Professional Documents

Culture Documents

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

You might also like

- Email Enrichment 1 - MasterDocument36 pagesEmail Enrichment 1 - MasterTom Master60% (5)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Research Paper "Document43 pagesResearch Paper "Pooja Rana75% (4)

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document6 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- TTR RRL: LimitedDocument5 pagesTTR RRL: LimitedShyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document6 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Standalone Financial Results, Form A For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Form A For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesConsolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Document1 pageStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Revised Financial Results For Sept 30, 2015 (Result)Document3 pagesRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Investor Presentation (Company Update)Document34 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- M iYN: Standalone Limited BoDocument5 pagesM iYN: Standalone Limited BoHimanshuNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Ref: Code No. 530427: Encl: As AboveDocument3 pagesRef: Code No. 530427: Encl: As AboveShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Investors Presentation (Company Update)Document15 pagesInvestors Presentation (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document6 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For March 31, 2016 (Result)Document1 pageStandalone & Consolidated Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- AmiBroker IntroductionDocument4 pagesAmiBroker Introductionnatarajan_arulNo ratings yet

- List of IP-1 Registered Companies As OnDocument163 pagesList of IP-1 Registered Companies As Ontariq yawerNo ratings yet

- Placement ADGITM 31st March 2022Document28 pagesPlacement ADGITM 31st March 2022Hritik SinghNo ratings yet

- Approved List 101109Document16 pagesApproved List 101109tudaya_rajNo ratings yet

- Ultra HNI 6Document2 pagesUltra HNI 6Rafi AzamNo ratings yet

- Ipo Sharekhan ProjectDocument73 pagesIpo Sharekhan ProjectSaadullah Khan100% (1)

- A Uncle Ji Project Sandeep JiDocument50 pagesA Uncle Ji Project Sandeep Jisandeep kumarNo ratings yet

- Introduction To Arbitration PDFDocument4 pagesIntroduction To Arbitration PDFSunil PatilNo ratings yet

- Catchment Mapping BillaDocument12 pagesCatchment Mapping Billa28-RPavan raj. BNo ratings yet

- StocksDocument5 pagesStocksDinesh AgrawalNo ratings yet

- ICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Document5 pagesICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Vijaykumar D SNo ratings yet

- Comapany Profile: Company Name: - Jhaveri SecuritiesDocument6 pagesComapany Profile: Company Name: - Jhaveri SecuritiesChetanTejaniNo ratings yet

- Statement of Axis Account No:916010041539247 For The Period (From: 01-08-2022 To: 01-02-2023)Document18 pagesStatement of Axis Account No:916010041539247 For The Period (From: 01-08-2022 To: 01-02-2023)rahulbhasinNo ratings yet

- April 11 Gur Kothi SalDocument7 pagesApril 11 Gur Kothi SalvikasNo ratings yet

- Appointments in Various Financial Institution Final 2 20Document3 pagesAppointments in Various Financial Institution Final 2 20Krishna SewaNo ratings yet

- Security Analysis & Portfolio ManagementDocument28 pagesSecurity Analysis & Portfolio ManagementNishu JainNo ratings yet

- GoldmanSachsS - India Multibaggers - 230603 - 084154 22Document1 pageGoldmanSachsS - India Multibaggers - 230603 - 084154 22viayNo ratings yet

- The Top 100 Powerful CEO's in IndiaDocument3 pagesThe Top 100 Powerful CEO's in IndiavavNo ratings yet

- Stock Market: Presented by Zaid ShahsahebDocument16 pagesStock Market: Presented by Zaid ShahsahebZaid Ismail ShahNo ratings yet

- Google Maps Places Scraper 19 Jul 2022Document16 pagesGoogle Maps Places Scraper 19 Jul 2022K. SanjuNo ratings yet

- SEBIAnnual ReportDocument201 pagesSEBIAnnual Reportthexplorer008No ratings yet

- List of Companys Which Constitute CNX MIDCAP IndexDocument6 pagesList of Companys Which Constitute CNX MIDCAP Indextaufiq_786No ratings yet

- Project ReportDocument55 pagesProject Reportkushal_ghosh20009742100% (6)

- Stock MKT IndicesDocument20 pagesStock MKT IndicesDivyesh GandhiNo ratings yet

- Sr. No. Symbol Company NameDocument96 pagesSr. No. Symbol Company NamepujushahNo ratings yet

- List of Participating Organisations For Campus Placement Programme Aug-Sept 2018 Center Interview DateDocument10 pagesList of Participating Organisations For Campus Placement Programme Aug-Sept 2018 Center Interview DateMLastTryNo ratings yet

- Research Report Sample - 9018Document11 pagesResearch Report Sample - 9018saurabh davisNo ratings yet

- IBHFL IPO Abridged ProspectusDocument48 pagesIBHFL IPO Abridged Prospectusratan203No ratings yet

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

UNIROYAL MARTNE EXPORTS LIMITED

CP9/495(1'1 /19), Vengatam P.O, Calicut.673 303, Kerata, lndia

Tel : 0496 2633781, ?633782, Fax : +91496 2633783

E-mail : ume@uniroyalmarine.com

www. un iroyaImari ne. com

CIN : L1 51 24K11 992PLC00667 4

Ref: UME/BSE/10/2016

May 28, 2016

)

Scrip Code No: 526113

The General Manager

Department of Corporate Services

Bombay Stock Exchange Ltd.

1s(Floor,PJTowers

Dalal Street, Mumbai-

4OO 001

Dear Sir,

Ref, Our Letter dated 17.05.2016 intimatino the date

of Board Meeting.

This is to inform you that the.Board of Directors of the company

at its meeting herd on

2'th May 2016 has approved the Audited ri^"rrci"i L.ritr for the

quarter and year

ended 3lst March 2016.

we are enclosinq herewith a copy of the Audited financiar resurts

and the

of the companv in the format as prescribed under crause 33 of SEBI (ristingAudit report

;;iis;ii";;

and disclosure requirements) regulations, 2015,

Kindly take the same on record.

Thanking you

Yours faithfully

For.

UnAal

Marine Exports Limited.

z-^54,R6*u^urpanakkat

Company Secretary

FORM A

(For Audit Report with unmodified opinion)

and Disclosure Requirements)

(Pursuant to Regulation 33 of SEBI (Listing Obligations

Regulations, 2015)

Name

ofthe comPanY

Uniroyal Marine ExPorts Limited

Annual Financial Statements For the year ended

Type Of Audit Observation

Frequency of Observation

Not Applicable

Signed by-

Anush

Thomas

ManaginB Director

Bindu Suresh

Chief Financial Officer

lndukumar M G

Partner (M. No. 200004)

For. Kuruvilla & lndukumar

Chartered Accountants

Firm Reg No.0138825

lype Mathew

Audit Committees Chairman

\,DtY

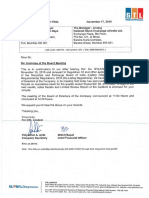

UNIROYAL MARINE EXPORTS LIMITED

CP&/495(11/19), Vengalam P.O, Caticut - 673 303, Kerata, lndia

Tet : 0496 2633781,2633782, Fax : +91496 2633783

E.mait : ume@uniroyalmarine, com

www. un iroyalmari ne. com

CtN

statement

of

Ll 5i 24K11 992pLC00667 4

Audited Financial Results for the Quarter and Year ended 31-03-2016

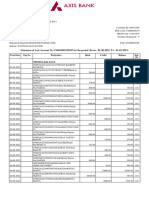

For the three months ended

Part {

1

Net Sales/income flom operations

.

Other Operating lncome

otal income from operations (net)

Expenses

a) lncrease/decrease in stock in

trade and work in Progress

b) Consumption of raw materials

c) Purchase oI traded goods

d) Shipping/Freight & expenses

e) Employees cost

Depreciation

g) Other expenditure

Profiu(loss) from Operations before

lncome,lnteresl and Exceptional

Profit before lnterest and Exceptional ltems

lnteresl

Profit afler lnteresl but before

Exceptional itmes (5-6)

period expense/Exceptional items

Paid-up equity share cpital

(Face value Rs.1O)

'13 Reserves

excluding Revaluation

Reserves (B/S)

(313.33)

(317.9s1

14 Earnings Per Share (EPS) Rs.

a) Basic and diluted EPs before Extra

Ordinary items for the period, for the

year to date and for the previous

b)

year)

Basic and diluted EPS afler Extra-

(0.18)

o.ts

(1.471

0.0?

(2.60)

(0.18)

0-15

11.47)

0.0?

(2.60)

4251418

4249998

4260195

4251418

4260195

63-610/o

6s.s9%

65.75%

65.61'/o

65.750/"

Nit

Nit

Nit

NiI

Ni

Nit

Nit

Nit

Nit

Ni

Nit

Ni

Nit

Nit

Ni

2228082

2229502

2219305

2224042

2219305

100y"

1000/.

1000/.

100v"

100%

34.390/0

34.410/.

34.25%

34.39y"

34.250/,

ordinary items for the period, for the

year to date and ,or the previous year

Parl2

A

1

PARTICULARS OF SHAREHOLDING

Public shareholding

i.Number of shares

ii.Percentage oI shareholding

2

Promoters and Promoter Group Shareholding:

a. Pledged/Encumbered:

i. Number of shares:

ii. Percentage of shares (as a

o/o

ofthe total

share holding of promoter and promoter group)

iii. Percentage of shares (as a % ofthe total

share capital of the company)

b. Non Encumbered

i. Number

ofshares:

7o ofthe total

shareholding ofthe Promoter and Promoter

group)

ii. Percentage ofshares (as a

Percentage of shares (as a o/o ofthe total

share capital of the company)

ed and surplus

receives against share warrant}

,-ii-ticationmo,*ypendingallotment

Trade Payables

Other cunent liabilities

at their

on record by the Board of Directors

al

The above results were reviewed by the

meeting held on 28-05-2016'

2)

3)

4\

of marine products and

predominantly relates to processing & exporting

Seqment information : Company's operation

turnover'

in

total

is not sisnificant

its irimiry segment' local tumover

fiorrres between audited figures

20.16 and March 31, 2o'1sare the^balancing

The fioures,or quarter ended March 31,

g1'

2015 respecti;ly' and the unaudited

l'l"ttt

ulrctr-ii] ioio

in reo;d or the fult nnanciat year enoeo

'no

2ol4 respectively' being the end ofthe

'

oublished Year-to-date finu'""

''l

review'

lo limited

linan"lat v"a's' *hich were subjected

the

whereever necessary to confirm with

been regrouped and/or rectassified

for the previous periods have

;;';,"il;;;;;;;

ir::il];li;iil";;re"Ji'" 'rto'""""i0!'

Figures

current period

presentation

lnvestor comPlaintsi

"

;;;dl;;,-l.l,i

Kozhikods

it' t*ii 'nJ'"""t0"'

Received:

Opening

Disposed:1

Closing Pending: Nil

Managing Director

28-05-2016

o\

You might also like

- Email Enrichment 1 - MasterDocument36 pagesEmail Enrichment 1 - MasterTom Master60% (5)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Research Paper "Document43 pagesResearch Paper "Pooja Rana75% (4)

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document8 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document6 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- TTR RRL: LimitedDocument5 pagesTTR RRL: LimitedShyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document6 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Standalone Financial Results, Form A For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Form A For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesConsolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Document1 pageStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Revised Financial Results For Sept 30, 2015 (Result)Document3 pagesRevised Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Investor Presentation (Company Update)Document34 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- M iYN: Standalone Limited BoDocument5 pagesM iYN: Standalone Limited BoHimanshuNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Ref: Code No. 530427: Encl: As AboveDocument3 pagesRef: Code No. 530427: Encl: As AboveShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Investors Presentation (Company Update)Document15 pagesInvestors Presentation (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document6 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For March 31, 2016 (Result)Document1 pageStandalone & Consolidated Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- AmiBroker IntroductionDocument4 pagesAmiBroker Introductionnatarajan_arulNo ratings yet

- List of IP-1 Registered Companies As OnDocument163 pagesList of IP-1 Registered Companies As Ontariq yawerNo ratings yet

- Placement ADGITM 31st March 2022Document28 pagesPlacement ADGITM 31st March 2022Hritik SinghNo ratings yet

- Approved List 101109Document16 pagesApproved List 101109tudaya_rajNo ratings yet

- Ultra HNI 6Document2 pagesUltra HNI 6Rafi AzamNo ratings yet

- Ipo Sharekhan ProjectDocument73 pagesIpo Sharekhan ProjectSaadullah Khan100% (1)

- A Uncle Ji Project Sandeep JiDocument50 pagesA Uncle Ji Project Sandeep Jisandeep kumarNo ratings yet

- Introduction To Arbitration PDFDocument4 pagesIntroduction To Arbitration PDFSunil PatilNo ratings yet

- Catchment Mapping BillaDocument12 pagesCatchment Mapping Billa28-RPavan raj. BNo ratings yet

- StocksDocument5 pagesStocksDinesh AgrawalNo ratings yet

- ICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Document5 pagesICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Vijaykumar D SNo ratings yet

- Comapany Profile: Company Name: - Jhaveri SecuritiesDocument6 pagesComapany Profile: Company Name: - Jhaveri SecuritiesChetanTejaniNo ratings yet

- Statement of Axis Account No:916010041539247 For The Period (From: 01-08-2022 To: 01-02-2023)Document18 pagesStatement of Axis Account No:916010041539247 For The Period (From: 01-08-2022 To: 01-02-2023)rahulbhasinNo ratings yet

- April 11 Gur Kothi SalDocument7 pagesApril 11 Gur Kothi SalvikasNo ratings yet

- Appointments in Various Financial Institution Final 2 20Document3 pagesAppointments in Various Financial Institution Final 2 20Krishna SewaNo ratings yet

- Security Analysis & Portfolio ManagementDocument28 pagesSecurity Analysis & Portfolio ManagementNishu JainNo ratings yet

- GoldmanSachsS - India Multibaggers - 230603 - 084154 22Document1 pageGoldmanSachsS - India Multibaggers - 230603 - 084154 22viayNo ratings yet

- The Top 100 Powerful CEO's in IndiaDocument3 pagesThe Top 100 Powerful CEO's in IndiavavNo ratings yet

- Stock Market: Presented by Zaid ShahsahebDocument16 pagesStock Market: Presented by Zaid ShahsahebZaid Ismail ShahNo ratings yet

- Google Maps Places Scraper 19 Jul 2022Document16 pagesGoogle Maps Places Scraper 19 Jul 2022K. SanjuNo ratings yet

- SEBIAnnual ReportDocument201 pagesSEBIAnnual Reportthexplorer008No ratings yet

- List of Companys Which Constitute CNX MIDCAP IndexDocument6 pagesList of Companys Which Constitute CNX MIDCAP Indextaufiq_786No ratings yet

- Project ReportDocument55 pagesProject Reportkushal_ghosh20009742100% (6)

- Stock MKT IndicesDocument20 pagesStock MKT IndicesDivyesh GandhiNo ratings yet

- Sr. No. Symbol Company NameDocument96 pagesSr. No. Symbol Company NamepujushahNo ratings yet

- List of Participating Organisations For Campus Placement Programme Aug-Sept 2018 Center Interview DateDocument10 pagesList of Participating Organisations For Campus Placement Programme Aug-Sept 2018 Center Interview DateMLastTryNo ratings yet

- Research Report Sample - 9018Document11 pagesResearch Report Sample - 9018saurabh davisNo ratings yet

- IBHFL IPO Abridged ProspectusDocument48 pagesIBHFL IPO Abridged Prospectusratan203No ratings yet