Professional Documents

Culture Documents

List of Table Title Page No. Executive Summary

List of Table Title Page No. Executive Summary

Uploaded by

Ami KallalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

List of Table Title Page No. Executive Summary

List of Table Title Page No. Executive Summary

Uploaded by

Ami KallalCopyright:

Available Formats

Credit Risk Management in Banks

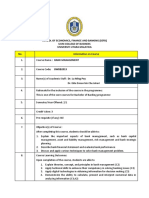

List of Table

Title

Executive Summary

Chapter: 1

1.1: Introduction

1.2 : Objectives of the study

1.3: Methodology of the study

1.4: Sources of data

1.5: Secondary Data:

1.6: Data analysis

Chapter: 2

2.1: Credit Risk Management:

2.2: What is credit?

2.3: What is credit risk?

2.4: What is credit risk management?

2.4.1: Identification

2.4.2: Measurement

2.4.3: Calculation of Credit risk

2.4.4: Aggregation

2.4.5: Planning and management

2.4.6: Monitoring

2.5: PRISM Model of credit risk management

2.6: Why manage credit risk?

Chapter : 3

3.01: Credit Risk Management Process

3.02: Credit Processing/Appraisal

3.03: Credit Assessment & Risk Grading

3.04: Credit Documentation

3.05: Credit Administration

3.05: Disbursement

3.06: Monitoring and Control of Individual Credits

3.07: Monitoring the Overall Credit Portfolio (Stress Testing)

3.08: Classification of credit

3.09: Managing Problem Credits/Recovery

Chapter 04:

4.01: Findings

4.02: Recommendations

Chapter 5: Conclusion

Bibliography

Page No.

1

2

2

2

2

2

2

3

3

3

3

3

3

4

4

4

4

5

5

5

6

6

6

6

8

14

16

17

18

19

19

20

20

20

21

22

23

You might also like

- Implementing Enterprise Risk Management: From Methods to ApplicationsFrom EverandImplementing Enterprise Risk Management: From Methods to ApplicationsNo ratings yet

- FRM Part 2 TopicsDocument4 pagesFRM Part 2 Topicschan6No ratings yet

- Hitt Chapter 1Document21 pagesHitt Chapter 1Ami KallalNo ratings yet

- Credit Risk AssessmentDocument115 pagesCredit Risk AssessmentMehra Riya100% (4)

- T A BLE O F C O N TE N T: No. Particular Page NoDocument2 pagesT A BLE O F C O N TE N T: No. Particular Page NoMohammad Salahuddin MahmudNo ratings yet

- Project Proposal of MeDocument3 pagesProject Proposal of MeTahsin MonabilNo ratings yet

- Karaviti Msc2009Document68 pagesKaraviti Msc2009Inza NsaNo ratings yet

- Risk Management IndexDocument2 pagesRisk Management Indexdevendramanoj07No ratings yet

- My Thesis Book Finally 111Document48 pagesMy Thesis Book Finally 111asiikahin4No ratings yet

- Analysis of Credit Risk Management of Al-Arafah Islami BankDocument46 pagesAnalysis of Credit Risk Management of Al-Arafah Islami BankFahimNo ratings yet

- Chapter One: Introduction : Table of Content Acknowledgement AbbreviationDocument2 pagesChapter One: Introduction : Table of Content Acknowledgement Abbreviationraazoo19No ratings yet

- Ken Sing Ton FileDocument43 pagesKen Sing Ton FilemaliashokukNo ratings yet

- Skripsi - Critical Success Factors For Effective Risk Management Procedures in Financial IndustriesDocument83 pagesSkripsi - Critical Success Factors For Effective Risk Management Procedures in Financial IndustriesSAID MUHAMAD ALFARUQNo ratings yet

- AMCT Syllabus: Certificate in Financial Fundamentals For BusinessDocument2 pagesAMCT Syllabus: Certificate in Financial Fundamentals For BusinessSd HussainNo ratings yet

- Risk Management of CBDDocument47 pagesRisk Management of CBDM Zubair SyedNo ratings yet

- Thesis Paper On Credit Operations of Mercantile Bank LimitedDocument11 pagesThesis Paper On Credit Operations of Mercantile Bank LimitedSharifMahmudNo ratings yet

- 0 BZ C5 NQ Luwu IBa Et ZZXItb Wts RK EDocument15 pages0 BZ C5 NQ Luwu IBa Et ZZXItb Wts RK Eyohannes johnNo ratings yet

- Syllabus Credit ManagementDocument2 pagesSyllabus Credit ManagementMd Salah UddinNo ratings yet

- CMDocument6 pagesCMRoman AhmadNo ratings yet

- Laxmi Priya - Credit ManagementDocument39 pagesLaxmi Priya - Credit Managementmoongem infocityNo ratings yet

- Sujal Project BlackbookDocument44 pagesSujal Project Blackbooksujal1utekarNo ratings yet

- Guidelines On Credit Risk ManagementDocument99 pagesGuidelines On Credit Risk ManagementVallabh Utpat100% (1)

- A212 Syllabus BWBB2013Document6 pagesA212 Syllabus BWBB2013Hs HamdanNo ratings yet

- RiskManagementExaminationManaul 03 Credit Risk (PDF Library)Document100 pagesRiskManagementExaminationManaul 03 Credit Risk (PDF Library)utpalduttaicbmNo ratings yet

- Library Organization and Management - With Laws, Related Practices, and Trends - 20%Document18 pagesLibrary Organization and Management - With Laws, Related Practices, and Trends - 20%FhcRojo0% (1)

- Letter of TransmittalDocument8 pagesLetter of Transmittalmd.jewel ranaNo ratings yet

- Sujal Project BlackbookDocument41 pagesSujal Project Blackbooksujal1utekarNo ratings yet

- Credit Risk Management in Banks Project Report PDFDocument71 pagesCredit Risk Management in Banks Project Report PDFYashNo ratings yet

- Credit Risk Management Course TasterDocument58 pagesCredit Risk Management Course Tasterapurva0jainNo ratings yet

- Evaluation of Credit Risk Management andDocument66 pagesEvaluation of Credit Risk Management andlami gesherboNo ratings yet

- Khaled 11Document50 pagesKhaled 11Urmi MahabubNo ratings yet

- A Study On Credit Risk Management and PeDocument30 pagesA Study On Credit Risk Management and PeChaouki ChaoukiNo ratings yet

- L12 - Group 5 - QTNHTM - ReportDocument41 pagesL12 - Group 5 - QTNHTM - ReportPhạm Minh TàiNo ratings yet

- Credit Risk Management: A Study On: Premier Bank LTDDocument11 pagesCredit Risk Management: A Study On: Premier Bank LTDsabujNo ratings yet

- It Risk Management: Case StudyDocument72 pagesIt Risk Management: Case StudyAnisa FitriahNo ratings yet

- A Senior Essay Submitted To The Department of in The Partial Fulfillment of The Requirement For The Degree of Bachelor of Art (B.A) OFDocument48 pagesA Senior Essay Submitted To The Department of in The Partial Fulfillment of The Requirement For The Degree of Bachelor of Art (B.A) OFmubarek oumerNo ratings yet

- Yalemzewd TadesseDocument75 pagesYalemzewd TadesseMisganaw YeshiwasNo ratings yet

- CJR Forensik Kel 7Document18 pagesCJR Forensik Kel 7Maharani SinuratNo ratings yet

- Synopsis On Credit Reist Analysis-1Document6 pagesSynopsis On Credit Reist Analysis-1Nehal DarvadeNo ratings yet

- Misba JihadDocument40 pagesMisba JihadBirukNo ratings yet

- Credit Risk ManagementDocument56 pagesCredit Risk ManagementMazen AlbsharaNo ratings yet

- Syllabus Aug 2022 NHTM 2Document10 pagesSyllabus Aug 2022 NHTM 2Dương Thuỳ TrangNo ratings yet

- Rift Valley University Chiro CompusDocument6 pagesRift Valley University Chiro CompusBobasa S AhmedNo ratings yet

- Delinquency Management Topics Group 1Document3 pagesDelinquency Management Topics Group 1Rote MirandaNo ratings yet

- Tesis de Inglaterra PDFDocument357 pagesTesis de Inglaterra PDFVladimir TiconaNo ratings yet

- BMA Final Report Tut 3 Group FMTDocument42 pagesBMA Final Report Tut 3 Group FMThoanganhtrinh0809No ratings yet

- Acknowledgement Certificate Chapter 1: Introduction Page NoDocument3 pagesAcknowledgement Certificate Chapter 1: Introduction Page NoAbhishek_Singh_4789No ratings yet

- Table of ContentDocument1 pageTable of Contentsafi41No ratings yet

- UntitledDocument2 pagesUntitledBrian JerryNo ratings yet

- Particulars Numbe R: Janata Bank LTD: at A GalanceDocument52 pagesParticulars Numbe R: Janata Bank LTD: at A GalanceTareq AlamNo ratings yet

- Mba 13302155Document52 pagesMba 13302155Ekramul HaqueNo ratings yet

- Attachment 1Document14 pagesAttachment 1Talha TahirNo ratings yet

- ECON3073Document3 pagesECON3073kabraham207No ratings yet

- How Can A Medium-Sized Bank Develop Its Own Asset/Liability Risk Management System?Document55 pagesHow Can A Medium-Sized Bank Develop Its Own Asset/Liability Risk Management System?andymcnabNo ratings yet

- Syllabus Jan 2020-NHTM 2Document10 pagesSyllabus Jan 2020-NHTM 2Đặng Phước LộcNo ratings yet

- Risk ManagementDocument220 pagesRisk Managementnaved katuaNo ratings yet

- Internship Report Credit Management in Janata BankDocument53 pagesInternship Report Credit Management in Janata BankKuasha Nirob81% (21)

- BD Report RISK MANGEMENT IN PUBLIC AND PRIVATE BANKDocument81 pagesBD Report RISK MANGEMENT IN PUBLIC AND PRIVATE BANKJitender SinghNo ratings yet

- Assessment Toolkit 2017Document39 pagesAssessment Toolkit 2017Moussa Ag Mohamed AlyNo ratings yet

- Project Risk Management - Course Assignment 2023Document3 pagesProject Risk Management - Course Assignment 2023zelalemNo ratings yet

- DBBLDocument21 pagesDBBLAmi KallalNo ratings yet

- Hill and Jones Chapter 3Document25 pagesHill and Jones Chapter 3Ami Kallal100% (1)

- Functional Level Strategy Hill and JonesDocument34 pagesFunctional Level Strategy Hill and JonesAmi KallalNo ratings yet

- Library ManagementDocument13 pagesLibrary ManagementAmi KallalNo ratings yet

- Hitt Chapter 2Document18 pagesHitt Chapter 2Ami KallalNo ratings yet

- Library Orientation & Awareness/Training Programme For Science Direct & KNIMBUSDocument1 pageLibrary Orientation & Awareness/Training Programme For Science Direct & KNIMBUSAmi KallalNo ratings yet

- Use and Applications of Library SoftwareDocument85 pagesUse and Applications of Library SoftwareAmi KallalNo ratings yet

- BCS BangladeshDocument1 pageBCS BangladeshAmi KallalNo ratings yet