Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsBPI AM Organizational Changes PDF

BPI AM Organizational Changes PDF

Uploaded by

collieCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Metrobank Strama PaperDocument28 pagesMetrobank Strama PaperAnderei Acantilado67% (9)

- Chapter 2 Living Things in Ecosystems PDFDocument12 pagesChapter 2 Living Things in Ecosystems PDFJohn Rey BuntagNo ratings yet

- The Future of JournalismDocument4 pagesThe Future of JournalismHuy NguyenNo ratings yet

- Alternative InvestmentsDocument20 pagesAlternative InvestmentsPedro Ale100% (1)

- Into The Wild SummaryDocument8 pagesInto The Wild SummarydaggoooNo ratings yet

- Evidence Part IDocument10 pagesEvidence Part IVitz IgotNo ratings yet

- Scheme Annual Report 2018-2019 PDFDocument1,470 pagesScheme Annual Report 2018-2019 PDFAdya AbhijitaNo ratings yet

- Bank of The Philippine IslandDocument5 pagesBank of The Philippine IslandAdeline Mangulad MontebonNo ratings yet

- Anandu S March 2023Document3 pagesAnandu S March 2023NanduNo ratings yet

- Visha6iene Siwojd2kDocument13 pagesVisha6iene Siwojd2kVISHAL PANDYANo ratings yet

- Final StramaDocument75 pagesFinal StramaChristian Jay Patiño Orpano100% (1)

- Final StramaDocument74 pagesFinal StramaRalphDesiEscueta94% (36)

- MarketingDocument27 pagesMarketingy2f5kznqkzNo ratings yet

- FAB Group 8 On Private Equity FirmsDocument7 pagesFAB Group 8 On Private Equity Firmskartikay GulaniNo ratings yet

- About BpiDocument19 pagesAbout BpiPauline AntonioNo ratings yet

- What Is Private Equity/ Venture Capital?Document27 pagesWhat Is Private Equity/ Venture Capital?sanjuNo ratings yet

- GIC Report 2009Document54 pagesGIC Report 2009Devin KarterNo ratings yet

- NYSE_CIT_2005Document132 pagesNYSE_CIT_2005pcelica77No ratings yet

- HFOF Letter To Ivy ClientsDocument1 pageHFOF Letter To Ivy ClientsAbsolute ReturnNo ratings yet

- BDO Unibank 2019 Annual Report BDocument96 pagesBDO Unibank 2019 Annual Report Bnemson999No ratings yet

- BIMI To Manage PAMI Mutual FundsDocument1 pageBIMI To Manage PAMI Mutual FundsLaundry AvenueNo ratings yet

- IntroductionDocument2 pagesIntroductionPriscillaNo ratings yet

- Business Plan Group Assignment 2Document19 pagesBusiness Plan Group Assignment 2ddhaifina17No ratings yet

- Introduction To Unit Trust in MalaysiaDocument12 pagesIntroduction To Unit Trust in MalaysiaEdgy EdgyNo ratings yet

- SMIC-2022 IR Financial SupplementDocument80 pagesSMIC-2022 IR Financial SupplementArold MendizabalNo ratings yet

- BDO AnnualreportDocument66 pagesBDO AnnualreportJm ╭∩╮⎝⎲⎵⎲⎠╭∩╮No ratings yet

- FM 133 Capital-Wps OfficeDocument10 pagesFM 133 Capital-Wps OfficeJade Del MundoNo ratings yet

- PestelDocument3 pagesPestelMary Abigail Lapuz0% (1)

- Narrative Report - Chema C. PacionesDocument9 pagesNarrative Report - Chema C. PacionesMeach CallejoNo ratings yet

- Advisory FirmsDocument21 pagesAdvisory FirmsRakshita AsatiNo ratings yet

- Investment Linked Funds Annual Report 2019 PDFDocument54 pagesInvestment Linked Funds Annual Report 2019 PDFSafix YazidNo ratings yet

- TFG Asia-InvestmentsDocument33 pagesTFG Asia-InvestmentsYff DickNo ratings yet

- Wip BirlaDocument37 pagesWip BirlaSneha YadavNo ratings yet

- Strama Sem Project PDFDocument6 pagesStrama Sem Project PDFIvy PeraltaNo ratings yet

- Shailesh ShuklaDocument61 pagesShailesh Shuklashailesh shuklaNo ratings yet

- Philippine Bank of CommunicationsDocument30 pagesPhilippine Bank of CommunicationsGab ReyesNo ratings yet

- BPI: JV With Century Tokyo LeasingDocument2 pagesBPI: JV With Century Tokyo LeasingBusinessWorldNo ratings yet

- MfibriefDocument2 pagesMfibriefClifford OkwesiNo ratings yet

- Annual Report 2010-11-02Document151 pagesAnnual Report 2010-11-02anupraipurNo ratings yet

- Part A 1. Industry ProfileDocument67 pagesPart A 1. Industry ProfilebijuNo ratings yet

- Introduction To Venture CapitalDocument63 pagesIntroduction To Venture CapitalAbbos EgamkulovNo ratings yet

- BM Case StudyDocument5 pagesBM Case Studytimebegins4No ratings yet

- Project Report: "Study On Portfolio Management Services Strategies and Investors Awareness and Prefrence For It"Document49 pagesProject Report: "Study On Portfolio Management Services Strategies and Investors Awareness and Prefrence For It"Nitesh BaglaNo ratings yet

- Adeel BMDocument27 pagesAdeel BMttsopalNo ratings yet

- Corporate Banking Summer Internship ProgramDocument2 pagesCorporate Banking Summer Internship ProgramPrince JainNo ratings yet

- Uttam WealthDocument22 pagesUttam WealthMOHIT KUMARNo ratings yet

- Fast. Flexible. Focused.: IIFL Holdings Limited 21 Annual ReportDocument172 pagesFast. Flexible. Focused.: IIFL Holdings Limited 21 Annual ReportAvinash JainNo ratings yet

- BDO-2019-Sustainability Report PDFDocument72 pagesBDO-2019-Sustainability Report PDFJohn Michael Dela CruzNo ratings yet

- Investment Stock AnalysisDocument16 pagesInvestment Stock AnalysisKana Lou Cassandra BesanaNo ratings yet

- Pollux Properties LTD - Annual Report - FPE 31.12.2020Document135 pagesPollux Properties LTD - Annual Report - FPE 31.12.2020guntur secoundNo ratings yet

- André RWE Supplyside Policies1 - 06-10-2023Document4 pagesAndré RWE Supplyside Policies1 - 06-10-2023André QianNo ratings yet

- UNO Digital Bank Annual Report 2022Document65 pagesUNO Digital Bank Annual Report 2022tuando.bongbongNo ratings yet

- Project Submitted On Partial Fulfillment of The Requirement of Mms Programme INDocument25 pagesProject Submitted On Partial Fulfillment of The Requirement of Mms Programme INSurajNo ratings yet

- Meteor Training PresentationDocument32 pagesMeteor Training Presentationsisko1104No ratings yet

- Annual Report 2010-11-02Document151 pagesAnnual Report 2010-11-02Harish BhardwajNo ratings yet

- H Iskvd Fws VJ D1593434908629Document7 pagesH Iskvd Fws VJ D1593434908629Dev ShahNo ratings yet

- Annual Report 2011-12Document156 pagesAnnual Report 2011-12ershad123No ratings yet

- FaysalbankDocument541 pagesFaysalbankAnnie DollNo ratings yet

- Caspian Impact Investment Adviser Associate or SR Associate Equity Investments May 2023Document2 pagesCaspian Impact Investment Adviser Associate or SR Associate Equity Investments May 2023Tanmay AgrawalNo ratings yet

- Project Report On Sbi Mutual Fund PDFDocument60 pagesProject Report On Sbi Mutual Fund PDFRenuprakash KpNo ratings yet

- Ar07c enDocument8 pagesAr07c enMark ReinhardtNo ratings yet

- FinVolution Group Fourth Quarter and Full Year 2023 Earnings Conference Call TranscriptDocument12 pagesFinVolution Group Fourth Quarter and Full Year 2023 Earnings Conference Call Transcriptzw64362368No ratings yet

- Chapter1: Managers and ManagementDocument14 pagesChapter1: Managers and ManagementcollieNo ratings yet

- Motivation of Rhodes ScholarDocument1 pageMotivation of Rhodes ScholarcollieNo ratings yet

- The Motivation of A Rhodes ScholarDocument12 pagesThe Motivation of A Rhodes ScholarcollieNo ratings yet

- Gainesboro Machine Tools CorporationDocument15 pagesGainesboro Machine Tools CorporationcollieNo ratings yet

- Delicious IncDocument13 pagesDelicious InccollieNo ratings yet

- Deluxe CorporationDocument10 pagesDeluxe CorporationcollieNo ratings yet

- Emperador 2013Document114 pagesEmperador 2013collieNo ratings yet

- Krispy KremeDocument6 pagesKrispy KremecollieNo ratings yet

- LP Formulation ExDocument32 pagesLP Formulation ExcollieNo ratings yet

- Science and Technology in The PhilippinesDocument1 pageScience and Technology in The Philippinesnicole castilloNo ratings yet

- Punjab BotanyDocument9 pagesPunjab BotanyAYUSHNEWTONNo ratings yet

- Separators of Different GenerationsDocument46 pagesSeparators of Different GenerationsISLAM I. Fekry100% (8)

- CHEM 580: Computational Chemistry Fall 2020 From Schrodinger To Hartree-FockDocument41 pagesCHEM 580: Computational Chemistry Fall 2020 From Schrodinger To Hartree-FockciwebNo ratings yet

- Salgado 2017Document15 pagesSalgado 2017ferryararNo ratings yet

- Epson EPL-5800 Service ManualDocument116 pagesEpson EPL-5800 Service ManualHarris FNo ratings yet

- Innovative Strategies For Flood-Resilient CitiesDocument50 pagesInnovative Strategies For Flood-Resilient CitiesDaisy100% (1)

- Michael Downs - Lacan's Concept of The Object-Cause of Desire (Objet Petit A)Document23 pagesMichael Downs - Lacan's Concept of The Object-Cause of Desire (Objet Petit A)JustinWagnerNo ratings yet

- NEW Curriculum Vitae Marking Scheme (Jan 2022)Document2 pagesNEW Curriculum Vitae Marking Scheme (Jan 2022)TONo ratings yet

- Science DLPDocument12 pagesScience DLPGaila Mae SanorjoNo ratings yet

- 07. ĐỀ THI VÀO LỚP 10-CẦN THƠ (2020-2021)Document8 pages07. ĐỀ THI VÀO LỚP 10-CẦN THƠ (2020-2021)Vương ThànhNo ratings yet

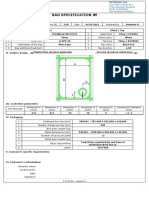

- Bag Specification 3LDocument1 pageBag Specification 3LBookWayNo ratings yet

- Newmaninan Concept of A GentlemanDocument4 pagesNewmaninan Concept of A GentlemanSakib Abrar TasnimNo ratings yet

- Tsil As Is&to Be Doc 4Document12 pagesTsil As Is&to Be Doc 4Ashok Kumar Panda100% (1)

- 11 - Trigonometric IdentitiesDocument6 pages11 - Trigonometric IdentitiesQwert RNo ratings yet

- End of Quiz: G-LITT001 CEE22 1st Sem (2023-2024) Review Quiz 6Document3 pagesEnd of Quiz: G-LITT001 CEE22 1st Sem (2023-2024) Review Quiz 6Dela Cruz ArabellaNo ratings yet

- Ex 3 SIDocument25 pagesEx 3 SIAB123No ratings yet

- Loop Switching PDFDocument176 pagesLoop Switching PDFshawnr7376No ratings yet

- Difference Between A Flywheel and A GovernorDocument3 pagesDifference Between A Flywheel and A GovernorRevanKumarBattuNo ratings yet

- SHRB-SN: 1" (25 MM) Deflection SHRB Spring Hanger With Neoprene and Bottom CupDocument1 pageSHRB-SN: 1" (25 MM) Deflection SHRB Spring Hanger With Neoprene and Bottom Cupsas999333No ratings yet

- Welc OME..Document26 pagesWelc OME..Priya RamNo ratings yet

- Naive BayesDocument36 pagesNaive BayesgibthaNo ratings yet

- Operator'S Manual: FANUC FAST Ethernet FANUC FAST Data ServerDocument240 pagesOperator'S Manual: FANUC FAST Ethernet FANUC FAST Data ServerSergio Trujillo CerroNo ratings yet

- Fortran CF DDocument160 pagesFortran CF DLahcen AkerkouchNo ratings yet

- LESSON 3: Talk About Your Weekend or Holiday Plan Using VerbsDocument3 pagesLESSON 3: Talk About Your Weekend or Holiday Plan Using VerbsjoannaNo ratings yet

- Getting-Started nrf8001 Bluefruit-Le-BreakoutDocument38 pagesGetting-Started nrf8001 Bluefruit-Le-BreakoutnescafefrNo ratings yet

BPI AM Organizational Changes PDF

BPI AM Organizational Changes PDF

Uploaded by

collie0 ratings0% found this document useful (0 votes)

12 views3 pagesOriginal Title

BPI AM Organizational Changes.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views3 pagesBPI AM Organizational Changes PDF

BPI AM Organizational Changes PDF

Uploaded by

collieCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

22 May 2013

Dear Valued Client,

In recognition of the need to flexibly adapt to a rapidly changing global environment and the continued

expansion of the economy and financial markets, we at BPI Asset Management have made some

important changes in the organization to better deliver our services to you.

We have strengthened integration across the areas of portfolio management, institutional account

management, wealth management, and private banking in order to improve efficiency and enhance our

customer value proposition. In line with this, the following changes shall take place:

Appointment of a New Chief Investment Officer

Estelito Lito C. Biacora (Senior Vice President) takes on his new role as Head of Investment

Management and Chief Investment Officer of BPI Asset Management. With 23 years of experience in

treasury and portfolio management, and most recently as Head of BPI Private Banking, Lito succeeds

the undersigned as I henceforth focus broadly on business strategy, growth opportunities and

governance as Chairman of the BPI Asset Allocation Committee (AAC). Lito shall be appointed ViceChairman of the AAC and will have overall responsibility of the entire investment process spanning

portfolio management of both segregated and pooled fund mandates, trading, economic research and

investment analysis.

BPI Asset Management shall continue to employ multiple investment management engines as we

execute portfolio management strategies across different investment brands: BPI Investment Funds,

Index Funds, Odyssey Funds and ALFM Funds (in an advisory capacity). Lito will be working

alongside highly experienced senior portfolio managers including Smith L. Chua (Vice President) who

joined BPI in 2011 following the acquisition of ING Investment Management Philippines. Smith, who

has 16 years of progressive experience in fund management, has consistently managed top

performing funds in the industry, and he will be responsible for the Odyssey Funds investment

process.

Attaching BPI Private Banking to Asset Management

We envisage the streamlining of client services to the high net worth customer segment by attaching

BPI Private Banking into the Asset Management and Trust umbrella. Private banking clients should

expect to further benefit from having greater access to investment solutions, broader product

coverage, and market expertise provided by our portfolio managers and investment analysts. We are

excited about the new innovations in the private banking space and we hope to bring this to our

customers thru synergies with asset management. I shall personally oversee this integration until we

appoint a new Head of BPI Private Banking.

Changes in Wealth Management

We have combined retail and wholesale distribution in one platform under our Wealth Management

services as we anticipate a movement towards open architecture for investment funds across the

industry. Mario T. Miranda (Senior Vice President), a 29 year veteran in the asset management and

trust industry is tasked with taking the wealth management business into the future through an

integrated traditional and digital investment funds distribution and advisory capability.

19th Floor BPI Building, 6768 Ayala Avenue, Makati City, Philippines 1226

www.bpiassetmanagement.com

Integration of Institutional Account Management

We have integrated the Institutional Business under the management of Paul Joseph "PJ" M. Garcia

(Senior Vice President) to help ensure consistency of service quality across the institutional account

spectrum. PJ was the Head of ING Investment Management Philippines and joined BPI in 2011 as a

result of the business acquisition. Institutional clients are anticipated to benefit from the valuable

market insights that PJ and the coverage team are expected to deliver apart from the usual client

services.

We have attached our Organizational Chart for your kind reference.

Once again, we take this opportunity to thank you for your continued trust and we look forward to

strengthening our partnership.

Sincerely,

Maria Theresa Marcial-Javier

Head, BPI Asset Management and Trust Group

You might also like

- Metrobank Strama PaperDocument28 pagesMetrobank Strama PaperAnderei Acantilado67% (9)

- Chapter 2 Living Things in Ecosystems PDFDocument12 pagesChapter 2 Living Things in Ecosystems PDFJohn Rey BuntagNo ratings yet

- The Future of JournalismDocument4 pagesThe Future of JournalismHuy NguyenNo ratings yet

- Alternative InvestmentsDocument20 pagesAlternative InvestmentsPedro Ale100% (1)

- Into The Wild SummaryDocument8 pagesInto The Wild SummarydaggoooNo ratings yet

- Evidence Part IDocument10 pagesEvidence Part IVitz IgotNo ratings yet

- Scheme Annual Report 2018-2019 PDFDocument1,470 pagesScheme Annual Report 2018-2019 PDFAdya AbhijitaNo ratings yet

- Bank of The Philippine IslandDocument5 pagesBank of The Philippine IslandAdeline Mangulad MontebonNo ratings yet

- Anandu S March 2023Document3 pagesAnandu S March 2023NanduNo ratings yet

- Visha6iene Siwojd2kDocument13 pagesVisha6iene Siwojd2kVISHAL PANDYANo ratings yet

- Final StramaDocument75 pagesFinal StramaChristian Jay Patiño Orpano100% (1)

- Final StramaDocument74 pagesFinal StramaRalphDesiEscueta94% (36)

- MarketingDocument27 pagesMarketingy2f5kznqkzNo ratings yet

- FAB Group 8 On Private Equity FirmsDocument7 pagesFAB Group 8 On Private Equity Firmskartikay GulaniNo ratings yet

- About BpiDocument19 pagesAbout BpiPauline AntonioNo ratings yet

- What Is Private Equity/ Venture Capital?Document27 pagesWhat Is Private Equity/ Venture Capital?sanjuNo ratings yet

- GIC Report 2009Document54 pagesGIC Report 2009Devin KarterNo ratings yet

- NYSE_CIT_2005Document132 pagesNYSE_CIT_2005pcelica77No ratings yet

- HFOF Letter To Ivy ClientsDocument1 pageHFOF Letter To Ivy ClientsAbsolute ReturnNo ratings yet

- BDO Unibank 2019 Annual Report BDocument96 pagesBDO Unibank 2019 Annual Report Bnemson999No ratings yet

- BIMI To Manage PAMI Mutual FundsDocument1 pageBIMI To Manage PAMI Mutual FundsLaundry AvenueNo ratings yet

- IntroductionDocument2 pagesIntroductionPriscillaNo ratings yet

- Business Plan Group Assignment 2Document19 pagesBusiness Plan Group Assignment 2ddhaifina17No ratings yet

- Introduction To Unit Trust in MalaysiaDocument12 pagesIntroduction To Unit Trust in MalaysiaEdgy EdgyNo ratings yet

- SMIC-2022 IR Financial SupplementDocument80 pagesSMIC-2022 IR Financial SupplementArold MendizabalNo ratings yet

- BDO AnnualreportDocument66 pagesBDO AnnualreportJm ╭∩╮⎝⎲⎵⎲⎠╭∩╮No ratings yet

- FM 133 Capital-Wps OfficeDocument10 pagesFM 133 Capital-Wps OfficeJade Del MundoNo ratings yet

- PestelDocument3 pagesPestelMary Abigail Lapuz0% (1)

- Narrative Report - Chema C. PacionesDocument9 pagesNarrative Report - Chema C. PacionesMeach CallejoNo ratings yet

- Advisory FirmsDocument21 pagesAdvisory FirmsRakshita AsatiNo ratings yet

- Investment Linked Funds Annual Report 2019 PDFDocument54 pagesInvestment Linked Funds Annual Report 2019 PDFSafix YazidNo ratings yet

- TFG Asia-InvestmentsDocument33 pagesTFG Asia-InvestmentsYff DickNo ratings yet

- Wip BirlaDocument37 pagesWip BirlaSneha YadavNo ratings yet

- Strama Sem Project PDFDocument6 pagesStrama Sem Project PDFIvy PeraltaNo ratings yet

- Shailesh ShuklaDocument61 pagesShailesh Shuklashailesh shuklaNo ratings yet

- Philippine Bank of CommunicationsDocument30 pagesPhilippine Bank of CommunicationsGab ReyesNo ratings yet

- BPI: JV With Century Tokyo LeasingDocument2 pagesBPI: JV With Century Tokyo LeasingBusinessWorldNo ratings yet

- MfibriefDocument2 pagesMfibriefClifford OkwesiNo ratings yet

- Annual Report 2010-11-02Document151 pagesAnnual Report 2010-11-02anupraipurNo ratings yet

- Part A 1. Industry ProfileDocument67 pagesPart A 1. Industry ProfilebijuNo ratings yet

- Introduction To Venture CapitalDocument63 pagesIntroduction To Venture CapitalAbbos EgamkulovNo ratings yet

- BM Case StudyDocument5 pagesBM Case Studytimebegins4No ratings yet

- Project Report: "Study On Portfolio Management Services Strategies and Investors Awareness and Prefrence For It"Document49 pagesProject Report: "Study On Portfolio Management Services Strategies and Investors Awareness and Prefrence For It"Nitesh BaglaNo ratings yet

- Adeel BMDocument27 pagesAdeel BMttsopalNo ratings yet

- Corporate Banking Summer Internship ProgramDocument2 pagesCorporate Banking Summer Internship ProgramPrince JainNo ratings yet

- Uttam WealthDocument22 pagesUttam WealthMOHIT KUMARNo ratings yet

- Fast. Flexible. Focused.: IIFL Holdings Limited 21 Annual ReportDocument172 pagesFast. Flexible. Focused.: IIFL Holdings Limited 21 Annual ReportAvinash JainNo ratings yet

- BDO-2019-Sustainability Report PDFDocument72 pagesBDO-2019-Sustainability Report PDFJohn Michael Dela CruzNo ratings yet

- Investment Stock AnalysisDocument16 pagesInvestment Stock AnalysisKana Lou Cassandra BesanaNo ratings yet

- Pollux Properties LTD - Annual Report - FPE 31.12.2020Document135 pagesPollux Properties LTD - Annual Report - FPE 31.12.2020guntur secoundNo ratings yet

- André RWE Supplyside Policies1 - 06-10-2023Document4 pagesAndré RWE Supplyside Policies1 - 06-10-2023André QianNo ratings yet

- UNO Digital Bank Annual Report 2022Document65 pagesUNO Digital Bank Annual Report 2022tuando.bongbongNo ratings yet

- Project Submitted On Partial Fulfillment of The Requirement of Mms Programme INDocument25 pagesProject Submitted On Partial Fulfillment of The Requirement of Mms Programme INSurajNo ratings yet

- Meteor Training PresentationDocument32 pagesMeteor Training Presentationsisko1104No ratings yet

- Annual Report 2010-11-02Document151 pagesAnnual Report 2010-11-02Harish BhardwajNo ratings yet

- H Iskvd Fws VJ D1593434908629Document7 pagesH Iskvd Fws VJ D1593434908629Dev ShahNo ratings yet

- Annual Report 2011-12Document156 pagesAnnual Report 2011-12ershad123No ratings yet

- FaysalbankDocument541 pagesFaysalbankAnnie DollNo ratings yet

- Caspian Impact Investment Adviser Associate or SR Associate Equity Investments May 2023Document2 pagesCaspian Impact Investment Adviser Associate or SR Associate Equity Investments May 2023Tanmay AgrawalNo ratings yet

- Project Report On Sbi Mutual Fund PDFDocument60 pagesProject Report On Sbi Mutual Fund PDFRenuprakash KpNo ratings yet

- Ar07c enDocument8 pagesAr07c enMark ReinhardtNo ratings yet

- FinVolution Group Fourth Quarter and Full Year 2023 Earnings Conference Call TranscriptDocument12 pagesFinVolution Group Fourth Quarter and Full Year 2023 Earnings Conference Call Transcriptzw64362368No ratings yet

- Chapter1: Managers and ManagementDocument14 pagesChapter1: Managers and ManagementcollieNo ratings yet

- Motivation of Rhodes ScholarDocument1 pageMotivation of Rhodes ScholarcollieNo ratings yet

- The Motivation of A Rhodes ScholarDocument12 pagesThe Motivation of A Rhodes ScholarcollieNo ratings yet

- Gainesboro Machine Tools CorporationDocument15 pagesGainesboro Machine Tools CorporationcollieNo ratings yet

- Delicious IncDocument13 pagesDelicious InccollieNo ratings yet

- Deluxe CorporationDocument10 pagesDeluxe CorporationcollieNo ratings yet

- Emperador 2013Document114 pagesEmperador 2013collieNo ratings yet

- Krispy KremeDocument6 pagesKrispy KremecollieNo ratings yet

- LP Formulation ExDocument32 pagesLP Formulation ExcollieNo ratings yet

- Science and Technology in The PhilippinesDocument1 pageScience and Technology in The Philippinesnicole castilloNo ratings yet

- Punjab BotanyDocument9 pagesPunjab BotanyAYUSHNEWTONNo ratings yet

- Separators of Different GenerationsDocument46 pagesSeparators of Different GenerationsISLAM I. Fekry100% (8)

- CHEM 580: Computational Chemistry Fall 2020 From Schrodinger To Hartree-FockDocument41 pagesCHEM 580: Computational Chemistry Fall 2020 From Schrodinger To Hartree-FockciwebNo ratings yet

- Salgado 2017Document15 pagesSalgado 2017ferryararNo ratings yet

- Epson EPL-5800 Service ManualDocument116 pagesEpson EPL-5800 Service ManualHarris FNo ratings yet

- Innovative Strategies For Flood-Resilient CitiesDocument50 pagesInnovative Strategies For Flood-Resilient CitiesDaisy100% (1)

- Michael Downs - Lacan's Concept of The Object-Cause of Desire (Objet Petit A)Document23 pagesMichael Downs - Lacan's Concept of The Object-Cause of Desire (Objet Petit A)JustinWagnerNo ratings yet

- NEW Curriculum Vitae Marking Scheme (Jan 2022)Document2 pagesNEW Curriculum Vitae Marking Scheme (Jan 2022)TONo ratings yet

- Science DLPDocument12 pagesScience DLPGaila Mae SanorjoNo ratings yet

- 07. ĐỀ THI VÀO LỚP 10-CẦN THƠ (2020-2021)Document8 pages07. ĐỀ THI VÀO LỚP 10-CẦN THƠ (2020-2021)Vương ThànhNo ratings yet

- Bag Specification 3LDocument1 pageBag Specification 3LBookWayNo ratings yet

- Newmaninan Concept of A GentlemanDocument4 pagesNewmaninan Concept of A GentlemanSakib Abrar TasnimNo ratings yet

- Tsil As Is&to Be Doc 4Document12 pagesTsil As Is&to Be Doc 4Ashok Kumar Panda100% (1)

- 11 - Trigonometric IdentitiesDocument6 pages11 - Trigonometric IdentitiesQwert RNo ratings yet

- End of Quiz: G-LITT001 CEE22 1st Sem (2023-2024) Review Quiz 6Document3 pagesEnd of Quiz: G-LITT001 CEE22 1st Sem (2023-2024) Review Quiz 6Dela Cruz ArabellaNo ratings yet

- Ex 3 SIDocument25 pagesEx 3 SIAB123No ratings yet

- Loop Switching PDFDocument176 pagesLoop Switching PDFshawnr7376No ratings yet

- Difference Between A Flywheel and A GovernorDocument3 pagesDifference Between A Flywheel and A GovernorRevanKumarBattuNo ratings yet

- SHRB-SN: 1" (25 MM) Deflection SHRB Spring Hanger With Neoprene and Bottom CupDocument1 pageSHRB-SN: 1" (25 MM) Deflection SHRB Spring Hanger With Neoprene and Bottom Cupsas999333No ratings yet

- Welc OME..Document26 pagesWelc OME..Priya RamNo ratings yet

- Naive BayesDocument36 pagesNaive BayesgibthaNo ratings yet

- Operator'S Manual: FANUC FAST Ethernet FANUC FAST Data ServerDocument240 pagesOperator'S Manual: FANUC FAST Ethernet FANUC FAST Data ServerSergio Trujillo CerroNo ratings yet

- Fortran CF DDocument160 pagesFortran CF DLahcen AkerkouchNo ratings yet

- LESSON 3: Talk About Your Weekend or Holiday Plan Using VerbsDocument3 pagesLESSON 3: Talk About Your Weekend or Holiday Plan Using VerbsjoannaNo ratings yet

- Getting-Started nrf8001 Bluefruit-Le-BreakoutDocument38 pagesGetting-Started nrf8001 Bluefruit-Le-BreakoutnescafefrNo ratings yet