

(8.2)

(25.5)

(9.8)

4QFY15

(9.4)

(8.5)

(9.5)

(29.2)

5.3

1QFY16

(11.3)

(1.9)

7.0

15.1

0.1

2QFY16

(15.3)

(9.8)

(11.3)

(19.2)

(6.1)

3QFY16

(12.1)

(6.3)

(2.1)

(13.7)

(8.2)

4QFY16

16.6

1.4

3.4

(20.3)

(8.1)

1QFY17

13.2

3.8

(1.3)

33.4

32.3

QTD

(4.2)

3.9

7.0

(0.9)

5.8

Source: Bloomberg, HDFC sec Inst Research

MSILs margins could face

some pressure from

appreciation of JPY

Quarterly Average Currency Exchange Rates

Currency

USD-INR

EUR-INR

GBP-INR

EUR-USD

GBP-USD

USD-JPY

JPY-INR

2QFY15

60.58

80.29

101.17

1.33

1.67

104.00

0.58

3QFY15

62.01

77.38

98.09

1.25

1.58

114.54

0.54

4QFY15

62.26

70.22

94.34

1.13

1.51

119.18

0.52

1QFY16

63.49

70.30

97.17

1.11

1.53

121.36

0.52

2QFY16

64.97

72.27

100.70

1.11

1.55

122.24

0.53

3QFY16

65.93

72.22

100.04

1.10

1.52

121.41

0.54

4QFY16

67.51

74.42

96.67

1.10

1.43

115.25

0.59

1QFY17

QTD

66.92 67.06

75.56 74.72

96.08 88.17

1.13

1.11

1.44

1.31

107.97 102.65

0.62

0.65

% QoQ

USD-INR

EUR-INR

GBP-INR

EUR-USD

GBP-USD

USD-JPY

JPY-INR

2QFY15

1.3

(2.0)

0.5

(3.4)

(0.8)

1.9

(0.5)

3QFY15

2.4

(3.6)

(3.0)

(5.8)

(5.2)

10.1

(6.9)

4QFY15

0.4

(9.3)

(3.8)

(9.8)

(4.3)

4.1

(3.7)

1QFY16

2.0

0.1

3.0

(1.7)

1.2

1.8

0.1

2QFY16

2.3

2.8

3.6

0.5

1.1

0.7

1.7

3QFY16

1.5

(0.1)

(0.7)

(1.5)

(2.1)

(0.7)

2.1

4QFY16

2.4

3.0

(3.4)

0.7

(5.7)

(5.1)

7.8

1QFY17

(0.9)

1.5

(0.6)

2.4

0.3

(6.3)

5.9

QTD

0.2

(1.1)

(8.2)

(1.3)

(8.5)

(4.9)

5.3

Source: Bloomberg, HDFC sec Inst Research

Page | 12

AUTOS : SECTOR UPDATE

Rating Definitions

BUY

Where the stock is expected to deliver more than 10% returns over the next 12 month period

NEUTRAL

Where the stock is expected to deliver (-)10% to 10% returns over the next 12 month period

SELL

Where the stock is expected to deliver less than (-)10% returns over the next 12 month period

Disclosure:

We, Sneha Prashant, MBA, Abhishek Jain, MBA & Rupin Shah, MS (Finance) authors and the names subscribed to this report, hereby certify that all of the views expressed in this research

report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific

recommendation(s) or view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its

Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further

Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any holding in stock Yes

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or

arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for

information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be

construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any

locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC

Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may

not be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd .

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived

from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services

for, any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies)

mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and

other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any

action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the

dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report,

or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any

other assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research

report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is

not based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach

different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served

as an officer, director or employee of the subject company. We have not received any compensation/benefits from the subject company or third party in connection with the Research

Report. HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

Page | 13

AUTOS : SECTOR UPDATE

HDFC securities

Institutional Equities

Unit No. 1602, 16th Floor, Tower A, Peninsula Business Park,

Senapati Bapat Marg, Lower Parel,

Mumbai - 400 013

Board : +91-22-6171 7330

www.hdfcsec.com

Page | 14

You might also like

- Policy DocumentsDocument1 pagePolicy DocumentsAlexandra Elena100% (1)

- BU 357 Wilfrid Laurier HomeworkDocument35 pagesBU 357 Wilfrid Laurier HomeworkNia ニア MulyaningsihNo ratings yet

- HCL - PDF Investment Banking Case StudyDocument25 pagesHCL - PDF Investment Banking Case Studyishanshandsome0% (1)

- Autos: PV & 2Ws Lead Cvs DragDocument14 pagesAutos: PV & 2Ws Lead Cvs DragumaganNo ratings yet

- IDirect Motogaze Aug16Document16 pagesIDirect Motogaze Aug16umaganNo ratings yet

- Fresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Document10 pagesFresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Vidhi MehtaNo ratings yet

- Green Shoots Turning Into Steady Growth!!!: Motogaze - September, 2014Document14 pagesGreen Shoots Turning Into Steady Growth!!!: Motogaze - September, 2014nnsriniNo ratings yet

- Uvs & Scooters Drive Growth in June!!!: Motogaze July 2016Document16 pagesUvs & Scooters Drive Growth in June!!!: Motogaze July 2016khaniyalalNo ratings yet

- IndiNivesh Best Sectors Stocks Post 2014Document49 pagesIndiNivesh Best Sectors Stocks Post 2014Arunddhuti RayNo ratings yet

- Buy Mind-India Equity Research I Construction Result Update (Small Cap)Document5 pagesBuy Mind-India Equity Research I Construction Result Update (Small Cap)anjugaduNo ratings yet

- Growth Sustains in May!!!: Motogaze June 2016Document16 pagesGrowth Sustains in May!!!: Motogaze June 2016umaganNo ratings yet

- May Bank Kim Eng PDFDocument19 pagesMay Bank Kim Eng PDFFerry PurwantoroNo ratings yet

- Mahindra & Mahindra 1Document6 pagesMahindra & Mahindra 1Ankit SinghalNo ratings yet

- Automobiles: CMP: INR3,390 TP: INR4,800 BuyDocument8 pagesAutomobiles: CMP: INR3,390 TP: INR4,800 BuyAsif ShaikhNo ratings yet

- Auto Monthly Update: November, 2011Document14 pagesAuto Monthly Update: November, 2011RounakNo ratings yet

- Hero Motocorp: CMP: Inr2,792 TP: Inr2,969 BuyDocument8 pagesHero Motocorp: CMP: Inr2,792 TP: Inr2,969 BuyDenisJose2014No ratings yet

- IDBICapital Auto Sep2010Document73 pagesIDBICapital Auto Sep2010raj.mehta2103No ratings yet

- Presentation Jan 2015Document32 pagesPresentation Jan 2015Asmeet ShahNo ratings yet

- Automobile Sector Result UpdatedDocument11 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- 4QFY14E Results Preview: Institutional ResearchDocument22 pages4QFY14E Results Preview: Institutional ResearchGunjan ShethNo ratings yet

- Market Outlook Market Outlook: I-Direct Top PicksDocument9 pagesMarket Outlook Market Outlook: I-Direct Top PicksAnonymous W7lVR9qs25No ratings yet

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- Mahindra & Mahindra 2Document6 pagesMahindra & Mahindra 2Ankit SinghalNo ratings yet

- India Cement (INDCEM) : Focus Shifts Towards Non-Southern RegionDocument11 pagesIndia Cement (INDCEM) : Focus Shifts Towards Non-Southern RegionumaganNo ratings yet

- Auto & Ancillary Banking and Financial Services Consumer and RelatedDocument1 pageAuto & Ancillary Banking and Financial Services Consumer and RelatedArunddhuti RayNo ratings yet

- Research Report On Mahindra...Document8 pagesResearch Report On Mahindra...Sahil ChhibberNo ratings yet

- Tech Mahindra (TECMAH) : LacklustreDocument11 pagesTech Mahindra (TECMAH) : Lacklustrejitendrasutar1975No ratings yet

- I-Direct Top Picks: Market Outlook: Key Triggers Ahead Market Outlook: Key Triggers AheadDocument14 pagesI-Direct Top Picks: Market Outlook: Key Triggers Ahead Market Outlook: Key Triggers AheadkumarrajdeepbsrNo ratings yet

- Market Outlook: Dealer's DiaryDocument17 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Bluedart Express (Bludar) : Best Financial Year Momentum Remains KeyDocument12 pagesBluedart Express (Bludar) : Best Financial Year Momentum Remains KeyAnkur MittalNo ratings yet

- Gail LTD: Better Than Expected, AccumulateDocument5 pagesGail LTD: Better Than Expected, AccumulateAn PNo ratings yet

- Market Outlook Market Outlook: I-Direct Top PicksDocument9 pagesMarket Outlook Market Outlook: I-Direct Top PicksJleodennis RajNo ratings yet

- Indian Commercial Vehicle Sector: Trends & Outlook: July 2010Document15 pagesIndian Commercial Vehicle Sector: Trends & Outlook: July 2010aniljainwisdomNo ratings yet

- Automobile Sector: Pre-Budget Buying Boosts SalesDocument11 pagesAutomobile Sector: Pre-Budget Buying Boosts SalesAngel BrokingNo ratings yet

- Two-Wheelers Update 27aug2014Document12 pagesTwo-Wheelers Update 27aug2014Chandreyee MannaNo ratings yet

- Astra International: All's Still in OrderDocument11 pagesAstra International: All's Still in OrdererlanggaherpNo ratings yet

- 4 May Opening BellDocument8 pages4 May Opening BelldineshganNo ratings yet

- Premarket OpeningBell ICICI 17.11.16Document8 pagesPremarket OpeningBell ICICI 17.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Auto Volumes Automobile Assembler Auto Sales in Fy15 Record An Impressive 31% Yoy Growth!Document4 pagesAuto Volumes Automobile Assembler Auto Sales in Fy15 Record An Impressive 31% Yoy Growth!Waqas Ashraf KhanNo ratings yet

- AngelBrokingResearch SetcoAutomotive 4QFY2015RUDocument10 pagesAngelBrokingResearch SetcoAutomotive 4QFY2015RUvijay4victorNo ratings yet

- Mahindra and Mahindra Q1FY13Document4 pagesMahindra and Mahindra Q1FY13Kiran Maruti ShindeNo ratings yet

- Idea Cellular: Wireless Traffic Momentum To SustainDocument10 pagesIdea Cellular: Wireless Traffic Momentum To SustainKothapatnam Suresh BabuNo ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- HDFC Bank (Hdfban) : Aligning With Market Conditions Slippages RiseDocument8 pagesHDFC Bank (Hdfban) : Aligning With Market Conditions Slippages RiseShyam RathiNo ratings yet

- Bharat Forge LTD - GlobalizationDocument8 pagesBharat Forge LTD - GlobalizationAnny MonuNo ratings yet

- Hero Motoco Elara ReportDocument7 pagesHero Motoco Elara ReportBhagyashree Lotlikar100% (1)

- 1 - 0 - 08072011fullerton Escorts 7th July 2011Document5 pages1 - 0 - 08072011fullerton Escorts 7th July 2011nit111No ratings yet

- India Equity Analytics Today: Buy Stock of KPIT TechDocument24 pagesIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedNo ratings yet

- JMV PreferredDocument25 pagesJMV PreferredAnonymous W7lVR9qs25No ratings yet

- Credit Rating of Tata MotorsDocument11 pagesCredit Rating of Tata MotorsSharonNo ratings yet

- 2 March OpeningbellDocument8 pages2 March OpeningbelldineshganNo ratings yet

- SSWL Sales Volume Grew 12% in January 2016 (Company Update)Document1 pageSSWL Sales Volume Grew 12% in January 2016 (Company Update)Shyam SunderNo ratings yet

- Autos: 2QFY17E Results PreviewDocument11 pagesAutos: 2QFY17E Results Previewarun_algoNo ratings yet

- Automobile Sector Result UpdatedDocument11 pagesAutomobile Sector Result UpdatedAngel BrokingNo ratings yet

- IDirect FreightForward Jun16Document10 pagesIDirect FreightForward Jun16arun_algoNo ratings yet

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsDocument9 pagesMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaNo ratings yet

- KPIT 2QFY16 Result Update - 151026Document4 pagesKPIT 2QFY16 Result Update - 151026girishrajsNo ratings yet

- TCS Analysts Q3 12Document31 pagesTCS Analysts Q3 12FirstpostNo ratings yet

- Sintex Industries (SININD) : Growth To Moderate FurtherDocument7 pagesSintex Industries (SININD) : Growth To Moderate Furtherred cornerNo ratings yet

- FSA Assignment WMP10055Document7 pagesFSA Assignment WMP10055Anshul VermaNo ratings yet

- Azerbaijan: Moving Toward More Diversified, Resilient, and Inclusive DevelopmentFrom EverandAzerbaijan: Moving Toward More Diversified, Resilient, and Inclusive DevelopmentNo ratings yet

- Aid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentFrom EverandAid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentNo ratings yet

- David Windover-The Triangle Trading Method-EnDocument156 pagesDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyNo ratings yet

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocument2 pagesFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyNo ratings yet

- MotiveWave Volume AnalysisDocument49 pagesMotiveWave Volume AnalysisDinesh ChoudharyNo ratings yet

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocument4 pagesEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyNo ratings yet

- ApplicationForm (GH FLATS)Document15 pagesApplicationForm (GH FLATS)Dinesh ChoudharyNo ratings yet

- Safe Software FME Desktop v2018Document1 pageSafe Software FME Desktop v2018Dinesh ChoudharyNo ratings yet

- Retail Research: Franklin India Prima Plus FundDocument3 pagesRetail Research: Franklin India Prima Plus FundDinesh ChoudharyNo ratings yet

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNo ratings yet

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocument4 pagesRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocument8 pagesRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyNo ratings yet

- Monthly Report - Nov 2016: Retail ResearchDocument10 pagesMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- Retail Research: SIP in Equity Schemes - A Ready ReckonerDocument6 pagesRetail Research: SIP in Equity Schemes - A Ready ReckonerDinesh ChoudharyNo ratings yet

- Report PDFDocument3 pagesReport PDFDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- Report PDFDocument10 pagesReport PDFDinesh ChoudharyNo ratings yet

- Post Budget Impact Analysis - MF & Debt: Retail ResearchDocument2 pagesPost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocument4 pagesRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- Giles v. Phelan Hallinan & Schmieg and Wells Fargo Bank, N.A., Amended Complaint Filed 12.9.11Document93 pagesGiles v. Phelan Hallinan & Schmieg and Wells Fargo Bank, N.A., Amended Complaint Filed 12.9.11Maddie O'DoulNo ratings yet

- Amref Sacco Bylaws PDFDocument24 pagesAmref Sacco Bylaws PDFSonnyboy MiguelNo ratings yet

- MifDocument2 pagesMifpatilshashiNo ratings yet

- 33 Pages Full GST Charts by CA. Keval MotaDocument33 pages33 Pages Full GST Charts by CA. Keval MotaSuratha ChinaraNo ratings yet

- CSIR Ib CHALLAN PDFDocument1 pageCSIR Ib CHALLAN PDFSathish KumarNo ratings yet

- IRD Rental Properties Ir264Document41 pagesIRD Rental Properties Ir264Roger DaltryNo ratings yet

- 5.) Pantaleon Vs AMEXDocument2 pages5.) Pantaleon Vs AMEXjoyceNo ratings yet

- Account Statement From 4 Jan 2024 To 23 Jan 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 4 Jan 2024 To 23 Jan 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancerangaswamy8194No ratings yet

- TM Clubs in ChicagoDocument24 pagesTM Clubs in ChicagovivektonapiNo ratings yet

- Accidental Damage and Breakdown Insurance Insurance Product Information DocumentDocument3 pagesAccidental Damage and Breakdown Insurance Insurance Product Information DocumentMoosaa Bin-SuhaylNo ratings yet

- Bank Reconcilaition Statement Problems PDF 1 4 PDFDocument4 pagesBank Reconcilaition Statement Problems PDF 1 4 PDFHakim JanNo ratings yet

- Accounting Policy Frameworks Asset Accounting FrameworkDocument38 pagesAccounting Policy Frameworks Asset Accounting Frameworkcole_sg100% (1)

- TransactionDocument1 pageTransactionEno WulandariNo ratings yet

- LT1 Assurance IntroductionDocument9 pagesLT1 Assurance IntroductionAbs PangaderNo ratings yet

- What Is AuditingDocument23 pagesWhat Is AuditingDeepa RamanathanNo ratings yet

- Schedule of Charges of Credit CardDocument1 pageSchedule of Charges of Credit CardTasneef ChowdhuryNo ratings yet

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- Loan AgreementDocument3 pagesLoan AgreementAlex RawlingsNo ratings yet

- A Late NotificationDocument3 pagesA Late NotificationOpie RanhaNo ratings yet

- Suhrud Ka Suhrud Ka Randi Randi Kar Kar Akashi Shah Akashi Shah 08HS2017 08HS2017 08HS2019Document37 pagesSuhrud Ka Suhrud Ka Randi Randi Kar Kar Akashi Shah Akashi Shah 08HS2017 08HS2017 08HS2019Suhrud Karandikar100% (5)

- Modification Contract Specification Brent Crude Oil Futures Contract 19062014Document6 pagesModification Contract Specification Brent Crude Oil Futures Contract 19062014Ankit AgarwalNo ratings yet

- 2022 Winston Family Reunion - Info PacketDocument5 pages2022 Winston Family Reunion - Info Packetapi-428777447No ratings yet

- All India Stock Traders1Document346 pagesAll India Stock Traders1December RealtyNo ratings yet

- $2,750,000,000 Fixed-to-Floating Rate Notes Due 2028: Issue Price: 100.000%Document63 pages$2,750,000,000 Fixed-to-Floating Rate Notes Due 2028: Issue Price: 100.000%Helpin HandNo ratings yet

- MAT App.8.17.16Document465 pagesMAT App.8.17.16Anonymous 1BWhWDBNo ratings yet

- COMMREV Doctrine - FinalsDocument8 pagesCOMMREV Doctrine - Finalsjamilove20No ratings yet

- Financial Inclusion 15012019Document5 pagesFinancial Inclusion 15012019Joydeep Chatterjee100% (1)