Professional Documents

Culture Documents

Caso Finanza

Caso Finanza

Uploaded by

julio0021Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caso Finanza

Caso Finanza

Uploaded by

julio0021Copyright:

Available Formats

PROGRAMA LATINOAMERICANO DE RECLUTAMIENTO DE TALENTOS

BUSINESS CASE CEO 2

A company called Wonderful Power (WP) just started its new activities as power producer.

The company is located in Utopia, a country ruled by Thomas More.

The founders of the company are International Flower (IF), holding 60% of the shares, and

Thomas More Investments (TMI), holding the remaining 40%.

The power capacity (net output) is 1000 MW.

At the commissioning of the Plant, there were some issues on the quality and correctness of the

gas metering unit, where the custody transfer with the gas supplier occurs. These issues still need

to be evaluated and attended.

Although commercial operation has been reached on 31st December 2011, the plant faces

plenty of problems. Many technical defects still need to be attended by the EPC contractor

who is on one hand willing to solve the easy and obvious flaws, but on the other hand reluctant

to tackle major issues, which inevitably will jeopardize the future operation of the plant. Both

parties, EPC contractor and WP are still negotiating these issues. The Board approved a max

expenditure of 5M$, borne by WP, to correct these technical issues.

The plant starts its commercial operation (COD) on 1st Jan 2012 with all its customers.

Wonderful Power sells 50% of its power capacity to a governmental owned body, Utopia

Power and Water Procurement (UPWP), under a 15 year Power Purchase Agreement (PPA),

and 50% of its power output to a cluster of industrial companies. Industrial customers signed up

for a 3 years contract. Water (except for auxiliary needs) is not produced at this plant. UPWP is

renowned as a reliable partner in terms of respecting contracts. There are other power

producers who can provide energy to your industrial customers.

The plants fuel efficiency is a risk/upside of Wonderful Power.

UPWP and the industrial customers are respectively dispatched at 50% and 60% of the

contracted capacity.

The total investment cost of the plant (TIC) is 800 million US$.

The budget assumptions for the first year of operation are reflected in Exhibit 1

Data on the plant is reflected in Exhibit 2

A loan of 600 million dollar has been secured with the Holy Sweet Bank Company (HSBC).

Detailed information on the loan is given in Exhibit 3

The opening Balance Sheet is reflected in Exhibit 4

The opening Cash Flow is given in Exhibit 5

PROGRAMA LATINOAMERICANO DE RECLUTAMIENTO DE TALENTOS

TO SOLVE

The plant capacity can be upgraded by investing in inlet coolers to deliver an additional

50 MW. Each of UPWP and the industrial customers need an additional 50 MW. How would

you approach this issue? Who would you consult for approval before green light to invest is

given?

Here the CEO should clearly involve the shareholders, the permitting authorities, lenders,

etc Deliberately no investments costs are specified, so it is important to see how the CEO

goes ahead not having all information (without saying that this info is really required). Does

the CEO make any reflections on the tariffs.

EXHIBIT 1: BUDGET DATA WONDERFUL POWER 2012

1. Contracted Sales Volumes

a. UPWP

i. Capacity= 500 MW

ii.Dispatch (average)= 50%

b. Cluster of Industrial Companies

i. Capacity= 500 MW

ii.Dispatch (average)= 60%

2. Sales Prices- Tariffs

UPWP

Industrial

Customers

Capacity Charge

US$/MW/h

12

Energy Charge

US $/MWh

4

3. Operational Costs

The operational cost for either type of customer is reflected in the table below:

Fixed

US$/year

5,000,000

Variable

US $/MWh

2

4. Key Performance Parameters of the plant:

a. Scheduled outage: 15%

b. Forced outage: 2 % (no penalties to be paid)

c. Outages are defined as a percentage of the number of hours per year

5. Cost of fuel

US$/MWh sold

1

PROGRAMA LATINOAMERICANO DE RECLUTAMIENTO DE TALENTOS

EXHIBIT 2: DATA WONDERFUL POWER PLANT

1. Power Capacity

1000 MW

2. Fuel

Gas Fired

3. Configuration

Combined Cycle Plant`

4. Total Investment cost (TIC)

800 M US $

5. Depreciation of the asset

30 years

6. Corrective Works- due to non compliance by the EPC contractor

Over the first 2 years of operation, at total aggregated amount of 20 M$ is required to

correct technical defects and other shortcomings on the plant.

EXHIBIT 3: LOAN CONDITIONS

1. Issuing Bank

Holy Sweet Bank Company (HSBC).

2. Total Amount

600 million

3. Currency

United States Dollar

4. Term

20 year, starting at the first day of commercial operation

5. Interest Rate

a. Year 1 to 5 (5 included): 4% fixed

b. Year 6 to 20: volatile Libor+ 70 bp

6. Capital Repayment

5 % p.a.

PROGRAMA LATINOAMERICANO DE RECLUTAMIENTO DE TALENTOS

EXHIBIT 4: OPENING BALANCE SHEET 2012

Wonderful Power

Balance Sheet

US$

Assets

1/1/2012

Plant

Cash

800,000,000

10,000,000

810,000,000

Total

Liabilities

Loan

Shareholder Equity

Rertained Earnings

Total

EXHIBIT 5: CASH FLOW STATEMENT

Cash Flow Statement

Us $

Opening Cash

Revenues

Fuel Cost

Operational Costs

Interest

Laon Repayment

Tax

Ending Cash

1/1/2012

10,000,000

600,000,000

210,000,000

0

810,000,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Short Term Financial Management 3rd Edition Maness Test BankDocument5 pagesShort Term Financial Management 3rd Edition Maness Test Bankjuanlucerofdqegwntai100% (17)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Black Book On CSR TCSDocument86 pagesBlack Book On CSR TCSShaikh Sohaib100% (1)

- Tcus Trust Capital Units Blue Border EditableDocument1 pageTcus Trust Capital Units Blue Border EditablejoeNo ratings yet

- Procedures For The Transfer of Shares of Stock From A Deceased Stockholder To Hisher HeirsDocument1 pageProcedures For The Transfer of Shares of Stock From A Deceased Stockholder To Hisher HeirsSittie Casanguan100% (1)

- Sharekhan Ltd. FINAL Report 2021Document81 pagesSharekhan Ltd. FINAL Report 2021Franklin RjamesNo ratings yet

- Royal Mail Group PLC: Company ProfileDocument10 pagesRoyal Mail Group PLC: Company ProfilechendoaelooriNo ratings yet

- DB&A Project at Atchison Steel CastingDocument4 pagesDB&A Project at Atchison Steel CastingFred AppleNo ratings yet

- Current Affairs 2017 PDF Capsule by AffairscloudDocument392 pagesCurrent Affairs 2017 PDF Capsule by Affairscloudkewal259No ratings yet

- Notes in Fi3Document5 pagesNotes in Fi3Gray JavierNo ratings yet

- Module 7 - Liquidation Based ValuationDocument27 pagesModule 7 - Liquidation Based ValuationKyrha Joy LaysonNo ratings yet

- Meaning of SuccessDocument23 pagesMeaning of SuccessMadhu ValetiNo ratings yet

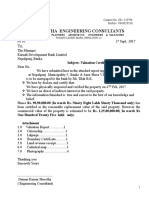

- Mammu ShresthaDocument8 pagesMammu ShresthaAbhishek ShresthaNo ratings yet

- The Extinction of Gold DerivativesDocument24 pagesThe Extinction of Gold DerivativesDANIELNo ratings yet

- 2024 05 21 - StatementDocument5 pages2024 05 21 - Statementcohibaman16No ratings yet

- Vikriti Year 2010 - 2011: by Chakrapani Ullal, USADocument14 pagesVikriti Year 2010 - 2011: by Chakrapani Ullal, USAfs420No ratings yet

- Appendix 23 - Instructions - FAR No. 4Document1 pageAppendix 23 - Instructions - FAR No. 4thessa_starNo ratings yet

- Republic v. Fernandez - CaseDocument2 pagesRepublic v. Fernandez - CaseRobehgene Atud-JavinarNo ratings yet

- MGL - Acg - QuizDocument1 pageMGL - Acg - Quizgmurali_179568No ratings yet

- BudgetingDocument35 pagesBudgetingRisty Ridharty DimanNo ratings yet

- Hjil 20 2 Sommers PhillipsDocument33 pagesHjil 20 2 Sommers PhillipsHelpin HandNo ratings yet

- Class-8 Maths Case Study Worksheet (Annual Exam 2023-2024) 2Document2 pagesClass-8 Maths Case Study Worksheet (Annual Exam 2023-2024) 2arjan.singh.sawhneyNo ratings yet

- 69 - Radiowealth Finance Company v. Del Rosario (138739)Document5 pages69 - Radiowealth Finance Company v. Del Rosario (138739)Jessie Marie dela PeñaNo ratings yet

- 25785Document2 pages25785Jose Francisco TorresNo ratings yet

- Ribka Septiani Natty - Analisa Kesehatan BankDocument9 pagesRibka Septiani Natty - Analisa Kesehatan BankRibka SeptianiNo ratings yet

- E006 - Exp PF-1Document4 pagesE006 - Exp PF-1Evhellsing StudioNo ratings yet

- Strategic Analysis On SonyDocument37 pagesStrategic Analysis On Sonylavkush_khannaNo ratings yet

- ERM - Experience From Japanese CompanyDocument38 pagesERM - Experience From Japanese CompanyNguyen Quoc HuyNo ratings yet

- Form Expense ClaimDocument2 pagesForm Expense Claimviedelamonde_3868443No ratings yet

- Travel InsuranceDocument16 pagesTravel InsuranceVamshi KrishnaNo ratings yet