Professional Documents

Culture Documents

MCI Case Questions

MCI Case Questions

Uploaded by

Alex GarmaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MCI Case Questions

MCI Case Questions

Uploaded by

Alex GarmaCopyright:

Available Formats

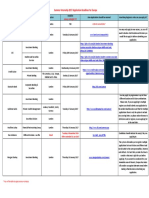

III Questions for MCI COMMUNICATIONS CORP

Assume that Mr English, the MCI CFO, has the following financing alternatives

available to him as of April, 1983:

a. $500 million of 12.5%, 20 year subordinated debentures.

b. $400 million of common stock.

c1. $600 million of 7.625%, 20 year convertible debentures with conversion

price of $54/share (i.e. each $1000 bond would be converted into 18.52

common shares). The debenture would be callable after 5 years1.

c2. $600 million of a unit package consisting of $1000 of 7.50%, 20 year

subordinated debentures and 18.18 warrants, each entitling the holder to

purchase one share of MCI common for $55. Payment can be made in cash

or by turning in the bond (for 18.18 shares). The warrants would be callable

after three years2 and exercisable until 1988.

d. $300 million of preferred stock with a dividend yield of 10%.

Rank these alternatives.

1

2

r f 115%

.

rm rf 5%

U (unlevered beta) = 0.77

Assume after 1988, MCI has a long-term D/V ratio of 0.5

At $1300, the nominal value of the debenture is $1000.

At $467. The value of the bond (without the warrant) at that time is expected to

be equal to $833.

You might also like

- Study Questions For The Spyder Active Sports CaseDocument1 pageStudy Questions For The Spyder Active Sports Casenidhivijay25070% (1)

- BBBV3 ForegroundReading Auto Warehouse UPS PDFDocument8 pagesBBBV3 ForegroundReading Auto Warehouse UPS PDFlanting wuNo ratings yet

- Ducati Case ExhibitsDocument10 pagesDucati Case Exhibitslucien_lu0% (1)

- Ocean Carriers FinalDocument5 pagesOcean Carriers FinalsaaaruuuNo ratings yet

- MCI Communications Draft v4Document6 pagesMCI Communications Draft v4Drake Ramoray100% (1)

- MCI Case Questions PDFDocument1 pageMCI Case Questions PDFAlex Garma0% (1)

- Responsible Investing - The ESG-efficient FrontierDocument26 pagesResponsible Investing - The ESG-efficient FrontierHiếu Nhi TrịnhNo ratings yet

- Hitting The EV Inflection PointDocument58 pagesHitting The EV Inflection PointAbishek AbhNo ratings yet

- This Study Resource Was: Planning DocumentDocument4 pagesThis Study Resource Was: Planning DocumentpalashNo ratings yet

- Topic 2: Business Strategy and Competitive Advantage: Value Creation, Value Captured and Willingness To Buy and SellDocument20 pagesTopic 2: Business Strategy and Competitive Advantage: Value Creation, Value Captured and Willingness To Buy and SellNainika KhannaNo ratings yet

- Victorian Renewable Hydrogen Industry Development PlanDocument68 pagesVictorian Renewable Hydrogen Industry Development PlansherlynNo ratings yet

- Boeing 777 - A Financial Analysis of New Product LaunchDocument26 pagesBoeing 777 - A Financial Analysis of New Product LaunchChristian CabariqueNo ratings yet

- Cooper Industries ADocument16 pagesCooper Industries AEshesh GuptaNo ratings yet

- Mci 292737Document11 pagesMci 292737ReikoNo ratings yet

- Berlin Airport: The Five Biggest MistakesDocument2 pagesBerlin Airport: The Five Biggest Mistakeselviagarcia25No ratings yet

- Plug Power Acquisition of United Hydrogen and Giner F3Document14 pagesPlug Power Acquisition of United Hydrogen and Giner F3JAYESH VAYANo ratings yet

- Ugcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCoDocument6 pagesUgcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCotimbulmanaluNo ratings yet

- Cost of Debt 0.07 0.04 WD 0.28 Cost of Equity 0.10 We 0.72 Wacc 8.81% Estimated WACC For NicholsonDocument6 pagesCost of Debt 0.07 0.04 WD 0.28 Cost of Equity 0.10 We 0.72 Wacc 8.81% Estimated WACC For NicholsonHarsh Borar0% (1)

- Stephanie Ott Advanced Corporate Finance Midterm The Boeing 777Document11 pagesStephanie Ott Advanced Corporate Finance Midterm The Boeing 777Steph OttNo ratings yet

- Kaplan & Norton - Strategic Learning & The Balanced ScorecardDocument7 pagesKaplan & Norton - Strategic Learning & The Balanced ScorecardYunasis AesongNo ratings yet

- 4 A+Green+Spider+projectDocument15 pages4 A+Green+Spider+projectJuan Carlos Villar RodriguezNo ratings yet

- China: Country Progress ReportDocument24 pagesChina: Country Progress ReportVi Anh TranNo ratings yet

- The Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalDocument10 pagesThe Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalSalil Kuwelkar100% (1)

- Ocean Carriers IncDocument26 pagesOcean Carriers IncvaibhavbrajeshNo ratings yet

- Cost Models For Current and Future Hydrogen Production: January 2007Document44 pagesCost Models For Current and Future Hydrogen Production: January 2007Zakiah Darajat NurfajrinNo ratings yet

- Ocean CarriersDocument16 pagesOcean CarriersSaurabh DhimanNo ratings yet

- Summary of Singapore's Economic PoliciesDocument1 pageSummary of Singapore's Economic PoliciesKahloon ThamNo ratings yet

- Was Robert Cizik's Diversification Strategy Consistent With The Company Priorities?Document8 pagesWas Robert Cizik's Diversification Strategy Consistent With The Company Priorities?minionNo ratings yet

- Kaplan & Norton 1996Document27 pagesKaplan & Norton 1996teranoceNo ratings yet

- LinearDocument3 pagesLinearAEKaidarovNo ratings yet

- Case 9 Questions - Linear TechnologyDocument1 pageCase 9 Questions - Linear TechnologybuddhacrisNo ratings yet

- Cooper Industries: Group 7 - Vijay (2008143) Balaji (2008124) Farid (2008127)Document9 pagesCooper Industries: Group 7 - Vijay (2008143) Balaji (2008124) Farid (2008127)sfaridahmadNo ratings yet

- 5 ForcesDocument4 pages5 ForcesSue S100% (1)

- The WM Wringley JR CompanyDocument3 pagesThe WM Wringley JR Companyavnish kumarNo ratings yet

- BSNS 4500-01 February 26, 2015 Gregory Livingston: ConclusionsDocument16 pagesBSNS 4500-01 February 26, 2015 Gregory Livingston: Conclusionsapi-282304259No ratings yet

- Ei FinalDocument14 pagesEi FinalrohitbaislaNo ratings yet

- Perspective Paper On Present & Future TechnologiesDocument11 pagesPerspective Paper On Present & Future Technologiesapi-360683034No ratings yet

- Team 14 - William WrigleyDocument7 pagesTeam 14 - William WrigleySyed Ahmedullah Hashmi100% (1)

- Ocean Carriers ExcelDocument14 pagesOcean Carriers Excel00jab000% (1)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - SampleTestNo ratings yet

- Creative Sports Solution-RevisedDocument4 pagesCreative Sports Solution-RevisedRohit KumarNo ratings yet

- Divdend Case StudyDocument28 pagesDivdend Case StudyAngad SinghNo ratings yet

- Thailand: Country Progress ReportDocument22 pagesThailand: Country Progress ReportVi Anh TranNo ratings yet

- Shouldice PDFDocument2 pagesShouldice PDFRizvi SyedNo ratings yet

- Panera Bread's PaperDocument4 pagesPanera Bread's PaperJJ100% (1)

- Project Information Document Integrated Safeguards Data Sheet Bangladesh Scaling Up Renewable Energy Project P161869Document34 pagesProject Information Document Integrated Safeguards Data Sheet Bangladesh Scaling Up Renewable Energy Project P161869Shakil Hossain SalmiNo ratings yet

- Project Management Gone Bad - The Berlin Airport Project - Project Management in ActionDocument3 pagesProject Management Gone Bad - The Berlin Airport Project - Project Management in ActionJulija SabulytėNo ratings yet

- Group Ariel StudentsDocument8 pagesGroup Ariel Studentsbaashii4No ratings yet

- Cooper Industries PresentationDocument25 pagesCooper Industries Presentationcannotes67% (3)

- Should Cooper Industries Acquire Nicholson File CompanyDocument1 pageShould Cooper Industries Acquire Nicholson File CompanyDiksha MulaniNo ratings yet

- 'Pursue Your Dream or Move On - ' Case Resume. Angelina SoldatenkoDocument2 pages'Pursue Your Dream or Move On - ' Case Resume. Angelina SoldatenkoAngelina SoldatenkoNo ratings yet

- CaseDocument1 pageCaseNurMunirahBustamamNo ratings yet

- A Case Study Groupe Ariel SDocument1 pageA Case Study Groupe Ariel SromanaNo ratings yet

- Iec 61730 2Nd Edition: The Dawn of New PV Safety RequirementsDocument18 pagesIec 61730 2Nd Edition: The Dawn of New PV Safety RequirementsanuchaNo ratings yet

- Roland Berger Energy Storage FinalDocument32 pagesRoland Berger Energy Storage FinalAman BansalNo ratings yet

- Wrigley AnalysisDocument140 pagesWrigley AnalysisBoonggy Boong25% (4)

- What Is The Efficient Markets Hypothesis? Explain This Concept in Your Own Words.300 WordsDocument3 pagesWhat Is The Efficient Markets Hypothesis? Explain This Concept in Your Own Words.300 WordsAnil RatnaniNo ratings yet

- MciDocument4 pagesMciIrene MaNo ratings yet

- BCM 3113 Exam 2022 AprilDocument4 pagesBCM 3113 Exam 2022 Aprilkorirenock764No ratings yet

- Old Midterm For Posting On Class PageDocument12 pagesOld Midterm For Posting On Class PageJack KlineNo ratings yet

- Assignment 1ADocument6 pagesAssignment 1AAlex GarmaNo ratings yet

- Cooper Industries Case QuestionsDocument1 pageCooper Industries Case QuestionsAlex GarmaNo ratings yet

- MCI Case Questions PDFDocument1 pageMCI Case Questions PDFAlex Garma0% (1)

- 2017 Europe Summer Internship Deadlinesv6Document1 page2017 Europe Summer Internship Deadlinesv6Alex GarmaNo ratings yet

- Jiro Dreams of Sushi - WikipediaDocument4 pagesJiro Dreams of Sushi - WikipediaAlex GarmaNo ratings yet

- Recipe - 2 - Managing Variability and QueuesDocument2 pagesRecipe - 2 - Managing Variability and QueuesAlex GarmaNo ratings yet

- Roland Berger Global Automotive Supplier 2016 FinalDocument41 pagesRoland Berger Global Automotive Supplier 2016 FinalAlex GarmaNo ratings yet