Professional Documents

Culture Documents

No Escaping The Taxman: PAN Must, I-T Notices On Dubious Deposits, Property Buys

No Escaping The Taxman: PAN Must, I-T Notices On Dubious Deposits, Property Buys

Uploaded by

ramprasadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

No Escaping The Taxman: PAN Must, I-T Notices On Dubious Deposits, Property Buys

No Escaping The Taxman: PAN Must, I-T Notices On Dubious Deposits, Property Buys

Uploaded by

ramprasadCopyright:

Available Formats

1 of 2

http://www.business-standard.com/article/printer-friendly-version?arti...

No escaping the taxman: PAN must, I-T notices

on dubious deposits, property buys

All banks will have to report to I-T dept on deposits above Rs 2.5 lakh in savings accounts

BS Web Team | New Delhi November 17, 2016 Last Updated at 09:30 IST

The

People queue up outside an ATM in New Delhi (Pic: Dalip Kumar)

government on Wednesday asked banks and post offices to report to the Income Tax Department all

deposits above Rs 2.5 lakh in savings accounts, and those in excess of Rs 12.5 lakh in current accounts,

made during the 50-day window for depositing demonetised high value notes.Banks and post offices now

have to file a relevant statement of financial transaction on or before January 31, 2017, the notification

said.

The Reserve Bank of India has asked banks to ensure customers submit a copy of PAN card for any cash

deposit exceeding Rs 50,000, if it is not already seeded with the account, to ensure tax rule compliance in

the wake of the recent decision to abolish Rs 500 and Rs 1,000 notes.

PAN required if combined cash deposits exceed Rs 2.5 lakh till December 30: Up until now, the limit

for cash deposit without PAN was Rs 50,000 per transaction. A lot of people were depositing less than Rs

50,000 per day to escape the PAN provision. But a circular issued on Tuesday says deposits made

17-Nov-2016 02:16 PM

2 of 2

http://www.business-standard.com/article/printer-friendly-version?arti...

between 9 Nov and 30 Dec 2016 will require a PAN if the combined sum exceeds Rs 2.5 lakh.

The government has been keeping a close vigil on the kind of deposits in bank accounts following the

recent demonetisation order and those who will deposit over Rs 2.5 lakh in cash will be scrutinised.

I-T lens on current account deposits over Rs 12.5 lakh

The Central Board of Direct Taxes (CBDT) has amended rules in the Income Tax Act and asked banks to

furnish a statement of financial transaction in one or more current accounts of a person for cash deposits

of Rs 12.5 lakh and above between November 9 and December 30.The CBDT's notification on November

15 also said that for all accounts except current accounts, banks would have to submit details of persons

depositing Rs 2.5 lakh and above for all accounts except current accounts

Taxmen preparing for swoop on dubious depositors post Dec 30

Come 2017, and the Income Tax department is preparing to serve notices on all those now depositing

money in banks that is disproportionate to their known sources of income. Informed sources said the

department will start serving the notices just after December 30 -- the deadline set by the central

government to deposit and exchange the demonetised Rs 500 and 1,000 notes. The Income Tax

department started preparing the notices from November 10 -- when banks opened across the country

after a day's closure following the demonetisation announcement.The notices will go to those who have

deposited or received cash in their accounts more than double their income.

Also being tracked are ash dealings and property purchases by suspicious account holdersThe

transactions under the tax lens include cash deposits of Rs 2.5 lakh or more in a savings bank account and

sale or purchase of immovable property valued at Rs 30 lakh or more.

Income tax notices to religious, charitable trusts: The Income-tax department has issued letter to dozen

of religious and charitable trusts, asking them to furnish details of cash balances as on November 8,

following the demonetisation of Rs 500 and Rs 1,000 currency notes.According to notice, the trust and

societies has been asked to submit cash balances as per their books of accounts as on 31 March up to 8

November to this office, it said. The notice also advises the management of such institutions not to deal

with Rs 1,000 and Rs 500 notes, by either accepting cash or paying in cash for any of your activities after

November 8, 2016.

Builders not spared either: The Income Tax department on Wednesday surveyed some real estate

players in the national Capital region to check reports of alleged profiteering and tax evasion by these

entities while converting the recently demonetised currency notes. Officials said the department

conducted the exercise on at least four such entities in the Delhi-NCR region and visited over

half-a-dozen premises. They said the tax sleuths made an inventory of cash and sale documents at these

locations and checked sale documents.The department, since last week, had detected unexplained cash

and sales worth Rs 100 crore in a similar crackdown by traders, jewellers and other operators while

converting demonetised currency notes.

Raids on jewellers: The tax department has surveyed various cities like Karnataka, Kolkata, Goa and

Mumbai and made significant recoveries. In the past week over 600 jewellers and 100 money exchangers

were sent notices by tax authorities to check illegal use of old currency. In Goa, a jeweler in Panaji was

caught with Rs. 90 lakh in cash and jewellery stocks. He was from Mumbai and sold jewelry worth Rs. 45

lakh to a client in Goa.Over 4 crores was found during raids in Bengal.

17-Nov-2016 02:16 PM

You might also like

- Project Proposal For G+7 Mixed Use BuildingDocument24 pagesProject Proposal For G+7 Mixed Use BuildingJoey MW95% (61)

- Chapter 7 - 12thEDITIONDocument22 pagesChapter 7 - 12thEDITIONHyewon50% (2)

- Project For Taxation LawDocument11 pagesProject For Taxation Lawtanmaya guptaNo ratings yet

- Regulatory Guide to Money Transmission & Payment Laws in the U.S.From EverandRegulatory Guide to Money Transmission & Payment Laws in the U.S.No ratings yet

- DA4387 Level I CFA Mock Exam 2018 Morning ADocument37 pagesDA4387 Level I CFA Mock Exam 2018 Morning AAisyah Amatul Ghina100% (1)

- Total Quality Management at HDFC BankDocument24 pagesTotal Quality Management at HDFC BankGarima GuptaNo ratings yet

- Accounting Assignments Week 1Document12 pagesAccounting Assignments Week 1Taufan Putra100% (1)

- Demonetisation Explained and NotificationsDocument31 pagesDemonetisation Explained and Notificationsaanchal singhNo ratings yet

- GaneDocument2 pagesGaneGeetanjali NainaNo ratings yet

- Demonetisation: Prime Minister of India Narendra ModiDocument9 pagesDemonetisation: Prime Minister of India Narendra ModiShashank AgrawalNo ratings yet

- Current Affairs 2017Document43 pagesCurrent Affairs 2017BaskarBossYuvanRomeo'zNo ratings yet

- Rs.500, RsDocument6 pagesRs.500, Rsanjana9No ratings yet

- Imp 2 PDFDocument86 pagesImp 2 PDFDebabrato SasmalNo ratings yet

- Imp 2 PDFDocument86 pagesImp 2 PDFDebabrato SasmalNo ratings yet

- M.seeni Ahamed Vs The Union of India On 10 November, 2016Document10 pagesM.seeni Ahamed Vs The Union of India On 10 November, 2016Surender SinghNo ratings yet

- DemonetisationDocument9 pagesDemonetisationchinuuu85br0% (1)

- Canvass: Capturing News With An Analytical EdgeDocument6 pagesCanvass: Capturing News With An Analytical EdgeRanjith RoshanNo ratings yet

- W.P. (MD) .No.21634 of 2016 and W.M.P. (MD) Nos.15454 To 15456 of 2016Document29 pagesW.P. (MD) .No.21634 of 2016 and W.M.P. (MD) Nos.15454 To 15456 of 2016Chitresh BahetiNo ratings yet

- Things To RemeberDocument19 pagesThings To Remebermammas collectionNo ratings yet

- Demon Et IzationDocument16 pagesDemon Et Izationashlesha tripathiNo ratings yet

- So Why Were Rs 500 and Rs 1000 Bank Notes Demonetized?: Currency Legal Tender National CurrencyDocument19 pagesSo Why Were Rs 500 and Rs 1000 Bank Notes Demonetized?: Currency Legal Tender National CurrencyAbhay SharmaNo ratings yet

- 2016 Indian Banknote DemonetisationDocument30 pages2016 Indian Banknote Demonetisation2003abhaypandeyNo ratings yet

- Have A TIN? Get Ready To File Tax Return: Sohel ParvezDocument3 pagesHave A TIN? Get Ready To File Tax Return: Sohel ParvezSmith DavidNo ratings yet

- From press-to-ATM - How Money Travels - The Indian ExpressDocument14 pagesFrom press-to-ATM - How Money Travels - The Indian ExpressImad ImadNo ratings yet

- The KnowledgeDocument13 pagesThe KnowledgeRahil AfricawalaNo ratings yet

- A Project Report On Concept of Demonetization "Effect and Causes"Document31 pagesA Project Report On Concept of Demonetization "Effect and Causes"Ashwani kumarNo ratings yet

- Paradox of Grift: Why Old Notes That The Poor Off-Loaded at A Discount Finally Sold at A PremiumDocument3 pagesParadox of Grift: Why Old Notes That The Poor Off-Loaded at A Discount Finally Sold at A PremiumDILLIP KUMAR MAHAPATRANo ratings yet

- Nicholas Cage Has Pretty Much Given Up On His Son. Here's .. DetonateDocument2 pagesNicholas Cage Has Pretty Much Given Up On His Son. Here's .. DetonatesunaifctmNo ratings yet

- DemonetisationDocument24 pagesDemonetisationcharandeep82% (11)

- GA Refresher January 2017Document60 pagesGA Refresher January 2017ajay kumarNo ratings yet

- MoneyDocument2 pagesMoneysunaifctmNo ratings yet

- Bank PaperDocument16 pagesBank Paperx menNo ratings yet

- Ayush PPT DemonetizationDocument15 pagesAyush PPT DemonetizationAYUSH MAHAJANNo ratings yet

- Rbi Report On DemonetisationDocument2 pagesRbi Report On DemonetisationshaktiNo ratings yet

- 10-04-2023Document9 pages10-04-2023sugankumar99No ratings yet

- Log Book Daily Work DoneDocument5 pagesLog Book Daily Work DoneGhulam MustufaNo ratings yet

- 2.2 Introduction To DemonitizationDocument5 pages2.2 Introduction To DemonitizationAshwanth .d chandranNo ratings yet

- Demonitizatin On Consumer Behaviour FMCGDocument52 pagesDemonitizatin On Consumer Behaviour FMCGMohit Agarwal88% (8)

- Note Pe Charcha White Paper 2Document4 pagesNote Pe Charcha White Paper 2Anonymous hwI1OZ56ENo ratings yet

- Manarat International University: Assignment OnDocument7 pagesManarat International University: Assignment Onzaf017100% (1)

- Prize Bond UnitDocument12 pagesPrize Bond UnitMuhammad IhsanNo ratings yet

- 20.12.22 - Morning Financial News UpdatesDocument5 pages20.12.22 - Morning Financial News UpdatesMeet SeshuNo ratings yet

- 16.11.2023 - The Banking FrontlineDocument7 pages16.11.2023 - The Banking Frontlineservice.chennaiboiNo ratings yet

- Eco Term PaperDocument16 pagesEco Term PaperRoshaniNo ratings yet

- Askari AssignmentDocument7 pagesAskari AssignmentSabih TariqNo ratings yet

- Monthly News Letter 01.12.10 To 31.12.10Document6 pagesMonthly News Letter 01.12.10 To 31.12.10poojaapandeyNo ratings yet

- Demon Et IzationDocument54 pagesDemon Et Izationtazeentaj2501No ratings yet

- Demonetisation of Rs. 500 and Rs 1000Document4 pagesDemonetisation of Rs. 500 and Rs 1000Pawan BhattaNo ratings yet

- SNAPSHOTMCRDocument374 pagesSNAPSHOTMCRcandeva2007No ratings yet

- Latest in BankingDocument11 pagesLatest in Bankingbrightlight1989No ratings yet

- Part Ii-Detailed Observations and RecommendationsDocument32 pagesPart Ii-Detailed Observations and RecommendationsAlicia NhsNo ratings yet

- 6 High-Value Cash Transactions That Can Get You An Income Tax NoticeDocument2 pages6 High-Value Cash Transactions That Can Get You An Income Tax NoticeNaga LingamNo ratings yet

- Presentation By: Chartered Accountant No. 248, 3 Main Road, Chamrajpet, Bangalore - 560 018Document404 pagesPresentation By: Chartered Accountant No. 248, 3 Main Road, Chamrajpet, Bangalore - 560 018AATISH BANKANo ratings yet

- Banking News: December 1, 2016: Bank Unions Demand Adequate Currency Notes To Meet Cash Needs of The PublicDocument32 pagesBanking News: December 1, 2016: Bank Unions Demand Adequate Currency Notes To Meet Cash Needs of The PublicbuharimNo ratings yet

- Impact of Demonetization On The Indian Economy - ArticleDocument8 pagesImpact of Demonetization On The Indian Economy - ArticleDeepak Rao RaoNo ratings yet

- Cpa Review Auditing ProblemsDocument16 pagesCpa Review Auditing ProblemsMellinia MantesNo ratings yet

- Demonetization in IndiaDocument27 pagesDemonetization in IndiaRoop MajithiaNo ratings yet

- Commented (S1) : Review The TitleDocument2 pagesCommented (S1) : Review The TitleshivankdalmiaNo ratings yet

- Press Information Bureau Government of IndiaDocument3 pagesPress Information Bureau Government of IndiazahidNo ratings yet

- Submitted By: Megha Bepari (PGP/20/330) Neelansh Khurana (PGP/20/334)Document3 pagesSubmitted By: Megha Bepari (PGP/20/330) Neelansh Khurana (PGP/20/334)Megha BepariNo ratings yet

- CCE - ClassificationDocument20 pagesCCE - ClassificationCatherine CaleroNo ratings yet

- Notes On Ruppe and DigitalisationDocument23 pagesNotes On Ruppe and DigitalisationsanjayNo ratings yet

- For Billing Enquiry Visit Https://selfcare - Tikona.inDocument1 pageFor Billing Enquiry Visit Https://selfcare - Tikona.incyberabadNo ratings yet

- Paper 19 PDFDocument3 pagesPaper 19 PDFWashim Alam50CNo ratings yet

- Awareness 07Document1 pageAwareness 07ALi ShAhNo ratings yet

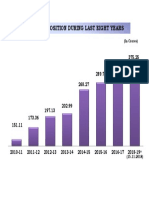

- Deposits Borrowings Average Cost of Funds: Financial Margin 1.81Document2 pagesDeposits Borrowings Average Cost of Funds: Financial Margin 1.81ramprasadNo ratings yet

- Presentation 1Document1 pagePresentation 1ramprasadNo ratings yet

- System Bus Structure: Minimum Mode 8086 Pin ConfigurationsDocument89 pagesSystem Bus Structure: Minimum Mode 8086 Pin ConfigurationsramprasadNo ratings yet

- Deposits Borrowings Average Cost of Funds: Financial Margin 1.81Document2 pagesDeposits Borrowings Average Cost of Funds: Financial Margin 1.81ramprasadNo ratings yet

- Service Report 84416096361 20210225Document1 pageService Report 84416096361 20210225ramprasadNo ratings yet

- Presentation New - 019Document1 pagePresentation New - 019ramprasadNo ratings yet

- Presentation 13333Document7 pagesPresentation 13333ramprasadNo ratings yet

- Developing PACS As Multi Service Center Workshop OnDocument6 pagesDeveloping PACS As Multi Service Center Workshop OnramprasadNo ratings yet

- PACS Shall Issue Deposit Receipts To MembersDocument5 pagesPACS Shall Issue Deposit Receipts To MembersramprasadNo ratings yet

- Total Advances: Impaired AdvancesDocument4 pagesTotal Advances: Impaired AdvancesramprasadNo ratings yet

- Presentation 1987456Document1 pagePresentation 1987456ramprasadNo ratings yet

- QbankDocument15 pagesQbankramprasadNo ratings yet

- Milk CostDocument1 pageMilk CostramprasadNo ratings yet

- Presentation 1Document1 pagePresentation 1ramprasadNo ratings yet

- Importance of PAN CardDocument1 pageImportance of PAN CardramprasadNo ratings yet

- Chapter 10 Making Capital Investment DecisionsDocument15 pagesChapter 10 Making Capital Investment DecisionsHồng HạnhNo ratings yet

- CH 14Document45 pagesCH 14jjupark2004No ratings yet

- Unit of Study Outline FINC2012bDocument8 pagesUnit of Study Outline FINC2012bMichaelTimothy0% (1)

- Gcse Business Revision Notes.Document45 pagesGcse Business Revision Notes.Den Tan015No ratings yet

- Cadbury ProjectDocument46 pagesCadbury Projectchinmay parsekarNo ratings yet

- BankingDocument50 pagesBankingKishore MallarapuNo ratings yet

- Accountancy ModelDocument124 pagesAccountancy ModelJose' YesoNo ratings yet

- Accounting 61 (Government Accounting & Npngo) : Jose Rizal UniversityDocument4 pagesAccounting 61 (Government Accounting & Npngo) : Jose Rizal UniversityGreg DomingoNo ratings yet

- Unipol PPDocument12 pagesUnipol PPyamakun100% (2)

- Report On Silk BankDocument85 pagesReport On Silk BankOsama AhmedNo ratings yet

- Exercise 3: 1. Initial Capital Investments (Compound Entry) DR CRDocument4 pagesExercise 3: 1. Initial Capital Investments (Compound Entry) DR CRasdfNo ratings yet

- Islamic Leadership Academy Course DescriptionDocument9 pagesIslamic Leadership Academy Course DescriptionRudewaan ArendseNo ratings yet

- The Global State of Family OfficesDocument20 pagesThe Global State of Family Officesmarianneowy100% (2)

- Leveraged FinanceDocument1 pageLeveraged Financeoogle12345No ratings yet

- Bill Gates PortfolioDocument33 pagesBill Gates PortfolioCarlCord100% (1)

- 1083full Download PDF of Bank Management and Financial Services Rose 9th Edition Test Bank All ChapterDocument57 pages1083full Download PDF of Bank Management and Financial Services Rose 9th Edition Test Bank All Chapterviaamhianja100% (5)

- TYBAF Amit Santosh Kanade Roll No. 2 Div. A (VP) Black BookDocument82 pagesTYBAF Amit Santosh Kanade Roll No. 2 Div. A (VP) Black BookÂmît JâdhâvNo ratings yet

- 10-1108 - Ijmf-12-2014-0187 (Jurnal Audit)Document21 pages10-1108 - Ijmf-12-2014-0187 (Jurnal Audit)indri retnoningtyasNo ratings yet

- Peoples Leasing Co. IPODocument18 pagesPeoples Leasing Co. IPOLBTodayNo ratings yet

- Valuation of SecuritiesDocument14 pagesValuation of SecuritiesMANISH28COOLNo ratings yet

- Capital+budgeting SolvedDocument22 pagesCapital+budgeting SolvedutamiNo ratings yet

- Category Attractiveness Analysis of WatchesDocument8 pagesCategory Attractiveness Analysis of WatchesCharmimgParthaNo ratings yet

- Allard Growth Fund December 2016Document3 pagesAllard Growth Fund December 2016James HoNo ratings yet

- Expense StudyDocument21 pagesExpense StudyIotalaseria PutuNo ratings yet

- Multiple ChoiceDocument6 pagesMultiple Choicetough mamaNo ratings yet