Professional Documents

Culture Documents

Challan NO./ ITNS 280: A D G P M 4 8 2 8 B

Challan NO./ ITNS 280: A D G P M 4 8 2 8 B

Uploaded by

Karur KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Challan NO./ ITNS 280: A D G P M 4 8 2 8 B

Challan NO./ ITNS 280: A D G P M 4 8 2 8 B

Uploaded by

Karur KumarCopyright:

Available Formats

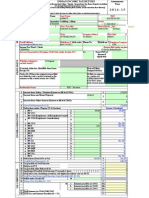

* Important : Please see notes overleaf before

filling up the challan

CHALLAN

NO./

ITNS 280

Single Copy (to be sent to the ZAO)

Tax Applicable (Tick One)*

(0020) INCOME-TAX ON COMPANIES

(CORPORATION TAX)

(0021) INCOME TAX (OTHER THAN

COMPANIES)

Assessment Year

- 1

0 1 5

Permanent Account Number

A D G P M 4 8 2 8 B

Full Name

K R I S

N A

A L

A S A

G A R,

Complete Address with City & State

N O

N A

: 1 9 ,

R A Y A

K

N

S T R

S A L

Tel. No.

E E T

E M

Pin

Type of Payment (Tick One)

Advance Tax (100)

Self Assessment Tax (300)

Tax on Regular Assessment (400)

Amount (in Rs. Only)

DETAILS OF PAYMENTS

Income Tax

Surcharge

Education Cess

Interest

Penalty

Others

Total

Total (in words)

CRORES

-----

LACS

----

Surtax (102)

Tax on Distributed Profits of Domestic Companies (106)

Tax on Distributed Income to Unit Holders (107)

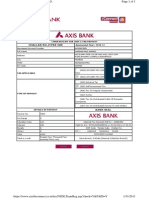

FOR USE IN RECEIVING BANK

1 6 0

Debit to A/c / Cheque credited on

D D

M M

Y Y

SPACE FOR BANK SEAL

1 6 0

Rupees One hundred and Sixty only

THOUSANDS

--------------

HUNDREDS

ONE

Paid in Cash/Debit to A/c /Cheque No.

Drawn on

TENS

SIX

Dated

UNITS

--

28.07.2016

(Name of the Bank and Branch)

Date:

28.07.2016

Rs.

Signature of person making payment

Taxpayers Counterfoil (To be filled up by tax payer)

SPACE FOR BANK SEAL

PAN

Received from

(Name)

Cash/ Debit to A/c /Cheque No.

For Rs.

Rs. (in words)

Drawn on

(Name of the Bank and Branch)

on account of

Companies/Other than Companies/Tax

Income Tax on

Type of Payment

for the Assessment Year

(Strike out whichever is not applicable)

(To be filled up by person making the payment)

Rs.

You might also like

- Challan 280Document2 pagesChallan 280ravibhartia1978No ratings yet

- RSD3Document1 pageRSD3Thaneshwar MishraNo ratings yet

- Challan NO./ ITNS 280Document2 pagesChallan NO./ ITNS 280amritaasraaNo ratings yet

- Challan 280Document1 pageChallan 280Mohit MehtaNo ratings yet

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Saravana KumarNo ratings yet

- Challan 280Document1 pageChallan 280purepuneetNo ratings yet

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDocument2 pagesChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshNo ratings yet

- CHALLAN 280 For 2013-14Document1 pageCHALLAN 280 For 2013-14mohanktvmNo ratings yet

- Challan 280-3Document1 pageChallan 280-3KamalNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment Yearanaga1982No ratings yet

- TDS TDSChallan280Document1 pageTDS TDSChallan280sikander1990No ratings yet

- ChallanDocument1 pageChallanRAVINDERNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- Challan F.Y 2012-13Document1 pageChallan F.Y 2012-13amit22505No ratings yet

- 27180Document1 page27180nupursingh604No ratings yet

- Sureshbhai (Challan)Document1 pageSureshbhai (Challan)Ketan DhameliyaNo ratings yet

- Challan No. ITNS 281 : Assessment YearDocument1 pageChallan No. ITNS 281 : Assessment YearTpm UmasankarNo ratings yet

- VP Goyalt Tds ChallanDocument1 pageVP Goyalt Tds Challanverma619No ratings yet

- Income Tax Proforma PakistanDocument16 pagesIncome Tax Proforma PakistanInayat UllahNo ratings yet

- Anita SahgalDocument3 pagesAnita SahgalNaveen AsthanaNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- Challan 280Document6 pagesChallan 280Narendra PrajapatiNo ratings yet

- Return ChallanDocument20 pagesReturn Challansyedfaisal_sNo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- IT-2 2011 With Formula and Surcharge and Annex DDocument15 pagesIT-2 2011 With Formula and Surcharge and Annex DPatti DaudNo ratings yet

- Challanitns 280Document2 pagesChallanitns 280VENKATALAKSHMINo ratings yet

- I.t.challan BlankDocument4 pagesI.t.challan Blankmaliktariq78100% (1)

- Akhtar Tax ReturnDocument7 pagesAkhtar Tax Returnsyedfaisal_sNo ratings yet

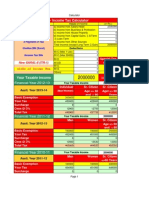

- Tax Calcuator Year WiseDocument5 pagesTax Calcuator Year WiseRajib MukherjeeNo ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- Income TaxDocument6 pagesIncome TaxKuldeep HoodaNo ratings yet

- Form 26QB: Income Tax DepartmentDocument3 pagesForm 26QB: Income Tax DepartmentAnand JaiswalNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalNo ratings yet

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

- Income Tax Payment Challan: PSID #: 144267713Document1 pageIncome Tax Payment Challan: PSID #: 144267713umar arshadNo ratings yet

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Document3 pagesSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarNo ratings yet

- ITR Form 1Document7 pagesITR Form 1gj29hereNo ratings yet

- 2013 Itr1 PR11Document9 pages2013 Itr1 PR11Akshay Kumar SahooNo ratings yet

- Axis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280Document1 pageAxis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280bha_goNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Document22 pagesSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7rahul srivastavaNo ratings yet

- GST FormatDocument3 pagesGST FormatAnmol GoyalNo ratings yet

- Oltas Servlet TanSearchDocument1 pageOltas Servlet TanSearchjmpnv007No ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Form PDF 688428240311221Document10 pagesForm PDF 688428240311221bhoomika rathodNo ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument7 pagesAssessment Year Sahaj Indian Income Tax Returnrajshri58No ratings yet

- Save This Page Print This Page Log OffDocument1 pageSave This Page Print This Page Log OffShanto JoseNo ratings yet

- Tax Deducted at Source (T.D.S.) : IND, HUF, EtcDocument1 pageTax Deducted at Source (T.D.S.) : IND, HUF, Etchit2011No ratings yet

- Itr 4 - Ay 2022-23 - VarunDocument10 pagesItr 4 - Ay 2022-23 - VarunAkash AggarwalNo ratings yet

- SRA Tax Return GuideDocument8 pagesSRA Tax Return Guidechopp7510No ratings yet

- Form PDF 250740030290722Document9 pagesForm PDF 250740030290722ANSH FFNo ratings yet

- Annual-Report FY-22 220909 030000Document171 pagesAnnual-Report FY-22 220909 030000Karur KumarNo ratings yet

- Annual Report Pankaj Piyush 2018 19Document99 pagesAnnual Report Pankaj Piyush 2018 19Karur KumarNo ratings yet

- May 12 Current AffaDocument6 pagesMay 12 Current AffaKarur KumarNo ratings yet

- 2016 Vegetable Oils Factsheet Groundnut Oil Europe FinalDocument13 pages2016 Vegetable Oils Factsheet Groundnut Oil Europe FinalKarur KumarNo ratings yet

- May 5, Current AffaiDocument3 pagesMay 5, Current AffaiKarur KumarNo ratings yet

- May 24 Current AffairDocument5 pagesMay 24 Current AffairKarur KumarNo ratings yet

- May 15current AffaDocument4 pagesMay 15current AffaKarur KumarNo ratings yet

- May 7 To 11 Current AffaiDocument5 pagesMay 7 To 11 Current AffaiKarur KumarNo ratings yet

- Advanced Bank MamagementDocument43 pagesAdvanced Bank MamagementKarur KumarNo ratings yet

- Accounting & Finance For Bankers Module CDocument43 pagesAccounting & Finance For Bankers Module CKarur KumarNo ratings yet