Professional Documents

Culture Documents

China, Continues To Add Capacity For Formaldehyde, Reigning As The Largest Producer Globally

China, Continues To Add Capacity For Formaldehyde, Reigning As The Largest Producer Globally

Uploaded by

KolliparaDeepakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

China, Continues To Add Capacity For Formaldehyde, Reigning As The Largest Producer Globally

China, Continues To Add Capacity For Formaldehyde, Reigning As The Largest Producer Globally

Uploaded by

KolliparaDeepakCopyright:

Available Formats

MARKET RESEARCH

Most formaldehyde producers are concerned primarily with satisfying captive requirements for

derivatives and/or supplying local merchant sales.

Formaldehyde is usually produced close to the point of consumption since it is fairly easy to make, is

costly to transport, and can develop problems associated with stability during transport. As a result,

world trade in formaldehyde is minimal.

World consumption of 37% formaldehyde is forecast to grow at an average annual rate of about 4%

from 2015 to 2020. Growth during 200609 was marginal, largely as a result of the global recession.

Northeast Asia, especially China, continues to add capacity for formaldehyde, reigning as the

largest producer globally.

China is the single-largest market for formaldehyde, accounting for 42% of world demand in 2015;

other countries with large markets include the United States, Germany, the Netherlands, Spain, Italy,

Belgium, Poland, Russia, India, South Korea, Japan, Brazil, and Canada.

China is forecast to experience high growth rates and significant volume increases in demand for

37% formaldehyde during 201520.

China now produces and consumes one-third of the world's formaldehyde. The largest amount of

formaldehyde finds application in the manufacture of Resins, viz., Phenol Formaldehyde (PF), Urea

Formaldehyde (UF) and Melamine Formaldehyde (MF) - which finds applications in laminates, plywood,

MDF, particle board and hard boards. UF, MF and PF resins accounted for approximately 66% of world

consumption.

DEMAND IN INDIA:

Formaldehyde is one of the major organic chemicals produced in India.

Almost all the consuming sectors of Formaldehyde have witnessed growth rates of more than 5% in the

past 5 years, indicating a strong demand of Formaldehyde in the present market scenario.

Resin Industry is the largest consumer of Formaldehyde accounting for more than half the domestic

production of the country and expected to achieve growth rates close to 10% in the next 5 years.

Uses as a direct and intermediate solvent are other major consumers of Formaldehyde in the country

expected to witness modest growth in the coming years.

Southern region of the country is the largest hub of Formaldehyde consumption, accounting for almost

half of domestic Formaldehyde consumption. Other regions of the country share approximate similar

Formaldehyde requirements, which are however, expected to increase in the future.

The market study firmly establishes a growing demand in India for Formaldehyde, which has been

increasing over the years, but in a non-continuous manner.

Formaldehyde demand is met through domestic production.

Formaldehyde demand is driven by use as solvent for a plethora of industries as well as exports. India

also exports moderate volumes of Formaldehyde. However, the production of Formaldehyde is not up to

the full capacity because of the lower demand of the chemical in the country.

Kanoria, Allied Resins and Allied Chemicals Ltd, INA India Ltd. and Aldehyde India are the chief

Formaldehyde manufacturers in the domestic market.

Though demand has seen a modest growth, it is still playing catch up to the domestic production. India's

excess domestic production mandates producers and exporters to export Formaldehyde.

Currently, Nepal is the biggest importer of Indian Formaldehyde, importing more than half of the total

quantity exported from India. Sri Lanka, Kenya, Bhutan and UAE also hold the rest amount of share.

Although, India needs to further expand its percentage of exports and increase the production up to its full

capacity so as to enhance the export market.

The five largest markets for formaldehyde are North America, Europe, Latin America, Middle East and

China.

You might also like

- Artifact 2Document7 pagesArtifact 2api-465941797100% (1)

- Risk and Opportunities ProcedureDocument4 pagesRisk and Opportunities ProcedureRotimi Shitta-Bey100% (1)

- Temenos Banking Reference Process - ReadMe PDFDocument13 pagesTemenos Banking Reference Process - ReadMe PDFAJ AmineNo ratings yet

- Urea Formaldehyde ResinDocument5 pagesUrea Formaldehyde ResinSarah Katrina Veliganilao SalvacionNo ratings yet

- Lubricant Market Globe Vs IndiaDocument19 pagesLubricant Market Globe Vs IndiaSandeep Walke100% (1)

- World Formaldehyde Production To Exceed 52 MLN Tonnes in 2017Document3 pagesWorld Formaldehyde Production To Exceed 52 MLN Tonnes in 2017Edwin AlarcónNo ratings yet

- Compiled Project ManagementDocument29 pagesCompiled Project ManagementAmirul Assyraf NoorNo ratings yet

- Contoh Report PMDocument29 pagesContoh Report PMmuhammad addinNo ratings yet

- Pre-Feasibility Report: 500 MT/day Formaldehyde PlantDocument10 pagesPre-Feasibility Report: 500 MT/day Formaldehyde PlantSanzar Rahman 1621555030No ratings yet

- Chemical Petrochemical IndustryDocument8 pagesChemical Petrochemical IndustryArav SoniNo ratings yet

- Chepter 2 HalfDocument15 pagesChepter 2 Halfdevpatel90No ratings yet

- Credit Note SampleDocument2 pagesCredit Note SamplePrashantAnchanNo ratings yet

- The Petrochemical Industry in India Has Been One of The Fastest Growing Industries in The CountryDocument6 pagesThe Petrochemical Industry in India Has Been One of The Fastest Growing Industries in The CountryVishakh KrishnanNo ratings yet

- ExportsDocument5 pagesExportsGaurav MehtaNo ratings yet

- Asian Paints Final Document Research ScribdDocument22 pagesAsian Paints Final Document Research ScribdPradip InjapuramNo ratings yet

- 160 P16che4b 2020051801115246Document3 pages160 P16che4b 2020051801115246ca23m008No ratings yet

- Chemical Sector:: Done By: Megan Stewart Grade 9 BibliographyDocument1 pageChemical Sector:: Done By: Megan Stewart Grade 9 BibliographycerbutzuNo ratings yet

- CHEMEXIL - Chemical Exports From India (Report)Document37 pagesCHEMEXIL - Chemical Exports From India (Report)Mayank GuptaNo ratings yet

- Chapter 1: Introduction: 1.1 Industry & Company OverviewDocument6 pagesChapter 1: Introduction: 1.1 Industry & Company OverviewraagulNo ratings yet

- Basty Sushmitha Shenoy - 4SF18MBA15 - Part B Main ReportDocument77 pagesBasty Sushmitha Shenoy - 4SF18MBA15 - Part B Main ReportDeepthi NNo ratings yet

- Als, EtcDocument8 pagesAls, Etc218-Harsh NarangNo ratings yet

- New Polyurethane Capacity Closes in On Tight MarketDocument5 pagesNew Polyurethane Capacity Closes in On Tight Marketkatie farrellNo ratings yet

- SWOT Analysis of HondaDocument3 pagesSWOT Analysis of HondaAman71900% (2)

- SA A Group05 Navin FluorineDocument3 pagesSA A Group05 Navin FluorineSneha KhuranaNo ratings yet

- HHI and 4 Firm Concentration-1Document12 pagesHHI and 4 Firm Concentration-1vuppalavhr254_189902No ratings yet

- PetrochemicalDocument3 pagesPetrochemicalVidhi DaveNo ratings yet

- Dhanuka AgritechDocument10 pagesDhanuka AgritechAshok JainNo ratings yet

- Industry Analysis Report Inorganic Chemicals IndustryDocument35 pagesIndustry Analysis Report Inorganic Chemicals Industrybalaji bysani100% (1)

- Imperatives For The Indian Chemical Industry: Imperative Basic Speciality KnowledgeDocument46 pagesImperatives For The Indian Chemical Industry: Imperative Basic Speciality KnowledgetejaasNo ratings yet

- Macroeconomics - Portriat of Foreign CountryDocument18 pagesMacroeconomics - Portriat of Foreign Countryapi-209718566No ratings yet

- Supply Demand Scenario of Organic Chemicals in IndiaDocument26 pagesSupply Demand Scenario of Organic Chemicals in IndiaShadab KhanNo ratings yet

- Top 5 Us Export and Import Commodities: FollowonheadonmasterpageaDocument6 pagesTop 5 Us Export and Import Commodities: FollowonheadonmasterpageaMelih AltıntaşNo ratings yet

- Petrochemicals Industry in IndiaDocument5 pagesPetrochemicals Industry in IndiaAhmed AlyaniNo ratings yet

- Company's History and Growth: StrengthsDocument12 pagesCompany's History and Growth: StrengthsMatt RockNo ratings yet

- Ford Swot AnalysisDocument3 pagesFord Swot AnalysisAnkur Anil Nahata100% (1)

- Assignment 4Document7 pagesAssignment 4Yash DNo ratings yet

- Ford SWOT Analysis 2013Document3 pagesFord SWOT Analysis 2013Vilgia DelarhozaNo ratings yet

- STM Pidilite Group2 SectionBDocument41 pagesSTM Pidilite Group2 SectionBSiddharth SharmaNo ratings yet

- Chemical Petrochemical SectorDocument6 pagesChemical Petrochemical SectorKu RatheeshNo ratings yet

- The Chemicals Subsectorv1Document13 pagesThe Chemicals Subsectorv1Makhosonke MkhonzaNo ratings yet

- India PHARMA Report-Mid Year 03Document44 pagesIndia PHARMA Report-Mid Year 03Sylvia GraceNo ratings yet

- Formatted Ford - 100 Marks Project 1Document71 pagesFormatted Ford - 100 Marks Project 1Mahesh ShahNo ratings yet

- Indian Petrochemical Industry: Vital To Economic Growth: Per CapitalDocument2 pagesIndian Petrochemical Industry: Vital To Economic Growth: Per CapitalWilliam Cajetan AlmeidaNo ratings yet

- Honda SWOT Analysis 2013 Strengths Weaknesses: Opportunities ThreatsDocument2 pagesHonda SWOT Analysis 2013 Strengths Weaknesses: Opportunities ThreatsPrateek ChaudharyNo ratings yet

- PAINT Industry AnalysisDocument19 pagesPAINT Industry AnalysisSrikanth ShagoreNo ratings yet

- A Report On Ford Motor Company: Birla Institute of Technology & Science, Pilani Second Semester (2012-2013)Document12 pagesA Report On Ford Motor Company: Birla Institute of Technology & Science, Pilani Second Semester (2012-2013)Ricky Imanda100% (1)

- Polymer Market IndiaDocument3 pagesPolymer Market IndiaRakshit MathurNo ratings yet

- SWOT Analysis For The Ford Motor CompanyDocument5 pagesSWOT Analysis For The Ford Motor CompanyCHARALABOS LABROU100% (1)

- DAP ExportDocument7 pagesDAP ExportSesennNo ratings yet

- Reliance Industries LTDDocument6 pagesReliance Industries LTDPrachi JainNo ratings yet

- Ford TQMDocument22 pagesFord TQMJames NitsugaNo ratings yet

- AbstractDocument26 pagesAbstractSohham ParingeNo ratings yet

- Comparison of Ford and Honda and Brief SWOT For Both CompaniesDocument47 pagesComparison of Ford and Honda and Brief SWOT For Both CompaniesSohham Paringe100% (1)

- The Indian Paint IndustryDocument57 pagesThe Indian Paint IndustryMumthaz AhmedNo ratings yet

- Annual Report 49th Web - ChemexcilDocument92 pagesAnnual Report 49th Web - ChemexcilMayank GuptaNo ratings yet

- ChemicalDocument8 pagesChemicalrajeshsinghjiNo ratings yet

- Equity Master Report 2015-16Document3 pagesEquity Master Report 2015-16Aalokek KumarNo ratings yet

- The Indian Paint Industry Has Been Doing Well For The Past Couple of YearsDocument4 pagesThe Indian Paint Industry Has Been Doing Well For The Past Couple of YearstanmoyIIPMNo ratings yet

- Indian Chemical IndustryDocument16 pagesIndian Chemical Industryhemant KumarNo ratings yet

- An Analysis of Changes in the Global Tobacco Market and its Effects on PMI's Internationalization and ExpansionFrom EverandAn Analysis of Changes in the Global Tobacco Market and its Effects on PMI's Internationalization and ExpansionNo ratings yet

- Enterprise Management Automobile Industry Business Cases: Renault Morocco, Tesla, Hyundai, TATA Motors, Daimler Mobility, ToyotaFrom EverandEnterprise Management Automobile Industry Business Cases: Renault Morocco, Tesla, Hyundai, TATA Motors, Daimler Mobility, ToyotaNo ratings yet

- 1.project FullDocument75 pages1.project FullKolliparaDeepakNo ratings yet

- 1 SMDocument11 pages1 SMKolliparaDeepakNo ratings yet

- Physical PropertiesDocument4 pagesPhysical PropertiesKolliparaDeepakNo ratings yet

- Properties of Formaldehyde PDFDocument120 pagesProperties of Formaldehyde PDFKolliparaDeepakNo ratings yet

- Mgo Peak No. 2 Theta Theta Sin 2 (Theta) H K 1 42.91 21.455 0.133787 2 0 2 62.3 31.15 0.2675789 2 2Document3 pagesMgo Peak No. 2 Theta Theta Sin 2 (Theta) H K 1 42.91 21.455 0.133787 2 0 2 62.3 31.15 0.2675789 2 2KolliparaDeepakNo ratings yet

- Updated Ratio1Document5 pagesUpdated Ratio1KolliparaDeepakNo ratings yet

- Public Notice 0606 PDFDocument1 pagePublic Notice 0606 PDFKolliparaDeepakNo ratings yet

- Chapter 21Document4 pagesChapter 21KolliparaDeepakNo ratings yet

- Charles Dickens-Hard Times-01 PDFDocument12 pagesCharles Dickens-Hard Times-01 PDFKolliparaDeepakNo ratings yet

- Chapter 13Document4 pagesChapter 13KolliparaDeepakNo ratings yet

- Installation Steps For ASPEN 8.4: Run As Administrator Run As AdministratorDocument1 pageInstallation Steps For ASPEN 8.4: Run As Administrator Run As AdministratorKolliparaDeepakNo ratings yet

- Agitation and MixingDocument77 pagesAgitation and MixingKolliparaDeepak100% (1)

- Chapter 5Document4 pagesChapter 5KolliparaDeepakNo ratings yet

- Chapter 4Document4 pagesChapter 4KolliparaDeepakNo ratings yet

- Equicapita - Advisor BrochureDocument1 pageEquicapita - Advisor BrochureEquicapita Income TrustNo ratings yet

- 790 Pi SpeedxDocument1 page790 Pi SpeedxtaniyaNo ratings yet

- Aca 2024 PlannerDocument1 pageAca 2024 Planneryfarhana2002No ratings yet

- Marketing Final ReportDocument70 pagesMarketing Final Reportsatya0% (1)

- KIA India Dealer Application FormDocument22 pagesKIA India Dealer Application FormAditya BhalotiaNo ratings yet

- Output and Performance-Based Roads Contract: A Case Study of Kaduna State, NigeriaDocument77 pagesOutput and Performance-Based Roads Contract: A Case Study of Kaduna State, NigeriaYusuf GiwaNo ratings yet

- Conjoint AnalysisDocument17 pagesConjoint Analysismark david sabellaNo ratings yet

- Actual Costing With Parallel COGM in S4HAHA22 Fiori App 1704696331Document25 pagesActual Costing With Parallel COGM in S4HAHA22 Fiori App 1704696331s25590No ratings yet

- Nmims Indore - BrochureDocument30 pagesNmims Indore - BrochureParas JatanaNo ratings yet

- SAP125 SAP Navigation 2005: SAP SCM-Procurement (MM) Academy ECC 6.0Document9 pagesSAP125 SAP Navigation 2005: SAP SCM-Procurement (MM) Academy ECC 6.0kngane8878No ratings yet

- Khyber City Fee ScheduleDocument2 pagesKhyber City Fee ScheduleMohsin KhanNo ratings yet

- Quality Management System Documents: Risk Based Audit Kyuc/Mr/Rba/09Document6 pagesQuality Management System Documents: Risk Based Audit Kyuc/Mr/Rba/09Harriet AliñabonNo ratings yet

- Communiqué de Presse Deal EasyvoyageDocument2 pagesCommuniqué de Presse Deal EasyvoyagertocquetNo ratings yet

- Eastern Assurance and Surety Co. v. IACDocument2 pagesEastern Assurance and Surety Co. v. IACIldefonso HernaezNo ratings yet

- SOCAP 10th Anniversary BookletDocument84 pagesSOCAP 10th Anniversary BookletSocial Capital Markets100% (1)

- The Anjuman Wazifa DIRECTOARY1Document25 pagesThe Anjuman Wazifa DIRECTOARY1Shoaib Raza JafriNo ratings yet

- IC Team Meeting Agenda 11594 ExampleDocument5 pagesIC Team Meeting Agenda 11594 Examplesarah latuNo ratings yet

- Report Accompanying The EstimateDocument3 pagesReport Accompanying The EstimateparameswarikumarNo ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiaPriya ShindeNo ratings yet

- Janpaul PSBC RushDocument26 pagesJanpaul PSBC RushvbmnmcNo ratings yet

- Informe Deoleo PDFDocument13 pagesInforme Deoleo PDFEneida6736No ratings yet

- Case Studies: AssignmentDocument5 pagesCase Studies: AssignmentMinahil AsadNo ratings yet

- Industry Profile Introduction To Banking:: A Study On Working Capital Analysis at Canara Bank SidlaghattaDocument74 pagesIndustry Profile Introduction To Banking:: A Study On Working Capital Analysis at Canara Bank SidlaghattaVinutha GowdaNo ratings yet

- COOPDocument18 pagesCOOPEmanuel LacedaNo ratings yet

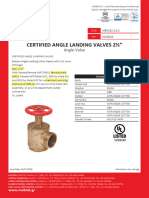

- 2.5 Mobiak Angle Valve (MBK281-2.5) UL ListedDocument2 pages2.5 Mobiak Angle Valve (MBK281-2.5) UL ListedAhmed SalahNo ratings yet

- Accounts Payable: Oracle Fusion FinancialsDocument20 pagesAccounts Payable: Oracle Fusion Financialsmaha AhmedNo ratings yet

- Definition of Kind of Business (Kob)Document5 pagesDefinition of Kind of Business (Kob)yandexNo ratings yet