Professional Documents

Culture Documents

4125test - Macroeconomics CH 1 and 2

4125test - Macroeconomics CH 1 and 2

Uploaded by

Neeraj TyagiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4125test - Macroeconomics CH 1 and 2

4125test - Macroeconomics CH 1 and 2

Uploaded by

Neeraj TyagiCopyright:

Available Formats

http://www.cbseguess.

com/

NATIONAL INCOME AND RELATED

AGGREGATES

M.M.-:40

Q 1.

Q 2.

Q 3.

Q 4.

Q 5.

Q 6.

Q 7.

Q 8.

Q 9.

Q 10.

Q 11.

Q 12.

Q 13.

Q 14.

TEST

Time-: 90 min.

In which situation GDPMP = GNPMP ? (1)

Define positive externalities with one example? (1)

Name the income in which interest on national debt included. (1)

Interest paid on loan taken by a household consumer is treated as a factor

payment or not? Give reason. (1)

What is the basic difference between private income and personal income? (1)

Define GNDI. (1)

When will NDPFC exceed NNPFC? (1)

Give two examples of unexpected obsolescence. (1)

Why government current transfers are not included in the calculation of GNDI?

(1)

Define contraction in circular flow of income. (1)

Write differences between Real GDP and Nominal GDP. (3)

Write the difference between National Income and Private Income. (3)

Explain why, due to the presence of externalities, real GDP in itself cannot be

treated as a true index of welfare. (4)

Distinguish between intermediate products and final products. Give reasons. (4)

i.

Purchase of Equipments for installation in a factory.

ii.

Purchase of food items by a hotel.

iii.

Purchase of car by a taxi driver.

iv. Purchase of a truck to carry goods by a production units.

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com |

www.niosguess.com | www.iitguess.com

http://www.cbseguess.com/

Q 15

State whether the following is a stock or a flow. Give reasons. (4)

www.cbseguess.com

Other Educational Portals

www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com |

www.niosguess.com | www.iitguess.com

Prepared By: - HARDEEP SINGH

9560941818

Q 16.

Q 17.

i.

ii.

Wealth

Cement production

iii.

iv.

Change in nations money supply

Investment

Will the following be included or not in the domestic income of India? Give

reasons for your answer. (6)

i.

Wages paid to the non-resident Indian working in an Indian company in

Singapore.

ii.

Salaries of non-residents working in Indian embassies.

iii.

Profits earned by a company in India owned by the non-residents.

iv. Profits earned by a branch of State Bank of India in England.

v. Scholarships given by Government of India.

vi.

Interest received by an Indian from banks.

Will the following be included in the national income of India? Give reasons for

your answers. (6)

i.

Purchase of a new shares of a domestic firm.

ii.

Furniture purchased by households.

iii.

Transport expenses by a firm.

iv. Expenditure on construction of a house.

v. Salary received by an Indian resident working in US embassy in New Delhi.

vi.

Interest paid on loan taken to buy a personal car.

Some Basic Concepts of Macroeconomics

Page 3

Prepared By: - HARDEEP SINGH

9560941818

Q 1.

Q 2.

Q 3. ECONOMICS

Q 4. Test Series of Class XIIth

2015-16

Q 5.

By

Q 6. MR. HARDEEP SINGH

Q 7. 9560941818, 9213556414

Q 8.

www.facebook.com/easywayeducation

Some Basic Concepts of Macroeconomics

Page 4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Collection Agency Removal LetterDocument4 pagesCollection Agency Removal LetterKNOWLEDGE SOURCENo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Foreign Exchange Risk Management - A Case StudyDocument15 pagesForeign Exchange Risk Management - A Case StudyHimanshu Kumar50% (2)

- Ch11 P11 Build A ModelDocument6 pagesCh11 P11 Build A ModelJDOLL1100% (2)

- Questions CCA AgadirDocument3 pagesQuestions CCA AgadirHamza El Maadani100% (1)

- Time: Hours Maximum Marks: 60: To ToDocument4 pagesTime: Hours Maximum Marks: 60: To ToNeeraj TyagiNo ratings yet

- B.study BDocument4 pagesB.study BNeeraj TyagiNo ratings yet

- Eco Class Xii WorksheetsDocument20 pagesEco Class Xii WorksheetsNeeraj TyagiNo ratings yet

- What Is Decision Support System? Explain The Components, Decision Making Phases and Analytical Models of DSSDocument4 pagesWhat Is Decision Support System? Explain The Components, Decision Making Phases and Analytical Models of DSSNeeraj TyagiNo ratings yet

- Write Your Mobile Number On Top of Form To Get SMS AlertsDocument8 pagesWrite Your Mobile Number On Top of Form To Get SMS AlertsNeeraj TyagiNo ratings yet

- Assignment PPCDocument7 pagesAssignment PPCNeeraj TyagiNo ratings yet

- Management Information SystemDocument9 pagesManagement Information SystemNeeraj Tyagi0% (2)

- What Is Free Cash Flow and How Do I Calculate It?: A Summary Provided by Pamela Peterson Drake, James Madison UniversityDocument8 pagesWhat Is Free Cash Flow and How Do I Calculate It?: A Summary Provided by Pamela Peterson Drake, James Madison UniversityNikhil GandhiNo ratings yet

- Book Keeping and Accounts Past Paper Series 4 2014Document12 pagesBook Keeping and Accounts Past Paper Series 4 2014cheah_chinNo ratings yet

- Project 1Document37 pagesProject 1Michael WellsNo ratings yet

- OddFalls Practice SetDocument28 pagesOddFalls Practice SetAntonio Jerome GageNo ratings yet

- Villa Vs Garcia BosqueDocument2 pagesVilla Vs Garcia BosqueJohn Michael VidaNo ratings yet

- Negotiable InstrumentsDocument3 pagesNegotiable InstrumentsCML0% (1)

- Swarnjayanti Gram Swarojgar Yojna 1999Document29 pagesSwarnjayanti Gram Swarojgar Yojna 1999Muzaffar HussainNo ratings yet

- Accounting CH 8Document29 pagesAccounting CH 8Nguyen Dac ThichNo ratings yet

- Bankasdasd Das AsdDocument9 pagesBankasdasd Das AsdRia AthirahNo ratings yet

- Accounting Principles O-LevelDocument4 pagesAccounting Principles O-LevelSalman Salim Khan100% (1)

- Simpl Is Cahier Des Charges Edi v18Document42 pagesSimpl Is Cahier Des Charges Edi v18Oussama RamboukNo ratings yet

- Chapter 11 Money Demand and The Equilibrium Interest RateDocument6 pagesChapter 11 Money Demand and The Equilibrium Interest RatepenelopegerhardNo ratings yet

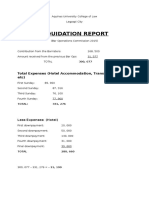

- Liquidation Report: Total Expenses (Hotel Accommodation, Transportation, Etc)Document3 pagesLiquidation Report: Total Expenses (Hotel Accommodation, Transportation, Etc)MaeJoyLoyolaBorlagdatanNo ratings yet

- Real Estate Mortgage - 2 Title - CorporationDocument2 pagesReal Estate Mortgage - 2 Title - CorporationgeorenceNo ratings yet

- Patterns of Philippine ExpenditureDocument4 pagesPatterns of Philippine ExpenditureChelsi Christine TenorioNo ratings yet

- Calveta Dining ServicesDocument7 pagesCalveta Dining ServicesSmera Eliza Philip100% (2)

- Questa Education Foundation Memorandum of UnderstandingDocument2 pagesQuesta Education Foundation Memorandum of UnderstandingInstitute for Higher Education PolicyNo ratings yet

- Summary of Money Market and Monetary Operations in IndiaDocument1 pageSummary of Money Market and Monetary Operations in IndiaSubigya BasnetNo ratings yet

- Acc1013 Jd14seta AnsDocument12 pagesAcc1013 Jd14seta AnsainonlelaNo ratings yet

- IssuesDocument10 pagesIssuesMujahid AmeenNo ratings yet

- BPI vs. Ulrich Forester G.R. No. L-25811Document1 pageBPI vs. Ulrich Forester G.R. No. L-25811Xander 4thNo ratings yet

- CH1Document30 pagesCH1Stephant Delahoya SihombingNo ratings yet

- Prelim Exam, Partnership Formation and Operation PDFDocument2 pagesPrelim Exam, Partnership Formation and Operation PDFIñego BegdorfNo ratings yet

- Account Management and Loss Allowance Guidance Checklist Pub CH A CCL Acct MGMT Loss Allowance ChecklistDocument5 pagesAccount Management and Loss Allowance Guidance Checklist Pub CH A CCL Acct MGMT Loss Allowance ChecklistHelpin HandNo ratings yet

- Final AccountsDocument65 pagesFinal AccountsAmit Mishra100% (1)

- Ch05 Bond Valuation SoluationsDocument6 pagesCh05 Bond Valuation SoluationsSeema Kiran50% (2)