Professional Documents

Culture Documents

Calendar Effects On Stock Market Returns: Evidence From The Stock Exchange of Mauritius

Calendar Effects On Stock Market Returns: Evidence From The Stock Exchange of Mauritius

Uploaded by

fredsvOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calendar Effects On Stock Market Returns: Evidence From The Stock Exchange of Mauritius

Calendar Effects On Stock Market Returns: Evidence From The Stock Exchange of Mauritius

Uploaded by

fredsvCopyright:

Available Formats

CALENDAREFFECTSONSTOCKMARKETRETURNS:

EVIDENCEFROMTHESTOCKEXCHANGEOFMAURITIUS

SewrajD*,SeetanahB^*,SannaseeV*,SoobadurU*,&SeetanahB**

*FacultyofLawandManagement

UniversityofMauritius

**RMIT,Melbourne,Australia

^Corresponding author: b.seetanah@uom.ac.mu

ABSTRACT

Efficient market stated that stocks return is indifferent in each trading day. But, the calendar effects

phenomenon made a different return in each single day in a week or month. This is an abnormal

return which can affect investor in deciding investment strategy, portfolio selection, and profit

management. This study investigates the day of the week effect, more precisely the Monday effect and

the January effect on the Stock Exchange of Mauritius (SEM) in order to get the information whether

these anomalies exist or not. Linear regression model, GARCH and EGARCH models are used to

answer our objective. The result shows that Monday effect is nonexistent in SEM. However, we find a

significant positive January effect at market level. This study also concludes that volatility shocks are

persistent in both daily and monthly returns and moreover, reports the presence of leverage effect in

the daily stock returns.

Electronic copy available at: http://ssrn.com/abstract=1594871

INTRODUCTION

Capital market efficiency has been a very popular topic for empirical research since Fama

(1970) introduced the theoretical analysis of market efficiency and proclaimed the Efficient

Market Hypotheses. Subsequently, a great deal of research was devoted to investigate the

randomness of stock price movements for the purpose of demonstrating the efficiency of

capital markets. Since then, all kinds of calendar anomalies in stock market return have been

documented extensively in the finance literature. Thus, it follows that market participants

can make extraordinary returns by observing past development of market returns, as the latter

follow a seasonal pattern which violates the assumption of weak market efficiency.

The study of calendar effects is relevant for financial managers, financial counsellors, market

professionals and investors in general, and all those interested in developing profitable

trading strategies. In a decision-making process, a rational financial decision maker must take

into account not only returns but also the variance (risk) or volatility of returns. It is

important to identify whether there are variations in volatility of stock returns and whether a

high (low) return is associated with a high (low) volatility for a given time. If certain patterns

in stock return volatility can be identified, then investors would make investments decisions

based on both return and risk easier. Uncovering certain volatility patterns in returns might

also benefit investors in valuation, portfolio optimization, option pricing and risk

management.

Studies on calendar effects have overwhelmingly been concentrated on developed country

cases (see Mehdian and Perry, 2001; Sullivan, Timmermann, and White, 2001; Steeley, 2001

and Chen and Singal, 2003) with very few studies related to developing countries and to our

knowledge none to small island developing state. As such this paper explores the calendar

effects on the stock market returns laying particular emphasis on the stock exchange of the

island of Mauritius and this is believed to bring an interesting supplement the literature. The

Stock Exchange of Mauritius Ltd (SEM), was incorporated in 1989, as a private limited

company responsible for the operation and promotion of an efficient and regulated securities

market in Mauritius, Since then, the SEM has made some important strides in its

development process and has undertaken a number of reforms for the enhancement of the

operational and regulatory efficiency of the local market.

viii

Electronic copy available at: http://ssrn.com/abstract=1594871

In the context of this study, two types of seasonalities are investigated here namely the

Monday effect and January effect in stock returns (SEMDEX). This paper seeks to provide

evidence on the day of the week effect and month of the year effect in the Stock Exchange of

Mauritius not only for return by using the Ordinary Least Squares method and GARCH (1,1)

specification, but also for both return and volatility specifications by using the EGARCH

(1,1) model.

The paper is organised as follows, in Section 2, some of the relevant previous studies on

January effect and Monday effects are briefly discussed. In section 3, the data, the different

statistical methodologies used for estimating the calendar effects, including several

descriptive statistics are presented. This section also provides the analysis of the results adn

section 4 concludes.

SECTION 2: LITERATURE REVIEW

STOCK MARKET ANOMALIES

With the development of Efficient Market Hypothesis, some contradicting studies-market

efficiency anomalies are also going on. Market efficiency anomalies are evidence that seems

inconsistent with the efficient market hypothesis. They indicate either market inefficiency

(profit opportunities) or inadequacies in the underlying asset-pricing model. After they are

documented and analyzed in the academic literature, anomalies often seem to disappear,

reverse, or attenuate. This raises the question of whether profit opportunities existed in the

past, but have since been arbitraged away, or whether the anomalies were simply statistical

aberrations that attracted the attention of academics and practitioners. Some of the different

kinds of anomalies are related to Fundamental anomalies, Technical Anomalies and Calendar

anomalies. It is noteworthy that this paper

CALENDAR EFFECTS

Calendar effect also is called seasonality effect. We can simply see from the meaning of

words, it is about the time. Actually, the seasonality effect which includes many effects

ix

dealing with the time is one of the main patterns of the market efficiency anomalies. The

people try to specify a certain period of time or a group of time to test the special

phenomenon about the stock returns, then to see if any rules we can follow or any speculation

opportunities we can catch. The first ever studies in calendar anomaly starting in 1930s and

include: January effect, the Monday effect, and the month of the year effect, monthly effect,

holiday effect, and turn of the year effect.

The day of the week effect has been intensively studies since the end of 70s. Most

researchers employ the simple linear regression model (to mention few French (1980),

Gibbons and Hess (1981), Jaffe and Westerfield (1985)).

However, as Connolly (1989, 1991) claim, several specific problems may arise while using

this approach: a) The returns are likely to be auto correlated; b) The residuals are possibly

non-normal; c) The issue of heteroskedasticity may arise; d) Outliers with high/low value of

return may distort the overall picture. Connolly (1989) therefore suggested using GARCH on

dummies, in order to deal with auto correlation and heteroskedasticity issues.

MONDAY EFFECT

Monday effect is the tendency for Monday stock returns to be low relative to other weekdays

and on average negative. Early market practitioners identified the Monday effect at least as

early as the 1920s, well in advance of the advent of studies manipulating electronic databases.

Kelly (1930) cites a three-year statistical study that identified Mondays as the worse day to

buy stocks. He ascribes the cause of the low Monday returns to, among other factors,

weekend decision making processing by individual investors.

Further Tests on U.S. Equity Markets

The first application of rigorous statistical testing of the difference in weekday returns results

from French (1980) studying the S&P 500 Index over the period 1953 through 1977 and from

Gibbons and Hess (1981) studying the S&P 500 Index and CRSP value- and equallyweighted indexes for NYSE and AMEX securities over the period 1962 through 1978. Keim

and Stambaugh (1984) extend the period over which the weekday seasonal is examined for

the S&P 500 Index and examine actively traded OTC securities. Linn and Lockwood (1988)

x

examine a larger sample of OTC securities. Using different time frames and different sets of

securities, these authors all find a statistically significant difference in returns across

weekdays and a significantly negative return for Monday.

On the other hand, some recent papers present evidence that the Monday effect in the US and

UK stock markets has gradually disappeared. For example, Fortune (1998) shows that after

1987 there is no evidence of a negative weekend return. Mehdian and Perry (2001) show that

in the 1987-1998 periods Monday returns are not significantly different from returns during

the rest of the week for the SP500, DJCOMP and NYSE (large-cap) indexes. Also, Coutts

and Hayes (1999) also show empirically that the Monday effect exists but is not as strong as

has been previously documented for the UK stock indexes.

There are four types of explanation for Monday effect

1. The Monday Effect and Statistical Errors

Some scholars, for instance Sullivan, Timmermann, and White (2001) suggest that an

apparent Monday effect arises from employing erroneous statistical methods. They have

argued that the weekday effect and other seasonal arise from data mining. For instance,

Sullivan, Timmermann, and White (2001) argue in the Journal of Econometrics that calendar

effects result from data mining. Their application of a new bootstrap procedure fails to

identify a weekend effect or other calendar effects. This conclusion, however, ignores the

vast replicatory work done on the weekend effect using many different statistical methods

and data samples.

2. Micro Market Effects

A second class of explanations involve the market microstructure, more specifically, issues

about settlement, dividends, and taxes. French (1980) proposed the calendar time hypothesis,

which would suggest that expected returns be actually larger over the weekend (Friday to

Monday) because of the three calendar days in between versus the usual one calendar day for

other days of the week. This hypothesis is at odds with the data. In 1982, Lakonishok and

Levi suggested that expected returns should be different across days due to the 5-day

settlement period, which has the effect of making expected returns higher on Fridays and

xi

lower on Mondays relative to either a trading or calendar time model. The general consensus

appears to be that the data does not support the precise predictions of their hypothesis. Board

and Sutcliffe (1988) present evidence that shows that settlement procedures in the U.K.

market tend to moderate the negative Monday effect. Thus, studies of international markets

provide mixed evidence on the influence of market microstructure factors in explaining the

Monday effect.

Further, in 1991, Branch and Echevarria conjectured that tax considerations that influence

share price response to ex-dividend status may influence the weekend effect if ex-dividend

dates are not systematic across weekdays. However, micro market explanations of the

weekend effect have not received strong empirical support in U.S. equity markets as they

found no difference, however, between samples of no dividend and ex-dividend securities.

3. Information Flow Effects

A third explanation involves different rates of flow of micro and macro information.

Basically, the release of bad news tends to be delayed until the weekend, according to French

(1980). Also, Steeley (2001) argues that the Monday effect in the UK stock market is related

to the systematic pattern of market wide news arrivals that concentrates between Tuesdays

and Thursdays. However, a number of studies have found that this does not explain the whole

effect.

4. The Role of Order Flow

Another set of explanation invokes the differential trading patterns of various market

participants, i.e. individuals are net sellers on Mondays, and individuals behave differently on

Mondays versus other days of the week. Or else, it could also be due to short selling activity short sellers close their position on Fridays as it is difficult to monitor over weekends

(perhaps most of them go on holiday). They sell the stocks on Monday leading to a fall in

prices. There are some studies that have documented different behavior of individuals on

Mondays versus other days. For example, Pettengill (1993) finds that individuals were much

more likely to invest in risky assets when the experiments were conducted on Fridays than

when they were on Mondays.

xii

Also, Chen and Singal (2003) apply a similar argument to short sellers. They argue that

speculative short sellers seek to closely monitor their positions in order to limit potential

losses. Because they would be unable to close their position over the weekend, they tend to

buy stocks on Fridays to close their open position and to reopen their position on Monday by

borrowing and selling stocks. This trading would tend to increase returns on Friday and

decrease returns on Monday.

Diminishing Monday effect

Although numerous researchers have offered explanations for negative Monday returns for

equity securities, none appears entirely satisfactory. Prevalence of this phenomenon argues

against explanations that dismiss it as due to misapplication of statistical methodology or as a

result of micro market structure. Likewise rational pricing explanations have produced mixed

empirical success, at best. Although patterns in information flow seem logical, empirical

results from examination of these flows likewise do not provide promising results. The most

consistent findings rely on variation on order flow patterns from various traders. Empirical

tests have done little to clarify, however, how these order flows are influenced by various

other patterns such as monthly return patterns. Further, although changes in transaction costs

might explain a reduction in the Monday-Friday return differential, it should not reverse this

differential as evidenced by large-firm securities in recent years. Last, it is not clear why

traders who never paid transaction costs would not have eliminated this pattern earlier

Other researchers report different findings. Cornell (1985) and Najand and Yung (1994) see

no weekend effect in the S&P 500 index futures: the effect seems to exist, they argue,

because the returns are affected by conditional heteroskedasticity. Connolly (1989) points out

that the effect disappears for some years and then reappears for others. Wang, Li, and

Erickson (1997) find that the Monday effect occurs primarily in the last two weeks (the

fourth and fifth weeks) of the month. For the UK stock market, Board and Sutcliffe (1988)

see the significance of the anomaly decreasing over time, and Steeley (2001) notes that the

weekend effect disappeared in the 1990s. Sullivan, Timmermann and White (2001) assert that

calendar effects, including day of the week effect, no longer remain significant in the context

of 100 years of data as the full universe. Seyed and Perry (2001) report evidence of reversal

of the Monday effect in major US equity markets.

xiii

JANUARY EFFECT

Stocks exhibit both higher returns and higher risk premiums in January. These results have

been corroborated in many foreign markets. But the higher returns accrue primarily to smaller

stocks. January does not appear to be an exceptional month for larger-capitalization issues.

An increasing collection of papers has found out that the average return to stocks in the

month of January is higher than in any other month of the year. This seasonal anomaly is

known in the literature as the January effect. The January effect is first studied by Wachtel

(1942). By using Dow Jones Industrial Average, Wachtel (1942) finds seasonality in stock

prices for the time period 1927-1942. Rozeff and Kinney (1976) also found high returns in

January. Keim (1983) uses monthly dummies to test for the January effect and also proves the

relationship between the January effect and size effect by computing regression for size

portfolio. Many subsequent studies also substantiate this effect. A typical definition of the

January effect is the tendency of the stock to rise between the last day of December and the

end of the first week of January. In the literature of the January effect, most of the studies

support the existence of the effect, and especially the January effect is more significant for

small firms. There are various explanations for the January effect, while tax-loss selling,

window dressing, data mining and performance hedging are the most popular ones.

Tax-Loss Selling Hypothesis

Many researchers argue that it individual investors who are driving the January effect by

selling their losing stocks in December, in order to realize capital losses for tax purposes,

then using the funds from these sales to re-establish their position in small capitalization

stocks in January, thus driving up prices. To preface the discussion of evidence of tax-loss

selling driving the January effect, it is necessary to qualify it with an explanation of why the

focus tends to be on individual investors. As most agree that January is driven by small

stocks, the focus automatically shifts to individual investors as institutional money managers

are generally focused on large specialization equities. If individuals have equity positions that

have accrued losses, they may wish to sell them before the end of the year in order to realize

these losses for tax purposes; also institutional investors are not usually concerned with tax

losses.

xiv

In Wachtel (1942), the main explanatory factor for the seasonal effect was tax-loss selling.

He argues that investors sell in mid December and the following rally in stock prices in both

late December and January is purely a reaction from low stock market levels earlier in the

month. Roll (1983) argues that since small capitalization stock are more volatile; they are

better candidates for tax-loss selling. Interestingly, he also finds that tax-loss selling is

present in large firms as well; however as large firms are generally highly liquid, the effect is

arbitraged away. Rolls findings support the idea of individual ownership, as he argues that

the small firms are driving the tax-loss selling explanation.

When considering the taxloss selling hypothesis as an explanation for January effect,

numerous researches conducted tests to see if the effect existed before tax laws were in place

in the US and are as follows. Firstly, Rettengill (1986), using 1913 as the first taxable year

finds no evidence of a post tax January effect. However, the period from 1918 to 1929 did

exhibit a significant January effect, confirming the tax-loss selling hypothesis. Moreover,

Brailsford and Easton (1993) found a much more significant January effect over the post-tax

period, however conclude that the tax-loss selling hypothesis cannot fully explain the

seasonal anomaly.

Chen and Singals paper (2004) is a very recent supporter for the tax-loss selling hypothesis.

In the first part, Chen and Singal (2004) test the existence of the January effect based on the

sample of common stocks traded on the New York Exchange (NYSE), the American Stock

Exchange (AMEX), and NASDAQ. The result is that the five-day January return is 2.1%,

which is higher compared with the five day December return of 1.1%. This implies the

continued existence of the January effect.

Many who argue against tax-loss selling as the solution, particularly Jones, Pearce, and

Wilson (1987), Pettengill (1986) and Berges, Mc Connell and Schlarbaum (1984), find that

the phenomenon existed prior to Federal income taxes, therefore making the hypothesis void.

Also Fountas and Segredakis (2002), in a study on emerging markets, find that while

seasonality in stock returns exists in many countries, there is little evidence to prove that the

tax-loss selling hypothesis explains the January effect.

xv

Explanations of January effects other than the Tax-loss selling Hypothesis encompass i)

Window Dressing (see Ritter and Chopra (1989), Lakonishok, Shleifer and Vishny (1991)

Eakins, and Sewell (1994), Ligon (1997) and Chen and Singal (2004) ii) Capital Asset

Pricing Model (Reinganum, Stoll and Whaley (1983) iii) Intergenerational Transfers

Hypothesis (Gamble (1993)) iv) Invertors Liquidity (Ogen (1990)) adn v) Data Mining

(Sullivian, Timmermann and White (2001))

Declining January effect

Although providing various kinds of explanations, most of the studies in the literature of the

January effect show evidence which supports this anomaly. However, some papers even

reject the January effect, and the most famous of these studies are by Anthony. One of

Anthonys paper (2003), which focuses on the U.S equity markets, shows a declining effect.

His study is based on several indices including the Dow Jones 30 Industrial Average, the

S&P 500, the Russell 1000, the Russell 2000 and Russell 3000. For all the indices, the power

ratios are declining during 1988 through 2000, while none of the factors that cause the

January effect reported in the literature is declining in this period. This trend pronounced for

both small and large firms.

Section 3: DATA AND METHODOLOGY

RESEARCH OBJECTIVES AND ITS INTENDED BENEFITS

For the purpose of this study, two types of seasonalties are investigated here, namely the dayof-the-week effect and January effect in stock returns (SEMDEX). Using the Linear

Generalized Autoregressive Conditional Heteroskedasticity model, the main aims of this

research are to:

1) Assess the presence of seasonality in stock returns; more precisely testing the

presence of Monday effect and January effect in SEMDEX.

2) Test whether SEM is efficient in the weak form;

3) Assess whether there are opportunities for supernormal profits in the SEMDEX;

xvi

4) Assess the impact of volatility on stock returns

This research shall also help investors in deciding when to invest on the SEMDEX in order to

maximise their returns as they can use the day-of-the-week effect and January effect

information to avoid and reduce the risk when investing in the Mauritian stock market.

Moreover, it can be of great help to scholars, portfolio managers, investors to find out about

seasonality in SEMDEX.

DATA

In order to carry a research on a particular subject, a researcher needs to collects data for

carrying out the research. Data can be categorized in two forms, namely, primary data and

secondary data. Primary data is information that is collected first hand by researches, for

example, surveys, interviews, and questionnaires. On the other hand, secondary data refers to

information that is already available and which is used by the researcher as a source of data

for his or her research. Different forms of secondary data include journals, census data,

newspaper articles and books. For the purpose of this study, secondary data would be used in

order to test for the seasonal effects on the stock exchange of Mauritius.

The data employed in this paper consist of the daily and monthly closing prices from

SEMDEX for the period January 1998 to December 2008, which have been obtained the

official website of the Stock Exchange of Mauritius. The reason why this period has been

chosen is that at the end of 1997, with the formation of a new electronic clearing and

settlement system and the beginning of daily trading, major developments of the SEM have

been recognized.

The SEMDEX is an index of prices of all listed shares and each stock is weighted according

to its share in the total market capitalization. Thus, changes, in the SEMDEX are dominated

by changes in the prices of shares with relatively higher market capitalization.

The index formula is as follows:

SEMDEX

Current

Market

Value

of

All

Listed

Shares

100

Base Market Value of All Listed Shares

xvii

where the market value of any class of shares is equal to the number of shares outstanding

times its market price.

As we are interested in the behavior of returns primarily rather than the behavior of indices

themselves the choice of the returns definition might seem to be crucial. An adjusted return

was used in testing seasonal daily anomalies and is calculated as:

Rt = ln (Pt /Pt1)

Where, Rt denotes Stock Return at time period t; Pt denotes Stock price Index at time period

t; and Pt1 denotes Stock price Index at time period t-1. In the case of a day following a nontrading day, the return is calculated using the closing price indices of the latest trading day.

Irregular frequency data, for instance daily stock prices do not arrive in a precisely regular

pattern as the presence of missing days due to holidays and other market closures which

means that the data do not follow a regular daily (7- or 5-day) frequency. In order to run OLS

regression and estimate the GARCH model, the data have to be converted into regular

frequency data by using the Identifier series option in Eviews. Thus after excluding non

trading days, the daily time series consists of 2746 observations.

METHODOLOGY

To test for the Monday and the January effects in stock market returns the following

specification is proposed for the mean equation.

DRETt = B1D1 + B2D2 + B3D3 + B4D4 + B5D5 + ut

(1)

MRETt = B1D1 + B2D2 + B3D3 + B4D4 + B5D5 + B6D6 + B7D7 + B8D8 + B9D9+ B10D10 +

B11D11+ B12D12 + ut

(2)

In equation (1) B1, B2, B3, B4, B5 are parameters and D1, D2, D3, D4 and D5 are dummy

variables for Monday, Tuesday, Wednesday, Thursday and Friday respectively. D1 = 1 if the

return is on Monday and 0 otherwise; D2 = 1 if the return is on Tuesday and 0 otherwise; and

xviii

so on. Similarly in equation (2) where the parameters B and the dummy variables D are 12

because of the 12 months of a year. For (2) D1 =1 for January and 0 otherwise, D2 =1 for

February and 0 otherwise and so on. The term ut is the disturbance term.

These models have been usually applied in the calendar anomalies literature. Firstly, the

above models will be estimated using the linear regression model (OLS) which assumes that

the data are normally distributed, serial uncorrelated and with constant variance (Wooldridge,

2003). We will examine whether that there are ARCH effects (ARCH-LM test). This is a

Lagrange multipler (LM) test for autoregressive conditional heteroskedasticity (ARCH) in the

residuals (Engle 1982). This particular specification of heteroskedasticity was motivated by

the observation that in many financial time series, the magnitude of residuals appeared to be

related to the magnitude of recent residuals. ARCH in itself does not invalidate standard LS

inference. However, ignoring ARCH effects may result in loss of efficiency.

For the purpose of this study, both OLS method and GARCH models will be employed as

the latter have an advantage over the ordinary least squares (OLS) regression in the sense that

it takes into consideration of not only the mean but also the risk or volatility of return. As

such, both the risk and return, which constitute the fundamentals of investment decision

process, are accounted for. In this respect, a better decision may be reached if an investor has

prior knowledge of whether there are variations in stock returns by the calendar effects and

whether a high daily or monthly return can be attributed to the correspondingly high

volatility. Moreover, revealing the specific volatility patterns in returns might also benefit

investors in risk management and portfolio optimization. In addition to this, the principle

advantage of employing GARCH models is the ability to capture the common empirical

observations in daily time series: fat tails due to time-varying volatility, skewness resulting

from mean non-stationarity, nonlinearity dependence, and volatility clustering. In addition to

this, if properly specified, the GARCH models should be able to significantly reduce the

excess skewness and kurtosis present in normal returns and also significantly remove the

ARCH effects.

The GARCH model was invented by Bollerslev (1986), and used in the study of calendar

effects by Connolly (1989). Instead of considering heteroskedasticity as a problem to be

corrected, the GARCH models treat heteroskedasticity as a variance to be modelled. As a

xix

result, not only are the deficiencies of least squares corrected, but a prediction is computed

for the variance of each error term.

GARCH MODEL

The GARCH (1, 1) model suitable for the studying of calendar anomalies is defined as:

Rt = + t

(3)

t ~ N(0, t2)

(4)

t2 = + 1 t-12 + 1 t-12

(5)

Where in equation (3), daily stock return, Rt, is regressed on a constant, ; t is an error term

which is dependent on past information and t2 is the conditional variance.

For the conditional variance, t2, to be nonnegative and positive, the following conditions

must be met: > 0 ; 1 0 and 1 + 1 <1

Engle and Bolleslev (1986) show that the persistence of shocks to volatility depends on the

sum of 1 + 1. Values of the sum lower than unity imply a tendency for the volatility

response to decay over time, at a slower rate the closer the sum is to unity. In contrast, values

of the sum equal to (or greater) unity imply indefinite (or increasing) volatility persistence to

shocks over time. It is often observed that downward volatilities in financial markets are

followed by higher volatilities than upward movements of the same magnitude.

E-GARCH MODEL

However, in spite of the apparent success of the GARCH model, there are some features of

the data, which this model is unable to pick out. For instance, non negativity constraints may

be violated and GARCH models cannot account for leverage effects. To deal with this

xx

problem, Nelson (1991) proposes the exponential GARCH or EGARCH model. Under the

EGARCH (1, 1) the conditional variance is given by

( )

( )

log t2 = + log t21 +

t 1

+ r t 1

t 1

t 1

Note that the left-hand side is the log of the conditional variance. This implies that the

leverage effect is exponential, and that forecasts of the conditional variance are guaranteed to

be nonnegative. The presence of leverage effects can be tested by the hypothesis that r0

and the impact is asymmetric if r 0.

ANALYSIS: MONDAY EFFECT

DESCRIPTIVE STATISTICS AND TEST

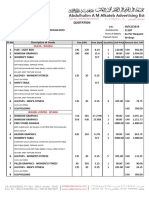

Table1: Summary statistics for daily Semdex returns across the days of the week for

different time periods.

Days

Monday

Tuesday

Wednesday

Thursday

Friday

ALL

Mean

0.000350

0.000279

0.000267

0.000286

0.000829

0.000403

StdDev

0.007060

0.007058

0.007370

0.006216

0.006853

0.006921

Skew.

0.337945

2.144718

0.711345

0.886217

0.816645

0.142070

Kurt.

31.14977

26.01129

14.10493

17.09404

27.86786

23.18399

Obs.

550

547

548

548

553

2746

From the table above, it can observed that the mean return seem to the lowest on Wednesdays

and highest on Fridays. And also, the mean return for Monday during this period is positive,

which is line with some recent papers that present evidence that the Monday effect in the US

and UK stock markets has gradually disappeared, for example Fortune (1998) and Mehdian

and Perry (2001).

As far as volatility is concerned, which is measured by standard deviation, it seems on

average to be lower on Tuesdays and higher on Fridays and Mondays across all years. Also,

there is negative skewness on Wednesday, Thursday and Friday. Excess kurtosis is present

for all days of the week, which means that ARCH/GARCH models have to be used to address

the excess kurtosis.

xxi

The returns on Fridays tend to be higher than Mondays for the period 1988 to 2008 and it can

be depicted from the graph below. This observation is consistent with literature, in the sense

that Cross (1973 findings on the S&P 500 Index over the period of 1953 and 1970 indicate

that the mean return on Friday is higher than the mean return on Monday. Similar results are

reported by French (1980), who also studied the S&P 500 index for the period of 1953-1977.

Figure 1: Observation graph showing Monday and Friday returns (1998-2008)

OLS REGRESSION

Table 2: Showing linear regression results for daily returns

Monday

Tuesday

Wednesday

Thursday

Friday

Coefficient

0.000350

0.000279

0.000267

0.000286

0.000829

tstatistic

1.1843

0.9441

0.9020

0.9664

2.8117

Prob

0.2364

0.3452

0.3671

0.3339

0.0049

The results obtained in Table 2 is consistent with the studies of Rogalski (1984) who used

simple linear regression in order to test for the existence of day of the week effects on S&P

500 and DJIA indices and the results showed that the Monday effect was insignificant in his

testing.

xxii

The coefficients from the OLS regression are consistent with our result in Table 10. All days

of the week have positive coefficients but which are all insignificant, except for Friday where

the p-value>0.05. Thus, there is the presence of day of the week effect on Friday. However,

the coefficient for the remaining days may be insignificant due to the presence of ARCH

effect, heteroskedasticity or serial correlation, all of which will be tested at a later stage in our

analysis. The GARCH (1, 1) model is also employed in order to get a better estimate of the

coefficients.

Moreover, the Durbin-Watson statistic in our output is 1.44, indicating the presence of serial

correlation in the residuals. The Durbin-Watson Statistic measures the serial correlation in the

residuals. As a rule of thumb, if the DW is less than 2, there is evidence of positive serial

correlation. There are better tests for serial correlation. In Testing for Serial Correlation, we

will later in our study discuss the Breusch-Godfrey Serial Correlation LM Test which

provides a more general testing framework than the Durbin-Watson test.

VOLATILITY IN DAILY STOCK RETURNS

The graph showing the daily return plotted on SEMDEX plotted against time can be observed

in Appendix 1, and it depicts the presence of volatility clustering. Financial time series, such

as stock prices, exchange rate, and inflation rate often exhibit the phenomenon of volatility

clustering. Volatility clustering or pooling refers the tendency for volatility for financial

markets to appear in bunches. Thus large returns (of either sign) are expected to follow large

returns, and small returns, and small returns (of either sign) to follow small returns.

Knowledge of volatility is of crucial importance in many areas. For instance, investors in the

stock market are obviously interested in the volatility could mean huge losses or gains and

hence greater uncertainty. In volatile market it is difficult for companies to raise capital in the

capital markets.

A characteristic of most of these financial time series is that in their level form they are

random walks; that is, they are nonstationary. On the other hand, in their first difference

form, they are generally stationary. Therefore, instead of modelling the levels of financial

time series, why not model their first difference? But these first often exhibit wide swings, or

volatility, suggesting that the variance of financial time series varies over time. And a method

to model the varying variance is the ARCH/GARCH model, which will be used for the

purpose of this study, originally developed by R.Engle.

xxiii

TESTING FOR STATIONARITY

Table 3: Augmented Dicker-Fuller test

Augmented

Dicker-Fuller

Test Statistic

Test critical values: 1% Level

5% Level

10% Level

t-statistic

-39.36226

Prob*

0.0000

-3.432540

-2.862393

-2.567269

*Mackinnon(1996)onesidedpvalues

Laglength:0(AutomaticbasedonSIC,MAXLAG=27)Schwerts(1989)principle,thatiskmax=12(n/100)^(0.25)

The augmented Dickey-Fuller (ADF) statistic, used in the test, is a negative number. From

the table above we conclude that the daily SEMDEX return is a non-stationary process when

tested at level.

Decision rule:

If

t* > ADF critical value, ==> not reject null hypothesis, i.e., unit root exists.

If

t* < ADF critical value, ==> reject null hypothesis, i.e., unit root does not exist.

The ADF statistic value is -39.36 and the associated one-sided p-value for is zero. In addition,

EViews reports the critical values at the 1%, 5% and 10% levels. Notice here that the tstatistic value less than the critical values so that we reject the null at conventional test sizes,

i.e. the data is stationary and doesnt need to be differenced.

TESTING FOR SERIAL CORRELATION

The Durbin-Watson statistic can be difficult to interpret, thus in order to test for first-order

serial correlation in residuals, the Breusch-Godfrey test is used.

Table 4: Breusch-Godfrey test

Breusch-Godfrey Serial Correlation LM Test:

F-statistic

229.6976

Obs*R-squared

212.3950

Prob. F(1,2740)

Prob. Chi Square(1)

0.0000

0.0000

Hypothesis setting for serial correlation:

xxiv

Null hypothesis: No serial correlation in the residuals (u)

Alternative

: There is serial correlation in the residuals (u)

The output presents the test statistics and associated probability values. The test regression

used to carry out the test is reported below the statistics. The statistic labelled Obs*Rsquared is the LM test statistic for the null hypothesis of no serial correlation. The

(effectively) zero probability value strongly indicates the presence of serial correlation in the

residuals. Since the p-value (0.0000) of Obs*R-squared is less than 5 percent (p<0.05), we

reject null hypothesis meaning that residuals (u) are serially correlated which is not desirable.

TESTING FOR HETEROSKEDASTICITY

Table 5: HeteroskedasticityTest:Whitetest

HeteroskedasticityTest:White

Fstatistic0.361796

Obs*Rsquared1.449055

ScaledexplainedSS16.07310

Prob.F(1,2741)0.8359

Prob.ChiSquare(1)0.8356

Prob.ChiSquare(1)0.0029

Dependentvariable:RESID^2

Collineartestregressorsdroppedfromspecification

Hypothesis setting for heteroskedasticity

Null hypothesis Ho

: Homoscedasticity (the variance of residual (u) is

constant)

Alternative hypothesis H1 : Heteroskedasticity (the variance of residual (u) is

not constant )

The Obs*R-squared statistic is Whites test statistic, computed as the number of observations

times the centered R2 from the test regression, and it follows a chi square distribution. If the

chi square value exceeds the critical value at the chosen level of significance, the conclusion

is that heteroskedasticity is present.

The p-value of Obs*R-squared shows that we cannot reject the null hypothesisl. So residuals

have constant variance which is desirable meaning that residuals are homoscedastic.

HISTOGRAM AND STATISTICS

xxv

Appendix 2 shows the skewness and Kurtosis of the distribution. The Skewness is a measure

of asymmetry of the distribution of the series around its mean. Since there is a negative

skewness of -0.142070, we conclude that the distribution has a long left tail. On the other

hand, Kurtosis measures the peakedness or flatness of a distribution. The Kurtosis of a

normal distribution is three. If the Kurtosis exceeds three, which is the case here, then the

distribution is flat (playkurtic) relative to the normal.

Departure from normality has also been tested using the Jarque-Bera Statistic. The hypothesis

for Jarque-Bera Statistic is as follows:

Null Hypothesis: residuals (u) are normally distribution

Alternative: Not normally distributed

Since the p-value of Jarque-Bera statistics is less than 5 percent (0.05) we can reject null and

accept

the

alternative,

that

is

residuals

(u)

are

not

normally

distributed.

TESTING FOR ARCH EFFECTS AFTER OLS REGRESSION

Table 6: ARCH LM Test

HeteroscedasticityTest:ARCH

Fstatistic1028.452

Obs*Rsquared748.5446

Prob.F(1,2744)0.0000

Prob.ChiSquare(1)0.0000

Table 6 reveal the inadequacy of OLS model as there are remaining ARCH effects due to the

untreated volatility of the returns in the models for various periods of study. Such volatility

needs to be modelled in order to provide a clearer picture of the monthly seasonal anomalies

on SEMDEX. Thus GARCH (1, 1) and EGARCH (1, 1) models are estimated for this

purpose in this analysis.

GARCH (1,1) MODEL

Table 7: Showing results of GARCH (1, 1) estimation of the mean equation for Monday

effect

Coefficient

zstatistic

xxvi

Prob

Monday

Tuesday

Wednesday

Thursday

Friday

0.000191

0.000109

0.000515

0.000363

0.000413

1.1843

0.9441

0.9020

0.9664

2.8117

0.2560

0.5259

0.0003

0.0175

0.0063

The results from Table 7 indicate that the highest return is observed on Wednesday

(0.0000515) and the lowest return is on Tuesday (0.000109), followed by Monday

(0.000191). The table reports day of the week effect on return equation. The estimated

coefficients for the all the week day dummy variables are positive and statistically significant

except for the Monday and Tuesday Dummy variables, where the p-value > 0.05. Thus, there

is no indication of Monday effect. This result seems to be contrary to the findings of French

(1980) and Agrawal and Tandon (1994) who found significantly negative returns on Monday.

This shows that the market is efficient in its weak form which states that share price

movement cannot be predicted in advance to form a trading strategy. The GARCH parameter

is close to 1, implying that the volatility shocks are persistent. For the daily returns on

SEMDEX it equals 0.817.

In Table 8, we include four new days of the week dummy variables in the conditional

variance equation in addition to the return equation. The variance equation reflects a

statistically significant and negative volatility and the highest being on Monday. In addition

to this, the conditional standard variance graph in Appendix 3 shows brief periods of high

volatility.

Table 8: Showing results of GARCH (1, 1) estimation of the variance equation for the

Monday effect

Monday

Tuesday

Wednesday

Friday

Coefficient

0.0000250

0.0000367

0.0000306

0.0000446

zstatistic

11.23203

18.14575

16.82445

21.90199

Prob

0.0000

0.0000

0.0000

0.0000

TESTING FOR ARCH EFFECT AFTER GARCH (1, 1) ESTIMATION

Table 9: ARCH LM Test

HeteroscedasticityTest:ARCH

xxvii

Fstatistic1.791573

Obs*Rsquared48.94757

Prob.F(1,129)0.0074

Prob.ChiSquare(1)0.0077

The Engle's ARCH LM tests indicate that there is no autocorrelation and no ARCH effects in

the standardized residual terms. Hence, the results of the specification tests are favourable.

We consider 27 lag orders. The Durbin Watson test also concludes that there is no presence

of serial correlation.

EGARCH (1, 1) MODEL

The EGARCH (1, 1) model allows returns to be asymmetrically correlated with future

volatility. Since the EGARCH (1, 1) model is in logarithmic form, there is no restriction on

the parameters in the EGARCH model in the condition that the sum of the terms must not

exceed unity in order to guarantee that the process is stationary. Volatility tends to rise in

response to bad news and to fall in response to good news.

Table 10: Showing EGARCH estimation for the day of the week effect

C(2)

C(3)

C(4)

C(5)

Coefficient

0.562893

0.332951

0.005699

0.968250

zstatistic

0.017892

0.007720

0.005663

0.001695

Prob

0.0000

0.0000

0.3143

0.0000

From Table 10, it can be seen that C (5) is negative and statistically significant indicating

significant leverage effect. The persistence parameter, C (5), is very large, implying that the

variance moves slowly through time. The asymmetry coefficient, C (4), is positive, implying

that the variance goes up more after positive residuals than after negative residuals.

ANALYSIS: JANUARY EFFECT

AN INFORMAL STUDY OF THE MONTHLY DATA SET

xxviii

Figure 2: Chart showing mean of monthly returns

According to the chart above, it can be clearly seen that monthly stock returns on SEMDEX

are higher in January than in other months. This result is consistent with literature. The first

studies, by Rozeff and Kinney (1976), Dyl (1977) and Brown et al. (1983) analyze the US

stock market and observe significant higher returns in January than in the other months of the

year. More recently, Haugen and Jorion (1996), Tonchev and Kim (2004) and Rosenberg

(2004) reach empirical findings similar to prior studies.

OLS REGRESSION

Table 11: Showing linear regression results for monthly returns

January

February

March

April

May

June

July

August

September

October

November

December

Coefficient

0.001901

0.000213

-0.000082

0.000051

-0.000012

0.000982

0.000075

0.000029

0.000441

0.000266

0.000887

0.000213

T-statistic

2.955158

0.407202

-0.127349

0.078976

-0.018388

1.526818

0.117092

0.044288

0.0.684953

0.413321

1.378772

0.331049

Prob.

0.0038

0.6846

0.8989

0.9372

0.9854

0.1294

0.9070

0.9647

0.4947

0.6801

0.1705

0.7412

After computing OLS regression, we conclude that the results from Table 11 are consistent

from the chart above, which shows that the highest return is in the month of January and the

lowest being on March. However, only the January return is statistically significant as Pxxix

value for that month < 0.05. Thus, the conclusion from the OLS regression is that January

effect is present.

The returns of the other months of the year may be statistically insignificant due to the

presence of ARCH effects, heteroscedasticity or serial correlation which will all be tested at a

later stage in our study.

TESTING FOR STATIONARITY

Table 12: Augmented Dicker Fuller Test-unit root test

Augmented DickerFuller Test

Statistic

Testcriticalvalues:1%Level

5%Level

10%Level

tstatistic

8.115519

Prob*

0.0000

3.480818

2.883579

2.578601

*Mackinnon(1996)onesidedpvalues

Laglength:0(AutomaticbasedonSIC,MAXLAG=12),Schwerts(1989)principle,thatiskmax=12(n/100)^(0.25)

Decision rule:

If

t* > ADF crtitical value, ==> not reject null hypothesis, i.e., unit root exists.

If

t* < ADF critical value, ==> reject null hypothesis, i.e., unit root does not exist.

The ADF statistic value is -8.11 and the associated one-sided p-value for is zero. In addition,

EViews reports the critical values at the 1%, 5% and 10% levels and t-statistic value less than

the critical values so that we reject the null at conventional test sizes, i.e. the data is stationary

and doesnt need to be differenced

TESTING FOR SERIAL CORRELATION

Table 13: Breusch-Godfrey test

BreuschGodfreySerialCorrelationLMTest:

Fstatistic18.05260

Obs*Rsquared17.38707

Prob.F(1,132)0.0000

Prob.ChiSquare(1)0.0000

Hypothesis setting for serial correlation:

xxx

Null hypothesis

: No serial correlation in the residuals (u)

Alternative

:There is serial correlation in the residuals (u)

The output presents the test statistics and associated probability values. The statistic labelled

Obs*R-squared is the LM test statistic for the null hypothesis of no serial correlation. The

(effectively) zero probability value strongly indicates the presence of serial correlation in the

residuals. Since the p-value (0.0000) of Obs*R-squared is less than 5 percent (p<0.05), we

reject null hypothesis meaning that residuals (u) are serially correlated which is not desirable.

TESTING FOR HETEROSKEDASTICITY

Table 14: HeteroskedasticityTest:WhiteTest

HeteroskedasticityTest:White

Fstatistic1.474295

Obs*Rsquared15.71516

ScaledexplainedSS30.78495

Prob.F(1,2741)0.1499

Prob.ChiSquare(1)0.1599

Prob.ChiSquare(1)0.0012

Dependentvariable:RESID^2

Collineartestregressorsdroppedfromspecification

Hypothesis setting for heteroscedasticity

Null hypothesis Ho

: Homoscedasticity

(the variance of residual (u) is

constant)

Alternative hypothesis H : Heteroskedasticity (the variance of residual (u) is

not constant )

If the chi square value exceeds the critical value at the chosen level of significance, the

conclusion is that heteroskedasticity is present. The p-value of Obs*R-squared shows that

we cannot reject null. So residuals have constant variance which is desirable meaning that

residuals are homoscedastic. Thus, we do not reject the null hypothesis

HISTOGRAM AND STATISTICS

From Appendix 4, it can be observed that there is a negative skewness of -0.424805, thus

concluding that the distribution has a long left tail. On the other hand, Kurtosis measures the

peakedness or flatness of a distribution. The Kurtosis of a normal distribution is three, and it

xxxi

can be seen that the kurtosis is 5.740618 and thus the distribution is flat (playkurtic) relative

to the normal.

Departure from normality has also been tested using the Jarque-Bera Statistic. The hypothesis

for Jarque-Bera Statistic is as follows:

Null Hypothesis: residuals (u) are normally distribution

Alternative: Not normally distributed

Since the p-value of Jarque-Bera statistics is less than 5 percent (0.05) we can reject null and

accept the alternative, that is residuals (u) are not normally distributed.

TESTING FOR ARCH EFFECTS AFTER OLS REGRESSION

Table 15: ARCH LM Test

HeteroscedasticityTest:ARCH

Fstatistic21.81333

Obs*Rsquared18.94757

Prob.F(1,129)0.0000

Prob.ChiSquare(1)0.0000

Table 2 reveal the inadequacy of OLS model as there are remaining ARCH effects due to the

untreated volatility of the returns in the models for various periods of study. Such volatility

needs to be modelled in order to provide a clearer picture of the monthly seasonal anomalies

on SEMDEX. Thus GARCH (1, 1) and EGARCH (1, 1) models are estimated for this

purpose in this analysis.

RESULT FROM GARCH (1, 1) ESTIMATION

Table 16: Showing results of GARCH (1, 1) estimation of the mean equation for January

effect

January

February

March

April

May

June

July

Coefficient

0.001793

0.000169

0.000448

0.000685

0.0000148

0.000484

0.000125

Std. Error

0.000493

0.000638

0.000638

0.000410

0.000800

0.000547

0.000378

xxxii

Z-statistic

3.638418

0.265196

-1.094426

-1.769058

-0.018559

0.885856

-0.330865

Prob.

0.0003

0.7909

0.2738

0.0769

0.9852

0.3756

0.7407

August

September

October

November

December

0.000214

0.000915

0.000887

0.001166

0.000361

0.000440

0.000422

0.000466

0.000586

0.000304

0.485538

2.166072

1.902676

1.988370

1.188201

0.6273

0.0303

0.0571

0.0468

0.2348

Table 16 reports monthly effects on return equation. The estimated coefficients for the all the

months are positive. But only the returns on January, September and November are

significant, as the p-value < 0.05. This shows that the month of the year effect is present.

The results indicate that the highest return is observed on January (0.001793) and the lowest

return is on November (0.001166), followed by September (0.000915). Thus, from the table

above, it can be concluded that there is the presence of January effect on SEM, which is in

line with the findings of Rozeff and Kinney (1976), Bhardwaj and Brooks (1992) and

Eleswarapu and Reinganum (1993) who found the presence of January effect on the NYSE

stocks for different periods of time. Moreover, the GARCH parameter is 0.499716, indicating

that there are volatility shocks.

Table 17: Showing results of GARCH (1, 1) estimation of the variance equation for the

January effect

January

February

March

April

May

June

July

August

September

November

December

Coefficient

-9.22E-07

-5.48E-06

-1.96E-06

-6.61E-07

-5.32E-06

-3.25E-06

-7.18E-07

-2.55E-06

-8.59E-07

-6.45E-06

-2.82E-06

Std. Error

3.01E-06

1.04E-06

1.69E-06

3.98E-06

2.77E-06

1.44E-06

1.90E-06

4.01E-06

2.48E-06

2.79E-06

2.04E-06

Z-statistic

-0.306886

-5.272291

-1.157193

-1.165942

-1.921445

-2.256938

-0.378163

-0.635814

0.347161

-2.311718

-1.378794

Prob.

0.7589

0.0000

0.2472

0.8682

0.0547

0.0240

0.7053

0.5249

0.7285

0.0208

0.1680

Table 17 shows that the variance equation reflects a statistically significant February and

November dummy variables and shows that negative volatility is the highest in November.

Thus the January effect may be due to the varying volatility as the January coefficient is

insignificant in the variance equation. Also, the conditional standard deviation graph in

Appendix 5 also show brief periods of high volatility.

xxxiii

HISTOGRAM NORMALITY TEST AFTER GARCH (1, 1) ESTIMATION

After using the GARCH (1,1) model, the kurtosis is close to 3, and the Jarque-Bera statistic

has a p-value of 0.32, implying that the data are consistent with a Normal distribution (and

constant variance). These results are displayed in Appendix 6.

TESTING FOR ARCH EFFECT AFTER GARCH (1, 1) ESTIMATION

Table 18: ARCH LM Test

HeteroscedasticityTest:ARCH

Fstatistic0.000661

Obs*Rsquared0.000671

Prob.F(1,129)0.9795

Prob.ChiSquare(1)0.9793

ARCH-LM test does not indicate the presence of the ARCH effect. These results indicate that

our model does not have a misspecification problem, and standardized residual terms do not

have autocorrelation and constant variance.

EGARCH (1, 1) MODEL

Table 19: Showing EGARCH estimation for the January effect

C(2)

C(3)

C(4)

C(5)

Coefficient

8.691450

0.929478

0.241431

0.366745

zstatistic

4.119945

4.198626

1.422587

2.196819

Prob

0.0000

0.0000

0.1549

0.0280

In table 19, the leverage effect term, expressed as C (5) in the model, is positive and

statistically different from zero, indicating that the news impact is asymmetric during the

sample period. There seem to be no leverage effects on the monthly returns on SEM as the

coefficient is statistically positive. As such, negative news on SEM cause volatility to

increase less than positive news of the same magnitude.

SECTION 4: CONCLUSION

xxxiv

This paper examined in the analysis section examines the existence of a daily pattern of

calendar anomalies in the Mauritian stock market using Ordinary least Squares (OLS),

GARCH and EGARCH models applied to capture the different behaviour of the time varying

volatility in the return series of SEMDEX, for the period January 1998 to December 2008.

There was no indication of the presence the Monday effect. This result seems to be contrary

to the findings of French (1980) and Agrawal and Tandon (1994) who found significantly

negative returns on Monday. The OLS estimation reveals that there is no day of the week

effect in the period from January 1998 to December 2008. The fact that there is any

indication of the Monday effect is confirmed by employing the GARCH models, where the

coefficient representing Monday is insignificant. And also, the GARCH parameter indicates

that volatility shocks are persistent in the daily returns. The EGARCH model shows that there

is leverage effect, that is, negative news on the SEM cause volatility to increase more than

positive news of the same magnitude.

The second part of the analysis section which examines the January effect on stock returns

reveals that there is the presence of the January effect in the Mauritian stock market for the

chosen period, by using both linear regression model and GARCH model. These findings are

consistent with the studies of Rozeff and Kinney (1976), Bhardwaj and Brooks (1992), and

Eleswarapu and Reinganum (1993) which found significant January effect across many stock

markets. However, the January effect cannot be explained by varying volatility as the January

coefficient is still significant in the variance equation. Besides, investors can use the January

effect information to avoid and reduce the risk when investing in the Mauritian stock market.

Also, it has been observed that there is no leverage effect on monthly returns on SEM, which

means that negative news on the SEM cause volatility to increase less than positive news of

the same magnitude.

REFERENCES

1. Aktham Issa Maghyerah, 2003, Seasonality and January Effect Anomalies in the

Jordanian Capital Market, Hashemite University, available at

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=441081 [Accessed at October

2009]

xxxv

2. Breadly Myers.,2006. Seventh Edition. Principles of Corporate Finance. New Delhi.

Tata McGraw-Hill Publishing Company Limited

3. Charles P. Jones, Douglas K. Pearce, Jack W. Wilson Source., 1987, Can Tax-Loss

Selling Explain the January Effect?, The Journal of Finance, Vol. 42, No. 2 pp. 453461, Available at http://www.jstor.org/stable/2328262. [Accessed at October 2009]

4. Chen, H., and V. Singal, 2003, Role of Speculative Short Sales in Price Formation:

Case of the Weekend Effect, Journal of Finance, pp. 685-705.

5. Damodar N. Gujarati.,1997. Basic Econometrics. Fourth Edition. New Delhi. Tata Mc

Graw-Hill Publishing Company Limited

6. Dimitris Kenourgios and Aristeidis Samitas, 2008, The Day of the Week Effect

Patterns on Stock Market Return and Volatility: Evidence for the Athens Stock

Exchange, International Research Journal of Finance and Economics, available at

http://www.eurojournals.com/finance.htm [Accessed at October 2009]

7. Dr. Baboo M Nowbutsing., December 2008. Study Guide, Financial Modelling and

Forecasting. ECON 3281 (5)

8. Elroy Dimson and Massoud Mussavian., 1998, A brief history of market efficiency,

European Financial Management, Volume 4, Number 1, pp 91-193, London Business

School

9. Eugene F. Fama., 1969, Efficient Capital Market: A Review of Theory and Empirical

Work, The Journal of Finance, Vol. 25, No. 2, pp. 383-417, Available from

http://www.jstor.org/stable/pdfplus/2325486.pdf

10. Eviews 6 Users Guide 1, 2007, United States of America, Quantitative Micro

Software, LL

11. Eviews 6 Users Guide 2, 2007, United States of America, Quantitative Micro

Software, LLC

12. Fama, E., 1991, Efficient Capital Markets: II, Journal of Finance pp. 1575-1617,

Available from http://www.e-m-h.org/Fama91.pdf [Accessed at October 2009]

13. Folliott Tyler, 2006, The January effect: a global perspective, Master of Business

Administration, Simon Fraser University

14. Hu Yue, 2005, Some empirical tests for the January effect, M.A (Economics). Simon

Fraser University

15. Josef Lakonishok and Seymour Smidt., 1988, Are Seasonal Anomalies Real? A

Ninety-Year Perspective, The Review of Financial Studies, Vol. 1, No. 4 (Winter,

xxxvi

1988), pp. 403-425, Available from http://www.jstor.org/stable/2962097 [Accessed at

October 2009]

16. Klesov Andriy, 2008, Calendar Effects on Stock Market: Case of Selected CIS and

CEE Countries, Master of Arts in Economics. National University Kyiv-Mohyla

Academy

17. Peter Reinhard Hansen, Asger Lunde, and James M.Nason., 2005, Testing the

significance of Calendar Effects, Working Paper Series, Federal Reserve Bank of

Atlanta

18. Pettengill, G., an Experimental Study of the 'Blue Monday' Hypothesis, Journal of

Socio-Economies (Fall 1993), pp. 241-257.

19. Pettengill, Glenn N., 2003, A Survey of the Monday Effect Literature, Quarterly

Journal of Business and Economics, Available from

http://www.allbusiness.com/business-finance/equity-funding-stock/898321-1.html

[Accessed at September 2009]

20. Philip S. Russel and Violet M. Torbey., 2002, The Efficient Market Hypothesis on

Trial: A Survey, Available from http://www.westga.edu/~bquest/2002/market.htm

[Accessed at October 2009]

21. Ricky Chee-Jiun Chia, Venus Khim-Sen Liew and Syed Azizi Wafa Syed Khalid

Wafa. 2006, Calendar Anomalies in The Malaysian Stock Market, Labuan School of

International Business and Finance, Universiti Malaysia Sabah

22. Robert A. Connolly Source., 1989, An Examination of the Robustness of the Weekend

Effect, The Journal of Financial and Quantitative Analysis, Vol. 24, No. 2 (Jun.,

1989), pp. 133 -169, Available from http://www.jstor.org/stable/2330769

23. Robert A. Connolly, 1989, An Examination of the Robustness of the Weekend Effect,

The Journal of Financial and Quantitative Analysis, Vol. 24, No. 2 (Jun., 1989), pp.

133 -169, University of Washington School of Business Administration Stable,

Available from http://www.jstor.org/stable/2330769 [Accessed at October 2009]

24. Siqi Guo and Zhiqiang Wang, 2007, Market efficiency anomalies: A study of

seasonality effect on the Chinese stock exchange, Master thesis, Umea University,

Umea School of Business

xxxvii

25. Steeley, J., 2001, A Note on Information Seasonality and the Disappearance of the

Weekend Effect in the UK Stock Market, Journal of Banking and Finance, pp. 19411956.

26. Sullivan, R., A. Timmermann, and H. White, 2001, Dangers of Data Mining: The

Case of Calendar Effects in Stock Returns, Journal of Econometrics (November

2001), pp. 249-286.

27. Yanxiang Anthony, Gu., 2003, The Diminishing Weekend Effect: Experience of G7

Countries, Academy of Accounting and Financial Studies Journal, available from

http://www.alliedacademies.org/Publications/Papers/AAFSJ%20Vol%207%20No%2

02%202003%20p%2071-77.pdf [Accessed at October 2009]

28. Yanxiang Anthony, Gu., 2006, The Declining January Effect: Experience of Five G7

Countries, Academy of Accounting and Financial Studies Journal, available at

http://www.allbusiness.com/economy-economic-indicators/economicindicators/13434941-1.html [Accessed at October 2009]

29. Zafar Mueen Nasir, 2005, Day of the Week Effect in Stock Return Evidence from

Karachi

Stock

Market,

Nahria

University,

Available

from

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=829524

30. Zvi Bodir, Alex Kane, Alan J Marcus, and Pitabas Mohanty.,2006.Sixth Edition.

Investments. New Delhi. Tata Mc Graw-Hill Publishing Company Limited

xxxviii

APPENDICES

Appendix 1: graph showing volatility on daily stock returns from January 1998 to December

2008

Appendix 2: The EViews outputs showing a histogram of the data series plus major

descriptive statistics for the daily returns after OLS regression

Appendix 3: Showing standard Deviation graph for daily SEMDEX returns from 1998 to

2008

xxxix

Appendix 4: The EViews outputs showing a histogram of the data series plus major

descriptive statistics for the monthly returns after OLS regression

Appendix 5: Showing standard Deviation graph for monthly SEMDEX returns from 1998 to

2008

xl

Appendix 6: The EViews outputs showing a histogram of the data series plus major

descriptive statistics for the monthly returns after GARCH (1, 1) estimation

xli

You might also like

- Stock Prices, Asset Portfolios and Macroeconomic Variables in Ten European CountriesDocument24 pagesStock Prices, Asset Portfolios and Macroeconomic Variables in Ten European CountriesMario CruzNo ratings yet

- Bomar BandsDocument1 pageBomar BandsfredsvNo ratings yet

- Accounting Assignments ListDocument8 pagesAccounting Assignments Listumar0% (1)

- Microeconomic Pindyck CH 16Document37 pagesMicroeconomic Pindyck CH 16JemiNo ratings yet

- OilCo LTDDocument4 pagesOilCo LTDEverjoyNo ratings yet

- Life Cycle Costing 1st Edition RicsDocument36 pagesLife Cycle Costing 1st Edition RicsAlemayehu Darge100% (1)

- Compton 2000Document13 pagesCompton 2000FarrukhShanNo ratings yet

- C10 PDFDocument55 pagesC10 PDFMickey KoenNo ratings yet

- Periodic Stochastic Volatility and Fat TailsDocument47 pagesPeriodic Stochastic Volatility and Fat TailsFjäll RävenNo ratings yet

- Calendar Effects in Global Markets: An Empirical Study (1987-2006)Document54 pagesCalendar Effects in Global Markets: An Empirical Study (1987-2006)Mickey KoenNo ratings yet

- Seasonality Effect On The Vietnamese Stock ExchangeDocument13 pagesSeasonality Effect On The Vietnamese Stock ExchangeNhu LeNo ratings yet

- The Nepalese Stock Market: Efficient and Calendar Anomalies: Dr. Fatta Bahadur K.C. and Nayan Krishna JoshiDocument46 pagesThe Nepalese Stock Market: Efficient and Calendar Anomalies: Dr. Fatta Bahadur K.C. and Nayan Krishna JoshiRambabu MahatoNo ratings yet

- The Turn-Of-The-Month-Effect Evidence From Periodic Generalized Autoregressive Conditional Heteroskedasticity (PGARCH) Model SSRN-id2584213Document19 pagesThe Turn-Of-The-Month-Effect Evidence From Periodic Generalized Autoregressive Conditional Heteroskedasticity (PGARCH) Model SSRN-id2584213Dom DeSiciliaNo ratings yet

- Weekend Effect 1998 2009Document18 pagesWeekend Effect 1998 2009Pragyan SarangiNo ratings yet

- Monday Effect & Stock Return SeasonalityDocument15 pagesMonday Effect & Stock Return Seasonalityom25507No ratings yet

- The Weekend and Reverse' Weekend Effects: An Analysis by Month of The Year, Week of The Month, and IndustryDocument28 pagesThe Weekend and Reverse' Weekend Effects: An Analysis by Month of The Year, Week of The Month, and IndustrykarollNo ratings yet

- Study of Calendar Anomalies in Indian Stock Markets IDocument16 pagesStudy of Calendar Anomalies in Indian Stock Markets ISrinu BonuNo ratings yet

- Stock Returns Seasonality in Emerging Asian Markets: Khushboo Aggarwal Mithilesh Kumar JhaDocument22 pagesStock Returns Seasonality in Emerging Asian Markets: Khushboo Aggarwal Mithilesh Kumar JhaUsama SarwarNo ratings yet

- Emh (Efficient Market Hypothesis)Document6 pagesEmh (Efficient Market Hypothesis)Sumit SrivastavNo ratings yet

- Stock Market Anomaly: Day of The Week Effect in Dhaka Stock ExchangeDocument14 pagesStock Market Anomaly: Day of The Week Effect in Dhaka Stock ExchangeAkter Uz ZamanNo ratings yet

- Market AnomaliesDocument8 pagesMarket AnomaliesUsman KashifNo ratings yet

- Adnan Karim - Stock Price Response To Earnings Announcements Using Evidence From The UK Stock MarketDocument32 pagesAdnan Karim - Stock Price Response To Earnings Announcements Using Evidence From The UK Stock MarketAdnan Karim100% (1)

- Artikel Internasional Abnormal ReturnDocument32 pagesArtikel Internasional Abnormal ReturnI Nyoman EndraNo ratings yet

- 01 Nishat MustafaDocument24 pages01 Nishat MustafaIqra JawedNo ratings yet

- Testing Semi-Strong Form Efficiency of Stock Market: 40: 4 Part II (Winter 2001) Pp. 651-674Document24 pagesTesting Semi-Strong Form Efficiency of Stock Market: 40: 4 Part II (Winter 2001) Pp. 651-674Zoya KhanNo ratings yet

- Daily Patterns in Stock Returns As Evidence From The New Zealand Stock MarketDocument6 pagesDaily Patterns in Stock Returns As Evidence From The New Zealand Stock MarkethacheemasterNo ratings yet

- The Monthly Effect in International Stock Markets: Evidence and ImplicationsDocument6 pagesThe Monthly Effect in International Stock Markets: Evidence and Implicationsmehul_mistry_3No ratings yet

- Day of The Week Effect ItalyDocument29 pagesDay of The Week Effect ItalyRENJiiiNo ratings yet

- US Day of The Week EffectDocument23 pagesUS Day of The Week EffectRENJiiiNo ratings yet

- Momentum TradingDocument7 pagesMomentum TradingInversiones BvlNo ratings yet

- Journal of Economics and Management: Katarzyna NiewińskaDocument17 pagesJournal of Economics and Management: Katarzyna NiewińskaUmer ArifNo ratings yet

- Fading MomentumDocument31 pagesFading MomentumChristopher OlsonNo ratings yet

- FM Stock Market Interest Rate and Output 062002Document49 pagesFM Stock Market Interest Rate and Output 062002Rizwan KhanNo ratings yet

- ALPHA Generation Through Weekend Effect in Small Firms: Özyeğin University Finance412Document22 pagesALPHA Generation Through Weekend Effect in Small Firms: Özyeğin University Finance412Ersin SeçkinNo ratings yet

- TOM EffectsDocument15 pagesTOM EffectsAhmed AÏRNo ratings yet

- Kunkel 1998Document13 pagesKunkel 1998FarrukhShanNo ratings yet

- Adaptive Market Hypothesis Evidence From Indian Bond MarketDocument14 pagesAdaptive Market Hypothesis Evidence From Indian Bond MarketsaravanakrisNo ratings yet

- Stock Market Conditions and Monetary Policy in ADocument52 pagesStock Market Conditions and Monetary Policy in AAmira TakiNo ratings yet

- The Benefits of Combining Seasonal Anomalies and Technical Trading RulesDocument17 pagesThe Benefits of Combining Seasonal Anomalies and Technical Trading RulesJuan Ernesto Martinez MatosNo ratings yet

- The Review of Macroeconomic Factors and Stock ReturnsDocument9 pagesThe Review of Macroeconomic Factors and Stock Returnsdiovolo UnaNo ratings yet

- Calendar Effects in US Stock MarketsDocument26 pagesCalendar Effects in US Stock MarketsMickey KoenNo ratings yet

- Do Mutual Funds Time The Market? Evidence From Portfolio HoldingsDocument49 pagesDo Mutual Funds Time The Market? Evidence From Portfolio HoldingsDidar RikhonNo ratings yet

- Event Study Using Anfis (A Neural Model) : Predicting The Impact of Anticipatory Action On Us Stock Market - AN FuzzyDocument8 pagesEvent Study Using Anfis (A Neural Model) : Predicting The Impact of Anticipatory Action On Us Stock Market - AN FuzzyJose GueraNo ratings yet

- Forex VolatilityDocument25 pagesForex VolatilityNoufal AnsariNo ratings yet

- Synthetic Trades Calendar Day Patterns FR 2001Document24 pagesSynthetic Trades Calendar Day Patterns FR 2001Justice tadiosNo ratings yet

- Stock Market Reaction To Good and Bad Inflation News: Johan Knif James Kolari Seppo PynnönenDocument42 pagesStock Market Reaction To Good and Bad Inflation News: Johan Knif James Kolari Seppo Pynnönenadnaan_79No ratings yet

- The News in Financial Asset Returns: Gerald P. Dwyer Jr. and Cesare RobottiDocument23 pagesThe News in Financial Asset Returns: Gerald P. Dwyer Jr. and Cesare RobottiIqra JawedNo ratings yet

- Properties of High Frequency DAX Returns Intraday Patterns, Philippe MassetDocument28 pagesProperties of High Frequency DAX Returns Intraday Patterns, Philippe MassetDigito DunkeyNo ratings yet

- ALPHA Generation Through Weekend Effect in Small Firms: Özyeğin University Finance412Document22 pagesALPHA Generation Through Weekend Effect in Small Firms: Özyeğin University Finance412Ersin SeçkinNo ratings yet

- Growth BCDocument30 pagesGrowth BCVikas SinglaNo ratings yet

- Predictability of Equity Reit Returns: Implications For Property Tactical Asset AllocationDocument24 pagesPredictability of Equity Reit Returns: Implications For Property Tactical Asset AllocationKarburatorNo ratings yet

- On The Presence of A Day-of-the-Week Effect in The Foreign Exchange MarketDocument8 pagesOn The Presence of A Day-of-the-Week Effect in The Foreign Exchange MarketapnreNo ratings yet

- Local ProjDocument35 pagesLocal ProjKevin CorfieldNo ratings yet

- 1 Fisher (1988) Recent Develoments in MacroeconomicsDocument47 pages1 Fisher (1988) Recent Develoments in MacroeconomicsEmily Tomaylla VillagarayNo ratings yet

- Khan 2021Document18 pagesKhan 2021Ahmadi AliNo ratings yet

- Week Days Efefct PaperDocument22 pagesWeek Days Efefct PaperImtiaz HussainNo ratings yet

- Stock Market Development and Economic Growth: Evidence From Developing CountriesDocument19 pagesStock Market Development and Economic Growth: Evidence From Developing CountriesSusovon JanaNo ratings yet

- January Effect and Lunar Effect in VietnamDocument8 pagesJanuary Effect and Lunar Effect in VietnamMahardiky BudiansyahNo ratings yet

- Research Paper 2004Document11 pagesResearch Paper 2004Khai NguyenNo ratings yet

- Wai Lee - Regimes - Nonparametric Identification and ForecastingDocument16 pagesWai Lee - Regimes - Nonparametric Identification and ForecastingramdabomNo ratings yet

- Term Report Fat MW Ss YeDocument27 pagesTerm Report Fat MW Ss YeYasmin El-AlawaNo ratings yet

- Inflation, Financial Markets and Long-Run Real Activity: Elisabeth Huybens, Bruce D. SmithDocument33 pagesInflation, Financial Markets and Long-Run Real Activity: Elisabeth Huybens, Bruce D. SmithSamuel Mulu SahileNo ratings yet

- Journal of International Business and EconomicsDocument10 pagesJournal of International Business and EconomicsAysha LipiNo ratings yet

- Hyst JST Aug2019Document57 pagesHyst JST Aug2019Pland SpringNo ratings yet

- Financial Markets and Economic Performance: A Model for Effective Decision MakingFrom EverandFinancial Markets and Economic Performance: A Model for Effective Decision MakingNo ratings yet

- 6 Factors That Influence Exchange RatesDocument2 pages6 Factors That Influence Exchange RatesfredsvNo ratings yet

- VIX Wikipedia enDocument6 pagesVIX Wikipedia enfredsvNo ratings yet

- Using Bollinger Band® - Bands - To Gauge TrendsDocument3 pagesUsing Bollinger Band® - Bands - To Gauge TrendsfredsvNo ratings yet

- The Rise and Fall of S&P500 Variance FuturesDocument25 pagesThe Rise and Fall of S&P500 Variance FuturesfredsvNo ratings yet