Professional Documents

Culture Documents

Application For IRS Individual Taxpayer Identification Number

Application For IRS Individual Taxpayer Identification Number

Uploaded by

rkumbacCopyright:

Available Formats

You might also like

- I10 FormDocument1 pageI10 Formleomal320% (1)

- Tokyo: Travel GuideDocument88 pagesTokyo: Travel GuideBaleanu Andrei RazvanNo ratings yet

- LOI Marine SandDocument1 pageLOI Marine SandRajan Uthirapathy60% (5)

- Form W-8BEN Rev 920Document2 pagesForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- Medicaid ApplicationDocument27 pagesMedicaid ApplicationIndiana Family to Family100% (2)

- W9 FormDocument1 pageW9 FormChris GreeneNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- IRS Form W-9Document8 pagesIRS Form W-9SAHASec8No ratings yet

- Competition Act 2002Document12 pagesCompetition Act 2002Amit MishraNo ratings yet

- Unilever RFQDocument42 pagesUnilever RFQSingh AyishaNo ratings yet

- Supplier AddressesDocument475 pagesSupplier AddressesSandeep Kl K92% (12)

- FW 7Document1 pageFW 7klumer_xNo ratings yet

- WWW - Irs.gov Pub Irs-PDF Fw7Document1 pageWWW - Irs.gov Pub Irs-PDF Fw7desikudi9000No ratings yet

- W-7 FormDocument1 pageW-7 FormRaviLifewideNo ratings yet

- Form WDocument8 pagesForm Wcvd8107No ratings yet

- fw7 PDFDocument1 pagefw7 PDFRichard HughesNo ratings yet

- Application For IRS Individual Taxpayer Identification NumberDocument1 pageApplication For IRS Individual Taxpayer Identification NumberRavan SharmaNo ratings yet

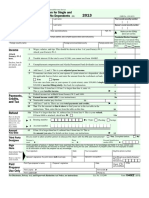

- Income Tax Return For Single and Joint Filers With No DependentsDocument2 pagesIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNo ratings yet

- Preview W8 W9 PDFDocument1 pagePreview W8 W9 PDFEugene ChoiNo ratings yet

- IRS fw7Document8 pagesIRS fw7Victor IkeNo ratings yet

- F1040ez PDFDocument2 pagesF1040ez PDFjc75aNo ratings yet

- W9Document1 pageW9chris2077No ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- ECWANDC Funding - Vendor W9 FormDocument1 pageECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilNo ratings yet

- F1040ez 2008Document2 pagesF1040ez 2008jonathandeauxNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationJude Thomas SmithNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationjntecnologiaNo ratings yet

- W 8ben TdaDocument1 pageW 8ben TdaAnamaria Suciu100% (1)

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationGreat Northern Insurance AgencyNo ratings yet

- Vendor Onboard PackageDocument6 pagesVendor Onboard PackageNick BlanchetteNo ratings yet

- I-730, Refugee/Asylee Relative Petition: Do Not Write in This Block - For Uscis Office OnlyDocument4 pagesI-730, Refugee/Asylee Relative Petition: Do Not Write in This Block - For Uscis Office Onlycarmenperez084No ratings yet

- I-129 NEW PDF WRITE OVER PDFDocument36 pagesI-129 NEW PDF WRITE OVER PDFAnonymous FkTNBO3K6RNo ratings yet

- Phisher's W8-BEN FormDocument2 pagesPhisher's W8-BEN FormJames BallNo ratings yet

- 1040 NR EzDocument2 pages1040 NR EzElena Alexandra CărăvanNo ratings yet

- Ssa 7050Document4 pagesSsa 7050tobehode100% (1)

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormJennifer LeetNo ratings yet

- Perdon de Pago I-912Document11 pagesPerdon de Pago I-912ChrisNo ratings yet

- W-8BEN Form - Frequently Asked QuestionsDocument2 pagesW-8BEN Form - Frequently Asked QuestionsAnkit ChhabraNo ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJeffery OsbunNo ratings yet

- Tax Information IntervieDocument2 pagesTax Information Intervieambet TayloNo ratings yet

- Form W9Document4 pagesForm W9Mary MilaniNo ratings yet

- F 8233Document2 pagesF 8233محمدجوزيايNo ratings yet

- Form W-8BEN R713072 01-06-2022Document2 pagesForm W-8BEN R713072 01-06-2022hasangundkalliNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDocument4 pagesCertificate of Foreign Status of Beneficial Owner For United States Tax WithholdingYudia0% (1)

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No Dependentspixel986No ratings yet

- Withholding Certificate For Pension or Annuity Payments: General InstructionsDocument6 pagesWithholding Certificate For Pension or Annuity Payments: General InstructionsАндрей КрайниковNo ratings yet

- Amazon Tax Information InterviewDocument2 pagesAmazon Tax Information Interviewasad nNo ratings yet

- FW 8 BenDocument1 pageFW 8 BenMashiel AlifNo ratings yet

- Instructions For Form W-7 (11 - 2023) - Internal Revenue ServiceDocument42 pagesInstructions For Form W-7 (11 - 2023) - Internal Revenue ServiceJurist PeaceNo ratings yet

- AlaAL ZAALIG2011Document5 pagesAlaAL ZAALIG2011Ala AlzaaligNo ratings yet

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- Sponsorship: Who's Eligible & How to ApplyFrom EverandSponsorship: Who's Eligible & How to ApplyNo ratings yet

- Work Permit: Types of Work Permits & Work Permit ExemptionsFrom EverandWork Permit: Types of Work Permits & Work Permit ExemptionsNo ratings yet

- Bank Statement 01 10 2022 21 10 2023 72508Document23 pagesBank Statement 01 10 2022 21 10 2023 72508ruaabkhan786No ratings yet

- Creating Continuous Flow and Making Material FlowDocument27 pagesCreating Continuous Flow and Making Material FlowManthan BhosleNo ratings yet

- Subros Limited Annual - Report 2012-13Document115 pagesSubros Limited Annual - Report 2012-13Selvaraji MuthuNo ratings yet

- Global Economy CWDocument22 pagesGlobal Economy CWCarol Jane VillanoboNo ratings yet

- What Is Economics About? Part OneDocument14 pagesWhat Is Economics About? Part Onesaqib razaNo ratings yet

- Keshmen Project ListDocument10 pagesKeshmen Project ListKevin LowNo ratings yet

- LearnersDocument4 pagesLearnersGerschwinNo ratings yet

- Diminishing Marginal Utility: Can You Get Too Much of Something?Document24 pagesDiminishing Marginal Utility: Can You Get Too Much of Something?Naeem HaiderNo ratings yet

- Renewable and Sustainable Energy Reviews: Thomas Poulsen, Rasmus LemaDocument14 pagesRenewable and Sustainable Energy Reviews: Thomas Poulsen, Rasmus LemaRosHan AwanNo ratings yet

- Elaine Fiona R. Villafuerte March 3. 2021 BSMA-2 Mrs. Ma. Carol Tubog Assignment #4: Philippine Development Plan 2017-2022 Reaction PaperDocument3 pagesElaine Fiona R. Villafuerte March 3. 2021 BSMA-2 Mrs. Ma. Carol Tubog Assignment #4: Philippine Development Plan 2017-2022 Reaction PaperElaine Fiona Villafuerte0% (1)

- Application of The Technology Life Cycle and S-Curves To The "Brain Drain" Area of KnowledgeDocument8 pagesApplication of The Technology Life Cycle and S-Curves To The "Brain Drain" Area of KnowledgeNikko SalomonNo ratings yet

- Fabozzi Handbook Fixed Income 7th EditionDocument2 pagesFabozzi Handbook Fixed Income 7th EditionBhagyeshGhagiNo ratings yet

- Ce Casecnan Vs CirDocument3 pagesCe Casecnan Vs CirJulioNo ratings yet

- The Political Environment: A Critical ConcernDocument42 pagesThe Political Environment: A Critical ConcernabraamNo ratings yet

- Eco2003f Supp Exam 2013Document19 pagesEco2003f Supp Exam 2013SiphoNo ratings yet

- CP16Document16 pagesCP16aneeshtaNo ratings yet

- The Money Boss Method: Savings, You've Achieved Financial Independence. If The Product Is Greater Than YourDocument1 pageThe Money Boss Method: Savings, You've Achieved Financial Independence. If The Product Is Greater Than YourEsmeralda HerreraNo ratings yet

- Rethinking MetropolitanDocument19 pagesRethinking MetropolitanViệt Dũng NgôNo ratings yet

- f8 2017 Sepdec Q PDFDocument4 pagesf8 2017 Sepdec Q PDFSameer Kumar MisraNo ratings yet

- Module - 1 EntrepreneurDocument19 pagesModule - 1 EntrepreneurRaghavendra SubbannaNo ratings yet

- Gold StandardDocument13 pagesGold Standardjyoti joonNo ratings yet

- Apv PDFDocument9 pagesApv PDFAnkit ThakurNo ratings yet

- Report of Receipts and Disbursements: FEC Form 3Document371 pagesReport of Receipts and Disbursements: FEC Form 3Daniel StraussNo ratings yet

- Reliance Pays Rs 50cr TaxDocument4 pagesReliance Pays Rs 50cr Taxug121No ratings yet

- Harmonized System Code PDFDocument20 pagesHarmonized System Code PDFRiza MaeNo ratings yet

Application For IRS Individual Taxpayer Identification Number

Application For IRS Individual Taxpayer Identification Number

Uploaded by

rkumbacOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application For IRS Individual Taxpayer Identification Number

Application For IRS Individual Taxpayer Identification Number

Uploaded by

rkumbacCopyright:

Available Formats

Form

W-7

Application for IRS Individual

Taxpayer Identification Number

(Rev. January 2012)

Department of the Treasury

Internal Revenue Service

OMB No. 1545-0074

For use by individuals who are not U.S. citizens or permanent residents.

See instructions.

FOR IRS USE ONLY

An IRS individual taxpayer identification number (ITIN) is for federal tax purposes only.

Before you begin:

Do not submit this form if you have, or are eligible to get, a U.S. social security number (SSN).

Getting an ITIN does not change your immigration status or your right to work in the United States

and does not make you eligible for the earned income credit.

Reason you are submitting Form W-7. Read the instructions for the box you check. Caution: If you check box b, c, d,

e, f, or g, you must file a tax return with Form W-7 unless you meet one of the exceptions (see instructions).

a

b

c

Nonresident alien required to get ITIN to claim tax treaty benefit

Nonresident alien filing a U.S. tax return

U.S. resident alien (based on days present in the United States) filing a U.S. tax return

Dependent of U.S. citizen/resident alien

Enter name and SSN/ITIN of U.S. citizen/resident alien (see instructions)

Spouse of U.S. citizen/resident alien

d

e

f

g

h

Name

Nonresident alien student, professor, or researcher filing a U.S. tax return or claiming an exception

Dependent/spouse of a nonresident alien holding a U.S. visa

Other (see instructions)

Additional information for a and f: Enter treaty country

and treaty article number

1a First name

Middle name

Last name

GUNAVATHI

1b First name

(see instructions)

Name at birth if

different . .

VAITHIAM POTTI MOHAN

Last name

Middle name

Street address, apartment number, or rural route number. If you have a P.O. box, see separate instructions.

Applicants

1800 GRAND AVE, APT #96

mailing address

City or town, state or province, and country. Include ZIP code or postal code where appropriate.

Foreign (nonU.S.) address

WEST DES MOINES, IA 50265

3 Street address, apartment number, or rural route number. Do not use a P.O. box number.

(if different from

above)

(see instructions)

Birth

information

Other

information

City or town, state or province, and country. Include ZIP code or postal code where appropriate.

4

Date of birth (month / day / year)

03/18/1988

6a Country(ies) of citizenship

City and state or province (optional)

Country of birth

INDIA

6b Foreign tax I.D. number (if any)

INDIA

6d Identification document(s) submitted (see instructions)

USCIS documentation

Other

Male

Female

6c Type of U.S. visa (if any), number, and expiration date

H4, WAC1102950680, 11-DEC-2013

Passport

Drivers license/State I.D.

Date of entry into the

United States

Issued by: INDIA

No.:

Exp. date: 0 4 / 1 8 /2 0 2 2 (MM/DD/YYYY)

K3479046

0 9 /0 3 / 2 0 1 2

6e Have you previously received a U.S. temporary taxpayer identification number (TIN) or employer identification number (EIN)?

No/Do not know. Skip line 6f.

Yes. Complete line 6f. If more than one, list on a sheet and attach to this form (see instructions).

6f Enter: TIN or EIN

Name under which it was issued

6g Name of college/university or company (see instructions)

City and state

Sign

Here

Signature of applicant (if delegate, see instructions)

Date (month / day / year)

Phone number

Name of delegate, if applicable (type or print)

/

/

Delegates relationship

to applicant

Signature

Date (month / day / year)

614-260-9071

Parent

Court-appointed guardian

Power of Attorney

Phone

Name and title (type or print)

/

/

Name of company

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 10229L

Acceptance

Agents

Use ONLY

Length of stay

Under penalties of perjury, I (applicant/delegate/acceptance agent) declare that I have examined this application, including accompanying

documentation and statements, and to the best of my knowledge and belief, it is true, correct, and complete. I authorize the IRS to disclose to my

acceptance agent returns or return information necessary to resolve matters regarding the assignment of my IRS individual taxpayer identification

number (ITIN), including any previously assigned taxpayer identifying number.

Keep a copy for

your records.

and

Fax

EIN

Office Code

Form W-7 (Rev. 1-2012)

You might also like

- I10 FormDocument1 pageI10 Formleomal320% (1)

- Tokyo: Travel GuideDocument88 pagesTokyo: Travel GuideBaleanu Andrei RazvanNo ratings yet

- LOI Marine SandDocument1 pageLOI Marine SandRajan Uthirapathy60% (5)

- Form W-8BEN Rev 920Document2 pagesForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- Medicaid ApplicationDocument27 pagesMedicaid ApplicationIndiana Family to Family100% (2)

- W9 FormDocument1 pageW9 FormChris GreeneNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- IRS Form W-9Document8 pagesIRS Form W-9SAHASec8No ratings yet

- Competition Act 2002Document12 pagesCompetition Act 2002Amit MishraNo ratings yet

- Unilever RFQDocument42 pagesUnilever RFQSingh AyishaNo ratings yet

- Supplier AddressesDocument475 pagesSupplier AddressesSandeep Kl K92% (12)

- FW 7Document1 pageFW 7klumer_xNo ratings yet

- WWW - Irs.gov Pub Irs-PDF Fw7Document1 pageWWW - Irs.gov Pub Irs-PDF Fw7desikudi9000No ratings yet

- W-7 FormDocument1 pageW-7 FormRaviLifewideNo ratings yet

- Form WDocument8 pagesForm Wcvd8107No ratings yet

- fw7 PDFDocument1 pagefw7 PDFRichard HughesNo ratings yet

- Application For IRS Individual Taxpayer Identification NumberDocument1 pageApplication For IRS Individual Taxpayer Identification NumberRavan SharmaNo ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument2 pagesIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNo ratings yet

- Preview W8 W9 PDFDocument1 pagePreview W8 W9 PDFEugene ChoiNo ratings yet

- IRS fw7Document8 pagesIRS fw7Victor IkeNo ratings yet

- F1040ez PDFDocument2 pagesF1040ez PDFjc75aNo ratings yet

- W9Document1 pageW9chris2077No ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- ECWANDC Funding - Vendor W9 FormDocument1 pageECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilNo ratings yet

- F1040ez 2008Document2 pagesF1040ez 2008jonathandeauxNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationJude Thomas SmithNo ratings yet

- FW 9Document1 pageFW 9Alfredo NavaNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationjntecnologiaNo ratings yet

- W 8ben TdaDocument1 pageW 8ben TdaAnamaria Suciu100% (1)

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationGreat Northern Insurance AgencyNo ratings yet

- Vendor Onboard PackageDocument6 pagesVendor Onboard PackageNick BlanchetteNo ratings yet

- I-730, Refugee/Asylee Relative Petition: Do Not Write in This Block - For Uscis Office OnlyDocument4 pagesI-730, Refugee/Asylee Relative Petition: Do Not Write in This Block - For Uscis Office Onlycarmenperez084No ratings yet

- I-129 NEW PDF WRITE OVER PDFDocument36 pagesI-129 NEW PDF WRITE OVER PDFAnonymous FkTNBO3K6RNo ratings yet

- Phisher's W8-BEN FormDocument2 pagesPhisher's W8-BEN FormJames BallNo ratings yet

- 1040 NR EzDocument2 pages1040 NR EzElena Alexandra CărăvanNo ratings yet

- Ssa 7050Document4 pagesSsa 7050tobehode100% (1)

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormJennifer LeetNo ratings yet

- Perdon de Pago I-912Document11 pagesPerdon de Pago I-912ChrisNo ratings yet

- W-8BEN Form - Frequently Asked QuestionsDocument2 pagesW-8BEN Form - Frequently Asked QuestionsAnkit ChhabraNo ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJeffery OsbunNo ratings yet

- Tax Information IntervieDocument2 pagesTax Information Intervieambet TayloNo ratings yet

- Form W9Document4 pagesForm W9Mary MilaniNo ratings yet

- F 8233Document2 pagesF 8233محمدجوزيايNo ratings yet

- Form W-8BEN R713072 01-06-2022Document2 pagesForm W-8BEN R713072 01-06-2022hasangundkalliNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDocument4 pagesCertificate of Foreign Status of Beneficial Owner For United States Tax WithholdingYudia0% (1)

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No Dependentspixel986No ratings yet

- Withholding Certificate For Pension or Annuity Payments: General InstructionsDocument6 pagesWithholding Certificate For Pension or Annuity Payments: General InstructionsАндрей КрайниковNo ratings yet

- Amazon Tax Information InterviewDocument2 pagesAmazon Tax Information Interviewasad nNo ratings yet

- FW 8 BenDocument1 pageFW 8 BenMashiel AlifNo ratings yet

- Instructions For Form W-7 (11 - 2023) - Internal Revenue ServiceDocument42 pagesInstructions For Form W-7 (11 - 2023) - Internal Revenue ServiceJurist PeaceNo ratings yet

- AlaAL ZAALIG2011Document5 pagesAlaAL ZAALIG2011Ala AlzaaligNo ratings yet

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- Sponsorship: Who's Eligible & How to ApplyFrom EverandSponsorship: Who's Eligible & How to ApplyNo ratings yet

- Work Permit: Types of Work Permits & Work Permit ExemptionsFrom EverandWork Permit: Types of Work Permits & Work Permit ExemptionsNo ratings yet

- Bank Statement 01 10 2022 21 10 2023 72508Document23 pagesBank Statement 01 10 2022 21 10 2023 72508ruaabkhan786No ratings yet

- Creating Continuous Flow and Making Material FlowDocument27 pagesCreating Continuous Flow and Making Material FlowManthan BhosleNo ratings yet

- Subros Limited Annual - Report 2012-13Document115 pagesSubros Limited Annual - Report 2012-13Selvaraji MuthuNo ratings yet

- Global Economy CWDocument22 pagesGlobal Economy CWCarol Jane VillanoboNo ratings yet

- What Is Economics About? Part OneDocument14 pagesWhat Is Economics About? Part Onesaqib razaNo ratings yet

- Keshmen Project ListDocument10 pagesKeshmen Project ListKevin LowNo ratings yet

- LearnersDocument4 pagesLearnersGerschwinNo ratings yet

- Diminishing Marginal Utility: Can You Get Too Much of Something?Document24 pagesDiminishing Marginal Utility: Can You Get Too Much of Something?Naeem HaiderNo ratings yet

- Renewable and Sustainable Energy Reviews: Thomas Poulsen, Rasmus LemaDocument14 pagesRenewable and Sustainable Energy Reviews: Thomas Poulsen, Rasmus LemaRosHan AwanNo ratings yet

- Elaine Fiona R. Villafuerte March 3. 2021 BSMA-2 Mrs. Ma. Carol Tubog Assignment #4: Philippine Development Plan 2017-2022 Reaction PaperDocument3 pagesElaine Fiona R. Villafuerte March 3. 2021 BSMA-2 Mrs. Ma. Carol Tubog Assignment #4: Philippine Development Plan 2017-2022 Reaction PaperElaine Fiona Villafuerte0% (1)

- Application of The Technology Life Cycle and S-Curves To The "Brain Drain" Area of KnowledgeDocument8 pagesApplication of The Technology Life Cycle and S-Curves To The "Brain Drain" Area of KnowledgeNikko SalomonNo ratings yet

- Fabozzi Handbook Fixed Income 7th EditionDocument2 pagesFabozzi Handbook Fixed Income 7th EditionBhagyeshGhagiNo ratings yet

- Ce Casecnan Vs CirDocument3 pagesCe Casecnan Vs CirJulioNo ratings yet

- The Political Environment: A Critical ConcernDocument42 pagesThe Political Environment: A Critical ConcernabraamNo ratings yet

- Eco2003f Supp Exam 2013Document19 pagesEco2003f Supp Exam 2013SiphoNo ratings yet

- CP16Document16 pagesCP16aneeshtaNo ratings yet

- The Money Boss Method: Savings, You've Achieved Financial Independence. If The Product Is Greater Than YourDocument1 pageThe Money Boss Method: Savings, You've Achieved Financial Independence. If The Product Is Greater Than YourEsmeralda HerreraNo ratings yet

- Rethinking MetropolitanDocument19 pagesRethinking MetropolitanViệt Dũng NgôNo ratings yet

- f8 2017 Sepdec Q PDFDocument4 pagesf8 2017 Sepdec Q PDFSameer Kumar MisraNo ratings yet

- Module - 1 EntrepreneurDocument19 pagesModule - 1 EntrepreneurRaghavendra SubbannaNo ratings yet

- Gold StandardDocument13 pagesGold Standardjyoti joonNo ratings yet

- Apv PDFDocument9 pagesApv PDFAnkit ThakurNo ratings yet

- Report of Receipts and Disbursements: FEC Form 3Document371 pagesReport of Receipts and Disbursements: FEC Form 3Daniel StraussNo ratings yet

- Reliance Pays Rs 50cr TaxDocument4 pagesReliance Pays Rs 50cr Taxug121No ratings yet

- Harmonized System Code PDFDocument20 pagesHarmonized System Code PDFRiza MaeNo ratings yet