Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

50 viewsDiscussion-Biovail Corporation

Discussion-Biovail Corporation

Uploaded by

Owl1. A truck carrying products worth $10-20 million was involved in an accident, raising questions around how the revenue from the products should be recognized and how much the insurance payout would be.

2. Two banks cut their stock ratings for the company due to perceived issues with poor supply chain management, though evidence for production delays was not clear.

3. The company's stock value declined substantially after one analyst reported poor revenue and earnings despite rapid sales growth being reported. Attempts were made to discredit the analyst, leading to an SEC investigation and lawsuit.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Biovail Case Study AnswerDocument6 pagesBiovail Case Study AnsweralfredNo ratings yet

- Jun18l1eth-E02 QaDocument3 pagesJun18l1eth-E02 Qarafav10No ratings yet

- Full Download Financial Statement Analysis 11th Edition Subramanyam Test BankDocument35 pagesFull Download Financial Statement Analysis 11th Edition Subramanyam Test Bankjulianwellsueiy100% (38)

- R03.2 Standard II Integrity of Capital Markets - AnswersDocument26 pagesR03.2 Standard II Integrity of Capital Markets - AnswersxssfsdfsfNo ratings yet

- Applied Economics Module 2Document57 pagesApplied Economics Module 2Billy Joe93% (45)

- R03.2 Standard II Integrity of Capital MarketsDocument8 pagesR03.2 Standard II Integrity of Capital MarketsxczcNo ratings yet

- Applied Economics11 - q1 - m2 - Applied Economics - v3Document57 pagesApplied Economics11 - q1 - m2 - Applied Economics - v3Analiza Pascua100% (1)

- Bio VailDocument22 pagesBio VailNurAshikinMohamadNo ratings yet

- EXHIBITS 1-99 For July 17 2012 HSBC HearingUR7 PDFDocument530 pagesEXHIBITS 1-99 For July 17 2012 HSBC HearingUR7 PDFseymourwardNo ratings yet

- BPI Glitch Case StudyDocument9 pagesBPI Glitch Case StudyJillian Bermoy100% (1)

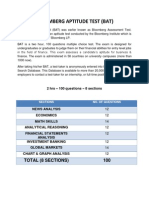

- Bloomberg Aptitude Test (BAT)Document10 pagesBloomberg Aptitude Test (BAT)Shivgan Joshi100% (1)

- 2.2. Written Assignment Unit 2_BUS 5115Document8 pages2.2. Written Assignment Unit 2_BUS 5115hanu hanuNo ratings yet

- Kumpulan MINICASE Ethichs AADocument52 pagesKumpulan MINICASE Ethichs AASully Kemala OctisariNo ratings yet

- PWC Negligence Over Colonial BankDocument8 pagesPWC Negligence Over Colonial BankPurnima Sidhant BabbarNo ratings yet

- Transfer PricingDocument27 pagesTransfer PricingSejal Kumar JainNo ratings yet

- Case 1.1 Mattel IncDocument14 pagesCase 1.1 Mattel IncAlexa Rodriguez100% (1)

- Analysis of Ethical Issues Involved in The Global Financial Crisis (2008)Document5 pagesAnalysis of Ethical Issues Involved in The Global Financial Crisis (2008)Abhijeet SiteNo ratings yet

- Assignment Evaluating Biovail-1Document4 pagesAssignment Evaluating Biovail-1parikh.jiteshNo ratings yet

- BiovailDocument6 pagesBiovailToo YunHangNo ratings yet

- Presentation Description: Financial Statement Fraud & Corporate Governancethe Satyam CaseDocument5 pagesPresentation Description: Financial Statement Fraud & Corporate Governancethe Satyam CaseRandolph LangstiehNo ratings yet

- Dwnload Full Contemporary Auditing 11th Edition Knapp Solutions Manual PDFDocument35 pagesDwnload Full Contemporary Auditing 11th Edition Knapp Solutions Manual PDFfurmediatetbpwnk100% (21)

- Case Study-ADocument7 pagesCase Study-ARito KatoNo ratings yet

- A Case Applying Revenue Recognition StandardsDocument17 pagesA Case Applying Revenue Recognition StandardsMajdouline FarazdagNo ratings yet

- Bankocracy by John LanchesterDocument3 pagesBankocracy by John LanchesterS.No ratings yet

- Written Assignment Unit 2Document2 pagesWritten Assignment Unit 2dontelamb3cNo ratings yet

- Solution Manual For Contemporary Auditing 11th Edition Knapp ISBN 9781305970816Document36 pagesSolution Manual For Contemporary Auditing 11th Edition Knapp ISBN 9781305970816kylescottokjfxibrqy100% (37)

- CFA L1 SCHWSR FL Test Only Ques - NDocument38 pagesCFA L1 SCHWSR FL Test Only Ques - NAdamNo ratings yet

- Ab F1 Mock Exam For Sept 2018Document15 pagesAb F1 Mock Exam For Sept 2018zcdzcdzcsdcdcNo ratings yet

- Ethics CaseDocument3 pagesEthics Casekishi8mempinNo ratings yet

- Bus 5115 Business Written Assignment Unit 2Document4 pagesBus 5115 Business Written Assignment Unit 2MohamedNo ratings yet

- Diagnostic Test: Question TextDocument60 pagesDiagnostic Test: Question TextpankajmadhavNo ratings yet

- Corporate ScamsDocument22 pagesCorporate ScamsLaili Abdullah100% (1)

- Chapter 4Document23 pagesChapter 4mohamedxuseen215No ratings yet

- Ethics Cases: A Business Case Presented To The Accountancy DepartmentDocument6 pagesEthics Cases: A Business Case Presented To The Accountancy Departmentkeith105No ratings yet

- The Rise and Fall of Worldcom: The World'S Largest Accounting FraudDocument14 pagesThe Rise and Fall of Worldcom: The World'S Largest Accounting FraudkanabaramitNo ratings yet

- Case 2Document5 pagesCase 2Jerome MandapNo ratings yet

- I. Background of The StudyDocument13 pagesI. Background of The StudyalyssaNo ratings yet

- Worldcom: Corporate FraudDocument10 pagesWorldcom: Corporate FraudGhazanfarNo ratings yet

- Summary JobDocument2 pagesSummary JobHendry Piqué SNo ratings yet

- All Was Not Well Wells FargoDocument20 pagesAll Was Not Well Wells FargoNahom G KassayeNo ratings yet

- 111年會考 中會題庫Document99 pages111年會考 中會題庫KirosTeklehaimanotNo ratings yet

- The Financial System Is A Farce:: Part ThreeDocument4 pagesThe Financial System Is A Farce:: Part ThreeVALUEWALK LLCNo ratings yet

- Chapter 1 (Exercises)Document3 pagesChapter 1 (Exercises)claudiazdeandresNo ratings yet

- Evidence of Intent To Commit An Actual Fraud MF GlobalDocument19 pagesEvidence of Intent To Commit An Actual Fraud MF GlobalInvestor ProtectionNo ratings yet

- Ethical and Professional StandardsDocument6 pagesEthical and Professional StandardsCharu KokraNo ratings yet

- Top Management Challenges: Fiscal Year 2018: U.S. Office of Personnel Management Office of The Inspector GeneralDocument28 pagesTop Management Challenges: Fiscal Year 2018: U.S. Office of Personnel Management Office of The Inspector GeneralRahul PambharNo ratings yet

- Mgni Research Thesis 1-7-2021Document54 pagesMgni Research Thesis 1-7-2021Raghu AlankarNo ratings yet

- US Treasury SIGTARP Report: Exiting TARP Repayments by The Largest Financial Institutions (2011)Document94 pagesUS Treasury SIGTARP Report: Exiting TARP Repayments by The Largest Financial Institutions (2011)wmartin46No ratings yet

- Was Senior Management at Barings Aware That There Was A Problem at BFS? ExplainDocument4 pagesWas Senior Management at Barings Aware That There Was A Problem at BFS? ExplainetravoNo ratings yet

- Full Download Contemporary Auditing Real Issues and Cases 8th Edition Knapp Solutions ManualDocument36 pagesFull Download Contemporary Auditing Real Issues and Cases 8th Edition Knapp Solutions Manualtarafahelmus3100% (27)

- Unit 2 AssignmentDocument6 pagesUnit 2 AssignmentmohamedNo ratings yet

- Fin 075 Special Topics in Banking and Microfinance Prelim ExamDocument3 pagesFin 075 Special Topics in Banking and Microfinance Prelim ExamCarlo DiazNo ratings yet

- The Role of Operational Risk in Rogue TradingDocument6 pagesThe Role of Operational Risk in Rogue TradingpsoonekNo ratings yet

- BarclaysDocument24 pagesBarclayspamheavenNo ratings yet

- Worldcom Inc.: Case Study On The Most Controversial Fraud in U.S. HistoryDocument34 pagesWorldcom Inc.: Case Study On The Most Controversial Fraud in U.S. HistoryEira ShaneNo ratings yet

- How Unethical Practices Almost Destroyed WorldcomDocument13 pagesHow Unethical Practices Almost Destroyed WorldcomVinkie ChawlaNo ratings yet

- How Unethical Practices Almost Destroyed WorldcomDocument13 pagesHow Unethical Practices Almost Destroyed WorldcomVinkie ChawlaNo ratings yet

- How Unethical Practices Almost Destroyed WorldcomDocument13 pagesHow Unethical Practices Almost Destroyed WorldcomshivmittalNo ratings yet

- Match: A Systematic, Sane Process for Hiring the Right Person Every TimeFrom EverandMatch: A Systematic, Sane Process for Hiring the Right Person Every TimeNo ratings yet

- Resisting Corporate Corruption: Cases in Practical Ethics From Enron Through The Financial CrisisFrom EverandResisting Corporate Corruption: Cases in Practical Ethics From Enron Through The Financial CrisisNo ratings yet

- EnronDocument4 pagesEnronOwlNo ratings yet

- Deegan (2014) - Chapter 1Document23 pagesDeegan (2014) - Chapter 1OwlNo ratings yet

- 3M HistoryDocument3 pages3M HistoryOwlNo ratings yet

- Napier Haniffa Introduction To Islamic Accounting 2011Document14 pagesNapier Haniffa Introduction To Islamic Accounting 2011OwlNo ratings yet

- The Evolution of Accounting TheoryDocument4 pagesThe Evolution of Accounting TheoryOwl100% (1)

- Difference of RM and ERMDocument1 pageDifference of RM and ERMOwlNo ratings yet

- Borrowing CostsDocument8 pagesBorrowing CostsOwlNo ratings yet

- Chapter 07Document22 pagesChapter 07OwlNo ratings yet

- Role of The Accountant in SADDocument32 pagesRole of The Accountant in SADOwlNo ratings yet

- ? Big Data Is The Term For A Collection of Data Sets So Large and Complex That It BecomesDocument1 page? Big Data Is The Term For A Collection of Data Sets So Large and Complex That It BecomesOwlNo ratings yet

Discussion-Biovail Corporation

Discussion-Biovail Corporation

Uploaded by

Owl0 ratings0% found this document useful (0 votes)

50 views1 page1. A truck carrying products worth $10-20 million was involved in an accident, raising questions around how the revenue from the products should be recognized and how much the insurance payout would be.

2. Two banks cut their stock ratings for the company due to perceived issues with poor supply chain management, though evidence for production delays was not clear.

3. The company's stock value declined substantially after one analyst reported poor revenue and earnings despite rapid sales growth being reported. Attempts were made to discredit the analyst, leading to an SEC investigation and lawsuit.

Original Description:

Case Study Summary

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. A truck carrying products worth $10-20 million was involved in an accident, raising questions around how the revenue from the products should be recognized and how much the insurance payout would be.

2. Two banks cut their stock ratings for the company due to perceived issues with poor supply chain management, though evidence for production delays was not clear.

3. The company's stock value declined substantially after one analyst reported poor revenue and earnings despite rapid sales growth being reported. Attempts were made to discredit the analyst, leading to an SEC investigation and lawsuit.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

50 views1 pageDiscussion-Biovail Corporation

Discussion-Biovail Corporation

Uploaded by

Owl1. A truck carrying products worth $10-20 million was involved in an accident, raising questions around how the revenue from the products should be recognized and how much the insurance payout would be.

2. Two banks cut their stock ratings for the company due to perceived issues with poor supply chain management, though evidence for production delays was not clear.

3. The company's stock value declined substantially after one analyst reported poor revenue and earnings despite rapid sales growth being reported. Attempts were made to discredit the analyst, leading to an SEC investigation and lawsuit.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

1.

Truck Accident

Manager/Key Person: Brian Crombie (CFO), Vice President of Finance (Kenneth Howling)

Problem: Improper revenue recognition

Theory: Conservatism

Points:

-

FOB shipping point vs. FOB destination

Net of reserves?

Valuation of the products on truck (range from $10 million to $20million)

Saleable in the future (after inspection)

Products are fully insured (how much will insurance company pay back?)

2. Stock Rating Cutting

Manager/Key Person: Canadian Imperial Bank of Commerce, J. P. Morgan Securities Inc.

Problem: Poor supply chain management

Theory: Transparency

Points:

-

Production delays & operational uncertainties (evidence of these did not mentioned in

the txt of case study)

3. Stock Value Declines Substantially

Manager/Key Person: Jerry Treppel (Mariss predecessor at Banc of America Securities),

Biovails Executives, SEC

Problem: Unclear information

Theory: Intimidation, Fairness, Transparency

Points:

-

Poor revenue and earnings performance, but rapid sales growth was reported

Biovails Executives failed to persuade Jerry to retract his report, and then defame Jerry

which lead to investigation by SEC, Jerry sue Biovail

4. Following the spirit of U.S. GAAP or just box ticking?

Manager/Key Person: Maris (Jerrys successor at Banc of America Securities)

Problem: Following the accounting standards strategically

Theory: Full disclosure

Points:

-

Channel stuffing or really following seasonal customer buying patterns?

o

Channel stuffing is a business practice in which a company, or a sales force within a

company, inflates its sales figures by forcing more products through a distribution

channel than the channel is capable of selling. (SS > DD)

The products on the truck on the truck should be third quarter item or fourth quarter

item?

You might also like

- Biovail Case Study AnswerDocument6 pagesBiovail Case Study AnsweralfredNo ratings yet

- Jun18l1eth-E02 QaDocument3 pagesJun18l1eth-E02 Qarafav10No ratings yet

- Full Download Financial Statement Analysis 11th Edition Subramanyam Test BankDocument35 pagesFull Download Financial Statement Analysis 11th Edition Subramanyam Test Bankjulianwellsueiy100% (38)

- R03.2 Standard II Integrity of Capital Markets - AnswersDocument26 pagesR03.2 Standard II Integrity of Capital Markets - AnswersxssfsdfsfNo ratings yet

- Applied Economics Module 2Document57 pagesApplied Economics Module 2Billy Joe93% (45)

- R03.2 Standard II Integrity of Capital MarketsDocument8 pagesR03.2 Standard II Integrity of Capital MarketsxczcNo ratings yet

- Applied Economics11 - q1 - m2 - Applied Economics - v3Document57 pagesApplied Economics11 - q1 - m2 - Applied Economics - v3Analiza Pascua100% (1)

- Bio VailDocument22 pagesBio VailNurAshikinMohamadNo ratings yet

- EXHIBITS 1-99 For July 17 2012 HSBC HearingUR7 PDFDocument530 pagesEXHIBITS 1-99 For July 17 2012 HSBC HearingUR7 PDFseymourwardNo ratings yet

- BPI Glitch Case StudyDocument9 pagesBPI Glitch Case StudyJillian Bermoy100% (1)

- Bloomberg Aptitude Test (BAT)Document10 pagesBloomberg Aptitude Test (BAT)Shivgan Joshi100% (1)

- 2.2. Written Assignment Unit 2_BUS 5115Document8 pages2.2. Written Assignment Unit 2_BUS 5115hanu hanuNo ratings yet

- Kumpulan MINICASE Ethichs AADocument52 pagesKumpulan MINICASE Ethichs AASully Kemala OctisariNo ratings yet

- PWC Negligence Over Colonial BankDocument8 pagesPWC Negligence Over Colonial BankPurnima Sidhant BabbarNo ratings yet

- Transfer PricingDocument27 pagesTransfer PricingSejal Kumar JainNo ratings yet

- Case 1.1 Mattel IncDocument14 pagesCase 1.1 Mattel IncAlexa Rodriguez100% (1)

- Analysis of Ethical Issues Involved in The Global Financial Crisis (2008)Document5 pagesAnalysis of Ethical Issues Involved in The Global Financial Crisis (2008)Abhijeet SiteNo ratings yet

- Assignment Evaluating Biovail-1Document4 pagesAssignment Evaluating Biovail-1parikh.jiteshNo ratings yet

- BiovailDocument6 pagesBiovailToo YunHangNo ratings yet

- Presentation Description: Financial Statement Fraud & Corporate Governancethe Satyam CaseDocument5 pagesPresentation Description: Financial Statement Fraud & Corporate Governancethe Satyam CaseRandolph LangstiehNo ratings yet

- Dwnload Full Contemporary Auditing 11th Edition Knapp Solutions Manual PDFDocument35 pagesDwnload Full Contemporary Auditing 11th Edition Knapp Solutions Manual PDFfurmediatetbpwnk100% (21)

- Case Study-ADocument7 pagesCase Study-ARito KatoNo ratings yet

- A Case Applying Revenue Recognition StandardsDocument17 pagesA Case Applying Revenue Recognition StandardsMajdouline FarazdagNo ratings yet

- Bankocracy by John LanchesterDocument3 pagesBankocracy by John LanchesterS.No ratings yet

- Written Assignment Unit 2Document2 pagesWritten Assignment Unit 2dontelamb3cNo ratings yet

- Solution Manual For Contemporary Auditing 11th Edition Knapp ISBN 9781305970816Document36 pagesSolution Manual For Contemporary Auditing 11th Edition Knapp ISBN 9781305970816kylescottokjfxibrqy100% (37)

- CFA L1 SCHWSR FL Test Only Ques - NDocument38 pagesCFA L1 SCHWSR FL Test Only Ques - NAdamNo ratings yet

- Ab F1 Mock Exam For Sept 2018Document15 pagesAb F1 Mock Exam For Sept 2018zcdzcdzcsdcdcNo ratings yet

- Ethics CaseDocument3 pagesEthics Casekishi8mempinNo ratings yet

- Bus 5115 Business Written Assignment Unit 2Document4 pagesBus 5115 Business Written Assignment Unit 2MohamedNo ratings yet

- Diagnostic Test: Question TextDocument60 pagesDiagnostic Test: Question TextpankajmadhavNo ratings yet

- Corporate ScamsDocument22 pagesCorporate ScamsLaili Abdullah100% (1)

- Chapter 4Document23 pagesChapter 4mohamedxuseen215No ratings yet

- Ethics Cases: A Business Case Presented To The Accountancy DepartmentDocument6 pagesEthics Cases: A Business Case Presented To The Accountancy Departmentkeith105No ratings yet

- The Rise and Fall of Worldcom: The World'S Largest Accounting FraudDocument14 pagesThe Rise and Fall of Worldcom: The World'S Largest Accounting FraudkanabaramitNo ratings yet

- Case 2Document5 pagesCase 2Jerome MandapNo ratings yet

- I. Background of The StudyDocument13 pagesI. Background of The StudyalyssaNo ratings yet

- Worldcom: Corporate FraudDocument10 pagesWorldcom: Corporate FraudGhazanfarNo ratings yet

- Summary JobDocument2 pagesSummary JobHendry Piqué SNo ratings yet

- All Was Not Well Wells FargoDocument20 pagesAll Was Not Well Wells FargoNahom G KassayeNo ratings yet

- 111年會考 中會題庫Document99 pages111年會考 中會題庫KirosTeklehaimanotNo ratings yet

- The Financial System Is A Farce:: Part ThreeDocument4 pagesThe Financial System Is A Farce:: Part ThreeVALUEWALK LLCNo ratings yet

- Chapter 1 (Exercises)Document3 pagesChapter 1 (Exercises)claudiazdeandresNo ratings yet

- Evidence of Intent To Commit An Actual Fraud MF GlobalDocument19 pagesEvidence of Intent To Commit An Actual Fraud MF GlobalInvestor ProtectionNo ratings yet

- Ethical and Professional StandardsDocument6 pagesEthical and Professional StandardsCharu KokraNo ratings yet

- Top Management Challenges: Fiscal Year 2018: U.S. Office of Personnel Management Office of The Inspector GeneralDocument28 pagesTop Management Challenges: Fiscal Year 2018: U.S. Office of Personnel Management Office of The Inspector GeneralRahul PambharNo ratings yet

- Mgni Research Thesis 1-7-2021Document54 pagesMgni Research Thesis 1-7-2021Raghu AlankarNo ratings yet

- US Treasury SIGTARP Report: Exiting TARP Repayments by The Largest Financial Institutions (2011)Document94 pagesUS Treasury SIGTARP Report: Exiting TARP Repayments by The Largest Financial Institutions (2011)wmartin46No ratings yet

- Was Senior Management at Barings Aware That There Was A Problem at BFS? ExplainDocument4 pagesWas Senior Management at Barings Aware That There Was A Problem at BFS? ExplainetravoNo ratings yet

- Full Download Contemporary Auditing Real Issues and Cases 8th Edition Knapp Solutions ManualDocument36 pagesFull Download Contemporary Auditing Real Issues and Cases 8th Edition Knapp Solutions Manualtarafahelmus3100% (27)

- Unit 2 AssignmentDocument6 pagesUnit 2 AssignmentmohamedNo ratings yet

- Fin 075 Special Topics in Banking and Microfinance Prelim ExamDocument3 pagesFin 075 Special Topics in Banking and Microfinance Prelim ExamCarlo DiazNo ratings yet

- The Role of Operational Risk in Rogue TradingDocument6 pagesThe Role of Operational Risk in Rogue TradingpsoonekNo ratings yet

- BarclaysDocument24 pagesBarclayspamheavenNo ratings yet

- Worldcom Inc.: Case Study On The Most Controversial Fraud in U.S. HistoryDocument34 pagesWorldcom Inc.: Case Study On The Most Controversial Fraud in U.S. HistoryEira ShaneNo ratings yet

- How Unethical Practices Almost Destroyed WorldcomDocument13 pagesHow Unethical Practices Almost Destroyed WorldcomVinkie ChawlaNo ratings yet

- How Unethical Practices Almost Destroyed WorldcomDocument13 pagesHow Unethical Practices Almost Destroyed WorldcomVinkie ChawlaNo ratings yet

- How Unethical Practices Almost Destroyed WorldcomDocument13 pagesHow Unethical Practices Almost Destroyed WorldcomshivmittalNo ratings yet

- Match: A Systematic, Sane Process for Hiring the Right Person Every TimeFrom EverandMatch: A Systematic, Sane Process for Hiring the Right Person Every TimeNo ratings yet

- Resisting Corporate Corruption: Cases in Practical Ethics From Enron Through The Financial CrisisFrom EverandResisting Corporate Corruption: Cases in Practical Ethics From Enron Through The Financial CrisisNo ratings yet

- EnronDocument4 pagesEnronOwlNo ratings yet

- Deegan (2014) - Chapter 1Document23 pagesDeegan (2014) - Chapter 1OwlNo ratings yet

- 3M HistoryDocument3 pages3M HistoryOwlNo ratings yet

- Napier Haniffa Introduction To Islamic Accounting 2011Document14 pagesNapier Haniffa Introduction To Islamic Accounting 2011OwlNo ratings yet

- The Evolution of Accounting TheoryDocument4 pagesThe Evolution of Accounting TheoryOwl100% (1)

- Difference of RM and ERMDocument1 pageDifference of RM and ERMOwlNo ratings yet

- Borrowing CostsDocument8 pagesBorrowing CostsOwlNo ratings yet

- Chapter 07Document22 pagesChapter 07OwlNo ratings yet

- Role of The Accountant in SADDocument32 pagesRole of The Accountant in SADOwlNo ratings yet

- ? Big Data Is The Term For A Collection of Data Sets So Large and Complex That It BecomesDocument1 page? Big Data Is The Term For A Collection of Data Sets So Large and Complex That It BecomesOwlNo ratings yet