Professional Documents

Culture Documents

Financing:: 1. Role of Shareholders As Stakeholders

Financing:: 1. Role of Shareholders As Stakeholders

Uploaded by

rammar147Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financing:: 1. Role of Shareholders As Stakeholders

Financing:: 1. Role of Shareholders As Stakeholders

Uploaded by

rammar147Copyright:

Available Formats

1.

ROLE OF SHAREHOLDERS AS STAKEHOLDERS

FINANCING : One of the primary reasons for going public is to raise funds from investors. In

return, the company's founders give up part ownership to these new investors. Private companies

and startups may also raise funds through private placements, which are share issues to a select

group of individuals and institutions. The founders of a startup company, including venture capital

backers, may also provide additional capital in exchange for a higher percentage of the

ownership. Unlike bond investors, shareholders do not get periodic interest payments or their

original investment back from the company.

OPERATIONS : One of the primary reasons for going public is to raise funds from investors. In

return, the company's founders give up part ownership to these new investors. Private companies

and startups may also raise funds through private placements, which are share issues to a select

group of individuals and institutions. The founders of a startup company, including venture capital

backers, may also provide additional capital in exchange for a higher percentage of the

ownership. Unlike bond investors, shareholders do not get periodic interest payments or their

original investment back from the company.

GOVERNANCE : Public companies usually have formal corporate governance policies, such

as the composition and roles of different board committees, the role of the chairman, codes of

conduct and business ethics. Boards of directors answer to shareholders, not to management.

Public companies must provide timely and complete disclosures to shareholders. Senior

executives often spend a few days each quarter discussing operations and general business

conditions with shareholders, market analysts and the business media. The chief executive and

the chief financial officer sign off on financial documents, thus making them accountable for errors

and omissions.

CONTROL : Shareholders usually determine who controls a public company. A widely held

company, in which there is not a single majority shareholder, is vulnerable to hostile takeover

attempts. Shareholders can block such moves if they are satisfied with the current management

or if they believe the offering price is insufficient. Institutional shareholders may publicly call on

company management to consider strategic options, such as selling off the company or merging

with another company.

2. DUTIES OF ORGANISATION TOWARDS SHAREHOLDERS

Company should provide a fair return on the investment made by

shareholders. If shareholders do not get proper dividend then they will

hesitate to invest additional funds in the concern.

Shareholders should be kept fully informed about the working of the

company for healthy growth of the business. Shareholders who are the

owners of business should be provided with correct information about

company to enable them to give them true and fair position of the

company to enable them to decide about further investments.

You might also like

- Mastery Quiz 1 - 2 - CourseraDocument12 pagesMastery Quiz 1 - 2 - CourseraLight76% (21)

- Business PlanDocument50 pagesBusiness PlanEENADU EENADU100% (1)

- Case Jonah Creighton: Ethics and Value Based LeadershipDocument16 pagesCase Jonah Creighton: Ethics and Value Based Leadershiprammar147No ratings yet

- Chapter 1 - Finan 1Document15 pagesChapter 1 - Finan 1Rara MiyanaNo ratings yet

- Chapter 1 - An Overview of Financial ManagementDocument18 pagesChapter 1 - An Overview of Financial ManagementYzah CariagaNo ratings yet

- Questions Mba - MidtermDocument6 pagesQuestions Mba - Midtermاماني محمدNo ratings yet

- CourseSummary Q3Document16 pagesCourseSummary Q3nani.faminialNo ratings yet

- Answers To Review QuestionsDocument5 pagesAnswers To Review QuestionsMaria ArshadNo ratings yet

- 1 Joint Stock Company PPT by ManasDocument10 pages1 Joint Stock Company PPT by ManaspadhnedebcNo ratings yet

- Bahr 1ST ReviewerDocument12 pagesBahr 1ST ReviewerTricia Nicole BahintingNo ratings yet

- A Report On "Stock Offerings and Investor Monitoring": Submitted ToDocument17 pagesA Report On "Stock Offerings and Investor Monitoring": Submitted ToAtiaTahiraNo ratings yet

- Entrepreneurship AssingmentDocument7 pagesEntrepreneurship AssingmentUtsav ChakrabortyNo ratings yet

- Individual Assignement Financial AccountingDocument4 pagesIndividual Assignement Financial AccountingkafilmohammedamineNo ratings yet

- Finance CompilationDocument14 pagesFinance CompilationNo NameNo ratings yet

- Overview of Financial ManagementDocument55 pagesOverview of Financial ManagementCenelyn PajarillaNo ratings yet

- Notes For MpharmDocument20 pagesNotes For MpharmsomaiyahsarwarNo ratings yet

- Shareholders and Agency ProblemDocument3 pagesShareholders and Agency ProblemfoodNo ratings yet

- Partnership, Can Be Utilized. Under This Arrangement, One or More PartnersDocument7 pagesPartnership, Can Be Utilized. Under This Arrangement, One or More PartnersMahaboob HossainNo ratings yet

- Business FinanceDocument90 pagesBusiness FinanceSandara beldo100% (1)

- Reviewer FinanceDocument9 pagesReviewer FinanceChristine Marie RamirezNo ratings yet

- Samson, Roel Rhodael P. AC1204 MWF 10:30AM - 12:00AM GR344MCDocument4 pagesSamson, Roel Rhodael P. AC1204 MWF 10:30AM - 12:00AM GR344MCroel rhodael samsonNo ratings yet

- Legal Structure: Which Is The Most Appropriate Legal Structure For The Business?Document23 pagesLegal Structure: Which Is The Most Appropriate Legal Structure For The Business?Junaid AwanNo ratings yet

- Module 1-Financial ManagementDocument4 pagesModule 1-Financial ManagementXienaNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementJayson LeybaNo ratings yet

- Week 10 LessonDocument9 pagesWeek 10 LessonKen TuazonNo ratings yet

- Brian Ghilliotti-Money and Banking-Ch 10 SummaryDocument7 pagesBrian Ghilliotti-Money and Banking-Ch 10 SummaryBrian GhilliottiNo ratings yet

- Introduction To Financial ManagementDocument37 pagesIntroduction To Financial ManagementEftakharul Haque BappyNo ratings yet

- A Report On Analysis of Venture Capital As A Source of FinanceDocument21 pagesA Report On Analysis of Venture Capital As A Source of Financearun883765No ratings yet

- Sas 301Document7 pagesSas 301midtown cyberNo ratings yet

- Business Finance Summary of ReportDocument8 pagesBusiness Finance Summary of ReportMARL VINCENT L LABITADNo ratings yet

- Chapter 1Document7 pagesChapter 1Abd El-Rahman El-syeoufyNo ratings yet

- Shareholders: What Roles Do They Play in A Corporation?Document3 pagesShareholders: What Roles Do They Play in A Corporation?AnooshayNo ratings yet

- StocksDocument9 pagesStocksHassan Tahir SialNo ratings yet

- Chapter 1 Fin 2200Document7 pagesChapter 1 Fin 2200cheeseNo ratings yet

- BFIN300 Full Hands OutDocument46 pagesBFIN300 Full Hands OutGauray LionNo ratings yet

- 302 Previous QuestionDocument22 pages302 Previous Questionmd. hasan.No ratings yet

- Markscheme For BMGT TestDocument5 pagesMarkscheme For BMGT Testanthoniaronald7No ratings yet

- Manajemen Keuangan Lanjutan - Tugas Minggu 1Document7 pagesManajemen Keuangan Lanjutan - Tugas Minggu 1NadiaNo ratings yet

- Project Finance AssignmentDocument10 pagesProject Finance AssignmentShaketia hallNo ratings yet

- Intro To Corporate FinanceDocument20 pagesIntro To Corporate Financemehnaz kNo ratings yet

- Assig 1 ACCOUNTING AND FINANCIAL MANAGEMENTDocument20 pagesAssig 1 ACCOUNTING AND FINANCIAL MANAGEMENTAnu kulethaNo ratings yet

- Chapter 2Document4 pagesChapter 2JavNo ratings yet

- Be 313 - Week 4-5 - Unit Learning CDocument32 pagesBe 313 - Week 4-5 - Unit Learning Cmhel cabigonNo ratings yet

- Chapter 1 - Intro To FMDocument62 pagesChapter 1 - Intro To FMJessa RosalesNo ratings yet

- LESSON 1: Introduction To Financial Management: TargetDocument51 pagesLESSON 1: Introduction To Financial Management: Targetmardie dejanoNo ratings yet

- EquityDocument5 pagesEquityAkansha NarayanNo ratings yet

- Company Law ConciseDocument30 pagesCompany Law ConciseKrupa Diamond DandNo ratings yet

- Business FinanceDocument17 pagesBusiness FinanceRhyme CabangbangNo ratings yet

- Unit 14 - StakeholdersDocument7 pagesUnit 14 - Stakeholders2011050No ratings yet

- Corporate Issuers - Zell Education 2024Document78 pagesCorporate Issuers - Zell Education 2024harshNo ratings yet

- Managerial Finance Reviewer (Prelims)Document4 pagesManagerial Finance Reviewer (Prelims)Kendall JennerNo ratings yet

- Module 1 Nature, Purpose, and Scope of Financial ManagementDocument4 pagesModule 1 Nature, Purpose, and Scope of Financial ManagementSofia YuNo ratings yet

- National Aviation College: Graduate ProgramsDocument11 pagesNational Aviation College: Graduate Programscn comNo ratings yet

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaNo ratings yet

- Introduction To Corporate Finance: Corporatefinance Dr. Amnisuhailahabarahan Ja N Ua Ry, 2 0 2 0Document18 pagesIntroduction To Corporate Finance: Corporatefinance Dr. Amnisuhailahabarahan Ja N Ua Ry, 2 0 2 0Muhammad AsifNo ratings yet

- Topic 1 Corporate FinanceDocument8 pagesTopic 1 Corporate FinanceAbdallah SadikiNo ratings yet

- Organization and Management: Universal Scholastic Academe Sinisian East, Lemery, BatangasDocument11 pagesOrganization and Management: Universal Scholastic Academe Sinisian East, Lemery, BatangasCharlieNo ratings yet

- What Is The Danger of Issuing Too Much StockDocument11 pagesWhat Is The Danger of Issuing Too Much StockRafat ShultanaNo ratings yet

- ReportDocument3 pagesReportKavindya DinaniNo ratings yet

- FinanceDocument35 pagesFinanceaccswc21No ratings yet

- Lesson 5 Agency Problems and Accountability of Corporate Managers and 2Document39 pagesLesson 5 Agency Problems and Accountability of Corporate Managers and 2Dianne Pearl DelfinNo ratings yet

- Principal Agent Conflict & Financial Strategies-1Document38 pagesPrincipal Agent Conflict & Financial Strategies-1Vikas Sharma100% (3)

- Accountancy Project WorkDocument1 pageAccountancy Project Workrammar147No ratings yet

- Neutron Slow Down in Light WaterDocument8 pagesNeutron Slow Down in Light Waterrammar147No ratings yet

- Suggested Question Paper Design - AccountancyDocument1 pageSuggested Question Paper Design - Accountancyrammar147No ratings yet

- A Coupled CFD Monte Carlo Method For Simulating Complex Aerosol Dynamics in Turbulent FlowsDocument14 pagesA Coupled CFD Monte Carlo Method For Simulating Complex Aerosol Dynamics in Turbulent Flowsrammar147No ratings yet

- 2022 Rent Receipt 2Document1 page2022 Rent Receipt 2rammar147No ratings yet

- WCPT9 Scientific Program Madrid 2022Document52 pagesWCPT9 Scientific Program Madrid 2022rammar147No ratings yet

- Volume 5 Issue 4 Paper 3Document6 pagesVolume 5 Issue 4 Paper 3Niku BandiNo ratings yet

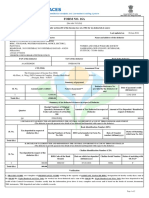

- Investment Scenario - : (A) FDI EQUITY INFLOWS (Equity Capital Components)Document1 pageInvestment Scenario - : (A) FDI EQUITY INFLOWS (Equity Capital Components)rammar147No ratings yet

- ITC Product MixDocument47 pagesITC Product MixMohit Malviya67% (3)

- Shielding CalculationDocument17 pagesShielding Calculationrammar147No ratings yet

- Leveraging: Case StudyDocument1 pageLeveraging: Case Studyrammar147No ratings yet

- MSC PHY-II-SEMDocument15 pagesMSC PHY-II-SEMrammar147No ratings yet

- Case Study 1Document11 pagesCase Study 1Jaspal Singh100% (1)

- Dose Due To Cylindrical SourceDocument9 pagesDose Due To Cylindrical Sourcerammar147No ratings yet

- Supersymmetry ReportDocument49 pagesSupersymmetry Reportrammar147No ratings yet

- Electronics Evaluation SchemeDocument189 pagesElectronics Evaluation Schemerammar147No ratings yet

- Dose Due To Cylindrical SourceDocument9 pagesDose Due To Cylindrical Sourcerammar147No ratings yet

- Inter University Accelerator Centre New Delhi: Advertisement No. 4/2014Document1 pageInter University Accelerator Centre New Delhi: Advertisement No. 4/2014rammar147No ratings yet

- Mco 07Document4 pagesMco 07rammar147No ratings yet

- Gorelik Why Is Space Three DimensionalDocument72 pagesGorelik Why Is Space Three Dimensionalrammar147No ratings yet

- NTSAA Iowa TestimonyDocument16 pagesNTSAA Iowa TestimonyScott Dauenhauer, CFP, MSFP, AIFNo ratings yet

- Berger Paints Balance Sheet Equity & Liabilities Shareholders' FundsDocument4 pagesBerger Paints Balance Sheet Equity & Liabilities Shareholders' FundsAbhilash DavidNo ratings yet

- BrochureDocument591 pagesBrochureRajkumarNo ratings yet

- Edmonton Event Growth and Attraction StrategyDocument22 pagesEdmonton Event Growth and Attraction StrategyEmily Mertz100% (2)

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- Group A9 - SoslpDocument10 pagesGroup A9 - SoslpRahul GandhiNo ratings yet

- Bintang Presentation - Fundraising Purwadhika X BintangDocument17 pagesBintang Presentation - Fundraising Purwadhika X BintangMarisa U. TambunanNo ratings yet

- Project Profile On Photography Studio: Production Capacity Per AnnumDocument5 pagesProject Profile On Photography Studio: Production Capacity Per Annumamit100% (1)

- Club Med: From Value Innovator To Follower: High Tech and Entrepreneurship StrategyDocument18 pagesClub Med: From Value Innovator To Follower: High Tech and Entrepreneurship StrategySravanthi DusiNo ratings yet

- KPMG Tax Rate Card 2010-11Document3 pagesKPMG Tax Rate Card 2010-11amit49No ratings yet

- Fame Export 1Document42 pagesFame Export 1sharedcaveNo ratings yet

- PlatformificationDocument8 pagesPlatformificationRahul AgarwalNo ratings yet

- KBL 2013 GBDocument232 pagesKBL 2013 GBLuxembourgAtaGlanceNo ratings yet

- How Does The Airplane Leasing Business Work? Why Do Airlines Buy The Planes, Then Sell Them To A Leasing Company and Then Lease It Back? - QuoraDocument8 pagesHow Does The Airplane Leasing Business Work? Why Do Airlines Buy The Planes, Then Sell Them To A Leasing Company and Then Lease It Back? - QuoraJagruti NiravNo ratings yet

- CAPM HandoutDocument37 pagesCAPM HandoutShashank ReddyNo ratings yet

- Articles Banking Terms Glossary of BankinDocument27 pagesArticles Banking Terms Glossary of Bankincoolguy.sudheer604762No ratings yet

- Jay CVDocument3 pagesJay CVJay UdeshiNo ratings yet

- Annual Report Sari Roti PDFDocument220 pagesAnnual Report Sari Roti PDFAmalia AshariNo ratings yet

- George Dussias Senior Valuation Consultant Ktimatiki Corfac International GreeceDocument5 pagesGeorge Dussias Senior Valuation Consultant Ktimatiki Corfac International GreeceKTIMATIKI CORFAC International Real Estate GreeceNo ratings yet

- Strategic Analysis On SonyDocument37 pagesStrategic Analysis On Sonylavkush_khannaNo ratings yet

- Special Economic Zone Public Purpose and Private PropertyDocument14 pagesSpecial Economic Zone Public Purpose and Private PropertyRonaky123456No ratings yet

- 07sol-Liabilities WB 1stDocument21 pages07sol-Liabilities WB 1stAins M. BantuasNo ratings yet

- Financial Services BBM NotesDocument44 pagesFinancial Services BBM Notesmanjunatha TKNo ratings yet

- Investment Pattern and Awareness of Salaried Class Investors in Tiruvannamalai District of TamilnaduDocument9 pagesInvestment Pattern and Awareness of Salaried Class Investors in Tiruvannamalai District of Tamilnadumurugan_muruNo ratings yet

- Employee HandbookDocument62 pagesEmployee HandbookKrishnaveni100% (1)

- CH 18 quiz-ACC302Document12 pagesCH 18 quiz-ACC302thangdongquay152No ratings yet

- Investor Protection Measures by Sebi: Dr. KVSN Jawahar Babu S. Damodahr NaiduDocument9 pagesInvestor Protection Measures by Sebi: Dr. KVSN Jawahar Babu S. Damodahr NaiduaswinecebeNo ratings yet

- Assumptions: DCF ModelDocument3 pagesAssumptions: DCF Modelniraj kumarNo ratings yet