Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsFIS Empirical Project Macrofactors Vs Yield Curve

FIS Empirical Project Macrofactors Vs Yield Curve

Uploaded by

Srikanth Kumar KonduriYou might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Wintel AnalysisDocument11 pagesWintel AnalysisSrikanth Kumar Konduri100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Report On Public Sector BankDocument21 pagesProject Report On Public Sector BankNikita Ladha100% (1)

- Final PPT of MarutiDocument21 pagesFinal PPT of MarutiSrikanth Kumar KonduriNo ratings yet

- Meet Mate INTM ProjectDocument22 pagesMeet Mate INTM ProjectSrikanth Kumar KonduriNo ratings yet

- FSABV Final ReportDocument3 pagesFSABV Final ReportSrikanth Kumar KonduriNo ratings yet

- Trading StrategyDocument1 pageTrading StrategySrikanth Kumar KonduriNo ratings yet

- Panel Data Analysis: Indian Pharmacy IndustryDocument11 pagesPanel Data Analysis: Indian Pharmacy IndustrySrikanth Kumar KonduriNo ratings yet

- LPO in IndiaDocument14 pagesLPO in IndiaSrikanth Kumar KonduriNo ratings yet

- IB - Doing Business in China - 2011Document27 pagesIB - Doing Business in China - 2011Srikanth Kumar KonduriNo ratings yet

- BC-2 Interaction With Foreign ClientsDocument24 pagesBC-2 Interaction With Foreign ClientsSrikanth Kumar KonduriNo ratings yet

- UK - SureInsureDocument14 pagesUK - SureInsureSrikanth Kumar KonduriNo ratings yet

- Cipla Vs Dr1Document10 pagesCipla Vs Dr1Srikanth Kumar KonduriNo ratings yet

- Study of Nationalized and Privatized Bank (SBI Vs HDFC Bank .)Document72 pagesStudy of Nationalized and Privatized Bank (SBI Vs HDFC Bank .)Shaina khatriNo ratings yet

- An Overview of Kyc NormsDocument5 pagesAn Overview of Kyc NormsArsh AhmedNo ratings yet

- Switchover Application Revised - 16042022Document1 pageSwitchover Application Revised - 16042022khageshcode89No ratings yet

- Money Barter To BitcoinsDocument12 pagesMoney Barter To BitcoinsbhavyaNo ratings yet

- Banking Regulation ActDocument19 pagesBanking Regulation Actgattani.swatiNo ratings yet

- Plagiarism Checker X - Report: Originality AssessmentDocument30 pagesPlagiarism Checker X - Report: Originality Assessmentaurorashiva1No ratings yet

- Introduction and Research MethodologyDocument21 pagesIntroduction and Research Methodologyਅਮਨਦੀਪ ਸਿੰਘ ਰੋਗਲਾNo ratings yet

- CFM AssignmentDocument26 pagesCFM AssignmentNaman VarshneyNo ratings yet

- Manishree Gupta - Kotak ProjectDocument106 pagesManishree Gupta - Kotak ProjectmanishreegNo ratings yet

- Dcom208 Banking Theory and Practice PDFDocument251 pagesDcom208 Banking Theory and Practice PDFLakshmanrao NayiniNo ratings yet

- Money MarketDocument70 pagesMoney Marketvandana_daki3941No ratings yet

- Coop. Project - Doc12Document78 pagesCoop. Project - Doc12PriyankaThakurNo ratings yet

- Urban Co-Operative Banks (Ucbs) in India Problems and ProspectsDocument11 pagesUrban Co-Operative Banks (Ucbs) in India Problems and ProspectsnilyemdeNo ratings yet

- Weekly Current Affairs PDF - General Knowledge For This Week 9th February - 15th February 2022 - Ixambee BeepediaDocument24 pagesWeekly Current Affairs PDF - General Knowledge For This Week 9th February - 15th February 2022 - Ixambee BeepediaDarshan BaishyaNo ratings yet

- MDI Finance Compendium 2016Document29 pagesMDI Finance Compendium 2016Khyati DahiyaNo ratings yet

- Economy NotesDocument22 pagesEconomy Notesg.prasanna saiNo ratings yet

- Gold Loan Application FormDocument7 pagesGold Loan Application FormMahesh PittalaNo ratings yet

- Uttrakhand EvictionDocument38 pagesUttrakhand Evictionromeet panigrahiNo ratings yet

- ManishDocument72 pagesManishManish Thakur100% (1)

- 160+ GD Topics For Bank Exams 2022 (With Answers)Document5 pages160+ GD Topics For Bank Exams 2022 (With Answers)Bharti JhaNo ratings yet

- Current Affairs Weekly PDF - June 2020 3rd Week (16-23) by AffairsCloudDocument21 pagesCurrent Affairs Weekly PDF - June 2020 3rd Week (16-23) by AffairsCloudPahulpreet SinghNo ratings yet

- Letter of Offer HEG LimitedDocument56 pagesLetter of Offer HEG LimitedM Kolappa PillaiNo ratings yet

- Economics (030) Set 58 C1 Marking Scheme Comptt 2020Document11 pagesEconomics (030) Set 58 C1 Marking Scheme Comptt 2020bhumika aggarwal100% (1)

- Monetary Policy ToolsDocument7 pagesMonetary Policy ToolsDeepak PathakNo ratings yet

- Final Report On NBFCDocument57 pagesFinal Report On NBFCPravash Poddar0% (1)

- 2023 151 Taxmann Com 176 NCLAT Chennai 27 02 2023 Nirej Vadakkedathu Paul Vs SunstaDocument45 pages2023 151 Taxmann Com 176 NCLAT Chennai 27 02 2023 Nirej Vadakkedathu Paul Vs SunstabhaviknagoriNo ratings yet

- Bank Exam Solved Question PapersDocument89 pagesBank Exam Solved Question Papersyadav76No ratings yet

- Highlights of The Interim Budget 2009Document54 pagesHighlights of The Interim Budget 2009Bindhu KutiNo ratings yet

FIS Empirical Project Macrofactors Vs Yield Curve

FIS Empirical Project Macrofactors Vs Yield Curve

Uploaded by

Srikanth Kumar Konduri0 ratings0% found this document useful (0 votes)

11 views2 pagesFixed Income Securities Project

Original Title

FIS Empirical Project Macrofactors vs Yield Curve

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

11 views2 pagesFIS Empirical Project Macrofactors Vs Yield Curve

FIS Empirical Project Macrofactors Vs Yield Curve

Uploaded by

Srikanth Kumar KonduriYou are on page 1of 2

Objective:

To analyze if there is any statistical relationship between the macroeconomic

indicators and the movements of yield curve in Indian Debt market.

Approach:

To fetch a time series data of both yield curve parameters and macroeconomic

parameters for a particular period and performing a regression analysis among

them to identify any significant statistical relationship among them.

Software used: MS-Excel Analysis Tools and Pivot Charts.

Description:

Based on the earlier factor analysis study conducted to explain the behaviour of

term structure of interest rates the parameters viz., level and slope (which

account for more than 9% of changes) are only chosen to describe the

characteristics of yield curve.

While Index of Industrial Production (IIP), Foreign Exchange Rate (Forex rate),

Wholesale Price Inflation (WPI) & Call Money Rate (CMR) are used to represent

the macro economic factors of Gross Domestic Product (GDP), Inflation &

intervention of Reserve bank of India (RBI).

The time period under the considered for the study is from Q1 FY05 to Q1 FY11

with above parameters obtained at the end of every quarter during that period.

For obtaining Level, Slope:

Only the benchmark risk-free GoI issued securities are considered for the given

period.

The trading transaction details of above bonds are obtained from the RBI website

and a pivot table chart is used to group those bond details into following three

categories:

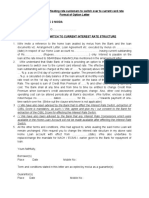

Type

of

Bond

Short Term

Medium

Term

Long Term

Maturity

years)

<1

1 to 5

(in

>5

Level = Average of (YTM of all the eligible LT, MT, ST securities transacted on first

day of quarter)

Slope = Difference between Average YTM of LT & ST securities

Then the changes in level and slope over consecutive quarters are calculated to

be used in the study.

For obtaining Macroeconomic factors:

These are fetched from CMIE database and then the Q-o-Q changes in those are

calculated to be used in the study.

Formulation of relationship:

Paramet

er

IIP(t)

CMR(t)

Forex(t)

WPI(t)

DSlope(t)

DLevel(t)

Regressed Upon

IIP(t-1), CMR(t-1), Forex(t-1), WPI(t-1), DSlope(t-1),

DLevel(t-1)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Wintel AnalysisDocument11 pagesWintel AnalysisSrikanth Kumar Konduri100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Report On Public Sector BankDocument21 pagesProject Report On Public Sector BankNikita Ladha100% (1)

- Final PPT of MarutiDocument21 pagesFinal PPT of MarutiSrikanth Kumar KonduriNo ratings yet

- Meet Mate INTM ProjectDocument22 pagesMeet Mate INTM ProjectSrikanth Kumar KonduriNo ratings yet

- FSABV Final ReportDocument3 pagesFSABV Final ReportSrikanth Kumar KonduriNo ratings yet

- Trading StrategyDocument1 pageTrading StrategySrikanth Kumar KonduriNo ratings yet

- Panel Data Analysis: Indian Pharmacy IndustryDocument11 pagesPanel Data Analysis: Indian Pharmacy IndustrySrikanth Kumar KonduriNo ratings yet

- LPO in IndiaDocument14 pagesLPO in IndiaSrikanth Kumar KonduriNo ratings yet

- IB - Doing Business in China - 2011Document27 pagesIB - Doing Business in China - 2011Srikanth Kumar KonduriNo ratings yet

- BC-2 Interaction With Foreign ClientsDocument24 pagesBC-2 Interaction With Foreign ClientsSrikanth Kumar KonduriNo ratings yet

- UK - SureInsureDocument14 pagesUK - SureInsureSrikanth Kumar KonduriNo ratings yet

- Cipla Vs Dr1Document10 pagesCipla Vs Dr1Srikanth Kumar KonduriNo ratings yet

- Study of Nationalized and Privatized Bank (SBI Vs HDFC Bank .)Document72 pagesStudy of Nationalized and Privatized Bank (SBI Vs HDFC Bank .)Shaina khatriNo ratings yet

- An Overview of Kyc NormsDocument5 pagesAn Overview of Kyc NormsArsh AhmedNo ratings yet

- Switchover Application Revised - 16042022Document1 pageSwitchover Application Revised - 16042022khageshcode89No ratings yet

- Money Barter To BitcoinsDocument12 pagesMoney Barter To BitcoinsbhavyaNo ratings yet

- Banking Regulation ActDocument19 pagesBanking Regulation Actgattani.swatiNo ratings yet

- Plagiarism Checker X - Report: Originality AssessmentDocument30 pagesPlagiarism Checker X - Report: Originality Assessmentaurorashiva1No ratings yet

- Introduction and Research MethodologyDocument21 pagesIntroduction and Research Methodologyਅਮਨਦੀਪ ਸਿੰਘ ਰੋਗਲਾNo ratings yet

- CFM AssignmentDocument26 pagesCFM AssignmentNaman VarshneyNo ratings yet

- Manishree Gupta - Kotak ProjectDocument106 pagesManishree Gupta - Kotak ProjectmanishreegNo ratings yet

- Dcom208 Banking Theory and Practice PDFDocument251 pagesDcom208 Banking Theory and Practice PDFLakshmanrao NayiniNo ratings yet

- Money MarketDocument70 pagesMoney Marketvandana_daki3941No ratings yet

- Coop. Project - Doc12Document78 pagesCoop. Project - Doc12PriyankaThakurNo ratings yet

- Urban Co-Operative Banks (Ucbs) in India Problems and ProspectsDocument11 pagesUrban Co-Operative Banks (Ucbs) in India Problems and ProspectsnilyemdeNo ratings yet

- Weekly Current Affairs PDF - General Knowledge For This Week 9th February - 15th February 2022 - Ixambee BeepediaDocument24 pagesWeekly Current Affairs PDF - General Knowledge For This Week 9th February - 15th February 2022 - Ixambee BeepediaDarshan BaishyaNo ratings yet

- MDI Finance Compendium 2016Document29 pagesMDI Finance Compendium 2016Khyati DahiyaNo ratings yet

- Economy NotesDocument22 pagesEconomy Notesg.prasanna saiNo ratings yet

- Gold Loan Application FormDocument7 pagesGold Loan Application FormMahesh PittalaNo ratings yet

- Uttrakhand EvictionDocument38 pagesUttrakhand Evictionromeet panigrahiNo ratings yet

- ManishDocument72 pagesManishManish Thakur100% (1)

- 160+ GD Topics For Bank Exams 2022 (With Answers)Document5 pages160+ GD Topics For Bank Exams 2022 (With Answers)Bharti JhaNo ratings yet

- Current Affairs Weekly PDF - June 2020 3rd Week (16-23) by AffairsCloudDocument21 pagesCurrent Affairs Weekly PDF - June 2020 3rd Week (16-23) by AffairsCloudPahulpreet SinghNo ratings yet

- Letter of Offer HEG LimitedDocument56 pagesLetter of Offer HEG LimitedM Kolappa PillaiNo ratings yet

- Economics (030) Set 58 C1 Marking Scheme Comptt 2020Document11 pagesEconomics (030) Set 58 C1 Marking Scheme Comptt 2020bhumika aggarwal100% (1)

- Monetary Policy ToolsDocument7 pagesMonetary Policy ToolsDeepak PathakNo ratings yet

- Final Report On NBFCDocument57 pagesFinal Report On NBFCPravash Poddar0% (1)

- 2023 151 Taxmann Com 176 NCLAT Chennai 27 02 2023 Nirej Vadakkedathu Paul Vs SunstaDocument45 pages2023 151 Taxmann Com 176 NCLAT Chennai 27 02 2023 Nirej Vadakkedathu Paul Vs SunstabhaviknagoriNo ratings yet

- Bank Exam Solved Question PapersDocument89 pagesBank Exam Solved Question Papersyadav76No ratings yet

- Highlights of The Interim Budget 2009Document54 pagesHighlights of The Interim Budget 2009Bindhu KutiNo ratings yet