Professional Documents

Culture Documents

Turning A Corner: Investment Arguments

Turning A Corner: Investment Arguments

Uploaded by

Dinesh ChoudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Turning A Corner: Investment Arguments

Turning A Corner: Investment Arguments

Uploaded by

Dinesh ChoudharyCopyright:

Available Formats

INITIATING COVERAGE

7 SEP 2016

GMDC

BUY

INDUSTRY

CMP (as on 6 Sep 2016)

Target Price

METALS

Rs 93

Rs 125

Nifty

8,943

Sensex

28,978

KEY STOCK DATA

Bloomberg

GMDC IN

No. of Shares (mn)

318

MCap (Rs bn) / ($ mn)

29/442

6m avg traded value (Rs mn)

42

GMDC has seen its lignite volume taper off in the

past few years. Decline in international coal prices

and heavy state taxation further weighed on lignite

pricing. We expect lignite volumes to be close to

bottoming out, while strengthening international

coal prices and GST led normalization in taxation

should help support lignite pricing and profitability.

We initiate with a BUY and a TP of Rs 125 (5.0x FY18

EV/EBITDA).

Investment arguments

STOCK PERFORMANCE (%)

52 Week high / low

Turning a corner

Rs 101 / 52

3M

6M

12M

Absolute (%)

39.4

52.9

26.6

Relative (%)

32.1

35.4

10.2

SHAREHOLDING PATTERN (%)

Promoters

74.00

FIIs

2.02

FIs

13.10

Public & Others

10.88

Source : BSE

Ankur Kulshrestha

ankur.kulshrestha@hdfcsec.com

+91-22-6171 7346

Sarfaraz Singh

sarfaraz.singh@hdfcsec.com

+91-22-6171 7331

GMDCs lignite volumes have consistently declined

since FY12 given operational and land acquisition

issues. However, they may be close to bottoming

out despite the certain exhaustion of its largest

mine, Panandhro, as other mines ramp-up output

to replace lost volumes.

Declining imported coal prices have weighed on

GMDCs pricing in the past. Recent strengthening

(Imported coal prices up ~30% from the bottom in

Dec-15) is likely to put back some pricing power in

the hands of the miner, since most of its

customers do not have the much cheaper CIL coal

as an option due to logistical realities. Costlier

alternatives also lend support to the volumes.

Gujarat taxes lignite at a VAT rate of 22.5%, much

steeper compared to other lignite producing

states like Rajasthan and TN (VAT rates of 5 5.5%).

The taxation (VAT + excise) on lignite works out to

~37% of assessable value, allowing little elbow

room for GMDC to compete with alternatives (coal

VAT at 4%). With GST, taxation rates should

converge with other lignite mining states, leaving

more on the table for GMDC and its customers.

(current net realisations ~45% of sale price). We

note that an 18% GST rate would lower the levies

by ~Rs250/t (~45% of the FY16 lignite PBIT/t)

With the Akrimota power plant stabilizing, and a

sizeable (and growing) portfolio of renewable

assets, power division is expected to contribute

meaningfully to the earnings.

Valuation

and

view:

With

repeated

disappointments on volume front weighing it

down, GMDC trades at inexpensive valuations

(3.6/2.9x FY17/18 EV/EBITDA and 10-11 P/E).

Despite excess cash, payouts have been dismal.

Higher payouts/buybacks, in line with other PSUs,

should help rerate the valuations further.

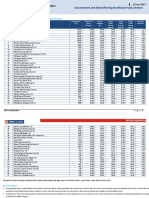

Financial Summary

(Rs mn)

Net Sales

EBITDA

PAT

Diluted EPS (Rs)

P/E (x)

EV / EBITDA (x)

RoE (%)

FY15

FY16 FY17E FY18E FY19E

14,188 11,894 13,715 14,462 15,755

5,216 3,135 3,855 4,472 5,285

3,911 2,279 3,320 3,446 4,056

12.3

7.2

10.4

10.8

12.8

7.5

12.9

8.9

8.5

7.3

3.6

5.0

3.6

2.9

2.0

12.8

6.9

9.6

9.3

10.2

Source: Company, HDFC sec Inst Research

HDFC securities Institutional Research is also available on Bloomberg HSLB <GO>& Thomson Reuters

GMDC : INITIATING COVERAGE

Lignite (Ext. as % of total)-LHS

80

Rs mn

65

60

FY19E

5,000

FY18E

70

FY17E

10,000

FY16

75

FY15

15,000

Source: Company, HDFC sec Inst Research

15.00

GMDC Mines - Overview

Panandhro

Rajpardi

Mata no Madh

Tadkeshwar

Bhavnagar

Umarsar

Mining

Capacity

3.0

1.0

4.8

2.5

5.0

1.0

Source: Company, HDFC sec Inst Research

Stripping

Ratio

3.6

15.1

9.5

9.5

22.0

9.5

Lignite CV

(kcal/kg)

3,058

N/A

3,801

2,881

3,440

4,195

mnT

10.2

11.3

Rajpardi

Tadkeshwar

Umarsar

10.9

10.00

8.4

8.7

7.0

5.00

-

FY11

Mine

Panandhro

Mata no Madh

Bhavnagar

FY16

Power

Others

FY15

20,000

Lignite

FY14

Lignite is the mainstay of GMDCs business

FY13

GMDCs lignite volumes have consistently declined

since FY12 given operational and land acquisition

issues. However, they may be close to bottoming

out despite the certain exhaustion of its largest

mine, Panandhro, as other mines ramp-up output

to replace lost volumes.

Lignite mining is the mainstay of GMDCs

business. It directly accounts for >65% of

external revenues and supports the pithead

power plant at Akrimota.

Akrimota Power plant. However, reserves in

Panandhro have run out and it will likely cease

production in FY17 itself.

From a peak of 11.3 mT in FY12, GMDC volumes

have tapered off and it produced only 7.0 mT in

FY16. The steep declines in some of the large

mines have been on account of delays in land

acquisition, changes in land use and operational

issues.

Key operational issues faced by GMDC

involve strata control and slope stability. E.g.

collapsing of benches at Rajpardi and

Bhavnagar, sliding of external dumps at

Tadkeshwar etc.

Land acquisition challenges, especially post

enactment of Land acquisition Act of 2013,

have increased. Further, specific issues like

transfer of leased land to forest/sanctuary

(Panandhro) and allowing the land under

mining lease to be used for private nonmining purposes by authorities (Tadkeshwar)

have hurt land availability for mining.

Volumes have tapered off

FY12

Lignite volumes may have bottomed out

FY14

Lignite, the mainstay of

GMDCs business has suffered

sharp declines in volumes due

to operational and land

acquisition issues at its mines.

Panandhro, the largest mine, supplies lignite to

Invesment thesis

Source: Company, HDFC sec Inst Research

Page | 2

GMDC : INITIATING COVERAGE

Lignite may be close to

bottoming out, despite the

exhaustion of Panandhro, the

largest mine as other mines

ramp up.

However, GMDCs production may be close to

bottoming out, despite the certainty of Panandhro

ceasing production sometime in FY17 itself.

2015 with a capacity of 1 mTPA will be used to

supply to Akrimota power plant. Given the higher

stated GCV of lignite (~4,200 kcal/kg) vs

Panandhro (~3,058 Kcal/kg), Umarsar should be

able to replace the higher capacity mine as a

source of lignite to Akrimota.

Declining imported coal prices have weighed on

GMDCs pricing in the past. Recent strengthening

(Imported coal prices up ~30% from the bottom in

Dec-15) is likely to put back some pricing power in

the hands of the miner, given most of its customers

do not have much cheaper CIL coal as an option due

to logistical realities. Costlier alternatives also lend

support to the volumes.

Despatch of lignite from Rajpardi project has

GMDC competes with imported coal and pet-

Umarsar, which was commissioned in March

restarted in 1QFY17 and is likely to replace some

of the lost volume from Panandhro.

Tadkeshwar and Bhavnagar, which have been

Declining coal price weighed

down GMDCs pricing in the

past, especially given the coast

based nature of its clientele

Rising imported coal prices improve lignite

competitiveness

impacted by aforementioned land acquisition

and R&R issues are expected to bring up the

remainder of the production loss from

Panandhro mine.

We note that our volume numbers remain at risk

given historical disappointments. GMDC has been

unable to meet its volume targets as some of the

aforementioned problems plagued its operations.

coke (to a limited extent). This is on account of

coastal/near-coast location of a large proportion

of its customers. Given geographical hurdles,

comparison with CIL is not useful, nearest

collieries (Western Coalfields) being >700 kms

away.

Lignite vs coal

Parameters

CV(Kcal/kg)

Moisture

Ash

Fixed Carbon

Sulphur

Imported

Lignite

Coal

2400 - 3360 5200 - 5600 2800 - 3200

6 - 8%

30 - 40%

35 - 40%

30 - 40%

4 - 5%

8 - 12%

30 - 40%

40 - 42%

22 - 25%

0.5 - 0.8%

0.1 - 0.2%

1 - 3%

CIL (F Grade)

Source: Company, MEAI, HDFC sec Inst Research

Landed imported coal prices have hardened by

~30% since the bottom in Dec-15 and are now

uncompetitive vs domestic coal and lignite.

Page | 3

GMDC : INITIATING COVERAGE

Lignite pricing now attractive vs alternatives

0.37

0.35

0.33

0.34

FY15

FY16

0.79

0.30

0.37

0.35

0.50

0.77

0.93

FY14

0.95

0.70

0.38

0.35

0.40

FY13

0.80

0.41

0.34

0.50

Coal India Realisations

FY12

GMDC Realisations

(Rs/'000 kcal)

Rs/'000 Kcal

0.90

0.60

GMDCs pricing more dynamic than CILs

0.32

0.28

1.00

0.20

0.59

GMDC - Imported Imported CIL (G15) Petcoke

Lignite Coal (RB1,

Coal

(Domestic)

SA)

(Indonesia)

Source: Company, Steelmint, Bloomberg, CBEC, HDFC sec Inst

Research

Note: Lignite prices of Tadkeshwar mine taken for reference

Prices inclusive respective levies. Petcoke : 7,800 kcal/kg, SA - RB1

- 6,000 kcal/kg, CIL, G15 2,950 kcal/kg

The relative realizations help assess comparative

pricing of GMDC with CIL coal. While largely

similar on an energy content basis, GMDC has

been more dynamic in pricing.

We note that due to lower average energy

content, GMDC gets hurt by flat levies more than

CIL. In other words, given the same pricing per

kcal, GMDC will earn lesser than CIL given lower

base pricing and higher cess. We do not expect

this to change meaningfully in the future.

0.10

-

FY11

Recent run-up in international

coal/pet-coke imparts support

to GMDCs pricing and volumes

Source: Company, Coal India, HDFC sec Inst Research

Note: Reported realizations/t (net of levies) used. Average grade of

3000 kcal/kg for GMDC and 4200 kcal/kg for Coal India assumed.

GMDC supplies ~80% of its volumes to small

customers

operating

in

sectors

like

bricks/ceramics, textiles, paper, chemicals and

other SMEs. These operations typically use handfired boilers which work better with lignite and

may be unable to use high energy intensity fuels.

Further, the ticket sizes of these customers

prevent them from accessing the imported coal

market meaningfully.

Page | 4

GMDC : INITIATING COVERAGE

GMDCs customers pay one of

the highest levies due to high

VAT in Gujarat (22.5%). This is

likely to come down with GST

implementation

Uneven lignite taxation another window of

opportunity

Gujarat taxes lignite at a VAT rate of 22.5%, much

steeper compared to other lignite producing states

(Rajasthan/TN @ 5.0-5.5%). The total taxation on

lignite works out to ~37% of assessable value,

allowing little elbow room for GMDC to compete

with alternatives. With GST expected to roll out,

taxations rates should converge, leaving more on

the table for GMDC and its customers.

Gujarat levies a 20% VAT and a 2.5% special VAT

on lignite, while coal and pet-coke are charged

VAT at 4%! State/central levies form a

substantial chunk of the sale price of lignite in

the state.

State & central levies form 40-45% of lignite sales

price

Vat, 18%

Basic, 46%

Clean cess,

19%

22.5%

5.0%

5.5%

Source: Company, TN CTD, RERC, HDFC sec Inst Research

Based on GMDCs pricing the effective rate of

taxation on lignite in Gujarat works out to 3537% (Excise + VAT as a % of assessable value)

Lignite taxation - Likely GST impact

Head

Basic Price (a)

Mine closure (b)

Royalties: 6% of Basic + 30%

contribution to DMF + 2% contribution

to NMET (Effective : 7.9%) (c)

Assessable (d=a+b+c)

Excise (6% of Assessable) (e)

Clean Cess (f)

Sub-Total (g=d+e+f)

VAT (20% of sub-total) (h)

Additional VAT 2.5% of subtotal (i)

Sales price (g+h+i)

Excise + VAT (e+h+i)

% of Assessable

GST @18% of Assessable (j)

Difference (e+h+i-j)

Rs/t

950

198

75

1,223

73

400

1,697

339

42

2,078

455

37%

220

235

Source: Company, HDFC sec Inst Research

Note: BA grade lignite (Bhavnagar Mine) taken for reference.

Excise, 4%

Royalty, 4%

VAT rate on lignite in states

Parameters

Gujarat

Tamil Nadu

Rajasthan

Mine

closure, 9%

Source: Company, HDFC sec Inst Research

Note: BA grade lignite (Bhavnagar Mine) taken for reference.

Amongst the lignite producing/consuming states,

Gujarat has the highest incidence of VAT. The

other two states tax lignite at rates similar to

that on coal.

We note that lignite royalties (~7.9%) are lesser

than coal (14.3%). However, royalties are levied

at base prices while VAT is levied on a cascade of

taxation on top of base prices that the producer

receives. In a hypothetical situation in which all

levies are normalized, i.e. coal and lignite levies

are bought on an even keel, GMDC still stands to

benefit given much higher incidence of taxation

on account of state VAT.

Page | 5

GMDC : INITIATING COVERAGE

With the Akrimota power plant stabilizing, and a

sizeable (and growing) portfolio of renewable

assets, power division is expected to contribute

meaningfully to the earnings.

GMDC now operates 410 MW of thermal, wind

and solar power capacity in Gujarat.

GMDC power capacity evolution

Thermal

Solar

5.0

5.0

5.0

151

151

151

250

250

250

250

FY14

FY15

FY16

MW

400

300

Wind

FY13

500

5.0

53

5.0

93

93

250

250

FY12

Stabilization of Akrimota

power plant and sizeable

renewable capacity should

contribute meaningfully

Power division to add meaningfully

FY11

Imposition of GST will remove the VAT anomaly and

render GMDCs lignite much more competitive vs

other energy sources. Substantial portion of this

relief should find its way into GMDCs net

realisations. Further, given levies under GST can be

offset, unlike current VAT regime.

200

100

0

Source: Company, HDFCsec

Of this, 250MW of thermal capacity at Akrimota

power plant is fed by mines in the vicinity.

Currently it is being fed by Panandhro, with

Umarsar/Mata-no-madh taking over after

exhaustion.

Page | 6

GMDC : INITIATING COVERAGE

Solid Balance Sheet Adds Further Comfort

Beset with low PLFs, last two years better

PLF (%)

65.2%

65.0%

60.0%

55.0%

62.0%

53.5%

53.5%

45.0%

chunk of the cash (~Rs 10 bn in FY15) is parked in

inter-corporate deposits, which yield reasonable

returns (average yield in FY14-16: 9.2%).

45.0%

FY16

FY15

FY14

FY13

40.0%

FY12

Given GMDCs net cash situation and planned

investments covered by expected cash flows,

Balance Sheet is expected to remain comfortable.

Return of cash to shareholders should be value

accretive.

GMDC is net cash (Rs13.7 bn at FY16E). A large

53.5%

50.0%

FY11

GMDC is net cash and

committed capex can be

funded easily from internal

cash flows. Return of excess

cash to shareholders should be

managements focus.

70.0%

Source: Company, HDFCsec

Akrimota has been beset with lower PLFs given

difficulties in running CFBC plants. This is similar

to the difficulties faced by other operators like

GIPCL. In 2013, GMDC engaged KEPCO (Korea

Electric Power Corporation) for a 15 years O&M

contract. The performance has markedly

improved in FY15-16 when the plant ran at PLFs

above 60% for the first time since FY10.

Under the terms of PPA with GUVNL the rate of

Return of Equity is 16%, Normative Plant Load

Factor is 68.5% and auxiliary consumption @

10%.

The renewable power capacity of ~156 MW is

split between 151MW of wind capacity at various

locations in Gujarat and 5MW of solar power at

Panandhro lignite project. These capacities

operate at PLFs of ~20% on an average. Further

50MW wind capacity is being added, for which

order was placed in September 2015.

We would prefer GMDC to return some of this

cash to shareholders, in line with PSUs in recent

past (MOIL, NMDC, Coal India). This would help

improve the return ratios too. While mining

capex remains minimal, GMDC has indicated

investments into renewables, touched upon

earlier, to the tune of ~Rs 4.5bn in FY17-18. This

should be easily covered with the cash generated

from operations.

In its FY16 full year results, GMDC had also

started proportionately consolidating the debt

from Bhavnagar Energy Corporation Ltd (BECL),

where it owns a 26% stake and is a promoter.

BECL is putting up a 500 MW power plant in

Bhavnagar district. First unit of the plant

(250MW) had its COD in May 2016. We await

1HFY17 numbers to see the treatment of BECL

debt under IndAS.

Page | 7

GMDC : INITIATING COVERAGE

Valuation of the company

A life-of-mine discounted cash flow (DCF) is the

best way to value a mining company. However,

the availability of life of mine data remains

limited. E.g. Panandhro has been widely

expected to run out sometime in FY14-16 period,

but still continues to produce well into FY17.

EV/EBITDA (Rolling 1-year Fwd)

10.0

mines where reserves/quality are not well

established. Lastly, we believe that the low near

term valuations that GMDC currently trades at

(4-5x EV/EBITDA) discounts on 6-7 years of mine

life on FY18 values. As such, we value GMDC at

5.0x FY18 EV/EBITDA.

P/E (Rolling 1-year forward)

Average

-1 Stdev

16.0

P/E (x)

+1 Stdev

Average

-1 Stdev

14.0

8.0

12.0

10.0

6.0

8.0

4.0

6.0

4.0

2.0

Source: Company, HDFC sec Inst Research

Apr-10

Aug-10

Dec-10

Apr-11

Aug-11

Dec-11

Apr-12

Aug-12

Dec-12

Apr-13

Aug-13

Dec-13

Apr-14

Aug-14

Dec-14

Apr-15

Aug-15

Dec-15

Apr-16

Aug-16

2.0

Apr-10

Aug-10

Dec-10

Apr-11

Aug-11

Dec-11

Apr-12

Aug-12

Dec-12

Apr-13

Aug-13

Dec-13

Apr-14

Aug-14

Dec-14

Apr-15

Aug-15

Dec-15

Apr-16

Aug-16

Valuations have taken a hit

due to recent disappointments.

Delivery on lignite volumes

should help valuations rerate

back to normal.

EV/EBITDA (x)

+1 Stdev

Further, GMDC continues to get allocations of

Source: Company, HDFC sec Inst Research

Page | 8

GMDC : INITIATING COVERAGE

Key Assumptions

FY15

8.71

1,272

1,495

Lignite volumes (mT)

Lignite realisations (Rs/T)

Power units (mn kWh)

FY16

6.98

1,283

1,574

FY17E

7.50

1,385

1,667

FY18E

7.50

1,413

1,763

FY19E

8.05

1,413

1,763

Source: Company, HDFC sec Inst Research

Comparative valuations

Company

MCap

(Rs mn)

CMP

(Rs)

TP

(Rs)

Reco

Coal India

Neyveli Lignite

GMDC

2,135.1

128.9

29.8

329

77

94

369

NR

125

Buy

NR

Buy

P/E (x)

FY17E

FY18E

16.2

13.8

9.2

7.7

8.9

8.5

EV/EBITDA (x)

FY17E

FY18E

8,2

7.0

5.2

4.6

3.6

2.9

RoE (%)

FY17E

FY18E

39.4

48.6

8.9

10.1

9.6

9.3

Source: Company, Bloomberg, HDFC sec Inst Research

Page | 9

GMDC : INITIATING COVERAGE

Income Statement

Year ending March (Rs mn)

Net Revenues

Growth %

Mining expenses

Royalty and clean energy cess

Employee expenses

Other operating expenses

Operating profits

Operating Profit Margin (%)

Other operating income

EBITDA

EBITDA %

EBITDA Growth %

Depreciation

EBIT

Other Income (including EO

items)

Interest

PBT

Tax

RPAT

EO (Loss) / Profit (Net Of Tax)

APAT

APAT Growth (%)

Adjusted EPS (Rs.)

EPS Growth (%)

Balance Sheet

FY15

14,188

10.0

4,733

1,464

964

1,811

5,216

36.8

223

5,438

38.3

(16.9)

1,373

4,066

FY16

11,894

(16.2)

3,682

2,028

1,017

2,032

3,135

26.4

234

3,369

28.3

(38.1)

1,325

2,044

FY17E

13,715

15.3

3,722

3,000

1,032

2,106

3,855

28.1

245

4,100

29.9

21.7

1,225

2,875

FY18E

14,462

5.4

3,730

3,000

1,048

2,212

4,472

30.9

258

4,730

32.7

15.4

1,318

3,412

FY19E

15,755

8.9

3,864

3,220

1,064

2,322

5,285

33.5

271

5,555

35.3

17.4

1,430

4,125

2,309

1,213

1,382

1,511

1,669

17

6,358

1,355

5,003

1,092

3,911

(10.9)

12.3

(10.9)

6

3,251

972

2,279

2,279

(41.7)

7.2

(41.7)

0

4,256

936

3,320

3,320

45.7

10.4

45.7

0

4,923

1,477

3,446

3,446

3.8

10.8

3.8

0

5,794

1,738

4,056

4,056

17.7

12.8

17.7

Source: Company, HDFC sec Inst Research

As at March (Rs mn)

SOURCES OF FUNDS

Share Capital

Reserves

Total Shareholders Funds

Long Term Debt

Short Term Debt

Total Debt

Deferred Taxes

Long Term Provisions & Others

TOTAL SOURCES OF FUNDS

APPLICATION OF FUNDS

Net Block

CWIP

Investments

LT Loans and Advances

Total Non-current Assets

Inventories

Debtors

Other Current Assets

Cash & Equivalents

Total Current Assets

Creditors

Other Current Liabilities &

Provns

Total Current Liabilities

Net Current Assets

TOTAL APPLICATION OF FUNDS

FY15

FY16

FY17E

FY18E

FY19E

636

31,781

32,417

0

0

0

2,079

4,207

38,703

636

33,032

33,668

0

0

0

1,625

5,164

40,456

636

35,203

35,839

0

0

0

1,625

5,164

42,628

636

37,502

38,138

0

0

0

1,625

5,164

44,926

636

40,409

41,045

0

0

0

1,625

5,164

47,834

17,562

745

2,989

7,447

28,743

521

811

905

10,838

13,075

515

17,516

1,035

3,242

6,293

28,085

435

974

905

13,685

15,998

681

17,291

1,535

3,242

6,293

28,360

572

634

905

15,737

17,848

634

19,473

1,035

3,242

6,293

30,042

490

753

905

16,435

18,583

753

20,043

535

3,242

6,293

30,112

667

758

905

19,096

21,426

758

2,603

2,947

2,947

2,947

2,947

3,118

9,957

38,700

3,628

12,370

40,455

3,581

14,267

42,627

3,700

14,883

44,925

3,705

17,721

47,833

Source: Company, HDFC sec Inst Research

Page | 10

GMDC : INITIATING COVERAGE

Cash Flow

Year ending March (Rs mn)

Reported PBT

Non-operating & EO items

Interest expenses

Depreciation

Working Capital Change

Tax paid

OPERATING CASH FLOW ( a )

Capex

Free cash flow (FCF)

Investments

Non-operating Income

INVESTING CASH FLOW ( b )

Debt Issuance/(Repaid)

Interest expenses

FCFE

Share Capital Issuance

Dividend

FINANCING CASH FLOW ( c )

NET CASH FLOW (a+b+c)

EO Items/Others

Closing Cash & Equivalents

Key Ratios

FY15

6,358

(2,309)

17

1,373

(3,893)

(2,177)

(631)

(551)

(1,181)

(386)

1,217

281

0

(17)

297

0

(1,148)

(1,165)

(1,515)

1,451

10,838

Source: Company, HDFC sec Inst Research

FY16

3,251

(1,213)

6

1,325

1,244

(972)

3,641

(600)

3,041

(253)

1,213

361

(0)

(6)

367

0

(1,148)

(1,155)

2,847

13,685

FY17E

4,256

(1,382)

0

1,225

156

(936)

3,319

(1,500)

1,819

0

1,382

(118)

0

0

(118)

0

(1,148)

(1,148)

2,053

15,737

FY18E

4,923

(1,511)

0

1,318

82

(1,477)

3,335

(3,000)

335

0

1,511

(1,489)

0

0

(1,489)

0

(1,148)

(1,148)

697

16,435

FY19E

5,794

(1,669)

0

1,430

(177)

(1,738)

3,641

(1,500)

2,141

0

1,669

169

0

0

169

0

(1,148)

(1,148)

2,661

19,096

PROFITABILITY (%)

EBITDA Margin

APAT Margin

RoE

Core RoCE

RoCE

EFFICIENCY

Tax Rate (%)

Asset Turnover (x)

Inventory (days)

Debtors (days)

Payables (days)

Cash Conversion Cycle (days)

Debt/EBITDA (x)

Net D/E

Interest Coverage

PER SHARE DATA

EPS (Rs/sh)

CEPS (Rs/sh)

DPS (Rs/sh)

BV (Rs/sh)

VALUATION

P/E

P/BV

EV/EBITDA

OCF/EV (%)

FCF/EV (%)

FCFE/Market Cap (%)

Dividend Yield (%)

FY15

FY16P

FY17E

FY18E

FY19E

38.3

27.6

12.8

20.9

13.6

28.3

19.2

6.9

10.6

6.9

29.9

24.2

9.6

15.0

9.6

32.7

23.8

9.3

15.0

9.3

35.3

25.7

10.2

17.0

10.2

21.3

0.5

13

17

15

15

N/M

N/M

N/M

29.9

0.4

15

27

18

23

N/M

N/M

N/M

22.0

0.5

13

21

18

17

N/M

N/M

N/M

30.0

0.5

13

17

18

13

N/M

N/M

N/M

30.0

0.5

13

17

18

13

N/M

N/M

N/M

12.3

20.1

3.0

101.9

7.2

11.3

3.0

105.9

10.4

14.3

3.0

112.7

10.8

15.0

3.0

119.9

12.8

17.3

3.0

129.1

7.5

0.9

3.6

(3.4%)

(6.4%)

(3.1%)

3.2

12.9

0.9

5.0

19.6%

16.3%

11.6%

3.2

8.9

0.8

3.6

21.1%

11.5%

5.8%

3.2

8.5

0.8

2.9

24.3%

2.4%

(3.9%)

3.2

7.3

0.7

2.0

28.0%

16.5%

7.8%

3.2

Source: Company, HDFC sec Inst Research

Page | 11

GMDC : INITIATING COVERAGE

RECOMMENDATION HISTORY

GMDC

Date

7-Sep-16

TP

150

CMP

93

Reco

BUY

Target

125

130

110

90

70

Sep-16

Aug-16

Jul-16

Jun-16

May-16

Apr-16

Mar-16

Feb-16

Jan-16

Dec-15

Nov-15

Oct-15

Sep-15

50

Rating Definitions

BUY

: Where the stock is expected to deliver more than 10% returns over the next 12 month period

NEUTRAL : Where the stock is expected to deliver (-)10% to 10% returns over the next 12 month period

SELL

: Where the stock is expected to deliver less than (-)10% returns over the next 12 month

d

Page | 12

GMDC : INITIATING COVERAGE

Disclosure:

We, Ankur Kulshrestha, PGDBM and Sarfaraz Singh, PGDM authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately

reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or

view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its

Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further

Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any holding in stock No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or

arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for

information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be

construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any

locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC

Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may

not be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd .

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived

from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services

for, any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies)

mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and

other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any

action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the

dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report,

or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any

other assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research

report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is

not based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach

different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served

as an officer, director or employee of the subject company. We have not received any compensation/benefits from the subject company or third party in connection with the Research

Report. HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475

HDFC securities

Institutional Equities

Unit No. 1602, 16th Floor, Tower A, Peninsula Business Park,

Senapati Bapat Marg, Lower Parel, Mumbai - 400 013

Board : +91-22-6171 7330 www.hdfcsec.com

Page | 13

You might also like

- Chapter 15 International FinanceDocument31 pagesChapter 15 International FinanceSANANDITA DASGUPTA 1723585100% (1)

- Coal India 25-07-2020Document11 pagesCoal India 25-07-2020Manoj DoshiNo ratings yet

- The Cherokee Nation of Indians - King 1898Document15 pagesThe Cherokee Nation of Indians - King 1898Kassandra M JournalistNo ratings yet

- Gujarat Mineral Development Corporation LTD: Retail ResearchDocument16 pagesGujarat Mineral Development Corporation LTD: Retail ResearchumaganNo ratings yet

- Gujarat Gas: CMP: INR407 Strong As A Hulk!Document8 pagesGujarat Gas: CMP: INR407 Strong As A Hulk!dashNo ratings yet

- A Virtual Monopoly: CMP '161 Target Price '213Document16 pagesA Virtual Monopoly: CMP '161 Target Price '213Angel BrokingNo ratings yet

- Mahanagar Gas Limited: Low Domestic Gas Price To Drive Up MarginsDocument6 pagesMahanagar Gas Limited: Low Domestic Gas Price To Drive Up MarginsdarshanmadeNo ratings yet

- Trimegah Coal - Hello Old Economy, I'm BackDocument46 pagesTrimegah Coal - Hello Old Economy, I'm BackRizki Jauhari IndraNo ratings yet

- Indian Coal SectorDocument9 pagesIndian Coal Sectorhimadri.banerji60No ratings yet

- LNG Demande in PakistanDocument21 pagesLNG Demande in PakistanAnonymous icnhaNsFNo ratings yet

- Watts & Bolts: A Monthly Round-Up of Key Data & ImplicationsDocument15 pagesWatts & Bolts: A Monthly Round-Up of Key Data & ImplicationsAshutosh GuptaNo ratings yet

- NMDC LTD: ESG Disclosure ScoreDocument6 pagesNMDC LTD: ESG Disclosure ScoreVivek S MayinkarNo ratings yet

- True Friend Sekuritas PTBA AnalysisDocument7 pagesTrue Friend Sekuritas PTBA Analysisyasinta faridaNo ratings yet

- Impact of Renegotiation of RasGas Contract On Indian Gas MarketDocument10 pagesImpact of Renegotiation of RasGas Contract On Indian Gas MarketRahul PrithianiNo ratings yet

- Gujarat Gas: Best Bet Among City Gas Distribution PlayersDocument12 pagesGujarat Gas: Best Bet Among City Gas Distribution PlayersshahavNo ratings yet

- RIL Motilal 220612Document10 pagesRIL Motilal 220612JK RastogiNo ratings yet

- Oil & Gas, Chemical & Telecom Sector: On Growth TrajectoryDocument12 pagesOil & Gas, Chemical & Telecom Sector: On Growth Trajectorylalit963No ratings yet

- India's Push-to-Renegotiate-Long-Term-LNG-ContractsDocument11 pagesIndia's Push-to-Renegotiate-Long-Term-LNG-ContractsAKSHAY PANWARNo ratings yet

- Matrix 31.01.23 v2Document6 pagesMatrix 31.01.23 v2khalsa.taranjitNo ratings yet

- ACC-Limited 44 QuarterUpdateDocument6 pagesACC-Limited 44 QuarterUpdateRohan RustagiNo ratings yet

- LNG EconomicsDocument19 pagesLNG EconomicsCal75% (4)

- Financial Analysis: Petronet LNG LTDDocument19 pagesFinancial Analysis: Petronet LNG LTDVivek AntilNo ratings yet

- Gujarat State Petronet Limited - Initiating CoverageDocument16 pagesGujarat State Petronet Limited - Initiating CoveragedurgeshrpNo ratings yet

- MGL 3R-Jan05 2021Document6 pagesMGL 3R-Jan05 2021Amruta RanawareNo ratings yet

- Lucky Cement Limited Construction and Materials Strong Pricing To Drive GrowthDocument10 pagesLucky Cement Limited Construction and Materials Strong Pricing To Drive GrowthZiaBilalNo ratings yet

- Indraprastha Gas Limited - SWOT AnalysisDocument27 pagesIndraprastha Gas Limited - SWOT Analysissujaysarkar850% (1)

- GAIL (India) Limited - R - 01042020Document9 pagesGAIL (India) Limited - R - 01042020Monu ChouhanNo ratings yet

- Natural Gas - UpdateDocument42 pagesNatural Gas - Updatesatish_xpNo ratings yet

- Ga - EnergyDocument20 pagesGa - EnergyPranks9827653878No ratings yet

- ESSAR REPORT Technical Session-III EOGEPL-Raniganj East CBM ProjectDocument33 pagesESSAR REPORT Technical Session-III EOGEPL-Raniganj East CBM Projectssinharay9No ratings yet

- Gujarat Gas - IC - HDFC Sec-201905311810331546623Document30 pagesGujarat Gas - IC - HDFC Sec-201905311810331546623Avijoy SenguptaNo ratings yet

- Metals & Mining: Steel Companies' Ebitda/Tonne Likely To Soften QoqDocument5 pagesMetals & Mining: Steel Companies' Ebitda/Tonne Likely To Soften QoqPorus Saranjit SinghNo ratings yet

- A Great Valuation Play Where Commodity Business Is A Cash CowDocument29 pagesA Great Valuation Play Where Commodity Business Is A Cash Cowgullapalli123No ratings yet

- Proof of Pudding: Highlights of The QuarterDocument9 pagesProof of Pudding: Highlights of The QuarterAnonymous y3hYf50mTNo ratings yet

- NMDC - FpoDocument10 pagesNMDC - FpoAngel BrokingNo ratings yet

- Gujarat Gas (GUJGA IN) - Company Update - PL IndiaDocument7 pagesGujarat Gas (GUJGA IN) - Company Update - PL IndiadarshanmaldeNo ratings yet

- Metals and Mining: Coal Block Case: Mine Owners' Woes ContinueDocument11 pagesMetals and Mining: Coal Block Case: Mine Owners' Woes ContinuennsriniNo ratings yet

- 1161 Research Pick of The Week JMFS 080833 b7049Document8 pages1161 Research Pick of The Week JMFS 080833 b7049Manipal SinghNo ratings yet

- Petronet Corporate Presentation Jan11Document31 pagesPetronet Corporate Presentation Jan11Ganesh DivekarNo ratings yet

- GAIL - Resuming Coverage - HDFCDocument22 pagesGAIL - Resuming Coverage - HDFCSD HAWKNo ratings yet

- JK Lakshmi Cement LTDDocument12 pagesJK Lakshmi Cement LTDViju K GNo ratings yet

- ADMR - Laporan Informasi Dan Fakta Material - 31257144 - EnglishDocument5 pagesADMR - Laporan Informasi Dan Fakta Material - 31257144 - Englishrakhimbjb78No ratings yet

- Tata Steel - Q2FY23 Result Update - 02112022 - 02-11-2022 - 12Document9 pagesTata Steel - Q2FY23 Result Update - 02112022 - 02-11-2022 - 12AnirudhNo ratings yet

- Power Sector News 26.11Document5 pagesPower Sector News 26.11anjali_atriNo ratings yet

- Indraprastha Gas LTDDocument27 pagesIndraprastha Gas LTDPrakash Kumar PaulNo ratings yet

- 6th City Gas Stakeholders PPT - GK Sharma - MGLDocument23 pages6th City Gas Stakeholders PPT - GK Sharma - MGLSHOBHIT KUMARNo ratings yet

- Reliance Industries: Robust Petchem PerformanceDocument17 pagesReliance Industries: Robust Petchem PerformanceANMOL NARANG PGP 2017-19 BatchNo ratings yet

- Gas Supply Scenario Till 2011-12 (MMSCMD)Document12 pagesGas Supply Scenario Till 2011-12 (MMSCMD)Ankita AroraNo ratings yet

- Coal India - IPO: Invest at Cut-OffDocument9 pagesCoal India - IPO: Invest at Cut-OffJoyraj DeyNo ratings yet

- Q1-FY23-Godawari & IspatDocument44 pagesQ1-FY23-Godawari & IspatshyamNo ratings yet

- Petronet Motilal OswalDocument8 pagesPetronet Motilal OswaljoeNo ratings yet

- Check For Answers. Hope You Will Find ItDocument11 pagesCheck For Answers. Hope You Will Find ItMohammad Nazmul IslamNo ratings yet

- Indraprastha Gas (IGL IN) : Q2FY22 Result UpdateDocument6 pagesIndraprastha Gas (IGL IN) : Q2FY22 Result UpdateMani SeshadrinathanNo ratings yet

- A Presentation On Gail (India)Document47 pagesA Presentation On Gail (India)gurpreet130% (1)

- Analysis October 07Document22 pagesAnalysis October 07Vaibhav KumarNo ratings yet

- Gas in India-A Virtual Conference Session: Emerging Trends, Developments and Gas Supply OutlookDocument27 pagesGas in India-A Virtual Conference Session: Emerging Trends, Developments and Gas Supply OutlookAbhimanyu SharmaNo ratings yet

- CMP: INR155 Under-Recoveries To Vanish by end-FY19Document6 pagesCMP: INR155 Under-Recoveries To Vanish by end-FY19anjugaduNo ratings yet

- Presentation On LNG For Pip Seminar in Pso HouseDocument26 pagesPresentation On LNG For Pip Seminar in Pso HouseRASHID AHMED SHAIKHNo ratings yet

- Gujarat State Petronet Limited (GSPL) : Analyst Meet UpdateDocument6 pagesGujarat State Petronet Limited (GSPL) : Analyst Meet UpdateRaghu KuchiNo ratings yet

- Kgi PTT 239026Document11 pagesKgi PTT 239026dtNo ratings yet

- Foundations of Natural Gas Price Formation: Misunderstandings Jeopardizing the Future of the IndustryFrom EverandFoundations of Natural Gas Price Formation: Misunderstandings Jeopardizing the Future of the IndustryNo ratings yet

- Market Research, Global Market for Germanium and Germanium ProductsFrom EverandMarket Research, Global Market for Germanium and Germanium ProductsNo ratings yet

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyNo ratings yet

- MotiveWave Volume AnalysisDocument49 pagesMotiveWave Volume AnalysisDinesh ChoudharyNo ratings yet

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocument2 pagesFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyNo ratings yet

- David Windover-The Triangle Trading Method-EnDocument156 pagesDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- Retail Research: Franklin India Prima Plus FundDocument3 pagesRetail Research: Franklin India Prima Plus FundDinesh ChoudharyNo ratings yet

- ApplicationForm (GH FLATS)Document15 pagesApplicationForm (GH FLATS)Dinesh ChoudharyNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyNo ratings yet

- Safe Software FME Desktop v2018Document1 pageSafe Software FME Desktop v2018Dinesh ChoudharyNo ratings yet

- Monthly Report - Nov 2016: Retail ResearchDocument10 pagesMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyNo ratings yet

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocument4 pagesEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyNo ratings yet

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- Post Budget Impact Analysis - MF & Debt: Retail ResearchDocument2 pagesPost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyNo ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- Report PDFDocument10 pagesReport PDFDinesh ChoudharyNo ratings yet

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocument4 pagesRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocument8 pagesRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNo ratings yet

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocument4 pagesRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Report PDFDocument3 pagesReport PDFDinesh ChoudharyNo ratings yet

- Retail Research: SIP in Equity Schemes - A Ready ReckonerDocument6 pagesRetail Research: SIP in Equity Schemes - A Ready ReckonerDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNo ratings yet

- Bar Questions and Answers From 2005 To 2011Document14 pagesBar Questions and Answers From 2005 To 2011Ma Theresa BuracNo ratings yet

- International Economics 13th Edition Carbaugh Test BankDocument16 pagesInternational Economics 13th Edition Carbaugh Test BankHeidiMartinqofa100% (59)

- Skeleton Arguments: A Practitioner's GuideDocument12 pagesSkeleton Arguments: A Practitioner's GuideLaexion100% (2)

- Manual Aspiradora LG Luv200rDocument75 pagesManual Aspiradora LG Luv200rrukaiserNo ratings yet

- Full Download Retail Management 8th Edition Weitz Solutions ManualDocument35 pagesFull Download Retail Management 8th Edition Weitz Solutions Manualangilaalomaw100% (28)

- Use Common Business Tools and Technology: D1.HGE - CL7.12 D1.HGA - CL6.12 D2.TCC - CL1.13 Trainee ManualDocument60 pagesUse Common Business Tools and Technology: D1.HGE - CL7.12 D1.HGA - CL6.12 D2.TCC - CL1.13 Trainee ManualPrincess Cordoves100% (1)

- Commercial Real Estate Interview PrepDocument8 pagesCommercial Real Estate Interview PrepciccioNo ratings yet

- For AdmissionDocument370 pagesFor AdmissionPajaniradjaNo ratings yet

- Oinp en FSSWDocument41 pagesOinp en FSSWmedlk100% (1)

- PowerGrid 1999Document71 pagesPowerGrid 1999Jonathan KokNo ratings yet

- Winner GOLDENGATEDocument1 pageWinner GOLDENGATEAnonymous xcyfRNyeMNo ratings yet

- Bar Examination 2005 Q&ADocument20 pagesBar Examination 2005 Q&ADianne Esidera RosalesNo ratings yet

- Gaurantee ExplainedDocument35 pagesGaurantee ExplainedGaurav SokhiNo ratings yet

- Veterinary Medicine 08-2016 Room AssignmentDocument7 pagesVeterinary Medicine 08-2016 Room AssignmentPRC BaguioNo ratings yet

- Cannon 11-27-2014Document76 pagesCannon 11-27-2014Dave MundyNo ratings yet

- Re-Alllignment Resolution-Sk TeppengDocument2 pagesRe-Alllignment Resolution-Sk TeppengLikey PromiseNo ratings yet

- Lecture ISO - 14915 - 2 - EN PDFDocument11 pagesLecture ISO - 14915 - 2 - EN PDFtest2012No ratings yet

- BMDocument55 pagesBMMilkyWay JonesNo ratings yet

- Rodel M. Sescon, MM: InstructorDocument23 pagesRodel M. Sescon, MM: InstructorR.v.EscoroNo ratings yet

- Ce303 HW1 PDFDocument2 pagesCe303 HW1 PDFالبرت آينشتاينNo ratings yet

- Academic Fanfare Tuba CompleteDocument4 pagesAcademic Fanfare Tuba CompleteRenato SouzaNo ratings yet

- Toaz - Info Kashato Shirts Entries PRDocument64 pagesToaz - Info Kashato Shirts Entries PRTylerNo ratings yet

- Aerosol Based Fire Extinguisher-1Document6 pagesAerosol Based Fire Extinguisher-1anuj mishra0% (1)

- Deed of Sale - Ludivina Baluyut - BlankDocument2 pagesDeed of Sale - Ludivina Baluyut - Blankroyrichard1228No ratings yet

- APASDEK Construction ServicesDocument2 pagesAPASDEK Construction ServicesLyric VideoNo ratings yet

- Cadre Restructuring AICEIA Objections Proposals To CBECDocument15 pagesCadre Restructuring AICEIA Objections Proposals To CBEChydexcustNo ratings yet

- Ramos v. Mandagan PDFDocument4 pagesRamos v. Mandagan PDFBlah BlamNo ratings yet

- 04 Rwa Application Form 2.0.Document1 page04 Rwa Application Form 2.0.JC JamesNo ratings yet