Professional Documents

Culture Documents

Simple Cash Flow Examples

Simple Cash Flow Examples

Uploaded by

AamirMalikCopyright:

Available Formats

You might also like

- Ricardo Vargas Pmbok Flow 6ed Color En-A0Document1 pageRicardo Vargas Pmbok Flow 6ed Color En-A0murdi.santoso83% (6)

- Chap 009Document68 pagesChap 009Mnar Abu-ShliebaNo ratings yet

- Scenario Analysis: ExampleDocument4 pagesScenario Analysis: ExampledefectivepieceNo ratings yet

- 7-Risk and Real Options in Capital BudgetingDocument38 pages7-Risk and Real Options in Capital BudgetingSameerbaskarNo ratings yet

- Battery Sizing Calculation For Ups Application: Need Constant Power Discharge Characteristics UndersizedDocument2 pagesBattery Sizing Calculation For Ups Application: Need Constant Power Discharge Characteristics UndersizedAamirMalik75% (4)

- Busn 233 CH 08 EeeeDocument102 pagesBusn 233 CH 08 EeeeDavid IoanaNo ratings yet

- The Basics of Capital Budgeting Evaluating Cash FlowsDocument59 pagesThe Basics of Capital Budgeting Evaluating Cash FlowsBabasab Patil (Karrisatte)No ratings yet

- Capital BudgetingDocument62 pagesCapital BudgetingAshwin AroraNo ratings yet

- Capital Exp DecisionsDocument24 pagesCapital Exp DecisionsGourav PandeyNo ratings yet

- Chapter 6 Answer Key (1 15)Document15 pagesChapter 6 Answer Key (1 15)Desrifta FaheraNo ratings yet

- Basic Tax EnvironmentDocument8 pagesBasic Tax EnvironmentPeregrin TookNo ratings yet

- Capital Budgeting: Techniques: Contents: Analytic Techniques NPV Vs IrrDocument32 pagesCapital Budgeting: Techniques: Contents: Analytic Techniques NPV Vs IrradnysamNo ratings yet

- BCC B Capital InvestmentDocument12 pagesBCC B Capital InvestmentNguyen Thi Tam NguyenNo ratings yet

- Net Present Value: Examples From Notes: Capital Budgeting IDocument25 pagesNet Present Value: Examples From Notes: Capital Budgeting Ikrish lopezNo ratings yet

- CHAPTER 2 (B) - Risk Analysis and Project EvaluationDocument79 pagesCHAPTER 2 (B) - Risk Analysis and Project EvaluationSarnisha Murugeshwaran (Shazzisha)No ratings yet

- Concepts and Techniques: Capital BudgetingDocument66 pagesConcepts and Techniques: Capital BudgetingAMJAD ALINo ratings yet

- CQF L01P01Document16 pagesCQF L01P01Mn AbdullaNo ratings yet

- Capital Budegeting Class ProblemsDocument19 pagesCapital Budegeting Class ProblemsVishnupriya PremkumarNo ratings yet

- Investment CriteriaDocument27 pagesInvestment CriteriaCharu ModiNo ratings yet

- AnswersDocument3 pagesAnswersAnghelNo ratings yet

- Capital InvestmentDocument34 pagesCapital InvestmentVincent WariwaNo ratings yet

- Additional Topic 6-Capital RationingDocument25 pagesAdditional Topic 6-Capital RationingJon Loh Soon WengNo ratings yet

- Chapter 6 Invetsment ExercisesDocument14 pagesChapter 6 Invetsment ExercisesAntonio Jose DuarteNo ratings yet

- IpDocument11 pagesIpMd TariqueNo ratings yet

- Capital Budgeting Examples - SolutionsDocument11 pagesCapital Budgeting Examples - Solutionsanik islamNo ratings yet

- NPV and IRRDocument19 pagesNPV and IRRGukan VenkatNo ratings yet

- Incremental Analysis: Lecture No. 21 Professor C. S. Park Fundamentals of Engineering EconomicsDocument21 pagesIncremental Analysis: Lecture No. 21 Professor C. S. Park Fundamentals of Engineering EconomicsNivika TiffanyNo ratings yet

- Chapter 9 Making Capital Investment DecisionsDocument32 pagesChapter 9 Making Capital Investment Decisionsiyun KNNo ratings yet

- Econ S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1Document6 pagesEcon S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1ADITYA MUNOTNo ratings yet

- Net Present Value FormulaDocument1 pageNet Present Value FormulaPrashanthPrashanthNo ratings yet

- 326 Chapter 9 - Fundamentals of Capital BudgetingDocument20 pages326 Chapter 9 - Fundamentals of Capital BudgetingAbira Bilal HanifNo ratings yet

- Capital BudgetingDocument38 pagesCapital Budgetingvini2710No ratings yet

- A) Year 0 Year 1 Year 2 Year 3Document13 pagesA) Year 0 Year 1 Year 2 Year 3Usman KhiljiNo ratings yet

- Chapter II Methods of Comparing Alternative ProposalsDocument17 pagesChapter II Methods of Comparing Alternative ProposalsJOHN100% (1)

- The Basics of Capital Budgeting: Solutions To End-Of-Chapter ProblemsDocument9 pagesThe Basics of Capital Budgeting: Solutions To End-Of-Chapter ProblemsTayeba AnwarNo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document41 pagesThe Basics of Capital Budgeting: Should We Build This Plant?Angga BayuNo ratings yet

- Lecture 28-31capital BudgetingDocument68 pagesLecture 28-31capital BudgetingNakul GoyalNo ratings yet

- GATLABAYAN - Activity #1 M3Document4 pagesGATLABAYAN - Activity #1 M3Al Dominic GatlabayanNo ratings yet

- A) Project ADocument9 pagesA) Project AАнастасия ОсипкинаNo ratings yet

- RWJ 08Document38 pagesRWJ 08Kunal PuriNo ratings yet

- Ch10 Tool KitDocument18 pagesCh10 Tool KitElias DEBSNo ratings yet

- Chap 11Document45 pagesChap 11SEATQMNo ratings yet

- Modified Internal Rate of Return (MIRR)Document8 pagesModified Internal Rate of Return (MIRR)JaJ08No ratings yet

- FCF Ch10 Excel Master StudentDocument32 pagesFCF Ch10 Excel Master StudentTosa EndrawanNo ratings yet

- Capital Budgeting With Inflation QestionsDocument9 pagesCapital Budgeting With Inflation QestionsM. Ekhtisham Tariq MustafaiNo ratings yet

- 5.2 Capital Budgeting - Risk AnalysisDocument18 pages5.2 Capital Budgeting - Risk Analysisp44187No ratings yet

- End of Chapter 11 SolutionDocument19 pagesEnd of Chapter 11 SolutionsaniyahNo ratings yet

- Investment CriteriaDocument25 pagesInvestment CriteriaCharu ModiNo ratings yet

- Chapter 12Document14 pagesChapter 12Naimmul FahimNo ratings yet

- Practice Problems Ch12Document57 pagesPractice Problems Ch12Kevin Baconga100% (2)

- Chapter 10 SolutionsDocument9 pagesChapter 10 Solutionsaroddddd23No ratings yet

- Economy Prob Set 1Document12 pagesEconomy Prob Set 1Joselito DaroyNo ratings yet

- Financial Management: Methods of Capital Budgeting EvaluationDocument21 pagesFinancial Management: Methods of Capital Budgeting EvaluationHawazin Al-wasilaNo ratings yet

- Final TestDocument9 pagesFinal TestIqtidar KhanNo ratings yet

- CH0620100916181206Document4 pagesCH0620100916181206Shubharth BharadwajNo ratings yet

- Module 2 - 3 Cost Benefit Evaluation TechniquesDocument15 pagesModule 2 - 3 Cost Benefit Evaluation TechniquesKarthik GoudNo ratings yet

- Capital Investment Appraisal For Long-Term DecisionsDocument39 pagesCapital Investment Appraisal For Long-Term DecisionsDevon PhamNo ratings yet

- 4 FinalsDocument59 pages4 FinalsXerez SingsonNo ratings yet

- Project IRR Equity IRRDocument35 pagesProject IRR Equity IRRsandeepniftianNo ratings yet

- Unit III-B PMDocument45 pagesUnit III-B PMAbdul AleemNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Project Life Cycle Iterative and Adaptive - Ultimate GuideDocument14 pagesProject Life Cycle Iterative and Adaptive - Ultimate GuideAamirMalikNo ratings yet

- Batteries Costing 1008Document10 pagesBatteries Costing 1008AamirMalikNo ratings yet

- PMP Memory SheetsDocument6 pagesPMP Memory SheetsAamirMalik100% (1)

- Cleanroom Design in 10 Easy StepsDocument8 pagesCleanroom Design in 10 Easy StepsAamirMalikNo ratings yet

- Biannual Maintenance of CFB BoilerDocument3 pagesBiannual Maintenance of CFB BoilerAamirMalikNo ratings yet

- Calculation ProgressDocument1 pageCalculation ProgressAamirMalikNo ratings yet

- Corn-Cob Vs Local CoalDocument1 pageCorn-Cob Vs Local CoalAamirMalikNo ratings yet

- Electric Inspector Form-BDocument11 pagesElectric Inspector Form-BAamirMalikNo ratings yet

- Biannual Maintenance of CFB BoilerDocument3 pagesBiannual Maintenance of CFB BoilerAamirMalikNo ratings yet

- 20% Coal 80% MSW Prefersibility StudyDocument3 pages20% Coal 80% MSW Prefersibility StudyAamirMalikNo ratings yet

- Envirable: Induction Heater CatalogDocument23 pagesEnvirable: Induction Heater CatalogAamirMalikNo ratings yet

- Flow Diagram of Fly Ash Brick PlantDocument1 pageFlow Diagram of Fly Ash Brick PlantAamirMalikNo ratings yet

- Why Don't We Use High Voltage DC Lines?Document2 pagesWhy Don't We Use High Voltage DC Lines?AamirMalikNo ratings yet

- TURBINE INVENTORY (Peter Brotherhood) : Sr. No Item Description Part No MOUDocument4 pagesTURBINE INVENTORY (Peter Brotherhood) : Sr. No Item Description Part No MOUAamirMalikNo ratings yet

- On Line Flue Gas Monitoring System ListDocument2 pagesOn Line Flue Gas Monitoring System ListAamirMalikNo ratings yet

- Product Catalogue - Melt Flow Indexer MFI - 100Document3 pagesProduct Catalogue - Melt Flow Indexer MFI - 100AamirMalikNo ratings yet

- 100% Coal Prefersibility StudyDocument3 pages100% Coal Prefersibility StudyAamirMalikNo ratings yet

- DC TransmissionDocument2 pagesDC TransmissionAamirMalikNo ratings yet

- Single Core Cables in ParallelDocument1 pageSingle Core Cables in ParallelAamirMalik100% (1)

- Catalogue - Coefficient of Friction Tester MXD-02Document2 pagesCatalogue - Coefficient of Friction Tester MXD-02AamirMalikNo ratings yet

- Param XLW (PC) Auto Tensile Tester: ProfessionalDocument3 pagesParam XLW (PC) Auto Tensile Tester: ProfessionalAamirMalik100% (1)

Simple Cash Flow Examples

Simple Cash Flow Examples

Uploaded by

AamirMalikOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Simple Cash Flow Examples

Simple Cash Flow Examples

Uploaded by

AamirMalikCopyright:

Available Formats

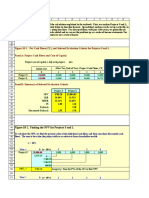

Simple example of cash flow analysis (NPV)

Project with 1 year of construction and 3 years of operation

Years

Cash flows

MARR =

1

(200,000)

15%

2

100,000

3

100,000

4

100,000

NPV =

$24,628.27

Remark: it is assumed - as default in Excel - that the cash transactions are at the end of the periods

Simple example of cash flow analysis (IRR)

Project with 1 year of construction and 3 years of operation

Years

Cash flows

MARR =

1

(200,000)

10%

2

100,000

15%

3

100,000

20%

4

100,000

25%

30%

NPV =

$44,259.27

$24,628.27

$8,873.46

($3,840.00) ($14,145.16)

Remark: it is assumed - as default in Excel - that the cash transactions are at the end of the periods

IRR =

23%

NPV graph

$50,000.00

$40,000.00

NPV

$30,000.00

$20,000.00

$10,000.00

$0.00

($10,000.00)10%

IRR

15%

($20,000.00)

MARR

20%

25%

30%

Example of cash flow with ambiguous values for IRR

Project with 1 year of construction and 4 years of operation

Years

Cash flows

MARR =

1

$106,500

10%

2

($200,000)

15%

3

$100,000

20%

4

($100,000)

25%

5

$100,000

30%

NPV =

$451.19

($326.07)

($306.07)

$208.00

$1,016.62

Remark: it is assumed - as default in Excel - that the cash transactions are at the end of the periods

IRR =

12% ?

NPV graph

$1,200.00

$1,000.00

NPV

$800.00

$600.00

$400.00

IRR?

$200.00

$0.00

($200.00)10%

15%

20%

($400.00)

MARR

25%

30%

Example of cash flow with ambiguous values for IRR

Project with 1 year of construction and 4 years of operation

Years

Cash flows

MARR =

1

$106,500

5%

2

($200,000)

10%

3

$100,000

15%

4

($100,000)

20%

5

$100,000

25%

Correcting the cash flows

Assuming re-investment rate of

Corrected C.F.

$0

5%

($88,175)

$4,762

$0

$100,000

NPV =

$2,488.80

($7,202.08) ($13,824.26) ($18,289.15) ($21,225.90)

Remark: it is assumed - as default in Excel - that the cash transactions are at the end of the periods

IRR =

6%

NPV graph

$5,000.00

IRR

$0.00

NPV

5%

($5,000.00)

10%

($10,000.00)

($15,000.00)

($20,000.00)

($25,000.00)

M ARR

15%

20%

25%

Simple example of cash flow analysis (NPV)

Project with 1 year of construction and 3 years of operation

Years

Cash flows

MARR =

NPV =

1

(200,000)

15%

2

100,000

$24,628.27 IRR =

3

100,000

4

100,000

23%

Remark: it is assumed - as default in Excel - that the cash transactions are at the end of the periods

Risk assumptions

Investment cost can be anything between 180,000 and 220,000

First year net income is most likely 100,000, but at worst 80,000 and at best 110,000

Final year net income is most likely 100,000, but at worst 70,000 and at best 120,000

Final year net income is most likely 100,000, but at worst 60,000 and at best 125,000

NPV

IRR

Worst Case

(220,000)

80,000

70,000

60,000

Best Case

(180,000) 110,000 120,000 125,000

Simple example of cash flow analysis (NPV)

Project with 1 year of construction and 3 years of operation

Years

Cash flows

MARR =

1

2

3

4

#ADDIN? #ADDIN? #ADDIN? #ADDIN?

15%

NPV =

#ADDIN? IRR =

#ADDIN?

Remark: it is assumed - as default in Excel - that the cash transactions are at the end of the periods

Risk assumptions

Investment cost can be anything between 180,000 and 220,000

First year net income is most likely 100,000, but at worst 80,000 and at best 110,000

Final year net income is most likely 100,000, but at worst 70,000 and at best 120,000

Final year net income is most likely 100,000, but at worst 60,000 and at best 125,000

NPV

IRR

Worst Case

(220,000)

80,000

70,000

60,000

Best Case

(180,000) 110,000 120,000 125,000

You might also like

- Ricardo Vargas Pmbok Flow 6ed Color En-A0Document1 pageRicardo Vargas Pmbok Flow 6ed Color En-A0murdi.santoso83% (6)

- Chap 009Document68 pagesChap 009Mnar Abu-ShliebaNo ratings yet

- Scenario Analysis: ExampleDocument4 pagesScenario Analysis: ExampledefectivepieceNo ratings yet

- 7-Risk and Real Options in Capital BudgetingDocument38 pages7-Risk and Real Options in Capital BudgetingSameerbaskarNo ratings yet

- Battery Sizing Calculation For Ups Application: Need Constant Power Discharge Characteristics UndersizedDocument2 pagesBattery Sizing Calculation For Ups Application: Need Constant Power Discharge Characteristics UndersizedAamirMalik75% (4)

- Busn 233 CH 08 EeeeDocument102 pagesBusn 233 CH 08 EeeeDavid IoanaNo ratings yet

- The Basics of Capital Budgeting Evaluating Cash FlowsDocument59 pagesThe Basics of Capital Budgeting Evaluating Cash FlowsBabasab Patil (Karrisatte)No ratings yet

- Capital BudgetingDocument62 pagesCapital BudgetingAshwin AroraNo ratings yet

- Capital Exp DecisionsDocument24 pagesCapital Exp DecisionsGourav PandeyNo ratings yet

- Chapter 6 Answer Key (1 15)Document15 pagesChapter 6 Answer Key (1 15)Desrifta FaheraNo ratings yet

- Basic Tax EnvironmentDocument8 pagesBasic Tax EnvironmentPeregrin TookNo ratings yet

- Capital Budgeting: Techniques: Contents: Analytic Techniques NPV Vs IrrDocument32 pagesCapital Budgeting: Techniques: Contents: Analytic Techniques NPV Vs IrradnysamNo ratings yet

- BCC B Capital InvestmentDocument12 pagesBCC B Capital InvestmentNguyen Thi Tam NguyenNo ratings yet

- Net Present Value: Examples From Notes: Capital Budgeting IDocument25 pagesNet Present Value: Examples From Notes: Capital Budgeting Ikrish lopezNo ratings yet

- CHAPTER 2 (B) - Risk Analysis and Project EvaluationDocument79 pagesCHAPTER 2 (B) - Risk Analysis and Project EvaluationSarnisha Murugeshwaran (Shazzisha)No ratings yet

- Concepts and Techniques: Capital BudgetingDocument66 pagesConcepts and Techniques: Capital BudgetingAMJAD ALINo ratings yet

- CQF L01P01Document16 pagesCQF L01P01Mn AbdullaNo ratings yet

- Capital Budegeting Class ProblemsDocument19 pagesCapital Budegeting Class ProblemsVishnupriya PremkumarNo ratings yet

- Investment CriteriaDocument27 pagesInvestment CriteriaCharu ModiNo ratings yet

- AnswersDocument3 pagesAnswersAnghelNo ratings yet

- Capital InvestmentDocument34 pagesCapital InvestmentVincent WariwaNo ratings yet

- Additional Topic 6-Capital RationingDocument25 pagesAdditional Topic 6-Capital RationingJon Loh Soon WengNo ratings yet

- Chapter 6 Invetsment ExercisesDocument14 pagesChapter 6 Invetsment ExercisesAntonio Jose DuarteNo ratings yet

- IpDocument11 pagesIpMd TariqueNo ratings yet

- Capital Budgeting Examples - SolutionsDocument11 pagesCapital Budgeting Examples - Solutionsanik islamNo ratings yet

- NPV and IRRDocument19 pagesNPV and IRRGukan VenkatNo ratings yet

- Incremental Analysis: Lecture No. 21 Professor C. S. Park Fundamentals of Engineering EconomicsDocument21 pagesIncremental Analysis: Lecture No. 21 Professor C. S. Park Fundamentals of Engineering EconomicsNivika TiffanyNo ratings yet

- Chapter 9 Making Capital Investment DecisionsDocument32 pagesChapter 9 Making Capital Investment Decisionsiyun KNNo ratings yet

- Econ S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1Document6 pagesEcon S-190 Introduction To Financial and Managerial Economics Mock Final Examination 2021 Question #1ADITYA MUNOTNo ratings yet

- Net Present Value FormulaDocument1 pageNet Present Value FormulaPrashanthPrashanthNo ratings yet

- 326 Chapter 9 - Fundamentals of Capital BudgetingDocument20 pages326 Chapter 9 - Fundamentals of Capital BudgetingAbira Bilal HanifNo ratings yet

- Capital BudgetingDocument38 pagesCapital Budgetingvini2710No ratings yet

- A) Year 0 Year 1 Year 2 Year 3Document13 pagesA) Year 0 Year 1 Year 2 Year 3Usman KhiljiNo ratings yet

- Chapter II Methods of Comparing Alternative ProposalsDocument17 pagesChapter II Methods of Comparing Alternative ProposalsJOHN100% (1)

- The Basics of Capital Budgeting: Solutions To End-Of-Chapter ProblemsDocument9 pagesThe Basics of Capital Budgeting: Solutions To End-Of-Chapter ProblemsTayeba AnwarNo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document41 pagesThe Basics of Capital Budgeting: Should We Build This Plant?Angga BayuNo ratings yet

- Lecture 28-31capital BudgetingDocument68 pagesLecture 28-31capital BudgetingNakul GoyalNo ratings yet

- GATLABAYAN - Activity #1 M3Document4 pagesGATLABAYAN - Activity #1 M3Al Dominic GatlabayanNo ratings yet

- A) Project ADocument9 pagesA) Project AАнастасия ОсипкинаNo ratings yet

- RWJ 08Document38 pagesRWJ 08Kunal PuriNo ratings yet

- Ch10 Tool KitDocument18 pagesCh10 Tool KitElias DEBSNo ratings yet

- Chap 11Document45 pagesChap 11SEATQMNo ratings yet

- Modified Internal Rate of Return (MIRR)Document8 pagesModified Internal Rate of Return (MIRR)JaJ08No ratings yet

- FCF Ch10 Excel Master StudentDocument32 pagesFCF Ch10 Excel Master StudentTosa EndrawanNo ratings yet

- Capital Budgeting With Inflation QestionsDocument9 pagesCapital Budgeting With Inflation QestionsM. Ekhtisham Tariq MustafaiNo ratings yet

- 5.2 Capital Budgeting - Risk AnalysisDocument18 pages5.2 Capital Budgeting - Risk Analysisp44187No ratings yet

- End of Chapter 11 SolutionDocument19 pagesEnd of Chapter 11 SolutionsaniyahNo ratings yet

- Investment CriteriaDocument25 pagesInvestment CriteriaCharu ModiNo ratings yet

- Chapter 12Document14 pagesChapter 12Naimmul FahimNo ratings yet

- Practice Problems Ch12Document57 pagesPractice Problems Ch12Kevin Baconga100% (2)

- Chapter 10 SolutionsDocument9 pagesChapter 10 Solutionsaroddddd23No ratings yet

- Economy Prob Set 1Document12 pagesEconomy Prob Set 1Joselito DaroyNo ratings yet

- Financial Management: Methods of Capital Budgeting EvaluationDocument21 pagesFinancial Management: Methods of Capital Budgeting EvaluationHawazin Al-wasilaNo ratings yet

- Final TestDocument9 pagesFinal TestIqtidar KhanNo ratings yet

- CH0620100916181206Document4 pagesCH0620100916181206Shubharth BharadwajNo ratings yet

- Module 2 - 3 Cost Benefit Evaluation TechniquesDocument15 pagesModule 2 - 3 Cost Benefit Evaluation TechniquesKarthik GoudNo ratings yet

- Capital Investment Appraisal For Long-Term DecisionsDocument39 pagesCapital Investment Appraisal For Long-Term DecisionsDevon PhamNo ratings yet

- 4 FinalsDocument59 pages4 FinalsXerez SingsonNo ratings yet

- Project IRR Equity IRRDocument35 pagesProject IRR Equity IRRsandeepniftianNo ratings yet

- Unit III-B PMDocument45 pagesUnit III-B PMAbdul AleemNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Project Life Cycle Iterative and Adaptive - Ultimate GuideDocument14 pagesProject Life Cycle Iterative and Adaptive - Ultimate GuideAamirMalikNo ratings yet

- Batteries Costing 1008Document10 pagesBatteries Costing 1008AamirMalikNo ratings yet

- PMP Memory SheetsDocument6 pagesPMP Memory SheetsAamirMalik100% (1)

- Cleanroom Design in 10 Easy StepsDocument8 pagesCleanroom Design in 10 Easy StepsAamirMalikNo ratings yet

- Biannual Maintenance of CFB BoilerDocument3 pagesBiannual Maintenance of CFB BoilerAamirMalikNo ratings yet

- Calculation ProgressDocument1 pageCalculation ProgressAamirMalikNo ratings yet

- Corn-Cob Vs Local CoalDocument1 pageCorn-Cob Vs Local CoalAamirMalikNo ratings yet

- Electric Inspector Form-BDocument11 pagesElectric Inspector Form-BAamirMalikNo ratings yet

- Biannual Maintenance of CFB BoilerDocument3 pagesBiannual Maintenance of CFB BoilerAamirMalikNo ratings yet

- 20% Coal 80% MSW Prefersibility StudyDocument3 pages20% Coal 80% MSW Prefersibility StudyAamirMalikNo ratings yet

- Envirable: Induction Heater CatalogDocument23 pagesEnvirable: Induction Heater CatalogAamirMalikNo ratings yet

- Flow Diagram of Fly Ash Brick PlantDocument1 pageFlow Diagram of Fly Ash Brick PlantAamirMalikNo ratings yet

- Why Don't We Use High Voltage DC Lines?Document2 pagesWhy Don't We Use High Voltage DC Lines?AamirMalikNo ratings yet

- TURBINE INVENTORY (Peter Brotherhood) : Sr. No Item Description Part No MOUDocument4 pagesTURBINE INVENTORY (Peter Brotherhood) : Sr. No Item Description Part No MOUAamirMalikNo ratings yet

- On Line Flue Gas Monitoring System ListDocument2 pagesOn Line Flue Gas Monitoring System ListAamirMalikNo ratings yet

- Product Catalogue - Melt Flow Indexer MFI - 100Document3 pagesProduct Catalogue - Melt Flow Indexer MFI - 100AamirMalikNo ratings yet

- 100% Coal Prefersibility StudyDocument3 pages100% Coal Prefersibility StudyAamirMalikNo ratings yet

- DC TransmissionDocument2 pagesDC TransmissionAamirMalikNo ratings yet

- Single Core Cables in ParallelDocument1 pageSingle Core Cables in ParallelAamirMalik100% (1)

- Catalogue - Coefficient of Friction Tester MXD-02Document2 pagesCatalogue - Coefficient of Friction Tester MXD-02AamirMalikNo ratings yet

- Param XLW (PC) Auto Tensile Tester: ProfessionalDocument3 pagesParam XLW (PC) Auto Tensile Tester: ProfessionalAamirMalik100% (1)