Professional Documents

Culture Documents

Westpack JUN 24 Mornng Report

Westpack JUN 24 Mornng Report

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Westpack JUN 24 Mornng Report

Westpack JUN 24 Mornng Report

Uploaded by

Miir ViirCopyright:

Available Formats

Thursday 24 June 2010

Morning Report

Foreign Exchange Market News and views

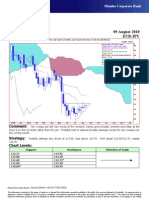

Previous Range Today’s Open Expected US equities were rattled initially by weak US new home sales data and later by

a slightly downgraded outlook from the US central bank’s FOMC meeting. The

Asia Overnight 8.00am NZD cross Range Today

S&P500 is currently down 0.2%. Earlier in Europe, falls in the order of 1-2% were seen on

NZD 0.7027-0.7062 0.7028-0.7161 Ï0.7132 0.7080-0.7200 renewed sovereign credit concerns. The Greek 10yr government bond rose 57bp in yield

AUD 0.8688-0.8745 0.8661-0.8781 Ï0.8732 Ï0.8168 0.8660-0.8800 to 10.37%, a level last seen during the April/May panic. Commodities fell 1.1%, oil (-2.4%)

underperforming on surprise stockpile gains. US 10yr treasuries are 6bp lower following

JPY 90.33-90.59 89.73-90.53 Ð89.90 Ï64.120 89.00-90.50 the weaker US data and FOMC assessment. The 5yr auction was unsurprisingly tepid given

EUR 1.2244-1.2285 1.2209-1.2344 Ï1.2312 Ï0.5793 1.2250-1.2400 its timing near the FOMC, yield above market and coverage sub-par.

GBP 1.4803-1.4835 1.4815-1.4975 Ï1.4955 Ï0.4769 1.4900-1.5000 The US dollar index weakened after a spike around the weak US data. EUR fell from 1.2300

to 1.2210 around midday Europe but then rallied to 1.2340. GBP ground higher from

1.4850 to 1.4970. The UK central bank minutes revealed one vote (out of 8) for a 25bp

NZ Domestic Market (Previous day’s closing rates) hike. USD/JPY declined from 90.40 to 89.80. Norway’s central bank remained on hold at

Cash Curve Govt Stock Swap Rates (Qtrly) 2.00% but revised down its interest rate path outlook.

AUD was very choppy between 0.8660 and 0.8780 for a modest gain post Sydney. A

Cash 2.75% Nov-11 3.78% 1 Year 3.80%

leadership challenge to PM Rudd was reported, supporting AUD given his mining tax

30 Days 2.89% 2 Years 4.30% proposal.

Apr-13 4.35%

3 Years 4.61%

60 Days 2.99% NZD rose from 0.7040 to 0.7160, belatedly pricing in the day’s strong current account

Apr-15 4.82% 4 Years 4.85% report. AUD/NZD fell from around 1.2350 to 1.2220.

90 Days 3.08%

5 Years 5.03%

Dec-17 5.27% The Fed was firmly on hold again following last night’s FOMC meeting, maintaining

180 Days 3.36% 7 Years 5.30% its commitment to “exceptionally low levels of the federal funds rate for an extended

1 Year 3.74% May-21 5.50% 10 Years 5.57% period”. While the US recovery is on track, financial market conditions were seen as “less

supportive of economic growth on balance, largely reflecting developments abroad”. That

aside, minor tweaks to the description of the economy left the picture broadly unchanged

World Bourses and Indices

compared to the April meeting. Kansas Fed President Hoenig once again dissented in

AUD USD favour of dropping the “extended period” commitment, saying that it limited the FOMC’s

Cash 4.50% 0.00 Fed Funds 0.00-0.25% flexibility.

90 Day 4.94% +0.02 3 Mth Libor 0.54% 0.00 US new home sales plunged to a record low of 300k in May from a downwardly revised

3 Year Bond 4.85% -0.09 10 Year Notes 3.11% -0.05 446k the previous month. The data is somewhat distorted by the end of the government

10 Year Bond 5.35% -0.07 30 Year Bonds 4.05% -0.04 tax credits on 30 April, and while a clearer picture will emerge over the next few months as

to the underlying state of the US housing market, it doesn’t look pretty. Supply of homes

at the current rate of sales jumped to 8.5 months’ worth from 5.8 months previously.

NZX 50 3054.3 +0.1 CRB 259.7 -3.0

S&P/ASX200 4486.1 -72.2 Gold 1235.8 -5.3 German GfK consumer confidence steady at 3.5 in July, supported by the improvement

Nikkei 9923.7 -189.2 Copper Fut. 294.00 -2.40 in the labour market and an increase in World Cup-related spending.

FT100 5178.5 -68.5 Oil (WTI) 75.85 -1.28 Eurozone flash PMI composite fell to 56.0 in June, reflecting a decline in services to

S&P500 1092.0 -3.3 NZ TWI 68.48 +0.64 55.4 while manufacturing was only marginally lower compared with May at 55.6. Overall,

with the exception of the ZEW survey, confidence indicators have held up relatively well in

June and suggest a robust GDP print for Q2. This said, some of the more forward looking

Upcoming Events components appear to be turning lower which does not bode well for the second half of

Date Country Release Last Forecast this year.

24 Jun NZ Q1 GDP 0.8% 0.7% UK BoE minutes for the 9-10 June MPC meeting revealed a surprise 7-1 vote to keep

Aus Q2 Survey of Industrial Trends 56.7 – the Bank rate unchanged at 0.50% and no change to the asset purchase programme. The

US May Durable Goods Orders 2.8% –2.2% dissenter was Andrew Sentance, a well-known “hawk” who voted for a 25bp hike, arguing

Initial Jobless Claims w/e 19/6 472k 460k that it was now appropriate to gradually withdraw “some of the exceptional monetary

Jpn May Corporate Services Prices %yr –1.1% – stimulus” given the recovery in demand and sticky inflation. There also appears to be a

range of opinions forming within the Committee, with the camp split into those who see

May Trade Balance ¥bn sa 729 627

inflation risks as still balanced but highly uncertain, those who see risks skewing towards

Eur Apr Industrial Orders 5.7% –2.0%

the upside, and those still concerned with downside pressures from financial market

25 Jun NZ May Merchandise Trade NZDmn 656 600

developments.

US Q1 GDP (F) 3.0%a 3.1%

Jun UoM Consumer Sentiment (F) 75.5a 76.0 Canada retail sales dropped by 2.0% in April, the biggest fall since Dec 2008. The fall

Jpn May National CPI %yr –1.2% –1.1% in the headline number was led by new car dealerships which experienced a 5.3% fall in

receipts. Sales ex-autos were 1.2% lower on the month.

Jun Tokyo CPI %yr –1.4% –1.3%

Can G8/G20 World Leaders’ Summits

28 Jun NZ Jun NBNZ Business Confidence 48.2% – Outlook

US May Chicago Fed Nat Act Index 0.29 –

AUD/USD and NZD/USD outlook next 24 hours: AUD should be contained within

May Personal Income 0.4% 0.5%

0.8650 and 0.8800, NZD by 0.7050 and 0.7150.

May Personal Spending 0.0% 0.2%

May PCE Deflator %yr 2.0% 1.8%

Jpn May Retail Trade 0.5% – Imre Speizer, Senior Market Strategist, NZ, Ph: (04) 470 8266

UK Jun Housing Survey %yr 2.0% – With contributions from Westpac Economics

Westpac Banking Corporation ABN 33 007 457 141 incorporated in Australia (NZ division). Information current as at 24 June 2010. All customers please note that this information has been prepared without taking account of your objectives,

financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs. Australian customers can obtain Westpac’s financial services

guide by calling +612 9284 8372, visiting www.westpac.com.au or visiting any Westpac Branch. The information may contain material provided directly by third parties, and while such material is published with permission, Westpac accepts

no responsibility for the accuracy or completeness of any such material. Except where contrary to law, Westpac intends by this notice to exclude liability for the information. The information is subject to change without notice and Westpac

is under no obligation to update the information or correct any inaccuracy which may become apparent at a later date. Westpac Banking Corporation is registered in England as a branch (branch number BR000106) and is authorised and

regulated by The Financial Services Authority. Westpac Europe Limited is a company registered in England (number 05660023) and is authorised and regulated by The Financial Services Authority. © 2010 Westpac Banking Corporation. Past

performance is not a reliable indicator of future performance. The forecasts given in this document are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable,

the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from these forecasts.

You might also like

- The Fall of Enron - Case SolutionDocument5 pagesThe Fall of Enron - Case SolutionJyotirmoy ChatterjeeNo ratings yet

- PowerBI Advanced Analytics With PowerBIDocument18 pagesPowerBI Advanced Analytics With PowerBIBruce Ge100% (7)

- Westpack JUL 20 Mornng ReportDocument1 pageWestpack JUL 20 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 18 Mornng ReportDocument1 pageWestpack JUN 18 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 29 Mornng ReportDocument1 pageWestpack JUN 29 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 29 Mornng ReportDocument1 pageWestpack JUL 29 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 03 Mornng ReportDocument1 pageWestpack AUG 03 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 04 Mornng ReportDocument1 pageWestpack AUG 04 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 21 Mornng ReportDocument1 pageWestpack JUL 21 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 08 Mornng ReportDocument1 pageWestpack JUL 08 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 02 Mornng ReportDocument1 pageWestpack JUL 02 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 15 Mornng ReportDocument1 pageWestpack JUL 15 Mornng ReportMiir ViirNo ratings yet

- JUN 08 Westpack Morning ReportDocument1 pageJUN 08 Westpack Morning ReportMiir ViirNo ratings yet

- Westpack JUL 28 Mornng ReportDocument1 pageWestpack JUL 28 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 28 Mornng ReportDocument1 pageWestpack JUN 28 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 05 Mornng ReportDocument1 pageWestpack JUL 05 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 21 Mornng ReportDocument1 pageWestpack JUN 21 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 01 Mornng ReportDocument1 pageWestpack JUL 01 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 22 Mornng ReportDocument1 pageWestpack JUN 22 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 15 Mornng ReportDocument1 pageWestpack JUN 15 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 16 Mornng ReportDocument1 pageWestpack JUN 16 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 09 Mornng ReportDocument1 pageWestpack JUL 09 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 12 Mornng ReportDocument1 pageWestpack JUL 12 Mornng ReportMiir ViirNo ratings yet

- ScotiaBank AUG 03 Daily FX UpdateDocument3 pagesScotiaBank AUG 03 Daily FX UpdateMiir ViirNo ratings yet

- Westpack JUL 26 Mornng ReportDocument1 pageWestpack JUL 26 Mornng ReportMiir ViirNo ratings yet

- Australian Dollar Outlook 19 May 2011Document1 pageAustralian Dollar Outlook 19 May 2011International Business Times AUNo ratings yet

- Westpack AUG 05 Mornng ReportDocument1 pageWestpack AUG 05 Mornng ReportMiir ViirNo ratings yet

- G10 FX Week Ahead: Tailgating Treasury YieldsDocument8 pagesG10 FX Week Ahead: Tailgating Treasury YieldsrockieballNo ratings yet

- ScotiaBank JUL 27 Daily FX UpdateDocument3 pagesScotiaBank JUL 27 Daily FX UpdateMiir ViirNo ratings yet

- Sep 16Document12 pagesSep 16kn0qNo ratings yet

- Westpack AUG 09 Mornng ReportDocument1 pageWestpack AUG 09 Mornng ReportMiir ViirNo ratings yet

- ScotiaBank AUG 04 Daily FX UpdateDocument3 pagesScotiaBank AUG 04 Daily FX UpdateMiir ViirNo ratings yet

- Inside Debt: U.S. Markets Today Chart of The DayDocument6 pagesInside Debt: U.S. Markets Today Chart of The DayBoris MangalNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Australian Dollar Outlook 24 May 2011Document1 pageAustralian Dollar Outlook 24 May 2011International Business Times AUNo ratings yet

- Daily Currency Briefing: Waiting For Godot?Document4 pagesDaily Currency Briefing: Waiting For Godot?timurrsNo ratings yet

- ScotiaBank AUG 06 Daily FX UpdateDocument3 pagesScotiaBank AUG 06 Daily FX UpdateMiir ViirNo ratings yet

- Ringgit Daily 19may17Document4 pagesRinggit Daily 19may17ChanBoonKeatNo ratings yet

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- Australian Dollar Outlook 21 June 2011Document1 pageAustralian Dollar Outlook 21 June 2011International Business Times AUNo ratings yet

- Global FX StrategyDocument4 pagesGlobal FX StrategyllaryNo ratings yet

- Australian Dollar Outlook 03 June 2011Document1 pageAustralian Dollar Outlook 03 June 2011International Business Times AUNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Jyske Bank Jul 28 em DailyDocument5 pagesJyske Bank Jul 28 em DailyMiir ViirNo ratings yet

- Australian Dollar Outlook 01 June 2011Document1 pageAustralian Dollar Outlook 01 June 2011International Business Times AUNo ratings yet

- Australian Dollar Outlook 20 June 2011Document1 pageAustralian Dollar Outlook 20 June 2011International Business Times AUNo ratings yet

- Market Analysis ReportDocument7 pagesMarket Analysis ReportPriya RathoreNo ratings yet

- AUG 06 UOB Global MarketsDocument2 pagesAUG 06 UOB Global MarketsMiir ViirNo ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument6 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Commodity Insight: Market OverviewDocument9 pagesCommodity Insight: Market OverviewThe red RoseNo ratings yet

- Australian Dollar Outlook 20 May 2011Document1 pageAustralian Dollar Outlook 20 May 2011International Business Times AUNo ratings yet

- Australian Dollar Outlook 23 August 2011Document1 pageAustralian Dollar Outlook 23 August 2011International Business Times AUNo ratings yet

- Australian Dollar Outlook 16 May 2011Document1 pageAustralian Dollar Outlook 16 May 2011International Business Times AUNo ratings yet

- FX Daily Report: Bell FX Currency OutlookDocument1 pageFX Daily Report: Bell FX Currency OutlookInternational Business Times AUNo ratings yet

- Australian Dollar Outlook 08/29/2011Document1 pageAustralian Dollar Outlook 08/29/2011International Business Times AUNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Week 6 OutlookDocument1 pageWeek 6 OutlookJC CalaycayNo ratings yet

- The Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyFrom EverandThe Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World EconomyRating: 5 out of 5 stars5/5 (1)

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-09-DJ European Forex TechnicalsDocument3 pagesAUG-09-DJ European Forex TechnicalsMiir ViirNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNo ratings yet

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirNo ratings yet

- Abad MarrietteJoyExcel Ex8Document13 pagesAbad MarrietteJoyExcel Ex8marriette joy abadNo ratings yet

- MO - Project Report - Group1Document16 pagesMO - Project Report - Group1Mohanapriya JayakumarNo ratings yet

- Assignment and License of Copyright Difference Under 1909 and 1957 ActDocument2 pagesAssignment and License of Copyright Difference Under 1909 and 1957 ActpravinsankalpNo ratings yet

- 7 NUBE Vs PEMADocument9 pages7 NUBE Vs PEMAAngelica Joyce BelenNo ratings yet

- Spinoff Splitoff Splitup CarveoutDocument2 pagesSpinoff Splitoff Splitup CarveouttransitxyzNo ratings yet

- Family Office Co Investing Webinar AxialDocument18 pagesFamily Office Co Investing Webinar AxialJoel Warren100% (1)

- Ethical DilemmaDocument2 pagesEthical Dilemmasheleftme100% (1)

- The Role of Business Sector in The Local Governance of Bacolod City (A Case of Metro Bacolod Chamber of Commerce and Industries)Document2 pagesThe Role of Business Sector in The Local Governance of Bacolod City (A Case of Metro Bacolod Chamber of Commerce and Industries)gen_nalaNo ratings yet

- Account PaperDocument8 pagesAccount PaperAhmad SiddiquiNo ratings yet

- 2011-2012 Ivy Sports Symposium Media KitDocument13 pages2011-2012 Ivy Sports Symposium Media KitSports Symposium Inc.No ratings yet

- WIP Scrap TransactiondDocument2 pagesWIP Scrap Transactiondvinksin4No ratings yet

- Godisnjak 2006Document463 pagesGodisnjak 2006edo_scribdNo ratings yet

- Organizational BehaviourDocument17 pagesOrganizational BehaviourSureshNo ratings yet

- Saudi Arabia - PresentationDocument16 pagesSaudi Arabia - PresentationamyhlyneNo ratings yet

- Lesson Plan Accounting 1Document2 pagesLesson Plan Accounting 1Christine Cayosa CahayagNo ratings yet

- Alexander Resume PDFDocument1 pageAlexander Resume PDFAlexander SitorusNo ratings yet

- Perancangan Relayout Tata Letak Fasilitas Guna Mengurangi Biaya Material Handling Pada UKM Tahu "SRT" KediriDocument10 pagesPerancangan Relayout Tata Letak Fasilitas Guna Mengurangi Biaya Material Handling Pada UKM Tahu "SRT" KedirianahNo ratings yet

- Group#7 SectionD Assignment#5 RevisedDocument34 pagesGroup#7 SectionD Assignment#5 RevisedNikhil VijayanNo ratings yet

- Ashok LeylandDocument10 pagesAshok LeylandVasundhara KediaNo ratings yet

- Lakme Lever Private Limited - Financial Reports, Balance Sheets and More - ToflerDocument4 pagesLakme Lever Private Limited - Financial Reports, Balance Sheets and More - Toflerkiyohe44160% (1)

- Relational Database Management System MaterialDocument38 pagesRelational Database Management System MaterialalbatrossaloneNo ratings yet

- New Strategy: Acw NotesDocument6 pagesNew Strategy: Acw NotesMorriesNo ratings yet

- REVLONDocument9 pagesREVLONmus4dd1qNo ratings yet

- Provisional Sum As Delay EventDocument10 pagesProvisional Sum As Delay EventGary LoNo ratings yet

- Financial Acctg & Reporting 1 - Chapter 12Document6 pagesFinancial Acctg & Reporting 1 - Chapter 12Mums TeaNo ratings yet

- Certificate of Liability InsuranceDocument1 pageCertificate of Liability Insurancelfmt7871No ratings yet

- MEC310 Quality Engineering 12813::sachin Kapur 3.0 0.0 0.0 3.0 Courses With Numerical and Conceptual FocusDocument8 pagesMEC310 Quality Engineering 12813::sachin Kapur 3.0 0.0 0.0 3.0 Courses With Numerical and Conceptual FocusVinu ThomasNo ratings yet

- Customer Relation Management (CRM) and Its Impact On Organizational Performance: A Case of Etisalat Telecommunication in AfghanistanDocument9 pagesCustomer Relation Management (CRM) and Its Impact On Organizational Performance: A Case of Etisalat Telecommunication in AfghanistanUIJRT United International Journal for Research & TechnologyNo ratings yet