Professional Documents

Culture Documents

State of Economy

State of Economy

Uploaded by

RaJaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State of Economy

State of Economy

Uploaded by

RaJaCopyright:

Available Formats

STATE OF THE ECONOMY | EDITORIAL

1 DECEMBER 2016

by: EDITORIAL

in: ECONOMY

Against the grain of the praise international financial institutions have been lavishing on

the Pakistani economy, the State Bank of Pakistans State of the Economy Report 201516 released earlier this month painted a much more dismal picture. The SBP has noted

that the Pakistani economy faces serious challenges. Agreeing with the governments

macroeconomic stability claims and noting that a higher growth rate in the country is

imminent, the bank has still raised a number of alarming markers that can destabilise the

economy. It pointed to high levels of public debt, low investment and saving levels,

declining exports, reliance on temporary measures for taxation and low levels of social

spending as the major concerns for the economy. Note that this does not include political

instability, which is one of the major factors the government has offered when explaining

why it has been unable to meet the targets it sets for itself. The SBP report does,

however, mention the cost of terrorism to be an astronomical $118 billion to the

economy. The low level of private sector investment confirms that businesses have a

rather low level of real confidence in the economic recovery narrative. Similarly, the

declining interest rates have made it less attractive for individuals to put their savings in

short to long-term investment schemes or bank accounts. Moreover, it is the trend of

increasing imports amidst low global oils prices as well as Pakistans declining exports

that could create a major foreign reserves crisis soon.

The taxation regime remains a major concern as big sectors remain outside the tax loop

while others have been brought in through fairly controversial measures. Low oil prices

have been a boon to the economy but the level of public debt has increased under the

PML-N government by around Rs2.3 trillion to Rs19.7 trillion. The debt-to-GDP ratio is

still over 60 percent, despite the governments promises to bring debt levels down to the

required ratio. The SBPs report also tries to balance the high praise that the government

has received from abroad and asks the government to remain on its feet and address

the key challenges it faces. There is a need for decisive action on issues such as tax

collection, instead of the current approach in which tax measures are announced, then

renounced, before being announced again. There have been complaints that the

economy is run in an ad-hoc manner. There is no doubt that Pakistan has high economic

potential but any good work by the government will end up being wasted if structural

issues such as implementing a proper tax regime and spending on social services are

not sorted out quickly.

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- ICWF Study PackDocument143 pagesICWF Study PackRaJa100% (4)

- Answer Tutorial 3 Partnership Part 2Document3 pagesAnswer Tutorial 3 Partnership Part 2athirah jamaludin100% (1)

- Cortland County Gutchess Lumber Sports ParkDocument14 pagesCortland County Gutchess Lumber Sports ParkNewsChannel 9No ratings yet

- Business TaxationDocument3 pagesBusiness TaxationRaJa50% (2)

- Economy of PakistanDocument5 pagesEconomy of PakistanZainab RanaNo ratings yet

- Name: Efshal Ateeq Roll No: B-23232 Project: Ict Submitted To: Sir Rahat BukhariDocument5 pagesName: Efshal Ateeq Roll No: B-23232 Project: Ict Submitted To: Sir Rahat BukhariEfshal AtiqueNo ratings yet

- The Economic Crisis in Pakistan and Their Solutions: T E C P T SDocument6 pagesThe Economic Crisis in Pakistan and Their Solutions: T E C P T SRaja EhsanNo ratings yet

- Asignment Pak EconomyDocument7 pagesAsignment Pak EconomymuzammilNo ratings yet

- EconomyDocument5 pagesEconomyShan Ali ShahNo ratings yet

- Pakistan's Economy in DoldrumsDocument3 pagesPakistan's Economy in DoldrumsAsif Khan ShinwariNo ratings yet

- Current Economic Situation of PakistanDocument4 pagesCurrent Economic Situation of PakistanMuhammad AhmedNo ratings yet

- The News ArticlesDocument10 pagesThe News ArticlesTari BabaNo ratings yet

- Final Exam HamidDocument7 pagesFinal Exam HamidHome PhoneNo ratings yet

- Debt Situation of PakistanDocument4 pagesDebt Situation of PakistanAli AhmerNo ratings yet

- Economic Crisis and Way Forward April 2019: Current State of The EconomyDocument4 pagesEconomic Crisis and Way Forward April 2019: Current State of The EconomySyed Ali ZeeshanNo ratings yet

- Economy of Pakistan-1Document15 pagesEconomy of Pakistan-1Leo MessiNo ratings yet

- Pakistan Monetry Policy 2011Document3 pagesPakistan Monetry Policy 2011ibrahim53No ratings yet

- Current Economic Situation of PakistanDocument5 pagesCurrent Economic Situation of PakistanKhurram SherazNo ratings yet

- Economic Crisis in PakistanDocument14 pagesEconomic Crisis in PakistantufailNo ratings yet

- Economical Analysis-Humaira RashidDocument4 pagesEconomical Analysis-Humaira RashidHumaira a RashidNo ratings yet

- Project Appraisal and Credit Management Assignment No 3 Section: A Presented To: Sir Mohammad AzfarDocument4 pagesProject Appraisal and Credit Management Assignment No 3 Section: A Presented To: Sir Mohammad AzfarRabbia JavedNo ratings yet

- Roshaane IntDocument6 pagesRoshaane IntRoshaane GulNo ratings yet

- Economic Revival: A Real Challenge in Pakistan: DR Muhammad KhanDocument3 pagesEconomic Revival: A Real Challenge in Pakistan: DR Muhammad KhanbilourNo ratings yet

- Project of Investment Management: Submitted ToDocument27 pagesProject of Investment Management: Submitted Toadnan Ahmad khanNo ratings yet

- Article EconomicsDocument2 pagesArticle EconomicsVicky JamNo ratings yet

- Untitled DocumentDocument14 pagesUntitled DocumentShivani BalaniNo ratings yet

- Pakistan Economic ReviewDocument3 pagesPakistan Economic Reviewanum khurshidNo ratings yet

- Impact of Corona VirusDocument4 pagesImpact of Corona VirusFaizan HussainNo ratings yet

- EconomyDocument6 pagesEconomyagha HaseebNo ratings yet

- Changing Economic RealitiesDocument17 pagesChanging Economic RealitiesmkhurramjahNo ratings yet

- Report On Demo BudgetDocument30 pagesReport On Demo Budgettajul1994bd_69738436No ratings yet

- What To Do About PakistanDocument41 pagesWhat To Do About PakistanhassanrajputpasNo ratings yet

- 22nd Loan Earmarked For Debt Servicing: Current State of The EconomyDocument5 pages22nd Loan Earmarked For Debt Servicing: Current State of The EconomyWaqas SaeedNo ratings yet

- Structural Problems Sap Pak Economy of VigourDocument3 pagesStructural Problems Sap Pak Economy of VigourRaza WazirNo ratings yet

- Sri Lanka Must Follow Pakistan's IMF Reform ModelDocument10 pagesSri Lanka Must Follow Pakistan's IMF Reform ModelThavamNo ratings yet

- Research Paper 4Document14 pagesResearch Paper 4Alishba AnjumNo ratings yet

- High Fiscal DeficitDocument14 pagesHigh Fiscal Deficituroosa vayaniNo ratings yet

- Economical Situation of PakistanDocument11 pagesEconomical Situation of PakistanHumaira a RashidNo ratings yet

- Pakistan's Economic Outlook, Future Challenges and Way Forward OutlineDocument3 pagesPakistan's Economic Outlook, Future Challenges and Way Forward OutlineFaisal JavedNo ratings yet

- Causes and ConsequencesDocument21 pagesCauses and Consequencesraiasad284No ratings yet

- Key Macro-Economic Challenges For India, at Present, Include: InflationDocument5 pagesKey Macro-Economic Challenges For India, at Present, Include: InflationAmita SinwarNo ratings yet

- Macro AssignmentDocument4 pagesMacro AssignmentShahxaib KhanNo ratings yet

- Express Business: Inflation Drops To 22-Month Low On New FormulaDocument7 pagesExpress Business: Inflation Drops To 22-Month Low On New Formulak.shaikhNo ratings yet

- Economic Challenges and OpportunitiesDocument3 pagesEconomic Challenges and OpportunitiesAsif Khan ShinwariNo ratings yet

- Pakistan EconomyDocument14 pagesPakistan EconomyAyesha KhanNo ratings yet

- Final Exam 13574 PDFDocument5 pagesFinal Exam 13574 PDFHome PhoneNo ratings yet

- Monetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigDocument9 pagesMonetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigAli AmjadNo ratings yet

- Pakistan Economy and IMFDocument5 pagesPakistan Economy and IMFsabir17No ratings yet

- Budget Insight 2010Document58 pagesBudget Insight 2010Muhammad Usman AshrafNo ratings yet

- Challenges To Pakistan EconomyDocument9 pagesChallenges To Pakistan Economydistinct86No ratings yet

- Monetaty Theory and PolicyDocument26 pagesMonetaty Theory and PolicyDanish HaseebNo ratings yet

- Economics AssignmentDocument17 pagesEconomics Assignmentapi-413236814No ratings yet

- Fiscal DeficitDocument13 pagesFiscal DeficitM. JAHANZAIB UnknownNo ratings yet

- China Has Announced On The 5th of March of This YearDocument1 pageChina Has Announced On The 5th of March of This YearaslambientalNo ratings yet

- ECONOMY OF PAKISTAN AssignmentDocument14 pagesECONOMY OF PAKISTAN Assignmentkashif afridiNo ratings yet

- HE Conomic Imes: It Isn't Big, But It's Full of BangDocument1 pageHE Conomic Imes: It Isn't Big, But It's Full of Bangsmdali05No ratings yet

- Fiscal Deficit InfoDocument12 pagesFiscal Deficit InfoSanket AiyaNo ratings yet

- Getting To The Core: Budget AnalysisDocument37 pagesGetting To The Core: Budget AnalysisfaizanbhamlaNo ratings yet

- Tax Reduction For Economic DevelopmentDocument3 pagesTax Reduction For Economic DevelopmentMohammad Shahjahan SiddiquiNo ratings yet

- China's Economic Trend Under The Impact of The EpidemicDocument10 pagesChina's Economic Trend Under The Impact of The EpidemicRumi AzhariNo ratings yet

- ESSAY OUT Line and EssayDocument21 pagesESSAY OUT Line and EssayRaJaNo ratings yet

- Indo Pak RelationDocument1 pageIndo Pak RelationRaJaNo ratings yet

- China React Over IndiaDocument1 pageChina React Over IndiaRaJaNo ratings yet

- Cost Accounting Solved MCQsDocument39 pagesCost Accounting Solved MCQsRaJa84% (43)

- CH-01 FinalDocument16 pagesCH-01 FinalRaJa100% (1)

- Application Form12Document1 pageApplication Form12RaJaNo ratings yet

- Government of Sindh Monitoring & Evaluation Cell Planning & Development DepartmentDocument2 pagesGovernment of Sindh Monitoring & Evaluation Cell Planning & Development DepartmentRaJaNo ratings yet

- Watchlist Map For TradesDocument2 pagesWatchlist Map For TradesPrashant TomarNo ratings yet

- Privatization of Public Transport in IndiaDocument13 pagesPrivatization of Public Transport in IndiaProf. R V SinghNo ratings yet

- 1.2 Budget Process BDocument4 pages1.2 Budget Process BHarsh RajNo ratings yet

- Act 8 International Bus and TradeDocument8 pagesAct 8 International Bus and Tradejulie ann mayoNo ratings yet

- LW09560 SalarySlipwithTaxDetailsDocument1 pageLW09560 SalarySlipwithTaxDetailsshreyas kotiNo ratings yet

- Cement Is A Key Infrastructure IndustryDocument2 pagesCement Is A Key Infrastructure Industryletter2lalNo ratings yet

- Edexcel Economics AS-level: Unit andDocument3 pagesEdexcel Economics AS-level: Unit andHussain AhmadNo ratings yet

- Daniels08 - Cross-National Cooperation and AgreementsDocument33 pagesDaniels08 - Cross-National Cooperation and AgreementsHuman Resource ManagementNo ratings yet

- Trade AgreementDocument6 pagesTrade AgreementSoumyajit KaramNo ratings yet

- Status of Dairy SectorDocument12 pagesStatus of Dairy SectorRamindra SuwalNo ratings yet

- An Offshore Banking UnitDocument2 pagesAn Offshore Banking UnitPrince RiveraNo ratings yet

- Problems of NPADocument3 pagesProblems of NPAJay KoliNo ratings yet

- 2018 TJX Companies Inc Prescreening NoticeDocument1 page2018 TJX Companies Inc Prescreening NoticeJls23 L DNo ratings yet

- Acct Statement XX6630 22032024Document28 pagesAcct Statement XX6630 22032024maahirzaveri27No ratings yet

- Exporting To South Africa Fact SheetDocument2 pagesExporting To South Africa Fact SheetDHL Express UKNo ratings yet

- International Economics A Policy Approach 10th Edition Kreinin Test BankDocument25 pagesInternational Economics A Policy Approach 10th Edition Kreinin Test BankElizabethPhillipsfztqc100% (64)

- 1A. HDFC Apr2019 EstatementDocument9 pages1A. HDFC Apr2019 EstatementNanu PatelNo ratings yet

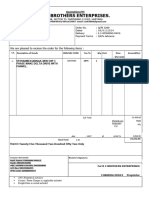

- R C Brothers Enterprises.: Quotation/PIDocument1 pageR C Brothers Enterprises.: Quotation/PIchandra mouliNo ratings yet

- Change Management in Icici BankDocument18 pagesChange Management in Icici BankSagar SharmaNo ratings yet

- Crystal Autocars Private Limited: Accessory - Tax InvoiceDocument2 pagesCrystal Autocars Private Limited: Accessory - Tax InvoiceDeepak BrohmaNo ratings yet

- Chapter 2 Closing CaseDocument1 pageChapter 2 Closing CaseMay RamosNo ratings yet

- June 22 StatementDocument17 pagesJune 22 Statementrangaswamy8194No ratings yet

- Topic GPDocument10 pagesTopic GPaidanNo ratings yet

- Lesson 36 (Unit 8b) PracticeDocument4 pagesLesson 36 (Unit 8b) PracticeWilly WonkaNo ratings yet

- MCQs by DanielDocument74 pagesMCQs by DanielAbubakar Butt100% (1)

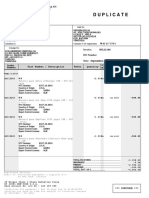

- Duplicate: Invoice: DO NumberDocument2 pagesDuplicate: Invoice: DO NumberLiau Zhan HongNo ratings yet

- SM Supersonic Stereo ExhibitsDocument9 pagesSM Supersonic Stereo ExhibitsAshish MittalNo ratings yet

- Value Date Post Date Remitter Branch Description Cheque No. Debit AmountDocument3 pagesValue Date Post Date Remitter Branch Description Cheque No. Debit AmountNithiyandran RajNo ratings yet