Professional Documents

Culture Documents

Section A: Basic Description About The Industry Present Scenario of The Industry

Section A: Basic Description About The Industry Present Scenario of The Industry

Uploaded by

DipPaulCopyright:

Available Formats

You might also like

- Sbi Reactivate FormDocument2 pagesSbi Reactivate FormRaja100% (2)

- Hope and Other Dangerous Pursuits - Discussion GuideDocument4 pagesHope and Other Dangerous Pursuits - Discussion GuideHoughton Mifflin Harcourt0% (2)

- The Killing of James BulgerDocument2 pagesThe Killing of James BulgerNurul Mardiah0% (1)

- Cotton and Products Annual Dhaka Bangladesh 4-1-2013Document12 pagesCotton and Products Annual Dhaka Bangladesh 4-1-2013iamnahidNo ratings yet

- Bangladesh Textile Industry HighlightsDocument19 pagesBangladesh Textile Industry HighlightsTanzina HaqueNo ratings yet

- Managerial Economics: Cotton Price Movements and Its Implications On Indian Fashion and Apparel MarketDocument15 pagesManagerial Economics: Cotton Price Movements and Its Implications On Indian Fashion and Apparel MarketRahulKumbhareNo ratings yet

- An Outlook On Textile Companies in PakistanDocument5 pagesAn Outlook On Textile Companies in Pakistanmuqaddas kianiNo ratings yet

- Assignment 6 - Cotton Cloth Industry in PakistanDocument4 pagesAssignment 6 - Cotton Cloth Industry in PakistanHaider RazaNo ratings yet

- Government of Pakistan Ministry of Textile Industry: PointsDocument3 pagesGovernment of Pakistan Ministry of Textile Industry: PointsASAD ULLAHNo ratings yet

- Commodity ReportDocument8 pagesCommodity Reporthamna MalikNo ratings yet

- Pakistan Textile Industry of Pakistan: Consulate General of Switzerland - KarachiDocument19 pagesPakistan Textile Industry of Pakistan: Consulate General of Switzerland - KarachiSadia KhawajaNo ratings yet

- World Trade in Apparel and TextileDocument19 pagesWorld Trade in Apparel and TextileTanuja TakNo ratings yet

- Gul Ahmed FinalDocument14 pagesGul Ahmed FinalMuhammad Abubakr NaeemNo ratings yet

- Running Head: The Cotton Industry in Pakistan and Its Export Potential. 1Document13 pagesRunning Head: The Cotton Industry in Pakistan and Its Export Potential. 1Sarmad SubhaniNo ratings yet

- Report On KnitwearDocument5 pagesReport On KnitwearHSNo ratings yet

- Bangladesh's Home Textile Share Is Rising in Global Market: September 22, 2018Document8 pagesBangladesh's Home Textile Share Is Rising in Global Market: September 22, 2018Admay Saney CM VBD Pabna DistrictNo ratings yet

- Textile Report - EOPDocument10 pagesTextile Report - EOPmrbluefaceNo ratings yet

- Cotton FibreDocument30 pagesCotton Fibreankit161019893980No ratings yet

- The Growth of Organized Retail Is A Significant Component of India's Current Economic SituationDocument11 pagesThe Growth of Organized Retail Is A Significant Component of India's Current Economic SituationVineeth S PanickerNo ratings yet

- Pakistan Studies Final ProjectDocument11 pagesPakistan Studies Final ProjectZaryab WaheedNo ratings yet

- TEXTILESDocument4 pagesTEXTILEStina21jangidNo ratings yet

- Taare Zameen ParDocument8 pagesTaare Zameen ParAnonymous mAB7MfNo ratings yet

- Fazal ClothDocument58 pagesFazal ClothHaider Sarwar100% (4)

- Bangladesh Is A Large Contributor To The Global Textile IndustryDocument8 pagesBangladesh Is A Large Contributor To The Global Textile IndustryVvajahat AliNo ratings yet

- Ban On Cotton Export2Document4 pagesBan On Cotton Export2Abhijeet GangulyNo ratings yet

- Textile Industry of PakistanDocument12 pagesTextile Industry of PakistanTayyab Yaqoob QaziNo ratings yet

- Bangalore University - Report - Textile (1) - FinalDocument33 pagesBangalore University - Report - Textile (1) - Finalyuvaraj sNo ratings yet

- Assignment On JuteDocument12 pagesAssignment On JuteAbid hasan50% (2)

- Sri Anjaneya Cotton Mills LimitedDocument63 pagesSri Anjaneya Cotton Mills LimitedPrashanth PB50% (2)

- Research Report On Spinning Sector of Bangladesh-InitiationDocument24 pagesResearch Report On Spinning Sector of Bangladesh-InitiationjohnsumonNo ratings yet

- Pakistan Textile IndustryDocument32 pagesPakistan Textile IndustrySadaqat AliNo ratings yet

- A Crisis in Textile IndustryDocument21 pagesA Crisis in Textile Industrymmtanveer78688% (8)

- Project Presentation: Group MembersDocument18 pagesProject Presentation: Group MembersMuhammad AsimNo ratings yet

- Write UpDocument19 pagesWrite Upbhigi_palkain12479No ratings yet

- Vidya DhoptkarDocument5 pagesVidya DhoptkarHasrat Ali MansooriNo ratings yet

- Role of Cotton in PakistanDocument3 pagesRole of Cotton in PakistanUmair Mushtaq SyedNo ratings yet

- History of Pakistan Textile IndustryDocument9 pagesHistory of Pakistan Textile Industryadilkhalique100% (4)

- China's Loss Ca Be India's Gain in Textile MarketDocument3 pagesChina's Loss Ca Be India's Gain in Textile MarketAdita AgarwalNo ratings yet

- Bangladeshi Leather IndustryDocument8 pagesBangladeshi Leather IndustrySyed Nayem100% (1)

- History of Textile Production in BangladeshDocument3 pagesHistory of Textile Production in Bangladeshsamihaz02No ratings yet

- PresentationDocument19 pagesPresentationMahak GuptaNo ratings yet

- ReportDocument19 pagesReportyuvaraj sNo ratings yet

- Internship Report On Gohar TextileDocument107 pagesInternship Report On Gohar Textilesiaapa60% (5)

- Pakistan Textiles Industry Challenges and SolutionsDocument12 pagesPakistan Textiles Industry Challenges and SolutionsMuqadas RehmanNo ratings yet

- Textile Industry of PakistanDocument11 pagesTextile Industry of PakistanhannahNo ratings yet

- Problems & Prospects of Jute Industry in BangladeshDocument12 pagesProblems & Prospects of Jute Industry in Bangladeshবুলকী Syeda Bashira100% (5)

- Textile Industry PakDocument60 pagesTextile Industry PakSyed Mubarik ShahNo ratings yet

- A Study On Cost and Cost Techniques at Reid Braids India - HassanDocument58 pagesA Study On Cost and Cost Techniques at Reid Braids India - HassanSuresh100% (1)

- Textile ReportDocument15 pagesTextile ReportSANIANo ratings yet

- Spinning Mill Organizational StudyDocument37 pagesSpinning Mill Organizational Studykarthick1679100% (5)

- Textile IndustryDocument70 pagesTextile Industryalkanm750No ratings yet

- An Overview of Textile Sector (May-June 2015)Document6 pagesAn Overview of Textile Sector (May-June 2015)Elina PashaNo ratings yet

- Problems and Prospects of The Jute Product in BangladeshDocument19 pagesProblems and Prospects of The Jute Product in BangladeshSagor199492% (13)

- Cotton 06 07 ScenarioDocument2 pagesCotton 06 07 Scenarioapi-3833893No ratings yet

- Apperal IndustryDocument4 pagesApperal IndustryYaseen Nazir MallaNo ratings yet

- Cotton PricessDocument27 pagesCotton PricessAhsan SohailNo ratings yet

- 20th October, 2021 Daily Global Regional Local Rice E-NewsletterDocument110 pages20th October, 2021 Daily Global Regional Local Rice E-NewsletterMujahid AliNo ratings yet

- 20th October, 2021 Daily Global Regional Local Rice E-NewsletterDocument110 pages20th October, 2021 Daily Global Regional Local Rice E-NewsletterMujahid AliNo ratings yet

- 20th October, 2021 Daily Global Regional Local Rice E-NewsletterDocument110 pages20th October, 2021 Daily Global Regional Local Rice E-NewsletterMujahid AliNo ratings yet

- Textle Sector of PakistanDocument4 pagesTextle Sector of PakistanM.Tahir KhanNo ratings yet

- The Pakistan Textile IndustryDocument95 pagesThe Pakistan Textile IndustryMuhammad Abubakar Riaz100% (3)

- Cotton Science and Processing Technology: Gene, Ginning, Garment and Green RecyclingFrom EverandCotton Science and Processing Technology: Gene, Ginning, Garment and Green RecyclingHua WangNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets: November 2021From EverandFood Outlook: Biannual Report on Global Food Markets: November 2021No ratings yet

- Public/Private Partnerships (PPP) : How Does A PPP Work?Document4 pagesPublic/Private Partnerships (PPP) : How Does A PPP Work?DipPaulNo ratings yet

- Md. Ibrahim Khalil: CareerobjectiveDocument2 pagesMd. Ibrahim Khalil: CareerobjectiveDipPaulNo ratings yet

- Rezwana MamDocument1 pageRezwana MamDipPaulNo ratings yet

- Business Plan Delight Ice-CreamDocument49 pagesBusiness Plan Delight Ice-CreamDipPaul100% (3)

- Distributes Interactive Software Worldwide For Video Game Systems, Personal Computers, Wireless Devices and The InternetDocument1 pageDistributes Interactive Software Worldwide For Video Game Systems, Personal Computers, Wireless Devices and The InternetDipPaulNo ratings yet

- 1 Scientific Management 1910 - 1935Document28 pages1 Scientific Management 1910 - 1935DipPaulNo ratings yet

- Engleski Jezik Seminarski RadDocument11 pagesEngleski Jezik Seminarski RadUna SavićNo ratings yet

- YÖKDİL Sosyal Deneme SınavıDocument25 pagesYÖKDİL Sosyal Deneme Sınavıahmet parlakNo ratings yet

- Okeke, Ogechi Lilian: BiodataDocument3 pagesOkeke, Ogechi Lilian: BiodatafelixNo ratings yet

- NCBTS PDFDocument41 pagesNCBTS PDFamareia yap100% (7)

- 2 - Week 2 - The Self According To PhilosophyDocument8 pages2 - Week 2 - The Self According To PhilosophySteve RogersNo ratings yet

- Memorial by Kriti KhokharDocument15 pagesMemorial by Kriti KhokharRishabh Jain0% (1)

- Julius Caesar Act I TestDocument2 pagesJulius Caesar Act I TestKalyn PerkinsNo ratings yet

- Chapter 3 Ins200Document11 pagesChapter 3 Ins2002024985375No ratings yet

- Bootcamp Invite Letter For Schools - Metro ManilaDocument4 pagesBootcamp Invite Letter For Schools - Metro ManilaMaryGraceBolambaoCuynoNo ratings yet

- INTESTATE TESTATE OF TEOFILO vs. PSCDocument2 pagesINTESTATE TESTATE OF TEOFILO vs. PSCTine NetNo ratings yet

- 3 1 2 A LanduseanddevelopmentDocument6 pages3 1 2 A Landuseanddevelopmentapi-276367162No ratings yet

- Ibn 'Arabi in The Later Islamic TraditionDocument444 pagesIbn 'Arabi in The Later Islamic Traditionqairul muzzammil100% (3)

- 10 PH2672 40 StkupDocument3 pages10 PH2672 40 StkupSasan Abbasi100% (1)

- Advisory Circular: U.S. Department of TransportationDocument22 pagesAdvisory Circular: U.S. Department of TransportationlocoboeingNo ratings yet

- Notice No. 08-2022 2nd Phase of Advt. No. 02-2022Document10 pagesNotice No. 08-2022 2nd Phase of Advt. No. 02-2022Sagar KumarNo ratings yet

- Process of Credit Adjustment in Your Loan AccountDocument2 pagesProcess of Credit Adjustment in Your Loan Accountankit Raghuvanshi100% (1)

- NN47227-102 08 01 Quick Start Configuration VOSSDocument59 pagesNN47227-102 08 01 Quick Start Configuration VOSSMarko MatićNo ratings yet

- SRC, Ppsa, LocDocument7 pagesSRC, Ppsa, LocKLNo ratings yet

- Final Issue Exploration EssayDocument6 pagesFinal Issue Exploration Essayapi-233205686No ratings yet

- Principios Matematicos de La HidraulicaDocument35 pagesPrincipios Matematicos de La HidraulicaNieves Olmos Ballesta100% (1)

- Action Plan RD-ELCDocument7 pagesAction Plan RD-ELCedenespejo1No ratings yet

- Shifting Intersections: Fluidity of Gender and Race in Chimamanda Ngozi Adichie's AmericanahDocument3 pagesShifting Intersections: Fluidity of Gender and Race in Chimamanda Ngozi Adichie's AmericanahSirley LewisNo ratings yet

- Edgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsDocument152 pagesEdgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsConstantin Clement VNo ratings yet

- Tutorial 4Document3 pagesTutorial 4Puvithera A/P GunasegaranNo ratings yet

- Critique DraftDocument4 pagesCritique DraftJuan HenesisNo ratings yet

- Fringes M IVDocument20 pagesFringes M IVrandomman5632No ratings yet

- UPDocument178 pagesUPDeepika Darkhorse ProfessionalsNo ratings yet

Section A: Basic Description About The Industry Present Scenario of The Industry

Section A: Basic Description About The Industry Present Scenario of The Industry

Uploaded by

DipPaulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Section A: Basic Description About The Industry Present Scenario of The Industry

Section A: Basic Description About The Industry Present Scenario of The Industry

Uploaded by

DipPaulCopyright:

Available Formats

Section A: Basic Description about the industry

Present scenario of the industry

Bangladesh may overtake China as the world's biggest cotton importer in the current crop

season thanks to strong demand from apparel makers, according to data from the US

Department of Agriculture.

In the year ending July 31, 2016, Bangladesh may import a record 5.75 million bales of the

fibre, up 6.5 percent from a year earlier, said the USDA last week. One bale weighs 480

pounds, or 218 kilograms. China is projected to import 5.5 million bales, the lowest since

2003, according to Bloomberg.

Bangladesh's share of the global cotton-export market doubled from 1995 to 2012, mostly

because of the strong performance of the garment sector, the World Bank said in an October

report.

Importance of the industry in national economy

Cotton plays a key role our national economy in term of generating direct and indirect

employment in the Agricultural and Industrial sectors. Textile and Garment industries

constitute the largest manufacturing sub-sector in Bangladesh's economy. It employs over 4.5

million people which accounts for 10.5% of the national GDP with 40% of manufacturing

value addition. 75% of total export earning comes from Textile Sector. Bangladesh ranks as

5th largest apparel exporter to USA after China, Vietnam, Mexico and Indonesia. Export

value of Textile Sector is $10.7 billion US$ of which $6.74 billion goes to EU, $2.60 billion

to US and $1.36 billion to rest of the world.

Cotton is the second important cash crops in Bangladesh after Jute. It is the main raw

materials of Textile industry. Annual requirement of raw cotton for textile industry of

Bangladesh is approx. 4 million bales. Around 3% of the national requirement is fulfilled

through the local production (nearly 0.1 million bales) from 40 thousand hectares of land and

remaining 97% requirement is fulfilled by importing raw cotton from Uzbekistan, Pakistan,

India, Brazil, Turkmenistan and from African countries (BCA, 2010). The present yield of

cotton per hectare is lower in comparison to other cotton growing countries. The productivity

of cotton in Bangladesh is only 450 kg lint ha-1 against the world average of 556 kg lint ha-1.

Recent import trend of the industry

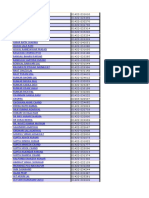

Cotton import by year

Cotton import in Bangladesh has been rapidly increasing by each year. From 1991 to 1993

there was a bit fall of import, but from 1994 to 2010 the import rate was dramatically

increased then fell again in 2011. From 2012 to 2016 the growth was exponential. A list of the

percentage and the amount of import are given in the next page.

Amount of import and percentage

Major Import destitanion of the industry

Bangladesh has to import almost all its cotton requirements to feed its spinning industry. In

2010 seasons, Bangladesh reportedly imported 827,000 Metric Tons 170-Kg bales from

different countries of which prominent import sources are Uzbekistan-42 %, India-22 %,

Africa-10 %, U.S.A-11 % and Pakistan7%.

Import Trade Matrix

Source: USDA

2010 cotton imports has reached 3.82 million bales (827,000 tons); an increase of 11.26

percent compared to previous year, due to competitive import prices and increased demand

from the growing spinning sub-sector. Uzbekistan continues to be the principal supplier of

raw cotton, enjoying 42 percent market share due to competitive prices and a short delivery

period. India has also emerged as a major supplier of raw cotton due to its price

competitiveness and geographical proximity. The share of U.S. raw cotton in the Bangladesh

import market has increased to about 11 in MY 2009/10 due to the new generation spinning

mills coming into operation, which prefer the high quality of US cotton. However, U.S.

cotton prices will have to remain competitive to offset the freight advantage and shorter

delivery periods enjoyed by neighboring suppliers.

You might also like

- Sbi Reactivate FormDocument2 pagesSbi Reactivate FormRaja100% (2)

- Hope and Other Dangerous Pursuits - Discussion GuideDocument4 pagesHope and Other Dangerous Pursuits - Discussion GuideHoughton Mifflin Harcourt0% (2)

- The Killing of James BulgerDocument2 pagesThe Killing of James BulgerNurul Mardiah0% (1)

- Cotton and Products Annual Dhaka Bangladesh 4-1-2013Document12 pagesCotton and Products Annual Dhaka Bangladesh 4-1-2013iamnahidNo ratings yet

- Bangladesh Textile Industry HighlightsDocument19 pagesBangladesh Textile Industry HighlightsTanzina HaqueNo ratings yet

- Managerial Economics: Cotton Price Movements and Its Implications On Indian Fashion and Apparel MarketDocument15 pagesManagerial Economics: Cotton Price Movements and Its Implications On Indian Fashion and Apparel MarketRahulKumbhareNo ratings yet

- An Outlook On Textile Companies in PakistanDocument5 pagesAn Outlook On Textile Companies in Pakistanmuqaddas kianiNo ratings yet

- Assignment 6 - Cotton Cloth Industry in PakistanDocument4 pagesAssignment 6 - Cotton Cloth Industry in PakistanHaider RazaNo ratings yet

- Government of Pakistan Ministry of Textile Industry: PointsDocument3 pagesGovernment of Pakistan Ministry of Textile Industry: PointsASAD ULLAHNo ratings yet

- Commodity ReportDocument8 pagesCommodity Reporthamna MalikNo ratings yet

- Pakistan Textile Industry of Pakistan: Consulate General of Switzerland - KarachiDocument19 pagesPakistan Textile Industry of Pakistan: Consulate General of Switzerland - KarachiSadia KhawajaNo ratings yet

- World Trade in Apparel and TextileDocument19 pagesWorld Trade in Apparel and TextileTanuja TakNo ratings yet

- Gul Ahmed FinalDocument14 pagesGul Ahmed FinalMuhammad Abubakr NaeemNo ratings yet

- Running Head: The Cotton Industry in Pakistan and Its Export Potential. 1Document13 pagesRunning Head: The Cotton Industry in Pakistan and Its Export Potential. 1Sarmad SubhaniNo ratings yet

- Report On KnitwearDocument5 pagesReport On KnitwearHSNo ratings yet

- Bangladesh's Home Textile Share Is Rising in Global Market: September 22, 2018Document8 pagesBangladesh's Home Textile Share Is Rising in Global Market: September 22, 2018Admay Saney CM VBD Pabna DistrictNo ratings yet

- Textile Report - EOPDocument10 pagesTextile Report - EOPmrbluefaceNo ratings yet

- Cotton FibreDocument30 pagesCotton Fibreankit161019893980No ratings yet

- The Growth of Organized Retail Is A Significant Component of India's Current Economic SituationDocument11 pagesThe Growth of Organized Retail Is A Significant Component of India's Current Economic SituationVineeth S PanickerNo ratings yet

- Pakistan Studies Final ProjectDocument11 pagesPakistan Studies Final ProjectZaryab WaheedNo ratings yet

- TEXTILESDocument4 pagesTEXTILEStina21jangidNo ratings yet

- Taare Zameen ParDocument8 pagesTaare Zameen ParAnonymous mAB7MfNo ratings yet

- Fazal ClothDocument58 pagesFazal ClothHaider Sarwar100% (4)

- Bangladesh Is A Large Contributor To The Global Textile IndustryDocument8 pagesBangladesh Is A Large Contributor To The Global Textile IndustryVvajahat AliNo ratings yet

- Ban On Cotton Export2Document4 pagesBan On Cotton Export2Abhijeet GangulyNo ratings yet

- Textile Industry of PakistanDocument12 pagesTextile Industry of PakistanTayyab Yaqoob QaziNo ratings yet

- Bangalore University - Report - Textile (1) - FinalDocument33 pagesBangalore University - Report - Textile (1) - Finalyuvaraj sNo ratings yet

- Assignment On JuteDocument12 pagesAssignment On JuteAbid hasan50% (2)

- Sri Anjaneya Cotton Mills LimitedDocument63 pagesSri Anjaneya Cotton Mills LimitedPrashanth PB50% (2)

- Research Report On Spinning Sector of Bangladesh-InitiationDocument24 pagesResearch Report On Spinning Sector of Bangladesh-InitiationjohnsumonNo ratings yet

- Pakistan Textile IndustryDocument32 pagesPakistan Textile IndustrySadaqat AliNo ratings yet

- A Crisis in Textile IndustryDocument21 pagesA Crisis in Textile Industrymmtanveer78688% (8)

- Project Presentation: Group MembersDocument18 pagesProject Presentation: Group MembersMuhammad AsimNo ratings yet

- Write UpDocument19 pagesWrite Upbhigi_palkain12479No ratings yet

- Vidya DhoptkarDocument5 pagesVidya DhoptkarHasrat Ali MansooriNo ratings yet

- Role of Cotton in PakistanDocument3 pagesRole of Cotton in PakistanUmair Mushtaq SyedNo ratings yet

- History of Pakistan Textile IndustryDocument9 pagesHistory of Pakistan Textile Industryadilkhalique100% (4)

- China's Loss Ca Be India's Gain in Textile MarketDocument3 pagesChina's Loss Ca Be India's Gain in Textile MarketAdita AgarwalNo ratings yet

- Bangladeshi Leather IndustryDocument8 pagesBangladeshi Leather IndustrySyed Nayem100% (1)

- History of Textile Production in BangladeshDocument3 pagesHistory of Textile Production in Bangladeshsamihaz02No ratings yet

- PresentationDocument19 pagesPresentationMahak GuptaNo ratings yet

- ReportDocument19 pagesReportyuvaraj sNo ratings yet

- Internship Report On Gohar TextileDocument107 pagesInternship Report On Gohar Textilesiaapa60% (5)

- Pakistan Textiles Industry Challenges and SolutionsDocument12 pagesPakistan Textiles Industry Challenges and SolutionsMuqadas RehmanNo ratings yet

- Textile Industry of PakistanDocument11 pagesTextile Industry of PakistanhannahNo ratings yet

- Problems & Prospects of Jute Industry in BangladeshDocument12 pagesProblems & Prospects of Jute Industry in Bangladeshবুলকী Syeda Bashira100% (5)

- Textile Industry PakDocument60 pagesTextile Industry PakSyed Mubarik ShahNo ratings yet

- A Study On Cost and Cost Techniques at Reid Braids India - HassanDocument58 pagesA Study On Cost and Cost Techniques at Reid Braids India - HassanSuresh100% (1)

- Textile ReportDocument15 pagesTextile ReportSANIANo ratings yet

- Spinning Mill Organizational StudyDocument37 pagesSpinning Mill Organizational Studykarthick1679100% (5)

- Textile IndustryDocument70 pagesTextile Industryalkanm750No ratings yet

- An Overview of Textile Sector (May-June 2015)Document6 pagesAn Overview of Textile Sector (May-June 2015)Elina PashaNo ratings yet

- Problems and Prospects of The Jute Product in BangladeshDocument19 pagesProblems and Prospects of The Jute Product in BangladeshSagor199492% (13)

- Cotton 06 07 ScenarioDocument2 pagesCotton 06 07 Scenarioapi-3833893No ratings yet

- Apperal IndustryDocument4 pagesApperal IndustryYaseen Nazir MallaNo ratings yet

- Cotton PricessDocument27 pagesCotton PricessAhsan SohailNo ratings yet

- 20th October, 2021 Daily Global Regional Local Rice E-NewsletterDocument110 pages20th October, 2021 Daily Global Regional Local Rice E-NewsletterMujahid AliNo ratings yet

- 20th October, 2021 Daily Global Regional Local Rice E-NewsletterDocument110 pages20th October, 2021 Daily Global Regional Local Rice E-NewsletterMujahid AliNo ratings yet

- 20th October, 2021 Daily Global Regional Local Rice E-NewsletterDocument110 pages20th October, 2021 Daily Global Regional Local Rice E-NewsletterMujahid AliNo ratings yet

- Textle Sector of PakistanDocument4 pagesTextle Sector of PakistanM.Tahir KhanNo ratings yet

- The Pakistan Textile IndustryDocument95 pagesThe Pakistan Textile IndustryMuhammad Abubakar Riaz100% (3)

- Cotton Science and Processing Technology: Gene, Ginning, Garment and Green RecyclingFrom EverandCotton Science and Processing Technology: Gene, Ginning, Garment and Green RecyclingHua WangNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets: November 2021From EverandFood Outlook: Biannual Report on Global Food Markets: November 2021No ratings yet

- Public/Private Partnerships (PPP) : How Does A PPP Work?Document4 pagesPublic/Private Partnerships (PPP) : How Does A PPP Work?DipPaulNo ratings yet

- Md. Ibrahim Khalil: CareerobjectiveDocument2 pagesMd. Ibrahim Khalil: CareerobjectiveDipPaulNo ratings yet

- Rezwana MamDocument1 pageRezwana MamDipPaulNo ratings yet

- Business Plan Delight Ice-CreamDocument49 pagesBusiness Plan Delight Ice-CreamDipPaul100% (3)

- Distributes Interactive Software Worldwide For Video Game Systems, Personal Computers, Wireless Devices and The InternetDocument1 pageDistributes Interactive Software Worldwide For Video Game Systems, Personal Computers, Wireless Devices and The InternetDipPaulNo ratings yet

- 1 Scientific Management 1910 - 1935Document28 pages1 Scientific Management 1910 - 1935DipPaulNo ratings yet

- Engleski Jezik Seminarski RadDocument11 pagesEngleski Jezik Seminarski RadUna SavićNo ratings yet

- YÖKDİL Sosyal Deneme SınavıDocument25 pagesYÖKDİL Sosyal Deneme Sınavıahmet parlakNo ratings yet

- Okeke, Ogechi Lilian: BiodataDocument3 pagesOkeke, Ogechi Lilian: BiodatafelixNo ratings yet

- NCBTS PDFDocument41 pagesNCBTS PDFamareia yap100% (7)

- 2 - Week 2 - The Self According To PhilosophyDocument8 pages2 - Week 2 - The Self According To PhilosophySteve RogersNo ratings yet

- Memorial by Kriti KhokharDocument15 pagesMemorial by Kriti KhokharRishabh Jain0% (1)

- Julius Caesar Act I TestDocument2 pagesJulius Caesar Act I TestKalyn PerkinsNo ratings yet

- Chapter 3 Ins200Document11 pagesChapter 3 Ins2002024985375No ratings yet

- Bootcamp Invite Letter For Schools - Metro ManilaDocument4 pagesBootcamp Invite Letter For Schools - Metro ManilaMaryGraceBolambaoCuynoNo ratings yet

- INTESTATE TESTATE OF TEOFILO vs. PSCDocument2 pagesINTESTATE TESTATE OF TEOFILO vs. PSCTine NetNo ratings yet

- 3 1 2 A LanduseanddevelopmentDocument6 pages3 1 2 A Landuseanddevelopmentapi-276367162No ratings yet

- Ibn 'Arabi in The Later Islamic TraditionDocument444 pagesIbn 'Arabi in The Later Islamic Traditionqairul muzzammil100% (3)

- 10 PH2672 40 StkupDocument3 pages10 PH2672 40 StkupSasan Abbasi100% (1)

- Advisory Circular: U.S. Department of TransportationDocument22 pagesAdvisory Circular: U.S. Department of TransportationlocoboeingNo ratings yet

- Notice No. 08-2022 2nd Phase of Advt. No. 02-2022Document10 pagesNotice No. 08-2022 2nd Phase of Advt. No. 02-2022Sagar KumarNo ratings yet

- Process of Credit Adjustment in Your Loan AccountDocument2 pagesProcess of Credit Adjustment in Your Loan Accountankit Raghuvanshi100% (1)

- NN47227-102 08 01 Quick Start Configuration VOSSDocument59 pagesNN47227-102 08 01 Quick Start Configuration VOSSMarko MatićNo ratings yet

- SRC, Ppsa, LocDocument7 pagesSRC, Ppsa, LocKLNo ratings yet

- Final Issue Exploration EssayDocument6 pagesFinal Issue Exploration Essayapi-233205686No ratings yet

- Principios Matematicos de La HidraulicaDocument35 pagesPrincipios Matematicos de La HidraulicaNieves Olmos Ballesta100% (1)

- Action Plan RD-ELCDocument7 pagesAction Plan RD-ELCedenespejo1No ratings yet

- Shifting Intersections: Fluidity of Gender and Race in Chimamanda Ngozi Adichie's AmericanahDocument3 pagesShifting Intersections: Fluidity of Gender and Race in Chimamanda Ngozi Adichie's AmericanahSirley LewisNo ratings yet

- Edgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsDocument152 pagesEdgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsConstantin Clement VNo ratings yet

- Tutorial 4Document3 pagesTutorial 4Puvithera A/P GunasegaranNo ratings yet

- Critique DraftDocument4 pagesCritique DraftJuan HenesisNo ratings yet

- Fringes M IVDocument20 pagesFringes M IVrandomman5632No ratings yet

- UPDocument178 pagesUPDeepika Darkhorse ProfessionalsNo ratings yet