Professional Documents

Culture Documents

Frost Tekes Presentation v2-1096

Frost Tekes Presentation v2-1096

Uploaded by

Pallavi ReddyCopyright:

Available Formats

You might also like

- Led Lights ProjectDocument75 pagesLed Lights ProjectAnonymous GXfghzr100% (2)

- Sheriffdirectory PDFDocument136 pagesSheriffdirectory PDFJP StorkNo ratings yet

- Lighting The WayDocument68 pagesLighting The WayParag DeshmukhNo ratings yet

- Worldwide Semiannual Augmented and Virtual Reality Spending GuideDocument2 pagesWorldwide Semiannual Augmented and Virtual Reality Spending GuideExneyder Montoya0% (1)

- Accelerating Innovation With Indian EngineeringDocument12 pagesAccelerating Innovation With Indian Engineeringrahulkanwar267856No ratings yet

- Us Banking Regulatory Outlook 2020Document48 pagesUs Banking Regulatory Outlook 2020Pallavi ReddyNo ratings yet

- MGM Springfield Host Community Agreement ExecutionDocument53 pagesMGM Springfield Host Community Agreement ExecutionMassLiveNo ratings yet

- Women's Tales From The New Mexico WPALa Diabla A PieDocument513 pagesWomen's Tales From The New Mexico WPALa Diabla A PieArte Público Press100% (3)

- BCG How To Win in A Transforming Lighting Industry Nov 2015Document36 pagesBCG How To Win in A Transforming Lighting Industry Nov 2015Ngoc Son PhamNo ratings yet

- Indian Lighting IndustryDocument12 pagesIndian Lighting IndustryRajneesh SehgalNo ratings yet

- Persistence Market ResearchDocument6 pagesPersistence Market Researchapi-302003482No ratings yet

- Mckinsey Lighting The Way AheadDocument68 pagesMckinsey Lighting The Way AheadYuttapong SupattaravongNo ratings yet

- An Analytical Study of LED Lights To Go Green and Being Energy Efficient - Summer Project Report by Akarsh Srivastava, Roll No - 02, PGDM - MarketingDocument39 pagesAn Analytical Study of LED Lights To Go Green and Being Energy Efficient - Summer Project Report by Akarsh Srivastava, Roll No - 02, PGDM - MarketingAkarsh Srivastava100% (1)

- Business Plan Led LightingDocument115 pagesBusiness Plan Led LightingAARON HUNDLEYNo ratings yet

- ReviewDocument3 pagesReviewPrasanna VenkateshNo ratings yet

- 13 Chapter 6Document76 pages13 Chapter 6Souvik BakshiNo ratings yet

- Indian LED Lighting Market Expected To Grow at CAGR of 45Document2 pagesIndian LED Lighting Market Expected To Grow at CAGR of 45Akhil GanjooNo ratings yet

- Illumination in Focus Spring 2014Document25 pagesIllumination in Focus Spring 2014Steve KirkmanNo ratings yet

- 22MBA12489_second progress reportDocument11 pages22MBA12489_second progress reportvaibhavjuneja636No ratings yet

- Smart Lighting and Control Systems Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDocument3 pagesSmart Lighting and Control Systems Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNo ratings yet

- Led Suppliers Directory: Leds Magazine ReviewDocument52 pagesLed Suppliers Directory: Leds Magazine ReviewChris RogersNo ratings yet

- CREE Case AnalysisDocument6 pagesCREE Case Analysisrim100% (1)

- Hype and Reality in The Middle East - Lux MagazineDocument3 pagesHype and Reality in The Middle East - Lux MagazineovaishashmiNo ratings yet

- Yole Automotive Lighting Technology Industry and Market Trends Flyer WebDocument5 pagesYole Automotive Lighting Technology Industry and Market Trends Flyer WebAnujeet Huddar100% (1)

- Led Report June 2013Document59 pagesLed Report June 2013Raghuraman ChandrasekharNo ratings yet

- The Japanese Led Light IndustryDocument10 pagesThe Japanese Led Light IndustryTiểu Ngọc ĐinhNo ratings yet

- How Is The Global Automobile Industry Evolving?Document4 pagesHow Is The Global Automobile Industry Evolving?Gazal ReyazNo ratings yet

- Thesis Proposal Lani BalanonDocument8 pagesThesis Proposal Lani BalanonKenneth GoNo ratings yet

- Summer Internship Project FINAL ReportDocument66 pagesSummer Internship Project FINAL ReportVikasReddyNo ratings yet

- Pitch Deck EzzingSolar 20160901 CompressedDocument20 pagesPitch Deck EzzingSolar 20160901 CompressedVega MiauNo ratings yet

- NXP Company Presentation April 2014Document130 pagesNXP Company Presentation April 2014Marivir GonzalesNo ratings yet

- LG - Marketing - Consumer PerceptionDocument101 pagesLG - Marketing - Consumer PerceptionRahul Gujjar0% (1)

- B2B Project: Group 6 - Section CDocument4 pagesB2B Project: Group 6 - Section CSweta SinghNo ratings yet

- Panasonic ReportDocument17 pagesPanasonic ReportRajiv DubeyNo ratings yet

- The World Market For Optoelectronic Components - 2011 EditionDocument4 pagesThe World Market For Optoelectronic Components - 2011 Editiond35_4everNo ratings yet

- CapstoneDocument7 pagesCapstonehasan_tvuNo ratings yet

- Technological - : Category Factors (PESTLE) Micromax LED TVDocument5 pagesTechnological - : Category Factors (PESTLE) Micromax LED TVrockyNo ratings yet

- Led I LCD I Plasma I Smart I Home Entertainment I Speakers I Mp3 PlayersDocument30 pagesLed I LCD I Plasma I Smart I Home Entertainment I Speakers I Mp3 PlayersNitish SharmaNo ratings yet

- Nasscom Booz Esr Report 2010Document12 pagesNasscom Booz Esr Report 2010Prashant GuptaNo ratings yet

- (796958755) Electronics & Semiconductor Market Research PDFDocument10 pages(796958755) Electronics & Semiconductor Market Research PDFAlex Hales PerryNo ratings yet

- Trends and Future of The Electric Lighting Equipment Manufacturing IndustryDocument15 pagesTrends and Future of The Electric Lighting Equipment Manufacturing IndustryjackNo ratings yet

- Case Study On VideoconDocument12 pagesCase Study On VideocondinishaNo ratings yet

- Capturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021From EverandCapturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021No ratings yet

- RD - Energy As A Service MarketDocument16 pagesRD - Energy As A Service Marketmadhav.moshimoshiNo ratings yet

- Strategic Analysis EV Market ReportDocument5 pagesStrategic Analysis EV Market ReportKavin VimalNo ratings yet

- Ede 1112Document60 pagesEde 1112javierodNo ratings yet

- November 23, 2011: Consumer Durables Market - An OverviewDocument8 pagesNovember 23, 2011: Consumer Durables Market - An OverviewsidhupandyaNo ratings yet

- February 2014 PresentationDocument15 pagesFebruary 2014 PresentationSeerat JangdaNo ratings yet

- Consumer Durables: Market Analysis - IndiaDocument13 pagesConsumer Durables: Market Analysis - IndiaPrantor Chakravarty100% (1)

- Solar Lighting in Emerging MarketsDocument80 pagesSolar Lighting in Emerging MarketsInternational Finance Corporation (IFC)No ratings yet

- A Study of Consumer Durable Market For Samsung Electronics LTDDocument53 pagesA Study of Consumer Durable Market For Samsung Electronics LTDSandeep OllaNo ratings yet

- Smart Lighting Market Analysis and Forecast 2025 by Global Marketing InsightsDocument5 pagesSmart Lighting Market Analysis and Forecast 2025 by Global Marketing InsightsEko Hadi Susanto100% (1)

- CFM AssignmentDocument6 pagesCFM AssignmentNikhil ChhabraNo ratings yet

- Status of The Auto Industry and A: Strategy To Make Canada A Product Development HubDocument40 pagesStatus of The Auto Industry and A: Strategy To Make Canada A Product Development Hubravikiran1955No ratings yet

- Havells India LimitedDocument15 pagesHavells India LimitedRohit PandeyNo ratings yet

- LED JAPAN Conference Brochure Final 071411Document13 pagesLED JAPAN Conference Brochure Final 071411Phan Xuan TrungNo ratings yet

- What Is The Strategic Direction of The Company Over The Last 3 Years? Is The Strategic Direction Likely To Last Till 2025?Document9 pagesWhat Is The Strategic Direction of The Company Over The Last 3 Years? Is The Strategic Direction Likely To Last Till 2025?Prince JoshiNo ratings yet

- Led Lamps Market Trends US, US Led Lighting Market Share, US Led Lighting Market Worth, US Led Lighting Manufacturers - Ken ResearchDocument119 pagesLed Lamps Market Trends US, US Led Lighting Market Share, US Led Lighting Market Worth, US Led Lighting Manufacturers - Ken ResearchTm RNo ratings yet

- Orient Electric: Company ProfileDocument11 pagesOrient Electric: Company ProfilePrince JoshiNo ratings yet

- Accenture High Performance Through More Profitable Business To Business ModelsDocument12 pagesAccenture High Performance Through More Profitable Business To Business ModelsDaniel TaylorNo ratings yet

- Market Survey On Programmable Stage Lighting - Industry Outlook, Growth Prospects and Key Opportunities - Facts and TrendsDocument2 pagesMarket Survey On Programmable Stage Lighting - Industry Outlook, Growth Prospects and Key Opportunities - Facts and Trendssurendra choudharyNo ratings yet

- Indian Low Medium Voltage Switch Gear Markets FinalDocument17 pagesIndian Low Medium Voltage Switch Gear Markets FinalpraveenramkrishNo ratings yet

- Technical and Vocational Education and Training in the Philippines in the Age of Industry 4.0From EverandTechnical and Vocational Education and Training in the Philippines in the Age of Industry 4.0No ratings yet

- Managing Compliance Financial RisksDocument4 pagesManaging Compliance Financial RisksPallavi ReddyNo ratings yet

- Hybrid 2.0: The Next-Gen Work Model Is Here To StayDocument27 pagesHybrid 2.0: The Next-Gen Work Model Is Here To StayPallavi Reddy100% (1)

- AFI FinTech SR AW Digital 0Document32 pagesAFI FinTech SR AW Digital 0Pallavi ReddyNo ratings yet

- Gartner Market Share Consulting 2018 2019 PDFDocument18 pagesGartner Market Share Consulting 2018 2019 PDFPallavi ReddyNo ratings yet

- Blockchain Technology OverviewDocument69 pagesBlockchain Technology OverviewPallavi ReddyNo ratings yet

- Max India AR 2018 19Document323 pagesMax India AR 2018 19Pallavi ReddyNo ratings yet

- The Jesuit ConspiracyDocument13 pagesThe Jesuit Conspiracykingblack804No ratings yet

- Political Science Project (SEM-II)Document26 pagesPolitical Science Project (SEM-II)Sagar RaiNo ratings yet

- Letter Advocating For Hazard PayDocument2 pagesLetter Advocating For Hazard PayQueens PostNo ratings yet

- Vivek Interview PDFDocument15 pagesVivek Interview PDFThe FederalistNo ratings yet

- #BlackLivesMatter Clinton & Trump - Overt or Covert, Acts of Commission or OmissionDocument2 pages#BlackLivesMatter Clinton & Trump - Overt or Covert, Acts of Commission or OmissionItsNot1984No ratings yet

- Yahoo TabsDocument145 pagesYahoo TabsKelli R. GrantNo ratings yet

- The Progressive Era, 1900-1920Document27 pagesThe Progressive Era, 1900-1920noo oneNo ratings yet

- Letter To AISD From Pease Parent Yvonne Ortiz-PrinceDocument2 pagesLetter To AISD From Pease Parent Yvonne Ortiz-PrinceKUTNewsNo ratings yet

- Standard Chartered - Annual Report 2006Document158 pagesStandard Chartered - Annual Report 2006Kamran Tahir95% (19)

- Latin American Legal PluralismDocument56 pagesLatin American Legal PluralismCPLJNo ratings yet

- KOF Index of Globalization 2013Document7 pagesKOF Index of Globalization 2013rallushNo ratings yet

- KS-02 Anzalone Liszt Grove For Margie Wakefield (July 2014)Document1 pageKS-02 Anzalone Liszt Grove For Margie Wakefield (July 2014)Daily Kos ElectionsNo ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- ThebostonteapartyDocument2 pagesThebostonteapartyapi-355864571No ratings yet

- De Quiros 10Document29 pagesDe Quiros 10melvingodricarceNo ratings yet

- Application YSEALI Academic Fellowship Spring 2018 Thai Applicants OnlyDocument11 pagesApplication YSEALI Academic Fellowship Spring 2018 Thai Applicants OnlyKyrieNo ratings yet

- The Citizenship Status of Our 44 PresidentsDocument6 pagesThe Citizenship Status of Our 44 Presidentspuzo1100% (5)

- CabreraDocument2 pagesCabreraJoshua GrayNo ratings yet

- August 15, 2011 - The Federal Crimes Watch DailyDocument3 pagesAugust 15, 2011 - The Federal Crimes Watch DailyDouglas McNabbNo ratings yet

- Modern Kitchen, Good Home, Strong Nation Joy ParrDocument11 pagesModern Kitchen, Good Home, Strong Nation Joy ParrVormtaalNo ratings yet

- Introduction To Contemporary Social Problems PDFDocument90 pagesIntroduction To Contemporary Social Problems PDFhayenje rebecca100% (1)

- Felon Voting Rights EssayDocument8 pagesFelon Voting Rights Essayapi-2905368750% (1)

- Assignment 3Document2 pagesAssignment 3Andrea GarmaNo ratings yet

- New Geographies of Extractive Industries in Latin AmericaDocument41 pagesNew Geographies of Extractive Industries in Latin AmericaklderaNo ratings yet

- American Politics Today Essentials 4th Edition Bianco Test Bank Full Chapter PDFDocument39 pagesAmerican Politics Today Essentials 4th Edition Bianco Test Bank Full Chapter PDFaffluencevillanzn0qkr100% (12)

- The Economic Development of Latin AmericaDocument338 pagesThe Economic Development of Latin AmericaArquero PeligroNo ratings yet

- The Laffer Curve Past Present and FutureDocument18 pagesThe Laffer Curve Past Present and FutureRullan RinaldiNo ratings yet

Frost Tekes Presentation v2-1096

Frost Tekes Presentation v2-1096

Uploaded by

Pallavi ReddyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Frost Tekes Presentation v2-1096

Frost Tekes Presentation v2-1096

Uploaded by

Pallavi ReddyCopyright:

Available Formats

The Global LED Lighting Market

Key Trends and Opportunities

Presented to

Tekes

June 2015

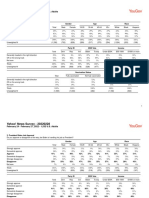

Total Lighting Market, including Traditional

Control Gear is the Fastest Growing Segment

Global Lighting Market: Historical and Forecast Market Size by Segment, 2014 & 2020

Control gear to gain a pivotal role with the

Year/USD bn

Lightsources

Control Gear

Fixtures

2014

24.4

7.9

55.0

2020

25.7

11.2

60.5

CAGR (2014-20)

1.0%

7.4%

1.9%

.

Source: Frost & Sullivan

rise of LED due to the long term increase on

functionality

The possibilities that LED offers will give

rise to increasingly complex control gear

giving comfort, security and flexibility to

120,000

lighting that has thus far only been seen in

100,000

niche markets

80,000

USD million

Fixtures

60,000

40,000

Control gear

Lightsources

The average price of control gear is

expected to rise notably in Europe and North

America by 2019 on top of the increase in

20,000

0

2012 2013 2014 2015 2016 2017 2018 2019

units globally

Lighting Industry and Markets

The LED revolution is happening now 40% of the market in value in 2015

Global Lighting Market: Historical and Forecast Market Size by Segment, 2014 & 2019

2013 and 2014 have been the

breakthrough years for LED in the

Year

Traditional

(USD m)

LED (USD m)

2014

54,972

27,261

27,261

-13.1%

70,100

16.8%

2019

CAGR (2014-19)

professional market, in Europe, North

.

Source: Frost & Sullivan

America and China. The other green

technologies are on the way out

2014 has seen significant inroads for

120,000

LED in the large residential market,

100,000

which will help LED to pass 40%

penetration of total lighting sales in

2015

USD million

80,000

60,000

40,000

20,000

0

2012 2013 2014 2015 2016 2017 2018 2019

LED

Traditional

Global LED Lighting Market

Revenue Forecast

Key Takeaway: the 2014 boom was driven by Europe, North America and China across applications; LED

replacement bulbs made significant progress in the Residential application worldwide

80,000.0

45.0

70,000.0

40.0

60,000.0

35.0

30.0

50,000.0

25.0

40,000.0

20.0

30,000.0

15.0

20,000.0

10.0

10,000.0

5.0

0.0

0.0

2012

2013

2014

2015

2016

2017

2018

2019

Revenue

16,939.0 23,936.0 32,285.0 40,070.0 47,303.0 54,361.0 61,854.0 70,100.0

Growth Rate

41.3

34.9

24.1

18.1

14.9

13.8

13.3

Year

Growth Rate (%)

Revenue ($ Million)

Total LED Lighting Market: Revenue Forecast, Global, 2012-2019

CAGR, 20142019 = 16.8%

Note: All figures are rounded. The base year is 2014. Source: Frost & Sullivan

Global LED Lighting Market

Key Figures (1/2)

Total LED Lighting Market: Market Engineering Measurements, Global, 2014

Market Overview

Market Stage

Growth

Average Price Per

LED Lightsource

Market Revenue

$32,285 M

$12.4

(2014)

Base Year Market

Growth Rate

Compound

Annual Growth

Rate

16.8%

34.9%

(CAGR, 20142019)

Decreasing

Stable

Market Size for

Last Year of Study

Period

$70,100 M

(2019)

(2014)

Customer Price

Sensitivity

7

(scale:1 [low] to 10 [high])

Degree of

Technical Change

9

(scale:1 [low] to 10 [high])

Market

Concentration

16.7%

(% of market share held by top

2 companies)

Increasing

Note: All figures are rounded. The base year is 2014. Source: Frost & Sullivan

Global LED Lighting Market

Key Figures (2/2)

Competitor Overview

Total Addressable Market

Number of

Companies that

Exited*

Number of

Competitors

5,000

Number of

Companies that

Entered*

30

10

(active market competitors in

2014)

Replacement Rate

(2014)

1522 years

(average period of unit

replacement)

(2014)

Industry Advancement

Average Product

Development

Time

912

months

Decreasing

Stable

Increasing

Average R&D

Spend as a

Percent of Market

Revenue

7.6%

Marketing Spend

as a Percent of

Market Revenue

5.0%

*Note: Companies with revenue of more than $50.0 M

Note: All figures are rounded. The base year is 2014. Source: Frost & Sullivan

Global LED Lighting Market

Europe and North America to mature first; higher growth rates during the

forecast period in younger markets

Europe: The implemented EU ban on incandescent and the

prospective ban on halogen drive LED adoption in the region.

CAGR 20142019 = 17.2%

North America:

Incandescent ban

stimulates demand;

utilities rebates

make SSL

affordable.

Asia-Pacific:

China is

embracing

LED and will

lead the

change for the

region.

CAGR

20142019 =

16.8%

CAGR 20142019 = 15.2%

Latin America: Price is the

key barrier to adoption outside

of high-end projects. LED will

increasingly be able to

challenge CFL.

CAGR 20142019 = 23.1%

Middle East and Africa: Growth expected

in the second half of the forecast period,

thanks to a sharp price decline.

CAGR 20142019 = 18.4%

Source: Frost & Sullivan

Global LED Lighting Market

Revenue Forecast by Region

Key Takeaway: APAC is confirmed the key area, especially outside of China in the long term

Total LED Lighting Market: Revenue Forecast by Region, Global, 2012-2019

CAGR, 20142019 = 16.8%

Revenue ($ Million)

80,000.0

60,000.0

40,000.0

20,000.0

0.0

2012

2013

2014

2015

2016

2017

2018

2019

Year

North America

Europe

Asia-Pacific

Middle East & Africa

Latin America

Note: All figures are rounded. The base year is 2014. Source: Frost & Sullivan

Global LED Lighting Market

Revenue Forecast by Application

Key Takeaway: Office and Industry will be the highest growth applications; Residential will be the largest

application by far by 2019

Total LED Lighting Market: Revenue Forecast by Application, Global, 2012-2019

CAGR, 20142019 = 16.8%

Revenue ($ Million)

80,000.0

60,000.0

40,000.0

20,000.0

0.0

2012

2013

2014

2015

2016

2017

Outdoor

Residential

2018

2019

Year

Architectural

Hospitality

Industrial

Office

Retail

Note: All figures are rounded. The base year is 2014. Source: Frost & Sullivan

Global LED Lighting Market

Percent Revenue Forecast by Distribution Channel

Key Takeaway: Wholesalers and retail have dominated the nascent stages of LED, and are now losing to direct sales

and project based solutions; however, indirect sales will grow as more standard products become available

Total LED Lighting Market: Percent Revenue* Forecast by Distribution Channel, Global, 2012-2019

100.0

Revenue (%)

80.0

60.0

40.0

20.0

0.0

Direct Sales

Wholesalers/Retail

2011

2012

2013

2014

2015

2016

2017

2018

30.0

70.0

31.2

68.8

33.0

67.0

34.0

66.0

35.0

65.0

34.0

66.0

33.7

66.3

34.2

65.8

Year

*The exhibit represents only the professional lighting end users and not the residential ones

Note: All figures are rounded. The base year is 2014. Source: Frost & Sullivan

Global LED Lighting Market

Key Messages

1

The LED revolution has happened, driven by

Europe, North America, and China. Further

growth will be less centralised and will challenge

the leading global participants.

LED replacement lamps are already at a price

point that successfully challenge traditional

technologies and will take over that market

completely by 2020.

The challenge is to offer noncommoditised

products that make the most of digital LED light

advantages. LED drivers and lighting

management services will be key.

The market for luminaires will be particularly

challenged, as LED requires new knowledge and

expensive R&D. Concentration in this very

fragmented market is expected.

New markets for services and solution designs

open up, but require good contacts and

customer knowledge, which might favour local

companies above global participants.

Source: Frost & Sullivan

Global LED Lighting Market

What next? 3 Big Predictions

The LED replacement lamp is the winner in the medium term, as it progressively replaces traditional

technologies around the world. The entire market for replacement lamps (the cash cow of the top

companies) is, however, doomed in the long term as next-generation fixtures will not have a lamp

socket.

The LED revolution will sweep away hundreds of fixture companies that cannot cope with the new

competencies and R&D needed. There is a chance for large LED lightsource manufacturers to save

good, medium-size fixture companies by providing the LED know-how in return for their help in

reaching local customers and winning project-based business together.

Lighting as a service (LaaS) on cloud-based networks for efficient and personalised management of

applications will pave the way for connected lighting and living, and better energy and facility

management. Financing, leasing, and maintenance are other service models that will evolve around

LaaS.

Source: Frost & Sullivan

Global LED Market

What next? Leveraging Lighting Management Systems to target verticals

Key Takeaway: Offices to focus on energy saving aspects, residential to focus on ambience

Global LED Lighting Market

What next? Services. Smart buildings, performance contracting and lightas-a-service are key trends driving future growth

Key Trends

Competitive

Landscape

Competitive

Success

Factors

Smart buildings, representing the convergence of green and smart technology trends,

will become increasingly important and a driver for consultancy based services.

Performance contracting is increasingly becoming a mainstay of the market; end

users are keen to maximise cost savings and improve efficiency.

Light-as-a-service (essentially leasing-type models and pay-as-you-use services) is a

concept that is gaining traction in the industry through its ability to enable businesses

to minimise upfront capital expenditure.

The increasing importance and value of lighting projects is attracting ever greater

competition within the sector.

BMS & FM companies are both actively targeting the sector.

Market participants need to be able to work in partnership with BMS companies, and

need to be able to work with not just light but also HVAC etc. With strong growth

forecast, establishing a market presence, a network of connections, and customer

relationships will be vital for future success. Supplies want to establish an entrenched

position.

With performance contracting becoming the customers preferred business model,

suppliers will need to develop service capabilities, or partner with facility management

companies, or energy service providers, to participate in the most dynamic part of the

market.

Global LED Lighting Market

What next? Services. Smart buildings to drive data-based consultancy

services

Smart buildings will become a mainstream reality, driven by the convergence of green and smart

technology and new market entrants.

Cloud-based services with a strong focus on data interpretation will be key enablers for a new

generation of intelligent buildings.

If lighting services companies manage to make a space for themselves in the data analytics

market, consulting contracts could potentially include very different new services -data based

services

Global LED Lighting Market

Performance contracting to become preferred business model

Performance contracting will become customers preferred business model and suppliers will need to

develop service capabilities or partner with facility management companies or energy service

providers to participate in the most dynamic part of the market.

EU energy savings

contract and

performance contracting

to grow at CAGR12-18

8.2% to reach 7,375.0

million by 2018.

Global LED Lighting Market

Light-as-a-service (LAAS)

Future trends in terms of business models include leasing-type models and pay-as-you-use

services.

The concept of light-as-a-service is expected by most market participants to pick-up as a service

offering in the future. Key advantages for the end-customer is the ability to use new technology,

increase comfort levels, and bringing related energy savings, whilst taking away the up-front

weight on the balance sheet of customers.

Where budgeting is a barrier for upgrades/retrofit, lease-type services will strive. Uptake is

expected to be faster in the industrial and public sectors.

X-as-a-service proposition is developing in adjacent and unrelated markets, and is proving a

success story. It would be interesting to study how quickly this type of services have picked up in

other markets (penetration rate), to understand typical conditions for success, and learn from

these other industries.

As reference, in the European passenger vehicle market, one of the oldest leasing markets,

the share of leased cars was 19% in 2011 and will grow to 23% by 2018.

Lighting Industry and Markets

Key Challenges for 2015

Description and Context

1

Offering Differentiation

Moving away from cost-based competition

2

Selling on Value

3

Refocusing on Total Cost

Ownership

Moving the core business from wholesale to services

Supporting a clients longer term vision in line with product design

benefits

4

Identifying Sector Specific

Routes to Market

Finding the best resource allocation model for a specific target

market

5

Selling to Developing

Markets

Correctly identifying and benchmarking the competitive landscape

6

Managing New Entrant

Disruption

18

Innovating to maintain a technical advantage

Lighting Industry and Markets

Challenges to Insights

Insight

1

Offering Differentiation

2

Selling on Value

3

Refocusing on Total Cost

Ownership

4

Moving away from cost-based

competition

Moving the core business from

wholesale to services

Supporting a clients longer term

vision in line with product design

benefits

Integrate Upstream Client

Decision Making

Minimise Client

Operational Risk

Provide Light Solution

Leasing

Identifying Sector Specific

Routes to Market

Finding the best resource

allocation model for a specific

target market

Manage/Educate Specifiers

more than End-Users

Selling to Developing

Markets

Correctly identifying and

benchmarking the competitive

landscape

Develop Better Market

Segment Models

Innovating to maintain a technical

advantage

Leverage Total Solutions

6

Managing New Entrant

Disruption

19

You might also like

- Led Lights ProjectDocument75 pagesLed Lights ProjectAnonymous GXfghzr100% (2)

- Sheriffdirectory PDFDocument136 pagesSheriffdirectory PDFJP StorkNo ratings yet

- Lighting The WayDocument68 pagesLighting The WayParag DeshmukhNo ratings yet

- Worldwide Semiannual Augmented and Virtual Reality Spending GuideDocument2 pagesWorldwide Semiannual Augmented and Virtual Reality Spending GuideExneyder Montoya0% (1)

- Accelerating Innovation With Indian EngineeringDocument12 pagesAccelerating Innovation With Indian Engineeringrahulkanwar267856No ratings yet

- Us Banking Regulatory Outlook 2020Document48 pagesUs Banking Regulatory Outlook 2020Pallavi ReddyNo ratings yet

- MGM Springfield Host Community Agreement ExecutionDocument53 pagesMGM Springfield Host Community Agreement ExecutionMassLiveNo ratings yet

- Women's Tales From The New Mexico WPALa Diabla A PieDocument513 pagesWomen's Tales From The New Mexico WPALa Diabla A PieArte Público Press100% (3)

- BCG How To Win in A Transforming Lighting Industry Nov 2015Document36 pagesBCG How To Win in A Transforming Lighting Industry Nov 2015Ngoc Son PhamNo ratings yet

- Indian Lighting IndustryDocument12 pagesIndian Lighting IndustryRajneesh SehgalNo ratings yet

- Persistence Market ResearchDocument6 pagesPersistence Market Researchapi-302003482No ratings yet

- Mckinsey Lighting The Way AheadDocument68 pagesMckinsey Lighting The Way AheadYuttapong SupattaravongNo ratings yet

- An Analytical Study of LED Lights To Go Green and Being Energy Efficient - Summer Project Report by Akarsh Srivastava, Roll No - 02, PGDM - MarketingDocument39 pagesAn Analytical Study of LED Lights To Go Green and Being Energy Efficient - Summer Project Report by Akarsh Srivastava, Roll No - 02, PGDM - MarketingAkarsh Srivastava100% (1)

- Business Plan Led LightingDocument115 pagesBusiness Plan Led LightingAARON HUNDLEYNo ratings yet

- ReviewDocument3 pagesReviewPrasanna VenkateshNo ratings yet

- 13 Chapter 6Document76 pages13 Chapter 6Souvik BakshiNo ratings yet

- Indian LED Lighting Market Expected To Grow at CAGR of 45Document2 pagesIndian LED Lighting Market Expected To Grow at CAGR of 45Akhil GanjooNo ratings yet

- Illumination in Focus Spring 2014Document25 pagesIllumination in Focus Spring 2014Steve KirkmanNo ratings yet

- 22MBA12489_second progress reportDocument11 pages22MBA12489_second progress reportvaibhavjuneja636No ratings yet

- Smart Lighting and Control Systems Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDocument3 pagesSmart Lighting and Control Systems Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNo ratings yet

- Led Suppliers Directory: Leds Magazine ReviewDocument52 pagesLed Suppliers Directory: Leds Magazine ReviewChris RogersNo ratings yet

- CREE Case AnalysisDocument6 pagesCREE Case Analysisrim100% (1)

- Hype and Reality in The Middle East - Lux MagazineDocument3 pagesHype and Reality in The Middle East - Lux MagazineovaishashmiNo ratings yet

- Yole Automotive Lighting Technology Industry and Market Trends Flyer WebDocument5 pagesYole Automotive Lighting Technology Industry and Market Trends Flyer WebAnujeet Huddar100% (1)

- Led Report June 2013Document59 pagesLed Report June 2013Raghuraman ChandrasekharNo ratings yet

- The Japanese Led Light IndustryDocument10 pagesThe Japanese Led Light IndustryTiểu Ngọc ĐinhNo ratings yet

- How Is The Global Automobile Industry Evolving?Document4 pagesHow Is The Global Automobile Industry Evolving?Gazal ReyazNo ratings yet

- Thesis Proposal Lani BalanonDocument8 pagesThesis Proposal Lani BalanonKenneth GoNo ratings yet

- Summer Internship Project FINAL ReportDocument66 pagesSummer Internship Project FINAL ReportVikasReddyNo ratings yet

- Pitch Deck EzzingSolar 20160901 CompressedDocument20 pagesPitch Deck EzzingSolar 20160901 CompressedVega MiauNo ratings yet

- NXP Company Presentation April 2014Document130 pagesNXP Company Presentation April 2014Marivir GonzalesNo ratings yet

- LG - Marketing - Consumer PerceptionDocument101 pagesLG - Marketing - Consumer PerceptionRahul Gujjar0% (1)

- B2B Project: Group 6 - Section CDocument4 pagesB2B Project: Group 6 - Section CSweta SinghNo ratings yet

- Panasonic ReportDocument17 pagesPanasonic ReportRajiv DubeyNo ratings yet

- The World Market For Optoelectronic Components - 2011 EditionDocument4 pagesThe World Market For Optoelectronic Components - 2011 Editiond35_4everNo ratings yet

- CapstoneDocument7 pagesCapstonehasan_tvuNo ratings yet

- Technological - : Category Factors (PESTLE) Micromax LED TVDocument5 pagesTechnological - : Category Factors (PESTLE) Micromax LED TVrockyNo ratings yet

- Led I LCD I Plasma I Smart I Home Entertainment I Speakers I Mp3 PlayersDocument30 pagesLed I LCD I Plasma I Smart I Home Entertainment I Speakers I Mp3 PlayersNitish SharmaNo ratings yet

- Nasscom Booz Esr Report 2010Document12 pagesNasscom Booz Esr Report 2010Prashant GuptaNo ratings yet

- (796958755) Electronics & Semiconductor Market Research PDFDocument10 pages(796958755) Electronics & Semiconductor Market Research PDFAlex Hales PerryNo ratings yet

- Trends and Future of The Electric Lighting Equipment Manufacturing IndustryDocument15 pagesTrends and Future of The Electric Lighting Equipment Manufacturing IndustryjackNo ratings yet

- Case Study On VideoconDocument12 pagesCase Study On VideocondinishaNo ratings yet

- Capturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021From EverandCapturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021No ratings yet

- RD - Energy As A Service MarketDocument16 pagesRD - Energy As A Service Marketmadhav.moshimoshiNo ratings yet

- Strategic Analysis EV Market ReportDocument5 pagesStrategic Analysis EV Market ReportKavin VimalNo ratings yet

- Ede 1112Document60 pagesEde 1112javierodNo ratings yet

- November 23, 2011: Consumer Durables Market - An OverviewDocument8 pagesNovember 23, 2011: Consumer Durables Market - An OverviewsidhupandyaNo ratings yet

- February 2014 PresentationDocument15 pagesFebruary 2014 PresentationSeerat JangdaNo ratings yet

- Consumer Durables: Market Analysis - IndiaDocument13 pagesConsumer Durables: Market Analysis - IndiaPrantor Chakravarty100% (1)

- Solar Lighting in Emerging MarketsDocument80 pagesSolar Lighting in Emerging MarketsInternational Finance Corporation (IFC)No ratings yet

- A Study of Consumer Durable Market For Samsung Electronics LTDDocument53 pagesA Study of Consumer Durable Market For Samsung Electronics LTDSandeep OllaNo ratings yet

- Smart Lighting Market Analysis and Forecast 2025 by Global Marketing InsightsDocument5 pagesSmart Lighting Market Analysis and Forecast 2025 by Global Marketing InsightsEko Hadi Susanto100% (1)

- CFM AssignmentDocument6 pagesCFM AssignmentNikhil ChhabraNo ratings yet

- Status of The Auto Industry and A: Strategy To Make Canada A Product Development HubDocument40 pagesStatus of The Auto Industry and A: Strategy To Make Canada A Product Development Hubravikiran1955No ratings yet

- Havells India LimitedDocument15 pagesHavells India LimitedRohit PandeyNo ratings yet

- LED JAPAN Conference Brochure Final 071411Document13 pagesLED JAPAN Conference Brochure Final 071411Phan Xuan TrungNo ratings yet

- What Is The Strategic Direction of The Company Over The Last 3 Years? Is The Strategic Direction Likely To Last Till 2025?Document9 pagesWhat Is The Strategic Direction of The Company Over The Last 3 Years? Is The Strategic Direction Likely To Last Till 2025?Prince JoshiNo ratings yet

- Led Lamps Market Trends US, US Led Lighting Market Share, US Led Lighting Market Worth, US Led Lighting Manufacturers - Ken ResearchDocument119 pagesLed Lamps Market Trends US, US Led Lighting Market Share, US Led Lighting Market Worth, US Led Lighting Manufacturers - Ken ResearchTm RNo ratings yet

- Orient Electric: Company ProfileDocument11 pagesOrient Electric: Company ProfilePrince JoshiNo ratings yet

- Accenture High Performance Through More Profitable Business To Business ModelsDocument12 pagesAccenture High Performance Through More Profitable Business To Business ModelsDaniel TaylorNo ratings yet

- Market Survey On Programmable Stage Lighting - Industry Outlook, Growth Prospects and Key Opportunities - Facts and TrendsDocument2 pagesMarket Survey On Programmable Stage Lighting - Industry Outlook, Growth Prospects and Key Opportunities - Facts and Trendssurendra choudharyNo ratings yet

- Indian Low Medium Voltage Switch Gear Markets FinalDocument17 pagesIndian Low Medium Voltage Switch Gear Markets FinalpraveenramkrishNo ratings yet

- Technical and Vocational Education and Training in the Philippines in the Age of Industry 4.0From EverandTechnical and Vocational Education and Training in the Philippines in the Age of Industry 4.0No ratings yet

- Managing Compliance Financial RisksDocument4 pagesManaging Compliance Financial RisksPallavi ReddyNo ratings yet

- Hybrid 2.0: The Next-Gen Work Model Is Here To StayDocument27 pagesHybrid 2.0: The Next-Gen Work Model Is Here To StayPallavi Reddy100% (1)

- AFI FinTech SR AW Digital 0Document32 pagesAFI FinTech SR AW Digital 0Pallavi ReddyNo ratings yet

- Gartner Market Share Consulting 2018 2019 PDFDocument18 pagesGartner Market Share Consulting 2018 2019 PDFPallavi ReddyNo ratings yet

- Blockchain Technology OverviewDocument69 pagesBlockchain Technology OverviewPallavi ReddyNo ratings yet

- Max India AR 2018 19Document323 pagesMax India AR 2018 19Pallavi ReddyNo ratings yet

- The Jesuit ConspiracyDocument13 pagesThe Jesuit Conspiracykingblack804No ratings yet

- Political Science Project (SEM-II)Document26 pagesPolitical Science Project (SEM-II)Sagar RaiNo ratings yet

- Letter Advocating For Hazard PayDocument2 pagesLetter Advocating For Hazard PayQueens PostNo ratings yet

- Vivek Interview PDFDocument15 pagesVivek Interview PDFThe FederalistNo ratings yet

- #BlackLivesMatter Clinton & Trump - Overt or Covert, Acts of Commission or OmissionDocument2 pages#BlackLivesMatter Clinton & Trump - Overt or Covert, Acts of Commission or OmissionItsNot1984No ratings yet

- Yahoo TabsDocument145 pagesYahoo TabsKelli R. GrantNo ratings yet

- The Progressive Era, 1900-1920Document27 pagesThe Progressive Era, 1900-1920noo oneNo ratings yet

- Letter To AISD From Pease Parent Yvonne Ortiz-PrinceDocument2 pagesLetter To AISD From Pease Parent Yvonne Ortiz-PrinceKUTNewsNo ratings yet

- Standard Chartered - Annual Report 2006Document158 pagesStandard Chartered - Annual Report 2006Kamran Tahir95% (19)

- Latin American Legal PluralismDocument56 pagesLatin American Legal PluralismCPLJNo ratings yet

- KOF Index of Globalization 2013Document7 pagesKOF Index of Globalization 2013rallushNo ratings yet

- KS-02 Anzalone Liszt Grove For Margie Wakefield (July 2014)Document1 pageKS-02 Anzalone Liszt Grove For Margie Wakefield (July 2014)Daily Kos ElectionsNo ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- ThebostonteapartyDocument2 pagesThebostonteapartyapi-355864571No ratings yet

- De Quiros 10Document29 pagesDe Quiros 10melvingodricarceNo ratings yet

- Application YSEALI Academic Fellowship Spring 2018 Thai Applicants OnlyDocument11 pagesApplication YSEALI Academic Fellowship Spring 2018 Thai Applicants OnlyKyrieNo ratings yet

- The Citizenship Status of Our 44 PresidentsDocument6 pagesThe Citizenship Status of Our 44 Presidentspuzo1100% (5)

- CabreraDocument2 pagesCabreraJoshua GrayNo ratings yet

- August 15, 2011 - The Federal Crimes Watch DailyDocument3 pagesAugust 15, 2011 - The Federal Crimes Watch DailyDouglas McNabbNo ratings yet

- Modern Kitchen, Good Home, Strong Nation Joy ParrDocument11 pagesModern Kitchen, Good Home, Strong Nation Joy ParrVormtaalNo ratings yet

- Introduction To Contemporary Social Problems PDFDocument90 pagesIntroduction To Contemporary Social Problems PDFhayenje rebecca100% (1)

- Felon Voting Rights EssayDocument8 pagesFelon Voting Rights Essayapi-2905368750% (1)

- Assignment 3Document2 pagesAssignment 3Andrea GarmaNo ratings yet

- New Geographies of Extractive Industries in Latin AmericaDocument41 pagesNew Geographies of Extractive Industries in Latin AmericaklderaNo ratings yet

- American Politics Today Essentials 4th Edition Bianco Test Bank Full Chapter PDFDocument39 pagesAmerican Politics Today Essentials 4th Edition Bianco Test Bank Full Chapter PDFaffluencevillanzn0qkr100% (12)

- The Economic Development of Latin AmericaDocument338 pagesThe Economic Development of Latin AmericaArquero PeligroNo ratings yet

- The Laffer Curve Past Present and FutureDocument18 pagesThe Laffer Curve Past Present and FutureRullan RinaldiNo ratings yet