Professional Documents

Culture Documents

Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private Respondents

Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private Respondents

Uploaded by

cha chaCopyright:

Available Formats

You might also like

- Party 1: Joint Venture Agreement On Delivery of Mt103 Funds Swift Two (2) Way For Credit Line (Confirmation)Document13 pagesParty 1: Joint Venture Agreement On Delivery of Mt103 Funds Swift Two (2) Way For Credit Line (Confirmation)NietzscheM82% (11)

- Civil Law (And Practical Exercises) - The 2022 Bar Beatles NotesDocument78 pagesCivil Law (And Practical Exercises) - The 2022 Bar Beatles Notescha cha100% (1)

- Civil Law (And Practical Exercises) - The 2022 Bar Beatles NotesDocument78 pagesCivil Law (And Practical Exercises) - The 2022 Bar Beatles Notescha cha100% (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Deed of Absolute Sale of An Unregistered LandDocument2 pagesDeed of Absolute Sale of An Unregistered Landcha cha100% (3)

- BPI Vs CA Assigned Case DigestDocument1 pageBPI Vs CA Assigned Case DigestJocelyn Yemyem Mantilla Veloso100% (2)

- Mutuum Case DigestsDocument18 pagesMutuum Case DigestsHaidelyn CapistranoNo ratings yet

- Manila Banking Corporation v. Teodoro JR., G.R. No. 53955, January 13, 1989 DIGESTDocument3 pagesManila Banking Corporation v. Teodoro JR., G.R. No. 53955, January 13, 1989 DIGESTAprilNo ratings yet

- BPIDocument5 pagesBPIHartel Buyuccan100% (1)

- Bpi vs. CaDocument8 pagesBpi vs. Cajade123_129No ratings yet

- Supreme Court: Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private RespondentsDocument10 pagesSupreme Court: Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private RespondentsBianca BeltranNo ratings yet

- Supreme Court: Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private RespondentsDocument7 pagesSupreme Court: Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private RespondentsKria Celestine ManglapusNo ratings yet

- ObliCon - Cases - 1240 To 1258Document159 pagesObliCon - Cases - 1240 To 1258Bianca BeltranNo ratings yet

- BPI v. CA - G.R. No. 104612Document5 pagesBPI v. CA - G.R. No. 104612newin12No ratings yet

- SPCL Bank DepositsDocument13 pagesSPCL Bank DepositsJImlan Sahipa IsmaelNo ratings yet

- 63 BPI Vs CADocument4 pages63 BPI Vs CACharm Divina LascotaNo ratings yet

- BPI v. CADocument5 pagesBPI v. CAElizabeth LotillaNo ratings yet

- Civil 2 Deposit CasesDocument11 pagesCivil 2 Deposit CasesbertobalicdangNo ratings yet

- 6BPI v. CA 232 SCRA 302 GR 104612 05101994 G.R. No. 104612Document6 pages6BPI v. CA 232 SCRA 302 GR 104612 05101994 G.R. No. 104612sensya na pogi langNo ratings yet

- 6BPI v. CA 232 SCRA 302 GR 104612 05101994 G.R. No. 104612Document6 pages6BPI v. CA 232 SCRA 302 GR 104612 05101994 G.R. No. 104612sensya na pogi langNo ratings yet

- Bpi Vs CaDocument4 pagesBpi Vs CaDrean TubislloNo ratings yet

- Case Banking DigestDocument14 pagesCase Banking DigestmaJmaJ567% (3)

- BPI V CA 1994Document9 pagesBPI V CA 1994Joyce KevienNo ratings yet

- Bank of The Philippine Islands vs. Court of AppealsDocument12 pagesBank of The Philippine Islands vs. Court of AppealsRomeo de la CruzNo ratings yet

- 127739-1994-Bank of The Philippine Islands v. Court Of20181112-5466-F64ifwDocument8 pages127739-1994-Bank of The Philippine Islands v. Court Of20181112-5466-F64ifwShairaCamilleGarciaNo ratings yet

- 1 - BPI V CADocument5 pages1 - BPI V CADanielle Palestroque SantosNo ratings yet

- Deposit Own DigestsDocument12 pagesDeposit Own Digestsviva_33No ratings yet

- Bpi VS Ca GR No. 104612Document2 pagesBpi VS Ca GR No. 104612Bert Rosete100% (1)

- Supreme CourtDocument22 pagesSupreme CourtBeatta RamirezNo ratings yet

- Payment Digest OBLICONDocument11 pagesPayment Digest OBLICONDumsteyNo ratings yet

- Facts:: Bpi vs. Intermediate Appellate Court 164 SCRA 630 (1988)Document9 pagesFacts:: Bpi vs. Intermediate Appellate Court 164 SCRA 630 (1988)Bluebells33No ratings yet

- Bpi vs. Iac L-66826, Aug. 19, 1988Document5 pagesBpi vs. Iac L-66826, Aug. 19, 1988rosario orda-caiseNo ratings yet

- BPI V CA Cred TransDocument4 pagesBPI V CA Cred TransPatricia Anne GonzalesNo ratings yet

- Deposit Cases Digests (BPI Vs IAC To Consolidated Terminals vs. Artex Development)Document11 pagesDeposit Cases Digests (BPI Vs IAC To Consolidated Terminals vs. Artex Development)Ron QuintoNo ratings yet

- BPI V CADocument2 pagesBPI V CAMarrian AbanteNo ratings yet

- BPI vs. IntermeDocument5 pagesBPI vs. IntermenbragasNo ratings yet

- G.R. No. 96727 August 28, 1996 Rizal Surety & Insurance Company vs. Court of Appeals and Transocean Transport CorporationDocument13 pagesG.R. No. 96727 August 28, 1996 Rizal Surety & Insurance Company vs. Court of Appeals and Transocean Transport CorporationGodfrey Saint-OmerNo ratings yet

- Case Digests Mercantile LawDocument3 pagesCase Digests Mercantile LawCheryl ChurlNo ratings yet

- BPI vs. First MetroDocument8 pagesBPI vs. First MetroRhona MarasiganNo ratings yet

- 39 Bank of The Philippine Islands vs. Court of AppealsDocument2 pages39 Bank of The Philippine Islands vs. Court of AppealsJemNo ratings yet

- Allied Bank vs. Lim Sio Wan, G.R. No. 133179march 27, 2008Document19 pagesAllied Bank vs. Lim Sio Wan, G.R. No. 133179march 27, 2008Aleiah Jean Libatique100% (1)

- BPI FAMILY SAVINGS BANK vs. FIRST METRO INVESTMENT CORP.Document6 pagesBPI FAMILY SAVINGS BANK vs. FIRST METRO INVESTMENT CORP.DANICA FLORESNo ratings yet

- 1 - BPI Family Savings Bank vs. First Metro InvestmentDocument6 pages1 - BPI Family Savings Bank vs. First Metro InvestmentRenz MagbuhosNo ratings yet

- NIL CasesDocument51 pagesNIL CasesLope Nam-iNo ratings yet

- 1884-1909 Obligations of The AgentDocument24 pages1884-1909 Obligations of The AgentMark Dungo0% (1)

- Lao v. SPI Soriano v. PPDocument7 pagesLao v. SPI Soriano v. PPStephen MallariNo ratings yet

- METROPOLITAN vs. MARIÑASDocument2 pagesMETROPOLITAN vs. MARIÑASMarianne AndresNo ratings yet

- Case Digest: Law On Banking and FinanceDocument25 pagesCase Digest: Law On Banking and FinanceHelen Joy Grijaldo JueleNo ratings yet

- BPI Family Savings Vs Firts Metro InvestmentDocument6 pagesBPI Family Savings Vs Firts Metro InvestmentRhona MarasiganNo ratings yet

- Case Title: BANK OF THE PHILIPPINE ISLANDS, Petitioner, vs. THEDocument83 pagesCase Title: BANK OF THE PHILIPPINE ISLANDS, Petitioner, vs. THEJoseph MacalintalNo ratings yet

- SCL BankingDocument130 pagesSCL BankingArste GimoNo ratings yet

- Commercial Law Case DigestDocument21 pagesCommercial Law Case DigestpacburroNo ratings yet

- Besa, Galang and Medina For Petitioner. de Santos and Delfino For RespondentsDocument23 pagesBesa, Galang and Medina For Petitioner. de Santos and Delfino For RespondentsJohn Ceasar Ucol ÜNo ratings yet

- Cases in OBLIGATIONS AND CONTRACTSDocument17 pagesCases in OBLIGATIONS AND CONTRACTSRommell Esteban ConcepcionNo ratings yet

- Agency Cases 1116Document26 pagesAgency Cases 1116Sherwin LingatingNo ratings yet

- Case Digest BankingDocument35 pagesCase Digest BankingEKANG0% (1)

- Negotiable InstrumentsDocument4 pagesNegotiable InstrumentsBrandon BeradNo ratings yet

- Arrieta Vs Naric 10 Scra 79 (1964)Document2 pagesArrieta Vs Naric 10 Scra 79 (1964)Benitez Gherold50% (2)

- Order And/ or Writ of Preliminary InjunctionDocument3 pagesOrder And/ or Writ of Preliminary InjunctionBernabe Manda JrNo ratings yet

- 05-Spouses Ong Vs BPI Family Savings Bank (JAE)Document10 pages05-Spouses Ong Vs BPI Family Savings Bank (JAE)thelawanditscomplexitiesNo ratings yet

- 1-Project Builders Vs CADocument8 pages1-Project Builders Vs CABreth1979No ratings yet

- 2pagsibigan v. CA 221 SCRA 202 GR 90169 04071993 G.R. No. 90169Document5 pages2pagsibigan v. CA 221 SCRA 202 GR 90169 04071993 G.R. No. 90169sensya na pogi langNo ratings yet

- Go Cinco Vs CaDocument6 pagesGo Cinco Vs CaCatherine MerillenoNo ratings yet

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionFrom EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNo ratings yet

- Criminal Law (And Practical Exercises)Document83 pagesCriminal Law (And Practical Exercises)cha chaNo ratings yet

- Affidavit of One and The Same PersonDocument2 pagesAffidavit of One and The Same Personcha chaNo ratings yet

- Affidavit of One and The Same PersonDocument2 pagesAffidavit of One and The Same Personcha chaNo ratings yet

- City of Pasig V RepDocument1 pageCity of Pasig V Repcha chaNo ratings yet

- Contract of LeaseDocument2 pagesContract of Leasecha chaNo ratings yet

- Carreon V AgcaoliDocument1 pageCarreon V Agcaolicha chaNo ratings yet

- Fernando V AcunaDocument11 pagesFernando V Acunacha chaNo ratings yet

- Heirs of Manlaban V RepDocument10 pagesHeirs of Manlaban V Repcha chaNo ratings yet

- Marcos II V CADocument12 pagesMarcos II V CAcha chaNo ratings yet

- Lorenzo V PosadasDocument12 pagesLorenzo V Posadascha chaNo ratings yet

- Lesson 23 Illustrating Simple and Compound InterestDocument12 pagesLesson 23 Illustrating Simple and Compound InterestANGELIE FERNANDEZNo ratings yet

- Standard Chartered Bank: EnvironmentDocument15 pagesStandard Chartered Bank: EnvironmentBatoolNo ratings yet

- UCO Bank, Global Indian Bank For Personal, Corporate, Rural Banking Services PDFDocument1 pageUCO Bank, Global Indian Bank For Personal, Corporate, Rural Banking Services PDFkan141080No ratings yet

- Banking: Prepared by DR Deepak Tandon IMI New DelhiDocument118 pagesBanking: Prepared by DR Deepak Tandon IMI New Delhidev mhaispurkarNo ratings yet

- Financial Markets and Institutions: Ninth Edition, Global EditionDocument46 pagesFinancial Markets and Institutions: Ninth Edition, Global EditionAli El MallahNo ratings yet

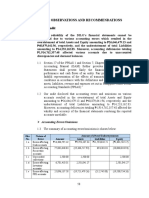

- Part Ii - Observations and Recommendations A. Financial AuditDocument54 pagesPart Ii - Observations and Recommendations A. Financial AuditAngel BacaniNo ratings yet

- Transaction HistoryDocument7 pagesTransaction Historychubbygamer02No ratings yet

- Answer Key: Sample Exam 1 Dr. Goh Beng WeeDocument8 pagesAnswer Key: Sample Exam 1 Dr. Goh Beng Weeqwerty1991srNo ratings yet

- 1.industry Profile: 1. Primary FunctionDocument70 pages1.industry Profile: 1. Primary FunctionBhavanams Rao0% (1)

- Money ND CreditDocument28 pagesMoney ND CreditSanchita JianNo ratings yet

- Fundamentals of Islamic Finance and Banking: Chapter 8: SalamDocument12 pagesFundamentals of Islamic Finance and Banking: Chapter 8: SalamIsmail Ahmad ZahidNo ratings yet

- AIBC Booklet 2013 - FinalDocument14 pagesAIBC Booklet 2013 - FinalRaghav MittalNo ratings yet

- Indusind BankDocument85 pagesIndusind BankMamata Panadi50% (2)

- Bank Agreement LetterDocument7 pagesBank Agreement LetterKellyNo ratings yet

- ICICIDocument2 pagesICICIs1v2000No ratings yet

- Real Estate InvestmentsDocument23 pagesReal Estate Investmentsjames100% (30)

- Procedure Payment Processing PDR - OSP.OPS-001Document9 pagesProcedure Payment Processing PDR - OSP.OPS-001Yulfiana SultanNo ratings yet

- FD CertificateDocument2 pagesFD CertificateSuresh BaswapathulaNo ratings yet

- Innovations of ATM Banking Services and Upcoming Challenges: Bangladesh PerspectiveDocument67 pagesInnovations of ATM Banking Services and Upcoming Challenges: Bangladesh PerspectiveRahu RayhanNo ratings yet

- s17 Cash and Cash Conversion CycleDocument22 pagess17 Cash and Cash Conversion CycleKranti PrajapatiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sourabh PunshiNo ratings yet

- Vijeta October 2022 - MDIDocument333 pagesVijeta October 2022 - MDIMihira SwarnaNo ratings yet

- Credit or DiscreditDocument1 pageCredit or DiscreditTukneNo ratings yet

- Term Paper of Business EnvironmentDocument22 pagesTerm Paper of Business EnvironmentAbbas Ansari0% (1)

- Singapore MAS HDB Latest Property Cooling Measure1478scribdDocument3 pagesSingapore MAS HDB Latest Property Cooling Measure1478scribdRobert AdamsNo ratings yet

- Arrieta V NaricDocument6 pagesArrieta V NaricEcnerolAicnelavNo ratings yet

- Online Payments Systems For E-CommerceDocument6 pagesOnline Payments Systems For E-Commerceoctal1No ratings yet

- Yardeni Stock Market CycleDocument36 pagesYardeni Stock Market CycleOmSilence2651100% (1)

- Main Conclusions of The Egrant Inc. Inquiry.Document21 pagesMain Conclusions of The Egrant Inc. Inquiry.Transparency MaltaNo ratings yet

Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private Respondents

Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private Respondents

Uploaded by

cha chaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private Respondents

Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private Respondents

Uploaded by

cha chaCopyright:

Available Formats

G.R. No.

104612 May 10, 1994

BANK OF THE PHILIPPINE ISLANDS (successorin- interest of COMMERCIAL AND TRUST

CO.), petitioner,

vs.

HON. COURT OF APPEALS, EASTERN PLYWOOD

CORP. and BENIGNO D. LIM, respondents.

(CBTC), the predecessor-in-interest of petitioner Bank

of the Philippine Islands (BPI). Sometime in March

1975, a joint checking account ("and" account) with

Lim in the amount of P120,000.00 was opened by

Mariano Velasco with funds withdrawn from the

account of Eastern and/or Lim. Various amounts were

later deposited or withdrawn from the joint account of

Velasco and Lim. The money therein was placed in

the money market.

Leonen, Ramirez & Associates for petitioner.

Constante A. Ancheta for private respondents.

DAVIDE, JR., J.:

The petitioner urges us to review and set aside the

amended Decision 1 of 6 March 1992 of respondent

Court of Appeals in CA- G.R. CV No. 25739 which

modified the Decision of 15 November 1990 of

Branch 19 of the Regional Trial Court (RTC) of Manila

in Civil Case No. 87-42967, entitled Bank of the

Philippine Islands (successor-in-interest of

Commercial Bank and Trust Company) versus

Eastern Plywood Corporation and Benigno D. Lim.

The Court of Appeals had affirmed the dismissal of

the complaint but had granted the defendants'

counterclaim for P331,261.44 which represents the

outstanding balance of their account with the plaintiff.

As culled from the records and the pleadings of the

parties, the following facts were duly established:

Private respondents Eastern Plywood Corporation

(Eastern) and

Benigno D. Lim (Lim), an officer and stockholder of

Eastern, held at least one joint bank account ("and/or"

account) with the Commercial Bank and Trust Co.

Velasco died on 7 April 1977. At the time of his death,

the outstanding balance of the account stood at

P662,522.87. On 5 May 1977, by virtue of an

Indemnity Undertaking executed by Lim for himself

and as President and General Manager of

Eastern, 2 one-half of this amount was provisionally

released and transferred to one of the bank accounts

of Eastern with CBTC. 3

Thereafter, on 18 August 1978, Eastern obtained a

loan of P73,000.00 from CBTC as "Additional

Working Capital," evidenced by the "Disclosure

Statement on Loan/Credit Transaction" (Disclosure

Statement) signed by CBTC through its branch

manager, Ceferino Jimenez, and Eastern, through

Lim, as its President and General Manager. 4 The

loan was payable on demand with interest at 14% per

annum.

For this loan, Eastern issued on the same day a

negotiable promissory note for P73,000.00 payable

on demand to the order of CBTC with interest at

14% per annum. 5 The note was signed by Lim both in

his own capacity and as President and General

Manager of Eastern. No reference to any security for

the loan appears on the note. In the Disclosure

Statement, the box with the printed word

"UNSECURED" was marked with "X" meaning

unsecured, while the line with the words "this loan is

wholly/partly secured by" is followed by the

typewritten words "Hold-Out on a 1:1 on C/A No.

2310-001-42," which refers to the joint account of

Velasco and Lim with a balance of P331,261.44.

In addition, Eastern and Lim, and CBTC signed

another document entitled "Holdout Agreement," also

dated 18 August 1978, 6 wherein it was stated that "as

security for the Loan [Lim and Eastern] have offered

[CBTC] and the latter accepts a holdout on said

[Current Account No. 2310-011-42 in the joint names

of Lim and Velasco] to the full extent of their alleged

interests therein as these may appear as a result of

final and definitive judicial action or a settlement

between and among the contesting parties

thereto." 7 Paragraph 02 of the Agreement provides

as follows:

Eastply [Eastern] and Mr. Lim

hereby confer upon Comtrust

[CBTC], when and if their alleged

interests in the Account Balance

shall have been established with

finality, ample and sufficient power

as shall be necessary to retain said

Account Balance and enable

Comtrust to apply the Account

Balance for the purpose of

liquidating the Loan in respect of

principal and/or accrued interest.

And paragraph 05 thereof reads:

The acceptance of this holdout shall

not impair the right of Comtrust to

declare the loan payable on

demand at any time, nor shall the

existence hereof and the nonresolution of the dispute between

the contending parties in respect of

entitlement to the Account Balance,

preclude Comtrust from instituting

an action for recovery against

Eastply and/or Mr. Lim in the event

the Loan is declared due and

payable and Eastply and/or Mr. Lim

shall default in payment of all

obligations and liabilities

thereunder.

In the meantime, a case for the settlement of

Velasco's estate was filed with Branch 152 of the RTC

of Pasig, entitled "In re Intestate Estate of Mariano

Velasco," and docketed as Sp. Proc. No. 8959. In the

said case, the whole balance of P331,261.44 in the

aforesaid joint account of Velasco and Lim was being

claimed as part of Velasco's estate. On 9 September

1986, the intestate court granted the urgent motion of

the heirs of Velasco to withdraw the deposit under the

joint account of Lim and Velasco and authorized the

heirs to divide among themselves the amount

withdrawn. 8

Sometime in 1980, CBTC was merged with BPI. 9 On

2 December 1987, BPI filed with the RTC of Manila a

complaint against Lim and Eastern demanding

payment of the promissory note for P73,000.00. The

complaint was docketed as Civil Case No. 87- 42967

and was raffled to Branch 19 of the said court, then

presided over by Judge Wenceslao M. Polo.

Defendants Lim and Eastern, in turn, filed a

counterclaim against BPI for the return of the balance

in the disputed account subject of the Holdout

Agreement and the interests thereon after deducting

the amount due on the promissory note.

After due proceedings, the trial court rendered its

decision on

15 November 1990 dismissing the complaint because

BPI failed to make out its case. Furthermore, it ruled

that "the promissory note in question is subject to the

'hold-out' agreement," 10 and that based on this

agreement, "it was the duty of plaintiff Bank [BPI] to

debit the account of the defendants under the

promissory note to set off the loan even though the

same has no fixed maturity." 11 As to the defendants'

counterclaim, the trial court, recognizing the fact that

the entire amount in question had been withdrawn by

Velasco's heirs pursuant to the order of the intestate

court in Sp. Proc. No. 8959, denied it because the

"said claim cannot be awarded without disturbing the

resolution" of the intestate court. 12

On 22 April 1992, BPI filed the instant petition alleging

therein that the Holdout Agreement in question was

subject to a suspensive condition stated therein, viz.,

that the "P331,261.44 shall become a security for

respondent Lim's promissory note only if respondents'

Lim and Eastern Plywood Corporation's interests to

that amount are established as a result of a final and

definitive judicial action or a settlement between and

among the contesting parties thereto." 15 Hence, BPI

asserts, the Court of Appeals erred in affirming the

trial court's decision dismissing the complaint on the

ground that it was the duty of CBTC to debit the

account of the defendants to set off the amount of

P73,000.00 covered by the promissory note.

Both parties appealed from the said decision to the

Court of Appeals. Their appeal was docketed as CAG.R. CV No. 25739.

Private respondents Eastern and Lim dispute the

"suspensive condition" argument of the petitioner.

They interpret the findings of both the trial and

appellate courts that the money deposited in the joint

account of Velasco and Lim came from Eastern and

Lim's own account as a finding that the money

deposited in the joint account of Lim and Velasco

"rightfully belong[ed] to Eastern Plywood Corporation

and/or Benigno Lim." And because the latter are the

rightful owners of the money in question, the

suspensive condition does not find any application in

this case and the bank had the duty to set off this

deposit with the loan. They add that the ruling of the

lower court that they own the disputed amount is the

final and definitive judicial action required by the

Holdout Agreement; hence, the petitioner can only

hold the amount of P73,000.00 representing the

security required for the note and must return the

rest. 16

On 23 January 1991, the Court of Appeals rendered a

decision affirming the decision of the trial court. It,

however, failed to rule on the defendants' (private

respondents') partial appeal from the trial court's

denial of their counterclaim. Upon their motion for

reconsideration, the Court of Appeals promulgated on

6 March 1992 an Amended Decision 13 wherein it

ruled that the settlement of Velasco's estate had

nothing to do with the claim of the defendants for the

return of the balance of their account with CBTC/BPI

as they were not privy to that case, and that the

defendants, as depositors of CBTC/BPI, are the

latter's creditors; hence, CBTC/BPI should have

protected the defendants' interest in Sp. Proc. No.

8959 when the said account was claimed by

Velasco's estate. It then ordered BPI "to pay

defendants the amount of P331,261.44 representing

the outstanding balance in the bank account of

defendants." 14

The petitioner filed a Reply to the aforesaid

Comment. The private respondents filed a Rejoinder

thereto.

We gave due course to the petition and required the

parties to submit simultaneously their memoranda.

The key issues in this case are whether BPI can

demand payment of the loan of P73,000.00 despite

the existence of the Holdout Agreement and whether

BPI is still liable to the private respondents on the

account subject of the Holdout Agreement after its

withdrawal by the heirs of Velasco.

The collection suit of BPI is based on the promissory

note for P73,000.00. On its face, the note is an

unconditional promise to pay the said amount, and as

stated by the respondent Court of Appeals, "[t]here is

no question that the promissory note is a negotiable

instrument." 17 It further correctly ruled that BPI was

not a holder in due course because the note was not

indorsed to BPI by the payee, CBTC. Only a

negotiation by indorsement could have operated as a

valid transfer to make BPI a holder in due course. It

acquired the note from CBTC by the contract of

merger or sale between the two banks. BPI,

therefore, took the note subject to the Holdout

Agreement.

We disagree, however, with the Court of Appeals in its

interpretation of the Holdout Agreement. It is clear

from paragraph 02 thereof that CBTC, or BPI as its

successor-in-interest, had every right to demand that

Eastern and Lim settle their liability under the

promissory note. It cannot be compelled to retain and

apply the deposit in Lim and Velasco's joint account to

the payment of the note. What the agreement

conferred on CBTC was a power, not a duty.

Generally, a bank is under no duty or obligation to

make the application. 18 To apply the deposit to the

payment of a loan is a privilege, a right of set-off

which the bank has the option to exercise. 19

Also, paragraph 05 of the Holdout Agreement itself

states that notwithstanding the agreement, CBTC was

not in any way precluded from demanding payment

from Eastern and from instituting an action to recover

payment of the loan. What it provides is an

alternative, not an exclusive, method of enforcing its

claim on the note. When it demanded payment of the

debt directly from Eastern and Lim, BPI had opted not

to exercise its right to apply part of the deposit subject

of the Holdout Agreement to the payment of the

promissory note for P73,000.00. Its suit for the

enforcement of the note was then in order and it was

error for the trial court to dismiss it on the theory that

it was set off by an equivalent portion in C/A No.

2310-001-42 which BPI should have debited. The

Court of Appeals also erred in affirming such

dismissal.

The "suspensive condition" theory of the petitioner is,

therefore, untenable.

The Court of Appeals correctly decided on the

counterclaim. The counterclaim of Eastern and Lim

for the return of the P331,261.44 20 was equivalent to

a demand that they be allowed to withdraw their

deposit with the bank. Article 1980 of the Civil Code

expressly provides that "[f]ixed, savings, and current

deposits of money in banks and similar institutions

shall be governed by the provisions concerning

simple loan." In Serrano vs. Central Bank of the

Philippines, 21we held that bank deposits are in the

nature of irregular deposits; they are really loans

because they earn interest. The relationship then

between a depositor and a bank is one of creditor and

debtor. The deposit under the questioned account

was an ordinary bank deposit; hence, it was payable

on demand of the depositor. 22

The account was proved and established to belong to

Eastern even if it was deposited in the names of Lim

and Velasco. As the real creditor of the bank, Eastern

has the right to withdraw it or to demand payment

thereof. BPI cannot be relieved of its duty to pay

Eastern simply because it already allowed the heirs of

Velasco to withdraw the whole balance of the

account. The petitioner should not have allowed such

withdrawal because it had admitted in the Holdout

Agreement the questioned ownership of the money

deposited in the account. As early as 12 May 1979,

CBTC was notified by the Corporate Secretary of

Eastern that the deposit in the joint account of

Velasco and Lim was being claimed by them and that

one-half was being claimed by the heirs of Velasco. 23

Moreover, the order of the court in Sp. Proc. No. 8959

merely authorized the heirs of Velasco to withdraw

the account. BPI was not specifically ordered to

release the account to the said heirs; hence, it was

under no judicial compulsion to do so. The

authorization given to the heirs of Velasco cannot be

construed as a final determination or adjudication that

the account belonged to Velasco. We have ruled that

when the ownership of a particular property is

disputed, the determination by a probate court of

whether that property is included in the estate of a

deceased is merely provisional in character and

cannot be the subject of execution. 24

Because the ownership of the deposit remained

undetermined, BPI, as the debtor with respect

thereto, had no right to pay to persons other than

those in whose favor the obligation was constituted or

whose right or authority to receive payment is

indisputable. The payment of the money deposited

with BPI that will extinguish its obligation to the

creditor-depositor is payment to the person of the

creditor or to one authorized by him or by the law to

receive it. 25 Payment made by the debtor to the

wrong party does not extinguish the obligation as to

the creditor who is without fault or negligence, even if

the debtor acted in utmost good faith and by mistake

as to the person of the creditor, or through error

induced by fraud of a third person. 26 The payment

then by BPI to the heirs of Velasco, even if done in

good faith, did not extinguish its obligation to the true

depositor, Eastern.

In the light of the above findings, the dismissal of the

petitioner's complaint is reversed and set aside. The

award on the counterclaim is sustained subject to a

modification of the interest.

that date until

payment

pursuant to

Article 2212 of

the Civil Code.

(2) The award of P331,264.44 in

favor of the private respondents

shall bear interest at the rate of

12% per annum computed from the

filing of the counterclaim.

No pronouncement as to costs.

SO ORDERED.

WHEREFORE, the instant petition is partly

GRANTED. The challenged amended decision in CAG.R. CV No. 25735 is hereby MODIFIED. As

modified:

(1) Private respondents are ordered

to pay the petitioner the promissory

note for P73,000.00 with interest at:

(a) 14% per

annum on the

principal,

computed from

18 August 1978

until payment;

(b) 12% per

annum on the

interest which

had accrued up

to the date of the

filing of the

complaint,

computed from

Case Digest:

BANK OF THE PHILIPPINE ISLANDS

vs.

HON. COURT OF APPEALS, EASTERN PLYWOOD

CORP. and BENIGNO D. LIM

G.R. No. 104612

May 10, 1994

FACTS:

Private respondents Eastern Plywood Corporation

(Eastern) and Benigno D. Lim (Lim), an officer and

stockholder of Eastern, held at least one joint bank

account with the Commercial Bank and Trust Co.

(CBTC), the predecessor-in-interest of petitioner Bank

of the Philippine Islands (BPI). Sometime in March

1975, a joint checking account with Lim in the amount

of P120,000.00 was opened by Mariano Velasco with

funds withdrawn from the account of Eastern and/or

Lim. Various amounts were later deposited or

withdrawn from the joint account of Velasco and Lim.

Velasco died on 7 April 1977. At the time of his death,

the outstanding balance of the account stood at

P662,522.87. On 5 May 1977, by virtue of an

Indemnity Undertaking executed by Lim for himself

and as President and General Manager of Eastern,

one-half of this amount was provisionally released

and transferred to one of the bank accounts of

Eastern with CBTC.

Thereafter, on 18 August 1978, Eastern obtained a

loan of P73,000.00 from CBTC as "Additional

Working Capital," evidenced by the "Disclosure

Statement on Loan/Credit Transaction" (Disclosure

Statement) signed by CBTC through its branch

manager. . The loan was payable on demand with

interest at 14% per annum.

For this loan, Eastern issued on the same day a

negotiable promissory note for P73,000.00 payable

on demand to the order of CBTC with interest at 14%

per annum. In the Disclosure Statement, the box with

the printed word "UNSECURED" was marked with "X"

meaning unsecured, while the line with the words

"this loan is wholly/partly secured by" is followed by

the typewritten words "Hold-Out on a 1:1 on C/A No.

2310-001-42," which refers to the joint account of

Velasco and Lim with a balance of P331,261.44.

Eastern and Lim, and CBTC signed another

document entitled "Holdout Agreement," dated 18

August 1978, wherein it was stated that "as security

for the Loan have offered [CBTC] and the latter

accepts a holdout on said [Current Account No. 2310011-42 in the joint names of Lim and Velasco] to the

full extent of their alleged interests therein as these

may appear as a result of final and definitive judicial

action or a settlement between and among the

contesting parties thereto."

Sometime in 1980, CBTC was merged with BPI. On

December 2, 1987, BPI filed with the RTC of Manila

a complaint against Lim and Eastern demanding

payment of the promissory note for P73,000.00.

Defendants Lim and Eastern, in turn, filed a

counterclaim against BPI for the return of the balance

in the disputed account subject of the Holdout

Agreement and the interests thereon after deducting

the amount due on the promissory note.

the trial court ruled that "the promissory note in

question is subject to the 'hold-out' agreement," and

that based on this agreement, "it was the duty of

plaintiff Bank [BPI] to debit the account of the

defendants under the promissory note to set off the

loan even though the same has no fixed maturity." As

to the defendants' counterclaim, the trial court,

recognizing the fact that the entire amount in question

had been withdrawn by Velasco's heirs pursuant to

the order of the intestate court in denied it because

the "said claim cannot be awarded without disturbing

the resolution" of the intestate court.

On 23 January 1991, the Court of Appeals rendered a

decision affirming the decision of the trial court. it

ruled that the settlement of Velasco's estate had

nothing to do with the claim of the defendants for the

return of the balance of their account with CBTC/BPI

as they were not privy to that case, and that the

defendants, as depositors of CBTC/BPI, are the

latter's creditors; hence, CBTC/BPI should have

protected the defendants' interest in Sp. Proc. No.

8959 when the said account was claimed by

Velasco's estate. It then ordered BPI "to pay

defendants the amount of P331,261.44 representing

the outstanding balance in the bank account of

defendants."

On 22 April 1992, BPI filed the instant petition alleging

therein that the Holdout Agreement in question was

subject to a suspensive condition the "P331,261.44

shall become a security for respondent Lim's

promissory note only if respondents' Lim and Eastern

Plywood Corporation's interests to that amount are

established as a result of a final and definitive judicial

action or a settlement between and among the

contesting parties thereto.

Issues:

can BPI demand payment of the loan of P73,000.00

despite the existence of the Holdout Agreement and

is BPI still liable to the private respondents on the

account subject of the Holdout Agreement after its

withdrawal by the heirs of Velasco.

Decision:

Yes The collection suit of BPI is based on the

promissory note for P73,000.00. On its face, the note

is an unconditional promise to pay the said amount,

and as stated by the respondent Court of Appeals,

further correctly ruled that BPI was not a holder in due

course because the note was not indorsed to BPI by

the payee, CBTC. Only a negotiation by indorsement

could have operated as a valid transfer to make BPI a

holder in due course. It acquired the note from CBTC

by the contract of merger or sale between the two

banks. BPI, therefore, took the note subject to the

Holdout Agreement.

It is clear from paragraph 02 thereof that CBTC, or

BPI as its successor-in-interest, had every right to

demand that Eastern and Lim settle their liability

under the promissory note. It cannot be compelled to

retain and apply the deposit in Lim and Velasco's joint

account to the payment of the note. What the

agreement conferred on CBTC was a power, not a

duty. Generally, a bank is under no duty or obligation

to make the application. To apply the deposit to the

payment of a loan is a privilege, a right of set-off

which the bank has the option to exercise.

Also, paragraph 05 of the Holdout Agreement itself

states that notwithstanding the agreement, CBTC was

not in any way precluded from demanding payment

from Eastern and from instituting an action to recover

payment of the loan. What it provides is an

alternative, not an exclusive, method of enforcing its

claim on the note. When it demanded payment of the

debt directly from Eastern and Lim, BPI had opted not

to exercise its right to apply part of the deposit subject

of the Holdout Agreement to the payment of the

promissory note for P73,000.00.

Yes. The account was proved and established to

belong to Eastern even if it was deposited in the

names of Lim and Velasco. As the real creditor of the

bank, Eastern has the right to withdraw it or to

demand payment thereof. BPI cannot be relieved of

its duty to pay Eastern simply because it already

allowed the heirs of Velasco to withdraw the whole

balance of the account.

As early as 12 May 1979, CBTC was notified by the

Corporate Secretary of Eastern that the deposit in the

joint account of Velasco and Lim was being claimed

by them and that one-half was being claimed by the

heirs of Velasco. 23

Moreover, the order of the court in Sp. Proc. No. 8959

merely authorized the heirs of Velasco to withdraw

the account. BPI was not specifically ordered to

release the account to the said heirs; hence, it was

under no judicial compulsion to do so. The

authorization given to the heirs of Velasco cannot be

construed as a final determination or adjudication that

the account belonged to Velasco. We have ruled

You might also like

- Party 1: Joint Venture Agreement On Delivery of Mt103 Funds Swift Two (2) Way For Credit Line (Confirmation)Document13 pagesParty 1: Joint Venture Agreement On Delivery of Mt103 Funds Swift Two (2) Way For Credit Line (Confirmation)NietzscheM82% (11)

- Civil Law (And Practical Exercises) - The 2022 Bar Beatles NotesDocument78 pagesCivil Law (And Practical Exercises) - The 2022 Bar Beatles Notescha cha100% (1)

- Civil Law (And Practical Exercises) - The 2022 Bar Beatles NotesDocument78 pagesCivil Law (And Practical Exercises) - The 2022 Bar Beatles Notescha cha100% (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Deed of Absolute Sale of An Unregistered LandDocument2 pagesDeed of Absolute Sale of An Unregistered Landcha cha100% (3)

- BPI Vs CA Assigned Case DigestDocument1 pageBPI Vs CA Assigned Case DigestJocelyn Yemyem Mantilla Veloso100% (2)

- Mutuum Case DigestsDocument18 pagesMutuum Case DigestsHaidelyn CapistranoNo ratings yet

- Manila Banking Corporation v. Teodoro JR., G.R. No. 53955, January 13, 1989 DIGESTDocument3 pagesManila Banking Corporation v. Teodoro JR., G.R. No. 53955, January 13, 1989 DIGESTAprilNo ratings yet

- BPIDocument5 pagesBPIHartel Buyuccan100% (1)

- Bpi vs. CaDocument8 pagesBpi vs. Cajade123_129No ratings yet

- Supreme Court: Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private RespondentsDocument10 pagesSupreme Court: Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private RespondentsBianca BeltranNo ratings yet

- Supreme Court: Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private RespondentsDocument7 pagesSupreme Court: Leonen, Ramirez & Associates For Petitioner. Constante A. Ancheta For Private RespondentsKria Celestine ManglapusNo ratings yet

- ObliCon - Cases - 1240 To 1258Document159 pagesObliCon - Cases - 1240 To 1258Bianca BeltranNo ratings yet

- BPI v. CA - G.R. No. 104612Document5 pagesBPI v. CA - G.R. No. 104612newin12No ratings yet

- SPCL Bank DepositsDocument13 pagesSPCL Bank DepositsJImlan Sahipa IsmaelNo ratings yet

- 63 BPI Vs CADocument4 pages63 BPI Vs CACharm Divina LascotaNo ratings yet

- BPI v. CADocument5 pagesBPI v. CAElizabeth LotillaNo ratings yet

- Civil 2 Deposit CasesDocument11 pagesCivil 2 Deposit CasesbertobalicdangNo ratings yet

- 6BPI v. CA 232 SCRA 302 GR 104612 05101994 G.R. No. 104612Document6 pages6BPI v. CA 232 SCRA 302 GR 104612 05101994 G.R. No. 104612sensya na pogi langNo ratings yet

- 6BPI v. CA 232 SCRA 302 GR 104612 05101994 G.R. No. 104612Document6 pages6BPI v. CA 232 SCRA 302 GR 104612 05101994 G.R. No. 104612sensya na pogi langNo ratings yet

- Bpi Vs CaDocument4 pagesBpi Vs CaDrean TubislloNo ratings yet

- Case Banking DigestDocument14 pagesCase Banking DigestmaJmaJ567% (3)

- BPI V CA 1994Document9 pagesBPI V CA 1994Joyce KevienNo ratings yet

- Bank of The Philippine Islands vs. Court of AppealsDocument12 pagesBank of The Philippine Islands vs. Court of AppealsRomeo de la CruzNo ratings yet

- 127739-1994-Bank of The Philippine Islands v. Court Of20181112-5466-F64ifwDocument8 pages127739-1994-Bank of The Philippine Islands v. Court Of20181112-5466-F64ifwShairaCamilleGarciaNo ratings yet

- 1 - BPI V CADocument5 pages1 - BPI V CADanielle Palestroque SantosNo ratings yet

- Deposit Own DigestsDocument12 pagesDeposit Own Digestsviva_33No ratings yet

- Bpi VS Ca GR No. 104612Document2 pagesBpi VS Ca GR No. 104612Bert Rosete100% (1)

- Supreme CourtDocument22 pagesSupreme CourtBeatta RamirezNo ratings yet

- Payment Digest OBLICONDocument11 pagesPayment Digest OBLICONDumsteyNo ratings yet

- Facts:: Bpi vs. Intermediate Appellate Court 164 SCRA 630 (1988)Document9 pagesFacts:: Bpi vs. Intermediate Appellate Court 164 SCRA 630 (1988)Bluebells33No ratings yet

- Bpi vs. Iac L-66826, Aug. 19, 1988Document5 pagesBpi vs. Iac L-66826, Aug. 19, 1988rosario orda-caiseNo ratings yet

- BPI V CA Cred TransDocument4 pagesBPI V CA Cred TransPatricia Anne GonzalesNo ratings yet

- Deposit Cases Digests (BPI Vs IAC To Consolidated Terminals vs. Artex Development)Document11 pagesDeposit Cases Digests (BPI Vs IAC To Consolidated Terminals vs. Artex Development)Ron QuintoNo ratings yet

- BPI V CADocument2 pagesBPI V CAMarrian AbanteNo ratings yet

- BPI vs. IntermeDocument5 pagesBPI vs. IntermenbragasNo ratings yet

- G.R. No. 96727 August 28, 1996 Rizal Surety & Insurance Company vs. Court of Appeals and Transocean Transport CorporationDocument13 pagesG.R. No. 96727 August 28, 1996 Rizal Surety & Insurance Company vs. Court of Appeals and Transocean Transport CorporationGodfrey Saint-OmerNo ratings yet

- Case Digests Mercantile LawDocument3 pagesCase Digests Mercantile LawCheryl ChurlNo ratings yet

- BPI vs. First MetroDocument8 pagesBPI vs. First MetroRhona MarasiganNo ratings yet

- 39 Bank of The Philippine Islands vs. Court of AppealsDocument2 pages39 Bank of The Philippine Islands vs. Court of AppealsJemNo ratings yet

- Allied Bank vs. Lim Sio Wan, G.R. No. 133179march 27, 2008Document19 pagesAllied Bank vs. Lim Sio Wan, G.R. No. 133179march 27, 2008Aleiah Jean Libatique100% (1)

- BPI FAMILY SAVINGS BANK vs. FIRST METRO INVESTMENT CORP.Document6 pagesBPI FAMILY SAVINGS BANK vs. FIRST METRO INVESTMENT CORP.DANICA FLORESNo ratings yet

- 1 - BPI Family Savings Bank vs. First Metro InvestmentDocument6 pages1 - BPI Family Savings Bank vs. First Metro InvestmentRenz MagbuhosNo ratings yet

- NIL CasesDocument51 pagesNIL CasesLope Nam-iNo ratings yet

- 1884-1909 Obligations of The AgentDocument24 pages1884-1909 Obligations of The AgentMark Dungo0% (1)

- Lao v. SPI Soriano v. PPDocument7 pagesLao v. SPI Soriano v. PPStephen MallariNo ratings yet

- METROPOLITAN vs. MARIÑASDocument2 pagesMETROPOLITAN vs. MARIÑASMarianne AndresNo ratings yet

- Case Digest: Law On Banking and FinanceDocument25 pagesCase Digest: Law On Banking and FinanceHelen Joy Grijaldo JueleNo ratings yet

- BPI Family Savings Vs Firts Metro InvestmentDocument6 pagesBPI Family Savings Vs Firts Metro InvestmentRhona MarasiganNo ratings yet

- Case Title: BANK OF THE PHILIPPINE ISLANDS, Petitioner, vs. THEDocument83 pagesCase Title: BANK OF THE PHILIPPINE ISLANDS, Petitioner, vs. THEJoseph MacalintalNo ratings yet

- SCL BankingDocument130 pagesSCL BankingArste GimoNo ratings yet

- Commercial Law Case DigestDocument21 pagesCommercial Law Case DigestpacburroNo ratings yet

- Besa, Galang and Medina For Petitioner. de Santos and Delfino For RespondentsDocument23 pagesBesa, Galang and Medina For Petitioner. de Santos and Delfino For RespondentsJohn Ceasar Ucol ÜNo ratings yet

- Cases in OBLIGATIONS AND CONTRACTSDocument17 pagesCases in OBLIGATIONS AND CONTRACTSRommell Esteban ConcepcionNo ratings yet

- Agency Cases 1116Document26 pagesAgency Cases 1116Sherwin LingatingNo ratings yet

- Case Digest BankingDocument35 pagesCase Digest BankingEKANG0% (1)

- Negotiable InstrumentsDocument4 pagesNegotiable InstrumentsBrandon BeradNo ratings yet

- Arrieta Vs Naric 10 Scra 79 (1964)Document2 pagesArrieta Vs Naric 10 Scra 79 (1964)Benitez Gherold50% (2)

- Order And/ or Writ of Preliminary InjunctionDocument3 pagesOrder And/ or Writ of Preliminary InjunctionBernabe Manda JrNo ratings yet

- 05-Spouses Ong Vs BPI Family Savings Bank (JAE)Document10 pages05-Spouses Ong Vs BPI Family Savings Bank (JAE)thelawanditscomplexitiesNo ratings yet

- 1-Project Builders Vs CADocument8 pages1-Project Builders Vs CABreth1979No ratings yet

- 2pagsibigan v. CA 221 SCRA 202 GR 90169 04071993 G.R. No. 90169Document5 pages2pagsibigan v. CA 221 SCRA 202 GR 90169 04071993 G.R. No. 90169sensya na pogi langNo ratings yet

- Go Cinco Vs CaDocument6 pagesGo Cinco Vs CaCatherine MerillenoNo ratings yet

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionFrom EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNo ratings yet

- Criminal Law (And Practical Exercises)Document83 pagesCriminal Law (And Practical Exercises)cha chaNo ratings yet

- Affidavit of One and The Same PersonDocument2 pagesAffidavit of One and The Same Personcha chaNo ratings yet

- Affidavit of One and The Same PersonDocument2 pagesAffidavit of One and The Same Personcha chaNo ratings yet

- City of Pasig V RepDocument1 pageCity of Pasig V Repcha chaNo ratings yet

- Contract of LeaseDocument2 pagesContract of Leasecha chaNo ratings yet

- Carreon V AgcaoliDocument1 pageCarreon V Agcaolicha chaNo ratings yet

- Fernando V AcunaDocument11 pagesFernando V Acunacha chaNo ratings yet

- Heirs of Manlaban V RepDocument10 pagesHeirs of Manlaban V Repcha chaNo ratings yet

- Marcos II V CADocument12 pagesMarcos II V CAcha chaNo ratings yet

- Lorenzo V PosadasDocument12 pagesLorenzo V Posadascha chaNo ratings yet

- Lesson 23 Illustrating Simple and Compound InterestDocument12 pagesLesson 23 Illustrating Simple and Compound InterestANGELIE FERNANDEZNo ratings yet

- Standard Chartered Bank: EnvironmentDocument15 pagesStandard Chartered Bank: EnvironmentBatoolNo ratings yet

- UCO Bank, Global Indian Bank For Personal, Corporate, Rural Banking Services PDFDocument1 pageUCO Bank, Global Indian Bank For Personal, Corporate, Rural Banking Services PDFkan141080No ratings yet

- Banking: Prepared by DR Deepak Tandon IMI New DelhiDocument118 pagesBanking: Prepared by DR Deepak Tandon IMI New Delhidev mhaispurkarNo ratings yet

- Financial Markets and Institutions: Ninth Edition, Global EditionDocument46 pagesFinancial Markets and Institutions: Ninth Edition, Global EditionAli El MallahNo ratings yet

- Part Ii - Observations and Recommendations A. Financial AuditDocument54 pagesPart Ii - Observations and Recommendations A. Financial AuditAngel BacaniNo ratings yet

- Transaction HistoryDocument7 pagesTransaction Historychubbygamer02No ratings yet

- Answer Key: Sample Exam 1 Dr. Goh Beng WeeDocument8 pagesAnswer Key: Sample Exam 1 Dr. Goh Beng Weeqwerty1991srNo ratings yet

- 1.industry Profile: 1. Primary FunctionDocument70 pages1.industry Profile: 1. Primary FunctionBhavanams Rao0% (1)

- Money ND CreditDocument28 pagesMoney ND CreditSanchita JianNo ratings yet

- Fundamentals of Islamic Finance and Banking: Chapter 8: SalamDocument12 pagesFundamentals of Islamic Finance and Banking: Chapter 8: SalamIsmail Ahmad ZahidNo ratings yet

- AIBC Booklet 2013 - FinalDocument14 pagesAIBC Booklet 2013 - FinalRaghav MittalNo ratings yet

- Indusind BankDocument85 pagesIndusind BankMamata Panadi50% (2)

- Bank Agreement LetterDocument7 pagesBank Agreement LetterKellyNo ratings yet

- ICICIDocument2 pagesICICIs1v2000No ratings yet

- Real Estate InvestmentsDocument23 pagesReal Estate Investmentsjames100% (30)

- Procedure Payment Processing PDR - OSP.OPS-001Document9 pagesProcedure Payment Processing PDR - OSP.OPS-001Yulfiana SultanNo ratings yet

- FD CertificateDocument2 pagesFD CertificateSuresh BaswapathulaNo ratings yet

- Innovations of ATM Banking Services and Upcoming Challenges: Bangladesh PerspectiveDocument67 pagesInnovations of ATM Banking Services and Upcoming Challenges: Bangladesh PerspectiveRahu RayhanNo ratings yet

- s17 Cash and Cash Conversion CycleDocument22 pagess17 Cash and Cash Conversion CycleKranti PrajapatiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sourabh PunshiNo ratings yet

- Vijeta October 2022 - MDIDocument333 pagesVijeta October 2022 - MDIMihira SwarnaNo ratings yet

- Credit or DiscreditDocument1 pageCredit or DiscreditTukneNo ratings yet

- Term Paper of Business EnvironmentDocument22 pagesTerm Paper of Business EnvironmentAbbas Ansari0% (1)

- Singapore MAS HDB Latest Property Cooling Measure1478scribdDocument3 pagesSingapore MAS HDB Latest Property Cooling Measure1478scribdRobert AdamsNo ratings yet

- Arrieta V NaricDocument6 pagesArrieta V NaricEcnerolAicnelavNo ratings yet

- Online Payments Systems For E-CommerceDocument6 pagesOnline Payments Systems For E-Commerceoctal1No ratings yet

- Yardeni Stock Market CycleDocument36 pagesYardeni Stock Market CycleOmSilence2651100% (1)

- Main Conclusions of The Egrant Inc. Inquiry.Document21 pagesMain Conclusions of The Egrant Inc. Inquiry.Transparency MaltaNo ratings yet