Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

You might also like

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document6 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document8 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form B For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form B For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesConsolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document1 pageStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Corporate Income TaxDocument24 pagesCorporate Income TaxRIRI RUMAIZHANo ratings yet

- Answer KeyDocument52 pagesAnswer KeyDevonNo ratings yet

- Chapter 08Document16 pagesChapter 08piyu100% (1)

- Cash Flow StatementDocument19 pagesCash Flow StatementGokul KulNo ratings yet

- Home Office Branch Accounting at CostDocument23 pagesHome Office Branch Accounting at CostJaylord ReyesNo ratings yet

- The City School: Ratio Analysis and InterpretationDocument9 pagesThe City School: Ratio Analysis and InterpretationHasan ShoaibNo ratings yet

- Case Study LBODocument4 pagesCase Study LBOadarshraj100% (3)

- Debit Credit in ExcelDocument9 pagesDebit Credit in ExcelDymanager 500kvTarbelaNo ratings yet

- Learning Competency: ObjectivesDocument6 pagesLearning Competency: ObjectiveshiNo ratings yet

- Winding Up A Company in Kenya George KinDocument21 pagesWinding Up A Company in Kenya George Kinnancy amooNo ratings yet

- Guideline Answers: Executive ProgrammeDocument70 pagesGuideline Answers: Executive ProgrammeRiya GoyalNo ratings yet

- Chapter 4 Credit Risk PDFDocument53 pagesChapter 4 Credit Risk PDFSyai GenjNo ratings yet

- SW3 SCFDocument4 pagesSW3 SCFJhazzie DolorNo ratings yet

- Full PFRS: Jeff-Mikesmith Sule, Friacc, Enp, Reb, Rea, Cpa, Micb L E CturerDocument20 pagesFull PFRS: Jeff-Mikesmith Sule, Friacc, Enp, Reb, Rea, Cpa, Micb L E Cturerメアリー フィオナNo ratings yet

- Fu-Wang Foods Ltd. AnalysisDocument27 pagesFu-Wang Foods Ltd. AnalysisAynul Bashar AmitNo ratings yet

- Multiple Choice QuestionsDocument77 pagesMultiple Choice QuestionsLara FloresNo ratings yet

- AFAR PROBLEMS QUIZZER With AnswersDocument26 pagesAFAR PROBLEMS QUIZZER With Answersjohn paulNo ratings yet

- Internal Reconstruction - HomeworkDocument25 pagesInternal Reconstruction - HomeworkYash ShewaleNo ratings yet

- Chapter 2 - Lesson 4Document18 pagesChapter 2 - Lesson 4JajaNo ratings yet

- Accc372 Mod 2022 VCDocument26 pagesAccc372 Mod 2022 VCakeeraNo ratings yet

- Partnership Operations - Sample ProblemsDocument2 pagesPartnership Operations - Sample ProblemsLyca Mae CubangbangNo ratings yet

- IAS 16 Problem SolutionsDocument2 pagesIAS 16 Problem SolutionsRimsha ArifNo ratings yet

- Why Do Stock Prices Go Up and DownDocument3 pagesWhy Do Stock Prices Go Up and DownclaudiatimanatNo ratings yet

- Foreign Exchange Act 2006 Act 723Document3 pagesForeign Exchange Act 2006 Act 723Nana Kojo E. DadzieNo ratings yet

- Financial Management 2 I. Risk and ReturnDocument2 pagesFinancial Management 2 I. Risk and ReturnCarla Jean CuyosNo ratings yet

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeHeinie Joy PauleNo ratings yet

- Public Notice of 57th AGM, Book Closure & E Voting Information, EtcDocument5 pagesPublic Notice of 57th AGM, Book Closure & E Voting Information, EtcSuhasNo ratings yet

- Sectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketDocument18 pagesSectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketChan Hui YanNo ratings yet

- Shabbir AhmadDocument2 pagesShabbir AhmadEkhlas AmmariNo ratings yet

- Banks Initiation June 21Document220 pagesBanks Initiation June 21anil1820No ratings yet

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

NllA

INFRASTRUCTURES

LIMITED

NILA/CS/2016/837

Date: November 14,2016

To,

The Department of Corporate Services

Bombay Stock Exchange Limited

Phiroze Jeejeebhoy Towers

Dalal Street Fort

MUMBAI - 400 001

To,

The Listing Department

National Stock Exchange of India Ltd.

Exchange Plaza, Plot no. C/1, G Block,

Bandra-Kurla Complex Bandra (E)

MUMBAI - 400 051

Scrip Code: 530377

Scrip Symbol: N I ~ I N F R A

.- -

Dear Sir,

Sub: Outcome of the Board Meetinp dated November 14.2016

Ref: Regulation 33 of SEBI (Listin Obligations and Disclosure Requirements1 Re_~ulations,

2015

This is to submit that the meeting of the Board of Directors of Nila Infrastructures Limited was held

today at the registered office whereat the Board of Directors has considered and approved the

Unaudited Financial Results for the quarter/half year ended on September 30,2016. The meeting

commenced today at 10:OO a.m. and concluded at 01:15 p.m.

*'

A copy of the Unaudited Financial Results along with the Limited Review Report thereon is

enclosed herewith.

Kindly take the same on your record and acknowledge the receipt.

Thanking you,

Yours faithfully,

For Nila Infrastructures Limited

Encl: a/a

Registered Office:

1st floor, Sarnbhaav House.

Opp. Chief Justice's Bungalow.

Bodakdev, Ahmedabad 380015

Tel.: +91 79 4003 681 7 1 18,2687 0258

Fax: +91 79 3012 6371

e-mall: Info@niIalnfra.com

CIN : L45201GJ1990PLC013417

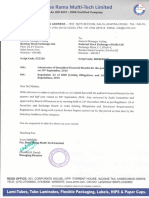

& NlLA INFRASTRUCTURES LIMITED

&g

-

Regd. Office:1st Floor, Sambhaav House, Opp. Chief Justice's Bungalow, Bodakdev, Ahmedabad 380015.

Phone: 079-40036617 Far: 079-26673922 Webme: w.nilalnfra.com E-mail: secretarial@niiainfra.com CIN: L45201GJ1990PLC013417

WM oi

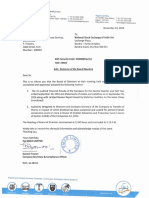

Unawritrd Financial R-t

tor tha ~ ~ r r t ~e rn Hd ~ MYear EWpn t a p t d v =,a16

Endnd

lneolnn from Operations

(a) Net Salesllncome fmm Opemiions

(b) Other Operating income

mtsl Income hom Operatior (Net)

m s w

5

6

7

8

9

10

11

12

13

18

16

(a) C061 of Materials consumed and Project expenses

(b) Purchase of Stock-in-Trade

(c) (Increase decrease in inventories of finished goods, work-ingmgress and

stock in k d e

(d) Employee beneMs expenses

(e) Depreciation and amortisation expanse

(9 FTotal E x p e I l ~

Rofn from Operations before Other Income, Finance Cost and

Exceptional ltems (1-2)

Other Income

Profit before Finance Cost and Exceptional liems (3+4)

Finance Cost

Pmflt after Finance Cost but before Exceptional Items (5-6)

Exceptional items

Rotit / (Loss) from Ordinary Activities before tax (7-8)

Tax expense

Net Pmfii I (Loss) from Ordinary Activities alter tax (9-10)

mordinary yltem

Net Ram IIlou) for Me wriod HI-12)

Paid-up &u& share capital; Face klue : 11- Per Share

Reserve excludi Revaluation Reserve as per bdance sheet of

previws accou#na year

1 Earnings Per Skre Before Exbaordin

[Ace w e of 7 11(not annnualisq Items)

(a) Basic

@) muted

ii Earnings Per Share Alter Extra ordiny Item)

[Ace Vdue of t 11- each) (not annnuatis )

(a) Basic

eat\)

1 The above results were reviewed by the Audi Committee and approved

by the Board of Directors of the Company at its meetings held on

November 14,2016. The StaMory Auditors of the Company have carried

out a limitedreview on the above result

A

1

(a)

(b)

(c)

2

(a)

@)

(c)

(d)

3

(a)

3.929.69

14,852.71

18,782.40

10.955,91

446.97

32.92

11,496.80

3388.30

2,116.87

17.19

3.966.12

690.99

IO,ls(M7

SuMolsl C u m

TOTAL

Directors.

3 Since the company has only one primary reportable segment i.e.

Constructionand Developmentof Infrastructureand Real Estate Projects,

there is no separate reportable segment as required by Accounting

Standard -17. Also there being no business outside India, the entire

business has been consideredas single geographicsegment

4 The previousperiod'sfigureshave been reworked, regrouped, rearranged

and reclassifiedwherever necessary.

755.00

1,653.05

3,424.85

168.60

6,001.50

36,2l#.70

(d) Short-term Provisions

(d) Short-term loans and Advances

2 The CEO and CFO certificate in respect of the above results in terms of

Regulation 17(8) of SEBl

Obligations and Disclosure

Requirements) Regulations, 2015 has been placed before the Board of

i is tin^

EQUITY I LUIBILITIES

Shareholders'Funds

Share Capi$l

Money Recehredagainst conwhbk wanants

Reserves and Surplus

Subtolal Shamholden' Funds

Non-Current liabiities

Long-term Bonowings

Wemi Tax liabirties (Net)

Other LonptermLiabiliies

Long-termProvisions

Subtotrl Non-CunantUabilillaP

Current Liabibs

Shor-term Borrowings

13,217.20

3,555.66

507.24

8,739.93

26,020.23

38P8.70

5 The CompensationCommittee of Nila InfrastructuresLimited under Wila

InfrastructuresLtd. ESOP 2014 has on July 23,2016 made an allotment

of 242500 Equity Shares upon exercise of stock options and

consequently the paid up share capital of the company is increased to

t 39.29.68,700 comprisingof392968700EqultySharesof? 11- each.

6 Pursuant to the SEBl (Listing Obligations and Disclosure Requirements)

ReguMons, 2015 ,the above financial result is being folwardedto the

Stock Exchanges (BSE and NSE) for uploading on lhelr respecme

websites and the same are also avalable on the Company's website at

www.niiainfra.com

7 Provisionfor Deferred Tax has not been consideredon quarterty basis but

the effectwould be given inthe annualfinancialresult

/

I1

You might also like

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document6 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document8 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form B For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form B For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesConsolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document1 pageStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Corporate Income TaxDocument24 pagesCorporate Income TaxRIRI RUMAIZHANo ratings yet

- Answer KeyDocument52 pagesAnswer KeyDevonNo ratings yet

- Chapter 08Document16 pagesChapter 08piyu100% (1)

- Cash Flow StatementDocument19 pagesCash Flow StatementGokul KulNo ratings yet

- Home Office Branch Accounting at CostDocument23 pagesHome Office Branch Accounting at CostJaylord ReyesNo ratings yet

- The City School: Ratio Analysis and InterpretationDocument9 pagesThe City School: Ratio Analysis and InterpretationHasan ShoaibNo ratings yet

- Case Study LBODocument4 pagesCase Study LBOadarshraj100% (3)

- Debit Credit in ExcelDocument9 pagesDebit Credit in ExcelDymanager 500kvTarbelaNo ratings yet

- Learning Competency: ObjectivesDocument6 pagesLearning Competency: ObjectiveshiNo ratings yet

- Winding Up A Company in Kenya George KinDocument21 pagesWinding Up A Company in Kenya George Kinnancy amooNo ratings yet

- Guideline Answers: Executive ProgrammeDocument70 pagesGuideline Answers: Executive ProgrammeRiya GoyalNo ratings yet

- Chapter 4 Credit Risk PDFDocument53 pagesChapter 4 Credit Risk PDFSyai GenjNo ratings yet

- SW3 SCFDocument4 pagesSW3 SCFJhazzie DolorNo ratings yet

- Full PFRS: Jeff-Mikesmith Sule, Friacc, Enp, Reb, Rea, Cpa, Micb L E CturerDocument20 pagesFull PFRS: Jeff-Mikesmith Sule, Friacc, Enp, Reb, Rea, Cpa, Micb L E Cturerメアリー フィオナNo ratings yet

- Fu-Wang Foods Ltd. AnalysisDocument27 pagesFu-Wang Foods Ltd. AnalysisAynul Bashar AmitNo ratings yet

- Multiple Choice QuestionsDocument77 pagesMultiple Choice QuestionsLara FloresNo ratings yet

- AFAR PROBLEMS QUIZZER With AnswersDocument26 pagesAFAR PROBLEMS QUIZZER With Answersjohn paulNo ratings yet

- Internal Reconstruction - HomeworkDocument25 pagesInternal Reconstruction - HomeworkYash ShewaleNo ratings yet

- Chapter 2 - Lesson 4Document18 pagesChapter 2 - Lesson 4JajaNo ratings yet

- Accc372 Mod 2022 VCDocument26 pagesAccc372 Mod 2022 VCakeeraNo ratings yet

- Partnership Operations - Sample ProblemsDocument2 pagesPartnership Operations - Sample ProblemsLyca Mae CubangbangNo ratings yet

- IAS 16 Problem SolutionsDocument2 pagesIAS 16 Problem SolutionsRimsha ArifNo ratings yet

- Why Do Stock Prices Go Up and DownDocument3 pagesWhy Do Stock Prices Go Up and DownclaudiatimanatNo ratings yet

- Foreign Exchange Act 2006 Act 723Document3 pagesForeign Exchange Act 2006 Act 723Nana Kojo E. DadzieNo ratings yet

- Financial Management 2 I. Risk and ReturnDocument2 pagesFinancial Management 2 I. Risk and ReturnCarla Jean CuyosNo ratings yet

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeHeinie Joy PauleNo ratings yet

- Public Notice of 57th AGM, Book Closure & E Voting Information, EtcDocument5 pagesPublic Notice of 57th AGM, Book Closure & E Voting Information, EtcSuhasNo ratings yet

- Sectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketDocument18 pagesSectoral Analysis of Factors Influencing Dividend Policy: Case of An Emerging Financial MarketChan Hui YanNo ratings yet

- Shabbir AhmadDocument2 pagesShabbir AhmadEkhlas AmmariNo ratings yet

- Banks Initiation June 21Document220 pagesBanks Initiation June 21anil1820No ratings yet