Professional Documents

Culture Documents

CT Diagnostic Presentation

CT Diagnostic Presentation

Uploaded by

Alfonso RobinsonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CT Diagnostic Presentation

CT Diagnostic Presentation

Uploaded by

Alfonso RobinsonCopyright:

Available Formats

Connecticut Economic

Competitiveness Diagnostic

Summary Results

Presentation to Commission for

Economic Competitiveness

April 8, 2016

Topics for todays discussion

Context for the Connecticut Economic Competitiveness Diagnostic

Connecticuts long run of strong economic growth

Recent trends that have created a new economic normal

Connecticuts distinctive assets

Five potential themes for further exploration

CONTEXT FOR THE CONNECTICUT ECONOMIC COMPETITIVENESS DIAGNOSTIC

The Economic Competitiveness Diagnostic provides a fact

base for discussion but is limited in scope

This diagnostic did

Commission

on Economic

Competitiveness

This diagnostic did not

Assemble an

independent, datadriven fact base

Intend to be

comprehensive in

scope

Incorporate a diverse

range of perspectives

Engage all possible

stakeholders

Identify potential

themes for the

Commission

consideration

Make policy or strategy

recommendations

Importantly, this diagnostic is just one element of the work that will help

shape the Commission's focus and priorities

|

CONTEXT FOR THE CONNECTICUT ECONOMIC COMPETITIVENESS DIAGNOSTIC

The diagnostic is one element of a broader effort to understand

and improve Connecticut's economic competitiveness

1. Diagnostic

Fact-based assessment of

current strengths and

challenges

Additional

competitiveness

diagnostics (e.g., on

taxes)

Launch of ongoing

stakeholder engagement

2. Strategy development

Integrated plan and vision

Detailed strategies for high

priority near term

opportunities (e.g., best

practice research, detailed

initiative design, feasibility

testing, implementation

plan, budgeting)

3. Execution

Resourcing and

implementation of near-term

opportunities

Strategy design for longerterm opportunities

Performance management

and reporting

Alignment around shortlist

of priorities

CONTEXT FOR THE CONNECTICUT ECONOMIC COMPETITIVENESS DIAGNOSTIC

The diagnostic was developed through data analysis and

qualitative input from interviews

Assembled an independent,

data-driven fact base

Federal, state, and private data

sources

Existing reports and analyses

Comparison of Connecticut

versus regional peer states and

by MSA

Incorporated a diverse range of

perspectives

Private

sector

Public

Sector

75+ interviews across sectors

and regions

Engagement with ~200

economic development

professionals

Social

sector

Large companies

Executive branch

City and town officials

Foundations

Start-ups

Site selection firms

Trade associations

Legislators

Commission on Economic

Competitiveness members

Direct service organizations

Academia

The Connecticut Economic Competitiveness diagnostic:

Key takeaways

Connecticut has had a long run of strong economic performance, making it a great state to

live and work

Recent trends have created a new economic normal and pose challenges for the states

competitiveness

A. Global and national forces are reshaping Connecticuts traditional core sectors

B. Peers are closing the gap on Connecticuts livability and cost advantages

C. Population trends are reshaping Connecticuts workforce

D. Perceptions are hardening on state governance and fiscal uncertainty

Connecticut has a portfolio of distinctive assets to address these trends and ensure longterm competitiveness

Five themes have emerged as potential areas for the Commission to consider exploring

in further detail

1. Cities: How should Connecticut revitalize its urban cores?

2. Growth sectors: How can Connecticut support its high potential, fast-changing sectors?

3. Transportation: What investments will best connect talent and businesses?

4. Fiscal outlook: How can Connecticut address its pension and budget challenges to

restore business confidence?

5. Public-private engagement: How can the State and the private sector collaborate to

jointly support long-term growth?

|

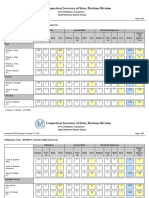

CONNECTICUTS LONG RUN OF STRONG ECONOMIC PERFORMANCE

Connecticuts economy performs well along several important

indicators, reflecting a long run of strong economic performance

GDP per capita, 2014

Productivity1, 2014

Median household income, 2014

Rank

State

Rank

State

Rank

State

Alaska: $66.2K

Alaska: $143.1K

Maryland: $76.2K

North Dakota: $65.2K

New York: $139.8K

New Hampshire: $73.4K

New York: $64.8K

Connecticut: $138.6K

Hawaii: $71.2K

Connecticut: $64.7K

California: $133.2K

Connecticut: $70.2K

1 Measured as GDP per worker

SOURCE: Moody's Analytics; BLS; US Census Bureau

A NEW ECONOMIC NORMAL FOR CONNECTICUT

The recession disrupted Connecticut's long run of solid

economic growth

Real GDP, population, and employment, 1980-2014

Indexed to year 1980

1.5

Recession

US GDP (+147%)

CT GDP (+126%)

1.0

0.5

0

1980

1990

SOURCE: Moodys Analytics; BLS; ACS; US Census

2000

2010

A NEW ECONOMIC NORMAL FOR CONNECTICUT

The recession disrupted Connecticut's long run of solid

economic growth

Real GDP, population, and employment, 1980-2014

Indexed to year 1980

1.5

Recession

US GDP (+147%)

CT GDP (+126%)

1.0

0.5

US Population (+42%)

CT Population (+16%)

0

1980

1990

SOURCE: Moodys Analytics; BLS; ACS; US Census

2000

2010

A NEW ECONOMIC NORMAL FOR CONNECTICUT

The recession disrupted Connecticut's long run of solid

economic growth

Real GDP, population, and employment, 1980-2014

Indexed to year 1980

1.5

Recession

US GDP (+147%)

CT GDP (+126%)

1.0

0.5

US Employment (+47%)

US Population (+42%)

CT Employment (+18%)

CT Population (+16%)

0

1980

1990

SOURCE: Moodys Analytics; BLS; ACS; US Census

2000

2010

A NEW ECONOMIC NORMAL FOR CONNECTICUT

Emerging trends have created a new economic normal and

pose challenges for the states competitiveness

Global and national forces are reshaping Connecticuts

traditional core sectors

Peers are closing the gap on Connecticuts livability

and cost advantages

Population trends are reshaping Connecticuts

workforce

Perceptions are hardening on state governance and

fiscal uncertainty

| 10

A NEW ECONOMIC NORMAL FOR CONNECTICUT

Emerging trends have created a new economic normal and

pose challenges for the states competitiveness

Global and national forces are reshaping Connecticuts

traditional core sectors

Peers are closing the gap on Connecticuts livability

and cost advantages

Population trends are reshaping Connecticuts

workforce

Perceptions are hardening on state governance and

fiscal uncertainty

| 11

FORCES ARE RESHAPING CONNECTICUTS CORE SECTORS

Manufacturing, Finance and Insurance have faced

recent challenges

Connecticut industry mix, 1980-2014

% of GDP

30

25

Manufacturing

20

15

10

5

Finance and Insurance

1980

1990

SOURCE: Moodys Analytics; US Bureau of Labor Statistics

2000

2010

2014

| 12

FORCES ARE RESHAPING CONNECTICUTS CORE SECTORS

Connecticut industries adding the most jobs pay below

the states current average wage

Average wage

Industries

with growing

employment

(2004-2014)

Industries

with

shrinking

employment

(2004-2014)

Fastest changing industries

Educational Services

Accommodation and

Food Services

Health Care and

Social Assistance

Manufacturing

Information

Construction

$54,018

$75,246

$65K, CT current average wage

Note: all figures are based on December 2014 data; excludes Agriculture and Mining related sectors

Measured as total wages & disbursements divided by total employees in industry

SOURCE: U.S. Bureau of Labor Statistics (BLS): Current Employment Statistics (CES),

Quarterly Census of Employment and Wages (QCEW); Moody's Analytics

| 13

FORCES ARE RESHAPING CONNECTICUTS CORE SECTORS

Job creation by young companies in recent years has not

returned to pre-recession levels

Connecticut firms by age

Number of firms

Connecticut job creation by age of firm

Number of jobs

00 to

to 55

>> 55 years

years

50,000

0 to 5

> 5 years

130,000

120,000

45,000

110,000

40,000

100,000

90,000

35,000

80,000

30,000

70,000

60,000

25,000

0

2004

2006

2006

2008

2008

2010

2010

2012

2012

2014

2014

0

2004

2006

2008

2010

2012

2014

0-5 year old firms accounted for 33% of total firms and 54% of jobs created in

2013, ranking Connecticut 40th (lowest) in the U.S.

NOTE: Excludes data for companies where establishment data is unknown (~10-15% of total Connecticut firms)

SOURCE: U.S. Census Longitudinal Business Database

| 14

FORCES ARE RESHAPING CONNECTICUTS CORE SECTORS

However, Manufacturing, Finance and Insurance remain

competitive growth engines for Connecticut

Connecticut projected sector performance (2014-2023) compared to specialization

Connecticut GDP growth CAGR, 2014-2023

Percent

Majority

tradable

Semi

tradable

Majority

non-tradable

Size represents

2014 GDP

5.0

4.5

Admin.; support; waste

4.0

Information

3.5

Professional services

3.0

Manufacturing

Management

Transportation & warehousing

Projected

US GDP 2.5

Growth

Rate

2.0

Education

Accommodation & food

Retail trade

Construction

Health care

1.5

Arts and entertainment

Finance & insurance

1.0

Wholesale trade

0.5

Government

0

0.80

0.85

0.90

0.95

1.00

1.05

1.10

1.15

1.20

1.25

1.30

1.35

1.40

1.45

1.50

1.55

1.60

Industry specialization as compared to US overall (LQ), 2014

SOURCE: Moodys Analytics, US Bureau of Labor Statistics

| 15

A NEW ECONOMIC NORMAL FOR CONNECTICUT

Emerging trends have created a new economic normal and

pose challenges for the states competitiveness

Global and national forces are reshaping Connecticuts

traditional core sectors

Peers are closing the gap on Connecticuts livability

and cost advantages

Population trends are reshaping Connecticuts

workforce

Perceptions are hardening on state governance and

fiscal uncertainty

| 16

PEERS ARE CLOSING THE GAP ON CONNECTICUTS ADVANTAGES

While Connecticut has always been safe and livable,

peers have closed the gap

Violent crime rate, 1985-2012

Number of violent crimes per 100k residents

2,400

2,200

2,000

1,800

1,600

1,400

1,200

1,000

800

Boston

600

NYC

400

CT

200

1985

1995

SOURCE: U.S. Department of Justice, FBI Uniform Crime Reporting Statistics

2005

2012

| 17

PEERS ARE CLOSING THE GAP ON CONNECTICUTS ADVANTAGES

Connecticuts tax rates are higher than U.S. averages and,

in some cases, peers

Statutory tax rates by state, 2015

XX% CT rate

New York

Massachusetts

Connecticut

All other states

CT state rank

CT-6.4%

U.S. Avg.

5.1%

Sales Tax

CT-6.7%

Personal

Income Tax1

U.S. Avg.

5.5%

39th

35th

CT-1.5%

Property

Tax2

U.S. Avg.

1.1%

40th

CT-12%

Estate Tax3

38th

U.S. Avg.

4.3%

1 Represents the highest marginal personal income tax rate

2 Mean Property Taxes on Owner-Occupied Housing as Percentage of Mean Home Value as of Calendar Year 2011

3 Tax Foundation data

SOURCE: Federation of Tax Administrators (2016); U.S. Census; Tax Foundation

| 18

PEERS ARE CLOSING THE GAP ON CONNECTICUTS ADVANTAGES

Connecticuts urban cores underperform

rest of State on key livability questions

Suburban1

90%

Rural2

Best performing

Lowest performing

Urban

Periphery3 Urban Core

82%

80%

21%

24%

68%

CT overall

82%

% of respondents satisfied in area

in which they live

% of respondents saying their area

and quality of life is worsening

20%

14%

60%

% of respondents saying they are

NOT able to obtain suitable

employment

27%

42%

67%

50%

49%

40%

% of respondents saying area does

not have adequate goods and

services to meet needs

30%

17%

21%

24%

NOTE: Survey based on 16,219 responses28% suburban, 13% rural residents, 38% urban periphery, 17% urban core residents, 5% wealthy

1 Includes locations such as North Haven and Granby located near larger urban centers 2 Includes locations such as Putnam and Sharon located

farther from an urban core

3 Includes locations such as Norwalk and East Haven located around urban cores

SOURCE: CT Data Haven, Apr-Oct 2015

| 19

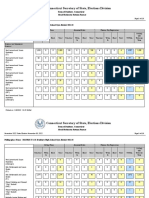

PEERS ARE CLOSING THE GAP ON CONNECTICUTS ADVANTAGES

Quality of life measures vary widely

across Connecticuts cities

Top quartile

Middle 50%

Bottom quartile

Livability metrics by city, 2014

CT overall Bridgeport

Insurance coverage

% of population without health

insurance

Hartford

New Haven Norwalk

Stamford Waterbury

8.5%

20.3%

15.5%

12.3%

17.0%

17.3%

12.6%

10,196

7,499

6,002

2,717

1,318

9,021

263

905

1,104

1,054

296

240

373

Cost of living

Median gross rent as a percentage

of household income

31.9%

37.4%

36.2%

36.4%

30.3%

32.5%

35.2%

Homelessness

Percent of total population

0.13%

0.30%

0.57%

ND

0.28%

0.31%

1.57%

Unemployment2

Percent

7.9%

14.6%

19.4%

11.2%

8.5%

9.3%

ND

School ranking

Nationally of 13,506 school districts1

Crime rates

Violent crime per 100k residents

NOTE: Quartiles are determined using cities >50,000 residents 1 School ranking calculated through surveys, health, safety, student culture, diversity and

state test scores 2 Unemployment based on ACS 2014 one year survey estimate for purposes of comparison with city-level data

SOURCE: Social Science Research Council; FBI U.S. Crime Database,

US Department of Housing and Urban Development; ACS 2014,

US Department of Education

| 20

PEERS ARE CLOSING THE GAP ON CONNECTICUTS ADVANTAGES

Many of Connecticuts auto commuters face significant

congestion challenges

Connecticut freeway commute times by urban area, 2014

Urban

area

New YorkNew Jersey

Hartford

Freeway

congestion rank3

(out of 101 urban

areas)

Percent additional time required during peak travel

compared to free flow periods

Avg. rush hour1

BridgeportStamford

Annual auto delays by urban area, 2014

188%

39%

New Haven

19%

Worcester

MA

15%

176%

Springfield

MA

14%

107%

86%

56%

51%

Mediumsize urban

area rank

Buffer to arrive on time2

44%

23%

Rank

(of 101

urban

areas)

Annual hours of

delay per auto

commuter

232%

215%

130%

105%

71%

65%

Example:

In New Haven, rush

hour commute takes

an average 19%

longer (e.g., 36 vs 30

minutes)

To be sure to arrive

on time, you must

depart 105% earlier

during peak vs. non

peak periods (e.g., 62

vs. 30 minutes)

BridgeportStamford

11

New YorkNew Jersey

38

Hartford CT

45

29

58

New Haven

40

49

11

86

Boston, MA

90

Providence,

RI

49

74

64

43

19

35

1 Based on the commuter stress index: the ratio of peak period (in peak direction) versus free flow travel time

2 Based on the planning time index: the ratio of peak period versus free flow time including buffer to ensure 95% on-time arrival

3 Top 101 US urban areas ranked by planning time index, from longest to shortest additional travel time

SOURCE: Texas A&M Urban Mobility Scorecard

| 21

A NEW ECONOMIC NORMAL FOR CONNECTICUT

Emerging trends have created a new economic normal and

pose challenges for the states competitiveness

Global and national forces are reshaping Connecticuts

traditional core sectors

Peers are closing the gap on Connecticuts livability

and cost advantages

Population trends are reshaping Connecticuts

workforce

Perceptions are hardening on state governance and

fiscal uncertainty

| 22

POPULATION TRENDS AND RESHAPING CONNECTICUT'S WORKFORCE

Connecticuts population growth has been negligible,

driven by high domestic out-migration

Connecticut population change, 2001-2014

Population in thousands

Births less deaths

Net international migration

Net domestic migration

% net change in total population

0.5%

0.6%

0.1%

0.1%

0.4%

13

12

11

0

12

11

11

9

15

-7

-8

-17

2001

2003

2005

0.3%

0.1%

16

16

-13

-17

-21

2007

Post 9/11 & economic expansion

-0.1%

6

19

-27

2009

2011

2013

2014

Recession & recovery

NOTE: Population data is unavailable for 2010

SOURCE: U.S. Census Bureau Population Estimate Program; Internal Revenue

Service 2013; U.S. Census American Community Survey

| 23

POPULATION TRENDS AND RESHAPING CONNECTICUT'S WORKFORCE

Three of the top six MSAs losing the greatest percentage of

their population to other states are in Connecticut

The cities Americans are leaving, 2013-2014

Percent of resident out-migration, top 20 out of 100 cities

Note: This data only looks at out-migration. Many of these cities also attract significant volumes of inward-migration

SOURCE: Bloomberg analysis of U.S. Census data, 2013-14 data

| 24

POPULATION TRENDS AND RESHAPING CONNECTICUT'S WORKFORCE

Connecticut is losing young and educated people to other

states

Net domestic migration by education, 2014

Net domestic migration by age, 2014

Population 25 years and older

Population 1 year and older

Graduate

Age 65+

-1,837

45 to 64

Bachelor's

-5,198

-4,571

-3,805

35 to 44

Some college or

associate's degree

921

-5,928

25 to 34

High school graduate

846

18 to 24

No high school diploma

SOURCE: U.S. Census 2014 American Community Survey

-889

987

1 to 17

-7,709

4,691

| 25

POPULATION TRENDS AND RESHAPING CONNECTICUT'S WORKFORCE

While Connecticut has a lower poverty rate than the

US, it has been growing at a higher rate

Poverty rate, 2010-2014

CT

% of population living below the poverty level

US

14.3

13.8

9.2

9.5

10.0

15.6

15.4

14.9

10.2

10.5

US CAGR, 2010-2014:

3.1%

CT CAGR, 2010-2014:

3.4%

2010

2012

2012

SOURCE: 2010-2014 American Community Survey 5-Year Estimates

2013

2014

| 26

A NEW ECONOMIC NORMAL FOR CONNECTICUT

Emerging trends have created a new economic normal and

pose challenges for the states competitiveness

Global and national forces are reshaping Connecticuts

traditional core sectors

Peers are closing the gap on Connecticuts livability

and cost advantages

Population trends are reshaping Connecticuts

workforce

Perceptions are hardening on state governance and

fiscal uncertainty

| 27

PERCEPTIONS ARE HARDING ON GOVERNANCE AND FISCAL UNCERTAINTY

Four factors are feeding the perception of a

negative business climate in Connecticut

Factors affecting the State and

national discussion on

Connecticuts business climate

[Businesses] say increasing pension

costs borne by the state government

could trigger tax increases that could

scare off companies in the state or

those looking to relocate - 1/2016

1. Fiscal fundamentals

2. Negative national publicity

3. Unpredictable governance

Immelt said the company's taxes have

been raised five times since 2011, while

support for our strategies has been

uneven. - 6/2015

4. Perceived lack of engagement

45th

47th

Connecticut's

ranking nation-wide

in cost of doing

business (2015)

| 28

CONNECTICUTS DISTINCTIVE ASSETS

To address these trends and ensure long-term competitiveness,

Connecticut can build on its distinctive assets

Talented population

Strong education

system

Blue-chip companies

and growth sectors

38% of those 25+ have at least a bachelor's degree vs. 30%

nationwide

3rd highest productivity in the country

6th best K-12 education system based on test scores and

funding levels, and #1 in some national rankings

7th highest AP participation rate in county, and 2nd highest

percentage of students scoring 3 or higher

50+% of enrolled college students attend a public institution

7th in the country in number of S&P 500 headquarters

Growing sub-sectors of strength, e.g., aerospace added 1,400

jobs in 2015

3.3% of all Fortune 1000 companies by revenue are in

Connecticut vs. 2.0% in Massachusetts and 2.9% in New Jersey

SOURCE: US Census; BLS; Education Week; Smart Asset; IPEDS; S&P Capital IQ; Fortune Magazine

| 29

CONNECTICUTS DISTINCTIVE ASSETS

To address these trends and ensure long-term competitiveness,

Connecticut can build on its distinctive assets

Strong research

output

8th in the U.S. on R&D as a share of GDP

High quality of life

#3 in quality of life of any US state (Forbes)

40% lower cost per sq. ft. of housing in Stamford vs. NYC

Strategic location

Academic research surged 38% from 09 to 13, moving CT from

32nd to 12th in the U.S. on academic R&D spend

3rd highest life expectancy in the US at 81 years

2nd lowest among peers in violent crime rates, 9th nation-wide

7th busiest Interstate system in the US by number of cars

~40+M Metro-North New Haven Line and ~11.5M Amtrak train

ridership each year

SOURCE: National Science Foundation; Social Science Research Council; Forbes; FBI; Zillow; Federal

Highway Adminstration

| 30

THEMES TO EXPLORE

Potential themes for the Commission to consider exploring

Growth sectors: How can Connecticut

support its high potential, fast-changing

sectors?

Transportation: What investments will

best connect talent and businesses?

Skills & workforce development

Performance and expansion aligned with

growth priorities

Enabling infrastructure (e.g., broadband)

Funding certainty

Modernized and aligned tax code and

regulatory/incentive regime

Access to jobs

Cities: How should CT revitalize its

urban cores?

Urban appeal and attraction of young talent

Economic opportunities for all

Entrepreneurship

Public-private engagement: How can

the State and the private sector

collaborate to jointly support long-term

growth?

Fiscal confidence: How can

Connecticut address its pension and

budget challenges to restore business

confidence?

Reignited dialogue, trust, and commitment

Pension sustainability

Sector- and opportunity-specific partnerships

Budget stability

Co-ownership of initiatives

| 31

The Connecticut Economic Competitiveness diagnostic:

Key takeaways

Connecticut has had a long run of strong economic performance, making it a great state to

live and work

Recent trends have created a new economic normal and pose challenges for the states

competitiveness

A. Global and national forces are reshaping Connecticuts traditional core sectors

B. Peers are closing the gap on Connecticuts livability and cost advantages

C. Population trends are reshaping Connecticuts workforce

D. Perceptions are hardening on state governance and fiscal uncertainty

Connecticut has a portfolio of distinctive assets to address these trends and ensure longterm competitiveness

Five themes have emerged as potential areas for the Commission to consider exploring

in further detail

1. Cities: How should Connecticut revitalize its urban cores?

2. Growth sectors: How can Connecticut support its high potential, fast-changing sectors?

3. Transportation: What investments will best connect talent and businesses?

4. Fiscal outlook: How can Connecticut address its pension and budget challenges to

restore business confidence?

5. Public-private engagement: How can the State and the private sector collaborate to

jointly support long-term growth?

| 32

Thank you

| 33

You might also like

- Danbury November 2023 Municipal Election Returns (Amended)Document91 pagesDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNo ratings yet

- Danbury November 2023 Municipal Election Returns (Amended)Document91 pagesDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNo ratings yet

- 2021 Danbury Head Moderator Return DataDocument136 pages2021 Danbury Head Moderator Return DataAlfonso RobinsonNo ratings yet

- Parables AssignmentDocument5 pagesParables Assignmentangel_grrl6827No ratings yet

- Jobs For AmericaDocument65 pagesJobs For AmericaDewita SoeharjonoNo ratings yet

- BTC Objectives Coverage RegulatoryFrameworkDocument18 pagesBTC Objectives Coverage RegulatoryFrameworkbarassaNo ratings yet

- 02016-2007 ErpDocument351 pages02016-2007 ErplosangelesNo ratings yet

- Technical Backgrounder - Million Jobs Plan (13 May 2014)Document5 pagesTechnical Backgrounder - Million Jobs Plan (13 May 2014)DavidReevelyNo ratings yet

- 17th Annual Report - EngDocument67 pages17th Annual Report - Engtickled_pinkNo ratings yet

- Economics of Pakistan-A Realistic Non-Political Analysis & Common Minimum Economic ProgramDocument27 pagesEconomics of Pakistan-A Realistic Non-Political Analysis & Common Minimum Economic Programnajeebcr9No ratings yet

- Weekly Trends March 24, 2016Document4 pagesWeekly Trends March 24, 2016dpbasicNo ratings yet

- Macroeconomics Canadian 15th Edition Mcconnell Test BankDocument50 pagesMacroeconomics Canadian 15th Edition Mcconnell Test Bankadeleiolanthe6zr1100% (27)

- Accounting For Growth: Comparing China and India: Barry Bosworth and Susan M. CollinsDocument37 pagesAccounting For Growth: Comparing China and India: Barry Bosworth and Susan M. CollinsChand PatelNo ratings yet

- ChristecoDocument28 pagesChristecoapi-236125865No ratings yet

- Efficiency 6hqo25cb8jopDocument8 pagesEfficiency 6hqo25cb8jopwjimenez1938No ratings yet

- Commerce - Jobs Session 2011Document9 pagesCommerce - Jobs Session 2011mbrackenburyNo ratings yet

- The Effects of of Equalization On Canada's Labour MobilityDocument9 pagesThe Effects of of Equalization On Canada's Labour MobilitySean McConnachieNo ratings yet

- Australia: Open For BusinessDocument7 pagesAustralia: Open For Businessapi-81108585No ratings yet

- APGov Econ CH 18Document26 pagesAPGov Econ CH 18ManasNo ratings yet

- Joyce Performance-Informed Budgeting in The United States-Tastes Great or Less FillingDocument20 pagesJoyce Performance-Informed Budgeting in The United States-Tastes Great or Less FillingInternational Consortium on Governmental Financial ManagementNo ratings yet

- Política EconómicaDocument26 pagesPolítica Económicajorge lNo ratings yet

- BCOM ME PresentationDocument57 pagesBCOM ME PresentationAISHWARYA MADDAMSETTYNo ratings yet

- 2015 2016 FPI Briefing Book 1.0Document72 pages2015 2016 FPI Briefing Book 1.0Casey SeilerNo ratings yet

- Hon. J.B. Hockey: TreasurerDocument21 pagesHon. J.B. Hockey: TreasurerPolitical AlertNo ratings yet

- Globalisation, Financial Stability and EmploymentDocument10 pagesGlobalisation, Financial Stability and EmploymentericaaliniNo ratings yet

- Public Sector Accounting Reform - The Cruel World of NeoliberalismDocument47 pagesPublic Sector Accounting Reform - The Cruel World of NeoliberalismAndy Wynne100% (1)

- New York at A Crossroads: A Transformation Plan For A New New YorkDocument31 pagesNew York at A Crossroads: A Transformation Plan For A New New YorkwqwerNo ratings yet

- Good Governance For A Better Tomorrow: Philippine Economic BriefingDocument68 pagesGood Governance For A Better Tomorrow: Philippine Economic BriefingpmellaNo ratings yet

- The Job Recovery Package For The State of Arizona - : Executive SummaryDocument17 pagesThe Job Recovery Package For The State of Arizona - : Executive SummaryArizonaGuardianNo ratings yet

- EL TRIMESTRE ECONÓMICO, Vol. LXXXVIII (2), Núm. 350, Abril-Junio de 2021, Pp. 373-417Document45 pagesEL TRIMESTRE ECONÓMICO, Vol. LXXXVIII (2), Núm. 350, Abril-Junio de 2021, Pp. 373-417Benjamin López OrtizNo ratings yet

- 2014 Liberal PlatformDocument44 pages2014 Liberal PlatformAndre FaustNo ratings yet

- Regional Council GuidebookDocument60 pagesRegional Council GuidebookNick ReismanNo ratings yet

- Enterprising States 2011Document135 pagesEnterprising States 2011U.S. Chamber of CommerceNo ratings yet

- Whats Next For China Jan 22 v2Document16 pagesWhats Next For China Jan 22 v2Ispon Asep YuranoNo ratings yet

- DOCUMENT: Gov. Dannel P. Malloy Connecticut Budget Fact Sheet (2/3/16)Document6 pagesDOCUMENT: Gov. Dannel P. Malloy Connecticut Budget Fact Sheet (2/3/16)NorwichBulletin.comNo ratings yet

- Measuring The Economy: A Primer On GDP and The National Income and Product AccountsDocument25 pagesMeasuring The Economy: A Primer On GDP and The National Income and Product AccountsLajilaNo ratings yet

- Reading Lesson 5Document18 pagesReading Lesson 5AnshumanNo ratings yet

- AMLO - A Contract With MexicoDocument36 pagesAMLO - A Contract With MexicodespiertmexNo ratings yet

- Enhancing Accountability For The Use of Public Sector Resources: How To Improve The Effectiveness of Public Accounts CommitteesDocument46 pagesEnhancing Accountability For The Use of Public Sector Resources: How To Improve The Effectiveness of Public Accounts Committeesfathinnorshafiq5330No ratings yet

- Union Budget 2010-2011: Presented byDocument44 pagesUnion Budget 2010-2011: Presented bynishantmeNo ratings yet

- Reading Lesson 1Document9 pagesReading Lesson 1AnshumanNo ratings yet

- Policies Leeper HandoutDocument24 pagesPolicies Leeper HandoutTf ChungNo ratings yet

- Dynamic of Fiscal Finance in USA LeeperDocument47 pagesDynamic of Fiscal Finance in USA LeeperAdnan AhmadNo ratings yet

- EHL - Will Falk Presentation On Five ZerosDocument39 pagesEHL - Will Falk Presentation On Five ZerosRobert Fraser RNNo ratings yet

- Presentation by NEDA Arsenio Balisacan 9.2.13Document29 pagesPresentation by NEDA Arsenio Balisacan 9.2.13Arangkada PhilippinesNo ratings yet

- Paying Taxes 2010Document116 pagesPaying Taxes 2010Christian JoneliukstisNo ratings yet

- Partnership For Growth Scorecard Rev 04aug2016 PDFDocument3 pagesPartnership For Growth Scorecard Rev 04aug2016 PDFhazeerkeedNo ratings yet

- Chapter 1 - Meaning and Measures of Economic DevelopmentDocument4 pagesChapter 1 - Meaning and Measures of Economic DevelopmentAlzen Marie DelvoNo ratings yet

- 3 Years Eco Survey Pt-1 Intro Conclusion @cse - UpdatesDocument217 pages3 Years Eco Survey Pt-1 Intro Conclusion @cse - UpdatesJit MukherheeNo ratings yet

- Areas of Concern in IndiaDocument17 pagesAreas of Concern in IndiaElle Gio CasibangNo ratings yet

- Fiscal &monetary Policy Its Trend Since 1990s: Presented By: Nou SinaDocument18 pagesFiscal &monetary Policy Its Trend Since 1990s: Presented By: Nou SinaRam Manoj YendruNo ratings yet

- Changing Economic Environment in IndiaDocument27 pagesChanging Economic Environment in IndiaMdheer09No ratings yet

- Canadian Health Care System: Sustainable? An Analytical Exploration of Current and Future Trends in Health Care FundingDocument13 pagesCanadian Health Care System: Sustainable? An Analytical Exploration of Current and Future Trends in Health Care FundingTim MitchellNo ratings yet

- Presentación de Rosselló Ante Sexta Reunión de La JCF. 31/marzo/2017Document25 pagesPresentación de Rosselló Ante Sexta Reunión de La JCF. 31/marzo/2017Victor Torres MontalvoNo ratings yet

- Economy Compilation Forum IAS PDFDocument62 pagesEconomy Compilation Forum IAS PDFKOTTE SAIKIRANNo ratings yet

- Professor Craig S. Maher Clow Faculty 408 Office Ph. 920-424-7304Document62 pagesProfessor Craig S. Maher Clow Faculty 408 Office Ph. 920-424-7304Diana PobladorNo ratings yet

- An Analysis of Estimates Arising From The Tennessee Econometric Model As Presented in An Economic Report To The Governor, 1995Document23 pagesAn Analysis of Estimates Arising From The Tennessee Econometric Model As Presented in An Economic Report To The Governor, 1995Joe AdamsNo ratings yet

- Building A Prosperity BlueprintDocument15 pagesBuilding A Prosperity BlueprintrubbermalletNo ratings yet

- ERS and Vision 2030 - April 2008Document64 pagesERS and Vision 2030 - April 2008Elijah NyangwaraNo ratings yet

- 48 National Cost Convention, 2007: Inaugural Address On Sustaining The Higher GrowthDocument8 pages48 National Cost Convention, 2007: Inaugural Address On Sustaining The Higher Growthapi-3705877No ratings yet

- Taking On The Three DeficitsDocument42 pagesTaking On The Three DeficitsInformation Technology and Innovation FoundationNo ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- St. Hiliare V City of Danbury (Complaint)Document91 pagesSt. Hiliare V City of Danbury (Complaint)Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 January 10Document29 pagesRe-Elect Mayor Esposito SEEC 20 January 10Alfonso RobinsonNo ratings yet

- Roberto Alves SEEC 20 January 10 (Termination)Document31 pagesRoberto Alves SEEC 20 January 10 (Termination)Alfonso RobinsonNo ratings yet

- 3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementDocument36 pages3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementAlfonso RobinsonNo ratings yet

- Alves For Danbury SEEC 20 July 10 2023Document102 pagesAlves For Danbury SEEC 20 July 10 2023Alfonso RobinsonNo ratings yet

- Danbury 2022 Head Moderators ReturnsDocument7 pagesDanbury 2022 Head Moderators ReturnsAlfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 October 10 2023Document75 pagesRe-Elect Mayor Esposito SEEC 20 October 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC Form 20 October 10 2022Document32 pagesRe-Elect Mayor Esposito SEEC Form 20 October 10 2022Alfonso RobinsonNo ratings yet

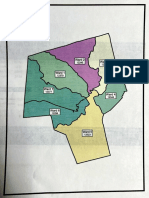

- To City of Danbury Election WardsDocument13 pagesTo City of Danbury Election WardsAlfonso RobinsonNo ratings yet

- Alves For Danbury SEEC 20 April 10 2023Document201 pagesAlves For Danbury SEEC 20 April 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 April 10 2023Document88 pagesRe-Elect Mayor Esposito SEEC 20 April 10 2023Alfonso RobinsonNo ratings yet

- Governor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtDocument5 pagesGovernor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtAlfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 July 10 2023Document80 pagesRe-Elect Mayor Esposito SEEC 20 July 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC Form 20 January 10 2023Document54 pagesRe-Elect Mayor Esposito SEEC Form 20 January 10 2023Alfonso RobinsonNo ratings yet

- 2022 Danbury Head Moderators Return DataDocument118 pages2022 Danbury Head Moderators Return DataAlfonso RobinsonNo ratings yet

- Danbury Democrats Ward Reappointment Proposal (Plan A)Document6 pagesDanbury Democrats Ward Reappointment Proposal (Plan A)Alfonso RobinsonNo ratings yet

- Danbury Republican Party Ward Reapportionment Proposal (Plan B)Document8 pagesDanbury Republican Party Ward Reapportionment Proposal (Plan B)Alfonso RobinsonNo ratings yet

- Joe DaSilva For Judge of Probate, Danbury CT 2022Document2 pagesJoe DaSilva For Judge of Probate, Danbury CT 2022Alfonso RobinsonNo ratings yet

- Danbury 2021 Election TotalsDocument9 pagesDanbury 2021 Election TotalsAlfonso RobinsonNo ratings yet

- Alves For Danbury Form 20 January 10Document37 pagesAlves For Danbury Form 20 January 10Alfonso RobinsonNo ratings yet

- Roberto Alves Mailer 09.30.21Document2 pagesRoberto Alves Mailer 09.30.21Alfonso RobinsonNo ratings yet

- Dean Esposito Form 20 October 2021Document104 pagesDean Esposito Form 20 October 2021Alfonso RobinsonNo ratings yet

- Alves For Danbury Form 20 October 26 (7 Days Until Election)Document35 pagesAlves For Danbury Form 20 October 26 (7 Days Until Election)Alfonso RobinsonNo ratings yet

- Dean Esposito Attack Mailer 09.20.21Document2 pagesDean Esposito Attack Mailer 09.20.21Alfonso RobinsonNo ratings yet

- Gartner Town Clerk Form 20 October 12Document33 pagesGartner Town Clerk Form 20 October 12Alfonso RobinsonNo ratings yet

- Assignment 01 MemberManagementDocument9 pagesAssignment 01 MemberManagementDinh Huu Khang (K16HCM)No ratings yet

- Heavy Duty and Static Dissipative Footwear With Mid-Sole DeviceDocument14 pagesHeavy Duty and Static Dissipative Footwear With Mid-Sole DeviceJenniferValleNo ratings yet

- Bts - Butter (CD) Target 2Document1 pageBts - Butter (CD) Target 2ife ogundeleNo ratings yet

- CORE122 - Introduction To The Philosophy of The Human PersonDocument6 pagesCORE122 - Introduction To The Philosophy of The Human PersonSHIENNA MAE ALVISNo ratings yet

- Tugas Tutorial 2 - English Morpho-SyntaxDocument2 pagesTugas Tutorial 2 - English Morpho-Syntaxlotus373No ratings yet

- How To Test SMTP Services Manually in Windows ServerDocument14 pagesHow To Test SMTP Services Manually in Windows ServerHaftamu HailuNo ratings yet

- Beowulf StoryDocument6 pagesBeowulf StoryAndrey Zoe De LeonNo ratings yet

- Sur MBL - Kmtcpusg482545Document2 pagesSur MBL - Kmtcpusg482545nanaNo ratings yet

- Edgerton, R. (1984) Anthropology and Mental Retardation. Research Approaches and OpportunitiesDocument24 pagesEdgerton, R. (1984) Anthropology and Mental Retardation. Research Approaches and OpportunitiesjuanitoendaraNo ratings yet

- Pres Level 2 Application Form Dublin 2024Document3 pagesPres Level 2 Application Form Dublin 2024maestroaffairsNo ratings yet

- January NightDocument7 pagesJanuary NightShazia ParveenNo ratings yet

- Revival Fires Baptist College Christian Ethics Professor: Dr. Dennis Corle Proper Use of AuthorityDocument19 pagesRevival Fires Baptist College Christian Ethics Professor: Dr. Dennis Corle Proper Use of AuthoritySnowman KingNo ratings yet

- KaramuntingDocument14 pagesKaramuntingHaresti MariantoNo ratings yet

- English File 4e Elementary TG PCM Comm 5ADocument1 pageEnglish File 4e Elementary TG PCM Comm 5ARaffael NuñezNo ratings yet

- Attendance DenmarkDocument3 pagesAttendance Denmarkdennis berja laguraNo ratings yet

- SV - ComplaintDocument72 pagesSV - ComplaintĐỗ Trà MyNo ratings yet

- Week 9 All About GreeceDocument18 pagesWeek 9 All About GreeceNo OneNo ratings yet

- Solutions To Chapter 6 Valuing StocksDocument20 pagesSolutions To Chapter 6 Valuing StocksSam TnNo ratings yet

- Illustration For Payback Calculation of AHFDocument7 pagesIllustration For Payback Calculation of AHFAditya PandeyNo ratings yet

- I. Demographic Profile/Information Name: Theodore Robert Bundy (Ted Bundy) Age: 42Document5 pagesI. Demographic Profile/Information Name: Theodore Robert Bundy (Ted Bundy) Age: 42Maanne MandalNo ratings yet

- CAR BLGF Covid Response UpdateDocument8 pagesCAR BLGF Covid Response UpdatenormanNo ratings yet

- Atlantic Coastwatch: An Era Ending?Document8 pagesAtlantic Coastwatch: An Era Ending?Friends of the Atlantic Coast Watch NewsletNo ratings yet

- Opening SalvoDocument6 pagesOpening SalvoMark James MarmolNo ratings yet

- Nmims: Entrepreneurship ManagementDocument264 pagesNmims: Entrepreneurship ManagementBhavi GolchhaNo ratings yet

- Mauro GiulianiDocument6 pagesMauro GiulianispeardzakNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- LabRel 1st 2014 TSNDocument126 pagesLabRel 1st 2014 TSNJose Gerfel GeraldeNo ratings yet

- Designation - Supply OfficerDocument3 pagesDesignation - Supply OfficerShirley P. SumugatNo ratings yet

- Winning The Easy GameDocument18 pagesWinning The Easy GameLeonardo PiovesanNo ratings yet