Professional Documents

Culture Documents

ACIS 4314 - Principles of Taxation Fall 2014: Class Times/ Location: Prerequisite

ACIS 4314 - Principles of Taxation Fall 2014: Class Times/ Location: Prerequisite

Uploaded by

JackOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACIS 4314 - Principles of Taxation Fall 2014: Class Times/ Location: Prerequisite

ACIS 4314 - Principles of Taxation Fall 2014: Class Times/ Location: Prerequisite

Uploaded by

JackCopyright:

Available Formats

ACIS 4314 Principles of Taxation

CLASS TIMES/

LOCATION:

Fall 2014

PREREQUISITE:

Section 80149: MWF 9:05 AM 9:55 AM / DER 3081

Section 80151: MWF 11:15 AM 12:05 PM / SURGE 109

Section 80150: MWF 12:20 PM - 1:10 PM / SURGE 107

ACIS 3314

INSTRUCTOR:

OFFICE:

EMAIL:

OFFICE HOURS:

COURSE WEBSITE:

Jingjing (Jing) Huang, Ph.D.

PAM 3112

jjhuang@vt.edu

Monday 2:30 PM - 3:30 PM and Wednesday 2:30 PM 3:30 PM

Located on Scholar at http://scholar.vt.edu/portal

COURSE DESCRIPTION:

Survey of basic concepts of federal income taxation that are common to all types of taxpayers (i.e.

individuals, corporations, and flow-through entities). Topics to be covered include tax policy objectives,

tax accounting methods that affect the timing of income and expense recognition, concepts of gross

income and trade or business expenses, income character, and tax issues associated with various property

transactions.

LEARNING OBJECTIVES:

Upon completion of this course, the student should be able to:

1. Apply the basic rules related to income and expense measurement, income character, property

transactions, and the timing of income and expense recognition in the tax context.

2. Identify the social and economic objectives embedded in the tax law that result in measures of taxable

income that differ from those used in other accounting contexts (e.g., financial reporting).

3. Develop basic research skills necessary to cope with frequent changes in tax rules.

4. Develop critical thinking skills necessary to become a knowledgeable consumer of and participant in

tax policy debates.

REQUIRED TEXT:

Custom text for Principles of Taxation - ACIS 4313 - Fall 2014

(Spilker, et al., Taxation of Individuals and Business Entities, 2015 Edition)

COURSE INFORMATION:

ACIS 4314 Principles of Taxation

Fall 2014

All course information (including syllabus, lecture presentation slides, etc.) will be available through the

Scholar web site for the course that is accessible through the Scholar portal: https://scholar.vt.edu/portal.

You are responsible for checking the Scholar site regularly for any announcements.

Note that lecture presentation slides will be regularly updated before each class. It is your responsibility to

check the updated lecture slides before each class.

GRADES:

The following grading scale will be used:

A

AB+

B

BC+

C

CD+

D

DF

92-100%

90-91%

88-89%

82-87%

80-81%

78-79%

72-77%

70-71%

68-69%

62-67%

60-61%

0-59%

Grade breakdown is as follows:

Exam 1

Exam 2

Exam 3 (Comprehensive Final)

Quizzes

Tax Project

25%

25%

25%

15%

10%

ASSIGNMENTS:

Exams: Exam dates and times appear in the schedule portion of this syllabus. During exams, students

may use one note sheet (8.5 x 11 sheet of paper) both sides, with original handwritten notes, plus a pencil,

and a calculator. When I say calculator, I mean calculator. You will not be able to use a smartphone or

other electronic device as a calculator during exams. No make-up exams will be given for Exams 1 or 2.

NO EXCEPTIONS! If either Exam 1 or 2 is missed, for any reason, the Exam 3 Comprehensive Final

score will replace the missed exam score. Since the Final is comprehensive, if you get a higher score on

your Final than your lowest score on either Exam 1 or Exam 2, the score from your Final will replace that

lowest score.

Quizzes: There will be an in-class quiz given for each chapter of the book. During quizzes, students may

use one note sheet (8.5 x 11 sheet of paper) both sides, with original handwritten notes, plus a pencil, and

2

ACIS 4314 Principles of Taxation

Fall 2014

a calculator. Quiz dates appear in the schedule portion of this syllabus. No make-up quizzes will be given.

NO EXCEPTIONS! I will drop your lowest quiz score to accommodate situations where it is necessary

for you to miss class.

Tax Project: You will be required to complete a tax project that will be due at the end of the semester. I

will provide the project instructions during the semester, and you are free to complete it as early or as late

in the semester as you choose. The available and due dates are in the schedule portion of this syllabus. NO

LATE PROJECT IS ACCEPTED! It is an individual project.

COMMUNICATION:

You are responsible for the content of any e-mail, My Scholar announcements or classroom

announcements. If you e-mail me, please include ACIS 4314 in the subject line. You must allow a

maximum of 24 hours Monday Friday for responding to your emails. Any emails received over the

weekend will be responded to on the following Monday latest. If my office hour does not work for you,

please email me to set up an appointment.

HONOR SYSTEM:

THE HONOR CODE WILL BE STRICTLY ENFORCED IN THIS COURSE. ALL ASSIGNMENTS

SUBMITTED SHALL BE CONSIDERED GRADED WORK, UNLESS OTHERWISE NOTED. ALL

ASPECTS OF YOUR COURSEWORK ARE COVERED BY THE HONOR SYSTEM. ANY

SUSPECTED VIOLATIONS OF THE HONOR CODE WILL BE PROMPTLY REPORTED TO THE

HONOR SYSTEM. HONESTY IN YOUR ACADEMIC WORK WILL DEVELOP INTO

PROFESSIONAL INTEGRITY. THE FACULTY AND STUDENTS OF VIRGINIA TECH WILL NOT

TOLERATE ANY FORM OF ACADEMIC DISHONESTY.

SPECIAL NEEDS:

If you need adaptations or accommodations because of a disability (learning disability, attention deficit

disorder, psychological, physical, etc.); if you have emergency medical information to share with me; or if

you need special arrangements in case the building must be evacuated, please make an appointment with

me as soon as possible. If you need captioning for videos, please let me know no later than two weeks in

advance of date on schedule for viewing.

CAVEAT:

This syllabus includes policies and plans for the course that may require adjustment. I reserve the right to

make changes at any time during the semester with notice to the class.

ACIS 4314 Principles of Taxation

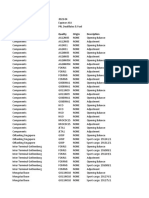

DATE

August 25

August 27

August 29

September 1

September 3

September 5

September 8

September 10

September 12

September 15

September 17

September 19

September 22

September 24

September 26

September 29

October 1

October 3

October 6

October 8

October 10

October 13

October 15

October 17

October 20

October 22

October 24

October 27

October 29

October 31

November 3

November 5

November 7

November 10

November 12

November 14

November 17

November 19

November 21

November 24

November 26

November 28

December 1

December 3

December 5

December 8

December 10

December 11

TOPIC

Course Introduction

Entities Overview

Entities Overview

Chapter 15 Quiz

Business Income, Deductions, and Accounting Methods

Business Income, Deductions, and Accounting Methods

Business Income, Deductions, and Accounting Methods

Chapter 8 Quiz

Property Acquisition and Cost Recovery

Property Acquisition and Cost Recovery

Property Acquisition and Cost Recovery

Chapter 9 Quiz

Review

EXAM 1

EY presentation

Property Dispositions

Property Dispositions

Chapter 10 Quiz

Corporate Operations

Corporate Operations

Fall Break No Class

Corporate Operations

Tax return project is available

Chapter 16 Quiz

Accounting for Income Taxes

Accounting for Income Taxes

Accounting for Income Taxes

Chapter 17 Quiz

Review

EXAM 2

Corporate Taxation: Nonliquidating Distributions

Corporate Taxation: Nonliquidating Distributions

Corporate Taxation: Nonliquidating Distributions

Chapter 18 Quiz

Corporate Formation, Reorganization, and Liquidation

Corporate Formation, Reorganization, and Liquidation

Corporate Formation, Reorganization, and Liquidation

Chapter 19 Quiz

Forming and Operating Partnerships

Forming and Operating Partnerships

Thanksgiving Break No Class

Thanksgiving Break No Class

Thanksgiving Break No Class

Chapter 20 Quiz

Dispositions of Partnership Interests and Partnership Distributions

Dispositions of Partnership Interests and Partnership Distributions

Tax return project is due

Chapter 21 Quiz

Review

Reading day

Fall 2014

READING

Chapter 15

Chapter 15

Chapter 15

Chapter 8

Chapter 8

Chapter 8

Chapter 9

Chapter 9

Chapter 9

Chapter 10

Chapter 10

Chapter 10

Chapter 16

Chapter 16

Chapter 16

Chapter 17

Chapter 17

Chapter 17

Chapter 18

Chapter 18

Chapter 18

Chapter 19

Chapter 19

Chapter 19

Chapter 20

Chapter 20

Chapter 21

Chapter 21

ACIS 4314 Principles of Taxation

Final exam schedule

December 16

COMPREHENSIVE FINAL EXAM Section 80149

December 12

COMPREHENSIVE FINAL EXAM Section 80150

December 17

COMPREHENSIVE FINAL EXAM Section 80151

Fall 2014

10:05AM 12:05PM

7:45 AM 9:45 AM

4:25PM - 6:25PM

You might also like

- Chapter 19 Homework SolutionDocument3 pagesChapter 19 Homework SolutionJack100% (1)

- Blockbuster Entertainment CorporationDocument4 pagesBlockbuster Entertainment Corporationmbagustin1100% (1)

- Chapter 21 HomeworkDocument5 pagesChapter 21 HomeworkJack100% (1)

- Ross12e Chapter03 TB AnswerkeyDocument44 pagesRoss12e Chapter03 TB AnswerkeyÂn TrầnNo ratings yet

- Syllabus Acc 101-503, 504Document4 pagesSyllabus Acc 101-503, 504alb3rtlinNo ratings yet

- BSBMGT502 Manage People Performance - Assessment 1 - 2019 - V2Document17 pagesBSBMGT502 Manage People Performance - Assessment 1 - 2019 - V2Ang Pari100% (1)

- 13sp2152 PDFDocument3 pages13sp2152 PDFMyra JohnsonNo ratings yet

- ACCY 312 Syllabus Spring-2020Document8 pagesACCY 312 Syllabus Spring-2020dsfsdfsdNo ratings yet

- Chapter 20 Homework SolutionDocument6 pagesChapter 20 Homework SolutionJackNo ratings yet

- The Five Types of Hotel AssetsDocument13 pagesThe Five Types of Hotel AssetsSharif Fayiz AbushaikhaNo ratings yet

- 3 B Business Plan Financial Projections - Moderate Complexity - Using Restaurant ExampleDocument6 pages3 B Business Plan Financial Projections - Moderate Complexity - Using Restaurant Examplemohd_shaarNo ratings yet

- Zhifeng - Yang@stonybrook - Edu: Online AsynchronousDocument6 pagesZhifeng - Yang@stonybrook - Edu: Online Asynchronousthomas benNo ratings yet

- BUSN 7008 Financial Statements and Reporting: Course DescriptionDocument8 pagesBUSN 7008 Financial Statements and Reporting: Course Descriptionprankster12No ratings yet

- Acct 100Document6 pagesAcct 100samueilNo ratings yet

- Principles of Accounting I - Financial: Instructor: Wesley A. Tucker, CPADocument8 pagesPrinciples of Accounting I - Financial: Instructor: Wesley A. Tucker, CPAnurul000No ratings yet

- Act 474 PDFDocument8 pagesAct 474 PDFAlex ChanNo ratings yet

- Syllabus - FSA - Fall 2020 - Section 004Document7 pagesSyllabus - FSA - Fall 2020 - Section 004RanjeetaTiwariNo ratings yet

- UoS Outline ACCT1006 SEM2 2014 ApprovedDocument6 pagesUoS Outline ACCT1006 SEM2 2014 ApprovedAbdulla ShaheedNo ratings yet

- ECON 211 Section 001 OutlineDocument7 pagesECON 211 Section 001 OutlinemaxNo ratings yet

- Managerial Accounting 251-306-002 (Fall 2021)Document5 pagesManagerial Accounting 251-306-002 (Fall 2021)윤소윤 / 학생 / 경영학과No ratings yet

- ECON 007 Course OutlineDocument4 pagesECON 007 Course OutlineLê Chấn PhongNo ratings yet

- ACC 470aDocument13 pagesACC 470asocalsurfyNo ratings yet

- Outline Eco 1021ADocument9 pagesOutline Eco 1021A942384232No ratings yet

- Acc707 Auditing and Assurance Services t116 GH 15 Feb 2015-FinalDocument11 pagesAcc707 Auditing and Assurance Services t116 GH 15 Feb 2015-FinalHaris AliNo ratings yet

- Syllabus EC655 Fall 2011Document8 pagesSyllabus EC655 Fall 2011nooriaanNo ratings yet

- ACG 4501 - 003 & 004 Government Accounting Syllabus CRN 24669 & 24683 - Gauci Spring 2015Document10 pagesACG 4501 - 003 & 004 Government Accounting Syllabus CRN 24669 & 24683 - Gauci Spring 2015rprasad05No ratings yet

- Department of Economics Course Outline: RequiredDocument4 pagesDepartment of Economics Course Outline: RequiredJinder SurprizeNo ratings yet

- UT Dallas Syllabus For Opre6302.501.11s Taught by Ganesh Janakiraman (gxj091000)Document8 pagesUT Dallas Syllabus For Opre6302.501.11s Taught by Ganesh Janakiraman (gxj091000)UT Dallas Provost's Technology GroupNo ratings yet

- ACG2021 - Introduction To Financial Accounting - All - Goslinga, JDocument11 pagesACG2021 - Introduction To Financial Accounting - All - Goslinga, Jmasondonovan033No ratings yet

- Course Syllabus & Schedule: ACC 202 - I ADocument8 pagesCourse Syllabus & Schedule: ACC 202 - I Aapi-291790077No ratings yet

- Merage School of Business University of California, Irvine Course Syllabus Introduction To Financial Accounting-Mgmt 30A Winter Quarter 2011Document9 pagesMerage School of Business University of California, Irvine Course Syllabus Introduction To Financial Accounting-Mgmt 30A Winter Quarter 2011Kourosh AdlparvarNo ratings yet

- Syllabus - MA - Fall 2020 - Section 001Document7 pagesSyllabus - MA - Fall 2020 - Section 001JoeNo ratings yet

- Instrumentation and ControlDocument121 pagesInstrumentation and ControlabbutalibbNo ratings yet

- ACCG340Document11 pagesACCG340Dung Tran0% (1)

- Advanced Taxation University Study MaterialDocument225 pagesAdvanced Taxation University Study MaterialSekar MuruganNo ratings yet

- ACCT2010 K MakDocument4 pagesACCT2010 K MakHiu Tung LamNo ratings yet

- ECON 2113 SyllabusDocument6 pagesECON 2113 SyllabusJason KristiantoNo ratings yet

- Accounting 300A: Intermediate AccountingDocument5 pagesAccounting 300A: Intermediate AccountingpeachyNo ratings yet

- ACCT2010 L10 L11 L12 Syllabus 2015Document4 pagesACCT2010 L10 L11 L12 Syllabus 2015jasNo ratings yet

- Spring 2020 - TL - ACCT 2021 2Document6 pagesSpring 2020 - TL - ACCT 2021 2anhNo ratings yet

- ACCT2010 SyllabusDocument4 pagesACCT2010 SyllabusAceNo ratings yet

- Bus 345 Ab1 Course Outline Winter (Tue CRN 10214) - K LownieDocument4 pagesBus 345 Ab1 Course Outline Winter (Tue CRN 10214) - K LownieGunni GillNo ratings yet

- Syllabus - Financial Statement Analysis - ACCT-UB 3.003 (Fall 2022)Document5 pagesSyllabus - Financial Statement Analysis - ACCT-UB 3.003 (Fall 2022)Ashley NguyenNo ratings yet

- MGST 613 F14 L01 Course OutlineDocument6 pagesMGST 613 F14 L01 Course OutlinedexterousncoolNo ratings yet

- A2 Sitxfin003 JassiDocument43 pagesA2 Sitxfin003 Jassitisha naharNo ratings yet

- Syllabus For Principles of Accounting IDocument8 pagesSyllabus For Principles of Accounting IJalexander26100% (1)

- Unit of Study Outline: Accounting, Business and SocietyDocument6 pagesUnit of Study Outline: Accounting, Business and SocietyNicyKOKNo ratings yet

- Principles of Accounting I: Jackson Community College ACCOUNTING 231-02 Winter 2013Document8 pagesPrinciples of Accounting I: Jackson Community College ACCOUNTING 231-02 Winter 2013shaharhr1No ratings yet

- Syllabus Fin4004 Spring 2014Document4 pagesSyllabus Fin4004 Spring 2014Jacob WSNo ratings yet

- OutlineDocument6 pagesOutlineDani CastroNo ratings yet

- ACTG 2010 - Kattelman Syllabus Fall 2015 OnlineDocument4 pagesACTG 2010 - Kattelman Syllabus Fall 2015 OnlineCherylNo ratings yet

- Risk and Financial Institutions ECONOMICS 2191A-001: RegistrationDocument6 pagesRisk and Financial Institutions ECONOMICS 2191A-001: RegistrationkmillatNo ratings yet

- Intermediate Financial Accounting Ii ACG 3113 - FALL 2014: Course InformationDocument7 pagesIntermediate Financial Accounting Ii ACG 3113 - FALL 2014: Course InformationAbdi hasenNo ratings yet

- UT Dallas Syllabus For Aim2301.003.11s Taught by Todd Kravet (tdk091000)Document6 pagesUT Dallas Syllabus For Aim2301.003.11s Taught by Todd Kravet (tdk091000)UT Dallas Provost's Technology GroupNo ratings yet

- ACCT 372 - Syllabus - Fall 2017upateoct10sep9tup-1Document11 pagesACCT 372 - Syllabus - Fall 2017upateoct10sep9tup-1Alex ChanNo ratings yet

- PHYS 2053 - General Physics I Syllabus f2014Document6 pagesPHYS 2053 - General Physics I Syllabus f2014nullNo ratings yet

- ECMC40 Syllabus 2012 Lec 01Document5 pagesECMC40 Syllabus 2012 Lec 01Adele BreakNo ratings yet

- BSBMGT502 Manage People Performance - Assessment 1 - 2019 - V2Document25 pagesBSBMGT502 Manage People Performance - Assessment 1 - 2019 - V2Ang PariNo ratings yet

- ACTG 316 Zhong, RongDocument5 pagesACTG 316 Zhong, RongMd Rasel Uddin ACMANo ratings yet

- ACC4210 Module Handbook 2014Document11 pagesACC4210 Module Handbook 2014Abhishek ChordiaNo ratings yet

- BUSI 407 Syllabus (Fall 2019)Document6 pagesBUSI 407 Syllabus (Fall 2019)gus10110No ratings yet

- ACCT 2010 - Principles of Accounting I: Acho@ust - HKDocument6 pagesACCT 2010 - Principles of Accounting I: Acho@ust - HKpapaNo ratings yet

- 2 - Intermediate Accounting I 1302-201Document3 pages2 - Intermediate Accounting I 1302-201Zaed MorebNo ratings yet

- ACCT2522 Management Accounting 1 Course Outline S1 2016Document17 pagesACCT2522 Management Accounting 1 Course Outline S1 2016Anna ChenNo ratings yet

- AC311 Spring 2011 Keating SyllabusDocument5 pagesAC311 Spring 2011 Keating SyllabusvanzorNo ratings yet

- Chap 21-2Document8 pagesChap 21-2JackNo ratings yet

- Chap+21+corrected SlideDocument1 pageChap+21+corrected SlideJackNo ratings yet

- Updated NotesDocument3 pagesUpdated NotesJackNo ratings yet

- CH+19 2Document9 pagesCH+19 2JackNo ratings yet

- Chapter 16 Homework SolutionsDocument6 pagesChapter 16 Homework SolutionsJackNo ratings yet

- Chap 18Document41 pagesChap 18JackNo ratings yet

- Chapter 15 Homework SolutionsDocument2 pagesChapter 15 Homework SolutionsJackNo ratings yet

- Chapter 10 Homework SolutionsDocument6 pagesChapter 10 Homework SolutionsJackNo ratings yet

- Chapter 10 - With NotesDocument47 pagesChapter 10 - With NotesJackNo ratings yet

- Depreciation Information SheetDocument4 pagesDepreciation Information SheetJackNo ratings yet

- Syllabus 4124 SPR 2015Document2 pagesSyllabus 4124 SPR 2015JackNo ratings yet

- Chapter 9 Homework SolutionsDocument5 pagesChapter 9 Homework SolutionsJackNo ratings yet

- Chapter 8Document48 pagesChapter 8JackNo ratings yet

- Full Thesis PDFDocument93 pagesFull Thesis PDFgaranNo ratings yet

- Cover Letter ConsultingDocument1 pageCover Letter ConsultingaliabhaNo ratings yet

- Kansas Tenants Handbook Circa 2003Document41 pagesKansas Tenants Handbook Circa 2003dosmasterNo ratings yet

- Sampa Video Case Analysis Submission by Abhishek Ojha EPGP 04B 003 Saurabh Singh EPGP 04B 102 and Toban Varghese EPGP 04B 116Document11 pagesSampa Video Case Analysis Submission by Abhishek Ojha EPGP 04B 003 Saurabh Singh EPGP 04B 102 and Toban Varghese EPGP 04B 116hernandezc_joseNo ratings yet

- Membership Application Form For Associate MemberDocument2 pagesMembership Application Form For Associate MemberIqbal Ahsan100% (1)

- Final IND AS Summary For Nov 19-CA PS BeniwalDocument15 pagesFinal IND AS Summary For Nov 19-CA PS BeniwalChirag AggarwalNo ratings yet

- FIN 534 Homework Set 5 Week 10 SolutionDocument4 pagesFIN 534 Homework Set 5 Week 10 SolutionmarywimberlyNo ratings yet

- Letter of Credit AmityDocument33 pagesLetter of Credit AmitySudhir Kochhar Fema AuthorNo ratings yet

- R22 FIRM Q-BankDocument8 pagesR22 FIRM Q-BankparamrajeshjainNo ratings yet

- Invoice 24-01-23Document1 pageInvoice 24-01-23Mohan DoifodeNo ratings yet

- Clarifies On News Item (Company Update)Document1 pageClarifies On News Item (Company Update)Shyam SunderNo ratings yet

- 10000015990Document242 pages10000015990Chapter 11 DocketsNo ratings yet

- Grade 11 Applied MathematicsDocument3 pagesGrade 11 Applied MathematicsPavni0% (1)

- TpaDocument40 pagesTpadeepankarkatNo ratings yet

- Syed Waji Ul Hassan Bokhari (FIND)Document3 pagesSyed Waji Ul Hassan Bokhari (FIND)HshhsbsNo ratings yet

- Emotion Drives Investor DecisionsDocument1 pageEmotion Drives Investor DecisionsTori PatrickNo ratings yet

- Business Math3Document22 pagesBusiness Math3drosbeastNo ratings yet

- Revision of Timelines For Submission of Returns On CIMSDocument12 pagesRevision of Timelines For Submission of Returns On CIMSchandanrajpurohit8No ratings yet

- 13 Compound Interest LectureDocument41 pages13 Compound Interest LectureMr.Clown 107No ratings yet

- Mental MathsDocument6 pagesMental MathsPoulomi ChakrabortyNo ratings yet

- 2023-04 Valuation Report - PRL Destillates & FuelDocument6 pages2023-04 Valuation Report - PRL Destillates & FuelJianyun ZhouNo ratings yet

- T3int 2010 Jun QDocument9 pagesT3int 2010 Jun QMuhammad SaadNo ratings yet

- Accomplisment Letter 120611Document3 pagesAccomplisment Letter 120611Latisha WalkerNo ratings yet

- MPRA - Paper - Litrature 41840 PDFDocument40 pagesMPRA - Paper - Litrature 41840 PDFDominic MichealNo ratings yet

- Trading Chart GuideDocument6 pagesTrading Chart GuideRo ChelleNo ratings yet

- (See Rule 31 (1) (B) )Document2 pages(See Rule 31 (1) (B) )B RNo ratings yet