Professional Documents

Culture Documents

50%(2)50% found this document useful (2 votes)

1K viewsFinance 8172765

Finance 8172765

Uploaded by

Md MirazPennington Airlines is considering changing its capital structure by increasing debt by $2 million and repurchasing $2 million of equity. This will result in $5 million of debt and $5 million of equity. The company estimates its new bonds will have a yield of 8.5%.

To calculate the estimated WACC, the assistant first calculates Pennington's unlevered beta and relevered beta given the new capital structure. Then, the cost of equity is calculated using the CAPM model. Finally, the WACC is calculated as a weighted average of the after-tax cost of debt and cost of equity. The estimated WACC for Pennington's new capital structure is 10.90%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- Problem Set Capital StructureQADocument15 pagesProblem Set Capital StructureQAIng Hong100% (1)

- Intermediate Accounting 2 Quiz 2: You AnsweredDocument10 pagesIntermediate Accounting 2 Quiz 2: You AnsweredRayman MamakNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Chapter 4Document50 pagesChapter 4Nguyen Hai AnhNo ratings yet

- Examination 2Document64 pagesExamination 2Leonie JeanNo ratings yet

- QuestionsDocument16 pagesQuestionsRuby JaneNo ratings yet

- A7 Topic 10 - Gross Profit Variance AnalysisDocument1 pageA7 Topic 10 - Gross Profit Variance AnalysisAnna CharlotteNo ratings yet

- Chap. 12 HomeworkDocument14 pagesChap. 12 HomeworkOmar KabeerNo ratings yet

- P1-PB. Sample Preboard Exam PDFDocument12 pagesP1-PB. Sample Preboard Exam PDFAj VesquiraNo ratings yet

- Auditing ProblemsDocument4 pagesAuditing ProblemsCristineJoyceMalubayIINo ratings yet

- Math HomeworkDocument2 pagesMath Homeworksubash1111@gmail.comNo ratings yet

- Practical Accounting 1Document21 pagesPractical Accounting 1Christine Nicole BacoNo ratings yet

- Chapter 04 - 12thDocument16 pagesChapter 04 - 12thSarah JamesNo ratings yet

- Problem I.: Borrowing Cost - ExercisesDocument2 pagesProblem I.: Borrowing Cost - Exercisesjingyuu kim100% (1)

- Bvps and EpsDocument30 pagesBvps and EpsRenzo Melliza100% (1)

- ReviewerDocument9 pagesReviewerMarielle JoyceNo ratings yet

- FAR MaterialDocument25 pagesFAR MaterialJerecko Ace ManlangatanNo ratings yet

- Conceptual FrameworkDocument65 pagesConceptual FrameworkKatKat OlarteNo ratings yet

- Additional Problems DepnRevaluation and ImpairmentDocument2 pagesAdditional Problems DepnRevaluation and Impairmentfinn heartNo ratings yet

- 2Document17 pages2shaniaNo ratings yet

- Pre Week NewDocument30 pagesPre Week NewAnonymous wDganZNo ratings yet

- Ppe 2Document7 pagesPpe 2Lara Lewis Achilles50% (2)

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Janine LerumNo ratings yet

- Third Week - Dsadfor PrintingDocument14 pagesThird Week - Dsadfor Printingyukiro rineva0% (2)

- 25781306Document19 pages25781306GuinevereNo ratings yet

- Ans For Decision MakingDocument5 pagesAns For Decision MakingSellKcNo ratings yet

- Finance Lease: Demo Teaching PresentationDocument52 pagesFinance Lease: Demo Teaching PresentationFaye Reyes100% (2)

- Notes and Loans ReceivableDocument10 pagesNotes and Loans ReceivableKent TumulakNo ratings yet

- Janet Wooster Owns A Retail Store That Sells New andDocument2 pagesJanet Wooster Owns A Retail Store That Sells New andAmit PandeyNo ratings yet

- ACC 221 - Fourth ExaminationDocument5 pagesACC 221 - Fourth ExaminationCharlesNo ratings yet

- Cost of Capital HandoutDocument5 pagesCost of Capital HandoutAli SajidNo ratings yet

- Chapter 20-Cash, Payables, and Liquidity Management: Multiple ChoiceDocument15 pagesChapter 20-Cash, Payables, and Liquidity Management: Multiple ChoiceadssdasdsadNo ratings yet

- Chapter 31SMEs Property Plant and EquipmentDocument2 pagesChapter 31SMEs Property Plant and EquipmentDez ZaNo ratings yet

- 221 ExamsDocument10 pages221 ExamsElla Mae AgoniaNo ratings yet

- Tax Chapter 1Document15 pagesTax Chapter 1chong chojun balsaNo ratings yet

- Quiz FinalDocument6 pagesQuiz FinalChriztel Joy Manansala100% (1)

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- Discussion Problems: FAR.2828-Notes Payable MAY 2020Document3 pagesDiscussion Problems: FAR.2828-Notes Payable MAY 2020stephen poncianoNo ratings yet

- Financial Management ProbsDocument7 pagesFinancial Management ProbsBenjamin AmponNo ratings yet

- Inventories, Biological Assets, Etc.Document3 pagesInventories, Biological Assets, Etc.Jobelle Candace Flores AbreraNo ratings yet

- Chapter 27 Earnings and Book Value Per ShareDocument19 pagesChapter 27 Earnings and Book Value Per ShareNhel AlvaroNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Debt RestructuringDocument2 pagesDebt RestructuringDañella Jane Baisa0% (1)

- Secor Chrystal Jean E. Shareholders EquityDocument53 pagesSecor Chrystal Jean E. Shareholders EquityAbriel BumatayNo ratings yet

- TB 14Document29 pagesTB 14rashed03nsu100% (3)

- Ratio Reviewer 2Document15 pagesRatio Reviewer 2Edgar Lay60% (5)

- Quiz Week 8 Akm 2Document6 pagesQuiz Week 8 Akm 2Tiara Eva TresnaNo ratings yet

- HW5 SolnDocument7 pagesHW5 SolnZhaohui Chen100% (1)

- p1 IaDocument1 pagep1 IaLeika Gay Soriano OlarteNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Share Based Payments - Problems: Problem 1Document5 pagesShare Based Payments - Problems: Problem 1PHI NGUYEN HOANG0% (1)

- Homework 2 (Shcheglova M.)Document3 pagesHomework 2 (Shcheglova M.)Мария ЩегловаNo ratings yet

- MAN 321 Corporate Finance Final Examination: Fall 2001Document8 pagesMAN 321 Corporate Finance Final Examination: Fall 2001Suzette Faith LandinginNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 10: Capital Structure and Leverage (Common Questions)Document4 pagesNanyang Business School AB1201 Financial Management Tutorial 10: Capital Structure and Leverage (Common Questions)asdsadsaNo ratings yet

- Financial Management AssignmentDocument3 pagesFinancial Management AssignmentHamza FayyazNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalReiner NuludNo ratings yet

- 4 - 16 - Capital StructureDocument2 pages4 - 16 - Capital StructurePham Ngoc VanNo ratings yet

- Spring2022 (July) Exam-Fin Part2Document4 pagesSpring2022 (July) Exam-Fin Part2Ahmed TharwatNo ratings yet

- FMA - Tute 10 - Dividend PolicyDocument3 pagesFMA - Tute 10 - Dividend PolicyPhuong VuongNo ratings yet

- Tutorial 7Document3 pagesTutorial 7casatn099No ratings yet

Finance 8172765

Finance 8172765

Uploaded by

Md Miraz50%(2)50% found this document useful (2 votes)

1K views2 pagesPennington Airlines is considering changing its capital structure by increasing debt by $2 million and repurchasing $2 million of equity. This will result in $5 million of debt and $5 million of equity. The company estimates its new bonds will have a yield of 8.5%.

To calculate the estimated WACC, the assistant first calculates Pennington's unlevered beta and relevered beta given the new capital structure. Then, the cost of equity is calculated using the CAPM model. Finally, the WACC is calculated as a weighted average of the after-tax cost of debt and cost of equity. The estimated WACC for Pennington's new capital structure is 10.90%.

Original Description:

finance

Original Title

Finance-8172765

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPennington Airlines is considering changing its capital structure by increasing debt by $2 million and repurchasing $2 million of equity. This will result in $5 million of debt and $5 million of equity. The company estimates its new bonds will have a yield of 8.5%.

To calculate the estimated WACC, the assistant first calculates Pennington's unlevered beta and relevered beta given the new capital structure. Then, the cost of equity is calculated using the CAPM model. Finally, the WACC is calculated as a weighted average of the after-tax cost of debt and cost of equity. The estimated WACC for Pennington's new capital structure is 10.90%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

50%(2)50% found this document useful (2 votes)

1K views2 pagesFinance 8172765

Finance 8172765

Uploaded by

Md MirazPennington Airlines is considering changing its capital structure by increasing debt by $2 million and repurchasing $2 million of equity. This will result in $5 million of debt and $5 million of equity. The company estimates its new bonds will have a yield of 8.5%.

To calculate the estimated WACC, the assistant first calculates Pennington's unlevered beta and relevered beta given the new capital structure. Then, the cost of equity is calculated using the CAPM model. Finally, the WACC is calculated as a weighted average of the after-tax cost of debt and cost of equity. The estimated WACC for Pennington's new capital structure is 10.90%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

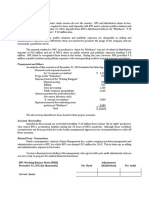

Question:

Pennington Airlines currently has a beta of 1.2. The companys capital

structure consists of $7 million of equity and $3 million of debt. The

company is considering changing its capital structure by increasing its

debt by $2 million and repurchasing common stock. After the plan is

completed, the company will have $5 million of debt and $5 million of

equity. The company estimates that if it goes ahead with the plan, its

bonds will have a nominal YTM of 8.5%. The companys tax rate is 40%.

The risk-free rate is 6% and the market risk premium is 7%. What is the

companys estimated WACC if it recapitalizes?

Solution: Computation of Weighted Average cost of capital

In this case we first calculate beta with no debt and the new cost of capital with the

new capital structure before you can calculate the firms Weighted Average Cost of

Capital.

Step 1:

equation:

Calculate the firms unlevered beta using the Hamada

bL

= bU[1 + (1 - T)(D/E)]

1.2

= bU[1 + (0.6)($3/$7)]

1.2

= 1.2571bU

bU

= 0.954545.

Step 2:

Calculate the firms new beta with the new capital structure:

bL = bU[1 + (1 - T)(D/E)]

bL = 0.954545[1 + (0.6)($5/$5)]

bL = 1.5273.

Step 3:

Calculate the firms new cost of equity with the new capital

structure:

ks = kRF + (RP)b

ks = 6% + 7%(1.5273)

ks = 16.6909%.

Step 4:

Calculate the firms new WACC:

WACC = wdkd(1 - T) + wcks

WACC = 0.5(8.5%)(0.6) + 0.5(16.6909%)

WACC = 10.8955% or 10.90%.

Hence the Weighted Average Cost of Capital is 10.90%

You might also like

- Problem Set Capital StructureQADocument15 pagesProblem Set Capital StructureQAIng Hong100% (1)

- Intermediate Accounting 2 Quiz 2: You AnsweredDocument10 pagesIntermediate Accounting 2 Quiz 2: You AnsweredRayman MamakNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Chapter 4Document50 pagesChapter 4Nguyen Hai AnhNo ratings yet

- Examination 2Document64 pagesExamination 2Leonie JeanNo ratings yet

- QuestionsDocument16 pagesQuestionsRuby JaneNo ratings yet

- A7 Topic 10 - Gross Profit Variance AnalysisDocument1 pageA7 Topic 10 - Gross Profit Variance AnalysisAnna CharlotteNo ratings yet

- Chap. 12 HomeworkDocument14 pagesChap. 12 HomeworkOmar KabeerNo ratings yet

- P1-PB. Sample Preboard Exam PDFDocument12 pagesP1-PB. Sample Preboard Exam PDFAj VesquiraNo ratings yet

- Auditing ProblemsDocument4 pagesAuditing ProblemsCristineJoyceMalubayIINo ratings yet

- Math HomeworkDocument2 pagesMath Homeworksubash1111@gmail.comNo ratings yet

- Practical Accounting 1Document21 pagesPractical Accounting 1Christine Nicole BacoNo ratings yet

- Chapter 04 - 12thDocument16 pagesChapter 04 - 12thSarah JamesNo ratings yet

- Problem I.: Borrowing Cost - ExercisesDocument2 pagesProblem I.: Borrowing Cost - Exercisesjingyuu kim100% (1)

- Bvps and EpsDocument30 pagesBvps and EpsRenzo Melliza100% (1)

- ReviewerDocument9 pagesReviewerMarielle JoyceNo ratings yet

- FAR MaterialDocument25 pagesFAR MaterialJerecko Ace ManlangatanNo ratings yet

- Conceptual FrameworkDocument65 pagesConceptual FrameworkKatKat OlarteNo ratings yet

- Additional Problems DepnRevaluation and ImpairmentDocument2 pagesAdditional Problems DepnRevaluation and Impairmentfinn heartNo ratings yet

- 2Document17 pages2shaniaNo ratings yet

- Pre Week NewDocument30 pagesPre Week NewAnonymous wDganZNo ratings yet

- Ppe 2Document7 pagesPpe 2Lara Lewis Achilles50% (2)

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Janine LerumNo ratings yet

- Third Week - Dsadfor PrintingDocument14 pagesThird Week - Dsadfor Printingyukiro rineva0% (2)

- 25781306Document19 pages25781306GuinevereNo ratings yet

- Ans For Decision MakingDocument5 pagesAns For Decision MakingSellKcNo ratings yet

- Finance Lease: Demo Teaching PresentationDocument52 pagesFinance Lease: Demo Teaching PresentationFaye Reyes100% (2)

- Notes and Loans ReceivableDocument10 pagesNotes and Loans ReceivableKent TumulakNo ratings yet

- Janet Wooster Owns A Retail Store That Sells New andDocument2 pagesJanet Wooster Owns A Retail Store That Sells New andAmit PandeyNo ratings yet

- ACC 221 - Fourth ExaminationDocument5 pagesACC 221 - Fourth ExaminationCharlesNo ratings yet

- Cost of Capital HandoutDocument5 pagesCost of Capital HandoutAli SajidNo ratings yet

- Chapter 20-Cash, Payables, and Liquidity Management: Multiple ChoiceDocument15 pagesChapter 20-Cash, Payables, and Liquidity Management: Multiple ChoiceadssdasdsadNo ratings yet

- Chapter 31SMEs Property Plant and EquipmentDocument2 pagesChapter 31SMEs Property Plant and EquipmentDez ZaNo ratings yet

- 221 ExamsDocument10 pages221 ExamsElla Mae AgoniaNo ratings yet

- Tax Chapter 1Document15 pagesTax Chapter 1chong chojun balsaNo ratings yet

- Quiz FinalDocument6 pagesQuiz FinalChriztel Joy Manansala100% (1)

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- Discussion Problems: FAR.2828-Notes Payable MAY 2020Document3 pagesDiscussion Problems: FAR.2828-Notes Payable MAY 2020stephen poncianoNo ratings yet

- Financial Management ProbsDocument7 pagesFinancial Management ProbsBenjamin AmponNo ratings yet

- Inventories, Biological Assets, Etc.Document3 pagesInventories, Biological Assets, Etc.Jobelle Candace Flores AbreraNo ratings yet

- Chapter 27 Earnings and Book Value Per ShareDocument19 pagesChapter 27 Earnings and Book Value Per ShareNhel AlvaroNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Debt RestructuringDocument2 pagesDebt RestructuringDañella Jane Baisa0% (1)

- Secor Chrystal Jean E. Shareholders EquityDocument53 pagesSecor Chrystal Jean E. Shareholders EquityAbriel BumatayNo ratings yet

- TB 14Document29 pagesTB 14rashed03nsu100% (3)

- Ratio Reviewer 2Document15 pagesRatio Reviewer 2Edgar Lay60% (5)

- Quiz Week 8 Akm 2Document6 pagesQuiz Week 8 Akm 2Tiara Eva TresnaNo ratings yet

- HW5 SolnDocument7 pagesHW5 SolnZhaohui Chen100% (1)

- p1 IaDocument1 pagep1 IaLeika Gay Soriano OlarteNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Share Based Payments - Problems: Problem 1Document5 pagesShare Based Payments - Problems: Problem 1PHI NGUYEN HOANG0% (1)

- Homework 2 (Shcheglova M.)Document3 pagesHomework 2 (Shcheglova M.)Мария ЩегловаNo ratings yet

- MAN 321 Corporate Finance Final Examination: Fall 2001Document8 pagesMAN 321 Corporate Finance Final Examination: Fall 2001Suzette Faith LandinginNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 10: Capital Structure and Leverage (Common Questions)Document4 pagesNanyang Business School AB1201 Financial Management Tutorial 10: Capital Structure and Leverage (Common Questions)asdsadsaNo ratings yet

- Financial Management AssignmentDocument3 pagesFinancial Management AssignmentHamza FayyazNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalReiner NuludNo ratings yet

- 4 - 16 - Capital StructureDocument2 pages4 - 16 - Capital StructurePham Ngoc VanNo ratings yet

- Spring2022 (July) Exam-Fin Part2Document4 pagesSpring2022 (July) Exam-Fin Part2Ahmed TharwatNo ratings yet

- FMA - Tute 10 - Dividend PolicyDocument3 pagesFMA - Tute 10 - Dividend PolicyPhuong VuongNo ratings yet

- Tutorial 7Document3 pagesTutorial 7casatn099No ratings yet