Professional Documents

Culture Documents

Berita 1 Oktober 2016 (Asli)

Berita 1 Oktober 2016 (Asli)

Uploaded by

PuputOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Berita 1 Oktober 2016 (Asli)

Berita 1 Oktober 2016 (Asli)

Uploaded by

PuputCopyright:

Available Formats

US sharply upgrades 2nd quarter growth to 1.

4%

WASHINGTON, Sept. 29 (AFP)

The US economy grew faster than originally thought in the second quarter of this year, with

Commerce Department figures released Thursday showing a 1.4 percent annual rate.

The Commerce Department's previous second-quarter GDP estimate had been a gloomier

1.1 percent. Thursday's figures however surpassed an analyst consensus, which had called for a

revision to 1.3 percent.

Job markets also showed signs of continued strength as the US Labor Department reported

Thursday that unemployment claims remained low in the week ending September 24, coming

in at 254,000.

In releasing the new numbers, which are derived from a fuller set of data than that used in

prior estimates, the Commerce Department said the general picture of US growth in the quarter

remained the same.

Jim O'Sullivan, chief US economist at High Frequency Economics, said the second quarter

revisions were fairly minor and that the growth in the quarter still looked weak. "The available

data are signalling a pickup" in the third quarter, he said in a client note.

The most notable change between the second and third estimates was that businesses' fixed

investments increased instead of decreasing, as they had in July's estimate, the department said

in a statement.

Personal consumption and exports also helped drive the results in the second quarter, it

said. These gains were partly offset by drops in state and local government spending as well as

spending on homes.

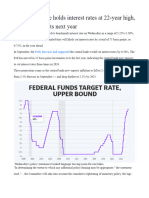

Along with the health of labor markets this year, the pace of economic growth has been a

key factor in monetary policymakers' deliberations on setting interest rates, which are at

historically low levels after having been raised for the first time in a decade in December.

Taken together with an anemic 1.1 percent growth rate in the first quarter, initial estimates

for the second quarter had helped paint a downcast portrait of the first half of 2016, stoking

nervousness about the health of the US economy.

The International Monetary Fund has said it plans to downgrade its 2016 forecast for the

US in light of the poor first half.

However, in congressional testimony on Wednesday, US Federal Reserve Chair Janet

Yellen said most Fed policymakers were confident in the economy and agreed that a rate hike

would be appropriate before the end of 2016.

In raising rates to 0.25-0.5 percent at the end of 2015, the Fed had announced the beginning

of the end of the monetary policies designed in the immediate aftermath of the Great Recession

of 2008-2009.

US Fed orders Chinese bank to tighten laundering controls

WASHINGTON, Sept. 29 (AFP)

The US Federal Reserve said Thursday that it had ordered the Agricultural Bank of China,

one of China's largest banks, to strengthen its internal controls against money laundering.

The move came after a former staffer sued the bank last year, saying said she had been

mistreated and forced her from her job after she had informed the Fed that the bank was possibly

in violation of rules on policing money laundering.

The staffer, Natasha Taft, settled her complaint with the bank in earlier this month without

any public finding of guilt.

But the Fed followed that up Thursday with an agreement that the bank will overhaul its

internal controls to ensure that transactions

The bank and the Fed entered the agreement "solely for the purpose of settling this matter

without a formal proceeding being filed and without the necessity for protracted or extended

hearings or testimony," according to the agreement.

The agreement gave the bank 60 days to complete a review and tell the Fed how it would

improve oversight and monitoring of transactions to prevent money laundering.

Mexico's central bank raises key rate as peso falls

MEXICO CITY, Sept. 29 (AFP)

Mexico's central bank raised its key interest rate on Thursday, citing inflationary pressure, the

peso's record drop and the risk of financial volatility linked to the US presidential election.

The Banco de Mexico hiked the overnight interbanking rate by half a percentage point to

4.75 percent.

"With this action, we seek to counter inflationary pressure and maintain expectations on

inflation well-anchored," the bank said in a statement.

The national currency fell to the psychological level of 20 pesos per dollar this month.

Analysts partly attribute the drop to concerns about Republican presidential candidate

Donald Trump's potential victory in the US November 8 election, which could hurt Mexico due

to his demand that the country pay for a massive wall across the border.

The bank's statement cited the risk of more volatility in international financial markets

"especially if nervousness about the possible consequences of the electoral process in the United

States worsens."

You might also like

- This Is A Customs Electronically Validated Entry Assessed by CustomsDocument6 pagesThis Is A Customs Electronically Validated Entry Assessed by CustomsDzifahManteauNo ratings yet

- USOnline PayslipDocument2 pagesUSOnline PayslipTami SariNo ratings yet

- 2019 - International Trade PolicyDocument17 pages2019 - International Trade PolicyJuana FernandezNo ratings yet

- 1703fed Cuts US Interest RatesDocument2 pages1703fed Cuts US Interest RatesVictorNo ratings yet

- Bank of England MustDocument4 pagesBank of England MustAli ShadanNo ratings yet

- First-Of-Its-Kind News ConferenceDocument11 pagesFirst-Of-Its-Kind News ConferenceKushal RastogiNo ratings yet

- Fed's Powell Again Stresses Patience As U.S. Economy's 'Narrative' UnfoldsDocument2 pagesFed's Powell Again Stresses Patience As U.S. Economy's 'Narrative' UnfoldsAnthony JCNo ratings yet

- Bahan Berita 10 OktoberDocument2 pagesBahan Berita 10 OktoberPuputNo ratings yet

- Fed Cuts Key Rate by A QuarterDocument2 pagesFed Cuts Key Rate by A QuarterhatanoloveNo ratings yet

- Is This The Turning Point For Interest RatesDocument7 pagesIs This The Turning Point For Interest RatesJasmine MagdyNo ratings yet

- Economy Shows Signs of Slowing, InfDocument1 pageEconomy Shows Signs of Slowing, Infandry rightNo ratings yet

- Date The Commentary Was Written: 23 December 2018Document6 pagesDate The Commentary Was Written: 23 December 2018Diya NahtaNo ratings yet

- US Jobs Seen Growing With Resilient Economy - Eco Week - BloombergDocument12 pagesUS Jobs Seen Growing With Resilient Economy - Eco Week - BloombergVineet YagnikNo ratings yet

- Economics Macro IA DraftDocument7 pagesEconomics Macro IA Draftsantran152No ratings yet

- Kimberly - Economics Internal AssesmentDocument8 pagesKimberly - Economics Internal Assesmentkimberly.weynata.4055No ratings yet

- Mortgage Buying - FedDocument2 pagesMortgage Buying - Fedcrow_the_robotNo ratings yet

- Article #8Document2 pagesArticle #8LauraNo ratings yet

- Hoisington Q4Document6 pagesHoisington Q4ZerohedgeNo ratings yet

- 2023-12-13-Federal Reserve Holds Interest Rates at 22-Year High, Signals Three Cuts Next YearDocument3 pages2023-12-13-Federal Reserve Holds Interest Rates at 22-Year High, Signals Three Cuts Next YearAurel AchilNo ratings yet

- 03-15-08 Boston Globe-Recession Is Here, Economist DeclaresDocument2 pages03-15-08 Boston Globe-Recession Is Here, Economist DeclaresMark WelkieNo ratings yet

- IMF Warns UK Government Against Further Tax CutsDocument6 pagesIMF Warns UK Government Against Further Tax CutssaythenamefiaNo ratings yet

- Berita 11 November 2016 (Asli)Document2 pagesBerita 11 November 2016 (Asli)PuputNo ratings yet

- US Economy Is On The Rise, Recent FED Reserve Reports ProveDocument2 pagesUS Economy Is On The Rise, Recent FED Reserve Reports ProveElias GarciaNo ratings yet

- Walter Brandimarte Daniel Bases: by andDocument4 pagesWalter Brandimarte Daniel Bases: by andtarun_0219No ratings yet

- The Day Ahead - April 17th 2013Document7 pagesThe Day Ahead - April 17th 2013wallstreetfoolNo ratings yet

- Moi A3Document1 pageMoi A3api-260353457No ratings yet

- Turc Des Affairs EtrangersDocument2 pagesTurc Des Affairs EtrangersOğuzhan ÖztürkNo ratings yet

- Higher Interest Rates On Way, Carney WarnsDocument3 pagesHigher Interest Rates On Way, Carney Warnsapi-25953522No ratings yet

- China's Economy Cools in Third QuarterDocument2 pagesChina's Economy Cools in Third QuarterTmr Gitu LoohNo ratings yet

- Here S How QuDocument4 pagesHere S How Qugcochin4No ratings yet

- Bank of England Keeps Rates at 15-Year High - ReutersDocument4 pagesBank of England Keeps Rates at 15-Year High - Reuterslynn.qijudyNo ratings yet

- 2013 - 06 - 22 - US Stocks Face More Hrdles After Fed TurbulenceDocument2 pages2013 - 06 - 22 - US Stocks Face More Hrdles After Fed TurbulenceLiew2020No ratings yet

- What Else Can The Federal Reserve Do To Support A Coronavirus-Ravaged Economy?Document5 pagesWhat Else Can The Federal Reserve Do To Support A Coronavirus-Ravaged Economy?Minu HarlalkaNo ratings yet

- Stock Market News Live Updates: Stock Futures Extend Declines As Pandemic Concerns ContinueDocument1 pageStock Market News Live Updates: Stock Futures Extend Declines As Pandemic Concerns ContinuezilchhourNo ratings yet

- Topnews 1Document2 pagesTopnews 1Md. Al MamunNo ratings yet

- US Interest Rate HikeDocument10 pagesUS Interest Rate HikeThavam RatnaNo ratings yet

- US Central Bank Chair Signals Rate Hike: Fresh Signals From The FedDocument2 pagesUS Central Bank Chair Signals Rate Hike: Fresh Signals From The FedDuo MaxwellNo ratings yet

- Morning News Notes: 2011-01-24Document1 pageMorning News Notes: 2011-01-24glerner133926No ratings yet

- Weekly Economic Commentary 07-11-2011Document4 pagesWeekly Economic Commentary 07-11-2011Jeremy A. MillerNo ratings yet

- Morning News Notes: 2011-01-14Document1 pageMorning News Notes: 2011-01-14glerner133926No ratings yet

- US Inflation Jumps As Fuel and Housing Costs RiseDocument4 pagesUS Inflation Jumps As Fuel and Housing Costs RiseproducaocpmNo ratings yet

- IMF Renews Call To Ease AusterityDocument7 pagesIMF Renews Call To Ease AusterityjarrowNo ratings yet

- Revenue Status Report FY 2011-2012 - General Fund 20111231Document19 pagesRevenue Status Report FY 2011-2012 - General Fund 20111231Infosys GriffinNo ratings yet

- Financial and Monetary SystemsDocument7 pagesFinancial and Monetary Systemslbel.ra97No ratings yet

- Policymakers Face Two NightmaresDocument5 pagesPolicymakers Face Two NightmaresSasha SitbonNo ratings yet

- Key Rates: Home Business Markets World Politics Tech Opinion Breakingviews Money Life Pictures VideoDocument23 pagesKey Rates: Home Business Markets World Politics Tech Opinion Breakingviews Money Life Pictures Videosujeet1077No ratings yet

- Fed Slows Its Tightening With Quarter-Point Interest Rate Rise - WSJDocument6 pagesFed Slows Its Tightening With Quarter-Point Interest Rate Rise - WSJHassaan ImranNo ratings yet

- BTTest PDFDocument33 pagesBTTest PDFZuraimie IsmailNo ratings yet

- Obama Insists On Tax Hike For Rich As Part of Fiscal DealDocument4 pagesObama Insists On Tax Hike For Rich As Part of Fiscal DealTaj FatyNo ratings yet

- Bond Market Points To Fed Standing Firm in Battle Against Inflation - Financial TimesDocument4 pagesBond Market Points To Fed Standing Firm in Battle Against Inflation - Financial TimeszidanexNo ratings yet

- Rise in US Core Inflation Highlights Stubborn Price PressuresDocument4 pagesRise in US Core Inflation Highlights Stubborn Price PressuresTrường Trường XuânNo ratings yet

- Australia Inflation - Why Plenty of Heav... Ing Lies Ahead Despite Recent SlowdownDocument6 pagesAustralia Inflation - Why Plenty of Heav... Ing Lies Ahead Despite Recent SlowdownmxNo ratings yet

- Berita 3 November 2016 (Asli)Document2 pagesBerita 3 November 2016 (Asli)PuputNo ratings yet

- Interest RatesDocument25 pagesInterest RatesMatthew KimNo ratings yet

- "Soc Sci Iv": John David A. Alvaro Ii-ADocument2 pages"Soc Sci Iv": John David A. Alvaro Ii-AJonnel AlejandrinoNo ratings yet

- Economist - The Federal Reserve MeetsDocument3 pagesEconomist - The Federal Reserve MeetsJeniffer GuillenNo ratings yet

- Stock Market UnstableDocument2 pagesStock Market UnstableHiroaki KomatsuNo ratings yet

- Recovery Strong But Risk Shifts To Emerging MarketsDocument2 pagesRecovery Strong But Risk Shifts To Emerging MarketsTheng RogerNo ratings yet

- Economy 5Document3 pagesEconomy 5Huyền TíttNo ratings yet

- Global Weekly Economic Update - Deloitte InsightsDocument8 pagesGlobal Weekly Economic Update - Deloitte InsightsSaba SiddiquiNo ratings yet

- Philippines Posts Forecast-Beating Q3 Growth But Risks Remain by ReutersDocument2 pagesPhilippines Posts Forecast-Beating Q3 Growth But Risks Remain by ReutersNutthakarn WisatsiriNo ratings yet

- Economics Reflection #3Document3 pagesEconomics Reflection #3Juliana FerreiraNo ratings yet

- Obama’S Empty Promises Vanished Hopes: An Analytical Review of a President’S Policy FailuresFrom EverandObama’S Empty Promises Vanished Hopes: An Analytical Review of a President’S Policy FailuresNo ratings yet

- Mexico To File WTO Complaint Over US Tariffs: MinistryDocument1 pageMexico To File WTO Complaint Over US Tariffs: MinistryPuputNo ratings yet

- Grammar: For Questions No. 16-25, Find The Underlined Word or Phrase A, B, C or D That Is IncorrectDocument2 pagesGrammar: For Questions No. 16-25, Find The Underlined Word or Phrase A, B, C or D That Is IncorrectPuputNo ratings yet

- Over 100 Questions English 3 in 1 (Primary 1)Document8 pagesOver 100 Questions English 3 in 1 (Primary 1)PuputNo ratings yet

- Bahan Berita 1 OktoberDocument2 pagesBahan Berita 1 OktoberPuputNo ratings yet

- Kunci Gitar Chord Lirik Ed Sheeran - PerfectDocument2 pagesKunci Gitar Chord Lirik Ed Sheeran - PerfectPuput100% (1)

- Little MixDocument15 pagesLittle MixPuputNo ratings yet

- Bahan Berita 5 OktoberDocument2 pagesBahan Berita 5 OktoberPuputNo ratings yet

- Euro Zone Sentiment Rises in October, Inflation Expectations DropDocument2 pagesEuro Zone Sentiment Rises in October, Inflation Expectations DropPuputNo ratings yet

- Stocks Rally With Crude Before Payrolls As China Nerves SubsideDocument2 pagesStocks Rally With Crude Before Payrolls As China Nerves SubsidePuputNo ratings yet

- Bahan Berita 15 OktoberDocument2 pagesBahan Berita 15 OktoberPuputNo ratings yet

- Bahan Berita 12 OktoberDocument2 pagesBahan Berita 12 OktoberPuputNo ratings yet

- Bahan Berita 6 OktoberDocument2 pagesBahan Berita 6 OktoberPuputNo ratings yet

- Bahan Berita 10 OktoberDocument2 pagesBahan Berita 10 OktoberPuputNo ratings yet

- Berita 14 November 2016 (Asli)Document2 pagesBerita 14 November 2016 (Asli)PuputNo ratings yet

- HL 3 November 2017 (Asli)Document2 pagesHL 3 November 2017 (Asli)PuputNo ratings yet

- Berita 7 Oktober 2016 (Asli)Document2 pagesBerita 7 Oktober 2016 (Asli)PuputNo ratings yet

- Berita 3 November 2016 (Asli)Document2 pagesBerita 3 November 2016 (Asli)PuputNo ratings yet

- Taylor Swift's ReputationDocument14 pagesTaylor Swift's ReputationPuputNo ratings yet

- Une Analyse Des Écrits Sur Les Impacts Du Jeu Sur L'apprentissageDocument20 pagesUne Analyse Des Écrits Sur Les Impacts Du Jeu Sur L'apprentissagePuputNo ratings yet

- d-494 - Wed - 20 DEC 2017Document8 pagesd-494 - Wed - 20 DEC 2017PuputNo ratings yet

- Penelitian 6 PDFDocument12 pagesPenelitian 6 PDFPuputNo ratings yet

- Artikel: Disusun Dan Diajukan Oleh: Leni Marlina NIM. 061222320029Document9 pagesArtikel: Disusun Dan Diajukan Oleh: Leni Marlina NIM. 061222320029PuputNo ratings yet

- Berita 8 Desember 2016 (Asli)Document2 pagesBerita 8 Desember 2016 (Asli)PuputNo ratings yet

- Berita 7 Desember 2016 (Asli)Document2 pagesBerita 7 Desember 2016 (Asli)PuputNo ratings yet

- 1429256427963Document4 pages1429256427963Aman VermaNo ratings yet

- Cross National Cooperation and AgreementsDocument22 pagesCross National Cooperation and AgreementsRana AnkitaNo ratings yet

- Economics Lecture3Document15 pagesEconomics Lecture3Muzamil AliNo ratings yet

- Analysis of Banking Industry: - Presented By-Santanu Banik Gourab Biswas Asish Kr. RoyDocument18 pagesAnalysis of Banking Industry: - Presented By-Santanu Banik Gourab Biswas Asish Kr. RoybgourabNo ratings yet

- National IncomeDocument1 pageNational IncomeAnmol SinghNo ratings yet

- International Trade & It's Impact On The EconomyDocument23 pagesInternational Trade & It's Impact On The EconomyFarukh KianiNo ratings yet

- Venezuela Annual InflationDocument1 pageVenezuela Annual Inflationshanke1No ratings yet

- Mahaveer Enterprises: Tax InvoiceDocument1 pageMahaveer Enterprises: Tax InvoiceAyush SrivastavNo ratings yet

- Akshar Agri India Private Limited: Bill of SupplyDocument1 pageAkshar Agri India Private Limited: Bill of SupplyAvnish JainNo ratings yet

- International Investment: Economic & Legal Aspects of Foreign Direct InvestmentDocument25 pagesInternational Investment: Economic & Legal Aspects of Foreign Direct InvestmentLê Đỗ Tuấn MinhNo ratings yet

- WTTC-travel and TourismDocument1 pageWTTC-travel and TourismAli KhavariNo ratings yet

- Factors Affecting: International TradeDocument15 pagesFactors Affecting: International Tradedeepanshu shuklaNo ratings yet

- International Business 2nd Edition Peng Test BankDocument17 pagesInternational Business 2nd Edition Peng Test Bankstephenhooverfjkaztqgrs100% (13)

- The Global Financial Crisis and The Challenge To Neoliberalism ...Document11 pagesThe Global Financial Crisis and The Challenge To Neoliberalism ...ian laurence pedranoNo ratings yet

- SK Infrastructure 15.10.2022Document1 pageSK Infrastructure 15.10.2022Poonam RaiNo ratings yet

- International Business - MGT520 Fall 2006 Quiz 02Document2 pagesInternational Business - MGT520 Fall 2006 Quiz 02Muhammad BilalNo ratings yet

- The Rising Trend of Poverty in PakistanDocument6 pagesThe Rising Trend of Poverty in PakistanMuhammad Javed KhurshidNo ratings yet

- Slides Developed by Jeff Madura, With Additions and Enhancements byDocument27 pagesSlides Developed by Jeff Madura, With Additions and Enhancements byjtomythe1No ratings yet

- API Is - Air.good - mt.k1 Ds2 en Excel v2 5997834Document68 pagesAPI Is - Air.good - mt.k1 Ds2 en Excel v2 5997834alireza.shadanpoorNo ratings yet

- Foreign Trade Multilier and Global RepercussionsDocument8 pagesForeign Trade Multilier and Global RepercussionsangelNo ratings yet

- Commerce Is The Branch of Production That Deals WiDocument6 pagesCommerce Is The Branch of Production That Deals WiAli SalehNo ratings yet

- MCQ Chap 4Document6 pagesMCQ Chap 4Diệu QuỳnhNo ratings yet

- Ekonomi Makro Islam - 1. Pengantar Ekonomi Makro IndonesiaDocument63 pagesEkonomi Makro Islam - 1. Pengantar Ekonomi Makro IndonesiaALIFAHNo ratings yet

- Research Paper Final Presentation1Document19 pagesResearch Paper Final Presentation1Satyendra DhakreNo ratings yet

- Domestic Markets & Monetary Management Department: ProvisionalDocument1 pageDomestic Markets & Monetary Management Department: ProvisionalIrfan KhanNo ratings yet

- Growth Vs Value GSDocument21 pagesGrowth Vs Value GSSamay Dhawan0% (3)

- Full Employment BudgetDocument5 pagesFull Employment BudgetDhanikaNo ratings yet