Professional Documents

Culture Documents

Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500Lacs

Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500Lacs

Uploaded by

Tripurari KumarCopyright:

Available Formats

You might also like

- Loan Appraisal FormatDocument7 pagesLoan Appraisal FormatKrishnamoorthySuresh50% (2)

- Partnership DeedDocument5 pagesPartnership DeedTripurari Kumar75% (4)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- AXIS PD Report FormatDocument7 pagesAXIS PD Report Formatvishal kharva100% (1)

- General Guidelines On Loans & Advance: Sachin Katiyar-Chief ManagerDocument53 pagesGeneral Guidelines On Loans & Advance: Sachin Katiyar-Chief Managersaurabh_shrutiNo ratings yet

- RBI Guidelines On Stress TestingDocument29 pagesRBI Guidelines On Stress TestingbankamitNo ratings yet

- DRUMS Project ReportDocument20 pagesDRUMS Project ReportTripurari Kumar100% (2)

- Solar Power Plant Project-LibreDocument43 pagesSolar Power Plant Project-LibreRamana KanthNo ratings yet

- T24 CollateralDocument79 pagesT24 CollateralMahmoud Shoman100% (3)

- New Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDocument17 pagesNew Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDominic Romero75% (4)

- Ubi Process Note of Shourya Virat Trading CompanyDocument11 pagesUbi Process Note of Shourya Virat Trading CompanyTripurari KumarNo ratings yet

- ES-1 500lacs and AboveDocument15 pagesES-1 500lacs and AboveTripurari KumarNo ratings yet

- Annexure - Common Loan Application Form With Formats I, II and III-EnglishDocument12 pagesAnnexure - Common Loan Application Form With Formats I, II and III-EnglishThe LoanWalaNo ratings yet

- Term Loan Review FormatDocument14 pagesTerm Loan Review Formatanuragmehta1985100% (2)

- Letter of Credit Appraisal NoteDocument8 pagesLetter of Credit Appraisal NoteNimitt ChoudharyNo ratings yet

- Credit Policy - Due Diligence: EpathshalaDocument9 pagesCredit Policy - Due Diligence: EpathshalaAjay Singh Phogat100% (1)

- Advances Pre Sanction and Post SanctionDocument16 pagesAdvances Pre Sanction and Post Sanctionmail2ncNo ratings yet

- 15.preparation of ProposalDocument48 pages15.preparation of Proposalpuran1234567890No ratings yet

- Allahabad Bank: Appraisal FormatDocument5 pagesAllahabad Bank: Appraisal FormatDEVENDRA BHARDWAJNo ratings yet

- Credit Appraisal Process GRP 10Document18 pagesCredit Appraisal Process GRP 10Priya JagtapNo ratings yet

- Book - Credit Monitoring & NPA - 31!3!2013Document172 pagesBook - Credit Monitoring & NPA - 31!3!2013Manoj KularNo ratings yet

- Check List LOANDocument12 pagesCheck List LOANshushanNo ratings yet

- Finova - PD Format Oct 2019Document8 pagesFinova - PD Format Oct 2019Madhusudan ParwalNo ratings yet

- India Home Loans LTD Credit Policy of India Home Loans LTDDocument9 pagesIndia Home Loans LTD Credit Policy of India Home Loans LTDvinayak_cNo ratings yet

- DocumentationDocument36 pagesDocumentationRamesh BethaNo ratings yet

- Change of Address FormDocument1 pageChange of Address FormgenesissinghNo ratings yet

- Questions: Company BackgroundDocument5 pagesQuestions: Company BackgroundVia Samantha de AustriaNo ratings yet

- Pre-Sanction Visit Report For Retail LendingDocument5 pagesPre-Sanction Visit Report For Retail Lendingneeraj guptaNo ratings yet

- Annexure I Pre-Sanction Inspection ReportDocument1 pageAnnexure I Pre-Sanction Inspection ReportAjay DuttaNo ratings yet

- Credit Appraisal of Project Financing and Working CapitalDocument70 pagesCredit Appraisal of Project Financing and Working CapitalSami ZamaNo ratings yet

- Appraisal Note For Fresh/renewal /enhancement of MSME Loans of Less Than Rs. 100 Lakhs (Total Limit) - Other Than MUDRA LoansDocument18 pagesAppraisal Note For Fresh/renewal /enhancement of MSME Loans of Less Than Rs. 100 Lakhs (Total Limit) - Other Than MUDRA LoanskiransaradhiNo ratings yet

- Preventive Vigilance MandatoryDocument22 pagesPreventive Vigilance MandatoryMehanNo ratings yet

- Credit Appraisal: by N.R.Trivedi Dy. Manager Credit Head Office, Saurashtra Gramin BankDocument13 pagesCredit Appraisal: by N.R.Trivedi Dy. Manager Credit Head Office, Saurashtra Gramin Bankniravtrivedi72No ratings yet

- Andhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsDocument9 pagesAndhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsSivaramakrishna NeelamNo ratings yet

- Guidance Note On Audit of BanksDocument808 pagesGuidance Note On Audit of BanksGanesh PhadatareNo ratings yet

- Chetna AdhiyaDocument5 pagesChetna AdhiyaVikash MauryaNo ratings yet

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- Credit Appraisal in SIDBIDocument131 pagesCredit Appraisal in SIDBIShakti MishraNo ratings yet

- Assessment of Working Capital Finance 95MIKGBVDocument31 pagesAssessment of Working Capital Finance 95MIKGBVpankaj_xaviers100% (1)

- Factors, Impact, Symptoms of NPADocument7 pagesFactors, Impact, Symptoms of NPAMahesh ChandankarNo ratings yet

- Assessment of Working CapitalDocument43 pagesAssessment of Working CapitalAshutosh VermaNo ratings yet

- Check List For Audit Irregularities Ba MangaluruDocument15 pagesCheck List For Audit Irregularities Ba MangaluruKislayNikharNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationRajkumar NateshanNo ratings yet

- Commercial Credit Information Report (CCR) - GuideDocument22 pagesCommercial Credit Information Report (CCR) - Guidecyber ageNo ratings yet

- 06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansDocument40 pages06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansTarannum Aurora 20DM226No ratings yet

- Promotion Study Material I To II and II To III-1Document131 pagesPromotion Study Material I To II and II To III-1Shuvajoy ChakrabortyNo ratings yet

- Loan CalculatorDocument15 pagesLoan CalculatorMahrukh ZubairNo ratings yet

- Sme WC AssessmentDocument8 pagesSme WC Assessmentvalinciamarget72No ratings yet

- Registration Form SHGDocument3 pagesRegistration Form SHGPrabha DineshNo ratings yet

- Adv 160Document100 pagesAdv 160Asif Rafi100% (1)

- Credit Audit Format-PeopleDocument13 pagesCredit Audit Format-Peoplenaidu_divya08100% (4)

- Loan Appraisal Format For Limits Less Than One CroreDocument14 pagesLoan Appraisal Format For Limits Less Than One Croresidh09870% (1)

- Working CapitalDocument62 pagesWorking CapitalHrithika AroraNo ratings yet

- Documentation of Bank (Bank of Baroda)Document40 pagesDocumentation of Bank (Bank of Baroda)Devesh Verma100% (1)

- Credit Appraisal ReportDocument76 pagesCredit Appraisal Reportnisheetsareen100% (5)

- Sme Study Modules For Quick Reference PDFDocument180 pagesSme Study Modules For Quick Reference PDFNilima ChowdhuryNo ratings yet

- Iba Cir FormatDocument1 pageIba Cir FormatUCO BANKNo ratings yet

- Credit Risk Management On (RBI)Document57 pagesCredit Risk Management On (RBI)Anvesh Chintakindi annuNo ratings yet

- Credit Risk Grading PDFDocument14 pagesCredit Risk Grading PDFaziz100% (1)

- My Project of Vijaya BankDocument103 pagesMy Project of Vijaya Banktamizharasid100% (1)

- Credit Appraisal ProcessDocument43 pagesCredit Appraisal ProcessAbhinav Singh100% (1)

- 1710-Dda 31.05.17Document53 pages1710-Dda 31.05.17sunilNo ratings yet

- Cash Credit Proposal For Bank FinanceDocument15 pagesCash Credit Proposal For Bank Financeajaya thakurNo ratings yet

- Uco BankDocument77 pagesUco BankSankalp PurwarNo ratings yet

- Presentation Camille AlbaneDocument42 pagesPresentation Camille AlbaneTripurari KumarNo ratings yet

- Presentation Camille Albane PDFDocument42 pagesPresentation Camille Albane PDFTripurari KumarNo ratings yet

- Egg Farming 20000Document14 pagesEgg Farming 20000Tripurari KumarNo ratings yet

- ES-1 500lacs and AboveDocument15 pagesES-1 500lacs and AboveTripurari KumarNo ratings yet

- Egg Farming 20000Document14 pagesEgg Farming 20000Tripurari KumarNo ratings yet

- Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsDocument8 pagesExecutive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsTripurari KumarNo ratings yet

- Ubi Process Note of Shourya Virat Trading CompanyDocument11 pagesUbi Process Note of Shourya Virat Trading CompanyTripurari KumarNo ratings yet

- Cost of Project: Smrity Paper Mills Private LimitedDocument17 pagesCost of Project: Smrity Paper Mills Private LimitedTripurari KumarNo ratings yet

- Asm Charitable Super Specialty Hospital and Medical CollegeDocument20 pagesAsm Charitable Super Specialty Hospital and Medical CollegeTripurari KumarNo ratings yet

- Hospital in PatnaDocument9 pagesHospital in PatnaTripurari KumarNo ratings yet

- Trouble Shooting FilingDocument6 pagesTrouble Shooting FilingTripurari KumarNo ratings yet

- Bihar Medical Services & Infrastructure Corporation LTD.: Performance Appraisal FormDocument10 pagesBihar Medical Services & Infrastructure Corporation LTD.: Performance Appraisal FormTripurari KumarNo ratings yet

- Permanual Ferro ScrapDocument421 pagesPermanual Ferro ScrapTripurari KumarNo ratings yet

- Exercises: CLASS - 10th Chapter - 1 (Development) EconomicsDocument31 pagesExercises: CLASS - 10th Chapter - 1 (Development) EconomicsDikshita BajajNo ratings yet

- Chapter 18 - Financial Management Learning GoalsDocument25 pagesChapter 18 - Financial Management Learning GoalsRille LuNo ratings yet

- Modified Guidelines On The Pag-IBIG Fund Affordable Housing ProgramDocument10 pagesModified Guidelines On The Pag-IBIG Fund Affordable Housing ProgramnadinemuchNo ratings yet

- Bank of Industry NigeriaDocument4 pagesBank of Industry NigeriaWalter KlotzNo ratings yet

- Summative Test 2 in Gen Math QUARTER 2Document3 pagesSummative Test 2 in Gen Math QUARTER 2Jessa BarberoNo ratings yet

- Credit Collection Units 1 3Document46 pagesCredit Collection Units 1 3elle gutierrezNo ratings yet

- Loan ComputationDocument13 pagesLoan ComputationJerson ArinqueNo ratings yet

- An Assessment of Credit Risk Management PracticesDocument27 pagesAn Assessment of Credit Risk Management PracticesHunde gutemaNo ratings yet

- Topic 1 Development of CreditDocument3 pagesTopic 1 Development of CreditPhilip Jayson CarengNo ratings yet

- Union Parivahan SchemeDocument1 pageUnion Parivahan SchemeBUDU GOLLARYNo ratings yet

- Connected LendingDocument11 pagesConnected Lendingmentor_muhaxheriNo ratings yet

- Micro and Small Scale Enterprises' Financing Preference in Line With POH and Access To Credit: Empirical Evidence From Entrepreneurs in EthiopiaDocument30 pagesMicro and Small Scale Enterprises' Financing Preference in Line With POH and Access To Credit: Empirical Evidence From Entrepreneurs in EthiopiaRajendra LamsalNo ratings yet

- 4 Current Liabilities MGMTDocument5 pages4 Current Liabilities MGMTMark Lawrence YusiNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter TenDocument29 pagesSolutions For End-of-Chapter Questions and Problems: Chapter Tenester jofreyNo ratings yet

- Stuy Town CW CapitalDocument50 pagesStuy Town CW CapitalrahNo ratings yet

- Abiy MogesDocument67 pagesAbiy MogesMelesNo ratings yet

- Corrected Business Plan ReportDocument45 pagesCorrected Business Plan ReportJeorge PaxNo ratings yet

- Chapter - 5 - Small BusinessDocument13 pagesChapter - 5 - Small BusinessMahedre ZenebeNo ratings yet

- Citibank Models Credit Risk On Hybrid Mortgage LoansDocument17 pagesCitibank Models Credit Risk On Hybrid Mortgage LoansHussein AtwiNo ratings yet

- KBW Investment KycDocument2 pagesKBW Investment KycGreen Sustain EnergyNo ratings yet

- Janata Bank Micro CreditDocument25 pagesJanata Bank Micro CreditMahfoz KazolNo ratings yet

- Application Transaction ProcedureDocument3 pagesApplication Transaction ProcedurefaridatunNo ratings yet

- Sanction, Documentation and Disbursement of CreditDocument32 pagesSanction, Documentation and Disbursement of Creditrajin_rammstein100% (1)

- Promissory NoteDocument4 pagesPromissory NoteAGBA NJI THOMASNo ratings yet

- Kyc Aml Master Key Module 4Document25 pagesKyc Aml Master Key Module 4prashant pradhan100% (3)

- Ketema Asfaw-1Document47 pagesKetema Asfaw-1Ketema AsfawNo ratings yet

- 20171012first Term Final Exam AnswersDocument4 pages20171012first Term Final Exam AnswersSaad Shehryar0% (1)

Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500Lacs

Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500Lacs

Uploaded by

Tripurari KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500Lacs

Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500Lacs

Uploaded by

Tripurari KumarCopyright:

Available Formats

ES-2

(Branch or SARAL or RO or FGMO or CO)

Executive Summary Format for Credit proposal of above Rs.10Lacs and less than Rs.500Lacs

Reference:

Date:

MEMORANDUM TO (SANCTIONING AUTHORITY)

A/C WITH:________BRANCH_______RO______ FGMO

A.1

A.2

A.3

G.

Name of the account

Address

CIN

Registration no., if applicable

PAN

Group, if any

Date of incorporation

Constitution

Dealing with bank since

Credit facility since

If the a/c is new, name of present

bankers, if any

Line of activity

H.

I.

BSR code (Sector)

Classification

J.

K.

L.

(If MSME, original investment in

P&M/equipment)

Category, if applicable

Banking arrangement

CGTMSE Coverage

B.

C.

D.

E.1

E.2

F.

: M/s Shourya Virat Trading Company

:

:

:

: NA

:

: Proprietorship

: New Account

New Account hence no applicable

: Current Account with IDBI Bank

: Trading of Raw Material and Finished Goods of PVC

Pipes and proposed to manufacture the PVC Pipes

: (Sector as per BSR code)

: (Agriculture, Micro/Small/medium/large industry,

Infrastructure/Non-infrastructure etc., whichever is

applicable)

:

: OBC

: Sole

: (Yes)

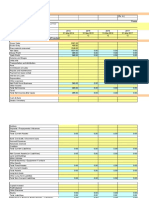

1. Purpose of Note (Synopsis of Final Recommendation)

Nature of

Limit

Existing

Limit.

Prop.

Limit

Applicable

Our Bank

0.00

Total

Other

Banks/FIs

0.00

0.00

Interest/Commission

[With reference to BR]

Existing /

Prop.

Effective

/Effective

rate

rate

(Rs. in _____)

Margin

Conces

sion

Exist

Prop

Total

0.00

Grand

0.00

Total

(The referred interest rate as well as approval of concession shall be enumerated.)

Delegated authority: The proposal falls within the delegated authority of bRA on account of _______.

Date of sanction / Last review

Sanctioning authority (previous sanction)

Due date of review

:

:

:

Name of the concern

Name of the Branch/RO

Asset classification

Status of account

Credit rating:

:

: Regular or EAS / SMA due to ______

ABS as of previous year

ABS as of current year

Date:

Date:

Rating Date

Internal Rating

2.

Names of Proprietor / Partners / Directors & their means:

Sr.

No.

Name

Designation

PAN

(Rs. in ______)

Means

Previou

s

Date:

DIN, if

applicable

Latest

Date:

Total

(PAN & DIN, if applicable should be invariably mentioned / Reason for variation in means to be

commented upon)

3.

4.1

Background

(Including

latest

development in business & present

request in brief.)

3.1 Firm/Company/Concern

3.2 Promoters / Directors

Proprietor / Partners

wherever

Capital

Structure,

applicable

Authorised Capital

Issued & Subscribed Capital

Paid Up Capital

Book Value

Market Value (Listed companies)

:

:

:

:

:

(number) of share of Rs.___ each

(number) of share of Rs.___ each

(number) of share of Rs.___ each

If applicable

4.2 Shareholding pattern

In case of company indicate following details:

Share Holder

No. of

Shares

Face Value

Current

Date:

Holding %

Previous

Date:

TOTAL

In case of partnership firms indicate capital contributed by each partner separately:

Name of the partner

Current/Date:

Previous/Date:

TOTAL

Page 2 of 9

Name of the concern

Name of the Branch/RO

4.3 Any significant change in share holding pattern

5.

Comments on the following:

5.1 Credit Report/s

5.2 Search report/s

5.3 CIBIL Report/s

(CIBIL report of promoters/guarantors should

also be commented upon along with

individual score)

6.1

Comment on due diligence of borrower

: (Along with Date of Report)

6.2

Whether the name of the concern /

directors/group concerns figure in RBI

defaulters / caution list / caution list of

exporters / wilful defaulters /ECGC SAL List.

If yes, furnish details (Date of the list shall

be mentioned)

: (RBI Defaulter List (Suit filed/No-suit filed

Dt....: Yes/No

RBI Wilful Defaulter (Suit filed/Non suit

filed) Dt....: Yes/No

ECGC SAL List Dt....: Yes/No

RBI caution List as on.... : Yes/No

Exporter Caution List as on ...: Yes/No)

6.3

Whether director / partner / proprietor is a

director in our / other bank or is related to

them. If yes i)

Name of such Director with name of

the Bank

ii)

Type of Relation

: (Yes/No

If yes, comments on the same)

6.4

Any litigation in force against the firm /

company or against the partners / director.

If so, mention details and present position

: (Yes/No

If yes, comments on the same)

7.

Whether account is taken / to be taken

over. If so norms for takeover are fulfilled

: Yes/No

If Yes, compliance of takeover norms

8.1

Operational experience of our bank with

regard to sister / allied concerns

Name of

Branch

Conduct

Working

Term

the

of

Capital

Loan

Concern

Account

of

other

Banks

on

sister

:

:

:

Contingent

Investments

Present

irregularity, if

any

: (Including Name of sister

Credit/CIBIL report thereof)

MOR

8.2

Comments

concerns

8.3

Brief Financials of Sister Concerns, if any

9.

Comments on foreign currency exposure

and un-hedged exposure, if any

: (Latest provision amount to be captured

from Finacle through UFCE menu &

compliance of UFCE policy including

pricing to be confirmed)

10.1 Nature & value of prime security (Immovable assets):

Nature / Description

Value

Dt. & Value along

of primary Security

Accepted by

with name of

Branch

Valuers

Mkt Value:

Distress Value:

Guideline Value:

Page 3 of 9

Insurance

Amount:

Date

of

Expiry:

concern

&

[Rs. in ____]

CERSAI

Remarks

Search with

date

Name of the concern

Name of the Branch/RO

Name of Valuer:

TOTAL

(Whether insurance is adequate should be comment upon. Details of valuation of plant & machinery, if

applicable shall also be provided. Comments on latest & previous valuation, wherever available should

be mentioned)

10.2 Nature & value of collateral security:

(Rs. In ____)

Nature / Description

Value

Dt. & Value along

Insurance

CERSAI

Remarks

of collateral

Accepted by

with name of

Search with

Security

Branch

Valuers

date

Mkt Value:

Amount:

Distress Value:

Date

of

Expiry:

Guideline Value:

Name of Valuer:

Total

Our Share

Collateral coverage

(In %)

(Whether insurance is adequate should be comment upon. Comments on latest & previous valuation,

wherever available should be mentioned)

Comments on Due diligence of property: (Primary/Collateral)

Comments on Title Search Report (Date of report/including specific comments on enforceability of

mortgage):

10.3

Personal guarantee / corporate guarantee:

Name of the

PAN

Latest Means

Guarantor

(Credit Report date _____)

(Rs. In ____)

Means as per last sanction

(Credit report date ____)

Total

(Reason for variation in means to be commented upon)

11

Financial indicators of borrower

S.

No.

Year ended / ending

a.

b.

c.

d.

e.

e(i)

Paid-Up Capital

Reserves & Surplus

Intangible assets

Tangible Net Worth (a+b-c)

Long Term Liabilities

(w/w unsecured loan i.e.

Quasi Equity)

Capital Employed (d+e)

Net Block

Investments

Non Current Assets

f.

g.

h.

i.

: -

Mar.__

(Aud.)

Name of statutory auditors: __________

Membership No. _________

Firm Registration No. __________

- Date of Certificate of C.A. who have audited the

latest financials: ________ (As per IC 9751

dt.28.11.13)]

(Rs. in ____)

Mar.__

Mar.___

Mar.___

Mar.___

(Aud.)

(Previous

(Aud /

(Proj.)

Sanction)*

Est.)

Page 4 of 9

Name of the concern

Name of the Branch/RO

j.

Net Working Capital (f-g-h-i)

or (k-l)

k.

Current Assets

l.

Current Liabilities

m.

Current Ratio (k/l)

n.

DER (TL/TNW) (e/d)

o.

TOL/TNW Ratio ((e+l)/d)

p.

TOL/TNW along with

Contingent Liabilities

q.

Net Sales

r.

Cost of Sales

s.

Operating Profit/EBDITA

t.

Other Income

u.

Interest/Finance Charges

v.

Depreciation

w.

Tax

x.

Net Profit after Tax (s+t-u-vw)

y.

Cash Accruals (v+x)

* As per previous sanction, wherever applicable.

11.1

11.2

Comments on Financial Indicators

Audit Notes in Balance Sheet if any, to be

specified

Comments on Restructuring, if any

:

:

12

Evaluation of the following:

Management Risk

Industry Risk

Business risk

13.

13.1

Conduct of the account

Regularity in submission of

Stock/Book Debt Statement

QPR/Half Yearly Statement

Financial Statements

CMA Data

Name of the Statement / Return

11.3

13.2

(If applicable Yes/No)

:

:

:

:

No. of Statements /

Return recd. During

the year

: (If

applicable

Number)

: (If

applicable

Number)

Stock Statement / BD

QPR/Half Yearly Statement

Page 5 of 9

Last Stat. /

Return recd.

(Date)

(Date)

Name of the concern

Name of the Branch/RO

13.3

Comments on operations / overdues

Particulars

Previous

Year

Current

Year

Credit Turnover

Sales

% of credit

turnover to sales

Maximum Debit

Balance

Average Debit

Balance

No. of days in

debit

Inward cheque

return (No.)

Outward Cheque

return (No.)

No. of occasions

excesses/ TOD

allowed

Maximum

Excesses/ TOD

allowed

Remarks:

13.4

13.5

13.6

Comments on statutory dues

Comments on invocation of BG/Devolvement

of LC, wherever applicable

Any irregular feature observed in the

monitoring report, wherever applicable

:

:

: (Including Date of MMR)

13.7

Value of account (During Financial Year):

i) Advances:

Previous year/Date:

- Interest Income

- Fee Based Income

ii) Third party products:

iii)

Retail / Consumer / Finance[to

No. of Accounts

employees associates]

iv) Deposits:

- Own

- Third Party

Amount

14.

14.1

Compliance to terms of sanction

Completion of Mortgage formalities & vetting

of mortgage by advocate along with date

14.2

Registration of Charges with RoC

14.3

Whether documents valid and in force

14.4

14.5

Compliances to CPAO observations along with

date of CPA

Whether all other terms and conditions

complied along with observations/remarks of

sanctioning authority, if any, as per previous

sanction / modification proposals

Page 6 of 9

(Rs. in _____)

Current year/Date:

Amount

Tenure

:

: (Yes/No

Date of completion of mortgage:

Date of legal vetting of mortgage: )

: (Yes/No

Search ID

Date:______)

: (Yes/No

Date of documents:

Date of DBC:

Date

of

legal

Vetting

documents:______)

: (Yes/No

Date:______)

(Yes/No)

of

Name of the concern

Name of the Branch/RO

14.6

14.7

14.8.1

14.8.2

14.9

14.10

(In case

Whether Consortium meetings

prescribed periodic intervals

held

at

Compliance of consortium/multiple banking

guidelines of the bank

Compliance on Loan Policy

Compliance of RBI guidelines

Date of last inspection of factory / stock /

assets, etc

Date of Technical Inspection, wherever

applicable

of non-compliance, suitable justification shall be

15.

Audit

observations

(Pending for compliance)

15.1RBI Inspection

15.2 RBIA (Internal Audit)

15.3Concurrent

15.4Statutory

15.5 Stock Audit

Date

: (Yes/No)

Date of last Consortium meeting

Gist of minutes:

: (Yes/No)

: (Yes/No)

(Yes/No)

: (Date:

Comments :)

: (Date:

Gist of inspection :)

provided)

Observations

Branch Replies

including COR

Present status

Exposure details from our bank including investment, if any.:

OUR BANK

Limits

Limits

O/s as on

Value of Prime

Nature of Facility

Existing

Recomm

Securities [Our

ended

share]

(Rs. in _____)

16.1

Irregularities,

if any

TOTAL

Investment

(Date of Stock-Book debt statement should be mentioned in prime securities)

16.2 Exposure details from banking system/FIs (Incl. Our Bank):

Existing Limits

Fund Based WC

Non Fund Based

Term Loan

Sl.

No.

Name of

the Bank

TOTAL

Proposed Limits

Sl.

Name of

No.

the Bank

% Share

Amt.

% Share

Fund Based WC

% Share

Amt.

Amt.

%

Share

Non Fund Based

% Share

Amt.

Amt.

(Rs. In _____)

Comments on

Conduct of the

Account and

position of last

sanction / review

Term Loan

% Share

Amt.

TOTAL

16.3

17.

17.1

Other liabilities of directors / partners [In

their individual capacity]

Comments on assessment of limits

Projected Level of Sales

Page 7 of 9

:

: (Overall limit and our share)

: (Including sales achieved during current

year, achievement vis-a-vis projection

during last year and details of major

customers/buyers)

Name of the concern

Name of the Branch/RO

17.2

Inventory / Receivable holding period

Particulars

: (Applicable for assessment under FBF

method)

[Rs. in _____]

Mar.____

Mar.___

Mar.____

Mar._____

(Aud.)

(Aud.)

(Aud. / Est.)

(Proj.)

Raw materials

- Indigenous

- Imported

(Months Consumption)

Stock in process

(Months Cost of Production)

Finished Goods

(Months Cost of Sales)

Stores

(Months Consumption)

Export Receivables

(Months Export Sales)

Domestic Receivables

(Months domestic Sales)

Other Current Assets

Sundry Creditors

(Months Purchases)

17.3

Working Capital Assessment

: (FBF/Cash Budget/turnover method)

17.4

Term Loan

17.5 Non-Fund Based Limits

:

17.5.1Nature: (Performance/Financial BG ) (Inland/Import LC)(Domestic/Foreign BG)

17.5.2Amount:

17.5.3Period/Usance: (Period of BG/Usance of LC)

17.5.4Commission:

17.5.5Margin: (By way of Cash/FDR)

17.5.6Assessment: (Including Name of major suppliers/LG beneficiaries/LC beneficiaries

(Buyers))

17.6

Any other matter including Forex

related

concessions

along

with

justification for concession, if any

: (Banks guidelines for considering concession in

interest rate/service charge as per circular

letter no.2163 dt.09.06.2015 shall be complied.)

18

INTERNAL CREDIT RATING

:

Marks Obtained

Previous Year

Current Year

ABS as of

ABS as of

Parameters

Borrower Rating

Facility Rating

Risk Mitigators

Business aspects

Total Marks with Grade

Rating Rationale:

(In case of down-gradation of credit rating, justification for the same shall be provided. Comments on

external rating, wherever applicable)

19.

Recommendations

:

We recommend for review/renewal/enhancement/fresh credit facilities as mentioned below on stated

terms and conditions:

(Rs. In _____)

Amount

Int./

Nature of Limit

Margin

Primary Security

Comm.

Existing

Proposed

Page 8 of 9

Name of the concern

Name of the Branch/RO

TOTAL

(Present Base Rate @ ________ w.e.f. ______ vide IC No._______ dt._________)

19.1

19.2

19.3

19.4

19.5

19.6

Collateral Security:

Personal/Corporate Guarantee:

Processing charges/Upfront Fees:

Upfront Contribution (In case of Term Loan)

Repayment Schedule (In case of Term Loan)

Other Matters:

20. Terms and conditions:

Annexure-I: Standard terms and conditions

Annexure-II: Undertakings to be obtained from the borrower

Annexure-III: Standard terms for advance under Consortium/Multiple Banking Arrangement

Annexure-IV: Sector Specific additional terms and conditions

Annexure-V: MIS template (As per Instruction Circular 9989 dt.01.07.2014)

Annexure-VI: Flow Chart (As per Instruction Circular 34-2015 dt.01.04.2015)

(In annexure-I/II/III/IV, standard conditions to be appropriately selected during the sanction process

based on nature of advance & constitution of the borrower as per Instruction Circular 9287

dt.16.05.2012. Further, standard terms and conditions should not be repeated in Point No.20 of the

Executive Summary and only reference of the annexure to be made therein.)

Page 9 of 9

You might also like

- Loan Appraisal FormatDocument7 pagesLoan Appraisal FormatKrishnamoorthySuresh50% (2)

- Partnership DeedDocument5 pagesPartnership DeedTripurari Kumar75% (4)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- AXIS PD Report FormatDocument7 pagesAXIS PD Report Formatvishal kharva100% (1)

- General Guidelines On Loans & Advance: Sachin Katiyar-Chief ManagerDocument53 pagesGeneral Guidelines On Loans & Advance: Sachin Katiyar-Chief Managersaurabh_shrutiNo ratings yet

- RBI Guidelines On Stress TestingDocument29 pagesRBI Guidelines On Stress TestingbankamitNo ratings yet

- DRUMS Project ReportDocument20 pagesDRUMS Project ReportTripurari Kumar100% (2)

- Solar Power Plant Project-LibreDocument43 pagesSolar Power Plant Project-LibreRamana KanthNo ratings yet

- T24 CollateralDocument79 pagesT24 CollateralMahmoud Shoman100% (3)

- New Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDocument17 pagesNew Central Bank Act (R.A. 7653) : Establishment and Organization of The Bangko Sentral NG PilipinasDominic Romero75% (4)

- Ubi Process Note of Shourya Virat Trading CompanyDocument11 pagesUbi Process Note of Shourya Virat Trading CompanyTripurari KumarNo ratings yet

- ES-1 500lacs and AboveDocument15 pagesES-1 500lacs and AboveTripurari KumarNo ratings yet

- Annexure - Common Loan Application Form With Formats I, II and III-EnglishDocument12 pagesAnnexure - Common Loan Application Form With Formats I, II and III-EnglishThe LoanWalaNo ratings yet

- Term Loan Review FormatDocument14 pagesTerm Loan Review Formatanuragmehta1985100% (2)

- Letter of Credit Appraisal NoteDocument8 pagesLetter of Credit Appraisal NoteNimitt ChoudharyNo ratings yet

- Credit Policy - Due Diligence: EpathshalaDocument9 pagesCredit Policy - Due Diligence: EpathshalaAjay Singh Phogat100% (1)

- Advances Pre Sanction and Post SanctionDocument16 pagesAdvances Pre Sanction and Post Sanctionmail2ncNo ratings yet

- 15.preparation of ProposalDocument48 pages15.preparation of Proposalpuran1234567890No ratings yet

- Allahabad Bank: Appraisal FormatDocument5 pagesAllahabad Bank: Appraisal FormatDEVENDRA BHARDWAJNo ratings yet

- Credit Appraisal Process GRP 10Document18 pagesCredit Appraisal Process GRP 10Priya JagtapNo ratings yet

- Book - Credit Monitoring & NPA - 31!3!2013Document172 pagesBook - Credit Monitoring & NPA - 31!3!2013Manoj KularNo ratings yet

- Check List LOANDocument12 pagesCheck List LOANshushanNo ratings yet

- Finova - PD Format Oct 2019Document8 pagesFinova - PD Format Oct 2019Madhusudan ParwalNo ratings yet

- India Home Loans LTD Credit Policy of India Home Loans LTDDocument9 pagesIndia Home Loans LTD Credit Policy of India Home Loans LTDvinayak_cNo ratings yet

- DocumentationDocument36 pagesDocumentationRamesh BethaNo ratings yet

- Change of Address FormDocument1 pageChange of Address FormgenesissinghNo ratings yet

- Questions: Company BackgroundDocument5 pagesQuestions: Company BackgroundVia Samantha de AustriaNo ratings yet

- Pre-Sanction Visit Report For Retail LendingDocument5 pagesPre-Sanction Visit Report For Retail Lendingneeraj guptaNo ratings yet

- Annexure I Pre-Sanction Inspection ReportDocument1 pageAnnexure I Pre-Sanction Inspection ReportAjay DuttaNo ratings yet

- Credit Appraisal of Project Financing and Working CapitalDocument70 pagesCredit Appraisal of Project Financing and Working CapitalSami ZamaNo ratings yet

- Appraisal Note For Fresh/renewal /enhancement of MSME Loans of Less Than Rs. 100 Lakhs (Total Limit) - Other Than MUDRA LoansDocument18 pagesAppraisal Note For Fresh/renewal /enhancement of MSME Loans of Less Than Rs. 100 Lakhs (Total Limit) - Other Than MUDRA LoanskiransaradhiNo ratings yet

- Preventive Vigilance MandatoryDocument22 pagesPreventive Vigilance MandatoryMehanNo ratings yet

- Credit Appraisal: by N.R.Trivedi Dy. Manager Credit Head Office, Saurashtra Gramin BankDocument13 pagesCredit Appraisal: by N.R.Trivedi Dy. Manager Credit Head Office, Saurashtra Gramin Bankniravtrivedi72No ratings yet

- Andhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsDocument9 pagesAndhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsSivaramakrishna NeelamNo ratings yet

- Guidance Note On Audit of BanksDocument808 pagesGuidance Note On Audit of BanksGanesh PhadatareNo ratings yet

- Chetna AdhiyaDocument5 pagesChetna AdhiyaVikash MauryaNo ratings yet

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- Credit Appraisal in SIDBIDocument131 pagesCredit Appraisal in SIDBIShakti MishraNo ratings yet

- Assessment of Working Capital Finance 95MIKGBVDocument31 pagesAssessment of Working Capital Finance 95MIKGBVpankaj_xaviers100% (1)

- Factors, Impact, Symptoms of NPADocument7 pagesFactors, Impact, Symptoms of NPAMahesh ChandankarNo ratings yet

- Assessment of Working CapitalDocument43 pagesAssessment of Working CapitalAshutosh VermaNo ratings yet

- Check List For Audit Irregularities Ba MangaluruDocument15 pagesCheck List For Audit Irregularities Ba MangaluruKislayNikharNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationRajkumar NateshanNo ratings yet

- Commercial Credit Information Report (CCR) - GuideDocument22 pagesCommercial Credit Information Report (CCR) - Guidecyber ageNo ratings yet

- 06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansDocument40 pages06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansTarannum Aurora 20DM226No ratings yet

- Promotion Study Material I To II and II To III-1Document131 pagesPromotion Study Material I To II and II To III-1Shuvajoy ChakrabortyNo ratings yet

- Loan CalculatorDocument15 pagesLoan CalculatorMahrukh ZubairNo ratings yet

- Sme WC AssessmentDocument8 pagesSme WC Assessmentvalinciamarget72No ratings yet

- Registration Form SHGDocument3 pagesRegistration Form SHGPrabha DineshNo ratings yet

- Adv 160Document100 pagesAdv 160Asif Rafi100% (1)

- Credit Audit Format-PeopleDocument13 pagesCredit Audit Format-Peoplenaidu_divya08100% (4)

- Loan Appraisal Format For Limits Less Than One CroreDocument14 pagesLoan Appraisal Format For Limits Less Than One Croresidh09870% (1)

- Working CapitalDocument62 pagesWorking CapitalHrithika AroraNo ratings yet

- Documentation of Bank (Bank of Baroda)Document40 pagesDocumentation of Bank (Bank of Baroda)Devesh Verma100% (1)

- Credit Appraisal ReportDocument76 pagesCredit Appraisal Reportnisheetsareen100% (5)

- Sme Study Modules For Quick Reference PDFDocument180 pagesSme Study Modules For Quick Reference PDFNilima ChowdhuryNo ratings yet

- Iba Cir FormatDocument1 pageIba Cir FormatUCO BANKNo ratings yet

- Credit Risk Management On (RBI)Document57 pagesCredit Risk Management On (RBI)Anvesh Chintakindi annuNo ratings yet

- Credit Risk Grading PDFDocument14 pagesCredit Risk Grading PDFaziz100% (1)

- My Project of Vijaya BankDocument103 pagesMy Project of Vijaya Banktamizharasid100% (1)

- Credit Appraisal ProcessDocument43 pagesCredit Appraisal ProcessAbhinav Singh100% (1)

- 1710-Dda 31.05.17Document53 pages1710-Dda 31.05.17sunilNo ratings yet

- Cash Credit Proposal For Bank FinanceDocument15 pagesCash Credit Proposal For Bank Financeajaya thakurNo ratings yet

- Uco BankDocument77 pagesUco BankSankalp PurwarNo ratings yet

- Presentation Camille AlbaneDocument42 pagesPresentation Camille AlbaneTripurari KumarNo ratings yet

- Presentation Camille Albane PDFDocument42 pagesPresentation Camille Albane PDFTripurari KumarNo ratings yet

- Egg Farming 20000Document14 pagesEgg Farming 20000Tripurari KumarNo ratings yet

- ES-1 500lacs and AboveDocument15 pagesES-1 500lacs and AboveTripurari KumarNo ratings yet

- Egg Farming 20000Document14 pagesEgg Farming 20000Tripurari KumarNo ratings yet

- Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsDocument8 pagesExecutive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsTripurari KumarNo ratings yet

- Ubi Process Note of Shourya Virat Trading CompanyDocument11 pagesUbi Process Note of Shourya Virat Trading CompanyTripurari KumarNo ratings yet

- Cost of Project: Smrity Paper Mills Private LimitedDocument17 pagesCost of Project: Smrity Paper Mills Private LimitedTripurari KumarNo ratings yet

- Asm Charitable Super Specialty Hospital and Medical CollegeDocument20 pagesAsm Charitable Super Specialty Hospital and Medical CollegeTripurari KumarNo ratings yet

- Hospital in PatnaDocument9 pagesHospital in PatnaTripurari KumarNo ratings yet

- Trouble Shooting FilingDocument6 pagesTrouble Shooting FilingTripurari KumarNo ratings yet

- Bihar Medical Services & Infrastructure Corporation LTD.: Performance Appraisal FormDocument10 pagesBihar Medical Services & Infrastructure Corporation LTD.: Performance Appraisal FormTripurari KumarNo ratings yet

- Permanual Ferro ScrapDocument421 pagesPermanual Ferro ScrapTripurari KumarNo ratings yet

- Exercises: CLASS - 10th Chapter - 1 (Development) EconomicsDocument31 pagesExercises: CLASS - 10th Chapter - 1 (Development) EconomicsDikshita BajajNo ratings yet

- Chapter 18 - Financial Management Learning GoalsDocument25 pagesChapter 18 - Financial Management Learning GoalsRille LuNo ratings yet

- Modified Guidelines On The Pag-IBIG Fund Affordable Housing ProgramDocument10 pagesModified Guidelines On The Pag-IBIG Fund Affordable Housing ProgramnadinemuchNo ratings yet

- Bank of Industry NigeriaDocument4 pagesBank of Industry NigeriaWalter KlotzNo ratings yet

- Summative Test 2 in Gen Math QUARTER 2Document3 pagesSummative Test 2 in Gen Math QUARTER 2Jessa BarberoNo ratings yet

- Credit Collection Units 1 3Document46 pagesCredit Collection Units 1 3elle gutierrezNo ratings yet

- Loan ComputationDocument13 pagesLoan ComputationJerson ArinqueNo ratings yet

- An Assessment of Credit Risk Management PracticesDocument27 pagesAn Assessment of Credit Risk Management PracticesHunde gutemaNo ratings yet

- Topic 1 Development of CreditDocument3 pagesTopic 1 Development of CreditPhilip Jayson CarengNo ratings yet

- Union Parivahan SchemeDocument1 pageUnion Parivahan SchemeBUDU GOLLARYNo ratings yet

- Connected LendingDocument11 pagesConnected Lendingmentor_muhaxheriNo ratings yet

- Micro and Small Scale Enterprises' Financing Preference in Line With POH and Access To Credit: Empirical Evidence From Entrepreneurs in EthiopiaDocument30 pagesMicro and Small Scale Enterprises' Financing Preference in Line With POH and Access To Credit: Empirical Evidence From Entrepreneurs in EthiopiaRajendra LamsalNo ratings yet

- 4 Current Liabilities MGMTDocument5 pages4 Current Liabilities MGMTMark Lawrence YusiNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter TenDocument29 pagesSolutions For End-of-Chapter Questions and Problems: Chapter Tenester jofreyNo ratings yet

- Stuy Town CW CapitalDocument50 pagesStuy Town CW CapitalrahNo ratings yet

- Abiy MogesDocument67 pagesAbiy MogesMelesNo ratings yet

- Corrected Business Plan ReportDocument45 pagesCorrected Business Plan ReportJeorge PaxNo ratings yet

- Chapter - 5 - Small BusinessDocument13 pagesChapter - 5 - Small BusinessMahedre ZenebeNo ratings yet

- Citibank Models Credit Risk On Hybrid Mortgage LoansDocument17 pagesCitibank Models Credit Risk On Hybrid Mortgage LoansHussein AtwiNo ratings yet

- KBW Investment KycDocument2 pagesKBW Investment KycGreen Sustain EnergyNo ratings yet

- Janata Bank Micro CreditDocument25 pagesJanata Bank Micro CreditMahfoz KazolNo ratings yet

- Application Transaction ProcedureDocument3 pagesApplication Transaction ProcedurefaridatunNo ratings yet

- Sanction, Documentation and Disbursement of CreditDocument32 pagesSanction, Documentation and Disbursement of Creditrajin_rammstein100% (1)

- Promissory NoteDocument4 pagesPromissory NoteAGBA NJI THOMASNo ratings yet

- Kyc Aml Master Key Module 4Document25 pagesKyc Aml Master Key Module 4prashant pradhan100% (3)

- Ketema Asfaw-1Document47 pagesKetema Asfaw-1Ketema AsfawNo ratings yet

- 20171012first Term Final Exam AnswersDocument4 pages20171012first Term Final Exam AnswersSaad Shehryar0% (1)