Professional Documents

Culture Documents

The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014

The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014

Uploaded by

John Paul Samuel ChuaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014

The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014

Uploaded by

John Paul Samuel ChuaCopyright:

Available Formats

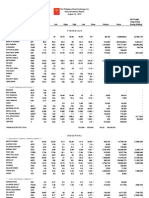

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 06 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

3,389,719

1,968,091

FINANCIALS

**** BANKS ****

ASIATRUST

ASIA UNITED

ASIA

AUB

70.4

70.65

71

71

70.4

70.4

48,120

BDO UNIBANK

BDO

79.3

79.4

77.95

79.6

77.95

79.3

2,149,050

170,021,077

53,005,944.5

BANK PH ISLANDS

BPI

85.9

86.3

85.6

86.7

85.1

85.9

802,370

69,041,307.5

(6,877,996.5)

CHINABANK

CHIB

58

58.05

58.05

58.05

58

58.05

9,140

530,292

CITYSTATE BANK

EXPORT BANK

EXPORT BANK B

EAST WEST BANK

CSB

EIBA

EIBB

EW

9.32

25.5

13.98

25.55

25.25

25.6

25.25

25.5

483,200

12,325,365

10,903,545

METROBANK

MBT

75.65

75.75

75.05

76.3

75.05

75.75

2,300,140

174,105,435.5

32,964,069

PB BANK

PBB

23.05

23.5

23.05

23.05

23.05

23.05

9,200

212,060

PBCOM

PHIL NATL BANK

PBC

PNB

55.1

82.8

67.95

83

82.9

83.1

82.8

82.8

541,100

44,872,679

20,786,883

PSBANK

PHILTRUST

RCBC

PSB

PTC

RCB

131.2

75

42.7

138

44

42.5

42.9

42.5

42.7

1,473,500

62,988,775

(13,639,475)

SECURITY BANK

UNION BANK

SECB

UBP

111.1

125.4

111.2

127

113.5

125.2

113.5

125.5

110.8

125.2

111.1

125.4

218,410

8,590

24,258,160

1,077,278

7,588,412

-

2.7

1.96

2.88

1.97

1.97

1.97

1.96

1.96

238,000

467,000

**** OTHER FINANCIAL INSTITUTIONS ****

AG FINANCE

BANKARD

AGF

BKD

BDO LEASING

BLFI

2.05

1,000

2,000

COL FINANCIAL

COL

15.5

16.2

16

16.2

16

16.2

11,100

179,320

FIRST ABACUS

FILIPINO FUND

FAF

FFI

0.78

8.3

0.83

8.5

8.1

8.6

8.1

8.5

8,800

72,410

IREMIT

2.57

2.77

2.51

2.55

2.5

2.55

9,000

22,740

2,500

MAYBANK ATR KE

MAKE

22.6

23

24.95

24.95

23.5

23.5

1,700

40,820

MEDCO HLDG

MED

0.217

0.227

0.22

0.24

0.22

0.239

260,000

61,040

MANULIFE

NTL REINSURANCE

PHIL STOCK EXCH

SUN LIFE

VANTAGE

MFC

NRCP

PSE

SLF

V

738

1.4

298

1,320

2.48

800

1.49

299

1,330

2.5

300

2.48

300

2.5

299

2.48

299

2.48

42,640

125,000

12,749,590

312,000

(1,064,440)

-

FINANCIALS SECTOR TOTAL

VOLUME :

8,740,060

VALUE :

576,729,068

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ALSONS CONS

ABOITIZ POWER

ACR

AP

1.31

35.7

1.33

36

35.15

36

35

35.7

5,238,900

184,993,000

23,057,820

ENERGY DEVT

FIRST GEN

EDC

FGEN

5.15

15.24

5.18

15.3

5.2

15.28

5.24

15.42

5.15

15.22

5.15

15.3

5,803,000

2,009,200

29,998,217

30,737,642

(3,536,265)

(8,715,444)

FIRST PHIL HLDG

CALAPAN VENTURE

MERALCO

FPH

H2O

MER

62.25

6.49

246.8

62.3

6.65

247

62.25

248.2

62.5

250.2

62

247

62.25

247

49,830

216,250

3,105,808

53,640,948

(332,159.5)

(8,083,088)

MANILA WATER

MWC

21.6

21.8

22.3

22.6

21.4

21.6

1,466,900

32,195,490

(15,928,695)

PETRON

PCOR

14

14.06

14

14.02

13.96

14

4,977,600

69,675,280

(25,468,514)

PHOENIX

PNX

5.03

5.05

5.09

5.09

5.05

5.05

86,700

438,820

(65,193)

SALCON POWER

TRANS ASIA

SPC

TA

4.3

1.76

4.64

1.77

1.77

1.8

1.75

1.77

4,193,000

7,397,320

(12,530)

VIVANT

VVT

9.04

11

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

4.99

5.15

4.99

4.99

20,000

99,900

BOGO MEDELLIN

CNTRL AZUCARERA

BMM

CAT

38.2

12

53

15.98

15

16

15

16

1,000

15,800

DEL MONTE

DNL INDUS

DMPL

DNL

22.65

6.95

22.7

6.98

22.95

6.98

23.8

7.05

22.7

6.92

22.7

6.95

109,700

8,743,900

2,530,270

61,004,262

(737,610)

(15,367,655)

EMPERADOR

EMP

11.4

11.5

11.44

11.5

11.22

11.5

485,300

5,551,704

(26)

ALLIANCE SELECT

FOOD

0.99

0.98

1.03

0.98

0.99

4,491,000

4,497,070

181,000

GINEBRA

GSMI

20.4

20.5

20

21

20

21

500

10,100

JOLLIBEE

JFC

151

152

152.6

152.9

151

151

601,520

91,441,337

(6,233,360)

LIBERTY FLOUR

LT GROUP

LFM

LTG

51.05

19.5

67

19.58

18.82

19.62

18.82

19.5

10,891,400

210,163,020

65,186,142

PANCAKE

PCKH

15

15.1

15.2

15.2

15

15

1,009,600

15,244,380

PUREFOODS

PF

224

232

229

231

224

224

363,450

83,143,122

(27,013,000)

PEPSI COLA

ROXAS AND CO

RFM CORP

PIP

RCI

RFM

4.25

3.06

5.22

4.26

4.39

5.3

4.26

5.2

4.3

5.33

4.25

5.2

4.26

5.22

858,000

511,400

3,659,620

2,702,285

(218,880)

45,169

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 06 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

ROXAS HLDG

ROX

5.66

5.67

5.6

5.68

5.6

5.66

39,600

223,915

56,600

SWIFT FOODS

SAN MIGUEL CORP

SFI

SMC

0.119

55.1

0.122

55.4

0.12

55.9

0.12

55.9

0.119

55

0.119

55.1

2,010,000

423,930

239,210

23,422,615

(5,982,403)

UNIV ROBINA

URC

115

115.8

116

118

115

115

3,003,070

346,967,975

(126,903,645)

VITARICH

VICTORIAS

VITA

VMC

0.6

2.52

0.63

2.54

0.6

2.51

0.6

2.54

0.6

2.48

0.6

2.52

854,000

2,472,000

512,400

6,219,750

2,520

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

CONCRETE A

CONCRETE B

SEACEM

DAVINCI CAPITAL

CA

CAB

CMT

DAVIN

11.38

11.6

11.5

11.7

11.4

11.4

8,500

98,034

38.5

15

1.04

0.86

54

1.09

0.88

0.85

0.89

0.85

0.86

55,000

47,700

EEI CORP

EEI

FEDERAL RES. INV

HOLCIM

LAFARGE REP

FED

HLCM

LRI

9.98

9.99

10.14

10.14

9.99

9.99

141,800

1,418,866

(70,432)

10.04

13.4

8.88

13.98

13.68

8.9

10.04

13.3

9

10.04

13.4

9

10.04

13.3

8.87

10.04

13.4

8.9

8,000

10,400

284,000

80,320

138,820

2,530,463

MEGAWIDE

MWIDE

PHINMA

PNCC

SUPERCITY

TKC STEEL

PHN

PNC

SRDC

T

11.48

11.5

11.7

11.7

11.46

11.48

414,400

4,777,532

(1,410,290)

12.02

0.8

1.7

12.5

1.76

1.71

1.76

1.7

1.76

58,000

98,760

(54,500)

VULCAN INDL

VUL

1.41

1.45

1.4

1.43

1.4

1.4

30,000

42,300

CHEMPHIL

CHEMREZ

EUROMED

LMG CHEMICALS

CIP

COAT

EURO

LMG

80

3.03

1.36

4

140

3.21

1.56

4.01

3.2

3.85

3.21

4.03

3.2

3.84

3.21

4.01

80,000

466,000

256,400

1,837,640

(256,400)

40,100

METROALLIANCE A

METROALLIANCE B

MELCO CROWN

MAH

MAHB

MCP

13.12

13.14

13.22

13.3

13.14

13.14

1,448,700

19,103,278

(8,063,122)

MABUHAY VINYL

PRYCE CORP

MVC

PPC

2.23

-

2.45

-

**** CHEMICALS ****

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

CONCEPCION

CHIPS

CIC

14

23.5

14.2

24

14.3

23.45

14.3

23.5

14.3

23.45

14.3

23.5

3,000

6,300

42,900

147,840

49,350

GREENERGY

INTEGRATED MICR

GREEN

IMI

0.01

2.56

0.011

2.67

0.01

2.56

0.011

2.56

0.01

2.56

0.011

2.56

51,800,000

5,000

518,800

12,800

(500,000)

-

IONICS

PANASONIC

ION

PMPC

0.38

5.6

0.4

5.95

0.38

-

0.38

-

0.38

-

0.38

-

730,000

-

277,400

-

FILSYN A

FILSYN B

PICOP RES

SPLASH CORP

FYN

FYNB

PCP

SPH

1.78

1.8

1.79

1.79

1.78

1.78

25,000

44,600

STENIEL

STN

1,116,930

**** OTHER INDUSTRIALS ****

INDUSTRIAL SECTOR TOTAL

VOLUME :

118,098,750

VALUE :

1,423,561,304

HOLDING FIRMS

**** HOLDING FIRMS ****

ASIA AMLGMATED

ABACORE CAPITAL

AAA

ABA

1.9

0.485

1.99

0.5

0.5

0.5

AYALA CORP

AC

520.5

ABOITIZ EQUITY

AEV

50.5

ALLIANCE GLOBAL

AGI

ANSCOR

ANS

ANGLO PHIL HLDG

APO

ATN HLDG A

ATN HLDG B

BHI HLDG

COSCO CAPITAL

0.485

0.485

2,238,000

521

521

524

520

521

288,090

150,220,575

(33,006,690)

51

50.2

51

50.2

50.5

1,352,370

68,415,220.5

(17,977,209.5)

26.9

27

26.85

27.1

26.85

27

15,222,100

411,100,335

88,642,270

6.55

6.6

6.5

6.6

6.5

6.55

51,900

339,855

1.65

1.75

1.75

1.75

1.75

1.75

3,000

5,250

ATN

ATNB

BH

COSCO

1.15

1.18

282.2

7.49

1.27

1.26

720

7.5

7.49

7.8

7.49

7.5

5,792,400

43,860,185

13,282,763

DMCI HLDG

DMC

60.85

61

59.05

61.1

59.05

61

1,269,270

77,197,326

39,006,008.5

FIL ESTATE CORP

FILINVEST DEV

FC

FDC

4.65

4.67

4.65

4.67

4.65

4.67

281,000

1,308,310

FJ PRINCE A

FJ PRINCE B

FORUM PACIFIC

GT CAPITAL

FJP

FJPB

FPI

GTCAP

2.92

2.61

0.194

734.5

3.15

3.5

0.199

735

724

744

724

735

106,530

77,887,585

27,966,280

HOUSE OF INV

HI

6.22

6.35

6.39

6.39

6.26

6.26

16,500

103,524

JG SUMMIT

JGS

37.4

37.5

38

38.2

37.4

37.4

1,541,000

58,079,550

4,110,645

JOLLIVILLE HLDG

KEPPEL HLDG A

JOH

KPH

4.77

4.22

5.5

5

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 06 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

KEPPEL HLDG B

LODESTAR

KPHB

LIHC

4.22

0.64

6.2

0.68

0.65

0.65

0.63

0.63

40,000

25,980

LOPEZ HLDG

LPZ

4.24

4.25

4.22

4.26

4.22

4.24

949,000

4,029,600

(373,900)

MARCVENTURES

MARC

3.28

3.34

3.28

3.34

3.28

3.3

625,000

2,067,070

MABUHAY HLDG

MINERALES IND

MHC

MIC

0.59

5.04

0.6

5.08

5.05

5.05

5.04

15,000

75,500

MJC INVESTMENTS

METRO PAC INV

MJIC

MPI

3.09

4.23

4

4.25

4.24

4.26

4.23

4.25

15,991,000

67,875,920

7,482,080

PACIFICA

PRIME ORION

PRIME MEDIA

PA

POPI

PRIM

0.037

0.415

1.68

0.04

0.46

1.78

1.79

1.79

1.79

1.79

40,000

71,600

REPUBLIC GLASS

SOLID GROUP

SYNERGY GRID

SINOPHIL

REG

SGI

SGP

SINO

2.38

1.21

250

0.285

2.54

1.24

390

0.3

0.3

0.3

0.295

0.295

550,000

164,750

SM INVESTMENTS

SM

682.5

683

682

694

682

683

235,710

161,868,225

(25,557,190)

SOUTH CHINA

SOC

1.01

1.04

1.05

1.05

22,000

22,450

SEAFRONT RES

TOP FRONTIER

SPM

TFHI

1.6

69

1.69

70

67.1

70

67.1

70

110,360

7,539,451.5

(1,171,758.5)

UNIOIL HLDG

WELLEX INDUS

ZEUS HLDG

UNI

WIN

ZHI

0.162

0.177

0.32

0.209

0.18

0.33

0.162

0.33

0.162

0.33

0.162

0.33

0.162

0.33

200,000

870,000

32,400

287,100

HOLDING FIRMS SECTOR TOTAL

VOLUME :

47,817,230

VALUE :

1,137,372,142

PROPERTY

**** PROPERTY ****

ARTHALAND CORP

ALCO

0.195

0.199

0.195

0.199

0.195

0.195

850,000

165,830

ANCHOR LAND

ALHI

12.72

13.3

13.26

13.3

13.26

13.3

1,000

13,268

13,268

AYALA LAND

ALI

25.65

25.7

25.8

26

25.5

25.65

8,071,400

207,488,320

(66,969,145)

ALPHALAND

ARANETA PROP

BELLE CORP

ALPHA

ARA

BEL

1.46

5.35

1.47

5.36

1.46

5.3

1.47

5.37

1.46

5.3

1.46

5.35

298,000

1,627,900

435,410

8,680,300

43,800

1,856,853

A BROWN

BRN

1.06

1.15

1.06

1.15

1.06

1.15

2,000

2,210

CITYLAND DEVT

CROWN EQUITIES

CEBU HLDG

CDC

CEI

CHI

1.02

0.073

5.34

1.1

0.078

5.49

5.49

5.49

5.34

5.49

7,700

41,263

CENTURY PROP

CPG

1.31

1.32

1.3

1.32

1.3

1.31

10,096,000

13,280,320

(5,023,320)

CEBU PROP A

CEBU PROP B

CYBER BAY

CPV

CPVB

CYBR

4.7

4.7

0.48

5.5

5.5

0.5

0.49

0.49

0.49

0.49

50,000

24,500

EMPIRE EAST

EVER GOTESCO

ELI

EVER

0.92

0.185

0.93

0.198

0.92

0.185

0.92

0.185

0.92

0.184

0.92

0.184

318,000

740,000

292,560

136,410

FILINVEST LAND

FLI

1.22

1.23

1.25

1.25

1.23

1.23

14,358,000

17,775,440

(12,668,410)

GLOBAL ESTATE

GERI

1.23

1.24

1.25

1.26

1.23

1.23

2,828,000

3,514,470

(1,072,000)

GOTESCO LAND A

GOTESCO LAND B

8990 HLDG

IRC PROP

GO

GOB

HOUSE

IRC

6.4

1.4

6.65

1.41

1.38

1.45

1.38

1.41

79,000

110,910

(27,600)

KEPPEL PROP

CITY AND LAND

MARSTEEL A

MARSTEEL B

MEGAWORLD

KEP

LAND

MC

MCB

MEG

2.83

1.64

3.58

3.1

1.7

3.59

3.51

3.59

3.51

3.58

55,882,000

199,509,260

109,568,430

MRC ALLIED

MRC

0.108

0.109

0.116

0.116

0.107

0.109

12,110,000

1,320,480

217,000

PHIL ESTATES

PRIMETOWN PROP

PRIMEX CORP

PHES

PMT

PRMX

0.375

2.71

0.38

2.89

2.71

2.71

2.71

2.71

5,000

13,550

ROBINSONS LAND

RLC

19.38

19.68

19.2

19.76

19.2

19.7

392,800

7,602,460

(117,700)

PHIL REALTY

ROCKWELL

RLT

ROCK

0.45

1.59

0.46

1.6

0.45

1.6

0.45

1.65

0.45

1.59

0.45

1.6

70,000

1,830,000

31,500

2,922,970

SHANG PROP

SHNG

3.15

3.2

3.2

3.2

3.15

3.15

5,000

15,800

STA LUCIA LAND

SLI

0.6

0.62

0.6

0.62

0.6

0.62

51,000

30,620

SM PRIME HLDG

SMPH

14.56

14.58

14.62

14.66

14.46

14.56

18,627,400

271,443,828

(83,044,552)

STARMALLS

STR

3.42

3.45

3.57

3.57

3.57

3.57

20,000

71,400

SUNTRUST HOME

SUN

0.9

0.93

0.92

0.92

0.9

0.9

114,000

103,300

PHIL TOBACCO

UNIWIDE HLDG

VISTA LAND

TFC

UW

VLL

16.68

5.11

31

5.13

5.2

5.2

5.09

5.13

14,436,000

74,101,762

(32,201,537)

PROPERTY SECTOR TOTAL

VOLUME :

142,871,200

SERVICES

**** MEDIA ****

VALUE :

809,130,511

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 06 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

ABS CBN

ABS

27.45

27.5

27.7

29

27.5

27.5

69,800

1,954,705

GMA NETWORK

GMA7

8.33

8.34

8.36

8.36

8.33

8.33

293,200

2,443,872

MANILA BULLETIN

MLA BRDCASTING

MB

MBC

0.64

2

0.65

-

0.68

-

0.68

-

0.65

-

0.65

-

44,000

-

28,630

-

**** TELECOMMUNICATIONS ****

GLOBE TELECOM

GLO

1,681

1,682

1,675

1,689

1,671

1,681

78,065

131,294,150

(57,784,975)

LIBERTY TELECOM

PTT CORP

PLDT

LIB

PTT

TEL

1.87

2,604

1.96

2,620

1.87

2,618

1.96

2,630

1.86

2,604

1.96

2,604

41,000

103,255

76,660

270,047,860

(173,093,180)

**** INFORMATION TECHNOLOGY ****

DFNN INC

DFNN

5.55

5.64

5.55

5.57

5.55

5.55

27,100

150,630

27,750

IMPERIAL A

IMPERIAL B

ISLAND INFO

ISM COMM

MG HLDG

NEXTSTAGE

IMP

IMPB

IS

ISM

MG

NXT

4.5

0.039

1.88

0.385

3.3

5

52.9

0.044

1.9

0.42

3.5

3.8

3.8

3.3

1,417,000

4,701,950

(19,000)

TRANSPACIFIC BR

PHILWEB

TBGI

WEB

1.8

7.58

2.04

7.98

7.9

7.98

10,500

83,853

YEHEY CORP

YEHEY

1.08

1.16

(11,440)

**** TRANSPORTATION SERVICES ****

2GO GROUP

2GO

2.13

2.14

2.09

2.25

2.09

2.14

391,000

857,050

ASIAN TERMINALS

ATI

10.22

10.8

11

11

11

11

100

1,100

CEBU AIR

CEB

49

49.95

49

49.95

49

49.95

2,900

142,385

(4,900)

INTL CONTAINER

ICT

95.9

96.9

95

96.5

95

95.9

1,248,450

119,979,011.5

(25,417,870.5)

LORENZO SHIPPNG

LSC

1.25

1.59

1.25

1.25

1.25

1.25

1,000

1,250

MACROASIA

PAL HLDG

MAC

PAL

2.9

5.5

3

5.75

3

5.4

3

5.75

2.9

5.4

3

5.75

10,181,000

2,400

30,532,850

13,560

209,200

-

HARBOR STAR

TUGS

1.49

1.5

1.35

1.53

1.35

1.49

5,093,000

7,478,570

461,990

**** HOTEL & LEISURE ****

ACESITE HOTEL

ACE

1.01

1.08

1.09

1.09

1.09

1.09

1,000

1,090

BOULEVARD HLDG

BHI

0.134

0.136

0.135

0.137

0.134

0.134

13,840,000

1,864,480

(202,600)

DISCOVERY WORLD

DWC

1.94

110,000

220,000

GRAND PLAZA

WATERFRONT

GPH

WPI

25.2

0.33

50

0.34

0.34

0.34

0.34

0.34

40,000

13,600

(13,600)

CENTRO ESCOLAR

CEU

10.22

10.5

10.6

10.6

10.5

10.5

13,100

137,716

(6,400)

FAR EASTERN U

IPEOPLE

STI HLDG

FEU

IPO

STI

1,105

11.4

0.67

1,115

12

0.68

1,105

0.67

1,105

0.68

1,105

0.67

1,105

0.67

70

502,000

77,350

340,240

141,680

18.1

8.48

27

8.5

8.52

8.59

8.47

8.5

1,291,900

10,990,279

(2,071,292)

0.013

15

7.56

0.014

15.2

7.57

15

7.7

15

7.72

15

7.55

15

7.57

1,000

2,943,300

15,000

22,512,690

13,419,726

**** EDUCATION ****

**** CASINOS & GAMING ****

BERJAYA

BLOOMBERRY

BCOR

BLOOM

IP EGAME

PACIFIC ONLINE

LEISURE AND RES

EG

LOTO

LR

MANILA JOCKEY

MJC

1.65

1.79

1.64

1.64

1.63

1.63

32,000

52,360

PRMIERE HORIZON

PHA

0.295

0.3

0.3

0.32

0.295

0.295

2,200,000

676,300

PHIL RACING

TRAVELLERS

PRC

RWM

8.81

9.59

9.2

9.6

9.5

9.7

9.5

9.6

1,752,200

16,813,691

(939,782)

CALATA CORP

PUREGOLD

CAL

PGOLD

3.25

39

3.29

39.05

38.65

39.1

38.65

39

3,277,100

127,892,005

40,996,090

ROBINSONS RTL

PHIL SEVEN CORP

RRHI

SEVN

57.5

100

57.6

103.5

57.6

100

57.7

100

57.4

99.5

57.6

100

3,953,430

227,639,111.5

89,622,963

27,960

2,795,995

255,995

APC GROUP

EASYCALL

NOW CORP

PAXYS

APC

ECP

NOW

PAX

0.59

2.56

0.37

2.49

0.61

2.82

0.385

2.52

0.59

2.51

0.61

2.52

0.59

2.49

0.6

2.49

475,000

232,000

284,710

579,640

PHILCOMSAT

GLOBALPORT

PHC

PORT

5.1

8.15

**** RETAIL ****

**** OTHER SERVICES ****

SERVICES SECTOR TOTAL

VOLUME :

51,576,530

MINING & OIL

**** MINING ****

VALUE :

1,032,834,029

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 06 , 2014

Name

Symbol

ATOK

APEX MINING

ABRA MINING

AB

APX

AR

ATLAS MINING

AT

BENGUET A

BENGUET B

COAL ASIA HLDG

BC

BCB

COAL

CENTURY PEAK

DIZON MINES

GEOGRACE

LEPANTO A

LEPANTO B

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

12.5

1.96

0.0047

17.7

2

0.0048

1.96

0.0041

1.96

0.0048

1.96

0.0041

1.96

0.0048

17,000

604,000,000

33,320

2,787,700

(378,000)

15.78

15.8

15.7

15.8

15.64

15.8

1,960,100

30,848,772

(62,642)

7.6

7.56

0.78

8

7.79

0.79

0.79

0.79

0.78

0.79

99,000

77,730

CPM

DIZ

GEO

LC

LCB

0.57

5.5

0.4

0.38

0.38

0.6

5.6

0.405

0.385

0.385

5.85

0.41

0.39

0.39

5.85

0.41

0.39

0.395

5.5

0.4

0.385

0.385

5.6

0.405

0.385

0.385

75,500

130,000

6,470,000

420,903

52,200

2,499,450

3,630,000

1,410,350

45,550

MANILA MINING A

MANILA MINING B

NIHAO

MA

MAB

NI

0.018

0.02

2.12

0.019

0.021

2.15

0.018

0.02

2.09

0.019

0.021

2.2

0.018

0.02

2.09

0.018

0.021

2.12

41,900,000

18,600,000

129,000

760,100

372,600

276,310

NICKEL ASIA

NIKL

16.9

16.98

16.94

17

16.9

17

305,900

5,183,124

561,580

OMICO CORP

ORNTL PENINSULA

OM

ORE

0.36

1.57

0.42

1.58

1.55

1.59

1.52

1.58

285,000

444,970

PHILEX

PX

8.72

8.88

9.18

9.18

8.72

8.72

1,825,400

16,249,938

(4,161,143)

SEMIRARA MINING

SCC

318

318.2

318

320

317.2

318

230,910

73,441,030

1,541,370

UNITED PARAGON

UPM

0.01

0.011

0.012

0.012

0.011

0.011

4,100,000

45,200

0.242

0.017

0.018

0.035

5.47

0.25

0.018

0.02

0.036

5.58

0.035

5.56

0.035

5.59

0.035

5.47

0.035

5.47

1,100,000

87,300

38,500

478,646

3,500

-

8.02

8.19

8.09

8.19

8.19

17,100

139,361

**** OIL ****

BASIC PETROLEUM

ORIENTAL A

ORIENTAL B

PHILODRILL

PETROENERGY

BSC

OPM

OPMB

OV

PERC

PX PETROLEUM

PXP

MINING & OIL SECTOR TOTAL

VOLUME :

684,962,210

VALUE :

135,560,204

PREFERRED

ABC PREF

ABS HLDG PDR

ABC

ABSP

26.8

26.95

26.8

27.5

26.8

26.95

1,860,600

50,118,000

21,703,615

AC PREF A

AC PREF B

ACPA

ACPB

524

527

525

527

524

527

7,000

3,677,450

BC PREF A

DMC PREF

FGEN PREF F

FGEN PREF G

FPH PREF

GLO PREF A

GMA HLDG PDR

LR PREF

BCP

DMCP

FGENF

FGENG

FPHP

GLOPA

GMAP

LRP

11.5

112

111

8.45

1

112

8.6

1.01

8.45

1.01

8.45

1.01

8.45

1.01

8.45

1.01

1,100

9,000

9,295

9,090

(845)

-

PF PREF

PCOR PREF

SFI PREF

SMC PREF 2A

PFP

PPREF

SFIP

SMC2A

1,050

107.5

1.22

75.5

1,070

107.6

75.6

1,050

107.6

75.75

1,050

107.7

75.75

1,050

107.4

75.5

1,050

107.4

75.5

1,100

7,100

1,443,600

1,155,000

763,494

109,176,374

(79,986,246.5)

SMC PREF 2B

SMC2B

77.1

78.4

77.2

77.2

77.1

77.1

1,000

77,110

SMC PREF 2C

SMC PREF 1

TEL PREF HH

SMC2C

SMCP1

TLHH

79.1

-

79.5

-

78.6

-

79

-

78.5

-

79

-

141,100

-

11,083,613

-

(10,996,753)

-

PREFERRED TOTAL

VOLUME :

3,471,600

VALUE :

176,069,426

PHIL. DEPOSITARY RECEIPTS

PHIL. DEPOSIT RECEIPTS TOTAL

VOLUME :

VALUE :

WARRANTS

LR WARRANT

LRW

0.32

0.33

0.33

0.33

0.33

0.33

10,000

3,300

MEG WARRANT

MEG WARRANT 2

MEGW1

MEGW2

2.38

2.25

2.58

2.64

2.37

-

2.37

-

2.37

-

2.37

-

1,000

-

2,370

-

17,500

-

WARRANTS TOTAL

VOLUME :

11,000

VALUE :

5,670

SMALL & MEDIUM ENTERPRISES

MAKATI FINANCE

IRIPPLE

MFIN

RPL

SMALL & MEDIUM ENTERPRISES TOTAL

3.55

9.62

11.7

3.5

-

3.5

VOLUME :

3.5

5,000

3.5

-

5,000

VALUE :

17,500

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 06 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

660

62,864

11,400

EXCHANGE TRADED FUNDS

FIRST METRO ETF

FMETF

95

95.4

95

EXCHANGE TRADED FUNDS TOTAL

TOTAL MAIN BOARD

95.4

VOLUME :

VOLUME :

95

95

660

1,054,071,640

VALUE :

VALUE :

62,864

5,115,267,622

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 06 , 2014

Name

Symbol

Bid

NO. OF ADVANCES:

NO. OF DECLINES:

NO. OF UNCHANGED:

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

77

62

44

NO. OF TRADED ISSUES:

NO. OF TRADES:

183

21,756

ODDLOT VOLUME:

ODDLOT VALUE:

37,109

123,294.77

BLOCK SALE VOLUME:

BLOCK SALE VALUE:

979,500

26,201,625.00

BLOCK SALES

SECURITY

AGI

PRICE

26.7500

VOLUME

979,500

VALUE

26,201,625.00

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining & Oil

SME

ETF

PSEi

All Shares

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,467.17

8,750.42

5,307.39

2,245.11

1,826.67

13,458.11

1,482.61

8,832.58

5,356.14

2,263.8

1,836.76

13,542.49

1,467.17

8,742.51

5,307.39

2,242.25

1,825.87

13,393.9

1,477.29

8,742.51

5,318.68

2,248.65

1,825.87

13,393.9

0.32

0.26

0.07

0.18

(0.22)

(0.38)

4.68

22.57

3.9

4.11

(4.04)

(51.24)

8,740,637

118,101,181

48,801,791

142,880,896

51,590,261

684,967,823

5,000

660

576,735,870.40

1,423,589,773.83

1,163,608,903.83

809,152,175.83

1,032,861,145.34

135,564,308.54

17,500.00

62,864.00

5,903.84

3,596.1

5,945.71

3,622.43

5,903.84

3,596.1

5,914.59

3,610.68

0.1

0.36

6.18

13.06

1,055,088,249

5,141,592,541.77

GRAND TOTAL

Note: Sectoral and Grand Total include Main Board, Oddlot, and Block Sale transactions.

FOREIGN BUYING:

FOREIGN SELLING:

NET FOREIGN BUYING/(SELLING):

TOTAL FOREIGN:

Php 3,035,294,266.01

Php 3,269,183,225.51

Php (233,888,959.50)

Php 6,304,477,491.52

Securities Under Suspension by the Exchange as of February 06 , 2014

ABC PREF

AC PREF A

ALPHALAND

ASIATRUST

EXPORT BANK

EXPORT BANK B

FIL ESTATE CORP

FPH PREF

FILSYN A

FILSYN B

GOTESCO LAND A

GOTESCO LAND B

METROALLIANCE A

METROALLIANCE B

MARSTEEL A

MARSTEEL B

PICOP RES

PHILCOMSAT

PRIMETOWN PROP

PNCC

PRYCE CORP

PTT CORP

SMC PREF 1

STENIEL

TEL PREF HH

UNIWIDE HLDG

ABC

ACPA

ALPHA

ASIA

EIBA

EIBB

FC

FPHP

FYN

FYNB

GO

GOB

MAH

MAHB

MC

MCB

PCP

PHC

PMT

PNC

PPC

PTT

SMCP1

STN

TLHH

UW

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 06 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

You might also like

- Blue Zones Recipes (Finished)Document2 pagesBlue Zones Recipes (Finished)api-270726910No ratings yet

- Darkness The-I Believe in A ThiDocument7 pagesDarkness The-I Believe in A ThiJon SymondsNo ratings yet

- Audition Scripts & FormatDocument9 pagesAudition Scripts & FormatGary YeoNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Chris DeNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Art JamesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015RafaelAndreiLaMadridNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014nadonecNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Melissa BaileyNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016J CervNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012srichardequipNo ratings yet

- Stockquotes 08132013Document7 pagesStockquotes 08132013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 03, 2012srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Ryan Samuel C. CervasNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013srichardequipNo ratings yet

- Stockquotes 05202016Document8 pagesStockquotes 05202016Radney BallentosNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013srichardequipNo ratings yet

- Stockquotes 08122013Document7 pagesStockquotes 08122013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesFrom EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Pse Anrpt2005Document66 pagesPse Anrpt2005John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2012Document60 pagesPse Anrpt2012John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2006Document88 pagesPse Anrpt2006John Paul Samuel ChuaNo ratings yet

- Philippine Stock Ex: ChangeDocument36 pagesPhilippine Stock Ex: ChangeJohn Paul Samuel ChuaNo ratings yet

- Conquering Frontiers Formidable: The Philippine Stock Exchange, IncDocument112 pagesConquering Frontiers Formidable: The Philippine Stock Exchange, IncJohn Paul Samuel ChuaNo ratings yet

- Pse Anrpt2003Document51 pagesPse Anrpt2003John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2010Document59 pagesPse Anrpt2010John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2007Document94 pagesPse Anrpt2007John Paul Samuel ChuaNo ratings yet

- Stockquotes 02042014 PDFDocument8 pagesStockquotes 02042014 PDFJohn Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014John Paul Samuel ChuaNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- Wizard - Pathfinder 2e Beginner Box PregenDocument4 pagesWizard - Pathfinder 2e Beginner Box PregenRahul GhatakNo ratings yet

- Emily in Paris Fashion Analysis FinalDocument9 pagesEmily in Paris Fashion Analysis FinalCHELSEALYANo ratings yet

- Page 1 of The Mafia and His Angel Part 2 (Tainted Hearts 2)Document2 pagesPage 1 of The Mafia and His Angel Part 2 (Tainted Hearts 2)adtiiNo ratings yet

- Retail Master Data Model and Business DevelopmentDocument17 pagesRetail Master Data Model and Business Developmenthieu thacoNo ratings yet

- English 2 Workshop Present Simple and Past SimpleDocument4 pagesEnglish 2 Workshop Present Simple and Past SimpleDina DiazNo ratings yet

- How To Construct An Authentic Ruff WTH Pictures and FB Tutorial and Diagrams.202202539Document42 pagesHow To Construct An Authentic Ruff WTH Pictures and FB Tutorial and Diagrams.202202539dbw_250100% (2)

- Simplex Air Cam Drum Brake: February 2012Document19 pagesSimplex Air Cam Drum Brake: February 2012Anonymous gTerattFpQ100% (1)

- How To Download and Install The HASP License ManagerDocument3 pagesHow To Download and Install The HASP License ManagererdNo ratings yet

- PV Connector InstructionsDocument2 pagesPV Connector InstructionsGeorge KattapuramNo ratings yet

- Open House For ButterfliesDocument52 pagesOpen House For ButterfliesBezdomniiNo ratings yet

- Orbit RolDocument32 pagesOrbit RolThanh CongNo ratings yet

- OpenText Media Management CE 22.2 - Tablet Client User Guide English (MEDMGTMOD220200-UIO-EN-01)Document160 pagesOpenText Media Management CE 22.2 - Tablet Client User Guide English (MEDMGTMOD220200-UIO-EN-01)Ankit SaxenaNo ratings yet

- Meniu Piscina Mancare EN Int 2021Document4 pagesMeniu Piscina Mancare EN Int 2021Habina ZoranNo ratings yet

- 01 - Fundamentals of SoundDocument21 pages01 - Fundamentals of SoundSteveDFNo ratings yet

- Log LiftDocument2 pagesLog LiftНаталья ПримаNo ratings yet

- Exercise Variables and PrinciplesDocument27 pagesExercise Variables and Principlesroselhyn SottoNo ratings yet

- 300 803 Dayton Audio Spa250 User Manual RevisedDocument4 pages300 803 Dayton Audio Spa250 User Manual RevisedThiago BalthazarNo ratings yet

- 20 Bodyweight Circuits For Rapid Fat Loss: Circuit #1Document22 pages20 Bodyweight Circuits For Rapid Fat Loss: Circuit #1Murad AlmjresiNo ratings yet

- Logcat 1663753460461Document2,945 pagesLogcat 1663753460461Dias BerlyantolinNo ratings yet

- Hanna BR Alette Pattern Pieces EnglishDocument4 pagesHanna BR Alette Pattern Pieces EnglishtoozaNo ratings yet

- A2.1 FINAL TEST OCTOBER - NOVEMBER 2021 - 10H00-13H00 - Attempt ReviewDocument12 pagesA2.1 FINAL TEST OCTOBER - NOVEMBER 2021 - 10H00-13H00 - Attempt ReviewSudden DeathNo ratings yet

- tripadvisor ru 21 01 11 21 05 result 11916 База от белорусовDocument1,390 pagestripadvisor ru 21 01 11 21 05 result 11916 База от белорусовАнна ПилюгаNo ratings yet

- Fluke 190-102 Scopemeter Specifications Spec Sheet134Document8 pagesFluke 190-102 Scopemeter Specifications Spec Sheet134Conrad ConradmannNo ratings yet

- AMVCS Newsletter - May 2019Document28 pagesAMVCS Newsletter - May 2019ken whyteNo ratings yet

- SHF Catalog 2014 D1a296ceDocument38 pagesSHF Catalog 2014 D1a296ceChrst AzertyNo ratings yet

- Preparation of FoodDocument36 pagesPreparation of FoodJUSTIN RECELESTINONo ratings yet

- 03 Task Performance 1Document2 pages03 Task Performance 1Millania ThanaNo ratings yet