Professional Documents

Culture Documents

EC5604 Corporate Finance Valuing Risky Corporate Debt in The Real and Monetary Economies

EC5604 Corporate Finance Valuing Risky Corporate Debt in The Real and Monetary Economies

Uploaded by

Rocky KhurasaniCopyright:

Available Formats

You might also like

- Peer-E-Kamil (PBUH) by Umera Ahmad English PDFDocument389 pagesPeer-E-Kamil (PBUH) by Umera Ahmad English PDFsaizzle92% (93)

- Retail Bank Business Capability ModelDocument8 pagesRetail Bank Business Capability ModelCapability Model100% (1)

- Case 2a - Flirting With Risk - SolutionDocument5 pagesCase 2a - Flirting With Risk - SolutionMahesh Satapathy67% (3)

- Chapter 5 Zvi Bodie - Alex Kane - Alan J.Marcus - Investments-McGraw-Hill Education (2018) PDFDocument40 pagesChapter 5 Zvi Bodie - Alex Kane - Alan J.Marcus - Investments-McGraw-Hill Education (2018) PDFEllin Damayanti100% (1)

- Final Exam Economics Formanagers: 1. The Macroeconomic Effects of The Indexation of Wages (2 Points)Document7 pagesFinal Exam Economics Formanagers: 1. The Macroeconomic Effects of The Indexation of Wages (2 Points)Zuka KazalikashviliNo ratings yet

- Chapter 4Document12 pagesChapter 4Crissa Mae FalsisNo ratings yet

- Yale University - Financial Market CourseDocument26 pagesYale University - Financial Market CourseNitendo CubeNo ratings yet

- SEx 1Document12 pagesSEx 1Amir Madani50% (2)

- For Ex Acca Articles 7 SeriesDocument28 pagesFor Ex Acca Articles 7 SerieshunkieNo ratings yet

- Tools FinanceDocument40 pagesTools FinanceHasnatNo ratings yet

- Tute 5 2021 IFIMDocument3 pagesTute 5 2021 IFIMptrip2323No ratings yet

- Money Mrkts 2ndDocument3 pagesMoney Mrkts 2ndygolcuNo ratings yet

- Chapter-1 Return and RiskDocument11 pagesChapter-1 Return and RiskAndualem ZenebeNo ratings yet

- 1-Trade Unions and Bargaining Power: Answer: Natural Rate of UnemploymentDocument4 pages1-Trade Unions and Bargaining Power: Answer: Natural Rate of UnemploymentWaqas SarwarNo ratings yet

- Case 17 Risk and ReturnDocument6 pagesCase 17 Risk and Returnnicole33% (3)

- 08 Handout 124Document11 pages08 Handout 124bernadette soteroNo ratings yet

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 1Document13 pagesFinancial Statement Analysis - Concept Questions and Solutions - Chapter 1ObydulRanaNo ratings yet

- CH-2 Risk and ReturnDocument8 pagesCH-2 Risk and ReturnMesay AdaneNo ratings yet

- The Basic Tools of Finance CH 14Document45 pagesThe Basic Tools of Finance CH 14Abdul Qadeer ZawriNo ratings yet

- CH 02 Mini CaseDocument18 pagesCH 02 Mini CaseCuong LeNo ratings yet

- Corporate Finance Assignment PDFDocument13 pagesCorporate Finance Assignment PDFسنا عبداللهNo ratings yet

- Risk Return SummeryDocument85 pagesRisk Return SummerySanaullah Tariq100% (1)

- CAHAPTER 5 InvestmentDocument15 pagesCAHAPTER 5 Investmentsiddev12344321No ratings yet

- Case 17 Risk and Return PDF FreeDocument6 pagesCase 17 Risk and Return PDF FreeJaja JijiNo ratings yet

- Abm 12 Buss Fin 2ND Semester Midterm Module 8 CollamatDocument14 pagesAbm 12 Buss Fin 2ND Semester Midterm Module 8 CollamatNizel Sherlyn NarsicoNo ratings yet

- Chapter 7Document9 pagesChapter 7Askar GaradNo ratings yet

- Group2 Effects of InflationDocument27 pagesGroup2 Effects of InflationScott AlephNo ratings yet

- Valuing Bonds: Answers To Concept Review QuestionsDocument4 pagesValuing Bonds: Answers To Concept Review QuestionsHuu DuyNo ratings yet

- Chapter 13 Tcdn GốcDocument27 pagesChapter 13 Tcdn GốcN KhNo ratings yet

- FM11 CH 04 Mini CaseDocument6 pagesFM11 CH 04 Mini CaseAmjad IqbalNo ratings yet

- ECO403 Short Question of Recommended Book RefrenceDocument21 pagesECO403 Short Question of Recommended Book RefrencemodmotNo ratings yet

- What Can Lead The Lead The Next Market CorrectionDocument4 pagesWhat Can Lead The Lead The Next Market Correctionmanindrag00No ratings yet

- Sample QuestionsDocument13 pagesSample Questionsisrael adesanyaNo ratings yet

- Time Value of MoneyDocument40 pagesTime Value of Moneypon jonNo ratings yet

- Time Value of MoneyDocument40 pagesTime Value of MoneyBoruto UzumakiNo ratings yet

- Notes On UncertaintyDocument8 pagesNotes On UncertaintySameen SakeebNo ratings yet

- New Microsoft Word DocumentDocument6 pagesNew Microsoft Word DocumentCharmi SatraNo ratings yet

- Investment & Portfolio Management FIN730: This Is January Effect Anomaly (Like July Effect in Pakistan)Document14 pagesInvestment & Portfolio Management FIN730: This Is January Effect Anomaly (Like July Effect in Pakistan)Abdul Rauf Khan100% (3)

- Capital Structure Decision AssignmentDocument9 pagesCapital Structure Decision Assignmentgeetikag2018No ratings yet

- An Assignment On International Economics Course No.:: Submitted To: Submitted byDocument6 pagesAn Assignment On International Economics Course No.:: Submitted To: Submitted byMD. MEHEDI HASAN BAPPYNo ratings yet

- CHAPTER 14 PowerPoint Presentation 1-1Document22 pagesCHAPTER 14 PowerPoint Presentation 1-1Cyrine EliasNo ratings yet

- FM-II-CH-1 Capital Structure and LeverageDocument14 pagesFM-II-CH-1 Capital Structure and LeverageAschalew Ye Giwen LijiNo ratings yet

- Risk and Rates of ReturnDocument23 pagesRisk and Rates of ReturnIo Aya100% (1)

- The Basic Tools of FinanceDocument42 pagesThe Basic Tools of FinanceSandra Hanania PasaribuNo ratings yet

- The Relation Between Risk and ReturnDocument8 pagesThe Relation Between Risk and ReturnBasharat TawheedaabadiNo ratings yet

- UntitledDocument42 pagesUntitledVivaan KothariNo ratings yet

- Practice QuestionsDocument4 pagesPractice Questionsradhika kumarfNo ratings yet

- Unit 1Document27 pagesUnit 1PalakNo ratings yet

- Business Finance$ Chapter 6: Interest Rates and Bond ValuationDocument8 pagesBusiness Finance$ Chapter 6: Interest Rates and Bond ValuationRumana SultanaNo ratings yet

- 8 Axioms of Finance: Professor Paul BolsterDocument8 pages8 Axioms of Finance: Professor Paul BolsterAnuja SawantNo ratings yet

- Week 1. Introduction and Portfolio Diversification and Supporting Financial InstitutionsDocument5 pagesWeek 1. Introduction and Portfolio Diversification and Supporting Financial InstitutionsJansunsetaNo ratings yet

- Finance Test Review 3Document32 pagesFinance Test Review 3Shaolin105No ratings yet

- ECO121Document3 pagesECO121Nguyen Thi Kim Chuyen (K16HL)No ratings yet

- CH 3 Discussion and Practice QuestionsDocument11 pagesCH 3 Discussion and Practice Questionsshimoni.mistry.180670107043No ratings yet

- Lecture 4 2016 ALMDocument70 pagesLecture 4 2016 ALMEmilioNo ratings yet

- Why Do Interest Rates Change?Document57 pagesWhy Do Interest Rates Change?Manoj KumarNo ratings yet

- Muhammad Atique 13900 Solution 1 (A) :: Midterm Exam (Hourly - II Spring - 2021Document5 pagesMuhammad Atique 13900 Solution 1 (A) :: Midterm Exam (Hourly - II Spring - 2021Mahek Anwar AliNo ratings yet

- Can Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?From EverandCan Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?No ratings yet

- 3rd Sem Finance True and False PDFDocument14 pages3rd Sem Finance True and False PDFMausam GhimireNo ratings yet

- Investment Analysis and Portfolio ManageDocument14 pagesInvestment Analysis and Portfolio ManageSannithi YamsawatNo ratings yet

- Financial MarketsDocument7 pagesFinancial MarketsPhilemon KatambarareNo ratings yet

- Investment CH 2Document7 pagesInvestment CH 2duresa dushuraNo ratings yet

- Source Readining David RicardoDocument10 pagesSource Readining David RicardoRocky KhurasaniNo ratings yet

- 5GRInvestmentAppraisal (1) .Doc LectDocument5 pages5GRInvestmentAppraisal (1) .Doc LectRocky KhurasaniNo ratings yet

- Jinnah India Indepence PDFDocument120 pagesJinnah India Indepence PDFAbu YildirimNo ratings yet

- (Pso) Pakistan State OilDocument4 pages(Pso) Pakistan State OilSalman AtherNo ratings yet

- Unit 3: Issue of Debentures: Learning OutcomesDocument30 pagesUnit 3: Issue of Debentures: Learning Outcomesashish malhotraNo ratings yet

- Financial Reporting Conceptual Framework of Financial Accounting KeyDocument13 pagesFinancial Reporting Conceptual Framework of Financial Accounting KeySteffNo ratings yet

- SFM SGSTD Dec 21Document23 pagesSFM SGSTD Dec 21Khader MohammedNo ratings yet

- Past Exam Question APMDocument3 pagesPast Exam Question APMWenhidzaNo ratings yet

- Developing Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsDocument24 pagesDeveloping Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsAyman SobhyNo ratings yet

- Fin Week 2Document3 pagesFin Week 2Morgan JunkemailNo ratings yet

- Live Stock, Index, Futures, Forex and Bitcoin Charts On TradingViewDocument1 pageLive Stock, Index, Futures, Forex and Bitcoin Charts On TradingViewJoe Boby SoegiartoNo ratings yet

- Doremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)Document4 pagesDoremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)Guiana WacasNo ratings yet

- Coma AssignmentDocument2 pagesComa AssignmentSWAGATO MUKHERJEENo ratings yet

- Company Analysis of Reliance Industries LTDDocument11 pagesCompany Analysis of Reliance Industries LTDSanny Das0% (1)

- Auditing Problems MC Quizzer 02Document15 pagesAuditing Problems MC Quizzer 02anndyNo ratings yet

- Lecture 0724-1Document28 pagesLecture 0724-1jasonnumahnalkelNo ratings yet

- Stock Research Websites 1701763877Document14 pagesStock Research Websites 1701763877rascalidkNo ratings yet

- Mergers FinanceDocument5 pagesMergers Financeveda20No ratings yet

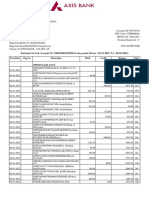

- Acct Statement - XX4920 - 02022023Document4 pagesAcct Statement - XX4920 - 02022023Popi BhowmikNo ratings yet

- Govan Mbeki Municipality: General Valuation Roll (Sectional Title)Document72 pagesGovan Mbeki Municipality: General Valuation Roll (Sectional Title)WikusNo ratings yet

- Initiating Coverage - Asian Paints 011220Document11 pagesInitiating Coverage - Asian Paints 011220Sourav NandaNo ratings yet

- Urdu Essay WritingDocument9 pagesUrdu Essay Writingb6yf8tcd100% (2)

- Statement of Changes in EquityDocument12 pagesStatement of Changes in Equitymaricar reyesNo ratings yet

- EL Investor-Factsheet-2021Document4 pagesEL Investor-Factsheet-2021Tey Boon KiatNo ratings yet

- s6 Aceiteka Mock Ent 1 2017Document3 pagess6 Aceiteka Mock Ent 1 2017Murungi SincereNo ratings yet

- KELOMPOK 2-Patnership Liquidation - Soal 2Document10 pagesKELOMPOK 2-Patnership Liquidation - Soal 2leli trisnaNo ratings yet

- Exceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionDocument5 pagesExceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionRyan S. AngelesNo ratings yet

- CH 1 Crvi BookDocument10 pagesCH 1 Crvi BookAbhijeetNo ratings yet

- ChallanFormDocument1 pageChallanFormSHIVAPPA HEBBALNo ratings yet

- CFS Income Statement ReceiptsDocument2 pagesCFS Income Statement ReceiptsRamana DvNo ratings yet

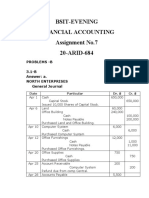

- Assignment No.7 AccountingDocument7 pagesAssignment No.7 Accountingibrar ghaniNo ratings yet

EC5604 Corporate Finance Valuing Risky Corporate Debt in The Real and Monetary Economies

EC5604 Corporate Finance Valuing Risky Corporate Debt in The Real and Monetary Economies

Uploaded by

Rocky KhurasaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EC5604 Corporate Finance Valuing Risky Corporate Debt in The Real and Monetary Economies

EC5604 Corporate Finance Valuing Risky Corporate Debt in The Real and Monetary Economies

Uploaded by

Rocky KhurasaniCopyright:

Available Formats

EC5604

Corporate Finance

Valuing Risky Corporate Debt

in the Real and Monetary Economies

Lecture 1

You know a lot already about valuing risky debt. If

you are in doubt about that, review Lectures 11, 14 and

the first few slides of Lecture 15 for EC5601. We need

to expand on that material a bit.

Recall that we learned if corporate debt is risky, the

shareholders possess a put option on the assets of the

firm. Thus the value of risky corporate debt can be

calculated as the value of the debt, as if it were

riskless, minus the value of the put on the firms assets.

Example: Assume we have no taxes. The value of Firm

B is 10,000 and has a required return on assets, rA =

10%.

Firm B, Assets = 10,000

1/2

4,000

Debt = 4,000

Equity = 0

1/2

18,000

Debt = 5,000

Equity = 13,000

EC5604

Corporate Finance

Lecture 1

Slide 2

Suppose that Firm B is levered with a 5000 nominal

Debt. The Debt is clearly risky from the depiction of

its FVs above.

How much is the debt worth? Recall,

Debt = PV(riskless Debt) - put option on Firms assets

Lets value the put first.

Asset Value =10,000

4,000

18,000

put value @5,000 strike price

1,000

If we short-sell the assets and lend the PV(18,000),

we expend,

18,000

10,000 - PV(18,000) 10,000

7142.86

1.05

which leads to

EC5604

Corporate Finance

Lecture 1

Slide 3

-7,142.86

18,000 - 4,000 =

14,000

18,000 - 18,000

= 0

These FVs are clearly worth 14 puts on the firms

assets, therefore one put is worth 510.20. The Debts

value thus is 5,000 / 1.05 510.20 4,251.70. Equity in Firm B is worth 5,748.30. Recall that this is

but a reflection of Put-Call Parity. With the risk of

financial distress, shareholders who hold a put option

on the firms assets own Equity that is worth more than

VASSETS VDEBT(riskless). Equity is actually worth

VEQUITY = VASSETS VDEBT(riskless) + VPUT.

You will not be surprised that a risk-component of any

financial liability, such as Debt or Equity, will have

risk that is associated with variation in or uncertainty

surrounding the purchasing power of money. In this

course we do not complicate matters by worrying

about how risks in the real economy translate into risks

in monetary values of corporate liabilities. You should

be aware, however, that interesting complications can

EC5604

Corporate Finance

Lecture 1

Slide 4

arise and you are now in a good position to understand

their nature.

First, we need some terminology. Let PGoods be the

money price of real goods and services. Then let

PGoods indicate the change in such prices. It follows

then that PGoods/PGoods(last periods) is the familiar

rate of inflation. The purchasing power of money is

1/PGoods, the number of real goods and services that can

be purchased by one unit of money.

One famous way that economists account for the

difference between nominal and real interest rates is

with the Fisher (Irving) Equation. The nominal rate of

interest is the money rate of interest that we see in the

everyday world. The real rate of interest is a theoretical

construct and, except in special circumstances, is not

easy to observe. The real rate of interest is the money

rate of interest when holding the purchasing power of

money (PPM) constant. Let us write the Fisher

equation in terms of returns on corporate Debt.

EC5604

Corporate Finance

Lecture 1

Slide 5

Required Rate of Return on Nominal Debt =

Required Rate of Return on Debt(PPM constant) +

Expected Rate of Inflation

The idea, of course, is a very simple one as originally

expressed by Fisher. If you are a debtholder, you will

require a higher rate of return on Debt when you

expect the purchasing power of money to erode.

Appealingly simple as it is, we can see quite

straightforwardly that the Fisher Equation is wrong

and in many circumstances would give a misleading

idea of how nominal required rates of return are

affected by purchasing power risk. The reason it is

wrong is that a nominal bond has an option component

in it and this is a call option on future purchasing

power. Without a correct calculation of this options

value, we cannot come to a correct value for the

nominal bond and therefore we cannot correctly

calculate its required return.

Before proceeding, let us apply the Fisher Equation to

a simple situation that has occurred in the past

hyperinflations. There are historical examples in

interwar Germany and post-war Eastern Europe

(Hungary) and China. Much modern monetary history

of South American economies has been nearly

EC5604

Corporate Finance

Lecture 1

Slide 6

hyperinflationary and today we have the example

presented to us by Robert Mugabes Zimbabwe.

Suppose the expected rate of inflation was 10,000%

per annum and that the real required return on Debt

was 5%. The Fisher Equation therefore says that the

nominal required return is 10,005%. Now let us ask

what would a nominal Debt of 100 be worth.

100/(1+rnominal) = 100/101.05 1

In other words, nominal bonds should be nearly

worthless in hyperinflations, if the hyperinflation is

expected to continue and if the Fisher Equation is

correct. What do we see in hyperinflations? Bond

values do tend to be quite low, but not nearly as low as

the Fisher Equation would suggest. In much of postwar South America inflation rates have consistently

been on the order of hundreds, and sometimes,

thousands, of percent per annum. Yet rates of return on

nominal bonds have generally been on the order of

20% to 50% per annum.

Why do nominal bonds have persistent value in

hyperinflations? Because nominal bonds contain a call

option on future purchasing power and this call option

will likely be exercised in the contingency that the

EC5604

Corporate Finance

Lecture 1

Slide 7

hyperinflation abates. We know that in option analysis

the likelihood that an option will be exercised can be

quite small, yet the option can still have great PV if the

net payoff (payoff minus strike price) is quite large

when the option is exercised. This is what is going on

with nominal bond values in hyperinflations. Let us

work through an example.

Imagine that in the real economy, the economic sector

in which real goods and services are produced, there is

an expected and required rate of return of 10%. Let us

call real goods and services corn. Corn, as you

know, can be either eaten or shoved back into the

ground as seed. There is a certain riskiness to

production in the real economy and it is expressed as

below.

100 corn units as seed

1/2

90 corn units

production

1/2

130 corn units

production

This real economy is, of course, embedded in a money

economy that has its own peculiar riskinesses. Suppose

EC5604

Corporate Finance

Lecture 1

Slide 8

the current price of corn is 1 per unit (PGoods = 1),

but there is a substantial chance of price inflation.

PGoods = 1

1/2

1/2

PGoods = 5

PGoods = 1

Note that the expected rate of inflation is 200%. The

Fisher equation tells us therefore that the required

nominal rate of return should be 210%. A nominal

100 bond should be worth 100/3.1 = 32.26. What is

the future purchasing power of a 100 nominal bond?

Purchasing Power of

100 nominal bond

1/2

20 corn units

1/2

100 corn units

Clearly, a nominal bond can deliver 20 units of corn

risklessly. Supposing that the real risk-free rate is 5%,

those riskless 20 corn units have a present value of 19

corn units. But there are the remaining risky future

EC5604

Corporate Finance

Lecture 1

Slide 9

corn units that the nominal bond can deliver. They

look like this.

Risky purchasing power

of 100 nominal bond

1/2

0 corn units

1/2

80 corn units

Now, do these future risky corn units have a present

value that is properly represented as an option value?

Yes, they do! They represent FVs from an option

because if you own a 100 nominal bond, you do not

have to exchange that bond for corn in the next period.

You can simply exchange the bond for another bond

and wait until purchasing power of bonds is restored to

your liking. You will more likely exchange the bond

for real goods when the purchasing power of bonds

and money is good. In other words, you can choose

when to exercise your consumption option.

Can we price this option? Yes, its easy. We price it

first in the real economy. The future corn units above

are exactly what we would get if we currently shortsold the production by 100 units of seed corn and

simultaneously lent the PV of 90 corn units. We would

EC5604

Corporate Finance

Lecture 1

Slide 10

end up with either 90+90 corn units or 130+90 (-40)

corn units. The current corn flows that result from

such transactions would be +100-90/1.05, or 14.3. This

is the value of a call option on the production from 100

units of seed corn at a strike price of 90 corn units.

The PV therefore of our future optional corn units at

the top of SLIDE 9 will be double the option value we

have just calculated, or 28.6 units of corn. Recall that

the risk-free portion of the nominal bond was worth 19

units of corn. Therefore a 100 nominal bond is worth

19 + 28.6 units of current corn, or 47.6 corn units. At

the current price of 1/corn, the nominal bond should

be worth 47.60, a bit more than the 32.26 predicted

by the Fisher Equation. The required nominal rate of

return is 100/47.60 1 = 110%, a good deal lower

than the 210% predicted by the Fisher Equation.

So, valuing nominal financial liabilities in a world of

purchasing power uncertainty is important and subtle.

It is too bad that the Fisher approach is a bit too crude.

What you should appreciate is that valuing of

corporate liabilities, such as Debt, in a world where we

have to worry about the interaction of purchasing

power risks, as well as the risks in the underlying real

economy will be challenging indeed.

You might also like

- Peer-E-Kamil (PBUH) by Umera Ahmad English PDFDocument389 pagesPeer-E-Kamil (PBUH) by Umera Ahmad English PDFsaizzle92% (93)

- Retail Bank Business Capability ModelDocument8 pagesRetail Bank Business Capability ModelCapability Model100% (1)

- Case 2a - Flirting With Risk - SolutionDocument5 pagesCase 2a - Flirting With Risk - SolutionMahesh Satapathy67% (3)

- Chapter 5 Zvi Bodie - Alex Kane - Alan J.Marcus - Investments-McGraw-Hill Education (2018) PDFDocument40 pagesChapter 5 Zvi Bodie - Alex Kane - Alan J.Marcus - Investments-McGraw-Hill Education (2018) PDFEllin Damayanti100% (1)

- Final Exam Economics Formanagers: 1. The Macroeconomic Effects of The Indexation of Wages (2 Points)Document7 pagesFinal Exam Economics Formanagers: 1. The Macroeconomic Effects of The Indexation of Wages (2 Points)Zuka KazalikashviliNo ratings yet

- Chapter 4Document12 pagesChapter 4Crissa Mae FalsisNo ratings yet

- Yale University - Financial Market CourseDocument26 pagesYale University - Financial Market CourseNitendo CubeNo ratings yet

- SEx 1Document12 pagesSEx 1Amir Madani50% (2)

- For Ex Acca Articles 7 SeriesDocument28 pagesFor Ex Acca Articles 7 SerieshunkieNo ratings yet

- Tools FinanceDocument40 pagesTools FinanceHasnatNo ratings yet

- Tute 5 2021 IFIMDocument3 pagesTute 5 2021 IFIMptrip2323No ratings yet

- Money Mrkts 2ndDocument3 pagesMoney Mrkts 2ndygolcuNo ratings yet

- Chapter-1 Return and RiskDocument11 pagesChapter-1 Return and RiskAndualem ZenebeNo ratings yet

- 1-Trade Unions and Bargaining Power: Answer: Natural Rate of UnemploymentDocument4 pages1-Trade Unions and Bargaining Power: Answer: Natural Rate of UnemploymentWaqas SarwarNo ratings yet

- Case 17 Risk and ReturnDocument6 pagesCase 17 Risk and Returnnicole33% (3)

- 08 Handout 124Document11 pages08 Handout 124bernadette soteroNo ratings yet

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 1Document13 pagesFinancial Statement Analysis - Concept Questions and Solutions - Chapter 1ObydulRanaNo ratings yet

- CH-2 Risk and ReturnDocument8 pagesCH-2 Risk and ReturnMesay AdaneNo ratings yet

- The Basic Tools of Finance CH 14Document45 pagesThe Basic Tools of Finance CH 14Abdul Qadeer ZawriNo ratings yet

- CH 02 Mini CaseDocument18 pagesCH 02 Mini CaseCuong LeNo ratings yet

- Corporate Finance Assignment PDFDocument13 pagesCorporate Finance Assignment PDFسنا عبداللهNo ratings yet

- Risk Return SummeryDocument85 pagesRisk Return SummerySanaullah Tariq100% (1)

- CAHAPTER 5 InvestmentDocument15 pagesCAHAPTER 5 Investmentsiddev12344321No ratings yet

- Case 17 Risk and Return PDF FreeDocument6 pagesCase 17 Risk and Return PDF FreeJaja JijiNo ratings yet

- Abm 12 Buss Fin 2ND Semester Midterm Module 8 CollamatDocument14 pagesAbm 12 Buss Fin 2ND Semester Midterm Module 8 CollamatNizel Sherlyn NarsicoNo ratings yet

- Chapter 7Document9 pagesChapter 7Askar GaradNo ratings yet

- Group2 Effects of InflationDocument27 pagesGroup2 Effects of InflationScott AlephNo ratings yet

- Valuing Bonds: Answers To Concept Review QuestionsDocument4 pagesValuing Bonds: Answers To Concept Review QuestionsHuu DuyNo ratings yet

- Chapter 13 Tcdn GốcDocument27 pagesChapter 13 Tcdn GốcN KhNo ratings yet

- FM11 CH 04 Mini CaseDocument6 pagesFM11 CH 04 Mini CaseAmjad IqbalNo ratings yet

- ECO403 Short Question of Recommended Book RefrenceDocument21 pagesECO403 Short Question of Recommended Book RefrencemodmotNo ratings yet

- What Can Lead The Lead The Next Market CorrectionDocument4 pagesWhat Can Lead The Lead The Next Market Correctionmanindrag00No ratings yet

- Sample QuestionsDocument13 pagesSample Questionsisrael adesanyaNo ratings yet

- Time Value of MoneyDocument40 pagesTime Value of Moneypon jonNo ratings yet

- Time Value of MoneyDocument40 pagesTime Value of MoneyBoruto UzumakiNo ratings yet

- Notes On UncertaintyDocument8 pagesNotes On UncertaintySameen SakeebNo ratings yet

- New Microsoft Word DocumentDocument6 pagesNew Microsoft Word DocumentCharmi SatraNo ratings yet

- Investment & Portfolio Management FIN730: This Is January Effect Anomaly (Like July Effect in Pakistan)Document14 pagesInvestment & Portfolio Management FIN730: This Is January Effect Anomaly (Like July Effect in Pakistan)Abdul Rauf Khan100% (3)

- Capital Structure Decision AssignmentDocument9 pagesCapital Structure Decision Assignmentgeetikag2018No ratings yet

- An Assignment On International Economics Course No.:: Submitted To: Submitted byDocument6 pagesAn Assignment On International Economics Course No.:: Submitted To: Submitted byMD. MEHEDI HASAN BAPPYNo ratings yet

- CHAPTER 14 PowerPoint Presentation 1-1Document22 pagesCHAPTER 14 PowerPoint Presentation 1-1Cyrine EliasNo ratings yet

- FM-II-CH-1 Capital Structure and LeverageDocument14 pagesFM-II-CH-1 Capital Structure and LeverageAschalew Ye Giwen LijiNo ratings yet

- Risk and Rates of ReturnDocument23 pagesRisk and Rates of ReturnIo Aya100% (1)

- The Basic Tools of FinanceDocument42 pagesThe Basic Tools of FinanceSandra Hanania PasaribuNo ratings yet

- The Relation Between Risk and ReturnDocument8 pagesThe Relation Between Risk and ReturnBasharat TawheedaabadiNo ratings yet

- UntitledDocument42 pagesUntitledVivaan KothariNo ratings yet

- Practice QuestionsDocument4 pagesPractice Questionsradhika kumarfNo ratings yet

- Unit 1Document27 pagesUnit 1PalakNo ratings yet

- Business Finance$ Chapter 6: Interest Rates and Bond ValuationDocument8 pagesBusiness Finance$ Chapter 6: Interest Rates and Bond ValuationRumana SultanaNo ratings yet

- 8 Axioms of Finance: Professor Paul BolsterDocument8 pages8 Axioms of Finance: Professor Paul BolsterAnuja SawantNo ratings yet

- Week 1. Introduction and Portfolio Diversification and Supporting Financial InstitutionsDocument5 pagesWeek 1. Introduction and Portfolio Diversification and Supporting Financial InstitutionsJansunsetaNo ratings yet

- Finance Test Review 3Document32 pagesFinance Test Review 3Shaolin105No ratings yet

- ECO121Document3 pagesECO121Nguyen Thi Kim Chuyen (K16HL)No ratings yet

- CH 3 Discussion and Practice QuestionsDocument11 pagesCH 3 Discussion and Practice Questionsshimoni.mistry.180670107043No ratings yet

- Lecture 4 2016 ALMDocument70 pagesLecture 4 2016 ALMEmilioNo ratings yet

- Why Do Interest Rates Change?Document57 pagesWhy Do Interest Rates Change?Manoj KumarNo ratings yet

- Muhammad Atique 13900 Solution 1 (A) :: Midterm Exam (Hourly - II Spring - 2021Document5 pagesMuhammad Atique 13900 Solution 1 (A) :: Midterm Exam (Hourly - II Spring - 2021Mahek Anwar AliNo ratings yet

- Can Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?From EverandCan Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?No ratings yet

- 3rd Sem Finance True and False PDFDocument14 pages3rd Sem Finance True and False PDFMausam GhimireNo ratings yet

- Investment Analysis and Portfolio ManageDocument14 pagesInvestment Analysis and Portfolio ManageSannithi YamsawatNo ratings yet

- Financial MarketsDocument7 pagesFinancial MarketsPhilemon KatambarareNo ratings yet

- Investment CH 2Document7 pagesInvestment CH 2duresa dushuraNo ratings yet

- Source Readining David RicardoDocument10 pagesSource Readining David RicardoRocky KhurasaniNo ratings yet

- 5GRInvestmentAppraisal (1) .Doc LectDocument5 pages5GRInvestmentAppraisal (1) .Doc LectRocky KhurasaniNo ratings yet

- Jinnah India Indepence PDFDocument120 pagesJinnah India Indepence PDFAbu YildirimNo ratings yet

- (Pso) Pakistan State OilDocument4 pages(Pso) Pakistan State OilSalman AtherNo ratings yet

- Unit 3: Issue of Debentures: Learning OutcomesDocument30 pagesUnit 3: Issue of Debentures: Learning Outcomesashish malhotraNo ratings yet

- Financial Reporting Conceptual Framework of Financial Accounting KeyDocument13 pagesFinancial Reporting Conceptual Framework of Financial Accounting KeySteffNo ratings yet

- SFM SGSTD Dec 21Document23 pagesSFM SGSTD Dec 21Khader MohammedNo ratings yet

- Past Exam Question APMDocument3 pagesPast Exam Question APMWenhidzaNo ratings yet

- Developing Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsDocument24 pagesDeveloping Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsAyman SobhyNo ratings yet

- Fin Week 2Document3 pagesFin Week 2Morgan JunkemailNo ratings yet

- Live Stock, Index, Futures, Forex and Bitcoin Charts On TradingViewDocument1 pageLive Stock, Index, Futures, Forex and Bitcoin Charts On TradingViewJoe Boby SoegiartoNo ratings yet

- Doremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)Document4 pagesDoremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)Guiana WacasNo ratings yet

- Coma AssignmentDocument2 pagesComa AssignmentSWAGATO MUKHERJEENo ratings yet

- Company Analysis of Reliance Industries LTDDocument11 pagesCompany Analysis of Reliance Industries LTDSanny Das0% (1)

- Auditing Problems MC Quizzer 02Document15 pagesAuditing Problems MC Quizzer 02anndyNo ratings yet

- Lecture 0724-1Document28 pagesLecture 0724-1jasonnumahnalkelNo ratings yet

- Stock Research Websites 1701763877Document14 pagesStock Research Websites 1701763877rascalidkNo ratings yet

- Mergers FinanceDocument5 pagesMergers Financeveda20No ratings yet

- Acct Statement - XX4920 - 02022023Document4 pagesAcct Statement - XX4920 - 02022023Popi BhowmikNo ratings yet

- Govan Mbeki Municipality: General Valuation Roll (Sectional Title)Document72 pagesGovan Mbeki Municipality: General Valuation Roll (Sectional Title)WikusNo ratings yet

- Initiating Coverage - Asian Paints 011220Document11 pagesInitiating Coverage - Asian Paints 011220Sourav NandaNo ratings yet

- Urdu Essay WritingDocument9 pagesUrdu Essay Writingb6yf8tcd100% (2)

- Statement of Changes in EquityDocument12 pagesStatement of Changes in Equitymaricar reyesNo ratings yet

- EL Investor-Factsheet-2021Document4 pagesEL Investor-Factsheet-2021Tey Boon KiatNo ratings yet

- s6 Aceiteka Mock Ent 1 2017Document3 pagess6 Aceiteka Mock Ent 1 2017Murungi SincereNo ratings yet

- KELOMPOK 2-Patnership Liquidation - Soal 2Document10 pagesKELOMPOK 2-Patnership Liquidation - Soal 2leli trisnaNo ratings yet

- Exceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionDocument5 pagesExceptional Service Grading Company: A Case Study On Employing Financial Ratio Analysis As A Basis For Business ExpansionRyan S. AngelesNo ratings yet

- CH 1 Crvi BookDocument10 pagesCH 1 Crvi BookAbhijeetNo ratings yet

- ChallanFormDocument1 pageChallanFormSHIVAPPA HEBBALNo ratings yet

- CFS Income Statement ReceiptsDocument2 pagesCFS Income Statement ReceiptsRamana DvNo ratings yet

- Assignment No.7 AccountingDocument7 pagesAssignment No.7 Accountingibrar ghaniNo ratings yet