Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

You might also like

- Termination EN2020Document4 pagesTermination EN2020Milos MihajlovicNo ratings yet

- Subcontracting With Chargeable Components" and "Material LedgerDocument4 pagesSubcontracting With Chargeable Components" and "Material LedgerjoeindNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document6 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Revised Statement of Assets & Liabilities As On September 30, 2015 (Result)Document4 pagesRevised Statement of Assets & Liabilities As On September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Eo Designating Data Protection Officer BarangayDocument3 pagesEo Designating Data Protection Officer BarangayAnne Kimberly Peñalba BabaanNo ratings yet

- Digital Marketing Company Dubai Best SEO Company in DubaiDocument2 pagesDigital Marketing Company Dubai Best SEO Company in Dubaileads dubaiNo ratings yet

- (CRP Po - MT - Xi) AdmitcardDocument4 pages(CRP Po - MT - Xi) Admitcarduncle wizNo ratings yet

- Benjamin C. Santos and Estrella, Remitio & Associates For Petitioner. Rodolfo V. Gumban For Private RespondentDocument5 pagesBenjamin C. Santos and Estrella, Remitio & Associates For Petitioner. Rodolfo V. Gumban For Private RespondentLouisa FerrarenNo ratings yet

- Colonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and PerceptionsDocument14 pagesColonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and Perceptionsanjangandak2932No ratings yet

- Uttar Pradesh Power Corporation Ltd. - PAYMENTDocument1 pageUttar Pradesh Power Corporation Ltd. - PAYMENTKKTiwariNo ratings yet

- Pak Us RelationDocument26 pagesPak Us Relationsajid93100% (2)

- 3 Statement Model Alphabet GoogleDocument8 pages3 Statement Model Alphabet GoogleSimran GargNo ratings yet

- Сooperation with traders EG 2022 mailDocument5 pagesСooperation with traders EG 2022 mailOSNo ratings yet

- Winning Results With Google Adwords Second EditionDocument401 pagesWinning Results With Google Adwords Second EditionsearchzakirNo ratings yet

- Primewater Infrastructure Corp - Google SearchDocument2 pagesPrimewater Infrastructure Corp - Google Searchbatusay575No ratings yet

- What Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionDocument3 pagesWhat Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionVirginia PalisukNo ratings yet

- U.S. Equal Employment Opportunity Commission v. Norfolk Southern Corp.Document33 pagesU.S. Equal Employment Opportunity Commission v. Norfolk Southern Corp.Ryan CaneNo ratings yet

- Bramley 2000Document5 pagesBramley 2000Andres SalcedoNo ratings yet

- Chapter 6 - Rural AdministrationDocument3 pagesChapter 6 - Rural Administrationlenkapradipta2011100% (1)

- FACTS:Morada, A Filipina Flight Stewardess For SAUDIA, Was A Attempted Raped by Saudia Arabian NationalDocument39 pagesFACTS:Morada, A Filipina Flight Stewardess For SAUDIA, Was A Attempted Raped by Saudia Arabian NationalVaness MendezNo ratings yet

- AS Units Revision Notes IAL EdexcelDocument10 pagesAS Units Revision Notes IAL EdexcelMahbub KhanNo ratings yet

- Regd. With A.D. C-11 ESI Corporation, Ashram Road, Ahmedabad-380014Document2 pagesRegd. With A.D. C-11 ESI Corporation, Ashram Road, Ahmedabad-380014Rajput Mittu100% (1)

- #75 - DUMAPIS, Et - Al. V. LEPANTODocument2 pages#75 - DUMAPIS, Et - Al. V. LEPANTOKê MilanNo ratings yet

- International Law of Sea PDFDocument14 pagesInternational Law of Sea PDFJitendra RavalNo ratings yet

- IPR International Conventions - Lectute 5Document20 pagesIPR International Conventions - Lectute 5Akhil AugustineNo ratings yet

- Informed Consent Di Instalasi Gawat Darurat RSUP Prof. Dr. R. D. Kandou ManadoDocument5 pagesInformed Consent Di Instalasi Gawat Darurat RSUP Prof. Dr. R. D. Kandou ManadomusdalifahNo ratings yet

- Notice Min Agenda PPT .PPSXDocument13 pagesNotice Min Agenda PPT .PPSXakankshaNo ratings yet

- Astha Life Insurance Company LimitedDocument8 pagesAstha Life Insurance Company Limitedanisulislam asifNo ratings yet

- Chuck Peruto For DA Position PaperDocument9 pagesChuck Peruto For DA Position PaperPhiladelphiaMagazine100% (1)

- Facebook, Inc. v. John Does 1-10 - Document No. 7Document4 pagesFacebook, Inc. v. John Does 1-10 - Document No. 7Justia.comNo ratings yet

- LHS Premium 61L: Sheet ofDocument1 pageLHS Premium 61L: Sheet ofpoke BullNo ratings yet

- Jeff Lynne See E13 1 Has Studied The Information You Gave PDFDocument1 pageJeff Lynne See E13 1 Has Studied The Information You Gave PDFAnbu jaromiaNo ratings yet

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

DECCAN BEARINGSLIMITED

DPI

~ ~ 1 s o 9 0 0 i : n o o s c o n n ~ ~ ~ ~BEARINGS

REGD. OFF : 31 51321, PROSPECT CHAMBERS,

2ND FLOOR, DR. D N ROAD, FORT, MUMBAI-400 001 (IhiilA)

TEL.

: (91) (22) 2285 2552 12204 4159

FAX

. (91) (22) 2287 5841

infoQdeccanbearings com

Webs~te. www.deccanbearings corn

CIN NO. : L29130MH1985PLC035747

I

I

~

I

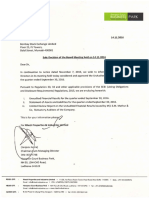

Date: 2gth October, 2016

To,

The Corporate Relations Department,

Bombay Stock Exchange Limited,

PJ Tower,

Dalal Street, Fort,

Mumbai- 400 001.

Dear Sir/ Madam,

Ref: - Scrio Code: 505703

Sub: Outcomeoft_he Board Meetina.

I

We are pleased to inform the Stock Exchange that the Board of Directors at their meeting held today

i.e. on 2gth October, 2016 at Registered Office of the Company situated at 315 / 321, Prospect

Chambers, 2"d floor, Dr D N Road Fort, Mumbai - 400001 has transacted the following Business:

e

Approved and adopted Un-audited Financial Result along with Limited Review report for the

Quarter and Half year ended 3oth September, 2016 and the statement of Assets and Liabilities

as on that date.

II

0

Consented and approved to conduct Postal Ballot to dispose off Leasehold land and

dilapidated Building Construction of the Company which is left unused since Period of 16

Years which is situated at Halo1 GIDC Dist. Vadodara in Gujarat.

I

Kindly acknowledge the receipt of the same.

Part l

Particulars

I(Rs. In Lakhs)

STATEMENT OF UNAUDITED RESULT FORTHE QUARTER AND SIX MONTHS ENDED 30/09/2016

13 months

I~receding3 l~orrespondil ~ e atro date

ended

ng 3 months figures for

months

(30/09/2016) ended

ended in the current

(30/06/2016) previous

. period

year

ended

(30/09/2015) (30/09/2016)

(Unaudited) (Unaudited)

(Refer Notes Below)

l ~ e atro date l~revious

figures for

year ended

the previous (31/03/2016)

year period

ended

(30/09/2015)

(Unaudited) (Unaudited) (Unaudited)

I

(Audited)

1 lncome from Operations

(a] iUet Sales/lncome from Operat~ons(Net of exctse duty)

ib] Other Operating Income

Total Income from Operations (Net)

2. Expenses

(dl Cost of Mater~alsConsumed

(b) Purchase of stock-tn trade

(c) Changes tn inventortes of fln~shedgoods, work-~n-progress

and stock ~n-trade

47.82

2 75

50.57

56.33

0.34

56.67

28:95

39.06

80.81

80.39

1 1

32.68

3.35

36.03

104.15

3.09

107.24

79.46

30.79

110.25

53.04

161.20

120.92

143 28

52.61

195.89

(d) Employee benef~tsexpense

(el Deprec~at~o~i

and amortlsatlon

expense

(f) Other expenses (Any item exceed~ng10% of the total expenses

relatlng to contlnulng operations to be shown separately)

Total Expenses

13. Profit/ (Loss) from operations before other income, finance

costs and exceptional items (1-2)

4 Other Income

5. Profit/(Loss) from ordinary activities before finance costs

and exceptional items (3-4)

6 F~nance

Costs

7. Profit/(Loss) from ordinary activities after finance costs but

before exceptional items (5+6)

8 Except~onalItems

9. Profit/(Loss) from ordinary activities before Tax (7t8)

10 Tax Expense

11. Net Prof~t/(Loss)from ord~naryactivities after Tax (9*10)

12. Net Profit/(Loss) for the period

13 Pad up equtty share capttal (Facevalue of the Share of

Rs 101 e a ~ l i )

14 Reserve excluding Revaluat~onReserves as per balance sheet

cf prevlous accounting year

15. Earnings per share (before extraordinary items)

(of Rs.101- each (not annualised) :

(a) Ras~c

(b) Dtluted

209.1 6

(30.24)

(23 72)

(17.01)

(53 96)

(10.67)

(13.27)

(30.24)

0.06

(23.72)

0.08

(17 01)

0.17

(53 96)

0.14

(10.67)

0 37

(13.27)

0.63

(30.30)

(17.18)

(13.90)

(17 18)

(54.10)

29.20

(24.90)

(11.04)

(30 30)

(23.80)

29.20

5.40

(11.04)

(13.90)

(3.33)

(30 30)

(30.30)

5.40

5.40

(17.18)

(17.18)

(24.90)

(24.90)

(11 04)

(11 04)

(10.57)

(10.57)

218 33

218.33

218.33

218 33

218.33

218.33

90 68

(1.39)

( 1 39)

0.25

0.25

(0 79)

(0.79)

(1.14)

(1.14)

(0.51)

(0 51)

(0 48)

(0.48)

r--

ANNEXURE lX

STATEMENT OF ASSETS AND L19BILITIES

1

Part~culars

1.

(Rs. In Lakhas)

I AS at

30.09.2016 31.03.2016

(Unaudited)

(Audited)

AS at

Shareholders' funds

(a) Share cap~tal

fh) Reserves and surplus

(c) Money recetved agalnst share warrants

Sub-total Shareholders' funds

2. Share application money pending allotment

3. Non-current liabilities

(a) Long-term borrowlngs

(b) Deferred tax l ~ a b ~ l ~(net)

t~es

(c) Other long term l~ab~lit~es

(d) Long-term provlslons

Sub-total Non-current liabilities

I.Current liab~lities

(a) Short-term borrow~ngs

ibr Trade payables

re) Other current l ~ a b ~ l ~ t ~ e s

id) Short-term provlslons

Sub-total Current liabilities

TOTAL E Q U l N AND LIABILITIES

B. ASSETS

1. Non-current assets

(a) Fixed assets

(b) Goodw~llon consolidat~on*

(c) Non-current investments

(d) Deferred tax assets (net)

(e) Long-term loans and advances

(f) Other non-current assets

Sub-total Non-current assets

2. Current assets

(a) Current ~nvestnients

(b) lnvehtor~es

(c) Trade recevables

(d) Cash and cash equivalents

(e) Short term loans and advances

(0Other current assets

Sub-total -Current assets

TOTAL -ASSETS

67 29

73 61

1 21

1 21

2 63

73 84

144 97

2 69

82 63

160 14

10 00

70 74

42 89

64 93

35 42

0 86

224 84

369.81

67 92

40 84

110 17

9 95

0 86

229 74

389.88

Notes:

(I) The Unaud~tedF~nanc~al

Result was rev~ewedby the Audit Committee and approved at the meetlng of the Board of Directorsof

the Company held on 29 10 2016

(11)F~guresfor the prevlous per~odsare re-classified/re-arranged/re-grouped, wherever necessary, to correspond w ~ t h

the current per~od's

class~f~cat~on/d~sclosure

1111)Segmental reporting as defined In Account~ngStandard 17 IScons~derednot appl~cable.

(IV) Prov~s~on

for taxat~onas per Actount~ngStandard 22, if any will be prov~dedat the end of the year.

Place Mumba~

Date 29 10 2016

DIN: 00108607

D- V. VORA & CO.

Chartered Accountants

36, BHANGWADI SHOPPING ARCADE, lST

FLOOR, KALBADEVI ROAD, MUMBAI - 400 002

Telephone # 2200414 2 1 22004 143

E-mail: dilipvoraca@hotmail.com

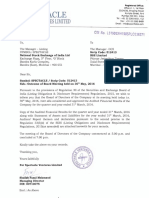

Review Report t o

Board of Directors

Deccan Bearings Limited

We have reviewed the accompanying statement of unaudited financial results of Deccan Bearings Limited

for the period ended 30 September, 2016. This statement is the responsibility of the Company's

Management and has been approved by the Board of Directors. Our responsibility is t o issue a report on

these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

Engagements t o Review Financial Statements issued by the Institute of Chartered Accountants of India.

This standard requires that we plan and perform the review t o obtain moderate assurance as t o whether

the financial statements are free of material misstatement. A review is limited primarily t o inquiries of

company personnel and analytical procedures applied t o financial data and thus provides less assurance

than an audit. We have not performed an audit and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come t o our attention that causes us t o believe that

the accompanying statement of unaudited financial results prepared in accordance with applicable

accounting standards and other recognized accounting practices and policies has not disclosed the

information required t o be disclosed in terms of Regulation 33 of the SEBl (Listing Obligations and

is closure Requirements) Regulations, 2015 including the manner in which it is t o be disclosed, or that it

contains any material misstatement.

Yours faithfully,

For D. V. VORA & CO.

Chartered Accountants

v w

Place: Mumbai

Date: 29/10/2016

D. V. Vora

Partner

Membership No.30013

You might also like

- Termination EN2020Document4 pagesTermination EN2020Milos MihajlovicNo ratings yet

- Subcontracting With Chargeable Components" and "Material LedgerDocument4 pagesSubcontracting With Chargeable Components" and "Material LedgerjoeindNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document6 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Revised Statement of Assets & Liabilities As On September 30, 2015 (Result)Document4 pagesRevised Statement of Assets & Liabilities As On September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Eo Designating Data Protection Officer BarangayDocument3 pagesEo Designating Data Protection Officer BarangayAnne Kimberly Peñalba BabaanNo ratings yet

- Digital Marketing Company Dubai Best SEO Company in DubaiDocument2 pagesDigital Marketing Company Dubai Best SEO Company in Dubaileads dubaiNo ratings yet

- (CRP Po - MT - Xi) AdmitcardDocument4 pages(CRP Po - MT - Xi) Admitcarduncle wizNo ratings yet

- Benjamin C. Santos and Estrella, Remitio & Associates For Petitioner. Rodolfo V. Gumban For Private RespondentDocument5 pagesBenjamin C. Santos and Estrella, Remitio & Associates For Petitioner. Rodolfo V. Gumban For Private RespondentLouisa FerrarenNo ratings yet

- Colonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and PerceptionsDocument14 pagesColonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and Perceptionsanjangandak2932No ratings yet

- Uttar Pradesh Power Corporation Ltd. - PAYMENTDocument1 pageUttar Pradesh Power Corporation Ltd. - PAYMENTKKTiwariNo ratings yet

- Pak Us RelationDocument26 pagesPak Us Relationsajid93100% (2)

- 3 Statement Model Alphabet GoogleDocument8 pages3 Statement Model Alphabet GoogleSimran GargNo ratings yet

- Сooperation with traders EG 2022 mailDocument5 pagesСooperation with traders EG 2022 mailOSNo ratings yet

- Winning Results With Google Adwords Second EditionDocument401 pagesWinning Results With Google Adwords Second EditionsearchzakirNo ratings yet

- Primewater Infrastructure Corp - Google SearchDocument2 pagesPrimewater Infrastructure Corp - Google Searchbatusay575No ratings yet

- What Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionDocument3 pagesWhat Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionVirginia PalisukNo ratings yet

- U.S. Equal Employment Opportunity Commission v. Norfolk Southern Corp.Document33 pagesU.S. Equal Employment Opportunity Commission v. Norfolk Southern Corp.Ryan CaneNo ratings yet

- Bramley 2000Document5 pagesBramley 2000Andres SalcedoNo ratings yet

- Chapter 6 - Rural AdministrationDocument3 pagesChapter 6 - Rural Administrationlenkapradipta2011100% (1)

- FACTS:Morada, A Filipina Flight Stewardess For SAUDIA, Was A Attempted Raped by Saudia Arabian NationalDocument39 pagesFACTS:Morada, A Filipina Flight Stewardess For SAUDIA, Was A Attempted Raped by Saudia Arabian NationalVaness MendezNo ratings yet

- AS Units Revision Notes IAL EdexcelDocument10 pagesAS Units Revision Notes IAL EdexcelMahbub KhanNo ratings yet

- Regd. With A.D. C-11 ESI Corporation, Ashram Road, Ahmedabad-380014Document2 pagesRegd. With A.D. C-11 ESI Corporation, Ashram Road, Ahmedabad-380014Rajput Mittu100% (1)

- #75 - DUMAPIS, Et - Al. V. LEPANTODocument2 pages#75 - DUMAPIS, Et - Al. V. LEPANTOKê MilanNo ratings yet

- International Law of Sea PDFDocument14 pagesInternational Law of Sea PDFJitendra RavalNo ratings yet

- IPR International Conventions - Lectute 5Document20 pagesIPR International Conventions - Lectute 5Akhil AugustineNo ratings yet

- Informed Consent Di Instalasi Gawat Darurat RSUP Prof. Dr. R. D. Kandou ManadoDocument5 pagesInformed Consent Di Instalasi Gawat Darurat RSUP Prof. Dr. R. D. Kandou ManadomusdalifahNo ratings yet

- Notice Min Agenda PPT .PPSXDocument13 pagesNotice Min Agenda PPT .PPSXakankshaNo ratings yet

- Astha Life Insurance Company LimitedDocument8 pagesAstha Life Insurance Company Limitedanisulislam asifNo ratings yet

- Chuck Peruto For DA Position PaperDocument9 pagesChuck Peruto For DA Position PaperPhiladelphiaMagazine100% (1)

- Facebook, Inc. v. John Does 1-10 - Document No. 7Document4 pagesFacebook, Inc. v. John Does 1-10 - Document No. 7Justia.comNo ratings yet

- LHS Premium 61L: Sheet ofDocument1 pageLHS Premium 61L: Sheet ofpoke BullNo ratings yet

- Jeff Lynne See E13 1 Has Studied The Information You Gave PDFDocument1 pageJeff Lynne See E13 1 Has Studied The Information You Gave PDFAnbu jaromiaNo ratings yet