Professional Documents

Culture Documents

Tax Audit: Tax Audit Conditions As Per Section 44AB-Every Person

Tax Audit: Tax Audit Conditions As Per Section 44AB-Every Person

Uploaded by

Siva KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Audit: Tax Audit Conditions As Per Section 44AB-Every Person

Tax Audit: Tax Audit Conditions As Per Section 44AB-Every Person

Uploaded by

Siva KumarCopyright:

Available Formats

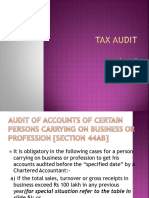

Tax Audit

Tax Audit Conditions

As per section 44AB- Every person

Carrying on business shall, if his total sales, turnover or gross receipts, as the case may

be, in business exceed or exceeds one crore rupees. ; or

Carrying on profession shall, if his gross receipts in profession exceed twenty-five lakh

rupees. ; or

Carrying on the business shall, if the profits and gains from the business are deemed to

be the profits and gains of such person under section 44AD and he has claimed such

income to be lower than the profits and gains so deemed to be the profits and gains of

his business and his income exceeds the maximum amount which is not chargeable to

income-tax in any previous year.

get his accounts of such previous year audited by a Chartered Accountant. The due date for filing

the Tax Audit Report u/s 44AB is 30th September of the Assessment year

You might also like

- Audit Project TAX AUDITDocument34 pagesAudit Project TAX AUDITkarthika kounder67% (9)

- Guidance On Tax Audit Under Section 44ABDocument5 pagesGuidance On Tax Audit Under Section 44ABSukumar BasuNo ratings yet

- TaxmanDocument51 pagesTaxmantax updateNo ratings yet

- BCH 601 SM12Document10 pagesBCH 601 SM12technical analysisNo ratings yet

- Section 44AB of Income Tax ActDocument6 pagesSection 44AB of Income Tax ActKANNAPPAN NAGARAJANNo ratings yet

- Income Tax AuditDocument4 pagesIncome Tax AuditRipgod GamingNo ratings yet

- Taxguru - In-Understanding of 44AB Tax AuditDocument8 pagesTaxguru - In-Understanding of 44AB Tax AuditrdaranNo ratings yet

- Taxmann-FAQ On Tax AuditDocument34 pagesTaxmann-FAQ On Tax AuditranjitNo ratings yet

- PGBP Part 2Document24 pagesPGBP Part 2Dhruv SetiaNo ratings yet

- (FAQs) Introduction & Applicability of Tax AuditDocument18 pages(FAQs) Introduction & Applicability of Tax Auditsukantabera215No ratings yet

- Tax Audit Under Section 44AB For AY 2022-23Document31 pagesTax Audit Under Section 44AB For AY 2022-23SRIKANTA ROUTNo ratings yet

- Chapter 1 Audit Under TaxDocument15 pagesChapter 1 Audit Under TaxSaurabh GogawaleNo ratings yet

- Tax On Presumptive Basis in Case of Certain Eligible BusinessesDocument15 pagesTax On Presumptive Basis in Case of Certain Eligible BusinessesSeemant GuptaNo ratings yet

- Unit 1 - Tax AuditDocument9 pagesUnit 1 - Tax AuditSHUBH RATHNo ratings yet

- Prajakta Mondhe: Amendments in Presumptive Taxation and Applicability of Tax Audit Under Income Tax Act, 1961Document4 pagesPrajakta Mondhe: Amendments in Presumptive Taxation and Applicability of Tax Audit Under Income Tax Act, 1961abc defNo ratings yet

- Tax On Presumptive Basis in Case of Certain Eligible BusinessesDocument16 pagesTax On Presumptive Basis in Case of Certain Eligible BusinessesBhanu SatyanarayanaNo ratings yet

- Presumptive Taxation - Section 44AD, 44ADA, 44AEAC - Taxguru - inDocument10 pagesPresumptive Taxation - Section 44AD, 44ADA, 44AEAC - Taxguru - inFinance KRIPPLNo ratings yet

- On Tax AuditDocument148 pagesOn Tax AuditAnmol KumarNo ratings yet

- 44aa, 44ab, 44adDocument5 pages44aa, 44ab, 44adRavikumar RajamaniNo ratings yet

- Income Tax AuditDocument21 pagesIncome Tax AuditindraNo ratings yet

- Tax Audit Practical AspectDocument50 pagesTax Audit Practical AspectUMA INDUS GASNo ratings yet

- Audit Project TAX AUDITDocument34 pagesAudit Project TAX AUDITkhairejoNo ratings yet

- Computing Profits and Gains of Business On Presumptive Basis. Sec 44adDocument29 pagesComputing Profits and Gains of Business On Presumptive Basis. Sec 44adkakaNo ratings yet

- Computing Profits and Gains of Business On Presumptive Basis. Sec 44adDocument29 pagesComputing Profits and Gains of Business On Presumptive Basis. Sec 44adkakaNo ratings yet

- Presumptive Taxation: - Under Income Tax Act, 1961Document21 pagesPresumptive Taxation: - Under Income Tax Act, 1961Saksham JoshiNo ratings yet

- Taxguru - In-Presumptive Taxation Us 44AD 44ADA 44AEDocument11 pagesTaxguru - In-Presumptive Taxation Us 44AD 44ADA 44AEPandian ChakravarthyNo ratings yet

- Summary Notes Pecentage Tax On Vat Exempt Sales and Transactions Section 116, NIRCDocument2 pagesSummary Notes Pecentage Tax On Vat Exempt Sales and Transactions Section 116, NIRCalmira garciaNo ratings yet

- Income Tax Act. 1961: Click To Edit Master Subtitle StyleDocument36 pagesIncome Tax Act. 1961: Click To Edit Master Subtitle StyleVishal Dilip ShahNo ratings yet

- Tax Audit Project - FinalDocument15 pagesTax Audit Project - Finalservervcnew0% (1)

- Presumptive Income - Updated! (Section 44AD, 44ADA, 44AEDocument4 pagesPresumptive Income - Updated! (Section 44AD, 44ADA, 44AEHema joshiNo ratings yet

- Presumptive TaxationDocument11 pagesPresumptive TaxationCA Piyush JainNo ratings yet

- Chapter-10.1 Tax AuditDocument47 pagesChapter-10.1 Tax AuditJinal SanghviNo ratings yet

- TAX AUDIT PresentationDocument124 pagesTAX AUDIT PresentationCA Shivam Luthra100% (1)

- Section 44AD (Practical)Document43 pagesSection 44AD (Practical)fintech ConsultancyNo ratings yet

- Accounting Periods and Methods of AccountingDocument11 pagesAccounting Periods and Methods of Accountingmhilet_chiNo ratings yet

- Opportunities Cost AccountantsDocument37 pagesOpportunities Cost AccountantswindislifeNo ratings yet

- Audit of Sole Trader and A Small CompanyDocument14 pagesAudit of Sole Trader and A Small CompanyrupaliNo ratings yet

- Tax Audit U/s 44 AB' AY 2015-16: Bycarssharma RSRV & AssociatesDocument83 pagesTax Audit U/s 44 AB' AY 2015-16: Bycarssharma RSRV & AssociatesSunil KumarNo ratings yet

- Tax Audit RuleDocument2 pagesTax Audit RuleCA kundan kumarNo ratings yet

- AUDITDocument32 pagesAUDITVijayraj ShettyNo ratings yet

- Aoc 4Document20 pagesAoc 4Sameer DhumaleNo ratings yet

- Section 44ADDocument35 pagesSection 44ADManoj PruthiNo ratings yet

- Section - 44ABDocument1 pageSection - 44ABSANJAY PRASADNo ratings yet

- Section 44AD Advance LearningDocument36 pagesSection 44AD Advance LearningSuriyakumar ShanmugavelNo ratings yet

- Taxguru - In-Concept Meaning of Turnover in Tax AuditDocument16 pagesTaxguru - In-Concept Meaning of Turnover in Tax AuditTAX FILLINGNo ratings yet

- Chapter 4 To 6Document32 pagesChapter 4 To 6solomonaauNo ratings yet

- Income From Business or ProfessionDocument24 pagesIncome From Business or ProfessionRahulMalikNo ratings yet

- Presumptive TaxationDocument15 pagesPresumptive TaxationSuvadip PalNo ratings yet

- Operating SegmentDocument2 pagesOperating SegmentZeena Joy Caser SantiagoNo ratings yet

- UNIFEEDS TaxDocument64 pagesUNIFEEDS TaxRheneir MoraNo ratings yet

- (Section 44AA and Rule 6F) - Maintenance of AccountDocument4 pages(Section 44AA and Rule 6F) - Maintenance of Accountsukantabera215No ratings yet

- Income Under The Head Profits and Gains of BusinessDocument4 pagesIncome Under The Head Profits and Gains of Businessatul.maurya0290No ratings yet

- Recent Trends in AuditingDocument35 pagesRecent Trends in Auditinghiralalboddu100% (7)

- Tax Liability of A Firm and PartnersDocument28 pagesTax Liability of A Firm and PartnersRohitNo ratings yet

- Tax Audit RequirementDocument2 pagesTax Audit Requirementbh_mehta_06No ratings yet

- Business Income TaxDocument8 pagesBusiness Income TaxAngelica Orion PanchoNo ratings yet

- Sec.44AA I.Tax Maintenance-Of-Books-Of-AccountsDocument6 pagesSec.44AA I.Tax Maintenance-Of-Books-Of-AccountsGOPAL TULSYANNo ratings yet