Professional Documents

Culture Documents

Principles of Management Accounting-Muhammad Junaid Ashraf & Abdul Rauf

Principles of Management Accounting-Muhammad Junaid Ashraf & Abdul Rauf

Uploaded by

Anonymous qAegy6GOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Principles of Management Accounting-Muhammad Junaid Ashraf & Abdul Rauf

Principles of Management Accounting-Muhammad Junaid Ashraf & Abdul Rauf

Uploaded by

Anonymous qAegy6GCopyright:

Available Formats

Lahore University of Management Sciences

ACCT130PrinciplesofManagementAccounting

Spring(20112012)

Instructor

Dr.MuhammadJunaidAshraf/AbdulRauf

RoomNo.

261/253

OfficeHours

TBA

Email

jashraf@lums.edu.pk/Abdul.rauf@lums.edu.pk

Telephone

8086/8143

Secretary/TA

TBA

TAOfficeHours

TBA

CourseURL(ifany) LMS

CourseBasics

CreditHours

3

Lecture(s)

NbrofLec(s)PerWeek

Duration

Recitation/Lab(perweek)

NbrofLec(s)PerWeek

Duration

Tutorial(perweek)

NbrofLec(s)PerWeek

Duration

CourseDistribution

Core

Elective

OpenforStudentCategory

CloseforStudentCategory

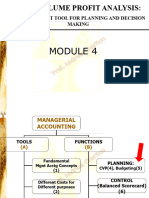

COURSEDESCRIPTION

Principles of Management Accounting, is a foundation level course in accounting. In this course, basic managerial accounting

concepts are introduced to aid students in apprehending the role of accounting in planning, decision-making and controlling. Basic

cost terminologies and concepts are introduced before studying product cost accumulation methods and other modern costing

techniques. The emphasis in this course is on understanding the importance and use of cost information for decision-making

purposes. Only by understanding how much things cost, can managers effectively and strategically reach decisions and evaluate

results in todays competitive market. From the evaluation of past results, your role as a manager would then be to plan and control

future activities; hence, the course will then cover the use of cost accounting information for management decision-making including

the role of budgeting as a management control tool.

COURSEPREREQUISITE(S)

N/A

COURSEOBJECTIVES

Theobjectiveofthecourseistoensurethatstudentsdevelopafunctionalknowledgeofbasicmanagerialaccountingprinciples.

Thiswillinclude:

(a)Anunderstandingofthedifferencesbetweenfinancialandmanagerialaccounting,

(b)Theabilitytocalculatecostsinbothajoborderandprocesscostaccountingsystemandunderstandthecostflow,

(c)Anunderstandingofthetypesofcostsandhowtheybehaveinordertoconductcostvolumeprofitanalyses,

(d)Anunderstandingoftheroleandpurposeofactivitybasedcostingfordecisionmakingpurposesincludingtheabilityto

calculatecostsunderanABCsystem,

(e)Anunderstandingofthedifferenttypesofbudgetsandtheabilitytopreparestaticandflexiblebudgets

Lahore University of Management Sciences

(f)Theabilitytoperformstandardcostvarianceanalysesandfixedandvariableoverheadvarianceanalysesandinterpretthese

results,

(g)Understandtheroleofaccountinginformationinbusinessdecisionmaking

(h)Understandthebasicdesignofmanagementcontrolsystemincludingperformancemeasurement,responsibilityaccounting

etc.

(i)Understandtheroleofethicsinmanagerialaccountingdecisionmaking

LearningOutcomes

Instructional methodology

The course will consist of a series of lectures. You are expected to come to class prepared and participate

in the discussions. Large amounts of materials will be covered quickly and each session builds on previous

ones. It is therefore important for you to remain current and master the basic concepts early in the course

in order to grasp the more difficult ones later on in the course.

Success in mastering managerial accounting concepts is greatly enhanced by solving practical problems.

You will only benefit from class discussions if you have first attempted to solve some problems on your

own. Do not approach the course with the attitude of memorizing rules or particular solution techniques.

We will provide in-class examples and self-study problems that are designed to help you understand and

apply the key concepts. Examination questions will test your understanding of those concepts, but by

posing problems or conceptual questions that differ from those that you have seen before.

Course Material:

Managerial Accounting, 12th edition, Garrison, Noreen, & Brewer, McGraw Hill.

Attendance Requirements:

Regular and in time attendance is required in this course. CP and attendance together account for 10% of

the final grade. Up to 5 absences will not result in any grade loss. However, absences exceeding this will

result in a proportionate reduction in marks.

Course Evaluation

Quizzes (Lowest scoring quiz will be dropped)

15%

Midterm Exam

35%

Class Participation and Attendance

10%

Final Exam

40%

- There will be no make-up for missed quizzes and a missed quiz will be considered as the lowest scoring

quiz.

GradingBreakupandPolicy

Assignment(s):

HomeWork:

Quiz(s):

ClassParticipation:

Attendance:

MidtermExamination:

Project:

FinalExamination:

Lahore University of Management Sciences

ExaminationDetail

Yes/No:

CombineSeparate:

Midterm

Duration:

Exam

PreferredDate:

ExamSpecifications:

Yes/No:

CombineSeparate:

FinalExam

Duration:

ExamSpecifications:

COURSEOVERVIEW

Week/

Lecture/

Topics

Module

01

02, 03

04, 05

06

07, 08

09, 10

11

12, 13

14

15

16, 17, 18

19, 20

21, 22

23

24

25, 26

27

28

Managerial Accounting and the

Business Environment

Cost Terms, Concepts, and

Classifications

Job Order Costing

Cost Behavior: Analysis and Use

Cost-Volume-Profit Relationships

Profit Planning

Variable Costing

Process Costing

Mid Term Review Session

MID-TERM EXAM

Activity-Based Costing

Standard Costs and the Balanced

Scorecard

Flexible Budgets and Overhead

Analysis

Decentralization and Segment

Reporting

Transfer pricing and Service

Department Charges

Relevant Costs for Decision Making

A basic introduction to Cost

Management techniques (target

costing, LCC, etc.)

Review Session

Textbook(s)/SupplementaryReadings

Recommended

ReadingsCHAPTERS

Objectives/

Application

Chapter 1

Chapter 2

Chapter 3

Chapter 5

Chapter 6

Chapter 9

Chapter 7

Chapter 4 (including Appendix)

Chapter 8

Chapter 10

Chapter 11

Chapter 12

App 12A and 12B

Chapter 13

Lahore University of Management Sciences

Course Outline

Chapter 1: Managerial Accounting and the Business Environment

Chapter Objectives:

a.

Identify the major differences and similarities between financial and managerial accounting.

b.

Understand the role of

management accountants in an organization.

c.

Understand the basic concepts underlying Just-In-Time (JIT), Total Quality Management (TQM),

Process Reengineering, and the Theory of Constraints (TOC).

d.

Understand the importance

of upholding ethical standards.

Practice problems:

Chapter 2: Cost Terms, Concepts, and Classifications

Chapter Objectives:

a. Identify and give examples of each of the three basic manufacturing cost categories.

b. Distinguish between product costs and period costs and give examples of each.

c. Prepare an income statement including calculation of the cost of goods sold.

d. Prepare a schedule of cost of goods manufactured.

e. Understand the differences between variable costs and fixed costs.

f. Understand the differences between direct and indirect costs.

g. Define and give examples of cost classifications used in making decisions: differential costs,

opportunity costs, and sunk costs.

Practice problems:

Chapter 3: Systems Design: Job-Order Costing

Chapter Objectives:

a. Distinguish between process costing and job-order costing and identify companies that would use

each method.

b. Identify the documents used in a job-order costing system.

c. Compute predetermined overhead rates and explain why estimated overhead costs (rather than actual

overhead costs) are used in the costing process.

d. Apply overhead cost to jobs using a predetermined overhead rate.

e. Determine underapplied or overapplied overhead.

f. Use the direct method to determine cost of goods sold.

Practice problems:

Chapter 4: Systems Design: Process Costing

Chapter Objectives:

a.

b.

c.

d.

e.

f.

Record the flow of materials, labor, and overhead through a process costing system.

Compute the equivalent units of production using the weighted-average method.

Prepare a quantity schedule using the weighted-average method.

Compute the costs per equivalent unit using the weighted-average method.

Prepare a cost reconciliation using the weighted-average method.

Compute the equivalent units of production using the FIFO method.

Lahore University of Management Sciences

g. Prepare a quantity schedule using the FIFO method.

h. Compute the costs per equivalent unit using the FIFO method.

i. Prepare a cost reconciliation using the FIFO method.

Practice problems:

Chapter 5: Cost Behavior: Analysis and Use

Chapter Objectives:

a. Understand how fixed and variable costs behave and how to use them to predict costs.

b. Use a scatter graph plot to diagnose cost behavior.

c. Analyze a mixed cost using the high-low method.

d. Prepare an income statement using the contribution format.

Practice problems:

Chapter 6: Cost-Volume-Profit Relationships

Chapter Objectives:

a. Explain how changes in activity affect contribution margin and net operating income.

b. Prepare and interpret a cost-volume-profit (CVP) graph.

c. Use the contribution margin ratio (CM ratio) to compute changes in contribution and net operating

income resulting from changes in sales volume.

d. Show the effects on contribution margin of changes in variable costs, fixed costs, selling price, and

volume.

e. Compute the break-even point in unit sales and sales dollars.

f. Determine the level of sales needed to achieve a desired target profit.

g. Compute the margin of safety and explain its significance.

h. Compute the degree of operating leverage at a particular level of sales and explain how it can be used

to predict changes in net income.

i. Compute the break-even point for a multiproduct company and explain the effects of shifts in the

sales mix on contribution margin and the break-even point.

Practice problems:

Chapter 7: Variable Costing: A Tool for Management

Chapter Objectives:

a. Explain how variable costing differs from absorption costing and compute unit product costs under

each method.

b. Prepare income statements using both variable and absorption costing.

c. Reconcile variable costing and absorption costing net operating incomes and explain why the two

amounts differ.

d. Understand the advantages and disadvantages of both variable and absorption costing.

Practice problems:

Chapter 8: Activity-Based Costing: A Tool to Aid Decision Making

Chapter Objectives:

a. Understand activity-based costing and how it differs from a traditional costing method.

b. Assign costs to cost pools using a first-stage allocation.

c. Compute activity rates for cost pools.

d. Assign costs to a cost object using a second-stage allocation.

Lahore University of Management Sciences

e. Use activity-based costing to compute product and customer margins.

Practice problems:

Chapter 9: Profit Planning

Chapter Objectives:

a. Understand why organizations budget and the processes they use to create budgets.

b. Prepare a sales budget, including a schedule of expected cash collections.

c. Prepare a production budget.

d. Prepare a direct materials budget, including a schedule of expected cash disbursements for purchases

of materials.

e. Prepare a direct labor budget.

f. Prepare a manufacturing overhead budget.

g. Prepare a selling and administrative expense budget.

h. Prepare a cash budget.

i. Prepare a budgeted income statement.

j. Prepare a budgeted balance sheet.

Practice problems:

Chapter 10: Standard Costs and the Balanced Scorecard

Chapter Objectives:

a. Explain how direct materials standards and direct labor standards are set.

b. Compute the direct materials price and quantity variances and explain their significance.

c. Compute the direct labor rate and efficiency variances and explain their significance.

d. Compute the variable manufacturing overhead spending and efficiency variances.

e. Understand how a balanced scorecard fits together and how it supports a companys strategy.

f. Compute delivery cycle time, throughput time, and manufacturing cycle efficiency (MCE).

Practice problems:

Chapter 11: Flexible Budgets and Overhead Analysis

Chapter Objectives:

a. Prepare a flexible budget and explain the advantages of the flexible budget approach over the static

budget approach.

b. Prepare a performance report for both variable and fixed overhead costs using the flexible budget

approach.

c. Use a flexible budget to prepare a variable overhead performance report containing only a spending

variance.

d. Use a flexible budget to prepare a variable overhead performance report containing both a spending

and efficiency variance.

e. Compute the predetermined overhead rate and apply overhead to products in a standard cost system.

f. Compute and interpret the fixed overhead budget and volume variances.

Practice problems:

Chapter 12: Segment Reporting and Decentralization

Chapter Objectives:

a. Prepare a segmented income statement using the contribution format and explain the difference

between traceable fixed costs and common fixed costs.

b. Compute return on investment (ROI) and show how changes in sales, expenses, and assets affect

ROI.

Lahore University of Management Sciences

c. Compute residual income and understand its strengths and weaknesses.

Practice problems:

Lahore University of Management Sciences

Chapter 13: Relevant Costs for Decision Making

Chapter Objectives:

a. Identify relevant and irrelevant costs and benefits in a decision.

b. Prepare an analysis showing whether a product line or other business segment should be dropped on

retained.

c. Prepare a make of buy analysis.

d. Prepare an analysis showing whether a special order should be accepted.

e. Determine the most profitable use of a constrained resource and the value of obtaining more of the

constrained resource.

f. Prepare an analysis showing whether joint products should be sold at the split-off point or processed

further.

Practice problems:

You might also like

- ACC 550 SyllabusDocument8 pagesACC 550 Syllabusjvj1234No ratings yet

- Test Bank - Chapter 7 Variable CostingDocument47 pagesTest Bank - Chapter 7 Variable CostingAiko E. Lara86% (7)

- Principles of Risk Risk Management Specimen Examination Guide v2Document10 pagesPrinciples of Risk Risk Management Specimen Examination Guide v2Anonymous qAegy6GNo ratings yet

- Cost Accounting Vol. IIDocument464 pagesCost Accounting Vol. IISrinivasa Rao Bandlamudi92% (25)

- Busines Plan-Juice StopDocument41 pagesBusines Plan-Juice StopShareef ChampNo ratings yet

- Managerial Accounting-Qazi Saud AhmedDocument4 pagesManagerial Accounting-Qazi Saud Ahmedqazisaudahmed100% (1)

- Management Accounting Course ContentDocument2 pagesManagement Accounting Course ContentM Abdus Shaheed MiahNo ratings yet

- 1 MGT Accg For MBA Course Outline KMU 2020-21 MTDocument4 pages1 MGT Accg For MBA Course Outline KMU 2020-21 MTassuluxuryapartmentsNo ratings yet

- ACCT 130-Principles of Management Accounting-Abdul Rauf-Ayesha Bhatti-Samia Kokhar-Junaid AshrafDocument7 pagesACCT 130-Principles of Management Accounting-Abdul Rauf-Ayesha Bhatti-Samia Kokhar-Junaid AshrafmuhammadmusakhanNo ratings yet

- Course Outline Cost AccountingDocument7 pagesCourse Outline Cost AccountingBilal ShahidNo ratings yet

- Accounting III ACCT 1120: Metropolitan Community College Course Outline FormDocument5 pagesAccounting III ACCT 1120: Metropolitan Community College Course Outline FormHumberto Romero ZecuaNo ratings yet

- 202 Syllabus Fall 14 Revised 9-22-14Document5 pages202 Syllabus Fall 14 Revised 9-22-14Alex HangNo ratings yet

- Course Outline Aacsb Mba 611 Management AccountingDocument6 pagesCourse Outline Aacsb Mba 611 Management AccountingNishant TripathiNo ratings yet

- Cost-1 Course OutlineDocument2 pagesCost-1 Course OutlineHussen AbdulkadirNo ratings yet

- Financial Planning & Analysis (Ferri) SU2016Document16 pagesFinancial Planning & Analysis (Ferri) SU2016darwin120% (1)

- ACC502Document6 pagesACC502waheedahmedarainNo ratings yet

- Management Accounting PDFDocument6 pagesManagement Accounting PDFSukalp MittalNo ratings yet

- MFIN 307 Outline 20212022Document4 pagesMFIN 307 Outline 20212022John QuachieNo ratings yet

- International Technological University: ACTN 910 Managerial AccountingDocument7 pagesInternational Technological University: ACTN 910 Managerial AccountinggsdeeepakNo ratings yet

- Courese Outline of Cost Accounting (New)Document5 pagesCourese Outline of Cost Accounting (New)RazzaqeeeNo ratings yet

- Managerial Accounting STANDARD PDFDocument0 pagesManagerial Accounting STANDARD PDFMichael YuNo ratings yet

- Strategic Cost Analysis For Decision Making Acc 3416Document7 pagesStrategic Cost Analysis For Decision Making Acc 3416Paul SchulmanNo ratings yet

- Indian Institute of Management Kozhikode Post Graduate Programme in ManagementDocument4 pagesIndian Institute of Management Kozhikode Post Graduate Programme in ManagementRiturajPaulNo ratings yet

- Updated - Cma - PGP 25 t2 Course OutlineDocument4 pagesUpdated - Cma - PGP 25 t2 Course OutlineSwati PorwalNo ratings yet

- ACC 204 Final Version Managerial Accounting SYH Fall 2022 SyllabusDocument24 pagesACC 204 Final Version Managerial Accounting SYH Fall 2022 Syllabusofgamesworld6No ratings yet

- Advanced Financial ModelingDocument4 pagesAdvanced Financial ModelingAQEELA MUNIRNo ratings yet

- Accounting For Decision Making - COURSE OUTLINEDocument3 pagesAccounting For Decision Making - COURSE OUTLINERahat- RasheedNo ratings yet

- Acct 525Document7 pagesAcct 525Henry TaboadaNo ratings yet

- Acctg 501 SPR21Document8 pagesAcctg 501 SPR21hdesta482No ratings yet

- 97 - Management - Accounting - Complete KİTAPDocument56 pages97 - Management - Accounting - Complete KİTAPasevim7348No ratings yet

- ECON 007 Course OutlineDocument4 pagesECON 007 Course OutlineLê Chấn PhongNo ratings yet

- Course Outline Management AccountingDocument9 pagesCourse Outline Management AccountingFarah YasserNo ratings yet

- Managerial Accounting STANDARDDocument37 pagesManagerial Accounting STANDARDCyn SyjucoNo ratings yet

- Cost and Management Accounting - Course OutlineDocument9 pagesCost and Management Accounting - Course OutlineJajJay100% (1)

- ManacDocument3 pagesManacMark Anthony ManarangNo ratings yet

- Cost & Management Accounting MBEDocument4 pagesCost & Management Accounting MBEnobie125No ratings yet

- Cost & Management Accounting For MBA 13, Binder 2014Document213 pagesCost & Management Accounting For MBA 13, Binder 2014SK Lashari100% (1)

- Study GuideDocument96 pagesStudy GuideKate Karen AlombroNo ratings yet

- Bac 205 Aeb 403 M.A Course OutlineDocument2 pagesBac 205 Aeb 403 M.A Course OutlineKelvin mwaiNo ratings yet

- ESU Operations Management Syllabus - Fall 2023Document8 pagesESU Operations Management Syllabus - Fall 2023anon_482261011No ratings yet

- ACCA FAB Tutor Toolkit Tutor Guidance (2019-20)Document7 pagesACCA FAB Tutor Toolkit Tutor Guidance (2019-20)Vimala RavishankarNo ratings yet

- 03 Engineering ManagementDocument6 pages03 Engineering ManagementThali MagalhãesNo ratings yet

- Cost Accounting SyallbusDocument4 pagesCost Accounting SyallbusJack100% (1)

- ACCT5955 Management Accounting Control Systems S12005Document17 pagesACCT5955 Management Accounting Control Systems S12005Sucipto Antoni100% (1)

- ACC350 Outline FinalDocument12 pagesACC350 Outline FinalHamza AsifNo ratings yet

- Module Handbook Sustainable Business 2018a (4) NEWDocument21 pagesModule Handbook Sustainable Business 2018a (4) NEWTrần ThiNo ratings yet

- ACCT 215 - Introductory Financial Accounting I: Course DescriptionDocument5 pagesACCT 215 - Introductory Financial Accounting I: Course DescriptionJayden FrosterNo ratings yet

- POM 102 SyllabusDocument8 pagesPOM 102 SyllabusmarkangeloarceoNo ratings yet

- Seminar Templates 2Document2 pagesSeminar Templates 2prasad0207No ratings yet

- Principles of Accounting Course OutlineDocument4 pagesPrinciples of Accounting Course OutlinefuriousTaherNo ratings yet

- Cost Accounting - Course Study Guide. (Repaired)Document9 pagesCost Accounting - Course Study Guide. (Repaired)syed Hassan100% (1)

- Jaipuria Institute of Management PGDM Trimester I Academic Year 2019-21Document14 pagesJaipuria Institute of Management PGDM Trimester I Academic Year 2019-21Utkarsh padiyarNo ratings yet

- Quantatative Methods SylDocument7 pagesQuantatative Methods SylThảo Bùi PhươngNo ratings yet

- ACG3341 Gaukel 2013fallDocument9 pagesACG3341 Gaukel 2013fallalnahary1No ratings yet

- CIMA Lecture GuideDocument16 pagesCIMA Lecture GuideElizabeth FernandezNo ratings yet

- Jaipuria Institute of Management PGDM Trimester Ii Academic Year 2019-20Document9 pagesJaipuria Institute of Management PGDM Trimester Ii Academic Year 2019-20Sanjana SinghNo ratings yet

- Cost Management Course Policy For Accounting Dept 1400Document5 pagesCost Management Course Policy For Accounting Dept 1400Zabih UllahNo ratings yet

- Module AkmenDocument14 pagesModule AkmenNeshaNo ratings yet

- Course Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionDocument4 pagesCourse Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionSefiager MarkosNo ratings yet

- Course Outline: Business 2257: Accounting and Business AnalysisDocument9 pagesCourse Outline: Business 2257: Accounting and Business AnalysistigerNo ratings yet

- Course Outline - Mathematical MethodsDocument3 pagesCourse Outline - Mathematical MethodsTNo ratings yet

- ACCT2017 Course Guide Semester 2 20102011 FinalDocument16 pagesACCT2017 Course Guide Semester 2 20102011 Finalmolengene882No ratings yet

- Analysis of Profitability and Financial Health of The Handloom Weavers Co-Operative Societies in Karur DistrictDocument2 pagesAnalysis of Profitability and Financial Health of The Handloom Weavers Co-Operative Societies in Karur DistrictAnonymous qAegy6GNo ratings yet

- Emerging Opportunities and Challenges For Small Scale Industries in An Emerging Indian EconomyDocument3 pagesEmerging Opportunities and Challenges For Small Scale Industries in An Emerging Indian EconomyAnonymous qAegy6GNo ratings yet

- Commerce: Make in India: An Innovation For Transforming India Into A Manufacturing LeaderDocument3 pagesCommerce: Make in India: An Innovation For Transforming India Into A Manufacturing LeaderAnonymous qAegy6GNo ratings yet

- Customer Perception On Service Quality Towards CRM Among Selected Banks in Madurai CityDocument3 pagesCustomer Perception On Service Quality Towards CRM Among Selected Banks in Madurai CityAnonymous qAegy6GNo ratings yet

- A Comparative Study of Financial Performance of BSNL and Idea Cellular LTDDocument3 pagesA Comparative Study of Financial Performance of BSNL and Idea Cellular LTDAnonymous qAegy6GNo ratings yet

- 2015 - 05 - 14 - UGDP Final Evaluation ReportDocument108 pages2015 - 05 - 14 - UGDP Final Evaluation ReportAnonymous qAegy6GNo ratings yet

- Annual Report 2016Document5 pagesAnnual Report 2016Anonymous qAegy6GNo ratings yet

- Impact of Watershed Development Programme On Employment Generation and Migration: A Case Study in Pakala Mandal of Chittoor DistrictDocument3 pagesImpact of Watershed Development Programme On Employment Generation and Migration: A Case Study in Pakala Mandal of Chittoor DistrictAnonymous qAegy6GNo ratings yet

- Engineering MechanicsDocument3 pagesEngineering MechanicsAnonymous qAegy6GNo ratings yet

- Conferencewebdiaepcb2015d3summary enDocument6 pagesConferencewebdiaepcb2015d3summary enAnonymous qAegy6GNo ratings yet

- E97 Examination Guide For Exams From 1 May 2016 To 30 April 2017Document22 pagesE97 Examination Guide For Exams From 1 May 2016 To 30 April 2017Anonymous qAegy6GNo ratings yet

- Functionalskills English153085 Resources LinksDocument18 pagesFunctionalskills English153085 Resources LinksAnonymous qAegy6GNo ratings yet

- Mgmtbooks PDFDocument60 pagesMgmtbooks PDFAnonymous qAegy6GNo ratings yet

- PHI Learning EEE Catalogue Books On Business Management EconomicsDocument240 pagesPHI Learning EEE Catalogue Books On Business Management EconomicsAnonymous qAegy6G100% (1)

- Hilton Cost ManagementDocument945 pagesHilton Cost ManagementAnonymous qAegy6GNo ratings yet

- Microfinance14062011 PDFDocument165 pagesMicrofinance14062011 PDFAnonymous qAegy6G100% (1)

- Inventory Costing and Capacity Analysis: True/FalseDocument56 pagesInventory Costing and Capacity Analysis: True/FalseambiNo ratings yet

- Marginal Costing Is Very Helpful in Managerial Decision MakingDocument5 pagesMarginal Costing Is Very Helpful in Managerial Decision MakingshankarinadarNo ratings yet

- Quiz Questions PPCDocument5 pagesQuiz Questions PPCSanket KasarNo ratings yet

- Activity 2 Total Analysis Vs Differential AnalysisDocument8 pagesActivity 2 Total Analysis Vs Differential AnalysisNicole Allyson AguantaNo ratings yet

- MOD 04 Cost Volume Profit Analysis (2023)Document102 pagesMOD 04 Cost Volume Profit Analysis (2023)georgiana.ioannouNo ratings yet

- Cost-Volume-Profit Analysis Problems: CalculateDocument3 pagesCost-Volume-Profit Analysis Problems: CalculateAsma Hatam100% (7)

- Tutorial CVPDocument7 pagesTutorial CVPLiyana IsmailNo ratings yet

- Instruction: Encircle The Letter of The Correct Answer in Each of The Given QuestionDocument6 pagesInstruction: Encircle The Letter of The Correct Answer in Each of The Given QuestionMarjorie PalmaNo ratings yet

- Differential Cost Analysis ExamplesDocument8 pagesDifferential Cost Analysis ExamplesMuhammad azeem100% (2)

- Problem 8-35 Hansen Mowen Cornerstone of Managerial AccountingDocument4 pagesProblem 8-35 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- Cost Accounting Exam Good For 2 Hours OnlyDocument6 pagesCost Accounting Exam Good For 2 Hours OnlyCaptain Jellyfish MasterNo ratings yet

- CPV Analysis PDFDocument42 pagesCPV Analysis PDFnevad0% (2)

- Câu 32 Trong Hình Tao Gửi Sai Nên Ai Làm Phần Đó Nhớ Sửa LạiDocument11 pagesCâu 32 Trong Hình Tao Gửi Sai Nên Ai Làm Phần Đó Nhớ Sửa LạiNhu Le ThaoNo ratings yet

- Ma 6e PPT CH 04 Se NewDocument34 pagesMa 6e PPT CH 04 Se NewJuliana AnuarNo ratings yet

- Module 4Document5 pagesModule 4NCTNo ratings yet

- Marginal Costing PDFDocument16 pagesMarginal Costing PDFaditiNo ratings yet

- CH 08Document73 pagesCH 08Mohammed SamyNo ratings yet

- Cost-Volume-Profit AnalysisDocument24 pagesCost-Volume-Profit AnalysisIbrahim ElsayedNo ratings yet

- Adms OneAdms One ClassDocument9 pagesAdms OneAdms One ClasssafwatNo ratings yet

- Chapter 19 - AnswerDocument16 pagesChapter 19 - Answerbv123bvNo ratings yet

- Acccob3 k48 Hw4 Valdez NeoDocument6 pagesAcccob3 k48 Hw4 Valdez NeoneovaldezNo ratings yet

- Answer KeyDocument7 pagesAnswer Keyma anneNo ratings yet

- Finals Answer KeyDocument13 pagesFinals Answer Keymarx marolinaNo ratings yet

- Additional FINAL ReviewDocument41 pagesAdditional FINAL ReviewMandeep SinghNo ratings yet

- Midterm 1+ 2 (T NG H P)Document13 pagesMidterm 1+ 2 (T NG H P)Shen NPTDNo ratings yet

- MGT Adv Serv 09.2019Document11 pagesMGT Adv Serv 09.2019Weddie Mae VillarizaNo ratings yet

- Product Pricing and Profit AnalysisDocument16 pagesProduct Pricing and Profit AnalysisCasey MagpileNo ratings yet

- Latihan CVPDocument2 pagesLatihan CVPAchmad RidwanNo ratings yet