Professional Documents

Culture Documents

Other Types of Mortgage Loans: Hybrid ARM 3/1, 5/1, 7/1, or 10/1

Other Types of Mortgage Loans: Hybrid ARM 3/1, 5/1, 7/1, or 10/1

Uploaded by

raqibappCopyright:

Available Formats

You might also like

- Simple Portfolio Optimization That WorksDocument164 pagesSimple Portfolio Optimization That WorksraqibappNo ratings yet

- Loan Type Sheet: Adjustable RateDocument3 pagesLoan Type Sheet: Adjustable RatejawadNo ratings yet

- MORTGAGEDocument9 pagesMORTGAGEbibin100% (1)

- What Is A 'Floating Interest Rate'Document21 pagesWhat Is A 'Floating Interest Rate'iyappaNo ratings yet

- AmortizationDocument22 pagesAmortizationROXANE FLORESNo ratings yet

- Mortgage Interest OnlyDocument17 pagesMortgage Interest Onlyanteras100% (1)

- Mortgage and Amortization (Math of Investment)Document2 pagesMortgage and Amortization (Math of Investment)RCNo ratings yet

- Fixed or Floating Interest Rate Home Loan: The Classic DilemmaDocument3 pagesFixed or Floating Interest Rate Home Loan: The Classic DilemmaAkash MahajanNo ratings yet

- Fixed or Floating Interest Rate Home Loan: The Classic DilemmaDocument3 pagesFixed or Floating Interest Rate Home Loan: The Classic DilemmaAkash MahajanNo ratings yet

- Mortgage FundamentalsDocument14 pagesMortgage FundamentalsMadhuPreethi Nachegari100% (1)

- Marketing of Financial Services AsignmentDocument11 pagesMarketing of Financial Services AsignmentMohit KumarNo ratings yet

- 6 Things To Know Before Taking A Home LoanDocument3 pages6 Things To Know Before Taking A Home LoanDrSivasundaram Anushan SvpnsscNo ratings yet

- Assignment 1 - Ahmed AlqatrawiDocument4 pagesAssignment 1 - Ahmed AlqatrawiBeka JoNo ratings yet

- Mortgage Loan DefinitionDocument65 pagesMortgage Loan DefinitionAnonymous iyQmvDnHnCNo ratings yet

- Mortgage System in USDocument63 pagesMortgage System in USAnkit SinghNo ratings yet

- Buying A HouseDocument35 pagesBuying A HouseDiwakar SHARMA100% (1)

- Asset Management (Mortgages) .1Document5 pagesAsset Management (Mortgages) .1Ken BiiNo ratings yet

- Tridel Condos and TownhousesDocument12 pagesTridel Condos and TownhouseskrishkissoonNo ratings yet

- Reverse MortgageDocument23 pagesReverse MortgageSakshi BansalNo ratings yet

- Housing FinanceDocument4 pagesHousing FinanceKIng KumarNo ratings yet

- (FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Document17 pages(FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Michelle GozonNo ratings yet

- Rem 7-6Document24 pagesRem 7-6Kevin JugaoNo ratings yet

- Why Bank Loans Are Enigma To BorrowersDocument3 pagesWhy Bank Loans Are Enigma To BorrowersMohammad Shahjahan SiddiquiNo ratings yet

- FINA 3780 Chapter 7Document49 pagesFINA 3780 Chapter 7roBinNo ratings yet

- Business MathDocument1 pageBusiness MathSilver SatinNo ratings yet

- Write A Note On Mortgage Market and Types of Mortgages in Pakistan?Document5 pagesWrite A Note On Mortgage Market and Types of Mortgages in Pakistan?Rizma RizwanNo ratings yet

- Applying For Home Loan Reduce Your Property Loan Interest BurdenDocument5 pagesApplying For Home Loan Reduce Your Property Loan Interest BurdenAlisha AntilNo ratings yet

- BondsDocument16 pagesBondsReignNo ratings yet

- Prelim Quiz 23Document2 pagesPrelim Quiz 23Michael Angelo Laguna Dela FuenteNo ratings yet

- Types of LoansDocument9 pagesTypes of LoansSanjay VaruteNo ratings yet

- Loan Terms QUESTIONSDocument13 pagesLoan Terms QUESTIONSPrince EG DltgNo ratings yet

- Interest RateDocument14 pagesInterest RatePriya RishiNo ratings yet

- Project Final AltafDocument60 pagesProject Final AltafVirendra BhavsarNo ratings yet

- Temp 6Document2 pagesTemp 6kev sunNo ratings yet

- What Is Sub Prime Lending?Document4 pagesWhat Is Sub Prime Lending?Priya HairNo ratings yet

- FAC About Loans PDFDocument5 pagesFAC About Loans PDFDenzel BrownNo ratings yet

- Mortgage Markets 2024Document6 pagesMortgage Markets 2024Ronalyn NatividadNo ratings yet

- Understanding Mortgage Exit Fees - v2Document3 pagesUnderstanding Mortgage Exit Fees - v2singhdeep258779No ratings yet

- BIWS Debt PrimerDocument7 pagesBIWS Debt PrimervinaymathewNo ratings yet

- Rakiba Mam AssnDocument9 pagesRakiba Mam AssnFahim IstiakNo ratings yet

- Equity Release United States Loan HUD: LenderDocument5 pagesEquity Release United States Loan HUD: Lender9870050214No ratings yet

- MATH +what Is Investment and LoanDocument11 pagesMATH +what Is Investment and LoanJhoana MaeNo ratings yet

- Tutorial Chapter 4 - NakishaDocument5 pagesTutorial Chapter 4 - NakishanurnakishasyazanaNo ratings yet

- Temp 5Document2 pagesTemp 5kev sunNo ratings yet

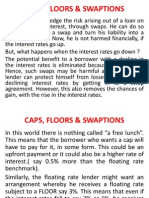

- Five-Caps, Floors & Swaptions 8Document8 pagesFive-Caps, Floors & Swaptions 8Akhilesh SinghNo ratings yet

- Explanation in FM ReportDocument4 pagesExplanation in FM Reportcreacion impresionesNo ratings yet

- Teju ProjectDocument20 pagesTeju Projecttmurekar7177No ratings yet

- MortgageDocument6 pagesMortgageMohin ChowdhuryNo ratings yet

- Business LoansDocument25 pagesBusiness LoansMai TiếnNo ratings yet

- Chapter 14 The Mortgage MarketsDocument5 pagesChapter 14 The Mortgage Marketslasha Kachkachishvili100% (1)

- Types of Mortgage and Loan TermsDocument6 pagesTypes of Mortgage and Loan TermsRajah EdwardNo ratings yet

- 8 MortgageDocument9 pages8 Mortgagefitnumanarshadna7No ratings yet

- Mortgages - 2Document2 pagesMortgages - 2Ken BiiNo ratings yet

- Abstract: Reverse Mortgage Is A Relatively New Financial Product Which Allows Senior Citizens To Keep Their House orDocument9 pagesAbstract: Reverse Mortgage Is A Relatively New Financial Product Which Allows Senior Citizens To Keep Their House orArunabh ChoudhuryNo ratings yet

- Chapter 23Document24 pagesChapter 23Abdur RehmanNo ratings yet

- This Line Is Only For CommerceDocument23 pagesThis Line Is Only For CommerceSourav SsinghNo ratings yet

- Interest in A Mortgage InfoDocument2 pagesInterest in A Mortgage InfoAbdur rehmanNo ratings yet

- RBI Cuts Repo Rate, How Much Would You Save On Home Loan?Document5 pagesRBI Cuts Repo Rate, How Much Would You Save On Home Loan?Dynamic LevelsNo ratings yet

- Asset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged)Document1 pageAsset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged)raqibappNo ratings yet

- Asset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 3Document1 pageAsset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 3raqibappNo ratings yet

- Asset-V1 NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 01 IntroductionDocument16 pagesAsset-V1 NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 01 IntroductionraqibappNo ratings yet

- Hek PDFDocument1 pageHek PDFraqibappNo ratings yet

- A Novel Hybrid Quicksort Algorithm Vectorized Using AVX-512 On Intel Skylake - 2017 (Paper - 44-A - Novel - Hybrid - Quicksort - Algorithm - Vectorized)Document9 pagesA Novel Hybrid Quicksort Algorithm Vectorized Using AVX-512 On Intel Skylake - 2017 (Paper - 44-A - Novel - Hybrid - Quicksort - Algorithm - Vectorized)raqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged) 6Document1 pageA Little Journey Inside Windows Memory (Dragged) 6raqibappNo ratings yet

- A Compilation Target For Probabilistic Programming Languages - 2014 (Paige14) (Dragged)Document1 pageA Compilation Target For Probabilistic Programming Languages - 2014 (Paige14) (Dragged)raqibappNo ratings yet

- Introducing OpenAIDocument3 pagesIntroducing OpenAIraqibappNo ratings yet

- Linear Algebra and Its Application.123 PDFDocument1 pageLinear Algebra and Its Application.123 PDFraqibappNo ratings yet

- 02 Basic Text ProcessingDocument23 pages02 Basic Text ProcessingraqibappNo ratings yet

- Linear Algebra and Its Application.130 PDFDocument1 pageLinear Algebra and Its Application.130 PDFraqibappNo ratings yet

- Linear Algebra and Its Application.124 PDFDocument1 pageLinear Algebra and Its Application.124 PDFraqibappNo ratings yet

- Linear Algebra and Its Application.116 PDFDocument1 pageLinear Algebra and Its Application.116 PDFraqibappNo ratings yet

- Linear Algebra and Its Application.122 PDFDocument1 pageLinear Algebra and Its Application.122 PDFraqibappNo ratings yet

Other Types of Mortgage Loans: Hybrid ARM 3/1, 5/1, 7/1, or 10/1

Other Types of Mortgage Loans: Hybrid ARM 3/1, 5/1, 7/1, or 10/1

Uploaded by

raqibappOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Other Types of Mortgage Loans: Hybrid ARM 3/1, 5/1, 7/1, or 10/1

Other Types of Mortgage Loans: Hybrid ARM 3/1, 5/1, 7/1, or 10/1

Uploaded by

raqibappCopyright:

Available Formats

Other Types of Mortgage Loans

There are many di"erent types of loans. This chart lists some of the more popular types.

These loans o"er a low interest rate and a relatively "xed

Hybrid ARM payment. A 3/1 has a !xed monthly payment for three years and

3/1, 5/1, 7/1, or 10/1 then converts to a traditional adjustable rate mortgage based on

the market.

Adjustable Rate Mortgage with low introductory rates. These

Option ARM loans are essentially extinct after the housing crisis of the late

2000s. Negative amortization may occur with these loans.

With this type of loan, the interest rate changes only once. For

example, with a 7/23 loan, the interest rate changes at the end of 7

Two-Step of 7/23 or years. After 7 years, the borrower must pay the entire loan balance

5/25 (Balloon Reset) in a balloon payment, re!nance to a new loan, or the interest rate

on the existing loan resets, typically higher than the market rate.

A loan designed to help borrowers with a small down payment

avoid PMI. This is really two loans: A !rst trust deed for 80% of the

Piggyback property value and a second trust deed for about 10-15% of the

property value. The borrower must have the remaining 5-10% as a

down payment.

A seller, builder, or buyer can o"er to make a lump-sum payment

Buydown at the beginning of the loan that is used to subsidize the monthly

payments for the !rst couple of years.

This type of loan is designed for the "rst-time homebuyer.

Graduated Payment Monthly payments are smaller in the !rst few years and grow to

(GPM) their full level after three to !ve years.

Home Appreciation

Loan or Shared

Appreciation Mortgage

(HAL/SAM)

Lenders loan a homeowner money with minimal or zero interest.

The lender receives the original amount borrowed when you sell,

re!nance, or pay o" the loan. In addition, the lender receives an

agreed-upon percentage of the homes appreciation. If no

appreciation occurred, the lender will receive no extra money.

Pledged Asset

A mortgage using non-retirement accounts as collateral.

Mortgage

A zero-down loan o!ered to veterans and guaranteed by the VA.

Lenders receive a 2% service fee for processing the loan, so your

VA Loan rate should re$ect that as a discount. Because there is no money

down, rates may still be higher than a conventional loan, so be sure

to consider traditional mortgage options as well.

Generally used to consolidate credit card debt, this loan permits

No-Equity Loan borrowers with good credit to borrow as much as 125% of their

homes value.

2016 Financial Knowledge Network, LLC.

16

You might also like

- Simple Portfolio Optimization That WorksDocument164 pagesSimple Portfolio Optimization That WorksraqibappNo ratings yet

- Loan Type Sheet: Adjustable RateDocument3 pagesLoan Type Sheet: Adjustable RatejawadNo ratings yet

- MORTGAGEDocument9 pagesMORTGAGEbibin100% (1)

- What Is A 'Floating Interest Rate'Document21 pagesWhat Is A 'Floating Interest Rate'iyappaNo ratings yet

- AmortizationDocument22 pagesAmortizationROXANE FLORESNo ratings yet

- Mortgage Interest OnlyDocument17 pagesMortgage Interest Onlyanteras100% (1)

- Mortgage and Amortization (Math of Investment)Document2 pagesMortgage and Amortization (Math of Investment)RCNo ratings yet

- Fixed or Floating Interest Rate Home Loan: The Classic DilemmaDocument3 pagesFixed or Floating Interest Rate Home Loan: The Classic DilemmaAkash MahajanNo ratings yet

- Fixed or Floating Interest Rate Home Loan: The Classic DilemmaDocument3 pagesFixed or Floating Interest Rate Home Loan: The Classic DilemmaAkash MahajanNo ratings yet

- Mortgage FundamentalsDocument14 pagesMortgage FundamentalsMadhuPreethi Nachegari100% (1)

- Marketing of Financial Services AsignmentDocument11 pagesMarketing of Financial Services AsignmentMohit KumarNo ratings yet

- 6 Things To Know Before Taking A Home LoanDocument3 pages6 Things To Know Before Taking A Home LoanDrSivasundaram Anushan SvpnsscNo ratings yet

- Assignment 1 - Ahmed AlqatrawiDocument4 pagesAssignment 1 - Ahmed AlqatrawiBeka JoNo ratings yet

- Mortgage Loan DefinitionDocument65 pagesMortgage Loan DefinitionAnonymous iyQmvDnHnCNo ratings yet

- Mortgage System in USDocument63 pagesMortgage System in USAnkit SinghNo ratings yet

- Buying A HouseDocument35 pagesBuying A HouseDiwakar SHARMA100% (1)

- Asset Management (Mortgages) .1Document5 pagesAsset Management (Mortgages) .1Ken BiiNo ratings yet

- Tridel Condos and TownhousesDocument12 pagesTridel Condos and TownhouseskrishkissoonNo ratings yet

- Reverse MortgageDocument23 pagesReverse MortgageSakshi BansalNo ratings yet

- Housing FinanceDocument4 pagesHousing FinanceKIng KumarNo ratings yet

- (FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Document17 pages(FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Michelle GozonNo ratings yet

- Rem 7-6Document24 pagesRem 7-6Kevin JugaoNo ratings yet

- Why Bank Loans Are Enigma To BorrowersDocument3 pagesWhy Bank Loans Are Enigma To BorrowersMohammad Shahjahan SiddiquiNo ratings yet

- FINA 3780 Chapter 7Document49 pagesFINA 3780 Chapter 7roBinNo ratings yet

- Business MathDocument1 pageBusiness MathSilver SatinNo ratings yet

- Write A Note On Mortgage Market and Types of Mortgages in Pakistan?Document5 pagesWrite A Note On Mortgage Market and Types of Mortgages in Pakistan?Rizma RizwanNo ratings yet

- Applying For Home Loan Reduce Your Property Loan Interest BurdenDocument5 pagesApplying For Home Loan Reduce Your Property Loan Interest BurdenAlisha AntilNo ratings yet

- BondsDocument16 pagesBondsReignNo ratings yet

- Prelim Quiz 23Document2 pagesPrelim Quiz 23Michael Angelo Laguna Dela FuenteNo ratings yet

- Types of LoansDocument9 pagesTypes of LoansSanjay VaruteNo ratings yet

- Loan Terms QUESTIONSDocument13 pagesLoan Terms QUESTIONSPrince EG DltgNo ratings yet

- Interest RateDocument14 pagesInterest RatePriya RishiNo ratings yet

- Project Final AltafDocument60 pagesProject Final AltafVirendra BhavsarNo ratings yet

- Temp 6Document2 pagesTemp 6kev sunNo ratings yet

- What Is Sub Prime Lending?Document4 pagesWhat Is Sub Prime Lending?Priya HairNo ratings yet

- FAC About Loans PDFDocument5 pagesFAC About Loans PDFDenzel BrownNo ratings yet

- Mortgage Markets 2024Document6 pagesMortgage Markets 2024Ronalyn NatividadNo ratings yet

- Understanding Mortgage Exit Fees - v2Document3 pagesUnderstanding Mortgage Exit Fees - v2singhdeep258779No ratings yet

- BIWS Debt PrimerDocument7 pagesBIWS Debt PrimervinaymathewNo ratings yet

- Rakiba Mam AssnDocument9 pagesRakiba Mam AssnFahim IstiakNo ratings yet

- Equity Release United States Loan HUD: LenderDocument5 pagesEquity Release United States Loan HUD: Lender9870050214No ratings yet

- MATH +what Is Investment and LoanDocument11 pagesMATH +what Is Investment and LoanJhoana MaeNo ratings yet

- Tutorial Chapter 4 - NakishaDocument5 pagesTutorial Chapter 4 - NakishanurnakishasyazanaNo ratings yet

- Temp 5Document2 pagesTemp 5kev sunNo ratings yet

- Five-Caps, Floors & Swaptions 8Document8 pagesFive-Caps, Floors & Swaptions 8Akhilesh SinghNo ratings yet

- Explanation in FM ReportDocument4 pagesExplanation in FM Reportcreacion impresionesNo ratings yet

- Teju ProjectDocument20 pagesTeju Projecttmurekar7177No ratings yet

- MortgageDocument6 pagesMortgageMohin ChowdhuryNo ratings yet

- Business LoansDocument25 pagesBusiness LoansMai TiếnNo ratings yet

- Chapter 14 The Mortgage MarketsDocument5 pagesChapter 14 The Mortgage Marketslasha Kachkachishvili100% (1)

- Types of Mortgage and Loan TermsDocument6 pagesTypes of Mortgage and Loan TermsRajah EdwardNo ratings yet

- 8 MortgageDocument9 pages8 Mortgagefitnumanarshadna7No ratings yet

- Mortgages - 2Document2 pagesMortgages - 2Ken BiiNo ratings yet

- Abstract: Reverse Mortgage Is A Relatively New Financial Product Which Allows Senior Citizens To Keep Their House orDocument9 pagesAbstract: Reverse Mortgage Is A Relatively New Financial Product Which Allows Senior Citizens To Keep Their House orArunabh ChoudhuryNo ratings yet

- Chapter 23Document24 pagesChapter 23Abdur RehmanNo ratings yet

- This Line Is Only For CommerceDocument23 pagesThis Line Is Only For CommerceSourav SsinghNo ratings yet

- Interest in A Mortgage InfoDocument2 pagesInterest in A Mortgage InfoAbdur rehmanNo ratings yet

- RBI Cuts Repo Rate, How Much Would You Save On Home Loan?Document5 pagesRBI Cuts Repo Rate, How Much Would You Save On Home Loan?Dynamic LevelsNo ratings yet

- Asset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged)Document1 pageAsset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged)raqibappNo ratings yet

- Asset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 3Document1 pageAsset-V1 - NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 - 03 - Why - Technical - Analysis - Works (Dragged) 3raqibappNo ratings yet

- Asset-V1 NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 01 IntroductionDocument16 pagesAsset-V1 NYIF+ITA - PC1x+2T2020+type@asset+block@Mod1 01 IntroductionraqibappNo ratings yet

- Hek PDFDocument1 pageHek PDFraqibappNo ratings yet

- A Novel Hybrid Quicksort Algorithm Vectorized Using AVX-512 On Intel Skylake - 2017 (Paper - 44-A - Novel - Hybrid - Quicksort - Algorithm - Vectorized)Document9 pagesA Novel Hybrid Quicksort Algorithm Vectorized Using AVX-512 On Intel Skylake - 2017 (Paper - 44-A - Novel - Hybrid - Quicksort - Algorithm - Vectorized)raqibappNo ratings yet

- A Little Journey Inside Windows Memory (Dragged) 6Document1 pageA Little Journey Inside Windows Memory (Dragged) 6raqibappNo ratings yet

- A Compilation Target For Probabilistic Programming Languages - 2014 (Paige14) (Dragged)Document1 pageA Compilation Target For Probabilistic Programming Languages - 2014 (Paige14) (Dragged)raqibappNo ratings yet

- Introducing OpenAIDocument3 pagesIntroducing OpenAIraqibappNo ratings yet

- Linear Algebra and Its Application.123 PDFDocument1 pageLinear Algebra and Its Application.123 PDFraqibappNo ratings yet

- 02 Basic Text ProcessingDocument23 pages02 Basic Text ProcessingraqibappNo ratings yet

- Linear Algebra and Its Application.130 PDFDocument1 pageLinear Algebra and Its Application.130 PDFraqibappNo ratings yet

- Linear Algebra and Its Application.124 PDFDocument1 pageLinear Algebra and Its Application.124 PDFraqibappNo ratings yet

- Linear Algebra and Its Application.116 PDFDocument1 pageLinear Algebra and Its Application.116 PDFraqibappNo ratings yet

- Linear Algebra and Its Application.122 PDFDocument1 pageLinear Algebra and Its Application.122 PDFraqibappNo ratings yet