Professional Documents

Culture Documents

Sales Note Sangam India 021215

Sales Note Sangam India 021215

Uploaded by

Rajasekhar Reddy AnekalluOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales Note Sangam India 021215

Sales Note Sangam India 021215

Uploaded by

Rajasekhar Reddy AnekalluCopyright:

Available Formats

Equity | India |Textile

Sales

Note

Sangam (India) Ltd.

Company Snapshot

CMP (`)

Target (`)

292

345

Potential upside

Absolute Rating

18%

BUY

Market Info (as on 2nd December 2015)

BSE Sensex

26118

Nifty S&P

7931

Stock Detail

B

BSE Group

BSE Code

514234

NSE Code

SANGAMIND

Bloomberg Code

SNGM IN

Market Cap (`bn)

11.32bn

Free Float (%)

5.66

52wk Hi/Low

299/68

Avg. Daily Volume (NSE)

105086

Face Value / Div. per share (`)

10.00/2.00

Shares Outstanding (mn)

39.4

Shareholding Pattern

Promoters

FIIs

DII

Others

47.35

3.00

4.03

45.62

Financial Snapshot

Sangam India is the flagship company of Sangam group & a Rajasthan based, leading manufacturer

of PV (Polyester Viscose) yarn in India. Company is one of the market leaders in PV dyed yarn with

25% market share. The company is also present in the Indian synthetic blended fabric and denim

segments with brands such as Sangam Suitings and Sangam Denim. The companys client base

includes Raymond, RSWM, Banswara Syntex, Donear, Siyaram and Grasim. It has a network of 100

dealers and 1,000 retailers across India. Sangams manufacturing facilities are located in Bhilwara,

Rajasthan. As of FY15, the company has a spinning capacity of 211,296 spindles and 3,128 rotors;

weaving capacity of 437 looms; and processing capacity of 53 mn meters P.A. Company also has a

good presence in export markets with export revenue contributes around 22%.

Investment Rationale

Foray into Seamless Wear Garment Segment

Company recently forayed into the seamless wear garment segment under its own brand Name

Channel Nine. Channel Nine offers wide range of the woman products including intimate wear,

shape wear, medical wear, active wear, casual wear and nightwear. In order to ensure best quality

products, company imported innovative seamless technology from Italy. Company has built up

manufacturing capacity of 3.6mn pieces p.a. with 36 seamless knitting machines. Channel Nine is

companys first direct to consumer brand i.e. B2C mode & this will pave way for improving margins

going forward. Company has already expanded its footprint across 600 multi brand outlets across

India & looking to expand its further with opening up 8-10 Exclusive Brand Outlets as well as newer

channels like online to capture the market share in `15000cr domestic innerwear industry.

Company expects higher double digit growth in this segment going ahead with improved margins.

Capacity Expansion to drive future Growth

(`mn)

Y/E March

FY13

FY14

FY15

FY16E

Net Sales

14790

14330

14690

15571

2140

1960

2170

2569

Net Profit

510

410

520

731

P/E(x)

2.6

3.4

5.9

15.6

ROE (%)

17%

12%

14%

17%

EPS

12.9

10.4

13.2

18.6

EBITDA

02nd December, 2015

In the past four years, in-house consumption of PV yarn has grown from 5% in 2010-11 to 18% in

2014-15. At the same time, consumption of cotton yarn stands at about 50% despite nearly doubled

capacities in the past four years. Company currently executing an expansion project having outlay

of `198cr being partly funded by term loans of `158cr to further enhance yarn & fabrics capacities

in order to ensure complete integration of textile value chain in the coming years. This projects is

envisages installing 26736 spindles of PV Dyed Yarns, 74 imported weaving machines & one denim

line & 2MW solar power plant. Capacity expansion will further minimal on external source of raw

materials for its denim fabrics as well seamless garment segment. This will ensure better

integration, efficiency in the value chain & will lead to higher scale.

Improving financial performance & margin.

Sangam India posted revenue CAGR of 6% between FY11-FY15. Also, operating margin of the

company remains flat at 14.5% in last few years. However, companys operating margin has

improved by 150bps to 16.1% in H1FY16 led by increasing export of value added products & better

integration. Further, company has invested close to `300 crore in capex (forward and backward

integration) in last few years but reduced its debt/equity ratio to 1.36x in H1FY16 from over 2.9x

in FY2011 due to strong positive cashflow.

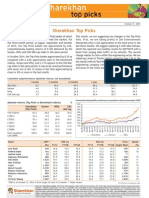

Share Price Performance

400

350

300

250

200

Valuation

150

100

Sangam (India) Ltd

Dec-15

Oct-15

BSE SENSEX

Rel. Perf.

1Mth

3 Mths

6Mths

15.0

30.9

125.8

Sangam (%)

(1.5)

1.8

(6.0)

Sensex (%)

Source: Company data, Retail Research

Dhiral Shah

Nov-15

Sep-15

Jul-15

Aug-15

Jun-15

Apr-15

May-15

Mar-15

Jan-15

Feb-15

Dec-14

50

1Yr

249.2

(8.4)

+91-22- 6614 2693

At CMP of `292, Sangam India trades at 15.7x its FY16E EPS of `18.6. Foray into seamless garment

segment & successful integration will lead to improvement in financial performance as well as

return ratios. We believe stock to trades at 18.5x its FY16E EPS, which gives a target price of `345,

thereby providing 18% upside from current level.

dhiral@geplcapital.com

Retail Desk

Equity | India | Textile

Sangam (India) Ltd.

02nd December , 2015

NOTES

GEPL CAPITAL Pvt Ltd

Reg Office: D-21 Dhanraj Mahal, CSM Marg, Colaba, Mumbai 400001

Analyst Certification

The following analysts hereby certify that their views about the companies and their securities discussed in this report are accurately expressed and that they have not received and will not receive direct or

indirect compensation in exchange for expressing specific recommendations or views in this report:

Name : Dhiral Shah

Sector : Textile

Disclaimer:

This message w/attachments (message) is intended solely for the use of the intended recipient(s) and may contain information that is privileged, confidential or proprietary. If you are not an intended recipient,

please notify the sender, and then please delete and destroy all copies and attachments, and be advised that any review or dissemination of, or the taking of any action in reliance on, the information contained

in or attached to this message is prohibited. Unless specifically indicated, this message is not an offer to sell or a solicitation of any investment products or other financial product or service, an official

confirmation of any transaction, or an official statement of Sender. All investments involve risks and investors should exercise prudence in making their investment decisions.

GEPL Capital makes no representation or warranty, express or implied, as to, and does not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any

information or opinions contained herein. GEPL Capital specifically prohibits redistribution of this material in whole or in part without the written permission of GEPL Capital and GEPL Capital accepts no liability

whatsoever for the actions of third parties in this regard.

Subject to applicable law, Sender may intercept, monitor, review and retain e-communications (EC) traveling through its networks/systems and may produce any such EC to regulators, law enforcement, in

litigation and as required by law. The laws of the country of each sender/recipient may impact the handling of EC, and EC may be archived, supervised and produced in countries other than the country in which

you are located. This message cannot be guaranteed to be secure or free of errors or viruses. Attachments that are part of this EC may have additional important disclosures and disclaimers, which you should

read. By messaging with Sender you consent to the foregoing. The disclosure contained in the reports produced by GEPL Capital shall be strictly governed by and construed in accordance with Indian law.

Retail Desk | Sales Note

You might also like

- Abercrombie & Fitch Is It Unethical To Be Exclusive?Document15 pagesAbercrombie & Fitch Is It Unethical To Be Exclusive?Garima SinghNo ratings yet

- Tata Steel Complete Financial ModelDocument64 pagesTata Steel Complete Financial Modelsiddharth.nt923450% (2)

- BoConcept Interior Design Magazine - 2006-2007Document188 pagesBoConcept Interior Design Magazine - 2006-2007IDrHotdogNo ratings yet

- Gandhi Roleplay Script Part 3Document14 pagesGandhi Roleplay Script Part 3priyalakshmiNo ratings yet

- CRISIL Research - Ier Report Harrisons PDFDocument22 pagesCRISIL Research - Ier Report Harrisons PDFdidwaniasNo ratings yet

- Funny StoriesDocument8 pagesFunny StoriesИнженер Луис А. ГарсиаNo ratings yet

- (UploadMB - Com) Deathtrap DungeonDocument44 pages(UploadMB - Com) Deathtrap Dungeonalucardd20100% (3)

- Sangam India Q2FY17 Result UpdateDocument12 pagesSangam India Q2FY17 Result UpdatedarshanmadeNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- GEPL Top 10 Value PicksDocument4 pagesGEPL Top 10 Value PicksAnonymous W7lVR9qs25No ratings yet

- GEPL Top 10 Value Stock Picks PDFDocument12 pagesGEPL Top 10 Value Stock Picks PDFPravin YeluriNo ratings yet

- AnandRathi Relaxo 05oct2012Document13 pagesAnandRathi Relaxo 05oct2012equityanalystinvestorNo ratings yet

- Ankit TNG Retail India Pvt. LTD.: Credit Analysis & Research LimitedDocument3 pagesAnkit TNG Retail India Pvt. LTD.: Credit Analysis & Research LimitedjshashaNo ratings yet

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Document23 pagesIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedNo ratings yet

- Indoco RemediesDocument19 pagesIndoco RemediesMNo ratings yet

- Jamna AutoDocument5 pagesJamna AutoSumit SinghNo ratings yet

- BIMBSec - Dialog Company Update - Higher and Deeper - 20120625Document2 pagesBIMBSec - Dialog Company Update - Higher and Deeper - 20120625Bimb SecNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- Ashok Leyland-Aug13 15Document4 pagesAshok Leyland-Aug13 15ajd.nanthakumarNo ratings yet

- Investor Presentation May 2016 (Company Update)Document29 pagesInvestor Presentation May 2016 (Company Update)Shyam SunderNo ratings yet

- Stock Market Today Tips - Book Profit On The Stock CMCDocument21 pagesStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNo ratings yet

- Sutlej Textiles Industries LTD 30 July 2015Document13 pagesSutlej Textiles Industries LTD 30 July 2015Yakub PashaNo ratings yet

- TopPicks 020820141Document7 pagesTopPicks 020820141Anonymous W7lVR9qs25No ratings yet

- Investor Presentation Q2FY17 (Company Update)Document30 pagesInvestor Presentation Q2FY17 (Company Update)Shyam SunderNo ratings yet

- Tata Consultancy Services LTD: Company ReportDocument10 pagesTata Consultancy Services LTD: Company Reportcksharma68No ratings yet

- (Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3Document17 pages(Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3equityanalystinvestor100% (1)

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- Bombay Rayon Fashions LTD.: Industry: Textiles IPO Price Band: Rs.60-70Document2 pagesBombay Rayon Fashions LTD.: Industry: Textiles IPO Price Band: Rs.60-70rajan10_kumar_805053No ratings yet

- Share India Securities Results Update Q3 FY22Document7 pagesShare India Securities Results Update Q3 FY22captkranthiNo ratings yet

- Axis Enam MergerDocument9 pagesAxis Enam MergernnsriniNo ratings yet

- 1 - 0 - 08072011fullerton Escorts 7th July 2011Document5 pages1 - 0 - 08072011fullerton Escorts 7th July 2011nit111No ratings yet

- Persistent Company UpdateDocument4 pagesPersistent Company UpdateAngel BrokingNo ratings yet

- TVS Motors: ' 96 ' 69 Fy13 Pe 8.8XDocument14 pagesTVS Motors: ' 96 ' 69 Fy13 Pe 8.8XVinit BolinjkarNo ratings yet

- SBI Securities Morning Update - 18-01-2023Document7 pagesSBI Securities Morning Update - 18-01-2023deepaksinghbishtNo ratings yet

- CRISIL Research Ier Report Sterlite Technologies 2012Document28 pagesCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNo ratings yet

- Sharekhan Top Picks: February 02, 2013Document7 pagesSharekhan Top Picks: February 02, 2013nit111No ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Marico LTD Q2'13 Earning EstimateDocument2 pagesMarico LTD Q2'13 Earning EstimateSuranjoy SinghNo ratings yet

- Investor Presentation (Company Update)Document59 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document14 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Smart Gains 42 PDFDocument4 pagesSmart Gains 42 PDF476No ratings yet

- NCL Industries (NCLIND: Poised For GrowthDocument5 pagesNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyNo ratings yet

- Sangam India Annual Report 2010-11Document72 pagesSangam India Annual Report 2010-11Kapil SharmaNo ratings yet

- Satin M16Document58 pagesSatin M16darshanmaldeNo ratings yet

- Infosys Ltd-Q2 FY12Document4 pagesInfosys Ltd-Q2 FY12Seema GusainNo ratings yet

- Deccan Cements (DECCEM: Value PlayDocument5 pagesDeccan Cements (DECCEM: Value PlayDinesh ChoudharyNo ratings yet

- Research: Sintex Industries LimitedDocument4 pagesResearch: Sintex Industries LimitedMohd KaifNo ratings yet

- Earnings Presentation For June 30, 2016 (Company Update)Document13 pagesEarnings Presentation For June 30, 2016 (Company Update)Shyam SunderNo ratings yet

- MphasisDocument4 pagesMphasisAngel BrokingNo ratings yet

- JK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97Document4 pagesJK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97ajd.nanthakumarNo ratings yet

- Results Press Release (Company Update)Document6 pagesResults Press Release (Company Update)Shyam SunderNo ratings yet

- Arman F L: Inancial Services TDDocument10 pagesArman F L: Inancial Services TDJatin SoniNo ratings yet

- Rambling Souls - Axis Bank - Equity ReportDocument11 pagesRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- Igarashi MotorsDocument4 pagesIgarashi MotorsDynamic LevelsNo ratings yet

- BIMBSec - QL 4QFY12 Results Review 20120523Document3 pagesBIMBSec - QL 4QFY12 Results Review 20120523Bimb SecNo ratings yet

- Vardhaman Special SteelsDocument5 pagesVardhaman Special SteelsupsahuNo ratings yet

- 9th, September 2015: Nifty Outlook Sectoral OutlookDocument5 pages9th, September 2015: Nifty Outlook Sectoral OutlookPrashantKumarNo ratings yet

- Adventa 3Q10-20100928-Not Flexible EnoughDocument5 pagesAdventa 3Q10-20100928-Not Flexible EnoughPiyu MahatmaNo ratings yet

- Research Scorecard: December 2015Document46 pagesResearch Scorecard: December 2015senkum812002No ratings yet

- CRISIL Research Ier Report Alok Industries 2012Document38 pagesCRISIL Research Ier Report Alok Industries 2012Akash MohindraNo ratings yet

- SRF Firstcall 031011Document20 pagesSRF Firstcall 031011srik48No ratings yet

- Suprajit Engineering Limited - Annual Report 2010-11Document72 pagesSuprajit Engineering Limited - Annual Report 2010-11red cornerNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2015: Joint Initiative of the ASEAN Capital Markets Forum and the Asian Development BankFrom EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2015: Joint Initiative of the ASEAN Capital Markets Forum and the Asian Development BankNo ratings yet

- Premarket MorningGlance SPA 15.12.16Document3 pagesPremarket MorningGlance SPA 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 15.12.16Document4 pagesPremarket CurrencyDaily ICICI 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket Technical&Derivative Angel 15.12.16Document5 pagesPremarket Technical&Derivative Angel 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Motilal 20.12.16Document5 pagesPremarket MarketOutlook Motilal 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 20.12.16Document3 pagesPremarket MorningGlance SPA 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Morning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersDocument6 pagesMorning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersRajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 21.12.16Document3 pagesPremarket MorningGlance SPA 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket Technical&Derivative Angel 21.12.16Document5 pagesPremarket Technical&Derivative Angel 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Dynamic 20.12.16Document7 pagesPremarket MorningReport Dynamic 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 20.12.16Document4 pagesPremarket CurrencyDaily ICICI 20.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MarketOutlook Motilal 19.12.16Document4 pagesPremarket MarketOutlook Motilal 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 21.12.16Document4 pagesPremarket CurrencyDaily ICICI 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket OpeningBell ICICI 21.12.16Document8 pagesPremarket OpeningBell ICICI 21.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 19.12.16Document4 pagesPremarket CurrencyDaily ICICI 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Daily Derivatives: December 1, 2016Document3 pagesDaily Derivatives: December 1, 2016Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Dynamic 19.12.16Document7 pagesPremarket MorningReport Dynamic 19.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Monthly Call: Apollo TyresDocument4 pagesMonthly Call: Apollo TyresRajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 09.12.16Document4 pagesPremarket CurrencyDaily ICICI 09.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket OpeningBell ICICI 30.11.16Document8 pagesPremarket OpeningBell ICICI 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Techno Funda Pick Techno Funda Pick: R Hal Research AnalystsDocument10 pagesTechno Funda Pick Techno Funda Pick: R Hal Research AnalystsRajasekhar Reddy AnekalluNo ratings yet

- Premarket CurrencyDaily ICICI 30.11.16Document4 pagesPremarket CurrencyDaily ICICI 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket DerivativesStrategist AnandRathi 30.11.16Document3 pagesPremarket DerivativesStrategist AnandRathi 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket Technical&Derivative Ashika 30.11.16Document4 pagesPremarket Technical&Derivative Ashika 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningReport Dynamic 30.11.16Document7 pagesPremarket MorningReport Dynamic 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket KnowledgeBrunch Microsec 30.11.16Document5 pagesPremarket KnowledgeBrunch Microsec 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Premarket MorningGlance SPA 30.11.16Document3 pagesPremarket MorningGlance SPA 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- General StoreDocument18 pagesGeneral StoreUrsu-Lungu IrinaNo ratings yet

- Harm's Reach by Alex BarclayDocument17 pagesHarm's Reach by Alex BarclayAnonymous W5F9r2b2hNo ratings yet

- First Conditional FormDocument3 pagesFirst Conditional Formmailas3367% (3)

- Badminton: Physical EducationDocument18 pagesBadminton: Physical EducationCathlene Joy SibucaoNo ratings yet

- Business Proposal For Setting Up of A Jacket 2003Document37 pagesBusiness Proposal For Setting Up of A Jacket 2003Abhinav Akash SinghNo ratings yet

- Haiti - List of Loa1 PDFDocument15 pagesHaiti - List of Loa1 PDFMuurish Dawn100% (1)

- 4.1. Structure Drills 1Document96 pages4.1. Structure Drills 1Miodrag UroševićNo ratings yet

- Tone Worksheet 02Document8 pagesTone Worksheet 02EvernickEdquilaMakabentaNo ratings yet

- CoC - Now Adv - Return of The Monolith PDFDocument14 pagesCoC - Now Adv - Return of The Monolith PDFLuca LiperiNo ratings yet

- Romeo and Juliet PowerpointDocument31 pagesRomeo and Juliet PowerpointbalanvbalanNo ratings yet

- Learning Urdu Through EnglishDocument19 pagesLearning Urdu Through Englishudayz4u50% (2)

- Spelling Bee PresentationDocument21 pagesSpelling Bee PresentationerikacharrisNo ratings yet

- Examen 2º Bach InglésDocument6 pagesExamen 2º Bach Ingléslisikratis1980No ratings yet

- Apac Eng FMX Product Guide Euro 3-5-140521Document27 pagesApac Eng FMX Product Guide Euro 3-5-140521mohanNo ratings yet

- FU The Freeform Universal RPG (Classic Rules)Document24 pagesFU The Freeform Universal RPG (Classic Rules)Joey ExampleNo ratings yet

- AB Question BookletDocument12 pagesAB Question BookletMonalisa ChatterjeeNo ratings yet

- Electric IronDocument18 pagesElectric IronDharam BassiNo ratings yet

- Mermaid SetDocument29 pagesMermaid Setitzmecherri13100% (2)

- Coin+Purse+with+Button (NOT MINE)Document6 pagesCoin+Purse+with+Button (NOT MINE)Tiny Bobble FishNo ratings yet

- Dance Collection Russian Stars 2012-2013 BPDocument47 pagesDance Collection Russian Stars 2012-2013 BPbestpointeNo ratings yet

- Endless Quest 04 - Return To BrookmereDocument164 pagesEndless Quest 04 - Return To BrookmereOscar Jose UnamunoNo ratings yet

- q1 Test in Science Grade 4 Two ColumnDocument4 pagesq1 Test in Science Grade 4 Two ColumnMagnolia Nicandro AutencioNo ratings yet

- Production ScheduleDocument2 pagesProduction Scheduleapi-329256627No ratings yet

- AungSanSuuKyi LetterfromBurma PDFDocument106 pagesAungSanSuuKyi LetterfromBurma PDFjlbmdmNo ratings yet

- YakshiDocument12 pagesYakshiDevesh Gupta100% (2)