Professional Documents

Culture Documents

Contact: 9033311500, 8866611600: Best of Luck

Contact: 9033311500, 8866611600: Best of Luck

Uploaded by

Ravi UdeshiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contact: 9033311500, 8866611600: Best of Luck

Contact: 9033311500, 8866611600: Best of Luck

Uploaded by

Ravi UdeshiCopyright:

Available Formats

Ravi Sirs Nimble Education for ISC,CBSE,ICSE, IB, AS & A Levels

Contact : 9033311500, 8866611600

------------------------------------------------------------------------------------------------------------------------------------MM : 24

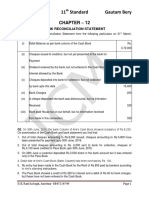

Bank Reconciliation Statement

Time: 35 min

------------------------------------------------------------------------------------------------------------------------------------Q1. The Bank balance as per Cashbook Dr. Rs 20,000 of Mr. Ronn did not agree with passbook. On

comparing the two books the following differences were found for the month ending March.

1.Cheque deposited into bank during the month of March Rs 35,000, of these cheques worth Rs

12,000 were credited in March and cheques worth Rs 23,000 were credited in month of April.

2.Bank credited interest Rs 200 and debited Rs 80 as bank charges.

3. Customers directly deposited into bank Rs 5,200 but on Rs 2,300 recorded in cashbook

4. Transferred Rs 3,500 from saving a/c to current a/c, the entry was recorded in passbook only.

5. Debit side of Passbook is overcast by Rs 350.

6. Cheques received Rs 5,600 and recorded in cashbook but is still not banked.

7. Cheques issued Rs 6,700 were dishonored by bank marked Signature not match. The same was

not recorded in cashbook.

8. Income tax refund credited in our bank a/c Rs 3,600, but no entry made in cashbook.

Prepare Bank Reconciliation statement for the month of March.

[12]

Q2. The Bank balance of Passbook showed an overdraft balance of Rs 3,900 for the month ending

October. The balance however did not match with cashbook. The following were the differences

1.Dr side cashbook over cast Rs 230.

2. Cheques worth Rs 21,000 were issued during the month. Of these cheques worth Rs 2,000 were

not deposited into bank by suppliers and cheques worth Rs 1,300 were misplaced by suppliers.

3. Bank paid insurance charges Rs 5,000 as per standing instructions for which no information was

passed to us.

4. No entry has been made in cashbook for dividend directly collected by Rs 500.

5. A bill of Rs 7,500 discounted with bank for Rs 7,350. The same was recorded in cashbook as if

there were no discounting charges included.

6. A cheque of Rs 2,700 deposited in savings account and recorded in savings passbook has been

debited in cashbook.

7. Bank charges debited twice in cashbook Rs 300.

8. A cheque of Rs 1,500 was received and not deposited into book. The entry was omitted to be

recorded in cashbook.

Prepare Bank Reconciliation statement for the month of October.

[12]

***************************

BEST OF LUCK

Ravi Sirs Nimble Education for ISC,CBSE,ICSE, IB, AS & A Levels

Contact : 9033311500, 8866611600

You might also like

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- Baj Audit Account 1.0Document8 pagesBaj Audit Account 1.0vrlthaker6128No ratings yet

- Dissolution TestDocument2 pagesDissolution TestRavi UdeshiNo ratings yet

- MGT 101Document4 pagesMGT 101Taiba ShehzadiNo ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- 11 05 17-31 12 17Document1 page11 05 17-31 12 17daya141079No ratings yet

- Monthly Current Affairs: November 2023Document199 pagesMonthly Current Affairs: November 2023Monsta XNo ratings yet

- Bank Reconciliation QuestionDocument2 pagesBank Reconciliation QuestionFinnNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementRadhakrishna MishraNo ratings yet

- Amiba TechDocument3 pagesAmiba TechBhanu ShringiNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Igcse - Extented Tutoring - 2023 - 2024 - Cash Book and BrsDocument6 pagesIgcse - Extented Tutoring - 2023 - 2024 - Cash Book and BrsMUSTHARI KHANNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMohammad Faizan Farooq Qadri AttariNo ratings yet

- Bank Reconciliation Statement 70Document6 pagesBank Reconciliation Statement 70xyzNo ratings yet

- 2019inds MS75Document4 pages2019inds MS75SubbareddyNo ratings yet

- Capinew Account June13Document7 pagesCapinew Account June13ashwinNo ratings yet

- Chapter EightDocument5 pagesChapter EightEng Abdulkadir MahamedNo ratings yet

- Brs Practise SheetDocument1 pageBrs Practise Sheetapi-252642432No ratings yet

- Bank Reconciliation Statement: Correct AnswerDocument4 pagesBank Reconciliation Statement: Correct AnswerFaisal Ali100% (1)

- Brs WorksheetDocument2 pagesBrs WorksheetSaurabh JainNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- SSCDocument4 pagesSSCAnonymous gvw9aCjNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Disbursement of Pension by Agency BanksDocument25 pagesDisbursement of Pension by Agency BanksnalluriimpNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- ACCA F3 Bank Recon and Errors 09 and Fixed AssetsDocument2 pagesACCA F3 Bank Recon and Errors 09 and Fixed AssetsAmos OkechNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- Sobha Mykonos - AGM Minutes - 03-Aug-2019Document7 pagesSobha Mykonos - AGM Minutes - 03-Aug-2019VansaNo ratings yet

- MR Solanki Vikram BEHIND I.O.C, 53, Mahadev Colony, Sendra Road Beawar Ajmer, BEAWAR-305901Document1 pageMR Solanki Vikram BEHIND I.O.C, 53, Mahadev Colony, Sendra Road Beawar Ajmer, BEAWAR-305901arsolanki.beawarNo ratings yet

- Challan Neeladri Appala Narasa KumariDocument1 pageChallan Neeladri Appala Narasa KumariRAM3692003No ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- BANK RECONCILIATION NotesDocument9 pagesBANK RECONCILIATION NotesNicole DomingoNo ratings yet

- Mrs Nithya S No.17 C, 3Rd Cross Street, Sri Sathya Sai Nagar, Rajakilpakkam, CHENNAI-600073Document1 pageMrs Nithya S No.17 C, 3Rd Cross Street, Sri Sathya Sai Nagar, Rajakilpakkam, CHENNAI-600073Prakash ChandrasekaranNo ratings yet

- Inactive Dormant Rbi CirDocument2 pagesInactive Dormant Rbi Cirruchikunwar07No ratings yet

- Rbi 1Document1 pageRbi 1mahes310No ratings yet

- 6134467757007882331Document1 page6134467757007882331Nitin GhotekarNo ratings yet

- Group AssaignmentDocument6 pagesGroup Assaignmentzeritu tilahunNo ratings yet

- 12.foundation Accounting Fasttrack Handwritten Notes by CMA CS RohanNimbalkarDocument142 pages12.foundation Accounting Fasttrack Handwritten Notes by CMA CS RohanNimbalkarsnehajainsneha52No ratings yet

- Rbi 2012-13 493Document3 pagesRbi 2012-13 493ambarishramanuj8771No ratings yet

- Learning Note of BUPGB, Raebareli-Uday Kumar, Asst. ManagerDocument8 pagesLearning Note of BUPGB, Raebareli-Uday Kumar, Asst. ManagerUday KumarNo ratings yet

- యూనియన్ PDFDocument4 pagesయూనియన్ PDFSurendra Telugu 9493884443No ratings yet

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- 1 Jul 2015-Master Circular On Customer Service - UCBs PDFDocument56 pages1 Jul 2015-Master Circular On Customer Service - UCBs PDFDisability Rights AllianceNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- PNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Document8 pagesPNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Anil DhankharNo ratings yet

- 16772BRSDocument47 pages16772BRSSketch KathayatNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Assigment BBM Finacial AccountingDocument6 pagesAssigment BBM Finacial Accountingtripathi_indramani5185No ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Kap 1 Workbook Se CH 9Document26 pagesKap 1 Workbook Se CH 9Zsadist20No ratings yet

- Cir 97-23Document3 pagesCir 97-23mondal.gurudas1954No ratings yet

- Abhyudaya Bank 2009-10Document10 pagesAbhyudaya Bank 2009-10Nilesh_Tiwari2010No ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- Concurrent Audit ReportDocument12 pagesConcurrent Audit ReportRUPESH KEDIANo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- ISC Commerce Syllabus PDFDocument9 pagesISC Commerce Syllabus PDFRavi UdeshiNo ratings yet

- Contact 9033311500, 8866611600Document2 pagesContact 9033311500, 8866611600Ravi UdeshiNo ratings yet

- Ledger & Trial BalanceDocument1 pageLedger & Trial BalanceRavi UdeshiNo ratings yet

- Accounting EquationsDocument2 pagesAccounting EquationsRavi UdeshiNo ratings yet

- Fiscal and Monetary PolicyDocument41 pagesFiscal and Monetary PolicyRavi UdeshiNo ratings yet

- Journals TestDocument1 pageJournals TestRavi UdeshiNo ratings yet

- ISC Commerce Syllabus PDFDocument9 pagesISC Commerce Syllabus PDFRavi UdeshiNo ratings yet

- Cashbook WorksheetDocument3 pagesCashbook WorksheetRavi UdeshiNo ratings yet

- Student Details Form 2017-18: SL No Name of Student School Student Contact No Father's Contact No Mother's Contact NoDocument1 pageStudent Details Form 2017-18: SL No Name of Student School Student Contact No Father's Contact No Mother's Contact NoRavi UdeshiNo ratings yet

- Accounting EquationsDocument2 pagesAccounting EquationsRavi UdeshiNo ratings yet

- Basic Identification of Accounts and ClassificationDocument6 pagesBasic Identification of Accounts and ClassificationRavi UdeshiNo ratings yet

- Dissolution TestDocument2 pagesDissolution TestRavi UdeshiNo ratings yet

- CBSE Class 11 Accountancy WorksheetDocument1 pageCBSE Class 11 Accountancy WorksheetRavi UdeshiNo ratings yet

- Basic Identification of Accounts and ClassificationDocument6 pagesBasic Identification of Accounts and ClassificationRavi UdeshiNo ratings yet

- Benz Gives You The Following Information:: Balance Sheet For Big Tasty Burger Fixed AssetsDocument1 pageBenz Gives You The Following Information:: Balance Sheet For Big Tasty Burger Fixed AssetsRavi UdeshiNo ratings yet

- IG BEP & Finance TestDocument2 pagesIG BEP & Finance TestRavi UdeshiNo ratings yet

- Benz Gives You The Following Information:: Balance Sheet For Big Tasty Burger Fixed AssetsDocument1 pageBenz Gives You The Following Information:: Balance Sheet For Big Tasty Burger Fixed AssetsRavi UdeshiNo ratings yet

- Ratio TestDocument1 pageRatio TestRavi UdeshiNo ratings yet

- Chap 14 Eco TestDocument1 pageChap 14 Eco TestRavi UdeshiNo ratings yet

- Chap 15 Eco TestDocument1 pageChap 15 Eco TestRavi UdeshiNo ratings yet