Professional Documents

Culture Documents

E Wallet

E Wallet

Uploaded by

Ishwar ChandraaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E Wallet

E Wallet

Uploaded by

Ishwar ChandraaCopyright:

Available Formats

International Journal of Recent Research and Review, Vol.

I, March 2012

ISSN 2277 8322

Electronic Commerce and E-wallet

Abhay Upadhayaya

Department of ABST,University of Rajasthan,Jaipur, India

Email: abhayu@rediffmail.com

Abstract- In electronic commerce, the challenges of

systems. The main objectives of EPS are to increase

payment transactions were initially underestimated.

efficiency, improve security, and enhance customer

Business via the internet and mobile telephony has

convenience and ease of use. Although these systems

so far been dominated by the methods of payment

are in their immaturity, some significant development

systems in traditional business. However, in light of

has been made for business-to-consumer (B2C)

advances in e-commerce, traditional business models

transactions the development and use of online payment

are increasingly coming up against their limits. To

systems were identified as important concerns [1].

understand the concept of electronic commerce, E-

Nonetheless B2C e-commerce is currently growing at

wallet is a convenient, easy-to-use, secure global

around 25% per year and growth has been much higher

payment system. It is flexible personal banking

in some segments (e.g. travel).

system with a number of payout and pay-in options.

II. PAYMENT CARDS

I-Payout use the latest security systems to ensure E-

Business people often use the term payment card as a

wallet security.

general term to describe all types of plastic cards that

Keywords- E-Wallet, Mobile commerce, Electronic

consumes use to make purchases. The main categories

payment system, Microsoft Wallet

of payment cards are credit cards, debit cards, and

charge cards.

I. INTRODUCTION

A. Credit card

Traditionally, a customer sees a product, examines it,

Has a spending limit based on the users credit history; a

and then pays for it by cash, check, or credit card. In the

user can pay off the entire credit card balance or pay a

e-commerce world, in most cases the customer does not

minimum amount each billing period.

actually see the concrete product at the time of

B. Debit card

transaction, and the method of payment is performed

Removes the amount of the sale from the cardholders

electronically. Electronic payment system or EPSs

bank account and transfers it to the sellers bank

enable a customer to pay for the goods and services

account.

online by using integrated hardware and software

37

III. MOBILE COMMERCE

C. Charge card

Carries no spending limit, and the entire amount

Mobile commerce or m-commerce is defined as a

charged to the card is due at the end of the billing

process of buying and selling of goods or services

period. Payment cards have several features that make

through

them an attractive and popular choice with both

representative in this category is of course mobile

consumers and merchants in online and offline

phone. Biggest benefit of m-commerce is, that terminal

transactions. For merchants, payment cards provide

is portable and there is radio coverage in major cities.

fraud protection. When a merchant accepts payment

There is also increasing amount of services available in

cards for online payment or for orders placed over the

m-commerce sector. For example- Data or Information

telephone - called card not present transactions because

services, which cover automatic or manual delivery of

the merchants location and the purchasers location are

sport news, weather information, stock market updates

different - the merchant can authenticate and authorize

to a mobile device. Financial services, which covers

purchases using a payment card processing network. For

paying bill or buying stocks, or even getting automatic

U.S. consumers, payment cards are advantageous

warnings if money in the account is running low or

because the Consumer Credit Protection Act limits the

predefined limit is exceeded.

cardholders liability to $50 if the card is used

wireless

technology.

Most

common

IV. E-wallet

fraudulently. Once the cardholder notifies the cards

The electronic wallet (E-wallet) provides all of the

issuer of the card theft, the cardholders liability ends.

functions of todays wallet on one convenient smart

Frequently, the payment cards issuer waives the $50

card eliminating the need for several cads. The E-Wallet

consumer liability when a stolen card is used to

will also provide numerous security features not

purchase goods. Perhaps the greatest advantage of using

available to regular wallet carriers. Identification is

payment cards is their worldwide acceptance. Payment

required for every credit card transaction and the card is

cards can be used anywhere in the world, and the

equipped with a disabling device if the card should be

currency conversion, if needed, is handled by the card

tampered with. Electronic-Wallet is a digital wallet (also

issuer. For online transactions, payment cards are

known as a E-wallet) which allows users to make

particularly advantageous. When a consumer reaches

electronic commerce transactions quickly and securely

the electronic checkout, he or she enters the payment

[2].

card number and his or her shipping and billing

Electronic wallets being very useful for frequent

information in the appropriate fields to complete the

online shoppers are commercially available for pocket,

transaction. The consumer does not need any special

palm-sized, handheld, and desktop PCs. They offer a

hardware or software to complete the transaction.

secure, convenient, and portable tool for online

shopping. They store personal and financial information

38

such as credit cards, passwords, PINs, and much more.

Then, E-wallets can be used for micro-payments. They

E-wallet is an electronic wallet for most important

also eliminate reentering personal information on the

personal information (credit cards, calling cards,

forms, resulting in higher speed and efficiency for

passwords, PINs, account numbers and more).So like a

online shoppers. Microsoft Passport consists of several

real wallet; E-wallet keeps information in cards. Several

services including, a single sign-in, wallet and kids

related pieces of information for example, a username, a

passport services. A single sign-in service allows the

password and a URL. Also to personalize cards with

customer to use a single name and password at a

icons, colors, and on some platforms, pictures. To help

growing number of participating e-commerce sites. The

keep cards organized, the cards created are stored in

shopper can use to make fast online purchases with a

categories. Wallet files can have many different

wallet service [3]. Kids passport service helps to

categories, and can be put in any kind of card in any

protect and control children's online privacy. We should

category. In addition, categories can be nested as well,

protect our wallet file with a password. With a password

allowing placing categories within categories.

protected wallet we must enter the wallets password

Different Wallets as per need can be created,

before we can see the information on any of the cards in

and different information in each wallet can be stored.

that wallet. Anyone can open a wallet that does not use

For example, a personal wallet file for our own cards

a password so we should set a password for any wallet

and an office wallet file that we share with an assistant

that contains personal information.

or other members of our team. We can place copies of

A. Starting with e-wallet

the same cards in different files as appropriate. For

When we start E-wallet for the first time, we are

example, we might want to place copies of the same

prompted to create a new wallet file to store our

cards in different files as appropriate. For example, we

information in. When were ready to add our own

might want our business credit card listed in both of our

information, we can add new categories and cards to

wallet files for extra convenience. To facilitate the

wallet and organize the information in a way that fits

credit-card

our needs.

order

process,

many

companies

are

introducing electronic wallet services. E-wallets allow

B. E-wallet security

us to keep track of our billing and shipping information

E-wallet protects your wallet information in two ways:

so that it can be entered with one click at participating

By requiring a password before displaying any cards

merchants' sites. E-wallets can also store echecks, ecash

in a password protected wallet.

and our credit-card information for multiple cards. A

By

popular example of an E-wallet on the market is

information in cards in password protected wallets in

Microsoft Wallet. To obtain Microsoft Wallet, one

our wallet file. This means that the information in

needs to set up a Microsoft Passport. After establishing

a Passport, a Microsoft E-wallet can be established.

39

encrypting

(making

unintelligible)

the

the file is translated into a secret code so that it cant

it's a physical device holding someone's cash and cards

be read by any other program.

along with a Bluetooth mobile connection.

C. Backup

VI. BENEFITS OF E-WALLET

For extra safety, we encourage to take backups of our E-

Send and receive payments anywhere in the world.

wallet files (as well as all of our important information).

Unlimited transfers.

The easiest way to do this is using the Automatic

Easy recurring payments and transfer.

Backup feature available on Windows PC. On this

Manage our account from our mobile phone.

platform, E-wallet will automatically make a backup of

World

our wallet file each time we close E-wallet.

available.

Ventures-branded

prepaid

MasterCard

Security for our bank account and credit card

V. TECHNOLOGY IN E-WALLET

numbers.

A digital wallet has both a software and information

Email or SMS notifications after transactions

component. The software provides security and

We are in complete control.

encryption for the personal information and for the

actual transaction. Typically, digital wallets are stored

Access our commissions faster.

on the client side and are easily self-maintained and

Pull money into our E-wallet from any bank

fully compatible with most e-commerce web sites. A

account.

server-side digital wallet, also known as a thin wallet, is

Receive wired funds/transfers directly into our

one that an organization creates for and maintains on

E-wallet.

its servers. Server-side digital wallets are gaining

Any bank account worldwide.

popularity among major retailers due to the security,

Transfer money from E-wallet to E-wallet without

efficiency, and added utility it provides to the end-user,

sharing personal account numbers

which increases their enjoyment of their overall

Request paper commissions checks.

purchase. The information component is basically a

VII. ISSUES TO TAKE CARE OF FOR E-WALLET

database of user-inputted information. This information

Main issue that should be taken care of for electronic

consists of shipping address, billing address, payment

payments system is Authentication which identifies

methods (including credit card numbers, expiry dates,

buyer and also makes sure that person is who he/she

and security numbers), and other information.

claims to be. Used methods are i.e. digital signature,

The key point to take from digital wallets is that they're

finger prints, password or smartcards etc. Data integrity

composed of both digital wallet devices and digital

which means, that there must be a way to verify that

wallet systems. There are dedicated digital wallet

data

devices such as the biometric wallet by Dunhill, where

is

not

changed

during

the

Confidentially must also be preserved.

40

transactions.

VIII. SECURITY FOR ONLINE SYSTEMS

B. Secure Electronic Transaction (SET)

There are two main systems for transaction security,

SET is an alternative, more complex security system

secure socket layer and secure electronic Transaction.

based on digital certificates and signatures [5]. SET

A.Secure

needs specific software and is more difficult for

Socket Layer(SSL)

cardholders to obtain and use, and despite the high level

SSL is the widely used secure service system and is an

of security offered it has not gained widespread use.

important measure to establish trust between online

IX. REFERENCES

seller and buyer [4]. Encryption and decryption allow

secure transfer of information between an Internet

[1]

Wesley, 1997

browser and server. Data cannot be intercepted or

changed

during transmission. SSL

also

Electronic Commerce: A Manager's Guide Addison-

[2]

permits

Online reference

http://en.wikipedia.org/wiki/Digital_wallet

merchant identification through SSL server certificates.

[3] David Kosivr,understanding electronic commerce:How

The SSL standard has been widely adopted because it is

online transactions can grow your business:, microsoft

relatively simple and easy to use and does not place

press, 1997

excessive demands on the average consumers home

[4] Zhang Jian, Analyzes based on the SET agreement

PC. SSL has an over 90% share of security measures,

electronic

about the same as credit cards among online payment

Security, 2006(10),pp:9-11.

systems.

Until

recently,

SSL

provided

services

commerce

safety

mechanism,

Netinfo

[5] Xu Wei, e-commerce online payment security issues.

exclusively for fixed networks. But as mobile networks

joint Hefei University Journal, 2000 (3), pp:23-25.

are increasingly important e-commerce markets, SSL

services for wireless devices have been developed.

41

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Access 2003 For IGCSE ICTDocument49 pagesAccess 2003 For IGCSE ICTIGCSE ICT84% (50)

- Portable VeterinarianDocument4 pagesPortable VeterinarianHeidi BlueNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ronak Karanpuria NLSIU CV B LDocument4 pagesRonak Karanpuria NLSIU CV B LIshwar ChandraaNo ratings yet

- Story of Enrica LexieDocument12 pagesStory of Enrica LexieIshwar ChandraaNo ratings yet

- Brochure of The CompetitionDocument2 pagesBrochure of The CompetitionIshwar ChandraaNo ratings yet

- Law of Contract - LLB - NotesDocument26 pagesLaw of Contract - LLB - NotesIshwar ChandraaNo ratings yet

- Latest News, Breaking News Live, Current Headlines, India News Online - The Indian ExpressDocument5 pagesLatest News, Breaking News Live, Current Headlines, India News Online - The Indian ExpressIshwar ChandraaNo ratings yet

- Code of Civil Procedure by Justice B S ChauhanDocument142 pagesCode of Civil Procedure by Justice B S Chauhannahar_sv1366100% (1)

- Sr. No. List of Moot Court CompetitionsDocument2 pagesSr. No. List of Moot Court CompetitionsIshwar ChandraaNo ratings yet

- Justice PlayDocument11 pagesJustice PlayIshwar ChandraaNo ratings yet

- An Analysis of Mordern Offence of SeditionDocument27 pagesAn Analysis of Mordern Offence of SeditionIshwar ChandraaNo ratings yet

- SocializationDocument8 pagesSocializationIshwar ChandraaNo ratings yet

- 4 RMLNLU-SCC Online International Media Moot Court Competition 2016 Bluebook KeyDocument2 pages4 RMLNLU-SCC Online International Media Moot Court Competition 2016 Bluebook KeyIshwar ChandraaNo ratings yet

- French Legal SystemDocument15 pagesFrench Legal SystemIshwar ChandraaNo ratings yet

- India, Malaysia, Indonesia, Japan, Mexico, Netherland, New Zealand, SingaporeDocument2 pagesIndia, Malaysia, Indonesia, Japan, Mexico, Netherland, New Zealand, SingaporeIshwar ChandraaNo ratings yet

- Multi SpectralDocument3 pagesMulti SpectralCris SosaNo ratings yet

- Design and Implementation of Automated Blood Bank Using Embedded SystemsDocument1 pageDesign and Implementation of Automated Blood Bank Using Embedded SystemsCarlos Eduardo Vásquez RoqueNo ratings yet

- Evolution of Apple: Amity School of Business Amity University, NoidaDocument45 pagesEvolution of Apple: Amity School of Business Amity University, NoidaNabeel Kidwai0% (1)

- DepEd RESOURCE-PACKAGE-TEMPLATE-onlyDocument6 pagesDepEd RESOURCE-PACKAGE-TEMPLATE-onlyFranklin PabelloNo ratings yet

- MSLs and The Use of IPadsDocument24 pagesMSLs and The Use of IPadsSiAgam DevinfoNo ratings yet

- MPEG-2 Long GoP Vs AVC Comp-StrategiesDocument22 pagesMPEG-2 Long GoP Vs AVC Comp-Strategiessathis_nskNo ratings yet

- Dsa Study Guide: Program. Paradigm Time & Space Complexity Data Structure AlgorithmsDocument1 pageDsa Study Guide: Program. Paradigm Time & Space Complexity Data Structure AlgorithmsdeepanshugabbaNo ratings yet

- (Klish) IELTS LEAF - Writing 1.3 (Formula 2)Document2 pages(Klish) IELTS LEAF - Writing 1.3 (Formula 2)Đặng Thanh HiềnNo ratings yet

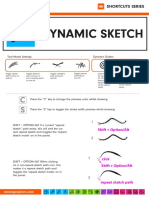

- Dynamicsketch v2 Astute Graphics ShortcutsDocument4 pagesDynamicsketch v2 Astute Graphics ShortcutsraminjprNo ratings yet

- 3com Wireless 8760 Dual-Radio 11A/B/G Poe Access PointDocument3 pages3com Wireless 8760 Dual-Radio 11A/B/G Poe Access PointManuel VejeranoNo ratings yet

- Khawla Mohammed Resume PDFDocument1 pageKhawla Mohammed Resume PDFAnonymous U8u2IyNo ratings yet

- 3D For Iphone Apps With Blender and SIO2 - Your Guide To Creating 3D Games and More With Open-Source SoftwareDocument331 pages3D For Iphone Apps With Blender and SIO2 - Your Guide To Creating 3D Games and More With Open-Source Software2224 Momynul IslamNo ratings yet

- Zerto 10 Questions WPDocument4 pagesZerto 10 Questions WPStefica van Barneveld-JuricNo ratings yet

- Factiva Search Builder Cheat SheetDocument5 pagesFactiva Search Builder Cheat SheetMykolaNo ratings yet

- AutoCAD Control Codes and Special Text CharactersDocument9 pagesAutoCAD Control Codes and Special Text CharacterschrysanthiiiiiiNo ratings yet

- CBC-Agricultural Crops Production NC IIIDocument127 pagesCBC-Agricultural Crops Production NC IIIbryan lumongsodNo ratings yet

- Link 1 For LS1 - LS2 - System Development Life CycleDocument8 pagesLink 1 For LS1 - LS2 - System Development Life Cycleodi.obiokalaNo ratings yet

- Slides Data AnalyticsDocument28 pagesSlides Data Analyticsrosan opNo ratings yet

- Er & RMDocument26 pagesEr & RMEftekher Ahmed AqibNo ratings yet

- Osi ModelDocument3 pagesOsi ModelMushawatuNo ratings yet

- Advertisement For Post of Computer and ICT Asst. 2022-04-06Document1 pageAdvertisement For Post of Computer and ICT Asst. 2022-04-06Amritmay MaityNo ratings yet

- Manage Qlik Sense SitesDocument427 pagesManage Qlik Sense SitesyogeshwariNo ratings yet

- JVC KD-SR86BTDocument152 pagesJVC KD-SR86BTXIAOJUN WANGNo ratings yet

- 0 Dumpacore 3rd Com - Samsung.android - App.contactsDocument373 pages0 Dumpacore 3rd Com - Samsung.android - App.contactsiuly iulyNo ratings yet

- Project SynopsisDocument15 pagesProject SynopsisVigneshNo ratings yet

- Stellarisware Release Notes: Sw-Rln-6852Document160 pagesStellarisware Release Notes: Sw-Rln-6852Akio TakeuchiNo ratings yet

- New DSD Manual Rvitm (4-7)Document72 pagesNew DSD Manual Rvitm (4-7)Spam SpamNo ratings yet

- Ronin M Quick Start Guide v1.6 enDocument2 pagesRonin M Quick Start Guide v1.6 enhawksharco2No ratings yet